Buod ng kumpanya

| WorldFirst Buod ng Pagsusuri | |

| Itinatag | 2004 |

| Nakarehistrong Bansa/Rehiyon | Australia |

| Regulasyon | ASIC (regulated); FCA (Exceeded) |

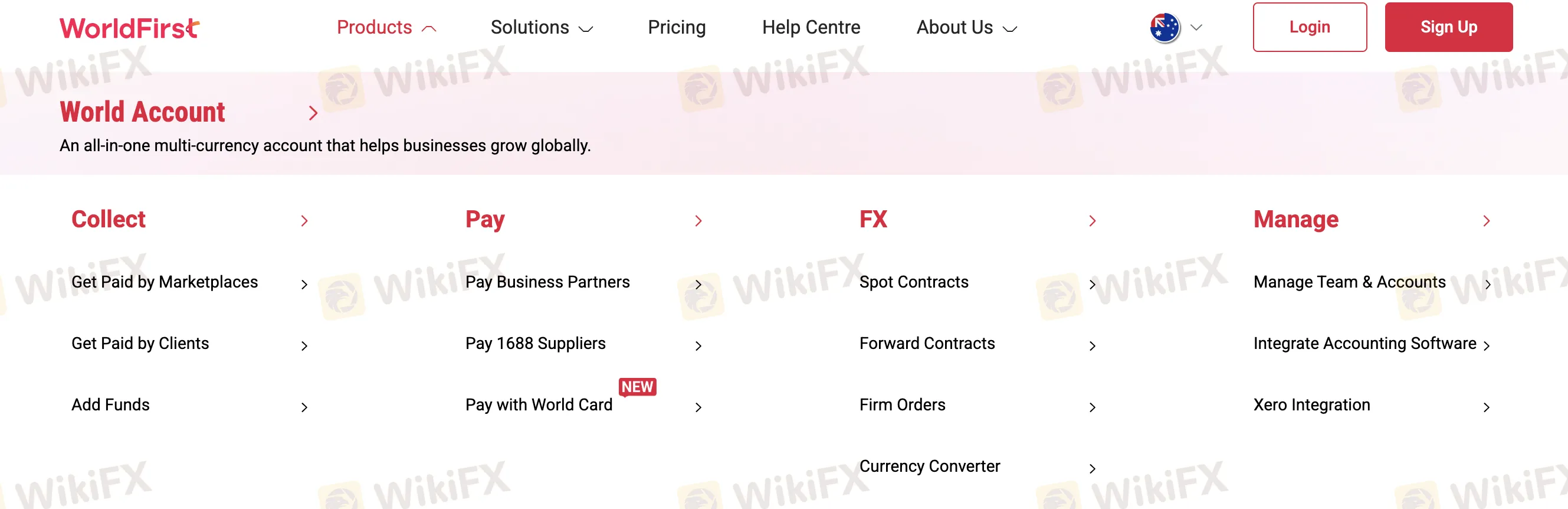

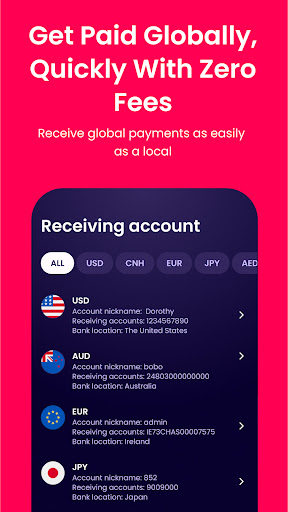

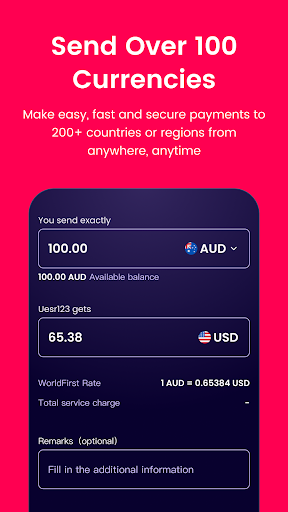

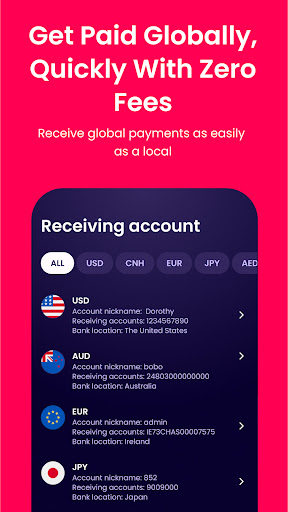

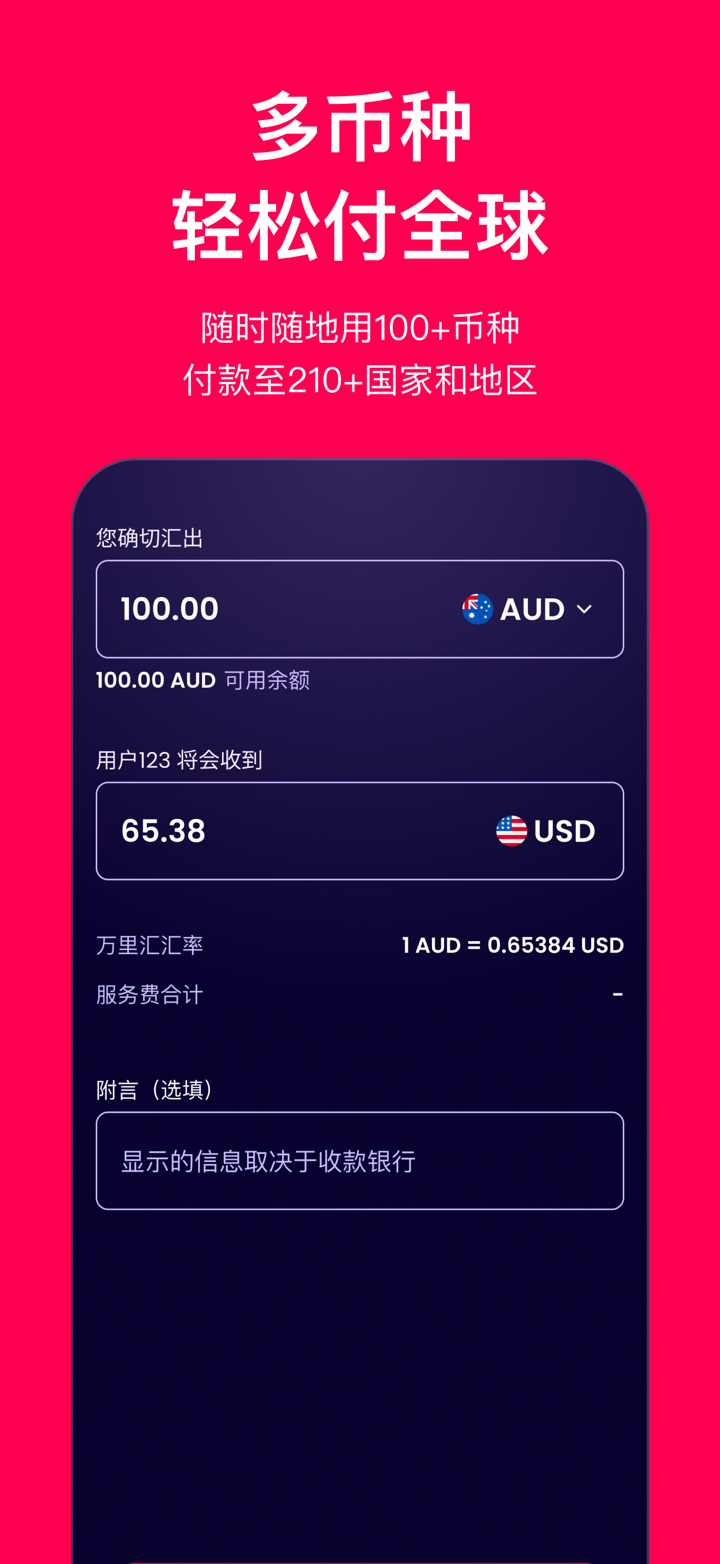

| Mga Produkto at Serbisyo | Palitan ng pera, internasyonal na pagbabayad, mga akawnt ng maraming pera, virtual na debit card, mass payments, forward contracts |

| Suporta sa Customer | Telepono (Australia): 1800 326 667 |

| Telepono (NZ): 0800 666 114 | |

| Telepono (Internasyonal): +61 2 8298 4990 | |

| Email: media@worldfirst.com | |

Impormasyon Tungkol sa WorldFirst

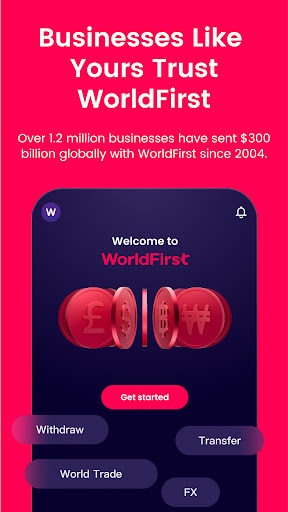

WorldFirst, itinatag noong 2004, ay isang organisasyon ng serbisyong pinansyal na nakabase sa Australia na nireregula ng ASIC na espesyalista sa global na mga pagbabayad sa negosyo at pagpapalit ng pera. Ang mga pangunahing tampok nito ay kinabibilangan ng mga akawnt ng maraming pera, mga solusyon sa palitan ng pera, at virtual na debit card, lahat na walang patuloy na bayad sa pagmamantini, na ginagawang angkop ito para sa mga negosyong e-commerce at SMEs.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Nireregula ng ASIC | Hinuhulma nang pangunahin para sa mga negosyo, hindi sa mga indibidwal |

| Libreng akawnt ng maraming pera at parehong-araw na paglilipat | |

| Transparent at may limitadong bayad sa palitan ng FX | |

| Mahabang kasaysayan ng operasyon |

Tunay ba ang WorldFirst?

Ang WorldFirst ay isang reguladong institusyon ng pananalapi. Pinayagan ng Australian Securities and Investments Commission (ASIC) ang World First Pty Ltd bilang isang Market Maker. Ang lisensiyang ito ay aktibo at wasto.

Bukod dito, iginawad sa kanila ng UK Financial Conduct Authority (FCA) ang isang lisensya sa mga serbisyong pangbayad. Gayunpaman, ang kasalukuyang status ng FCA nila ay "Exceeded", na nagpapahiwatig na ang lisensya ay maaaring hindi na aktibo o sumusunod sa regulasyon.

| Otoridad sa Regulasyon | Kasalukuyang Kalagayan | Reguladong Bansa | Uri ng Lisensya | Numero ng Lisensya |

| Australian Securities and Investments Commission (ASIC) | Reguladong | Australia | Market Maker (MM) | 000331945 |

| Financial Conduct Authority (FCA) | Exceeded | UK | Lisensya sa Pagbabayad | 900508 |

Mga Produkto at Serbisyo

WorldFirst ay malinaw na nakatuon bilang isang solusyon para sa B2B (negosyo-sa-negosyo), na may pokus sa mga bayad sa ibang bansa, serbisyong palitan ng pera, at pamamahala ng account para sa pandaigdigang kalakalan.

| Produkto/Serbisyo | Mga Tampok | Supported |

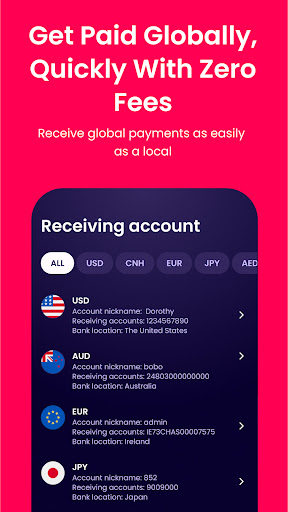

| Mga Account sa Maraming Pera | World Account – para sa pangangailangan ng pandaigdigang negosyo | ✔ |

| Koleksyon sa Marketplace | Makatanggap ng bayad mula sa Amazon, Etsy, Shopify, atbp. | ✔ |

| Pagbibigay ng Invoice sa Kliente | Makatanggap ng bayad nang direkta mula sa mga kliyente | ✔ |

| Paglilipat ng Pondo | Magpadala ng pondo sa mga kasosyo sa negosyo o supplier | ✔ |

| Mga Serbisyong Palitan ng Pera | Spot contracts, forward contracts, firm orders | ✔ |

| Mga Bayad gamit ang World Card | Magbayad gamit ang World Card | ✔ |

| Mga Bayad ng Korporasyon | Mga solusyon para sa importers/exporters | ✔ |

| Mga Bayad sa Tsina | Direct na mga bayad sa Tsina | ✔ |

| Pamamahala ng Team & Account | Mga tool ng admin para sa internal na mga team | ✔ |

| Integrasyon ng Software | Mag-integrate sa mga systema ng accounting tulad ng Xero | ✔ |

Mga Bayad ng WorldFirst

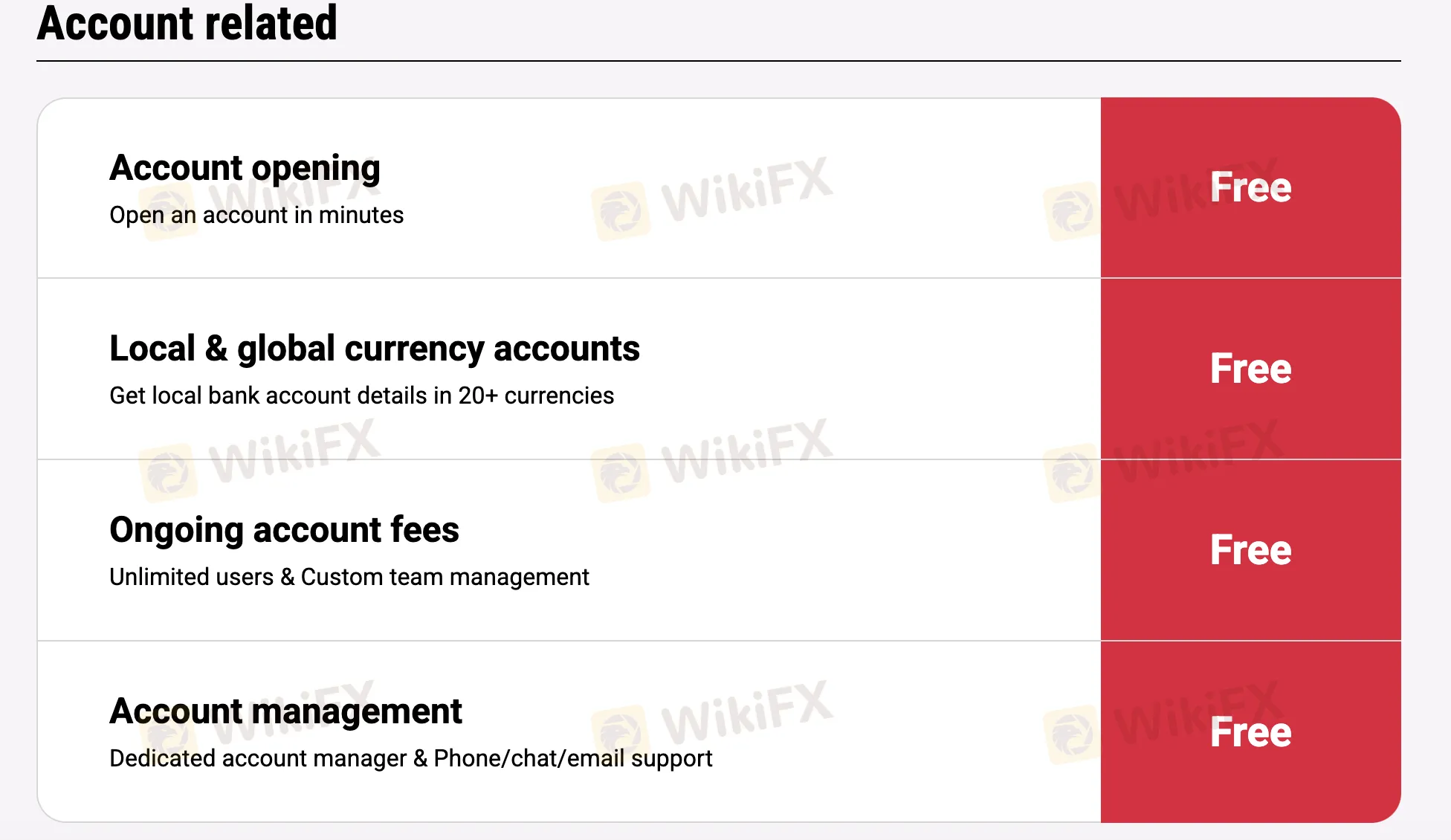

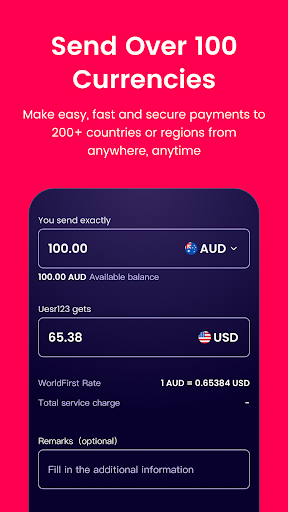

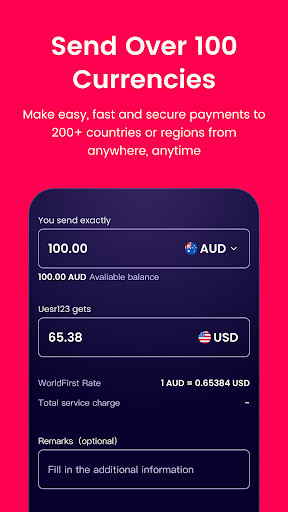

Ang mga rate ng WorldFirst ay kadalasang mas mababa kaysa sa pamantayan ng industriya, lalo na para sa mga organisasyon na namamahala ng mga bayad sa ibang bansa at FX. Ang karamihan sa mahahalagang serbisyo ay libre, at kung mayroong bayad (halimbawa, palitan ng pera), ito ay malinaw na may limitasyon o pinapanatili sa isang minimal na porsyento.

| Kategorya ng Serbisyo | Mga Detalye | Bayad |

| Pagbubukas at Pangangalaga ng Account | Buksan at panatilihin ang World Account | 0 |

| Lokal at Pandaigdigang Mga Account sa Pera | 20+ currencies | |

| Mga Ongoing Account Fees | Unlimited users, team management | |

| Dedicated Support | Phone, chat, at email support | |

| Pagtanggap at Pagtengga ng mga Bayad | Tanggapin ang mga bayad mula sa mga marketplace/kliyente | |

| Maglagay ng Pondo sa Iyong Account | Mula sa personal o negosyo account | |

| Magtengga ng Pondo | Hanggang sa 20+ currencies | |

| Mga Bayad at Palitan ng Pera | Lokal na mga bayad sa AUD/NZD | |

| Iba Pang Mga Bayad sa Pera | Lokal/o ibang bansa (non-AUD/NZD) | Mula sa 0.4%, capped sa AUD 15 |

| Bayad sa Iba Pang World Accounts | Kahit saan, agad | 0 |

| Bayad sa 1688 | Agad sa mga supplier | Hanggang sa 0.8% |

| FX para sa Major Currencies | USD, EUR, GBP, AUD, CAD, JPY | Hanggang sa 0.6% |

| FX para sa Minor Currencies | 40+ currencies | Mula sa 0.67% |

| Forward Contracts | Solusyon sa pamamahala ng panganib | Hanggang sa 0.2%/buwan |

| Full Value Transfer (FVT) - USA/UK/EEA | Siguraduhing natatanggap ang buong halaga | 0 |

| FVT - Iba Pang Mga Bansa | Fixed na AUD 25 | |

| World Card (Debit Card) | Application, 25 users, paggamit | 0 |

| Pera na Hindi Nasa Balanse | Palitan ng pera sa WorldFirst o Mastercard | Hanggang sa 1.5% |

| Mga Tool at Integrasyon | Mass payments, Xero, NetSuite integration | 0 |

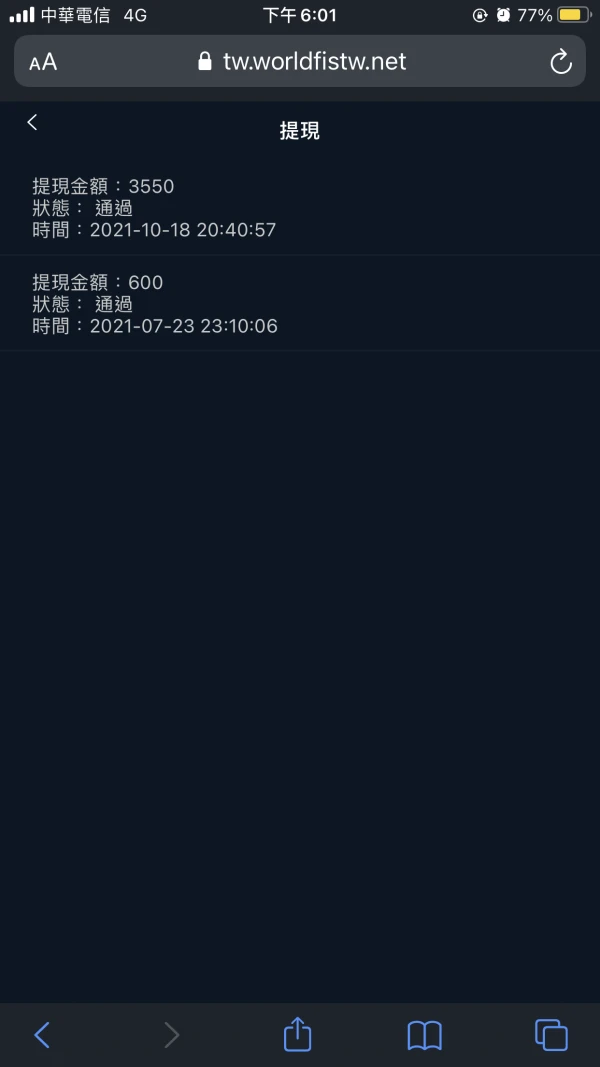

蘇義盛

Taiwan

Tumugon ang serbisyo sa customer at hiniling sa akin na magbayad ng $ 10,000 upang ma-unlock ang deposito. Sapagkat ang mga awtoridad sa pamamahala sa pananalapi ay may mas mahigpit na mga kinakailangan ng account at security ng asset, nangangailangan ng mas maraming deposito. Walang malinaw na mga regulasyon sa platform. Tila hindi makatuwiran na bawiin ang hindi nakakubkob na deposito.

Paglalahad

蘇義盛

Taiwan

Tugon sa serbisyo sa customer: Kamusta, ipinabatid ng kumpanya na dahil ang departamento ng teknikal ay nakakita ng isang abnormal na problema sa iyong account, na maaaring ninakaw. Kaya't ang pag-atras ay hindi nakapasa sa pagsusuri, at kailangan mong magbayad ng pondong peligro na $ 5000. Tanong: Hindi ako nagpatakbo nang abnormal, at ang pag-atras ng $ 20,572 ay hindi matagumpay. Humiling sa akin ang serbisyo sa customer na magbayad ng $ 5,000 dahil sa hindi tamang operasyon. Makatuwiran ba ito?

Paglalahad

蘇義盛

Taiwan

Hindi makaatras. Tinanong ako ng platform na magdeposito ng $ 5,000 para sa bayad sa peligro. Wala itong katuturan. Kami ay namumuhunan lamang, at hindi makontrol ang mga pag-atras at deposito sa platform. Akala ko ito ay isang platform ng pandaraya. Tanging ang opisyal na serbisyo sa customer ang tumugon. Walang telepono. Mayroon pa akong $ 25,124 sa aking account, ngunit hindi maka-withdraw.

Paglalahad

FX1485573802

Pilipinas

Ang WorldFirst ang aking pinupuntahan para sa mga internasyonal na paglilipat. Nakakapanatag na malaman na sila ay regulado ng ASIC at rehistrado sa AUSTRAC. Ang paglilipat ng pera ay walang abala, at malinaw sila tungkol sa anumang bayarin na kasama.

Positibo

Alfred

Indonesia

Sa totoo lang, mabibigyan ng 5 star ang WorldFirst, pero hanggang ngayon hindi pa dumarating ang pondo ko, dahil limang araw na. Sinusulat ko ang pagsusuring ito habang naghihintay…

Positibo

葉翰隆

Taiwan

Akala ko ito ay isang foreign exchange platform ngunit ang aking account ay naka-lock noong ako ay nag-withdraw. Hiniling nito sa akin na magbayad ng $5000 bilang margin ngunit maaari ko lamang itong kontakin sa linya. Hindi ako sigurado kung maibabalik ko ang margin.

Paglalahad