Perfil de la compañía

| LIGHT FX Resumen de la revisión | |

| Establecido | 2002 |

| País/Región Registrada | Japón |

| Regulación | Regulado por FSA (Japón) |

| Instrumentos de Mercado | Forex, Criptomonedas |

| Cuenta Demo | / |

| Apalancamiento | Hasta 1:25 |

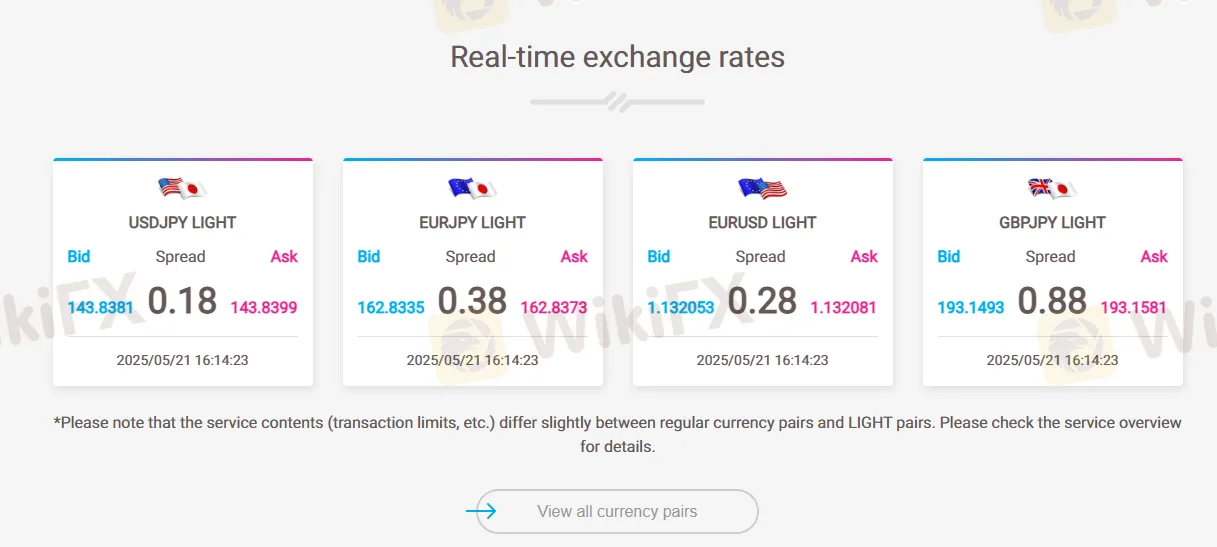

| Spread EUR/USD | Flotante alrededor de 0.28 pips |

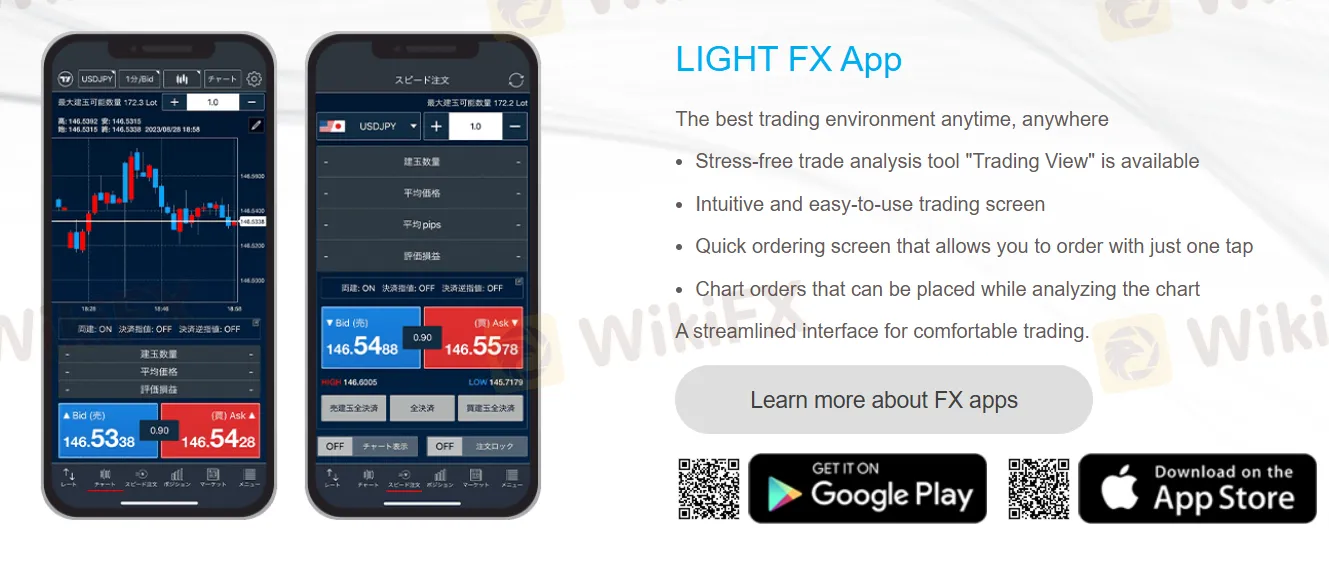

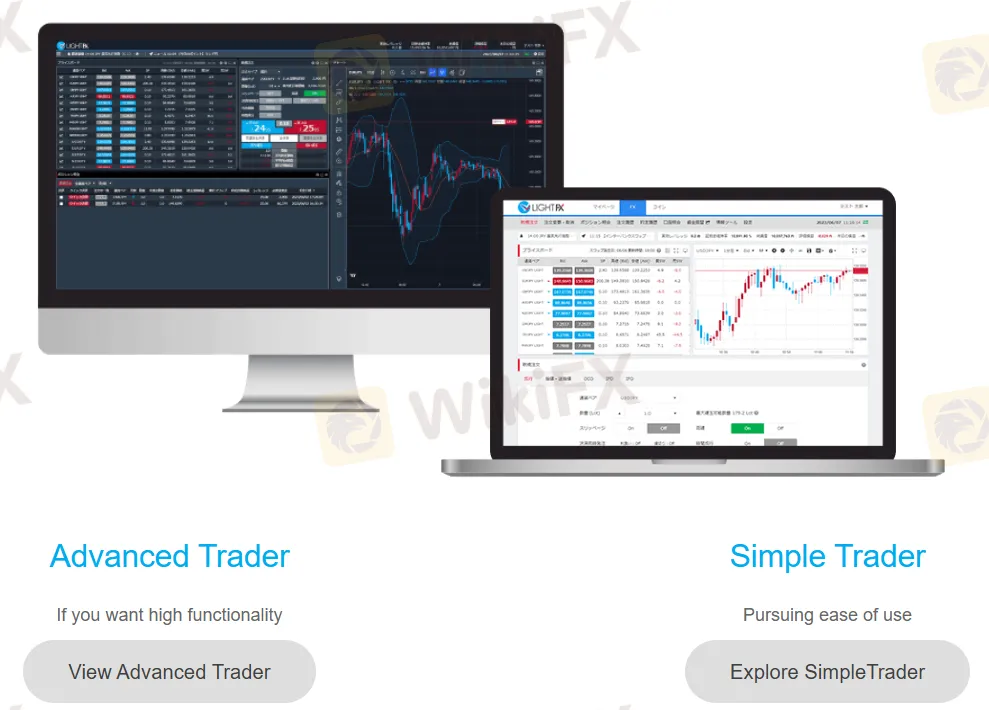

| Plataforma de Trading | Aplicación LIGHT FX, Simple Trader, Advanced Trader |

| Depósito Mínimo | 0 |

| Soporte al Cliente | Formulario de Contacto |

| Tel: 0120-637-105 | |

| Dirección: Traders Securities Co., Ltd. “LIGHT FX” Piso 28, Torre Ebisu Garden Place, 20-3 Ebisu 4-chome, Shibuya-ku, Tokio 150-6028 | |

| Redes Sociales: X | |

Información de LIGHT FX

LIGHT FX es un bróker con sede en Japón fundado en 2002, regulado por FSA. Ofrece trading de Forex y Criptomonedas.

Pros y Contras

| Pros | Contras |

| Regulado por FSA | Activos de trading limitados |

| Múltiples plataformas de trading | Sin soporte para MT4 y MT5 |

| Sin comisión | Sin cuentas demo |

| Permite trading con cantidades pequeñas | |

| Oficina física comprobada | |

| Largo tiempo de operación |

¿Es LIGHT FX Legítimo?

LIGHT FX está regulado por la Agencia de Servicios Financieros (FSA), bajo トレイダーズ証券株式会社, con número de licencia 関東財務局長(金商)第123号.

| Estado Regulatorio | Regulado Por | Institución Licenciada | Tipo de Licencia | Número de Licencia |

| Regulado | Agencia de Servicios Financieros (FSA) | トレイダーズ証券株式会社 | Licencia de Forex Minorista | 関東財務局長(金商)第123号 |

Encuesta de Campo de WikiFX

El equipo de investigación de campo de WikiFX visitó la dirección de LIGHT FX en Japón y encontramos su oficina en el lugar, lo que significa que la empresa opera con una oficina física.

¿Qué puedo comerciar en LIGHT FX?

| Instrumentos de Trading | Soportado |

| Forex | ✔ |

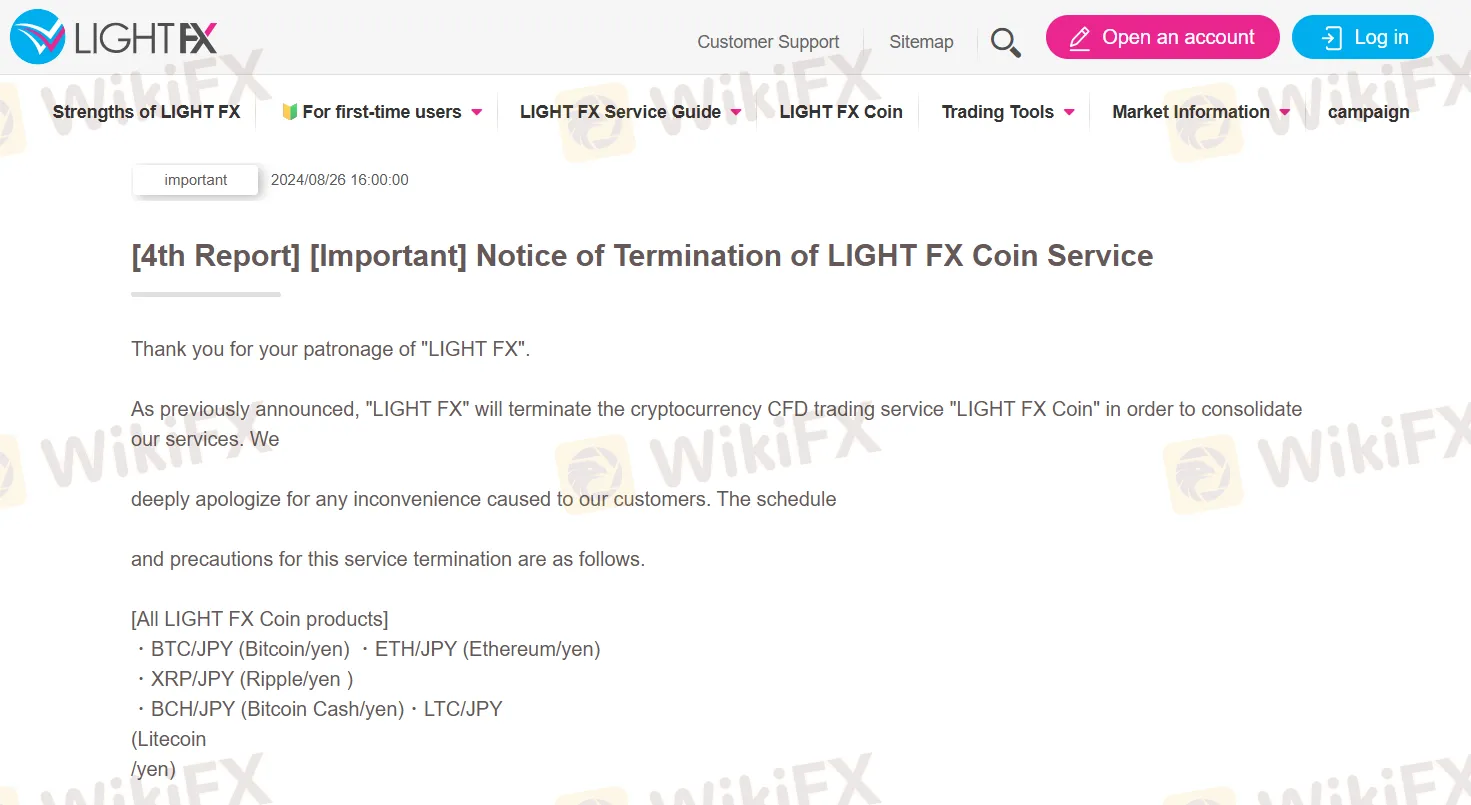

| Criptomonedas | ✔ |

| Mercancías | ❌ |

| Índices | ❌ |

| Acciones | ❌ |

| Bonos | ❌ |

| Opciones | ❌ |

| ETF | ❌ |

Apalancamiento

LIGHT FX ofrece un apalancamiento de hasta 1:25, dependiendo del instrumento y tipo de cuenta. El apalancamiento permite a los traders controlar posiciones más grandes con un capital más pequeño, amplificando tanto las ganancias potenciales como las pérdidas.

Plataforma de Trading

| Plataforma de Trading | Soportado | Dispositivos Disponibles | Adecuado para |

| App de LIGHT FX | ✔ | iOS, Android | / |

| Trader Simple | ✔ | Web (basado en navegador) | / |

| Trader Avanzado | ✔ | Web (basado en navegador) | / |

| MT4 | ❌ | / | Principiantes |

| MT5 | ❌ | / | Traders experimentados |

Depósito y Retiro

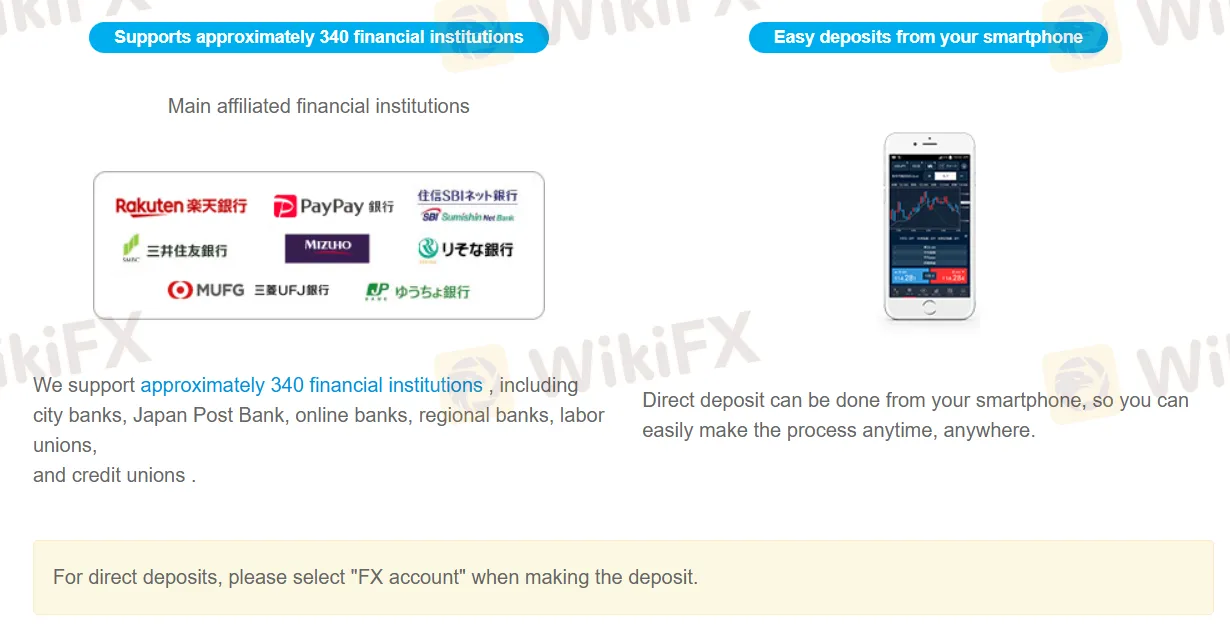

LIGHT FX no tiene un requisito de depósito mínimo, lo cual es ideal para nuevos inversores y aquellos que no tienen mucho capital para invertir.

| Método de Depósito | Depósito Mínimo | Comisión de Depósito | Tiempo de Depósito |

| Transferencia Bancaria | 0 | 0 | Menos de 24 horas |

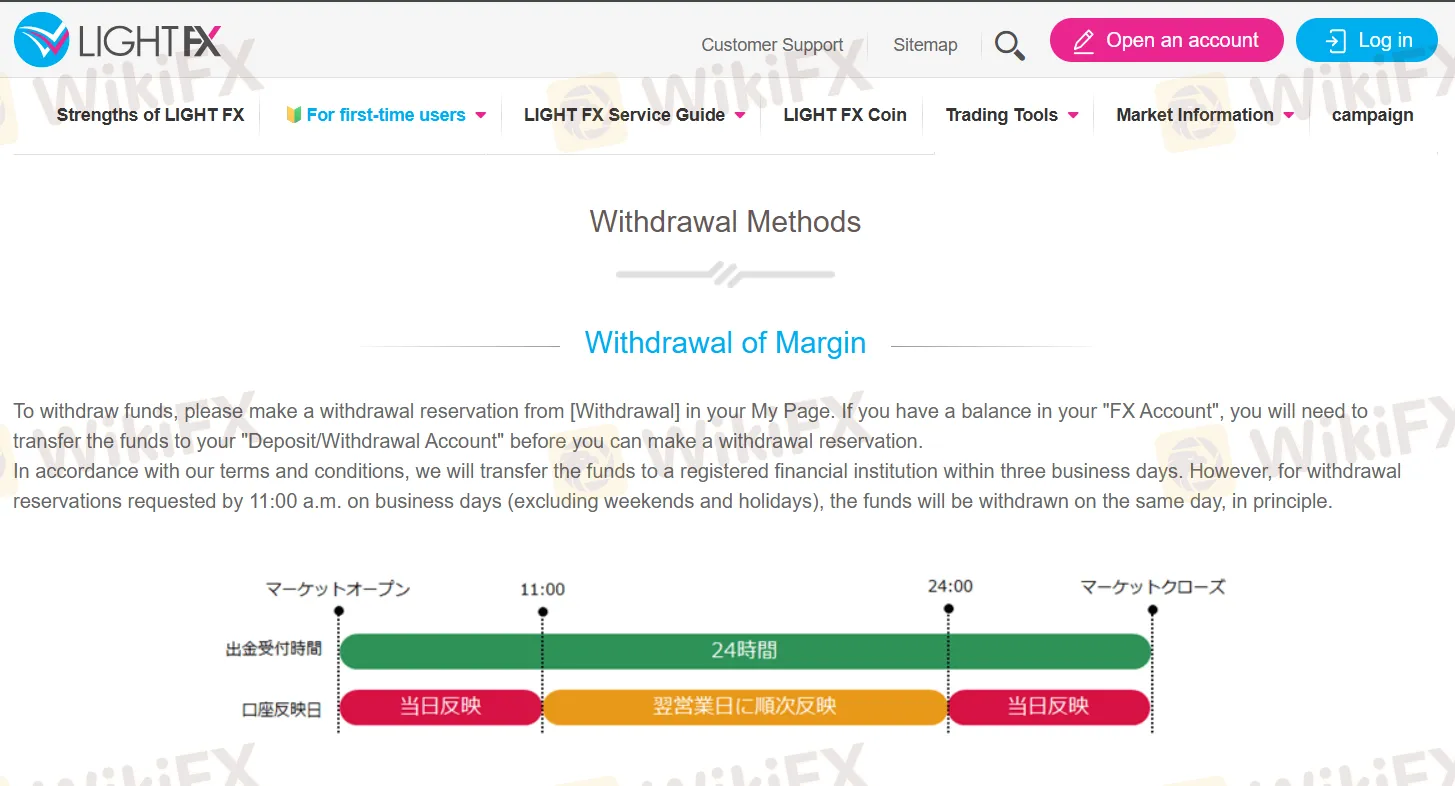

El servicio de retiro es proporcionado por LIGHT FX, con un monto mínimo de retiro de JPY 2000, con un tiempo de retiro de 3 días hábiles.

| Método de Retiro | Retiro Mínimo | Comisión de Retiro | Tiempo de Retiro |

| Transferencia Bancaria | JPY 2000 | / | 3 días hábiles |