Perfil de la compañía

| Resumen de la reseña de Going Securities | |

| Fecha de fundación | 2021 |

| País/Región registrado | Hong Kong |

| Regulación | SFC |

| Productos y Servicios | Futuros, valores, gestión de activos, gestión patrimonial, investigación de inversiones |

| Plataforma de Trading | Going Securities Pro |

| Soporte al Cliente | Tel: +852 2187 2100 |

| Email: cs@goingf.hk | |

| Dirección: Suite 3102, 31/F, Tower 6, The Gateway, Harbour City, Tsim Sha Tsui, KLN, Hong Kong | |

Información de Going Securities

Going Securities es un proveedor de servicios financieros de Hong Kong que ha extendido su presencia global en Toronto, Abu Dhabi, Beijing, Shanghai, Shenzhen, Tokio, Fuzhou y Singapur. Ofrece servicios financieros que incluyen futuros, valores, gestión de activos, gestión patrimonial e investigación de inversiones.

La empresa está actualmente regulada por SFC, lo que indica un cierto nivel de credibilidad y protección al cliente.

Pros y Contras

| Pros | Contras |

| Regulado por SFC | Estructura de tarifas poco clara |

| Presencia global |

¿Es Going Securities Legítimo?

Going Securities está siendo actualmente bien regulado por SFC (Comisión de Valores y Futuros de Hong Kong) con licencia no. BPS863.

| País Regulado | Regulador | Estado Actual | Entidad Regulada | Tipo de Licencia | Número de Licencia |

| SFC | Regulado | Going Securities Limited | Operaciones en contratos de futuros | BPS863 |

Productos y Servicios

Going Securities ofrece una amplia gama de servicios financieros, incluyendo operaciones de futuros y valores, gestión de activos, gestión patrimonial e investigación de inversiones.

La empresa ofrece soluciones personalizadas tanto para clientes individuales como institucionales, combinando acceso al mercado global con estrategias basadas en datos.

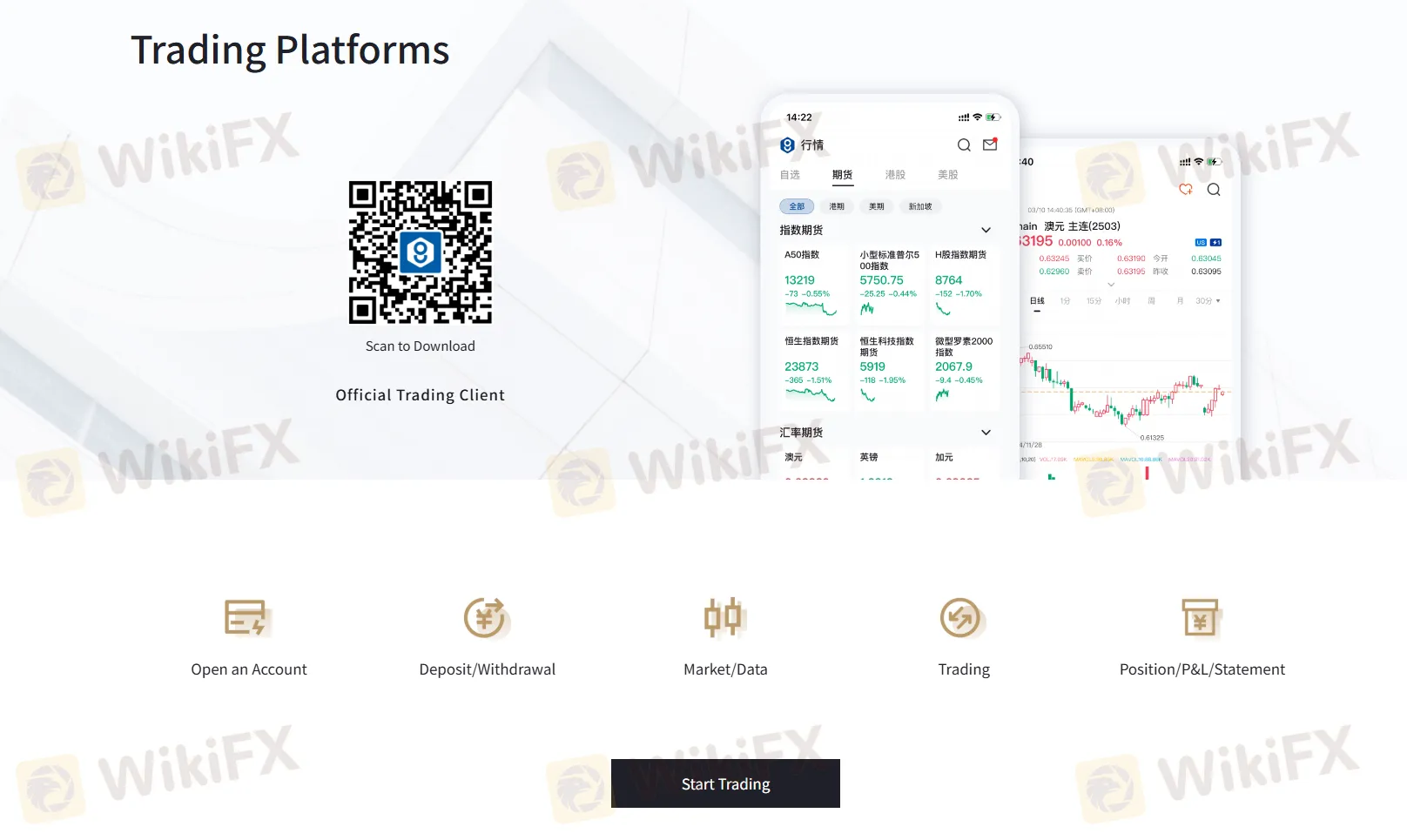

Plataforma de Trading

Going Securities ofrece una plataforma de trading propia: Going Securities Pro.

Los traders pueden descargar las plataformas desde teléfonos móviles escaneando el código QR en su sitio web y comenzar a operar con la empresa.