Описание компании

| Going Securities Обзор | |

| Основано | 2021 |

| Страна/Регион регистрации | Гонконг |

| Регулятор | SFC |

| Продукты и Услуги | Фьючерсы, ценные бумаги, управление активами, управление капиталом, исследования инвестиций |

| Торговая Платформа | Going Securities Pro |

| Поддержка Клиентов | Тел: +852 2187 2100 |

| Эл. почта: cs@goingf.hk | |

| Адрес: Suite 3102, 31/F, Tower 6, The Gateway, Harbour City, Tsim Sha Tsui, KLN, Гонконг | |

Информация о Going Securities

Going Securities - это поставщик финансовых услуг из Гонконга, который расширил свое глобальное присутствие в Торонто, Абу-Даби, Пекине, Шанхае, Шэньчжэне, Токио, Фучжоу и Сингапуре. Он предлагает финансовые услуги, включая фьючерсы, ценные бумаги, управление активами, управление капиталом и исследования инвестиций.

Компания в настоящее время регулируется SFC, что указывает на определенный уровень доверия и защиты клиентов.

Плюсы и Минусы

| Плюсы | Минусы |

| Регулируется SFC | Неясная структура комиссий |

| Глобальное присутствие |

Going Securities Легитимность

Going Securities в настоящее время хорошо регулируется SFC (Комиссия по ценным бумагам и фьючерсам Гонконга) с лицензией BPS863.

| Страна Регулирования | Регулятор | Текущий Статус | Регулируемая Сущность | Тип Лицензии | Лицензионный Номер |

| SFC | Регулируется | Going Securities Limited | Сделки с фьючерсами | BPS863 |

Продукты и Услуги

Going Securities предоставляет полный спектр финансовых услуг, включая торговлю фьючерсами и ценными бумагами, управление активами, управление капиталом и исследования инвестиций.

Компания предлагает индивидуальные решения как для физических лиц, так и для институциональных клиентов, объединяя доступ к глобальным рынкам с стратегиями на основе данных.

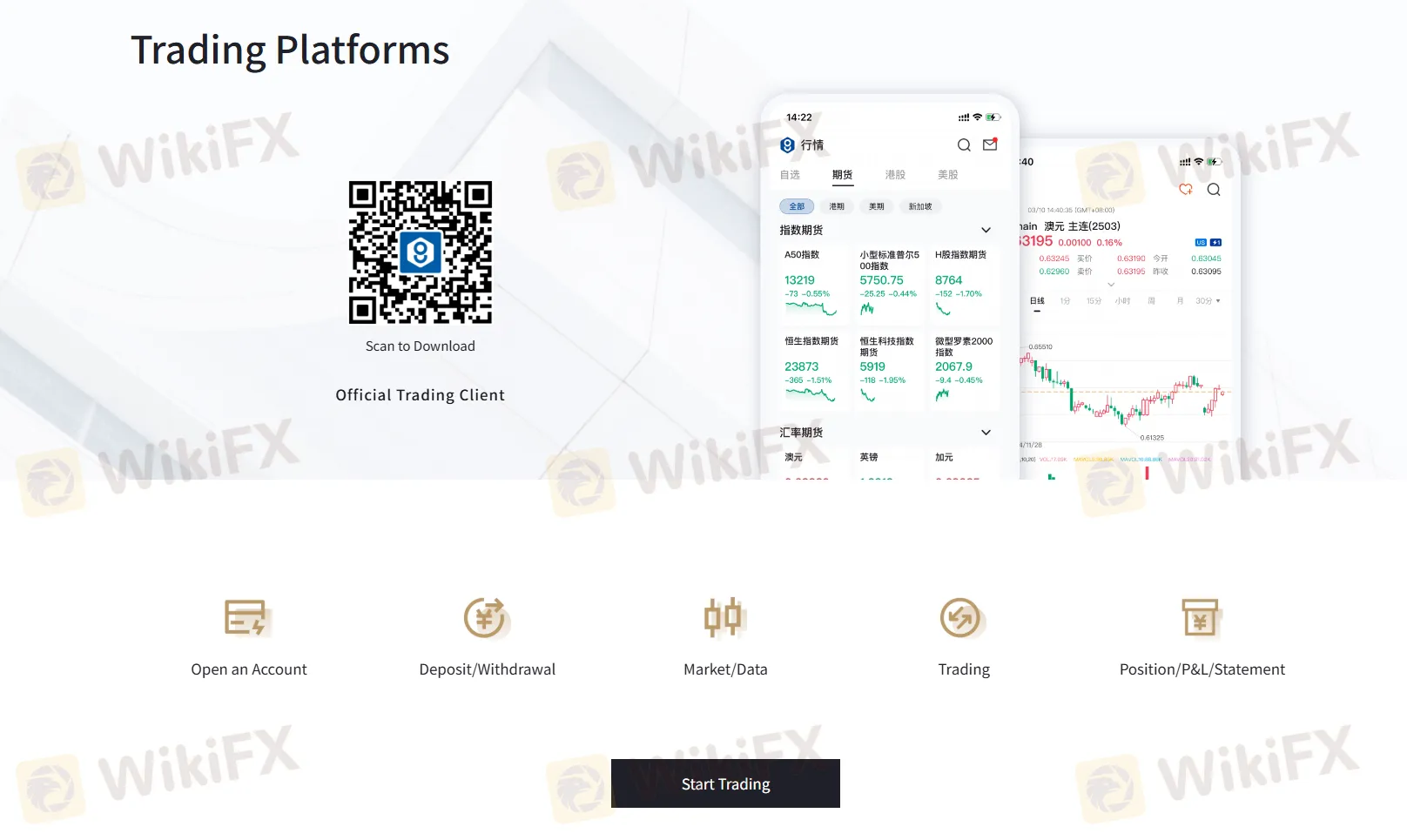

Торговая Платформа

Going Securities предлагает собственную торговую платформу: Going Securities Pro.

Трейдеры могут скачать платформы на мобильные телефоны, отсканировав QR-код на сайте компании, и начать торговлю с компанией.