Unternehmensprofil

| CloudfuturesÜberprüfungszusammenfassung | |

| Gegründet | 2019 |

| Registriertes Land/Region | China |

| Regulierung | CFFE |

| Marktinstrumente | Futures |

| Demo-Konto | ❌ |

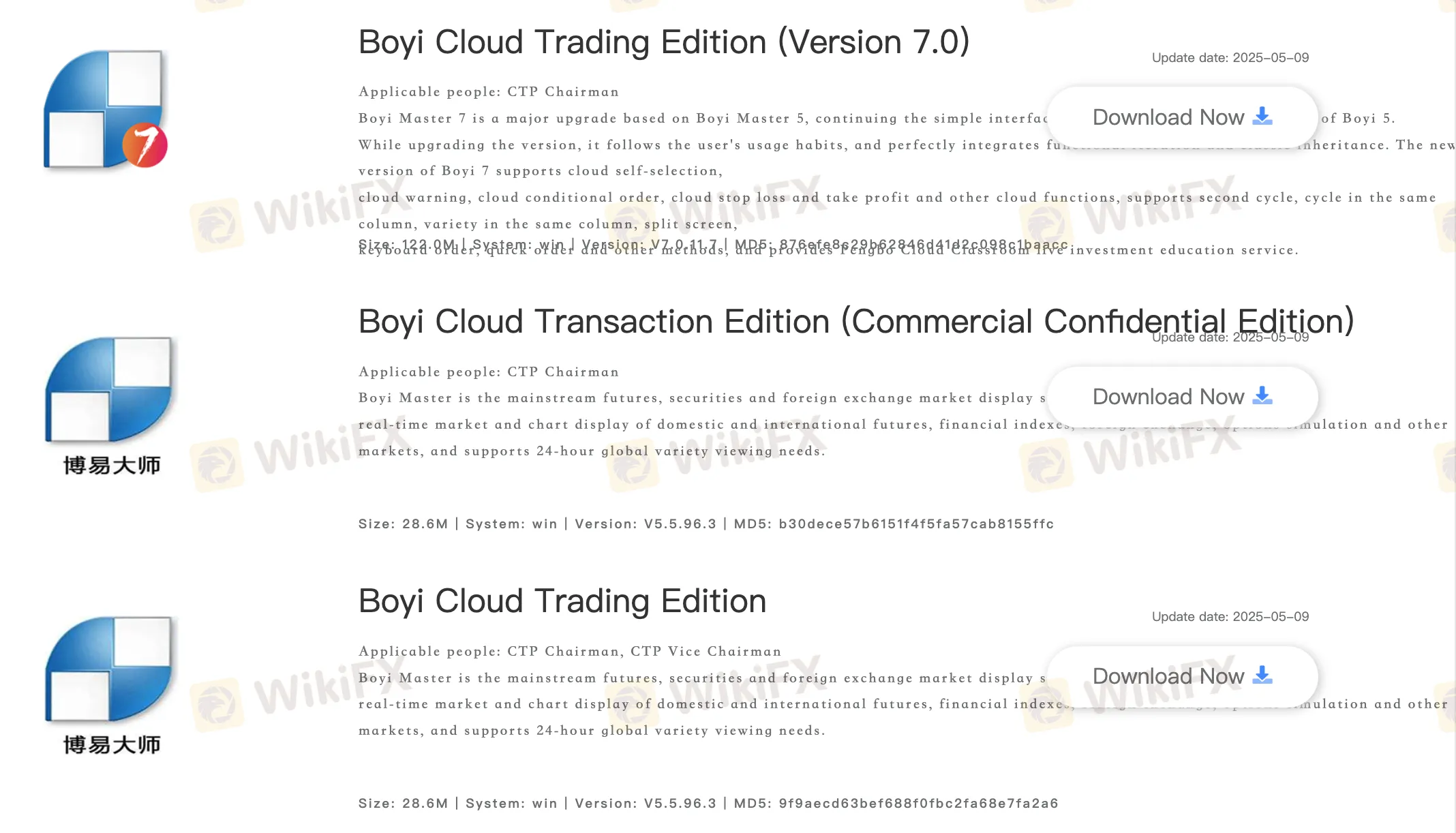

| Handelsplattform | Boyi Cloud Trading Edition (Version 7.0), Boyi Cloud Transaction Edition (Commercial Confidential Edition), Boyi Cloud Trading Edition, Panlifang Cloud Wealth Special Edition, Quick Issue V2 (Commercial Confidential Version), Quick Issue V3 (Commercial Confidential Version), Fast Issue V2, Quick Issue V3, etc. |

| Kundenbetreuung | Tel: 4001119992 |

| E-Mail: YCFQH@cloudfutures.cn | |

Cloudfutures Informationen

Cloudfutures ist ein regulierter Broker, der Handelsdienstleistungen für Futures auf verschiedenen Handelsplattformen anbietet. Der Broker bietet keine Demokonten und nur wenige Informationen zu den Handelsbedingungen. Da nur wenige Informationen bereitgestellt werden, fehlt es an Transparenz auf der Website.

Vor- und Nachteile

| Vorteile | Nachteile |

| Verschiedene Handelsplattformen | Keine Demokonten |

| Gut reguliert | Wenige Kontaktmöglichkeiten |

| Fehlende Transparenz |

Ist Cloudfutures legitim?

Ja. Cloudfutures ist von der CFFEX lizenziert, um Dienstleistungen anzubieten.

| Reguliertes Land | Regulierungsbehörde | Aktueller Status | Reguliertes Unternehmen | Lizenztyp | Lizenznummer |

| China Financial Futures Exchange | Reguliert | 云财富期货有限公司 | Futures-Lizenz | 0240 |

Was kann ich bei Cloudfutures handeln?

Cloudfutures bietet den Handel mit Futures an.

| Handelbare Instrumente | Unterstützt |

| Futures | ✔ |

| Forex | ❌ |

| Waren | ❌ |

| Indizes | ❌ |

| Aktien | ❌ |

| Kryptowährungen | ❌ |

| Anleihen | ❌ |

| Optionen | ❌ |

| ETFs | ❌ |

Handelsplattform

Der Broker bietet verschiedene Handelsplattformen an, darunter Boyi Cloud Trading Edition (Version 7.0), Boyi Cloud Transaction Edition (Commercial Confidential Edition), Boyi Cloud Trading Edition, Panlifang Cloud Wealth Special Edition, Quick Issue V2 (Commercial Confidential Version), Quick Issue V3 (Commercial Confidential Version), Fast Issue V2, Quick Issue V3, Fast Issue V2, Quick Issue V3, Winshun Cloud Trading Software (wh6), Cloud Wealth Futures, Travel, Disk Cube, Cloud Wealth Polestar 9.5, Cloud Wealth Polestar 9.5 MacOS, Cloud Wealth Polestar 8.5, Infinite Easy und Simulation Boyi Master.

Verfügbare Geräte: Desktop und Mobilgeräte.

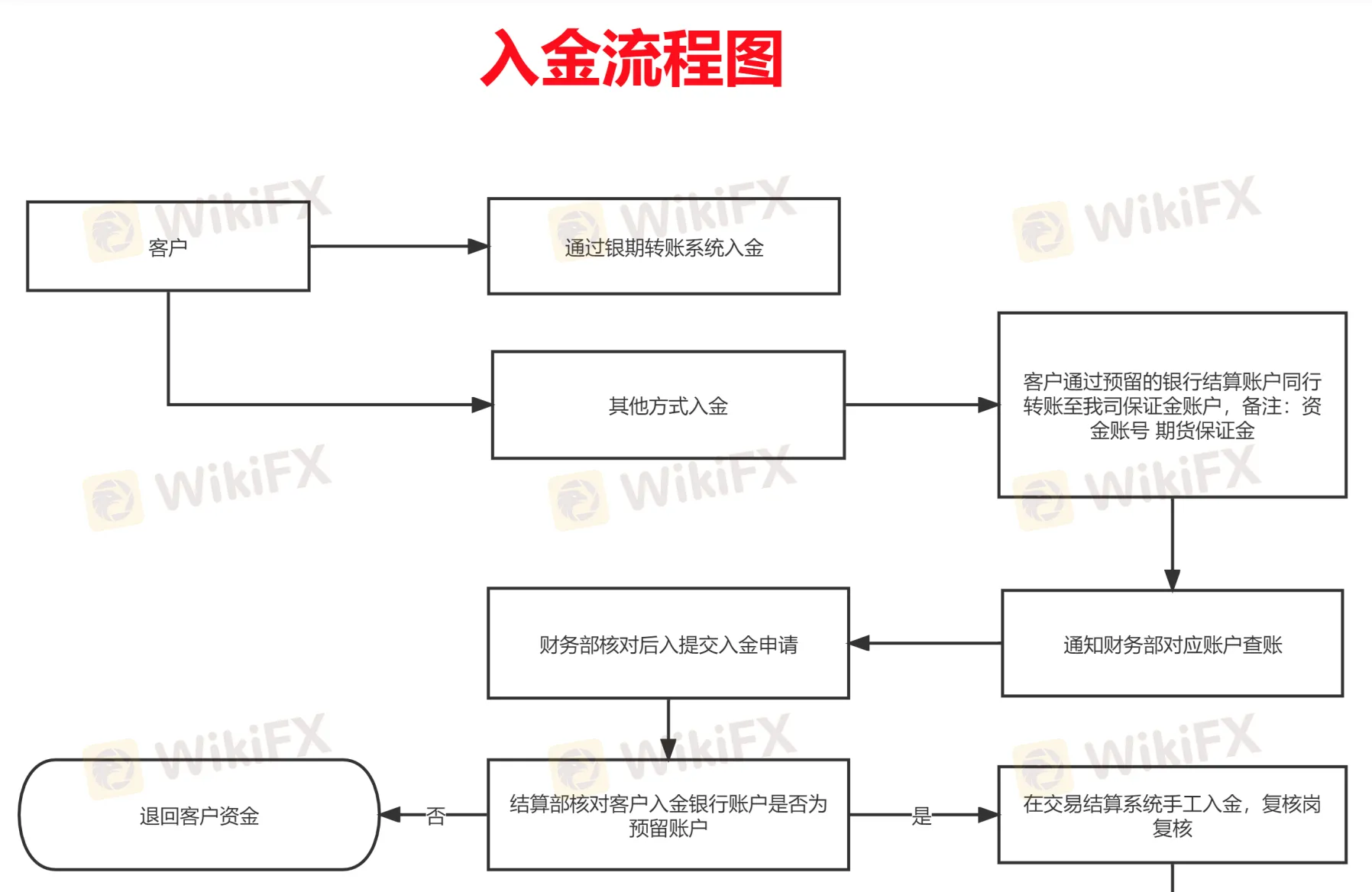

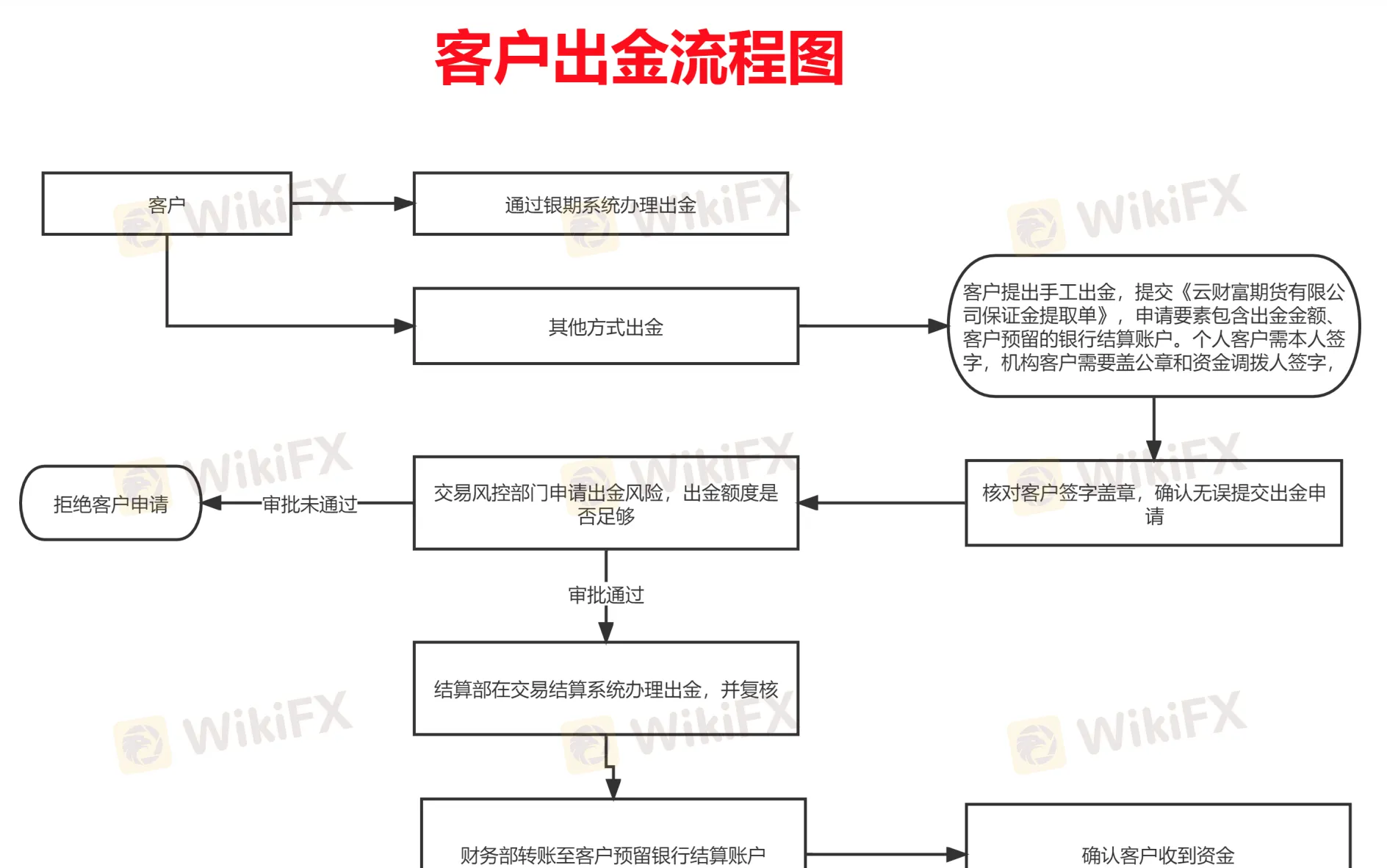

Einzahlung und Auszahlung

Es ist kein Mindesteinzahlungs- oder Auszahlungsbetrag festgelegt und es sind keine Gebühren oder Kosten angegeben. Die Website zeigt nur einen Einzahlungs- und Auszahlungsvorgang.