Calificación

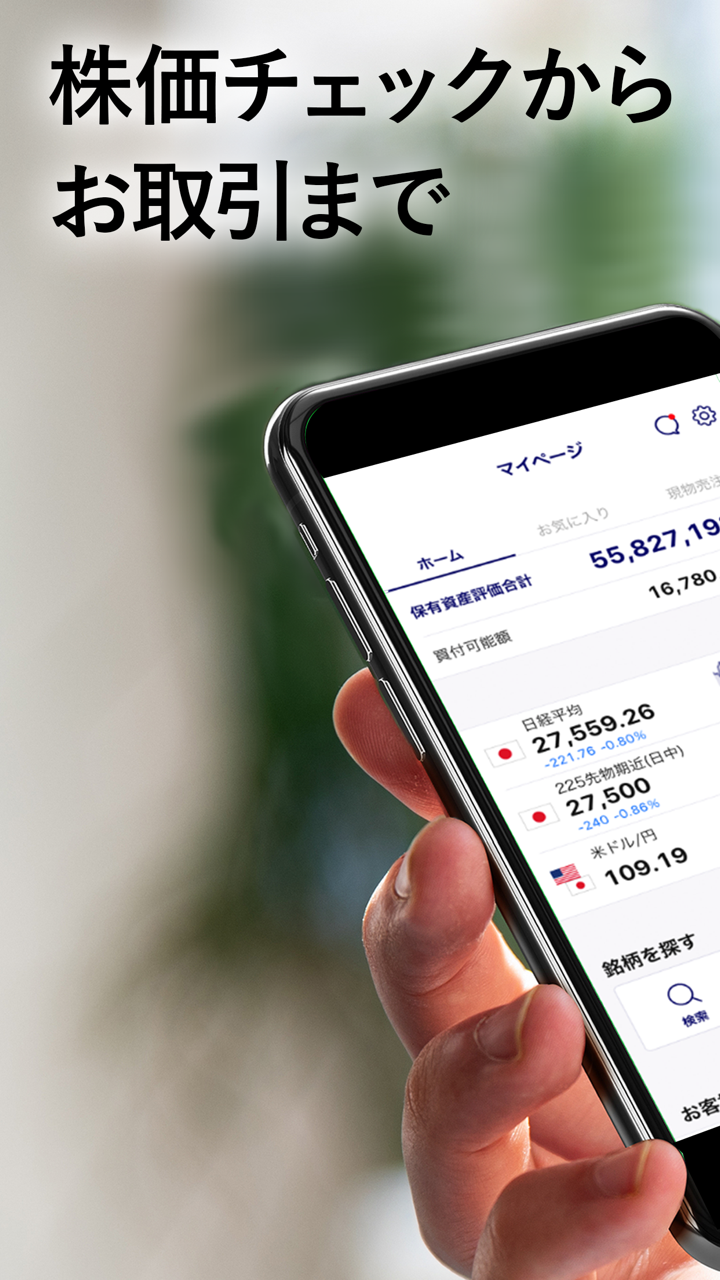

Mizuho FX

Japón | De 5 a 10 años |

Japón | De 5 a 10 años |https://fx.mizuho-sc.com/

Sitio web

Índice de calificación

Relación de capital

Relación de capital

Good

Capital

influencia

A

índice de influencia NO.1

Japón 9.15

Japón 9.15 Relación de capital

Relación de capital

Good

Capital

influencia

influencia

A

índice de influencia NO.1

Japón 9.15

Japón 9.15 Contacto

Regulador de Forex 1

Regulador de Forex 1

Núcleo único

1G

40G

1M*ADSL

Información básica

Japón

Japón

Los usuarios que vieron Mizuho FX también vieron..

TMGM

VT Markets

PU Prime

LIRUNEX

Fuente de búsqueda

Idioma de servicio

Análisis del mercado

publicación de material

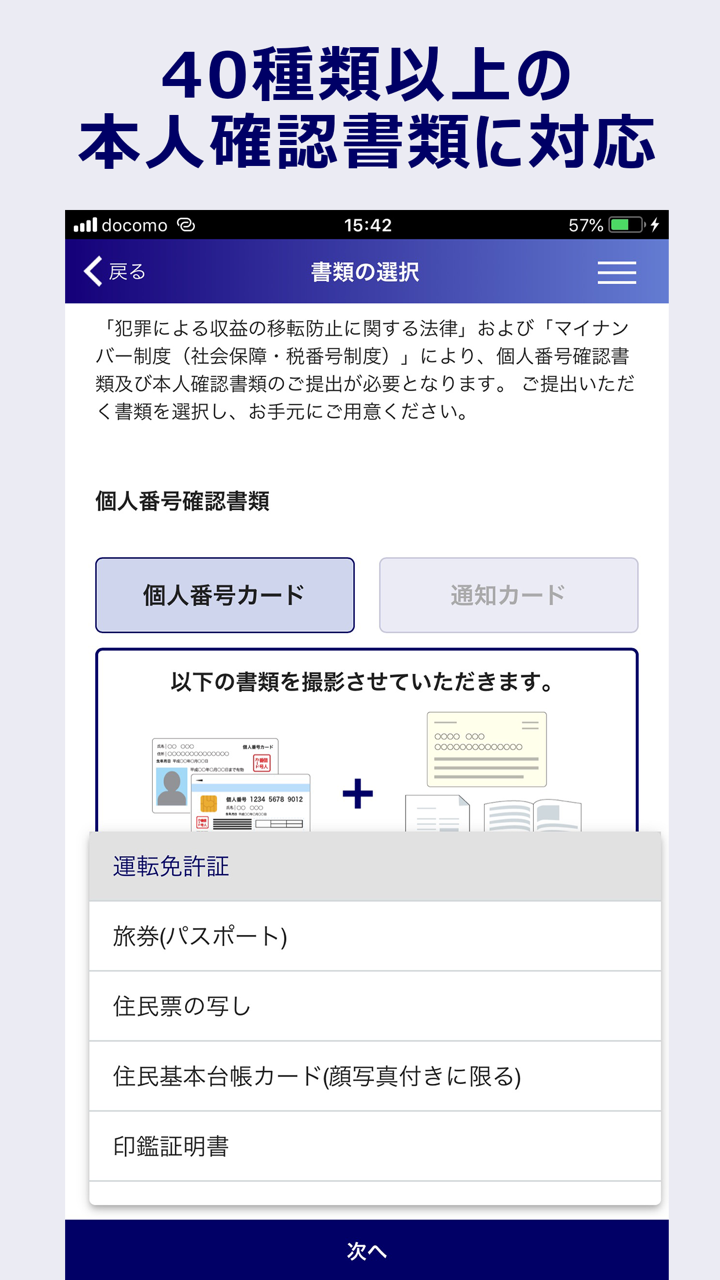

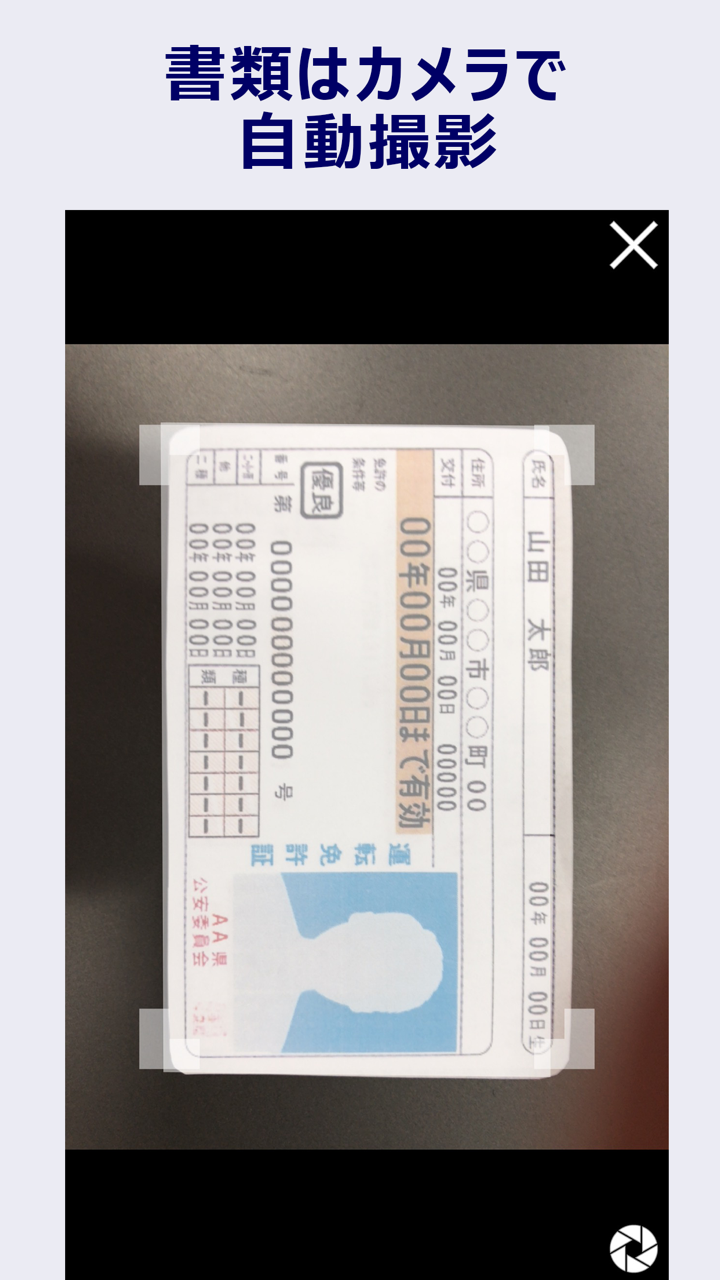

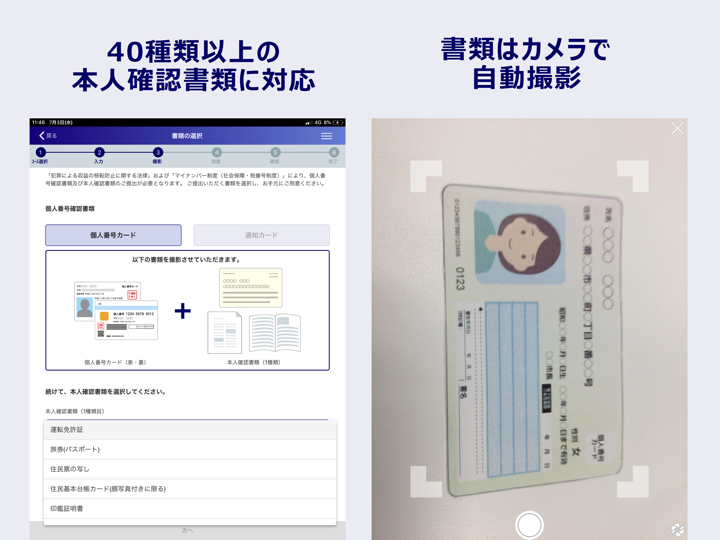

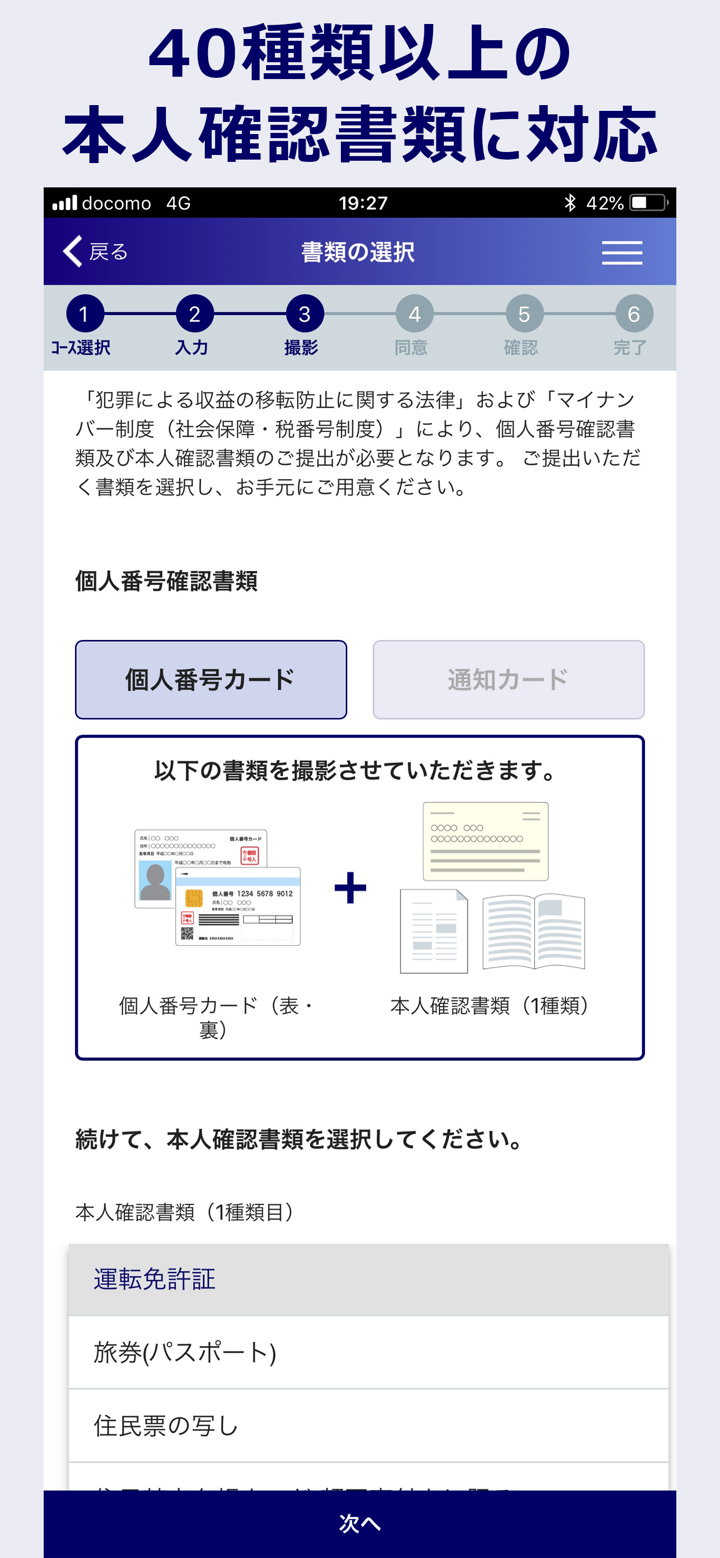

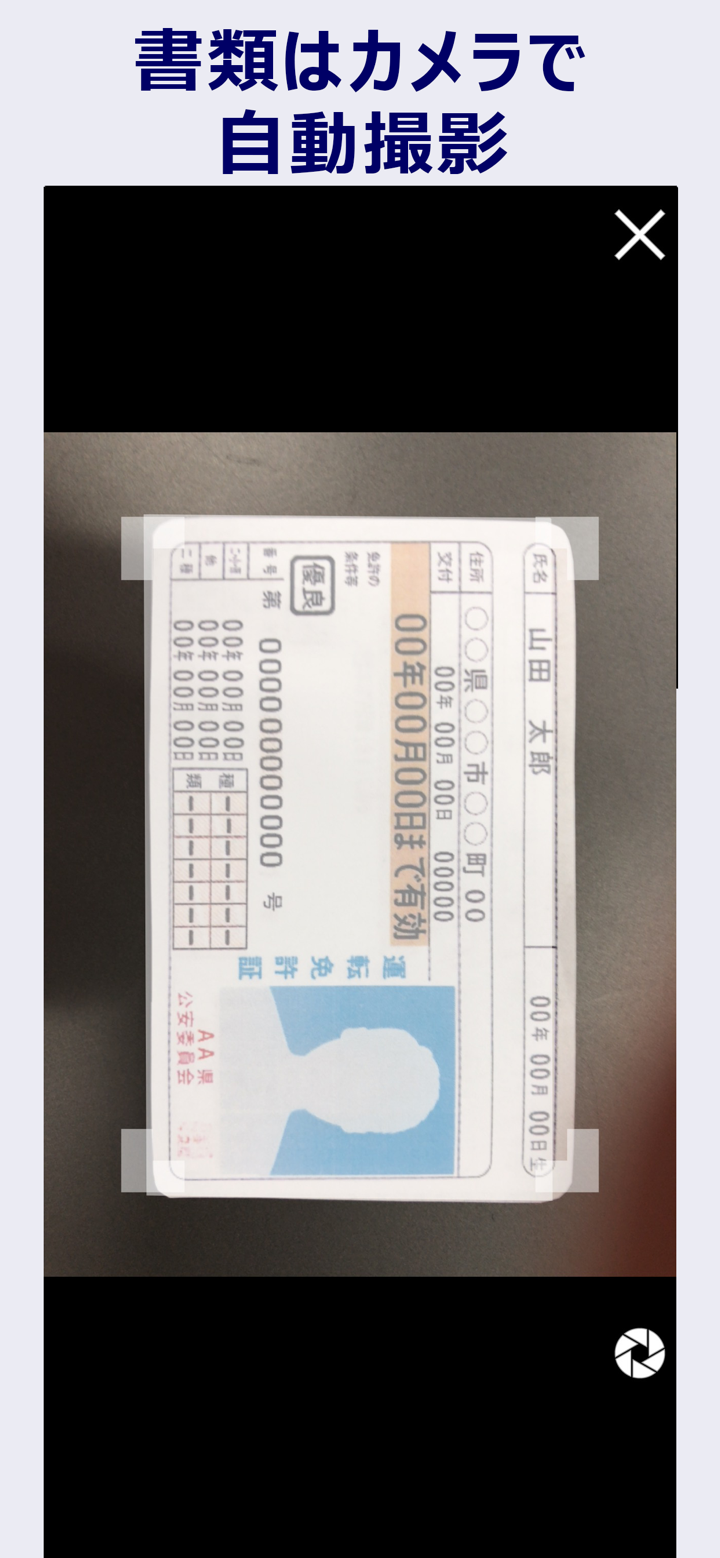

Identificación

mizuho-sc.com

23.42.66.204Ubicación del servidorEstados Unidos

Número de ICP--País/Área más visitada--Fecha de creación del nombre de dominio2000-08-24Nombre de sitio webWHOIS.1API.NETempresa matriz1API GMBH

Genealogía

Empresas Relacionadas

Q&A de Wiki

Can you tell me the typical spread for EUR/USD on a standard account with Mizuho FX?

Based on my direct research into Mizuho FX, I have not found a clearly listed typical spread for EUR/USD on a standard account. The available background information highlights Mizuho FX’s solid regulatory standing (with an FSA license in Japan) and describes their technology and risk controls as mature. In my experience, Japanese brokers regulated by the FSA often maintain tight spreads, especially on major pairs like EUR/USD. However, without transparent details published by Mizuho FX themselves, I cannot make any assumptions or guarantees about their exact spread levels. As a trader who values transparency, I always recommend confirming core trading conditions directly with a broker—especially because costs like spreads can have a significant impact on bottom-line results over time. With Mizuho FX being a long-standing, licensed entity under Mizuho Securities Co., Ltd, I expect reasonable practices, but for something as precise as the EUR/USD spread, I would advise contacting them or opening a demo account to assess live trading costs for yourself. I prefer this kind of careful due diligence to avoid surprises and ensure a trading environment that fits my cost expectations and strategy.

In what ways does Mizuho FX's regulatory standing help safeguard my funds?

As an experienced forex trader, regulatory status is always at the top of my due diligence checklist, particularly because it directly impacts the safety of my funds. For me, Mizuho FX’s regulation by the Japanese Financial Services Agency (FSA) stands out as a significant reassurance. The FSA is known for enforcing stringent standards on brokers operating in Japan, which includes strict capital requirements, robust risk controls, and detailed operational transparency. From my perspective, the fact that Mizuho FX has maintained its retail forex license for five to ten years shows a track record of complying with these tough requirements over time. This consistency matters to me; it suggests ongoing scrutiny and oversight. A broker regulated in Japan also tends to implement solid client fund protection protocols—such as segregation of client and company funds. While no regulatory framework can offer absolute guarantees, I believe being under the FSA’s supervision greatly reduces the risk of malpractice or sudden insolvency. Another point I consider is the scale and professionalism behind the broker. With Mizuho FX backed by an established securities company and employing thousands, there is further incentive to maintain their reputation and abide by regulatory norms. In summary, while I stay cautious and constantly monitor any broker I use, Mizuho FX’s regulatory status gives me a much higher degree of confidence when it comes to the safety of my trading capital.

Is it possible to trade particular assets such as Gold (XAU/USD) and Crude Oil through Mizuho FX?

Based on my own evaluation of Mizuho FX and the information available, my experience suggests that Mizuho FX primarily focuses on forex trading under strict Japanese regulation. While the broker is well-regulated by Japan’s FSA and boasts a long-standing presence in the market, there is no clear, verifiable evidence directly presented that confirms the availability of non-forex assets like Gold (XAU/USD) or Crude Oil for trading on their platform. As a trader who values transparency and regulatory alignment, I am cautious about making assumptions without explicit asset lists. Mizuho FX’s focus appears to be on major currency pairs, and its infrastructure is tailored to forex, which may indicate limited or no access to commodities such as precious metals or energy products. In my view, for traders who prioritize access to specific assets like gold or oil, it is essential to confirm these instruments are supported by the broker through official channels before committing any funds. Personally, when trading diverse asset classes is a priority, I only proceed with brokers offering clear, detailed product information and comprehensive disclosure. This conservative approach helps safeguard my trading capital and ensures that my strategies align with available instruments.

How do the different account types at Mizuho FX compare, and what sets each one apart?

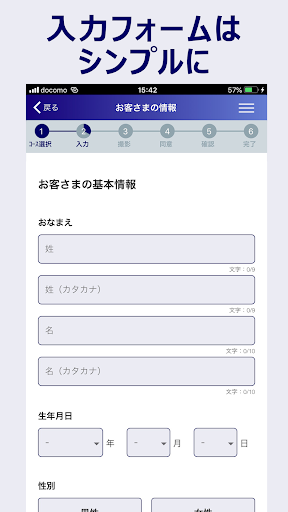

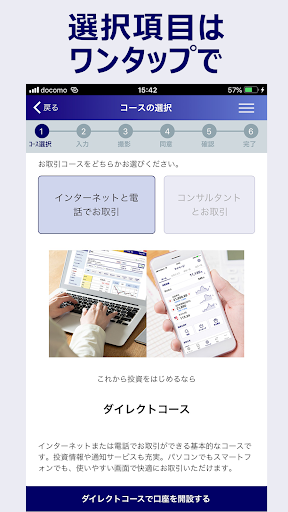

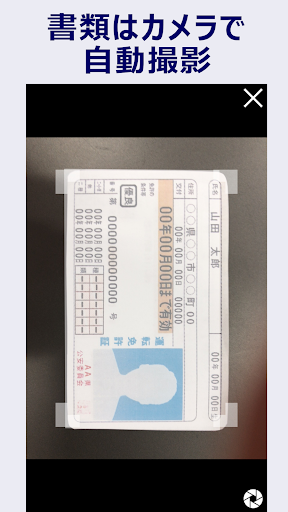

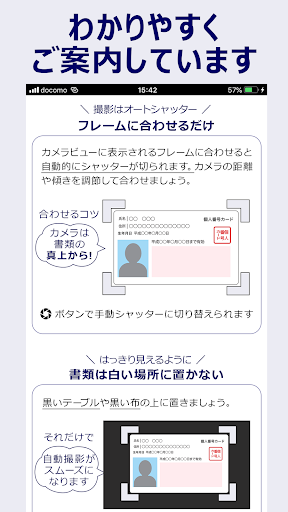

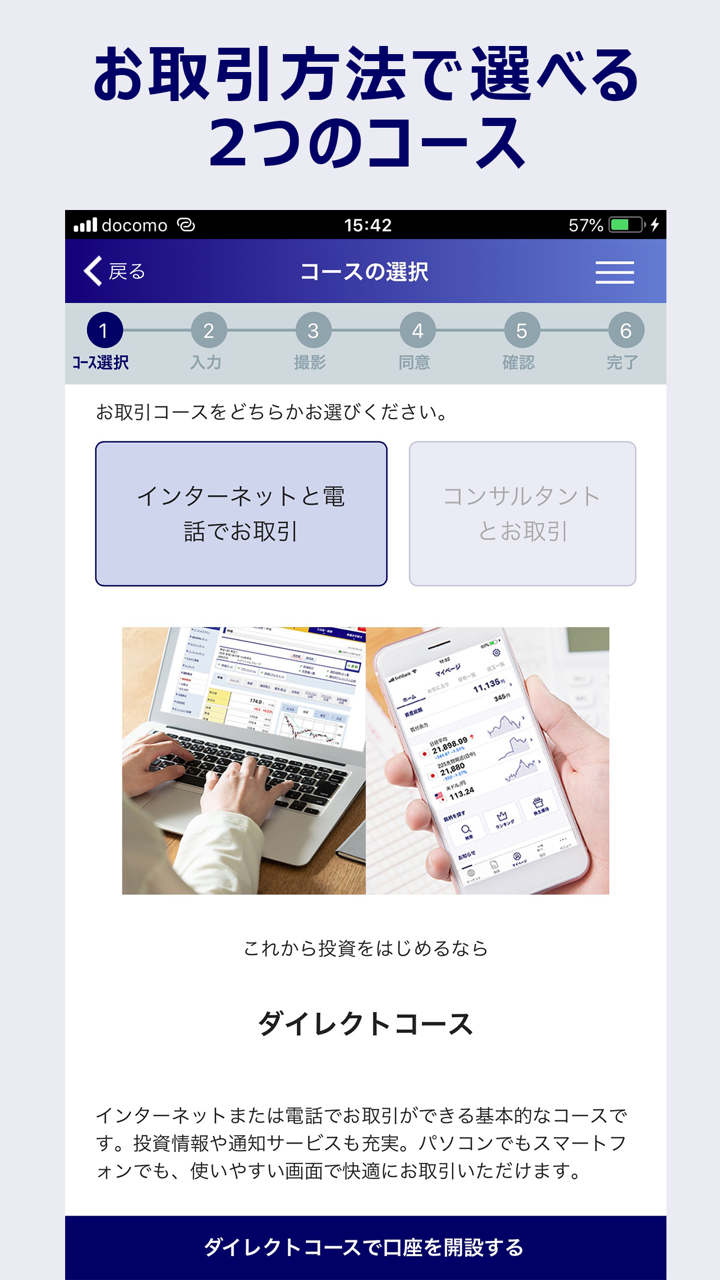

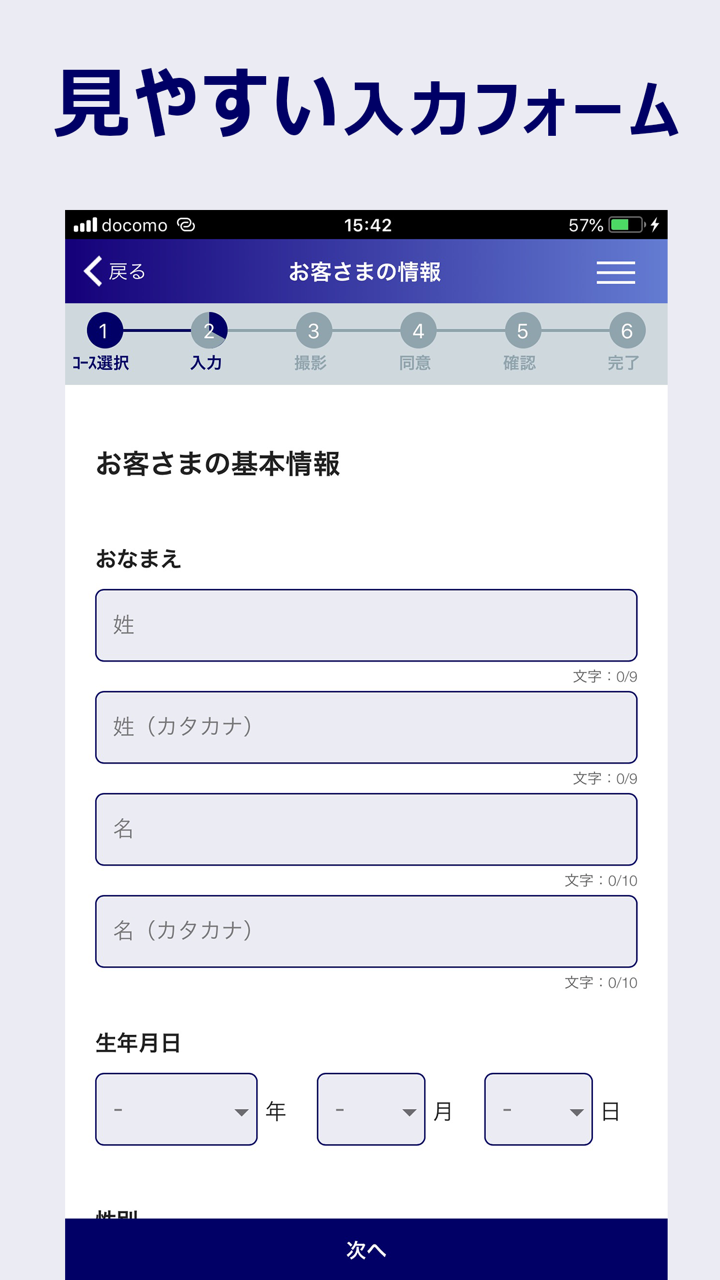

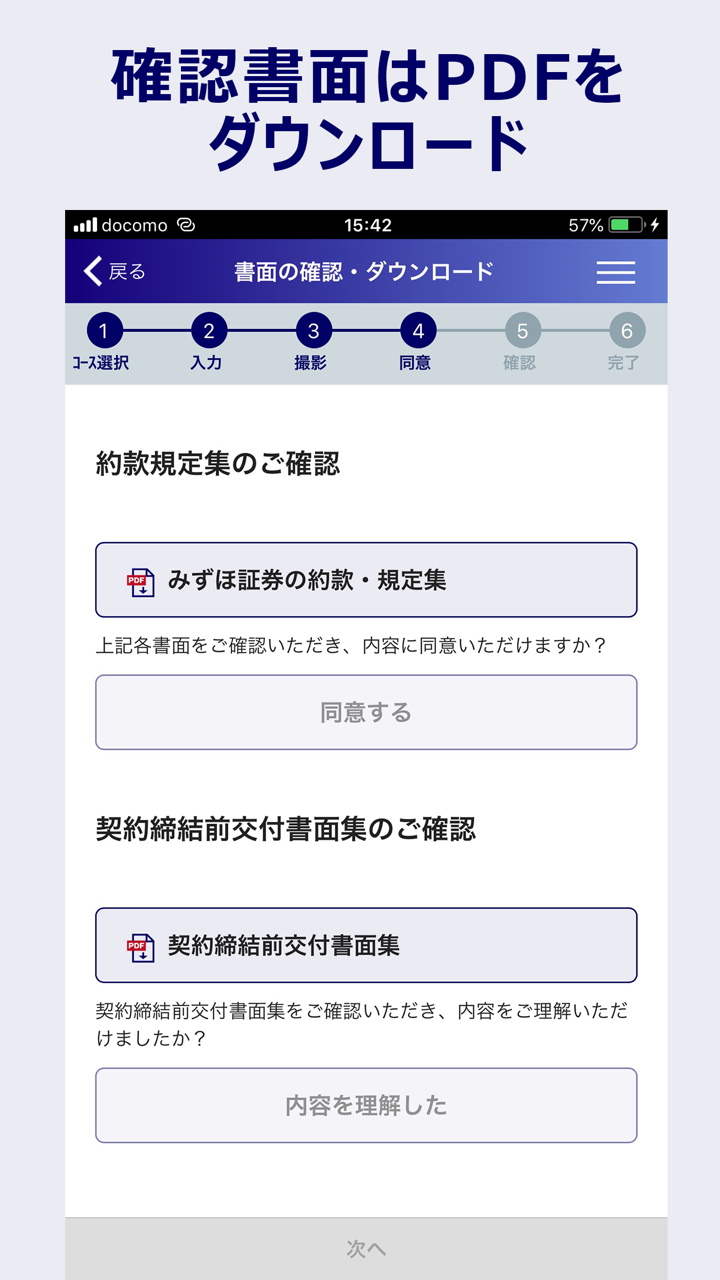

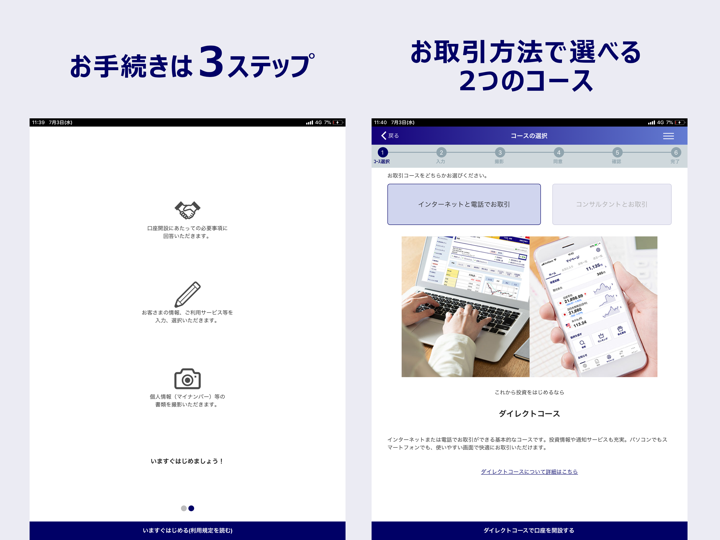

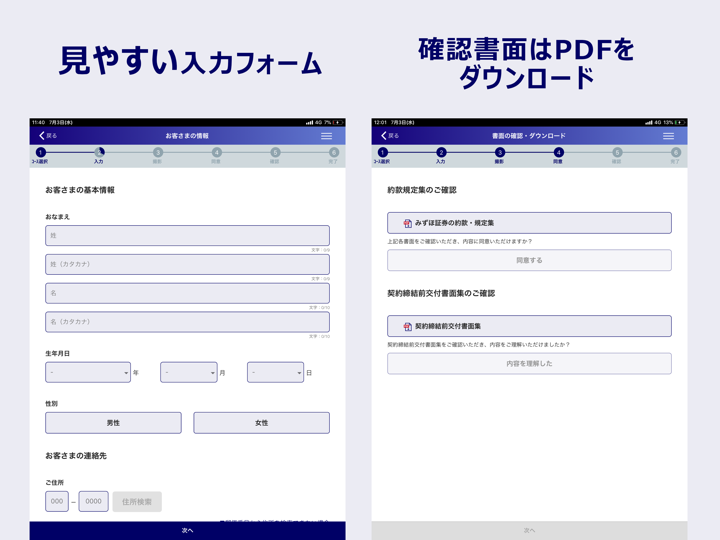

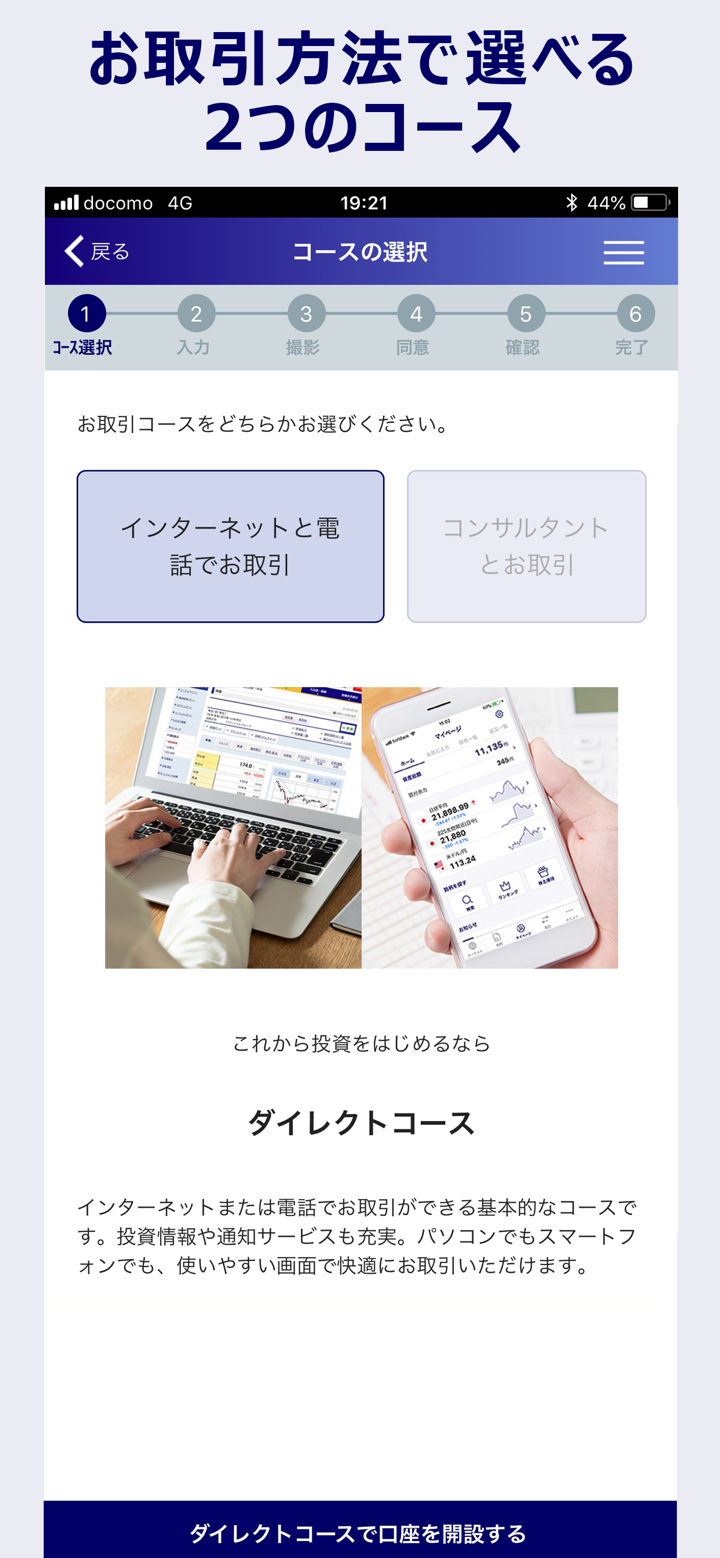

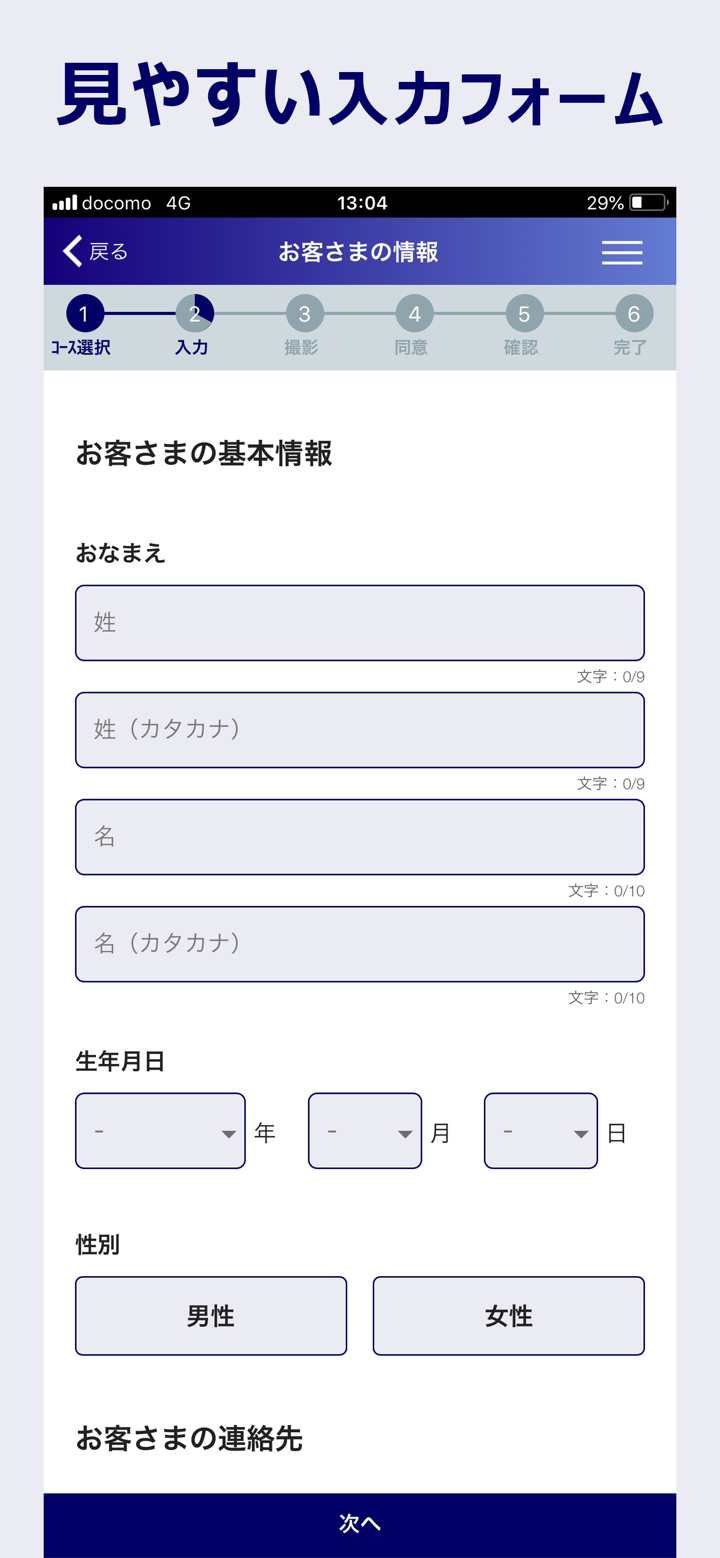

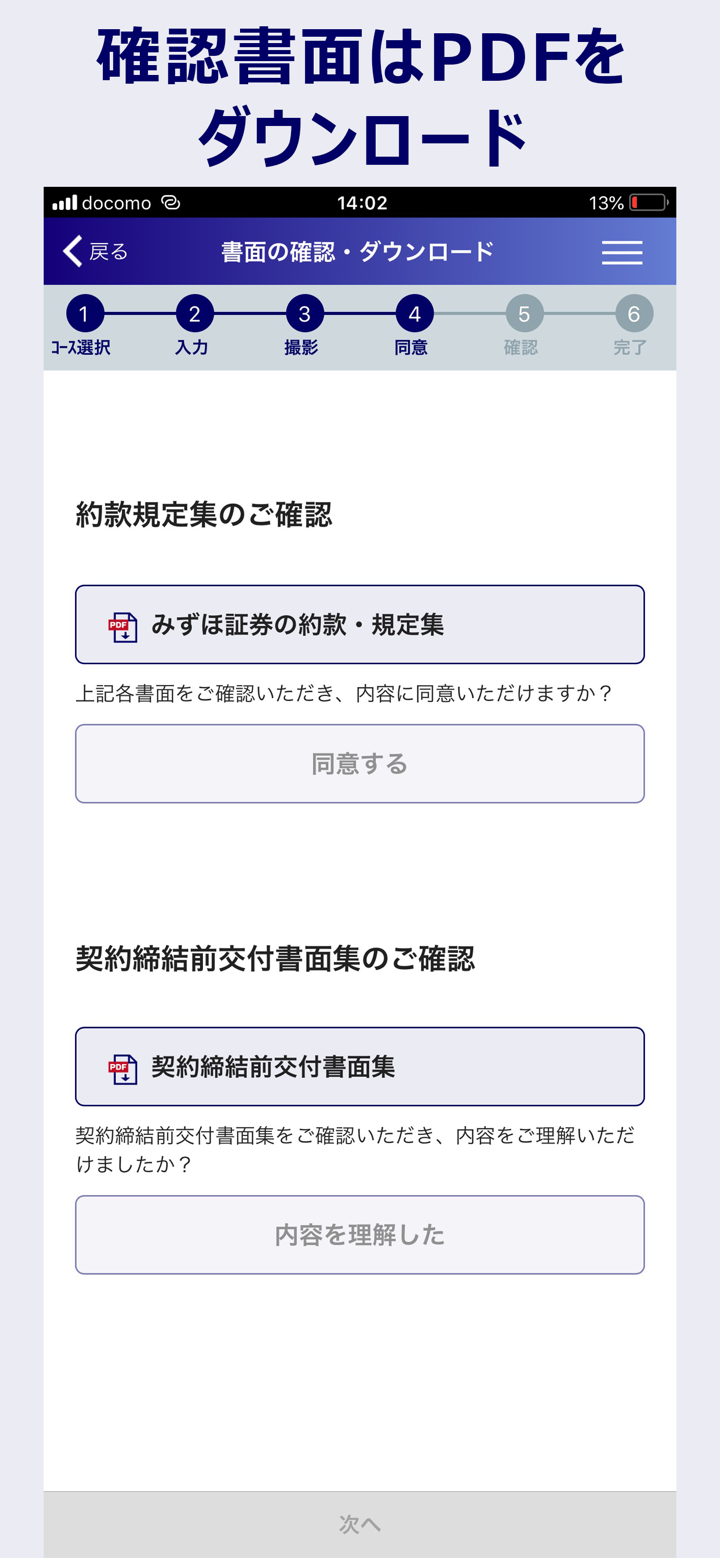

Based on my experience and the context available, evaluating the account types at Mizuho FX requires a conservative and careful approach due to the limited public information. From what I could gather, Mizuho FX operates under the regulation of Japan’s FSA, which for me is a notable mark of legitimacy, as Japanese regulations are among the strictest globally. The broker appears to offer retail forex trading services, and technical infrastructure is described as mature, with a focus on sound system services and a self-developed platform, which often means stability and ongoing support. However, there is a lack of detailed public breakdown regarding specific account types—such as distinctions in minimum deposits, spreads, or leverage. I was unable to locate separate descriptions for demo, standard, or VIP accounts, which I typically expect from brokers catering to diverse trader needs. This could suggest that Mizuho FX prioritizes simplicity or directs all customers through a relatively uniform service model, potentially driven by regulatory mandates in Japan. What stands out to me is the strong risk control and technical backbone, and the ease of onboarding via a dedicated app. While this inspires some confidence for straightforward forex trading, I remain cautious since greater account transparency would help traders like me make fully informed decisions about costs, trading conditions, and suitability for advanced strategies. I recommend reaching out directly to Mizuho FX for full clarification on account structures before opening an account.

Opiniones de los Usuarios1

Contenido que deseas comentar

Ingrese...

Comentar 1

TOP

TOP

Chrome

Extensión de Chrome

Consulta regulatoria de bróker de Forex global

Navegue por los sitios web de los brokers de divisas e identifique con precisión los brokers legítimos y los fraudulentos.

Instalar ahora