Información básica

Chipre

ChipreCalificación

Chipre

|

De 15 a 20 años

|

Chipre

|

De 15 a 20 años

| https://www.gpbfs.com.cy/

Sitio web

Índice de calificación

influencia

D

índice de influencia NO.1

Hungría 2.42

Hungría 2.42 Licencias

LicenciasInstitución autorizada:GPB Financial Services Ltd

Número de regulación:113/10

Núcleo único

1G

40G

1M*ADSL

Chipre

Chipre gpbfs.com.cy

gpbfs.com.cy Rusia

Rusia

| GPB FS Resumen de la reseña | |

| Fundación | 2009 |

| País/Región Registrada | Chipre |

| Regulación | CySEC |

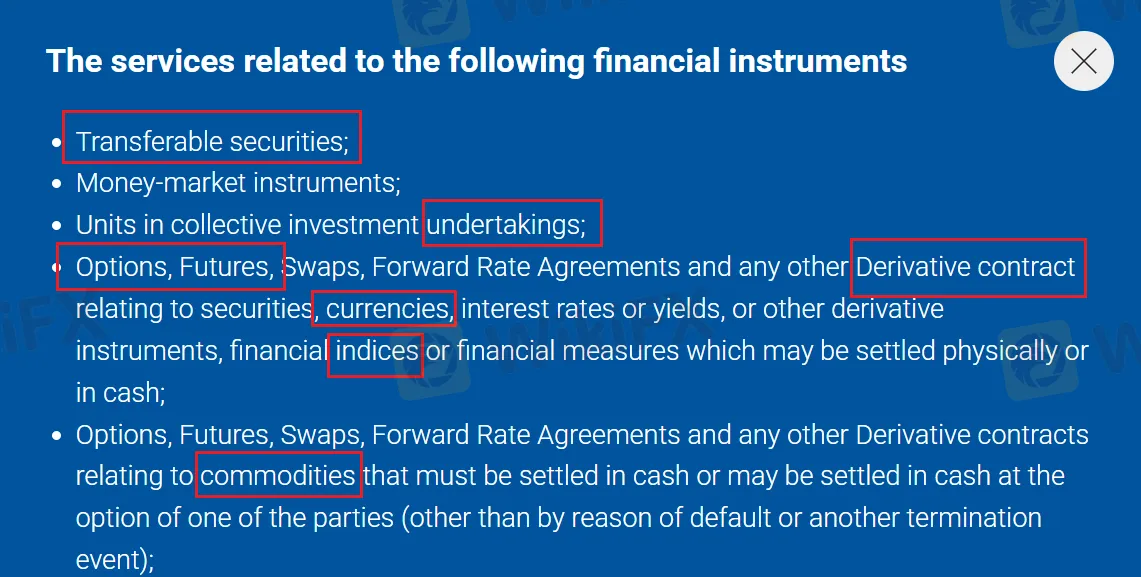

| Instrumentos de Mercado | Acciones, Forex, Futuros, Opciones, Índices, Materias primas, Derivados, Bonos |

| Cuenta Demo | / |

| Apalancamiento | / |

| Spread | / |

| Plataforma de Trading | / |

| Depósito Mínimo | / |

| Soporte al Cliente | Tel: +357 25 055 000 / +357 25 055 100 |

| Fax: +357 25 055 101 | |

| Email: brokerage@gpbfs.com.cy | |

| Dirección: 65 Spyrou Kyprianou Ave, Mesa Geitonia, Crystalserve Business Center, 2nd Floor 4003 Limassol, Chipre | |

GPB FS es una empresa que ofrece servicios de inversión y servicios financieros. Está registrada en Chipre y regulada por CySEC. GPB FS proporciona acciones, forex, futuros, opciones, índices, materias primas, derivados, bonos, etc. Desafortunadamente, GPB FS no proporciona suficiente información sobre los detalles de trading.

| Pros | Contras |

| Varios productos de trading | Falta de transparencia |

| Regulación CySEC | |

| Larga historia de operación | |

| Múltiples canales de contacto |

Sí, GPB FS está regulado por CySEC.

| Autoridad Reguladora | Comisión de Valores y Bolsa de Chipre (CySEC) |

| Estado Actual | Regulado |

| País Regulado | Chipre |

| Entidad Regulada | GPB Financial Services Ltd |

| Tipo de Licencia | Creador de Mercado (MM) |

| Número de Licencia | 113/10 |

| Instrumentos Negociables | Soportado |

| Acciones | ✔ |

| Forex | ✔ |

| Futuros | ✔ |

| Opciones | ✔ |

| Índices | ✔ |

| Productos Básicos | ✔ |

| Derivados | ✔ |

| Bonos | ✔ |

| Criptomonedas | ❌ |

| ETFs | ❌ |

Based on my research and direct experience in evaluating forex brokers, I found that GPB FS does not provide specific information regarding spreads for major currency pairs like EUR/USD on their standard accounts. This lack of transparency is a concern for me as a trader because spread information is essential—it's one of the main factors that directly affect trading costs and overall profitability. While GPB FS is regulated by CySEC in Cyprus and boasts a relatively long operational history, the fact that they do not disclose key trading conditions, such as typical spreads or account types, means I cannot give a reliable assessment of what to expect regarding costs per trade. From a risk management and trustworthiness perspective, I am always cautious with brokers that are not upfront about their trading conditions. Too much uncertainty around basic costs like spreads might make it challenging to plan trades effectively or to compare this broker with others where fee structures are clearer. For anyone considering trading with GPB FS, I recommend contacting their support directly to request up-to-date spread information and making sure all trading terms are fully understood before making any financial commitment. In my view, transparency is non-negotiable when selecting a broker to trust with my funds.

As an experienced forex trader, I've always prioritized transparency when choosing a broker, especially regarding total trading costs on instruments like indices. When assessing GPB FS, I found it troubling that there is no publicly available or detailed breakdown of their trading costs for indices such as the US100. According to my review, their official online sources and regulatory filings do not provide essential figures such as spreads, commissions, or overnight financing rates. This lack of disclosure is a significant red flag for me. While GPB FS is regulated by CySEC in Cyprus and has been active for over 15 years, even longstanding regulatory status does not substitute for clear and accessible information about trading fees. The absence of these details makes it virtually impossible for me to calculate the total costs I would incur when trading major indices, and such uncertainty increases the risk of encountering unexpected or unfavorable charges. From experience, hidden or vaguely described costs can erode trading profitability, particularly on leveraged instruments like the US100. Since transparent cost structures are vital to maintaining trust and managing risk, I personally would not proceed with trading indices at GPB FS until they provide comprehensive cost information directly and unambiguously. Traders should be extremely cautious about engaging with any broker under these opaque conditions, as unexpected fees can pose a significant risk to your capital.

As an experienced forex trader who values both transparency and robust regulatory safeguards, I approach brokers like GPB FS with particular attention to detail, especially concerning fees and trading conditions. Based on what is currently disclosed, I found it challenging to identify any specific information about GPB FS's commission charges, spread rates, or precise fee structure. The lack of transparent disclosure on such fundamental elements makes it difficult for me to fully assess their cost of trading or compare GPB FS with other brokers I've used. The regulatory oversight by CySEC and the firm's long-standing presence—more than 15 years in business—are positive factors. Typically, brokers regulated in Cyprus are expected to adhere to certain standards regarding fee disclosure and client protection. However, with GPB FS, I could not locate any breakdown of costs related to trading spreads, commissions per lot, overnight financing, deposit/withdrawal fees, or minimum deposit requirements. As someone accustomed to making informed decisions, this lack of clear fee information is a major consideration for me, as hidden costs and non-transparent pricing can have a material impact on trading profitability. Given my cautious approach to financial services, I believe it is essential for traders to have upfront and verifiable information about all trading costs before opening an account or making significant deposits. Without these details, I would personally hesitate to commit substantial capital or rely on GPB FS as a primary broker. Clarity and openness about fees are non-negotiable for ensuring my own risk management and financial well-being.

Reflecting on my due diligence process as a forex trader, I can confirm that GPB FS is regulated and overseen by a recognized financial authority. Specifically, GPB FS holds a license as a Market Maker under the supervision of the Cyprus Securities and Exchange Commission (CySEC), with license number 113/10. This means the company operates in accordance with the regulatory standards established by CySEC, which is the government body responsible for overseeing investment firms in Cyprus. In my experience, a CySEC license generally signifies a certain level of compliance with European regulatory requirements for client fund protection and operational transparency. However, I always remind myself that regulation alone does not guarantee a risk-free trading environment. It's essential to consider the overall reputation, transparency, and operational track record of any broker, even those under CySEC oversight. While GPB FS appears to meet the basic criteria of regulatory oversight, I would continue to exercise caution and thoroughly research all facets of their service before making any significant financial commitment. In my trading journey, I have learned that being conservative and diligent with such checks helps prevent potential pitfalls.

Ingrese...

TOP

TOP

Chrome

Extensión de Chrome

Consulta regulatoria de bróker de Forex global

Navegue por los sitios web de los brokers de divisas e identifique con precisión los brokers legítimos y los fraudulentos.

Instalar ahora