مقدمة عن الشركة

| Cloudfuturesملخص المراجعة | |

| تأسست | 2019 |

| البلد/المنطقة المسجلة | الصين |

| التنظيم | CFFE |

| أدوات السوق | العقود الآجلة |

| حساب تجريبي | ❌ |

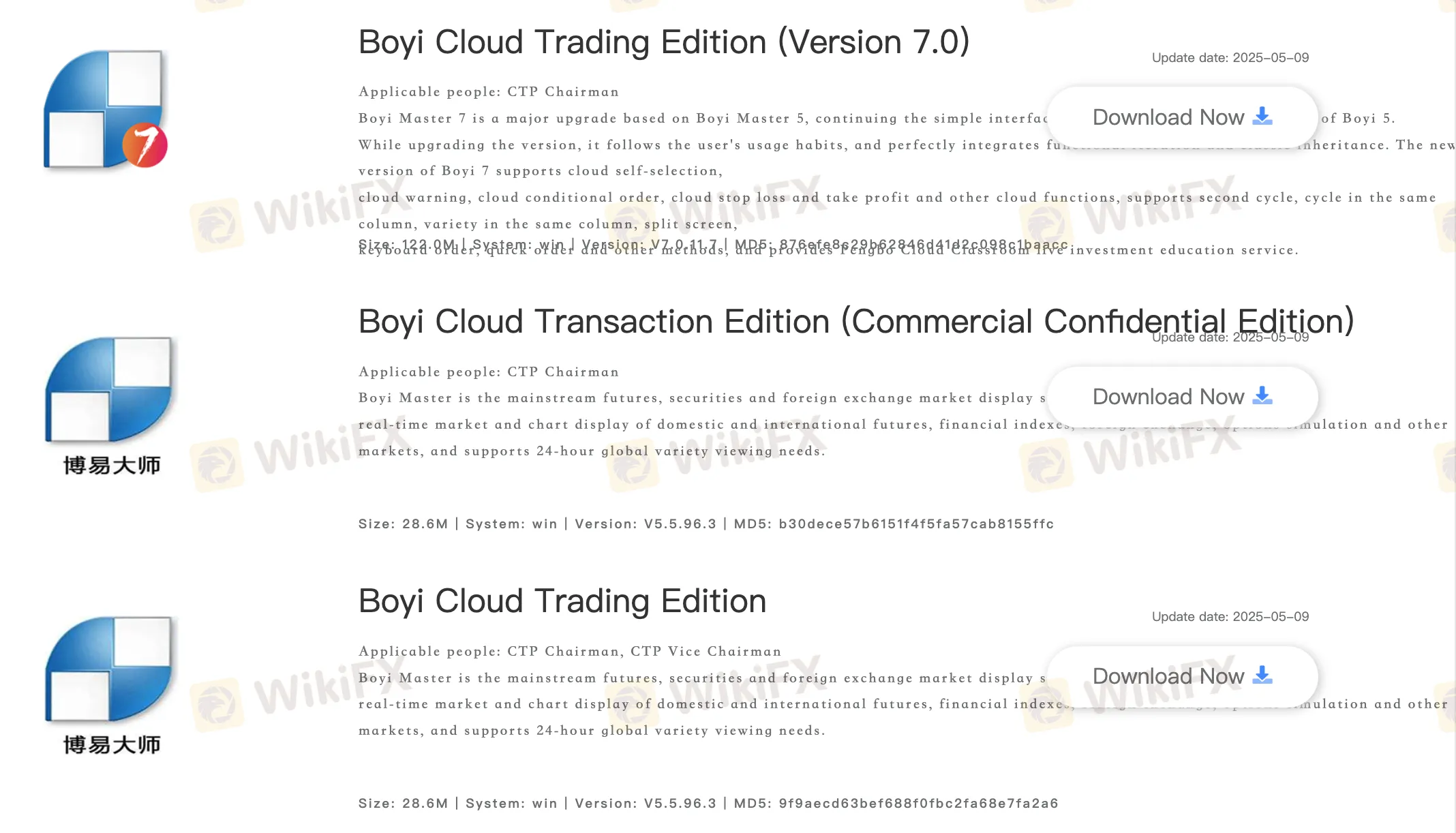

| منصة التداول | Boyi Cloud Trading Edition (الإصدار 7.0)، Boyi Cloud Transaction Edition (الإصدار التجاري السري)، Boyi Cloud Trading Edition، Panlifang Cloud Wealth Special Edition، Quick Issue V2 (الإصدار التجاري السري)، Quick Issue V3 (الإصدار التجاري السري)، Fast Issue V2، Quick Issue V3، وما إلى ذلك. |

| دعم العملاء | هاتف: 4001119992 |

| البريد الإلكتروني: YCFQH@cloudfutures.cn | |

معلومات Cloudfutures

Cloudfutures هو وسيط مرخص، يقدم خدمات تداول على العقود الآجلة على منصات تداول مختلفة. يقدم الوسيط لا حسابات تجريبية ومعلومات قليلة حول شروط التداول. نظرًا لقلة المعلومات المقدمة، هناك نقص في شفافية الموقع على الويب.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| منصات تداول متنوعة | لا توجد حسابات تجريبية |

| منظم بشكل جيد | قليل من قنوات الاتصال |

| نقص في الشفافية |

هل Cloudfutures شرعي؟

نعم. Cloudfutures مرخص من قبل CFFEX لتقديم الخدمات.

| البلد المنظم | الهيئة التنظيمية | الحالة الحالية | الكيان المنظم | نوع الترخيص | رقم الترخيص |

| بورصة العقود الآجلة المالية الصينية | منظم | 云财富期货有限公司 | ترخيص العقود الآجلة | 0240 |

ما الذي يمكنني التداول به على Cloudfutures؟

Cloudfutures يقدم تداول على العقود الآجلة.

| الأدوات التجارية | مدعوم |

| العقود الآجلة | ✔ |

| الفوركس | ❌ |

| السلع | ❌ |

| المؤشرات | ❌ |

| الأسهم | ❌ |

| العملات الرقمية | ❌ |

| السندات | ❌ |

| الخيارات | ❌ |

| صناديق الاستثمار المتداولة | ❌ |

منصة التداول

الوسيط يوفر مجموعة متنوعة من منصات التداول، بما في ذلك Boyi Cloud Trading Edition (الإصدار 7.0), Boyi Cloud Transaction Edition (الإصدار التجاري السري), Boyi Cloud Trading Edition, Panlifang Cloud Wealth Special Edition, Quick Issue V2 (الإصدار التجاري السري), Quick Issue V3 (الإصدار التجاري السري), Fast Issue V2, Quick Issue V3, Fast Issue V2, Quick Issue V3, Winshun Cloud Trading Software (wh6), Cloud Wealth Futures, Travel, Disk Cube, Cloud Wealth Polestar 9.5, Cloud Wealth Polestar 9.5 MacOS, Cloud Wealth Polestar 8.5, Infinite Easy و Simulation Boyi Master.

الأجهزة المتاحة: سطح المكتب والجوال.

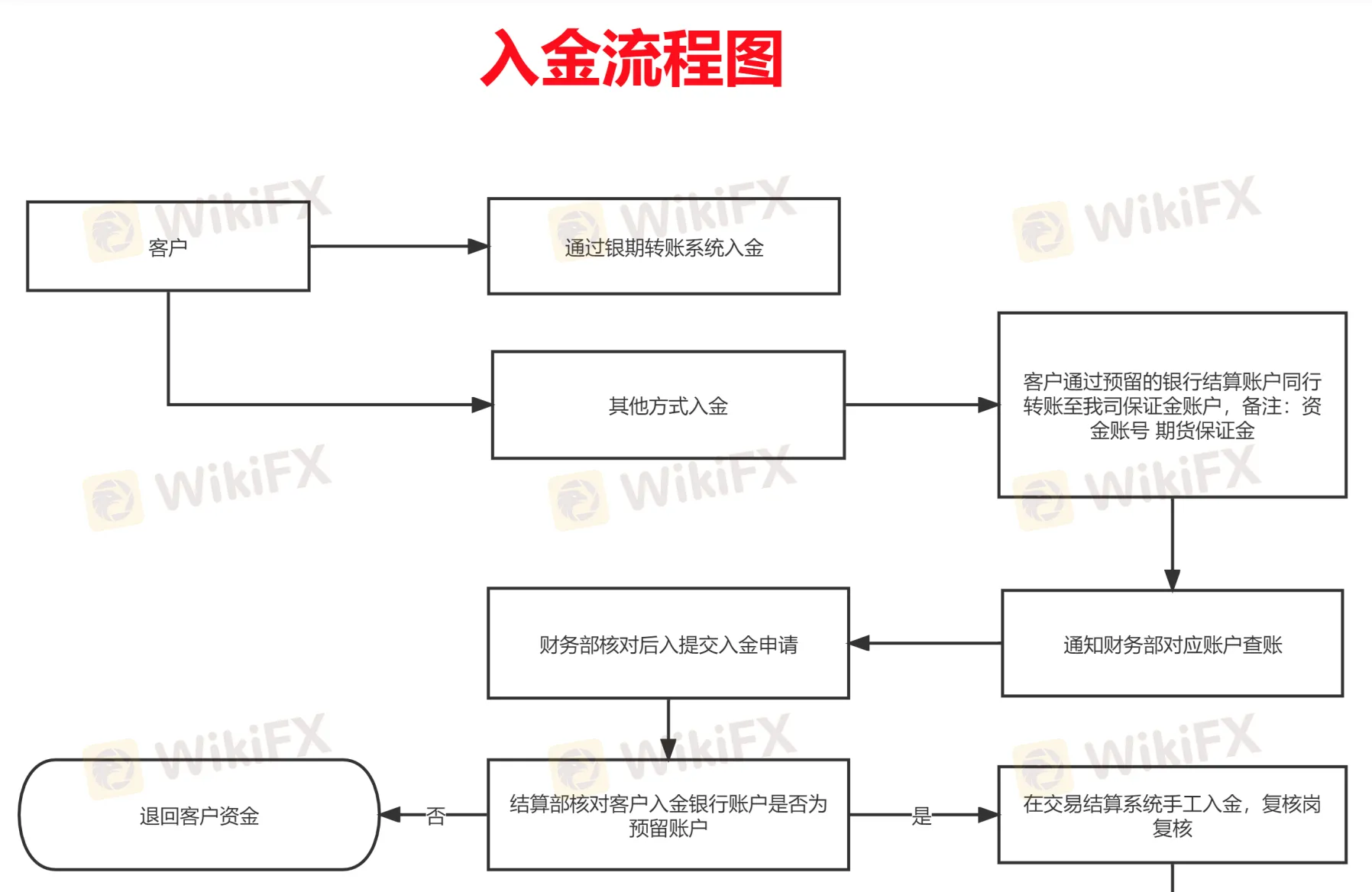

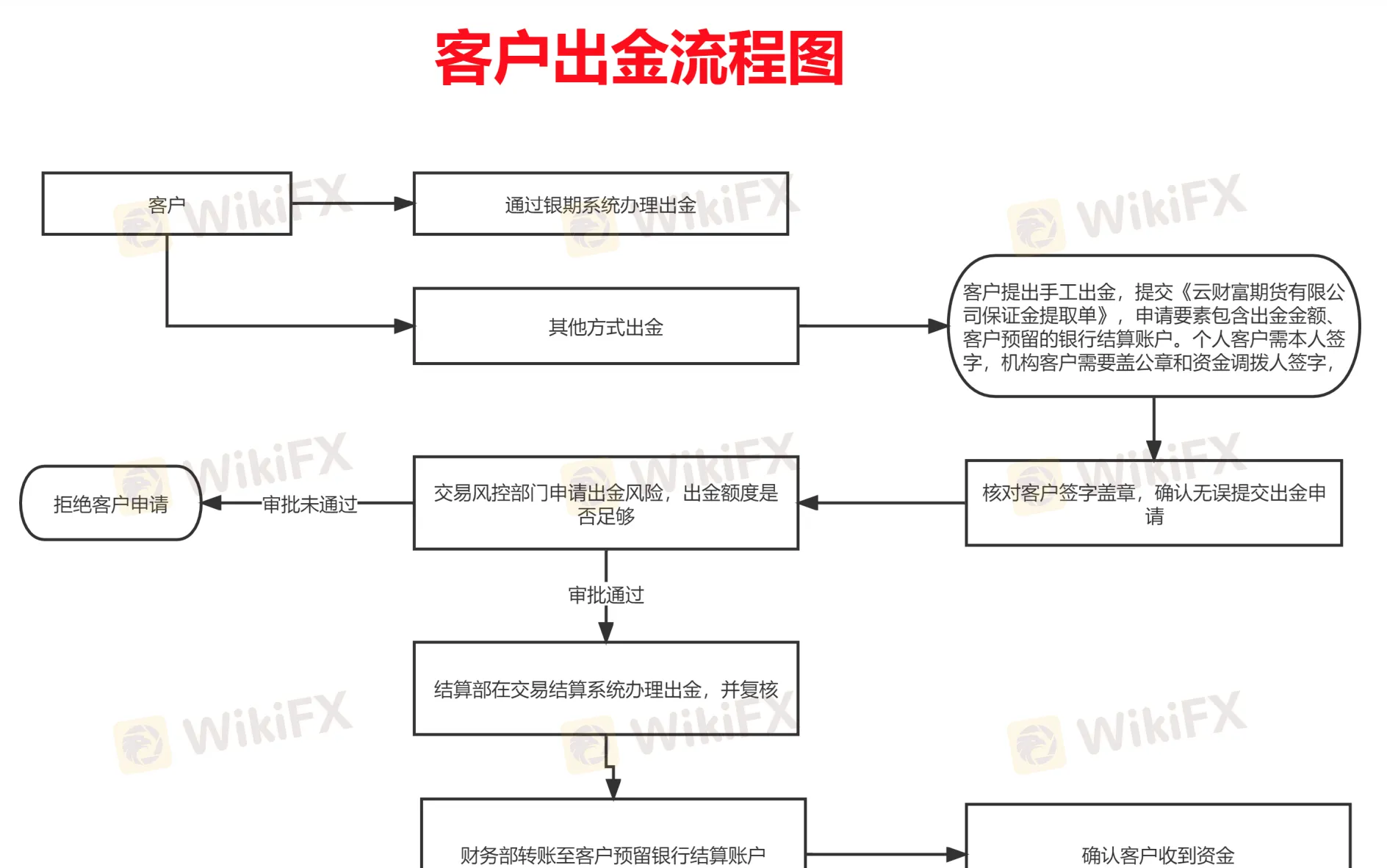

الإيداع والسحب

لا يوجد حد أدنى محدد لمبلغ الإيداع أو السحب ولا توجد رسوم أو تكاليف محددة. يظهر الموقع الإلكتروني فقط عملية الإيداع والسحب.