مقدمة عن الشركة

| Going Securities ملخص المراجعة | |

| تأسست | 2021 |

| البلد/المنطقة المسجلة | هونغ كونغ |

| التنظيم | SFC |

| المنتجات والخدمات | العقود الآجلة، الأوراق المالية، إدارة الأصول، إدارة الثروات، أبحاث الاستثمار |

| منصة التداول | Going Securities برو |

| دعم العملاء | هاتف: +852 2187 2100 |

| البريد الإلكتروني: cs@goingf.hk | |

| العنوان: جناح 3102، الطابق 31، برج 6، ذا جيتواي، هاربور سيتي، تسيم شا تسوي، كولون، هونغ كونغ | |

معلومات Going Securities

Going Securities هي مزود خدمات مالية في هونغ كونغ قد وسع وجودها العالمي في تورونتو، أبو ظبي، بكين، شنغهاي، شنتشن، طوكيو، فوتشو وسنغافورة. تقدم خدمات مالية تشمل العقود الآجلة، الأوراق المالية، إدارة الأصول، إدارة الثروات وأبحاث الاستثمار.

الشركة تخضع حاليًا لتنظيم SFC، مما يشير إلى مستوى معين من المصداقية وحماية العملاء.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| تنظيمها بواسطة SFC | هيكل رسوم غير واضح |

| وجود عالمي |

هل Going Securities شرعية؟

Going Securities تخضع حاليًا للتنظيم بشكل جيد من قبل SFC (هيئة الأوراق المالية والعقود الآجلة في هونغ كونغ) برقم ترخيص BPS863

| البلد المنظم | الجهة التنظيمية | الحالة الحالية | الكيان المنظم | نوع الترخيص | رقم الترخيص |

| SFC | منظم | Going Securities Limited | التعامل في عقود الآجلة | BPS863 |

المنتجات والخدمات

Going Securities تقدم مجموعة كاملة من الخدمات المالية، بما في ذلك تداول العقود الآجلة و الأوراق المالية، إدارة الأصول، إدارة الثروات، و أبحاث الاستثمار.

تقدم الشركة حلولًا مخصصة لكل من العملاء الفرديين والمؤسسات، مجمعة بين الوصول إلى الأسواق العالمية واستراتيجيات قائمة على البيانات.

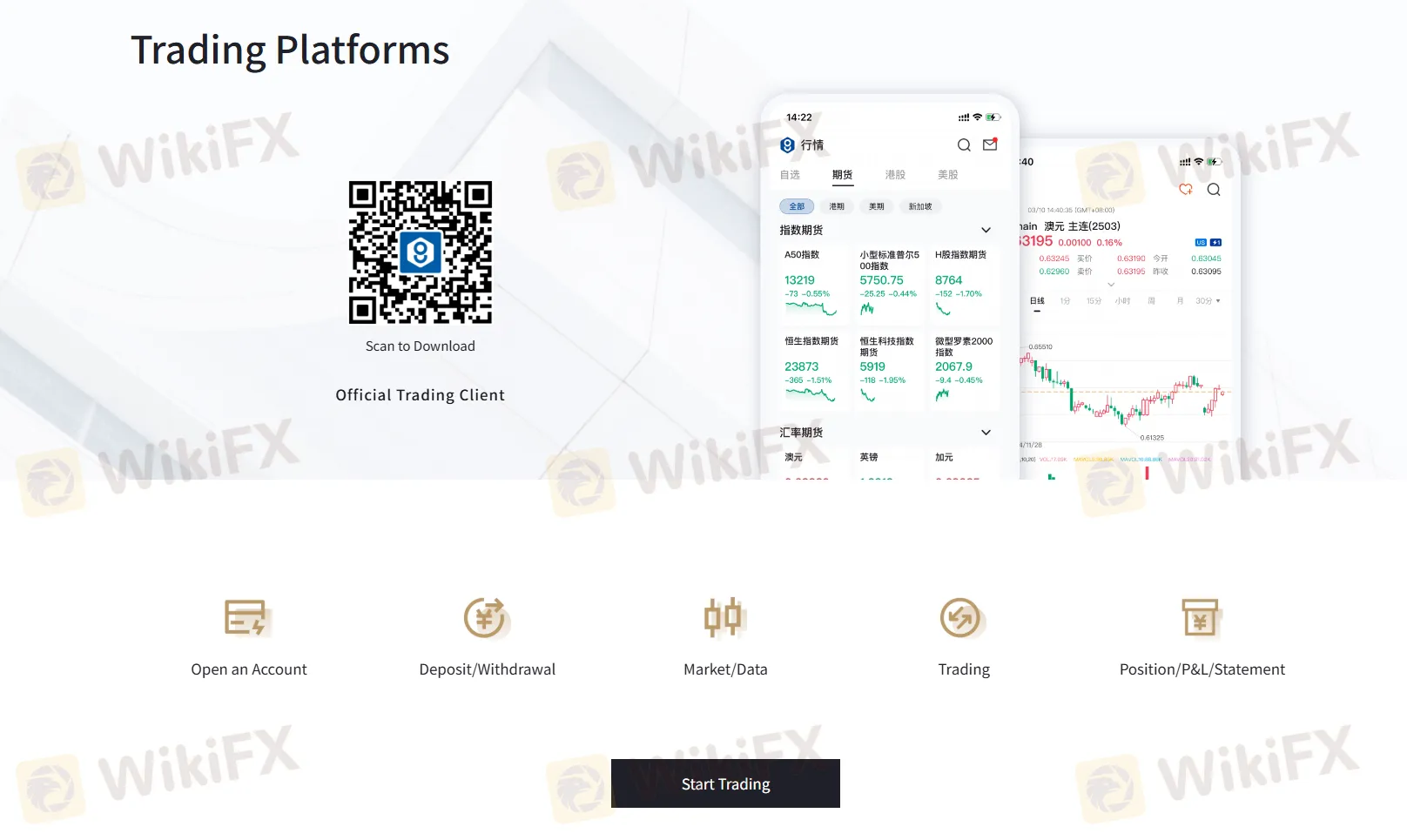

منصة التداول

Going Securities تقدم منصة تداول خاصة بها: Going Securities برو.

يمكن للمتداولين تنزيل المنصات من الهواتف المحمولة عن طريق مسح رمز الاستجابة السريعة على موقعها على الويب وبدء التداول مع الشركة.