Profil perusahaan

| GEX Ringkasan Ulasan | |

| Nama Perusahaan | GEX Ventures Pte Ltd. |

| Negara/Daerah Terdaftar | Singapura |

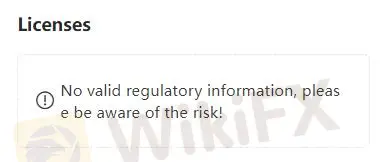

| Regulasi | Tidak Ada Regulasi |

| Layanan | penasehatan bisnis perusahaan, pengumpulan modal, investasi keuangan |

| Dukungan Pelanggan | Formulir Kontak, Tel: +65 6559 8888 |

| Alamat Perusahaan | 238A Thomson Road Novena Square Office Tower A |

Apa itu GEX?

GEX Ventures Pte Ltd., berbasis di Singapura, beroperasi terutama sebagai perusahaan keuangan yang menawarkan layanan penasehatan. Saat ini perusahaan tidak memiliki regulasi.

Kelebihan & Kekurangan

| Kelebihan | Kekurangan |

| Tidak Tersedia |

|

|

Kekurangan:

Tidak Ada Regulasi: GEX tidak memiliki regulasi, yang membuat pengguna khawatir tentang akuntabilitas dan transparansi perusahaan.

Kurangnya Informasi di Situs Web: Hanya informasi terbatas yang dapat ditemukan di situs web resmi, yang akan menghambat klien potensial dalam membuat keputusan yang berinformasi.

Apakah GEX Legal atau Penipuan?

Pengawasan Regulasi: GEX saat ini tidak memiliki pengawasan regulasi dan lisensi apa pun yang memungkinkannya untuk menjalankan standar operasionalnya di pasar keuangan. Kurangnya regulasi ini menimbulkan banyak risiko bagi investor, seperti kurangnya transparansi, kekhawatiran keamanan, dan tidak ada jaminan kepatuhan terhadap standar dan praktik industri.

Tanggapan Pengguna: Pengguna harus memeriksa ulasan dan tanggapan dari klien lain untuk mendapatkan pandangan yang lebih komprehensif tentang pialang ini, atau mencari ulasan di situs web dan forum terpercaya.

Langkah Keamanan: Sejauh ini kami belum menemukan informasi tentang langkah-langkah keamanan untuk pialang ini.

Layanan

GEX menyediakan layanan penasehatan yang mencakup banyak aspek bisnis perusahaan, termasuk pengumpulan modal dan investasi keuangan. Keahlian mereka meliputi memberikan panduan strategis tentang masalah perusahaan, membantu klien dalam menavigasi lanskap keuangan yang kompleks, dan memfasilitasi inisiatif pengumpulan modal.

Dukungan Pelanggan

GEX menawarkan dukungan pelanggan melalui berbagai saluran, termasuk formulir kontak di situs webnya dan garis telepon di +65 6559 8888. GEX juga menyediakan alamat fisik mereka, yaitu di 238A Thomson Road Novena Square Office Tower A, sehingga klien dapat memilih bantuan tatap muka jika diperlukan.

Kesimpulan

Sebagai perusahaan keuangan, GEX menyediakan terutama layanan konsultasi. Hanya terdapat informasi terbatas di situs resminya dan tidak ada regulasi juga.

Pertanyaan yang Sering Diajukan (FAQ)

Pertanyaan: Apakah GEX diatur atau tidak?

Jawaban: Tidak, tidak diatur.

Pertanyaan: Apakah GEX juga memberikan konsultasi untuk individu?

Jawaban: Ya.

Pertanyaan: Apakah GEX pilihan yang baik atau tidak?

Jawaban: Tidak. Kurangnya transparansi informasi dan regulasi.

Peringatan Risiko

Trading online melibatkan risiko yang signifikan, dan Anda dapat kehilangan seluruh modal yang diinvestasikan. Tidak cocok untuk semua trader atau investor. Pastikan Anda memahami risiko yang terlibat dan perhatikan bahwa informasi yang disediakan dalam ulasan ini dapat berubah karena pembaruan yang konstan dari layanan dan kebijakan perusahaan.