Profil perusahaan

| QNB FINANSINVEST Ringkasan Ulasan | |

| Didirikan | 2016 |

| Negara/Daerah Terdaftar | Turki |

| Regulasi | Tidak Diatur |

| Produk & Layanan | Produk investasi, transaksi saham, forex, transaksi investasi luar negeri, VIOP, instrumen utang, waran, derivatif luar negeri, transaksi dana investasi, transaksi dana yang diperdagangkan di bursa, dan konsultasi investasi |

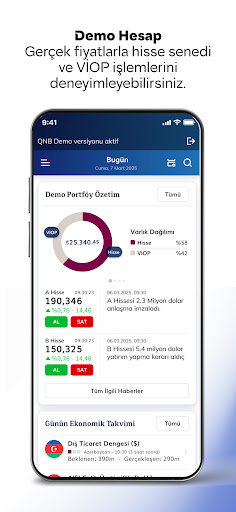

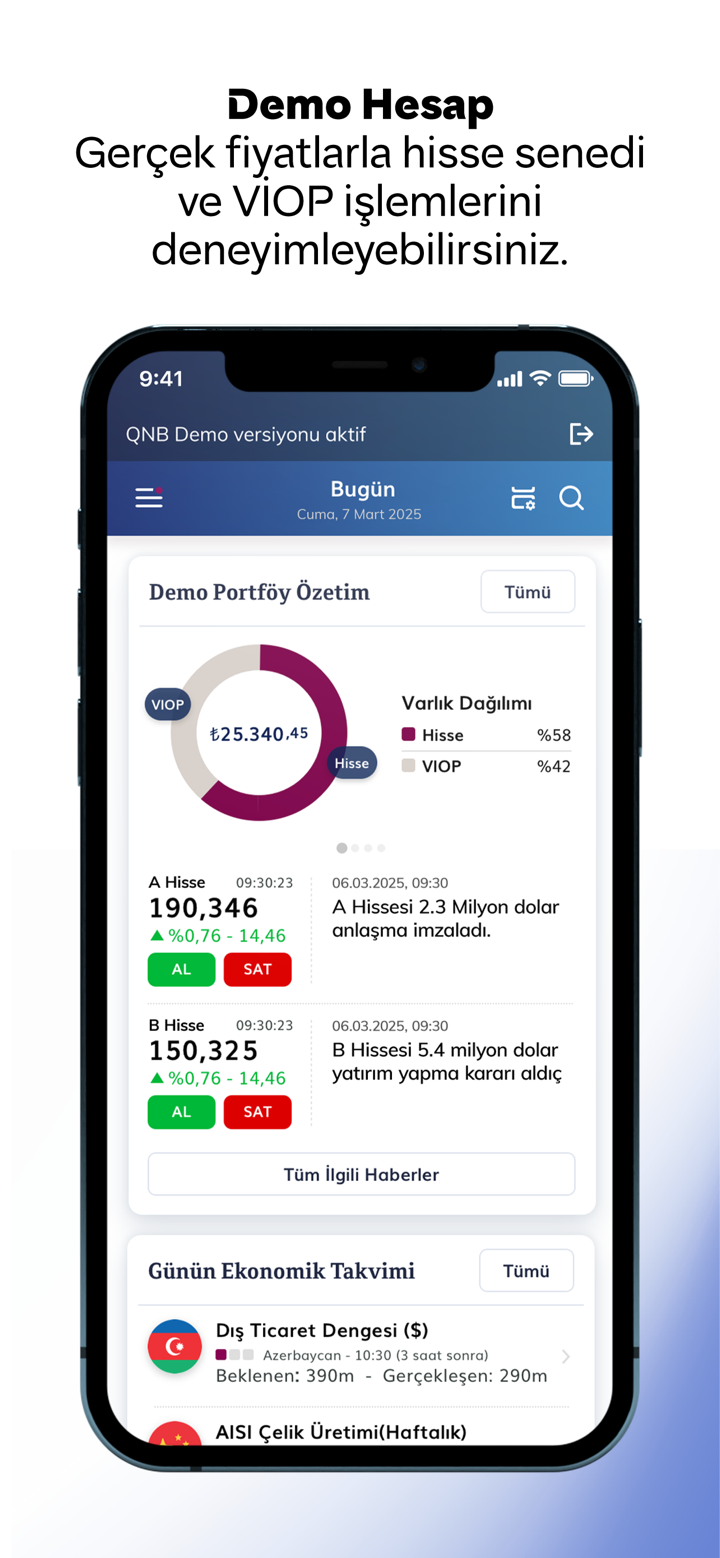

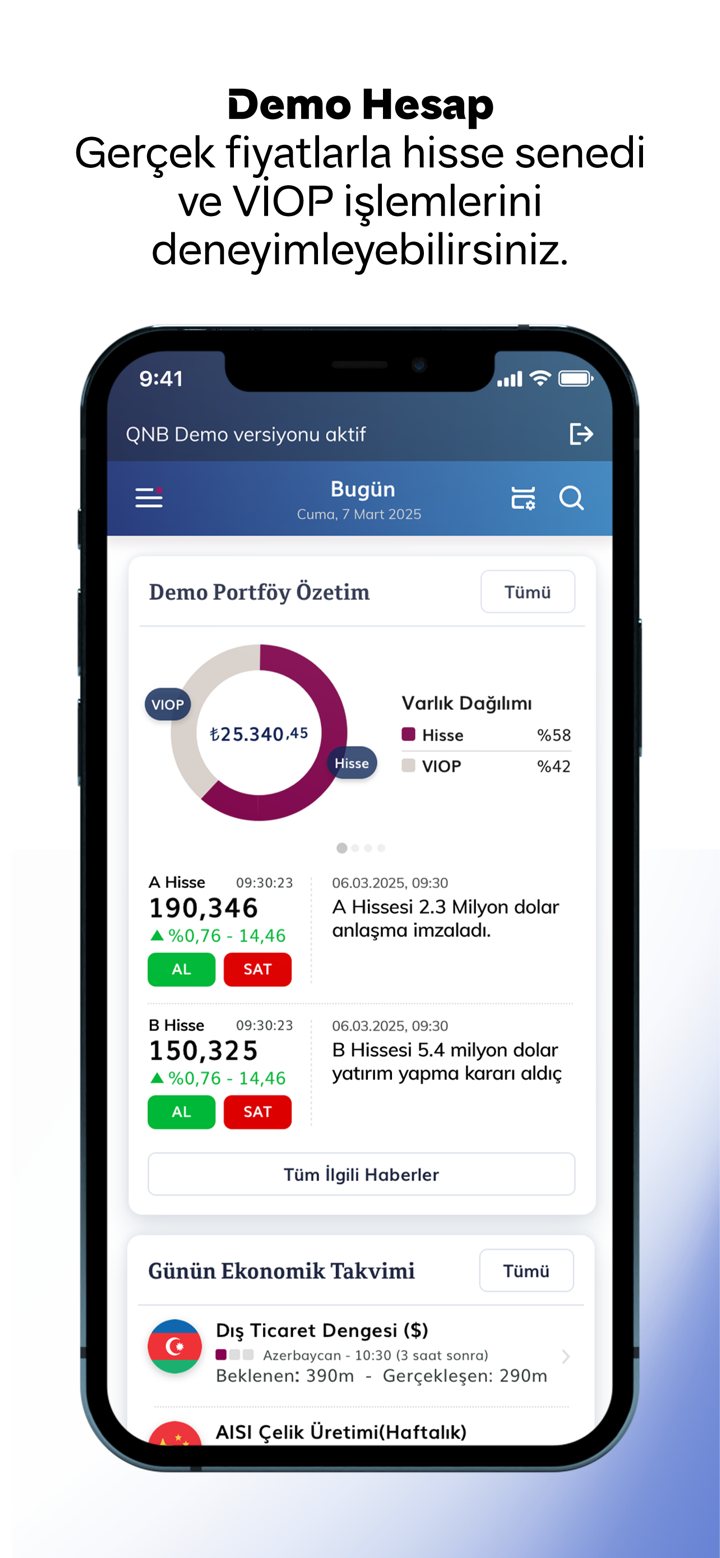

| Akun Demo | ❌ |

| Leverage | / |

| Spread | / |

| Platform Perdagangan | QNB Invest |

| Deposit Minimum | / |

| Dukungan Pelanggan | Obrolan langsung |

| Tel: +90 212 336 7373 | |

| Email: webinfo@qnbfi.com | |

| Twitter, Facebook, Instagram, YouTube, dan Linkedin | |

| Esentepe Mah. Büyükdere Cad. Kristal Kule Binası No: 215 Kat: 6-7 34394 Şişli / İstanbul | |

QNB Finansinvest, didirikan pada tahun 2016 dan berpusat di Turki, adalah lembaga keuangan yang menawarkan berbagai layanan dan produk kepada pelanggannya. Sebagai anak perusahaan dari QNB Group, salah satu lembaga keuangan terkemuka di Timur Tengah dan Afrika dengan aset lebih dari $150 miliar, QNB Finansinvest mendapatkan manfaat dari kekuatan dan stabilitas perusahaan induknya.

Dengan fokus pada manajemen portofolio, penasihat investasi, manajemen kekayaan, perbankan investasi, pendapatan tetap, surat berharga, dan dana investasi, QNB Finansinvest melayani baik klien individu maupun korporat. Sejak didirikan pada tahun 1996, perusahaan ini telah mengumpulkan pengalaman lebih dari 25 tahun dalam kegiatan pasar modal.

Kelebihan dan Kekurangan

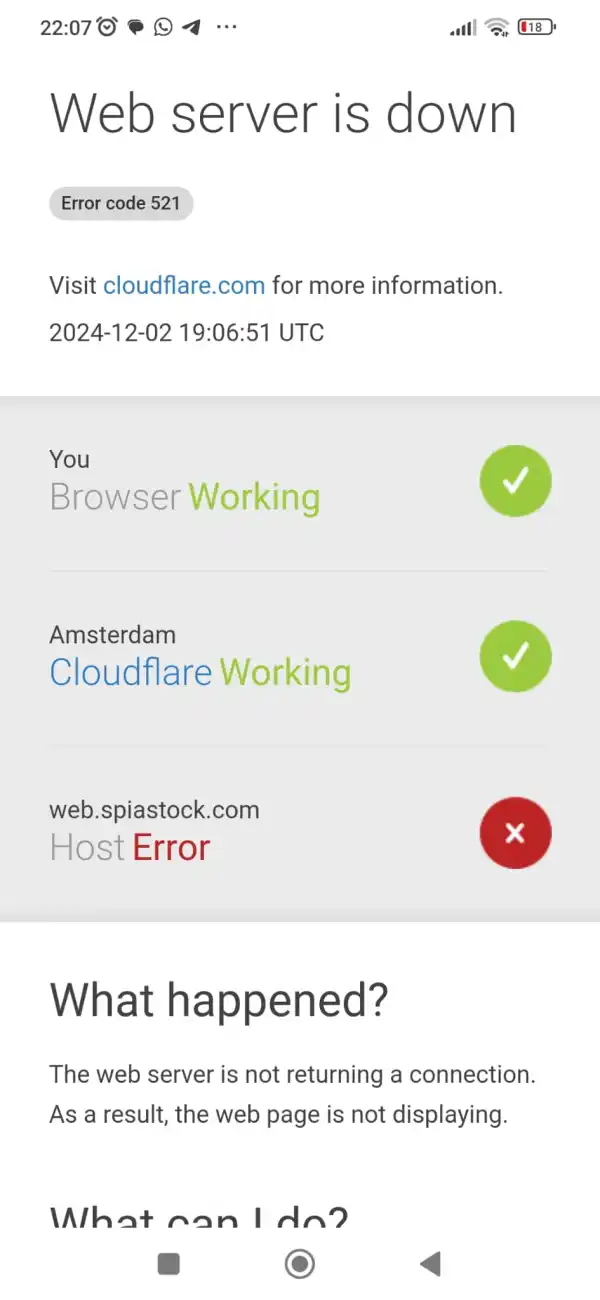

| Kelebihan | Kekurangan |

| Berbagai produk dan layanan | Website tidak dapat diakses |

| Dukungan obrolan langsung | Tidak diatur |

| Tidak ada akun demo | |

| Informasi terbatas tentang kondisi perdagangan | |

| Tidak mendukung MT4/5 |

Apakah QNB FINANSINVEST Legal?

QNB Finansinvest mengklaim bahwa mereka menawarkan langkah-langkah keamanan. Mereka menekankan keunggulan program keamanan enkripsi 128-bit mereka dibandingkan dengan enkripsi SSL-40 bit standar yang digunakan oleh pemain lain di pasar e-bisnis, dengan menyoroti adopsi luasnya oleh perusahaan pialang utama di Turki. Teknologi enkripsi ini dianggap sebagai standar industri, memberikan perlindungan yang lebih baik untuk informasi sensitif yang ditukar di platform mereka.

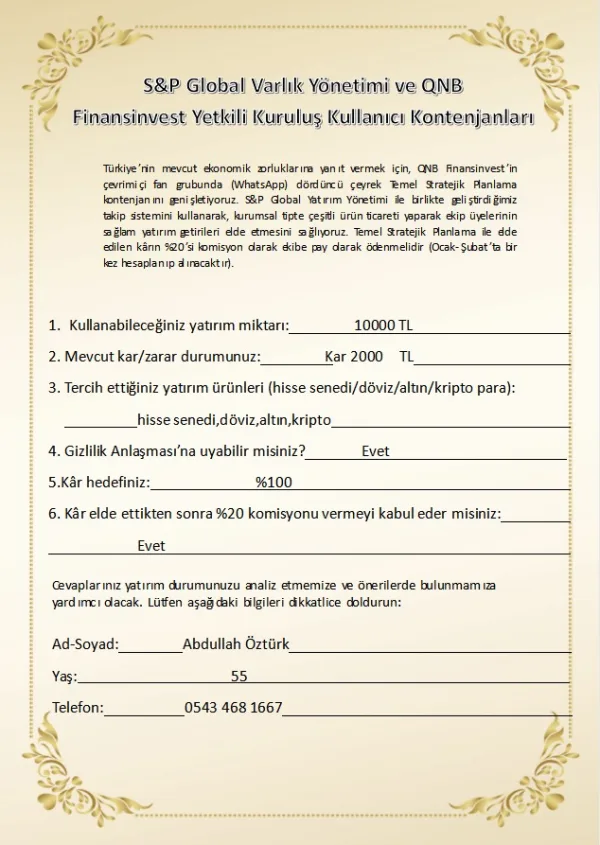

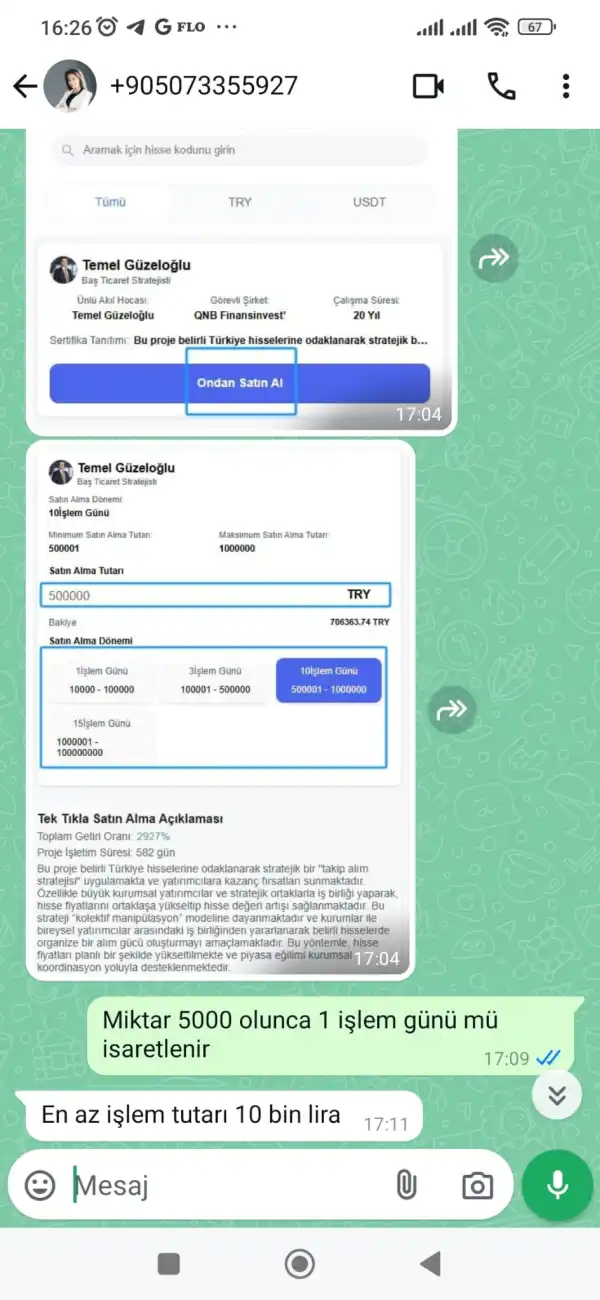

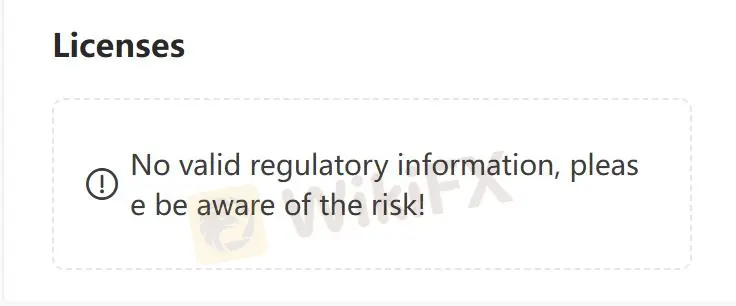

Namun, kekhawatiran yang signifikan muncul dari ketiadaan regulasi yang valid mengatur operasi QNB Finansinvest. Tanpa pengawasan pemerintah atau otoritas keuangan, investor menghadapi risiko inheren. Kurangnya pengawasan regulasi berarti tidak ada badan eksternal yang menjamin kepatuhan terhadap standar industri, praktik terbaik, dan persyaratan hukum. Akibatnya, investor terpapar potensi eksploitasi, karena ketiadaan regulasi memberikan ruang bagi praktik-praktik buruk dan aktivitas penipuan.

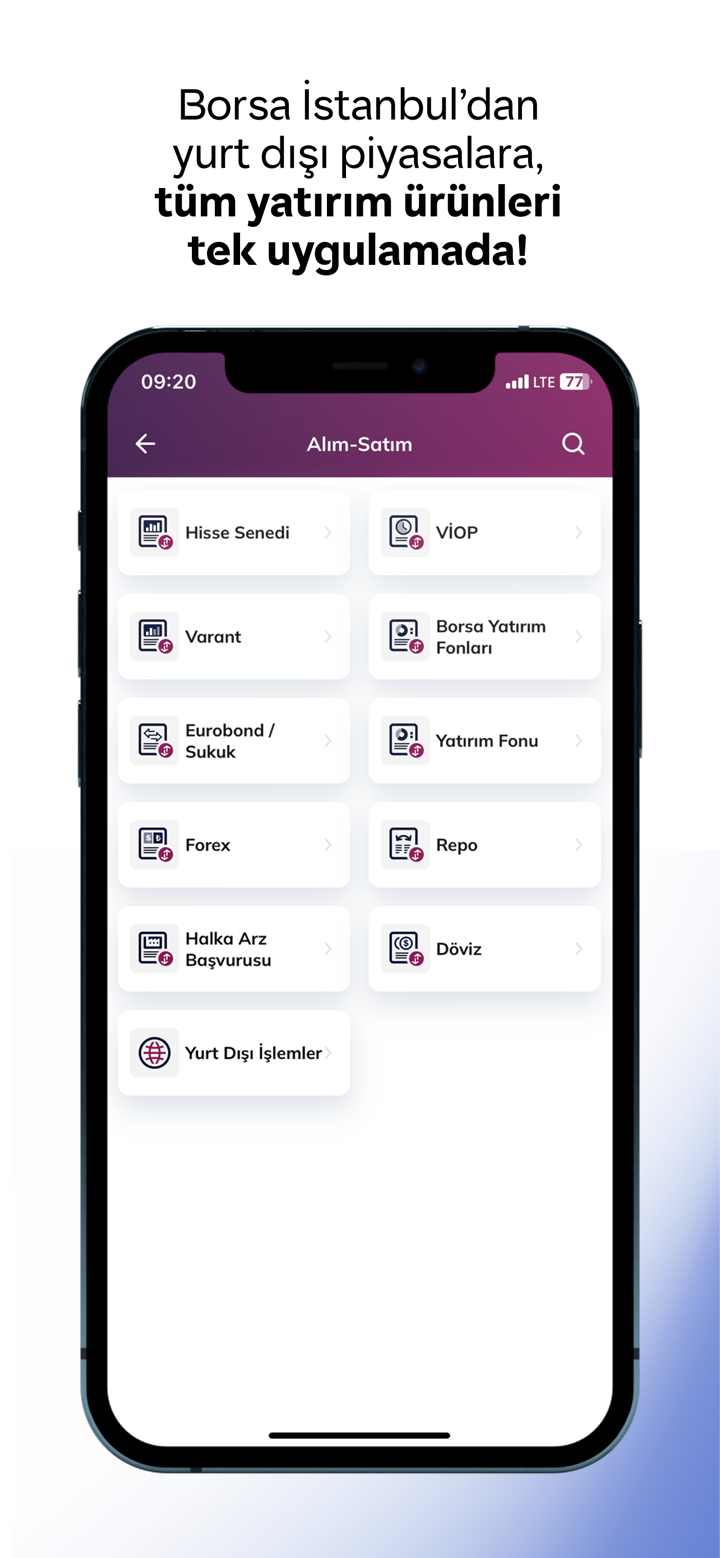

Produk dan Layanan

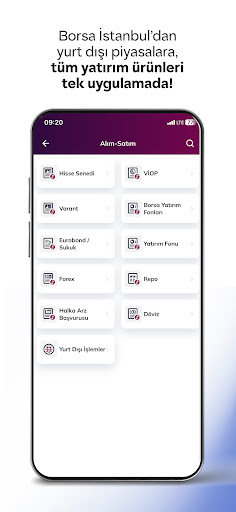

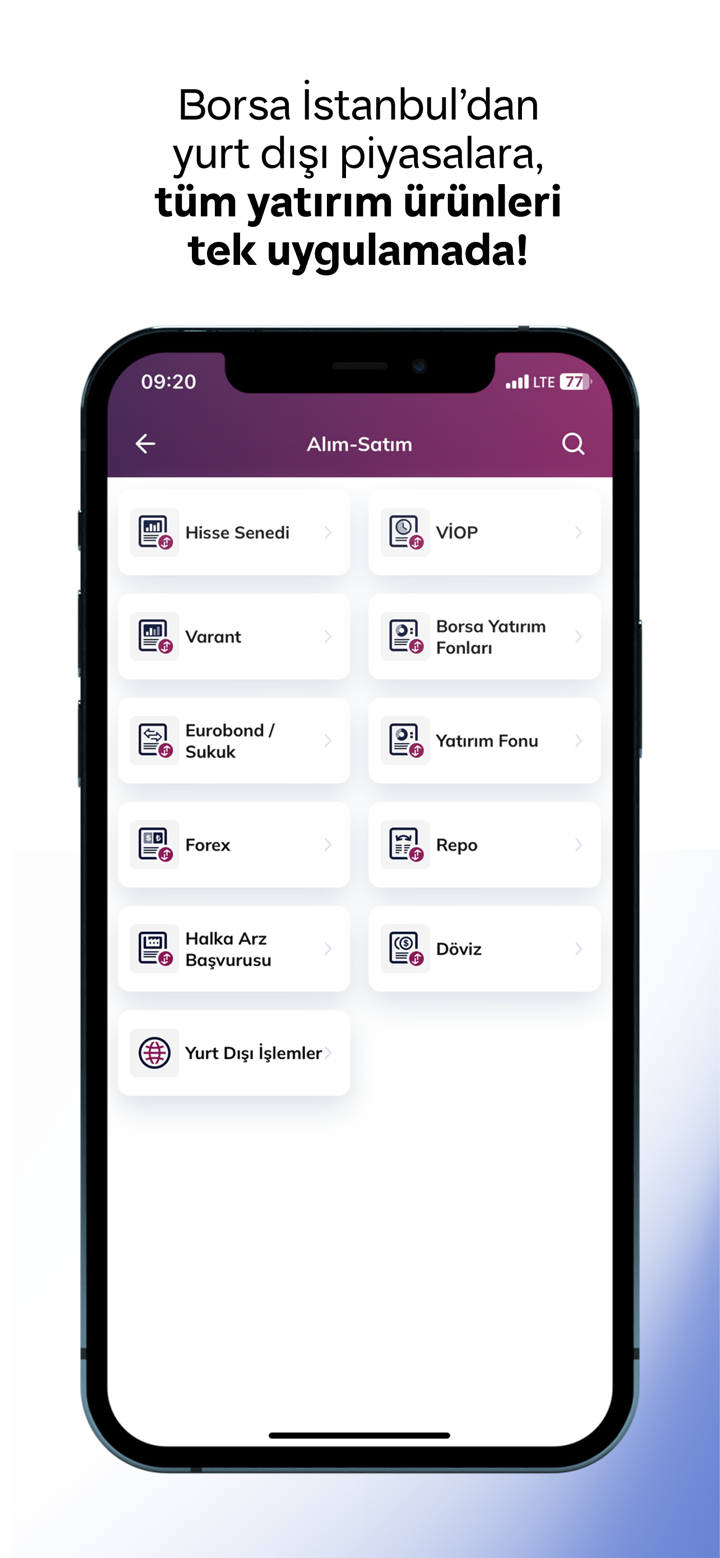

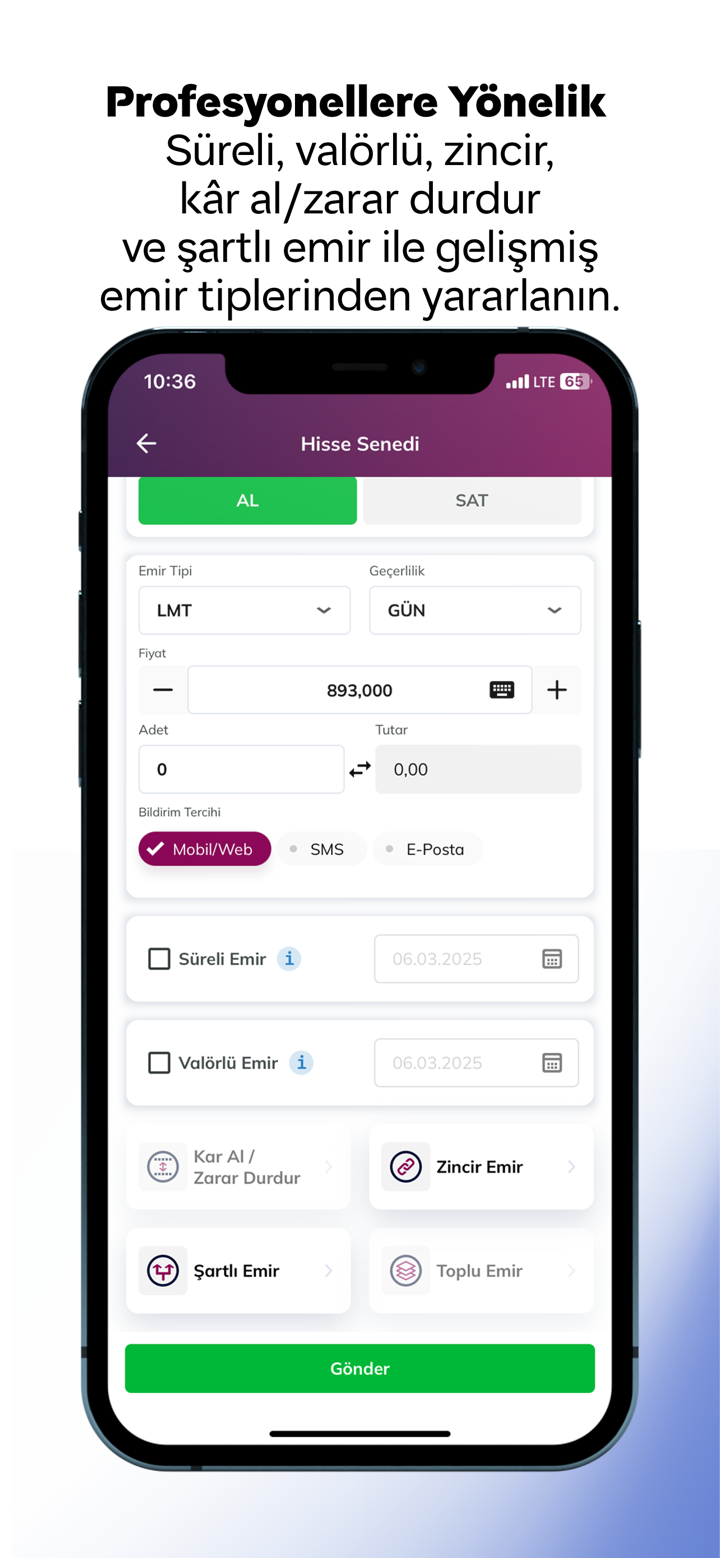

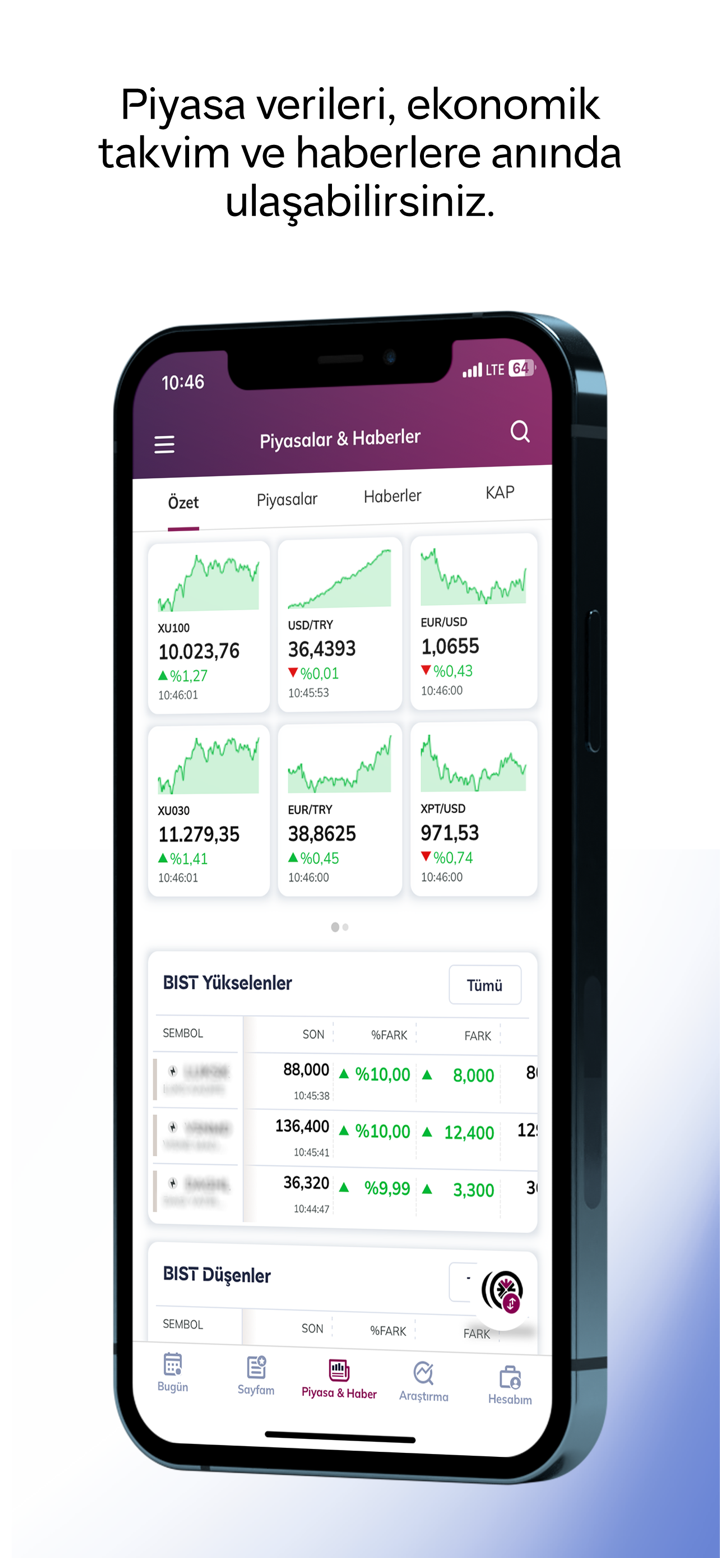

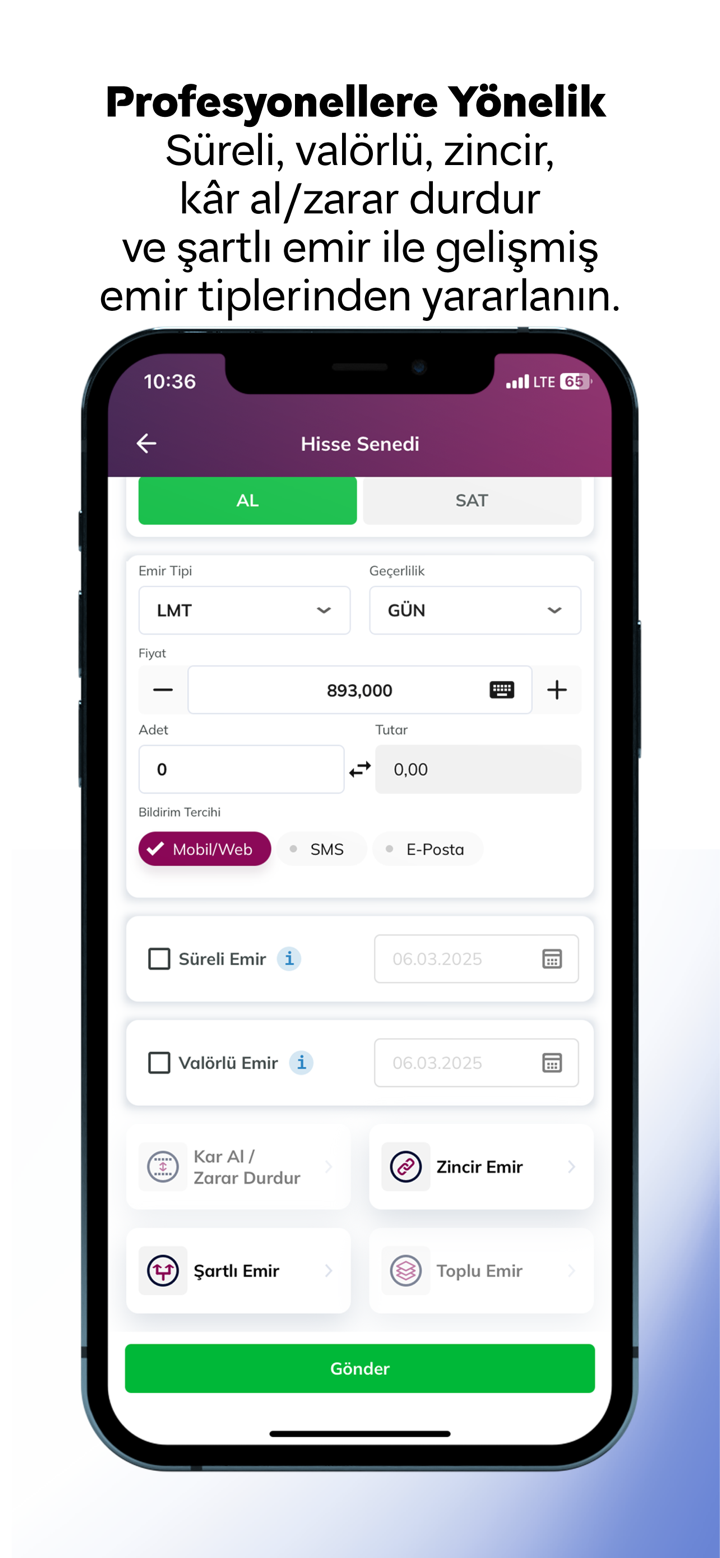

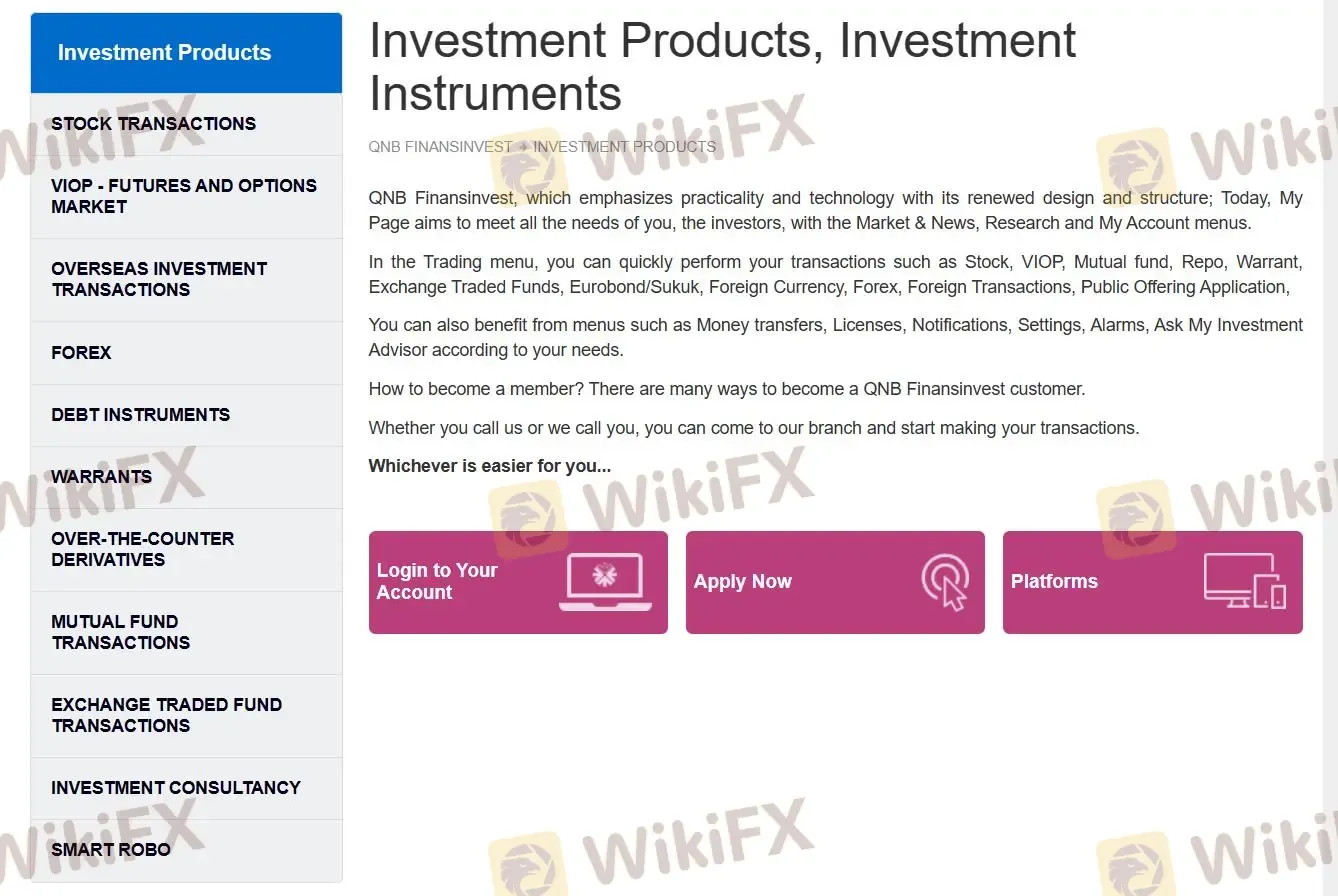

QNB FINANSINVEST menawarkan berbagai produk dan layanan investasi, termasuk produk investasi, transaksi saham, forex, transaksi investasi luar negeri, VIOP, instrumen utang, waran, derivatif over-the-country, transaksi dana investasi, transaksi dana yang diperdagangkan di bursa, dan konsultasi investasi.

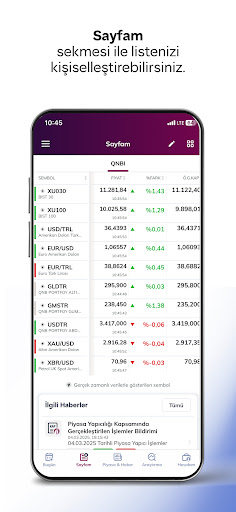

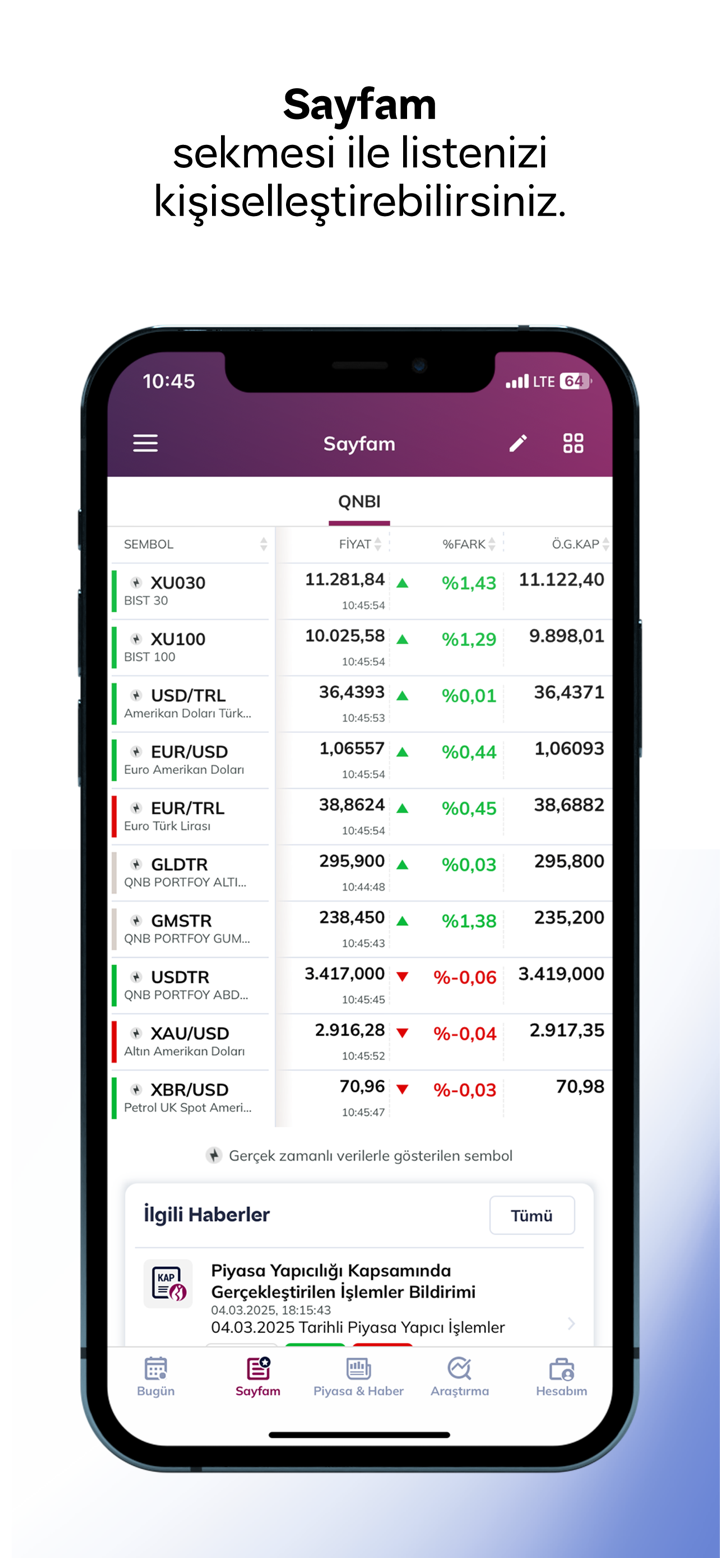

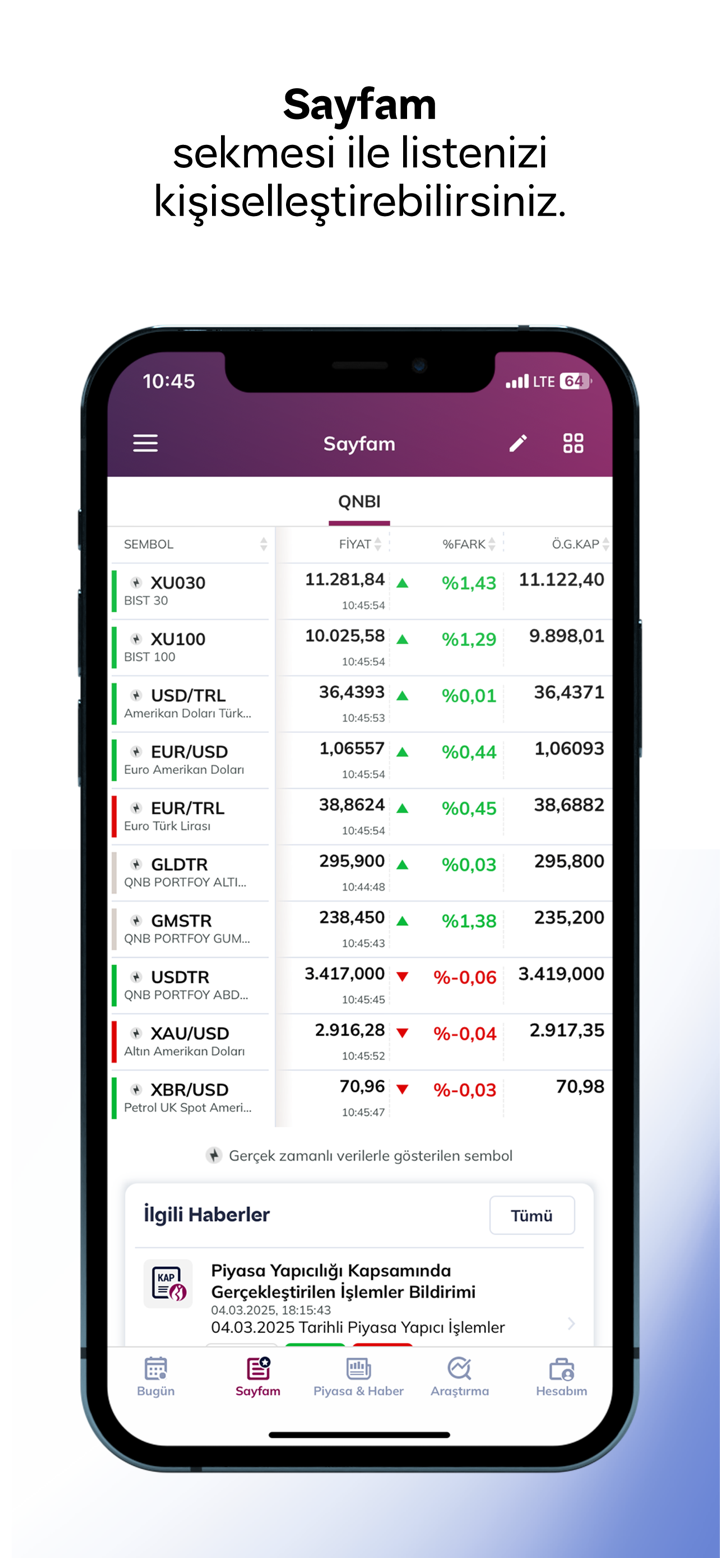

Forex: Pasangan mata uang, komoditas, indeks, dan Forex.

Produk investasi: Saham, VIOP, Reksa dana, Repo, Waran, Dana yang Diperdagangkan di Bursa, Eurobond/Sukuk, Mata Uang Asing, Forex, Transaksi Valas, Aplikasi Penawaran Umum.

VIOP: Membeli dan menjual kontrak saham, indeks saham (BIST-30), kurs mata uang (TL/Dolar, TL/Euro, Euro/Dolar), emas, komoditas, dan listrik dengan jaminan/premium tertentu untuk tujuan lindung nilai, investasi, dan arbitrase sesuai harapan.

Transaksi investasi luar negeri: Saham asing, dana yang diperdagangkan di bursa, eurobond, dan produk sukuk.

Instrumen utang: Produk pendapatan tetap seperti repo, surat utang negara, obligasi pemerintah, eurobond, dan obligasi sektor swasta.

Derivatif over-the-country: Forward, Swap, Futures, Opsi, dan produk terstruktur.

Transaksi dana investasi: Dana pasar uang, dana surat utang sektor swasta, dana surat utang jangka pendek, dana surat utang, dana surat utang eurobond, dana lindung nilai pertama, dana variabel portofolio QNB pertama, dan dana ekuitas utama portofolio ONB.

Transaksi dana yang diperdagangkan di bursa: GOLDIST, USDTR, QOUR, dan GMSTR.

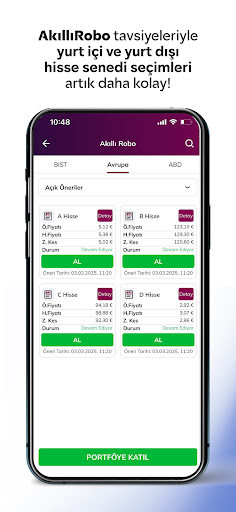

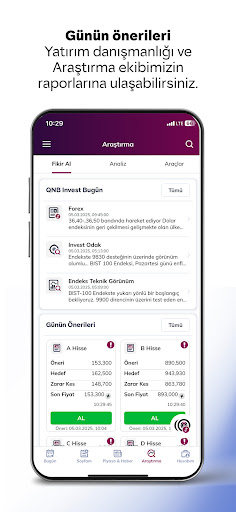

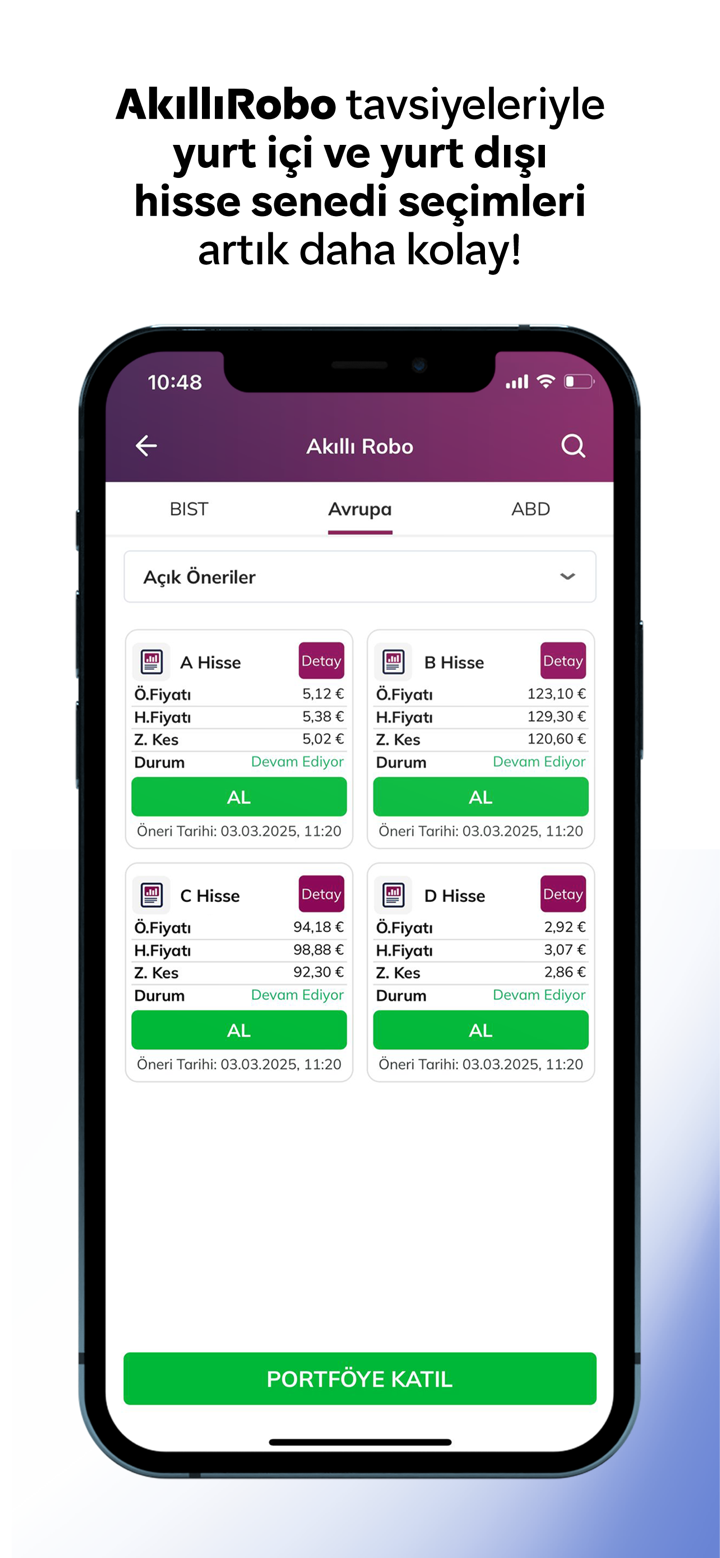

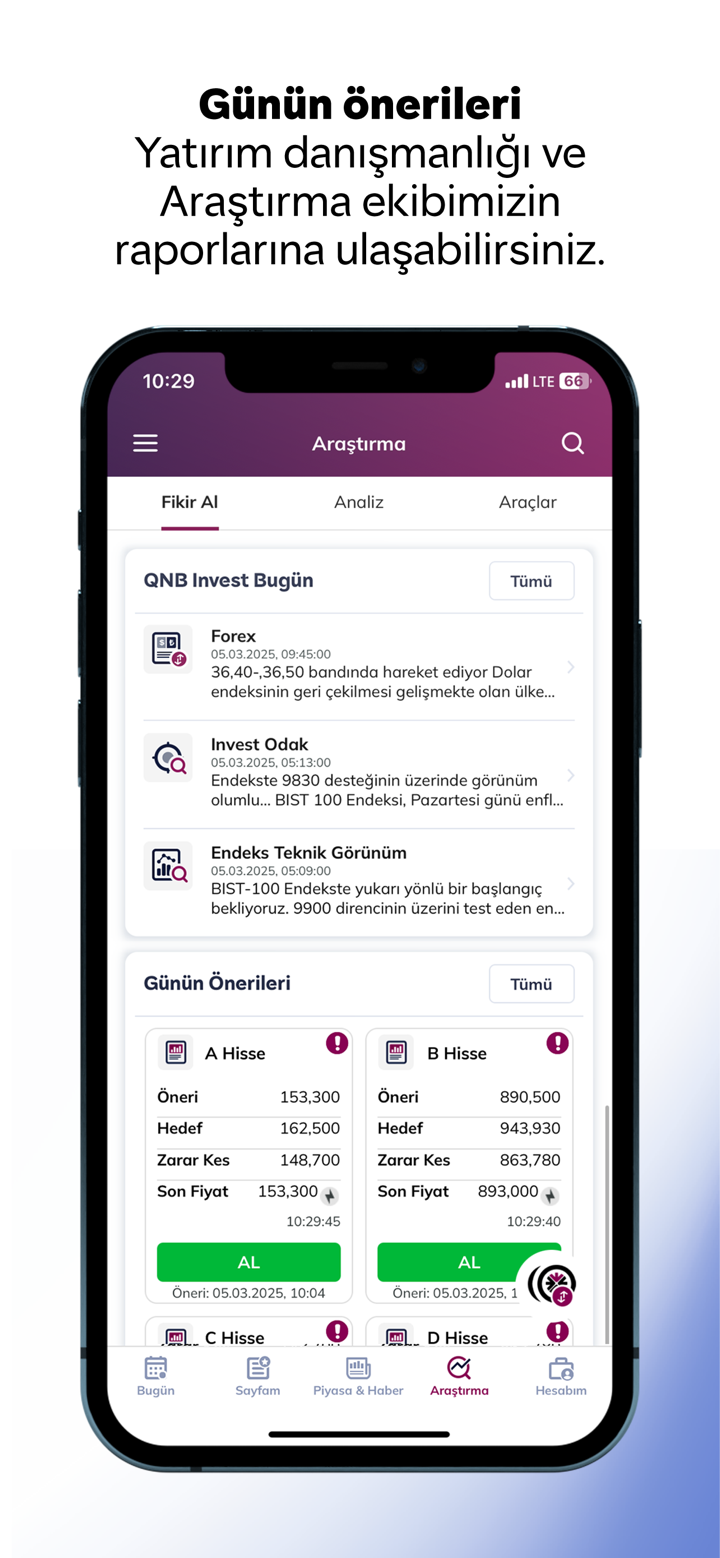

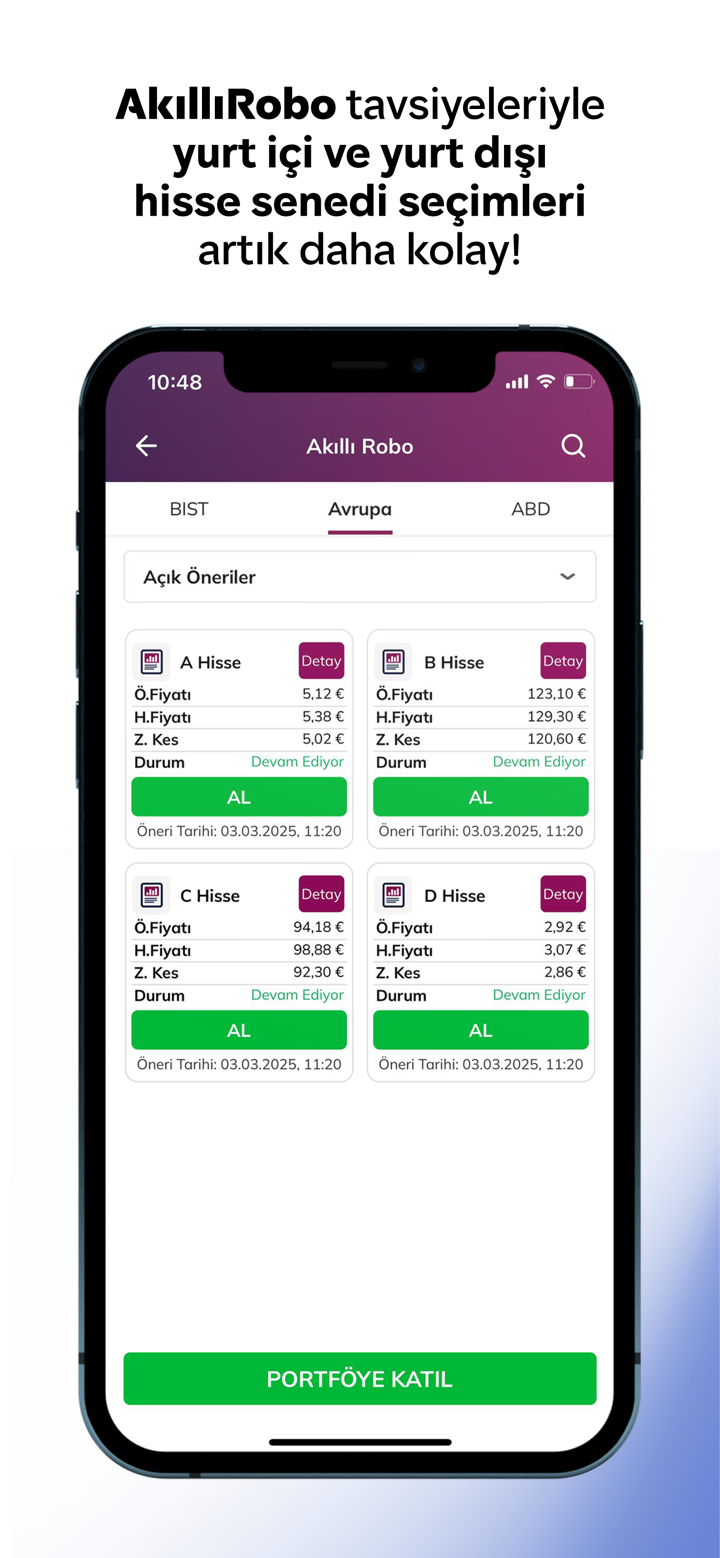

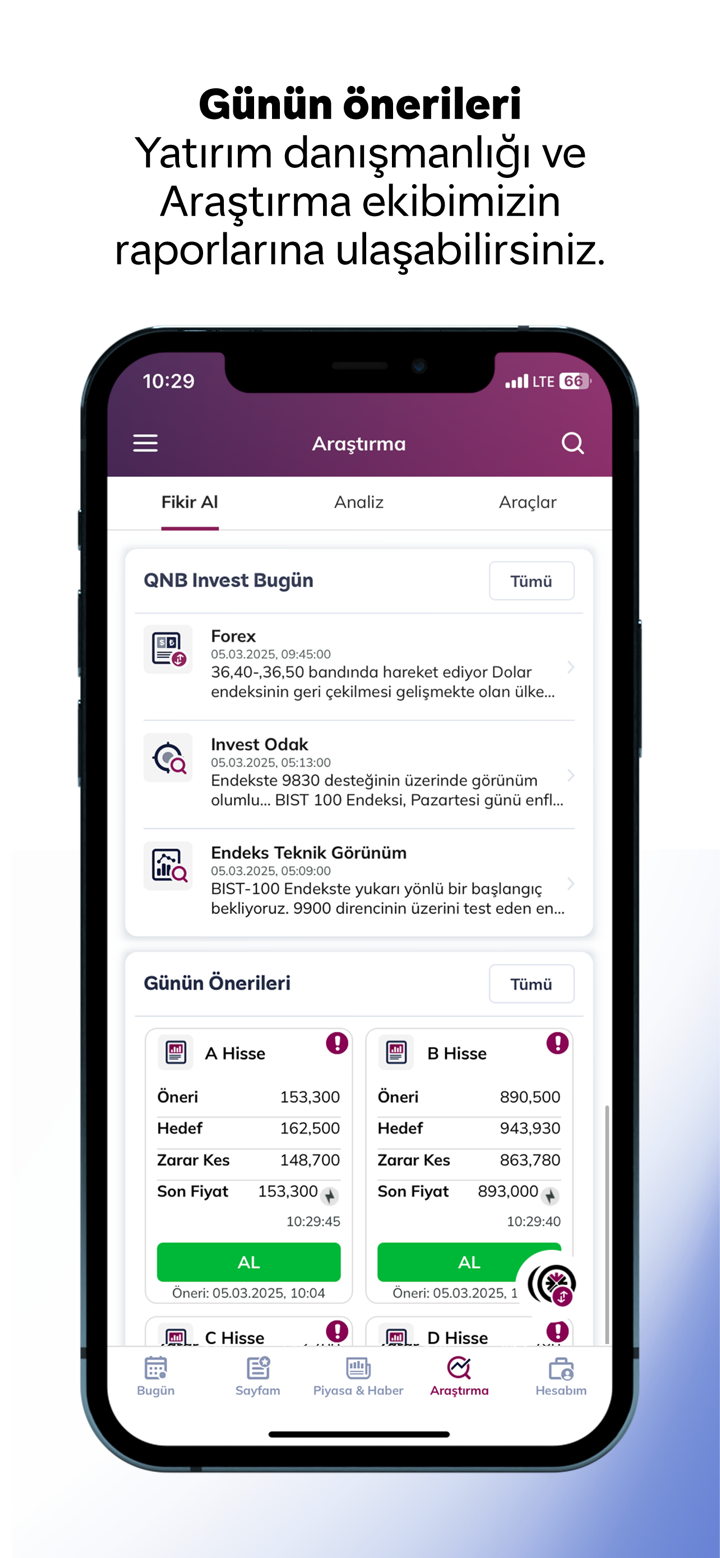

Konsultasi investasi: Rekomendasi perdagangan saham, penasihat investasi, portofolio model, dan dukungan resistensi saham.

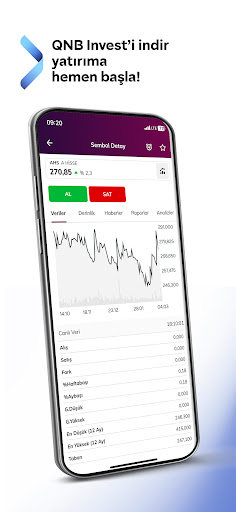

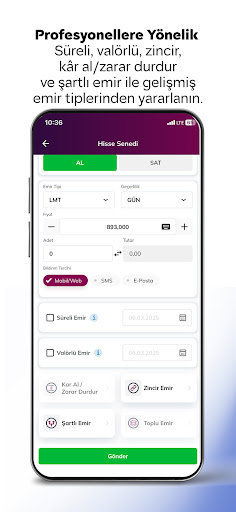

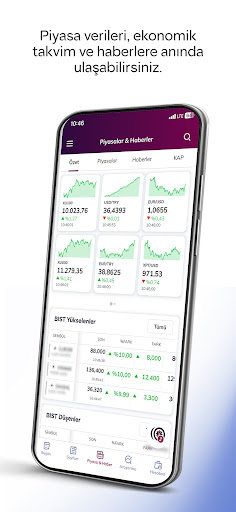

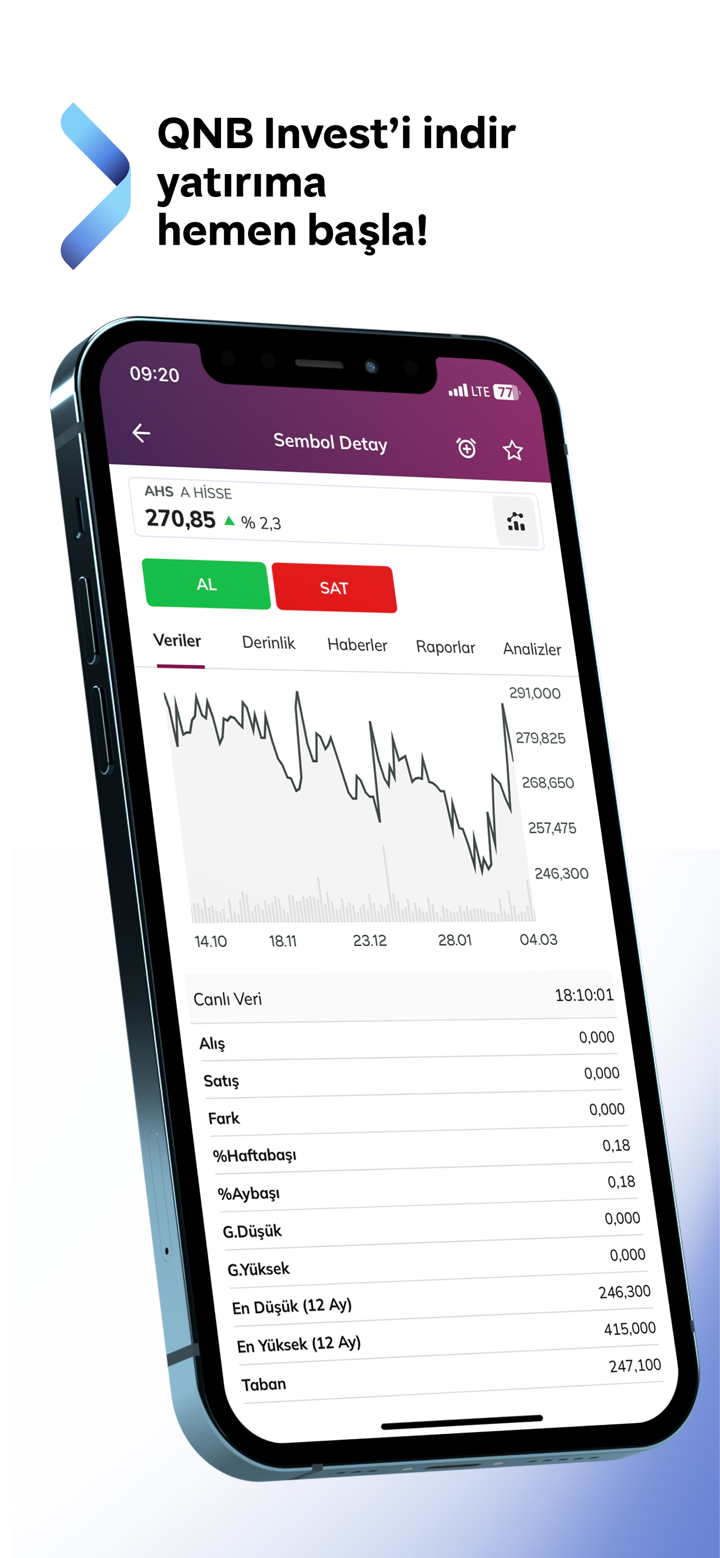

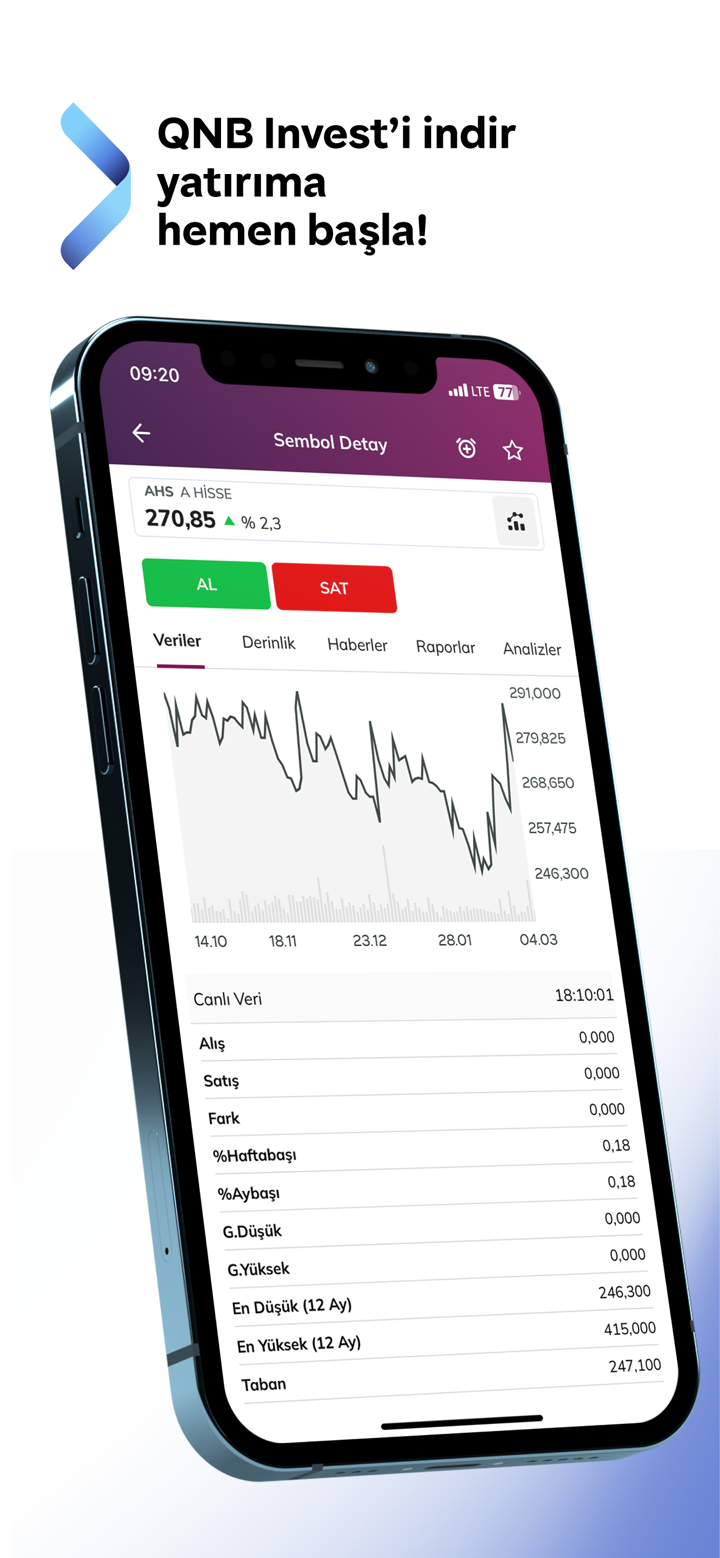

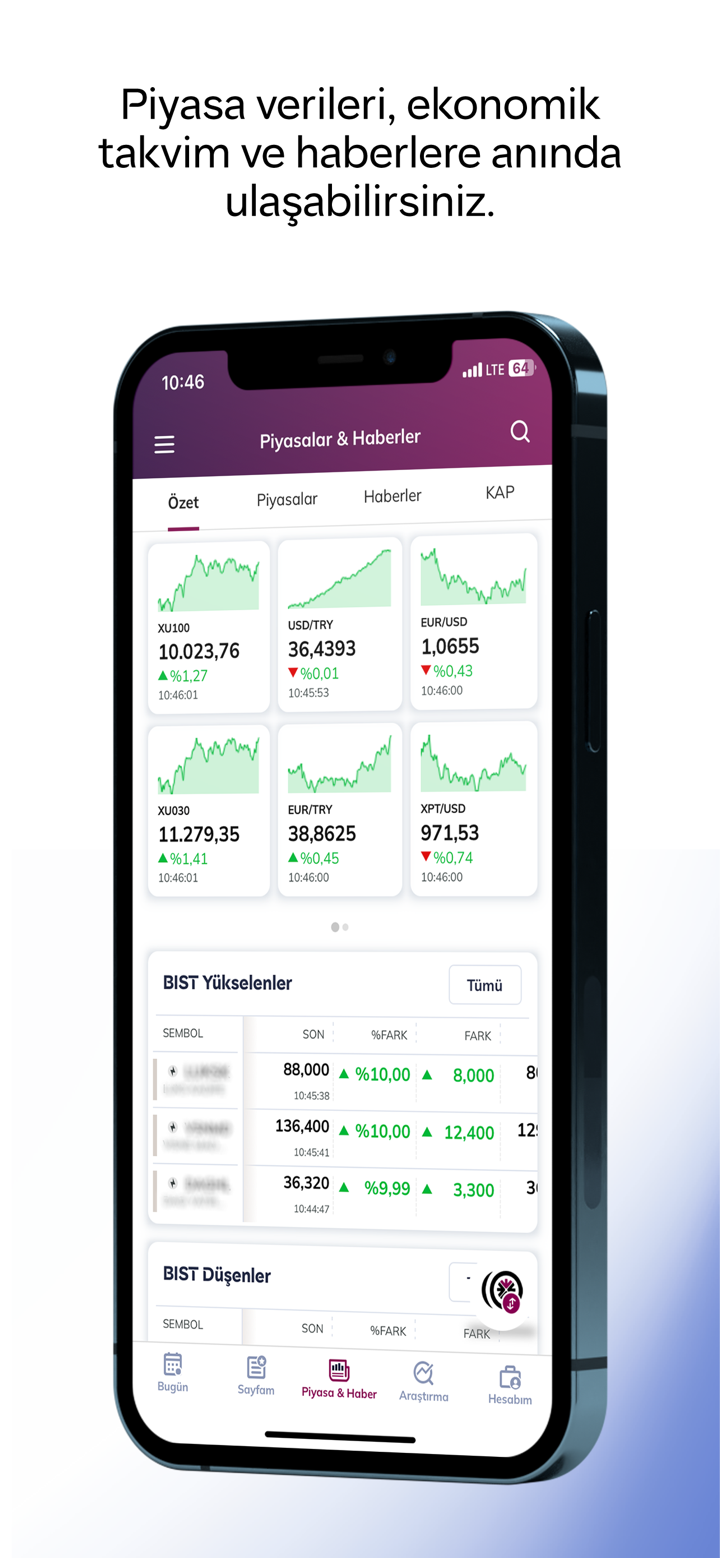

Platform Perdagangan

| Platform Perdagangan | Dukungan | Perangkat Tersedia | Cocok untuk |

| QNB Invest | ✔ | Web, Desktop, tablet, Android, iOS | / |

| MT4 | ❌ | / | Pemula |

| MT5 | ❌ | / | Trader berpengalaman |