Buod ng kumpanya

| YAMAGATAPangkalahatang Pagsusuri | |

| Itinatag | 2006 |

| Rehistradong Bansa/Rehiyon | Hapon |

| Regulasyon | FSA |

| Mga Produkto sa Pagkalakalan | Mga Stocks, ETF (Exchange-Traded Fund), REIT (Real Estate Investment Trust), Bonds, Futures, Options |

| Demo Account | ✅ |

| Singil | Depende sa mga produkto, mula 2,750 yen hanggang 588,500 yen |

| Suporta sa Customer | Tel: 023-631-7720 |

| Email: soumu@yamagatashoken.co.jp | |

| Address ng Kumpanya: 990-0042 yamagata city nanika-machi 2-1-41 (〒990-0042 山形市七日町2-1-41) | |

Itinatag noong 2006, YAMAGATA ay isang FSA-regulated securities broker na rehistrado sa Hapon, na nag-aalok ng mga serbisyo sa pagkalakalan sa U.S Stock (U.S. Equity Brokerage), Stocks (Spot Trading ng Domestic Stocks, Foreign Stocks, at iba pa), Bonds, Futures (JGB Futures), Investment Trusts, at Life Insurance.

Mga Kapakinabangan at Kadahilanan

| Kapakinabangan | Kadahilanan |

| Regulasyon ng FSA | Japanese reading threshold |

| Iba't ibang mga produkto sa pagkalakalan | |

| Mga demo account | |

| Malinaw na istraktura ng bayad |

Tunay ba ang YAMAGATA ?

Oo. Ang YAMAGATA ay kasalukuyang sinusubaybayan ng Financial Services Agency (FSA).

| Regulated Country | Regulator | Kasalukuyang Kalagayan | Regulated Entity | Uri ng Lisensya | License No. |

| Financial Services Agency (FSA) | Sumusunod sa Patakaran | YAMAGATA株式会社 | Retail Forex License | 東北財務局長(金商)第3号 |

Ano ang Maaari Kong I-trade sa YAMAGATA?

| Mga Tradable na Instrumento | Supported |

| Mga Stocks | ✔ |

| ETF (Exchange-Traded Fund) | ✔ |

| REIT (Real Estate Investment Trust) | ✔ |

| Mga Bonds | ✔ |

| Mga Futures | ✔ |

| Mga Options | ✔ |

| Forex | ❌ |

| Mga Commodities | ❌ |

| Mga Indices | ❌ |

| Mga Cryptocurrencies | ❌ |

YAMAGATA Mga Bayarin

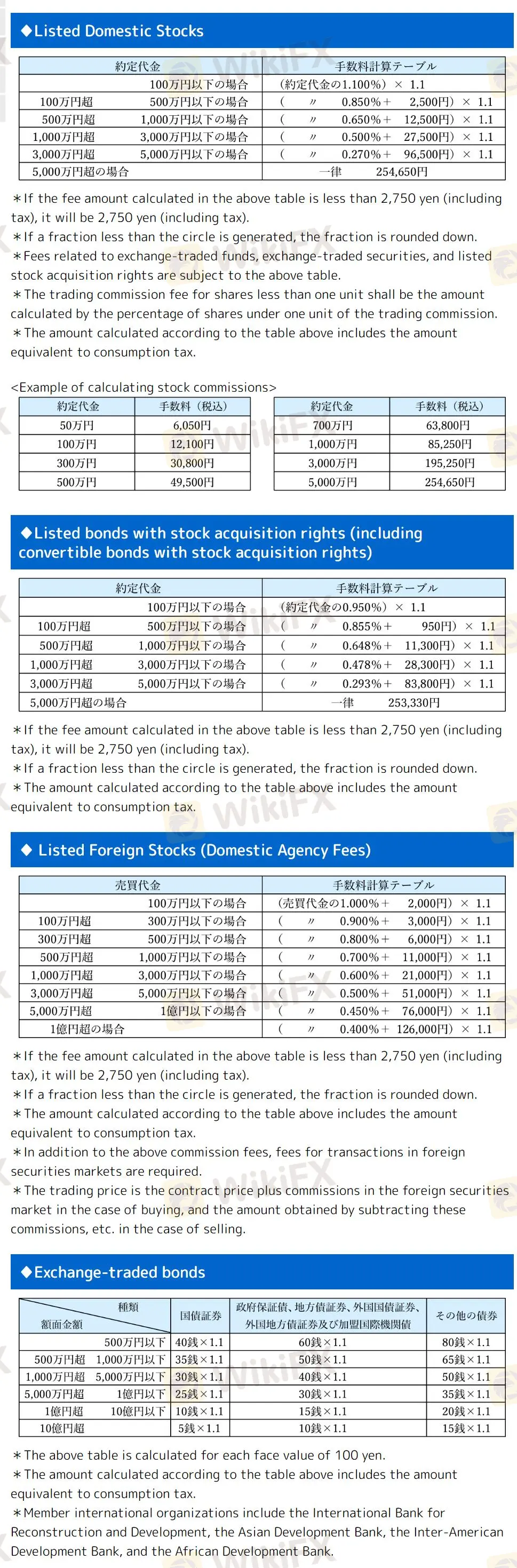

Mga Bayarin para sa Mga Stocks:

- Domestic Stocks & Bonds: Ang Minimum na bayad na 2,750 yen (kasama ang buwis) ay ipinapataw kung ang kalkuladong bayad ay mas mababa sa halagang ito. Ang mga bahagi ng yen ay pinapantay pababa.

- Mga Foreign Stocks: Parehong minimum na bayad ng domestic stocks, plus karagdagang bayarin para sa mga transaksyon sa foreign market.

- ETFs & Securities na may Stock Acquisition Rights: Sumusunod sa parehong istraktura ng bayad ng domestic stocks.

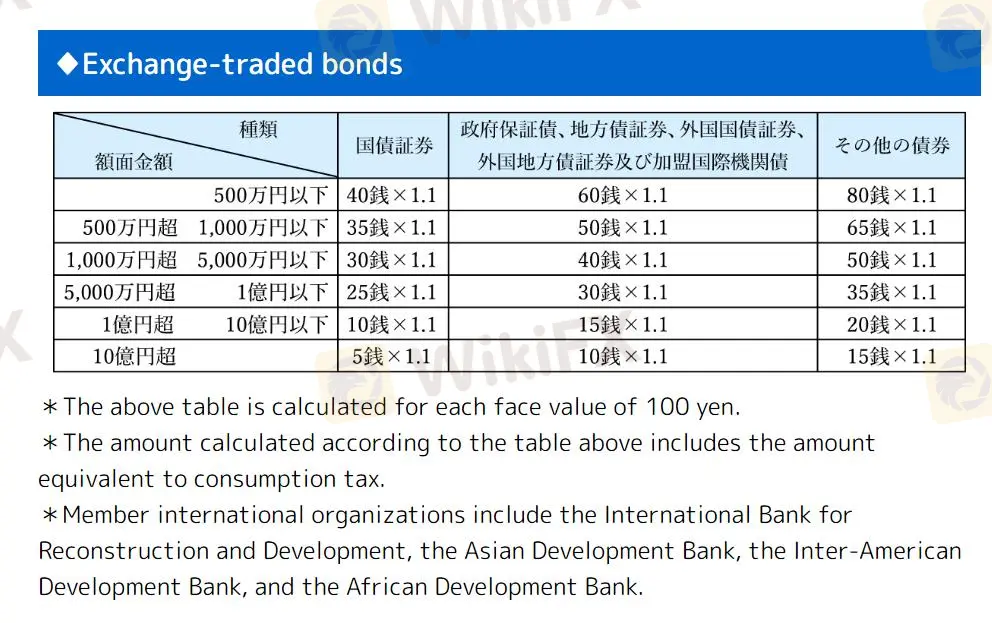

Mga Bayarin para sa Mga Bonds:

- Exchange-Traded Bonds: Mga bayarin na kinokolekta kada 100 yen na halaga, kasama ang consumption tax.

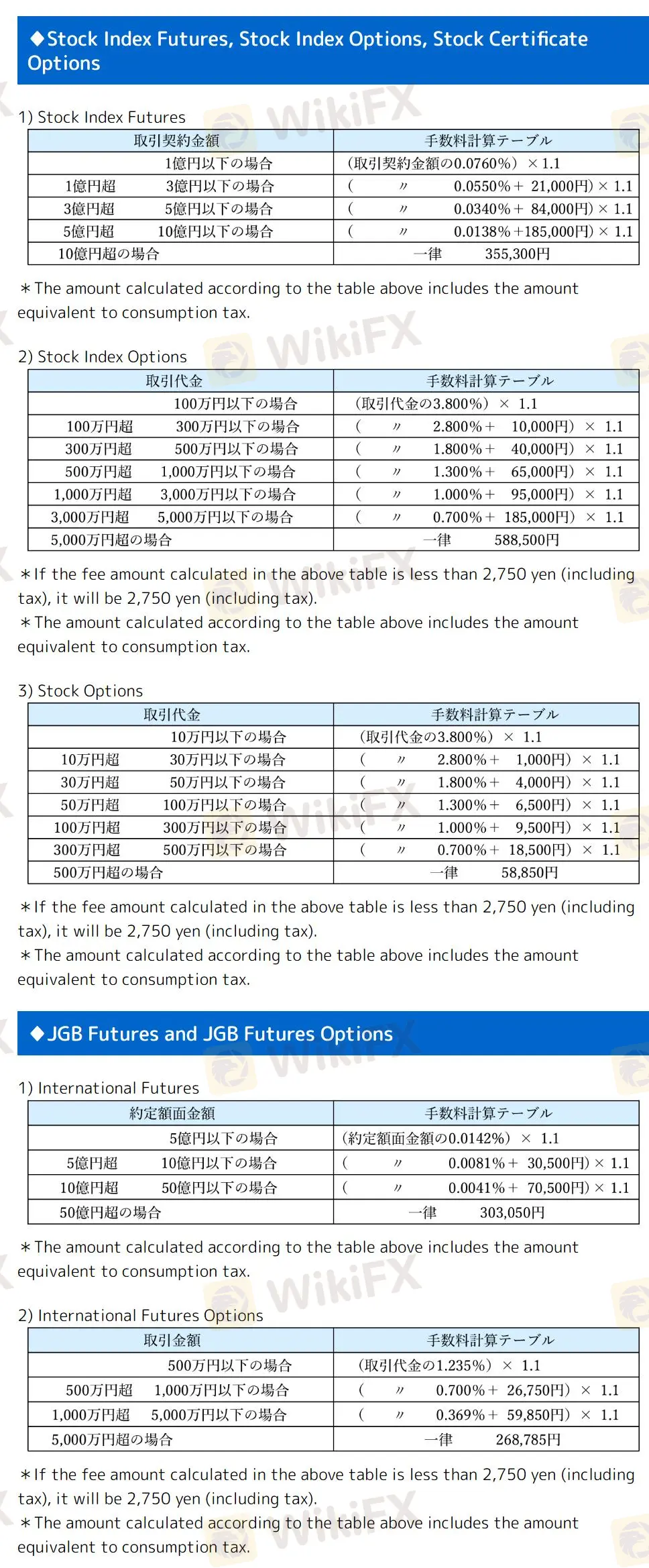

Mga Bayarin para sa Mga Futures at Options:

- Stock Index Futures: Kasama ang consumption tax sa mga bayarin.

- Stock Index Options & Stock Options: Minimum na bayad na 2,750 yen (kasama ang buwis) kung ang kalkuladong bayad ay mas mababa sa halagang ito.

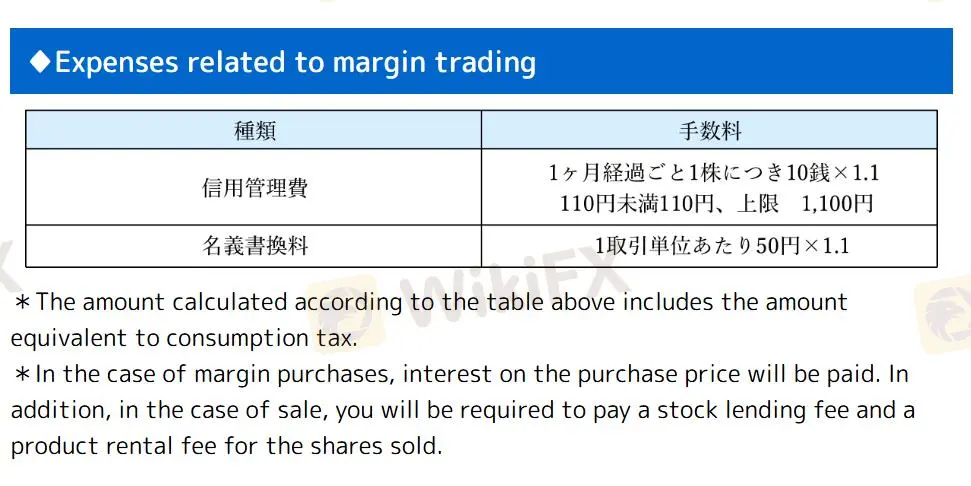

Gastos sa Margin Trading:

- Kasama ang interes sa mga presyo ng pagbili para sa mga pagbili at bayad sa pautang ng mga stocks para sa mga benta, kasama ang consumption tax.

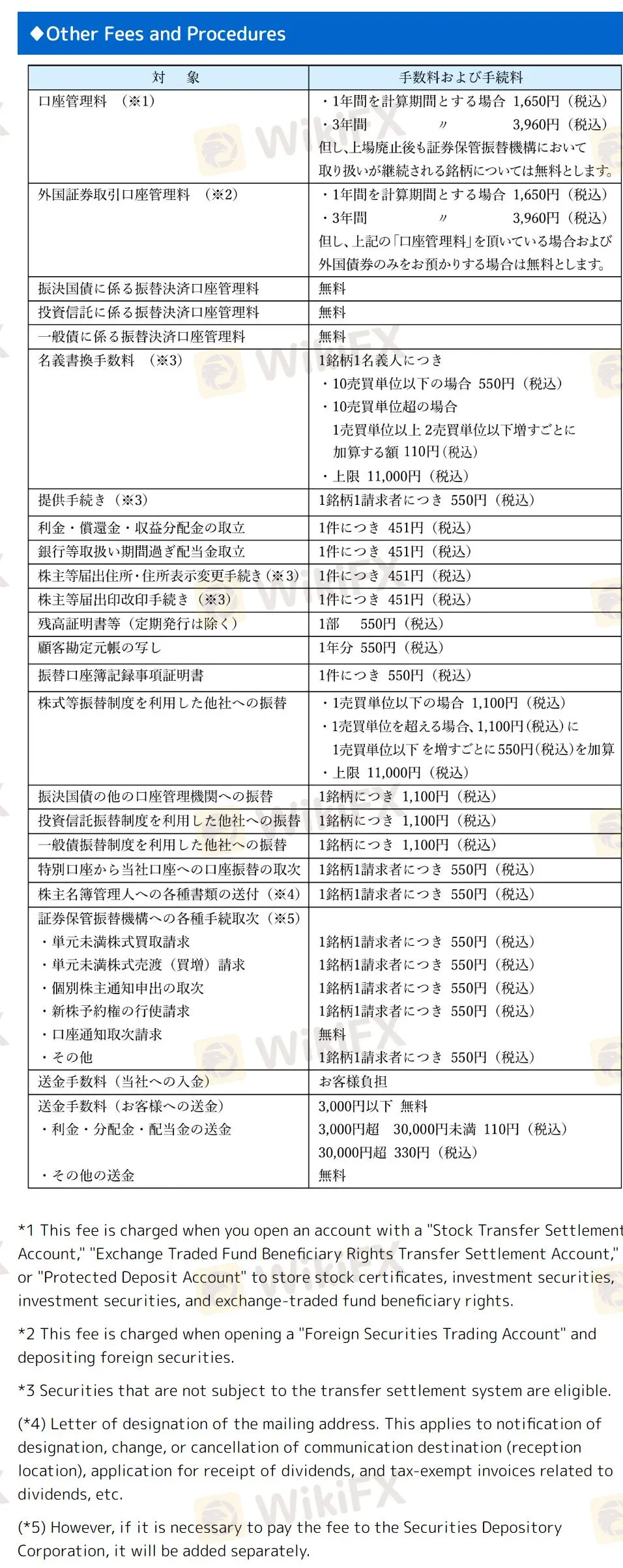

Karagdagang Bayarin:

- Mag-apply para sa pagbubukas ng partikular na mga account tulad ng stock transfer o foreign securities accounts.

- Mag-apply sa mga hindi maaaring ma-transfer na mga securities.

- Kasama ang mga bayarin para sa pagtukoy ng mailing address at mga dokumento kaugnay ng dividend.

- Maaaring kasama ang karagdagang bayarin para sa mga serbisyong ibinibigay ng Securities Depository Corporation.