Abstract:The restoration of China's economic activities is predicted to result in a total surplus of $836 billion. As other major central banks continue to tighten policy, fears of a worldwide recession may diminish. Skeptics, on the other hand, are concerned that a hawkish Federal Reserve will continue to control financial markets and the global economy.

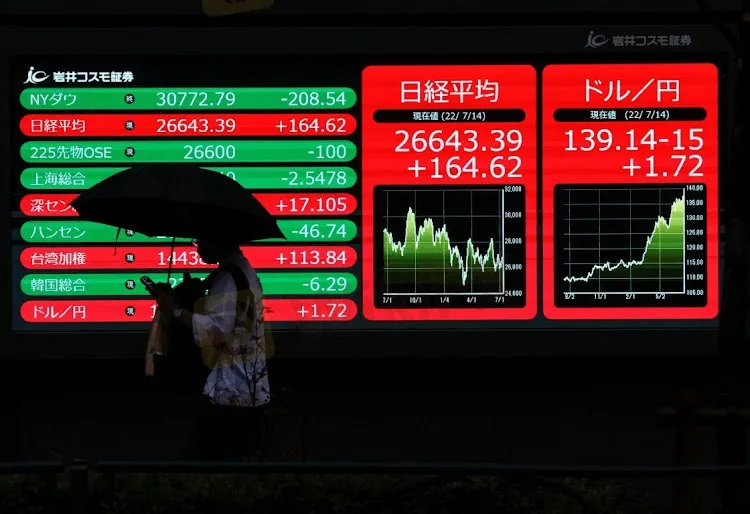

Asian stocks and equities have plenty more space to go.

When China switched to pro-growth policies in late 2022, global markets got a sugar rush. Other Asian assets argue that it is never too late to participate in the rally.

Chinese stocks account for another 20% of the increase. Furthermore, if demand in the world's second-largest economy rebounds, the oil may rise beyond $100 per barrel and copper could reach $10,000 per pound. A flood of forecasts has been made by strategists and money managers. Emerging market shares and some Asian currencies are also expected to rise.

The restoration of China's economic activities is predicted to result in a total surplus of $836 billion. As other major central banks continue to tighten policy, fears of a worldwide recession may diminish. Skeptics, on the other hand, are concerned that a hawkish Federal Reserve will continue to control financial markets and the global economy.

Morgan Stanley and Goldman Sachs Group Inc. predict that the MSCI China Index would rise by 10%. Meanwhile, Citi Global Wealth Investments anticipates a 20% increase in 2023 when compared to its global rivals.

Others, on the other hand, feel that Asian stocks will continue to increase even after the bull market has begun. South Korean and Taiwanese exporters would profit, as will Southeast Asian nations that rely on Chinese tourism, such as Thailand.

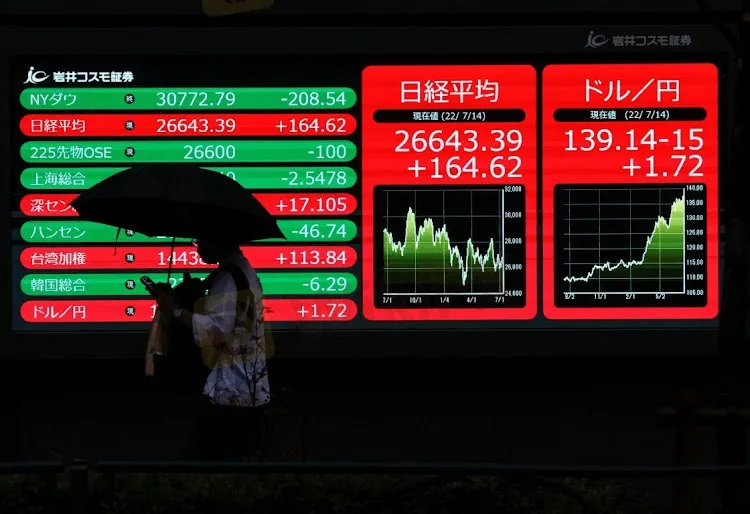

Another currency increase is on the way.

Since China relaxed virus restrictions in November, the offshore yuan has increased by almost 6%. According to UBS Global Wealth Management, if economic growth exceeds the trend in the second half of this year, the yen might reach 6.50 per dollar.

A 60-day correlation measure between the yuan and emerging-market currencies has risen to 0.70, the highest level in five months. The Thai baht and the South Korean won, both of which benefit from Chinese tourists, may profit from the reopening. The Chilean peso is projected to climb in reaction to the rising Chinese demand for copper.

Alan Wilson of Eurizon SLJ Capital is a money manager. According to him, the Chinese economy, its underlying assets, and the larger emerging market universe are at a tipping point.

Download the link for the mobile app

https://www.wikifx.com/en/download.html