Pocket Option Scam Alert: Real Trader Complaints

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:WikiFX issues a warning over unlicensed trading sites posing as established brokers, highlighting the lack of regulatory safeguards and growing risks of fraud and investor losses.

WikiFX monitoring has recently identified a series of impersonation websites designed to mislead investors by directly copying the identities of well-known, regulated brokers. These cases do not involve vague look-alikes or loosely inspired designs. Instead, the fake platforms use the real brokers logos and brand names, while operating under unrelated domain names.

Such impersonation schemes are particularly dangerous because they rely on the credibility already built by legitimate firms. Investors may believe they are interacting with a regulated broker, when in reality they are dealing with an unlicensed and unrelated website.

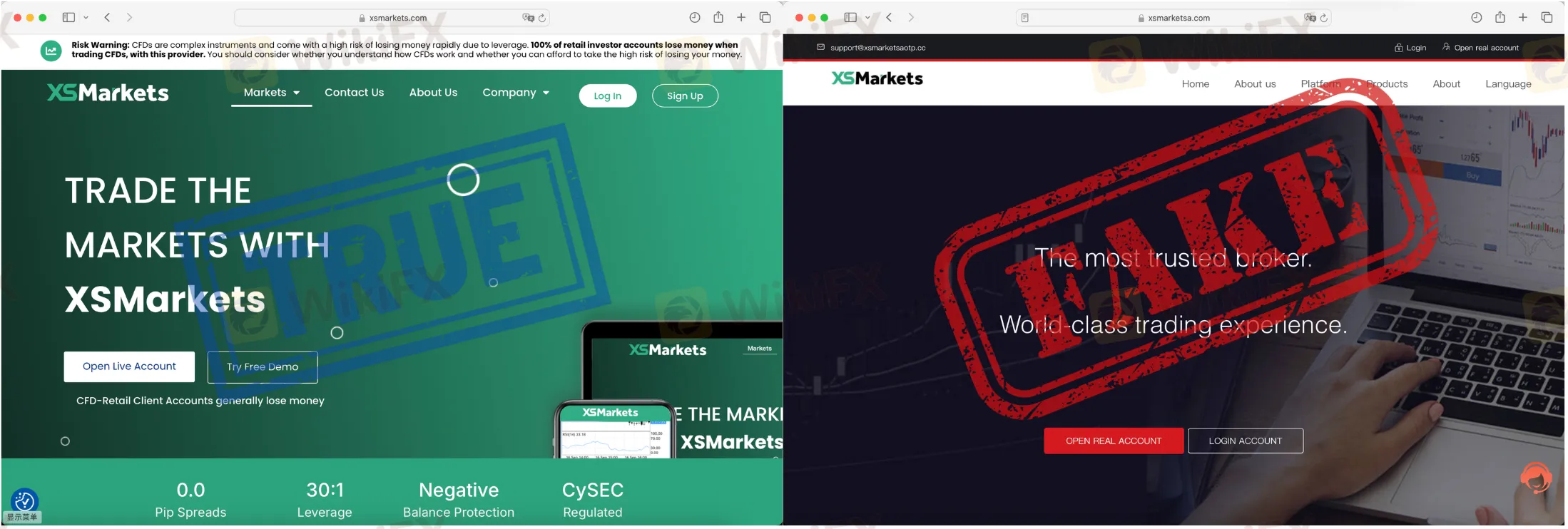

This article outlines three recent cases flagged by WikiFX, involving the impersonation of XSMarkets, FXTM, and Taurex.

The website xsmarketsa.com presents itself as XSMarkets, using the brokers name and logo to create the impression of legitimacy. However, verification through WikiFX shows that this domain is not connected to the regulated XSMarkets entity.

According to WikiFX records, the legitimate XSMarkets operates under regulatory supervision in Cyprus and holds a valid investment license. Its official information, regulatory status, and operational history can be independently confirmed through the WikiFX broker profile.

https://www.wikifx.com/en/dealer/2266154299.html

By contrast, the domain xsmarketsa.com does not appear in any regulatory register linked to XSMarkets. The use of the XSMarkets name and branding on this site therefore constitutes identity impersonation, exposing users to significant financial risk.

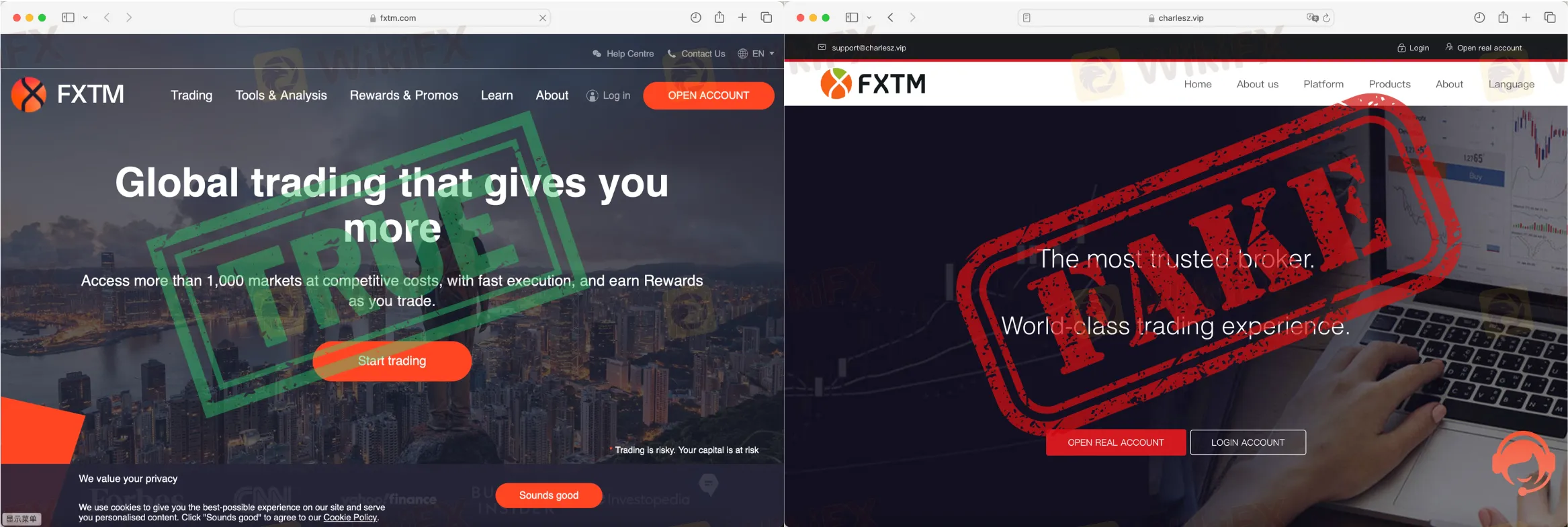

A similar pattern appears in the case of charlesz.vip, which impersonates FXTM (ForexTime). Although the domain name itself does not contain “FXTM,” the website openly uses FXTMs logo and presents itself as the broker.

FXTM is a long-established international broker with multiple regulatory licenses and a clearly documented operational history. WikiFX data confirms that FXTM has been operating for over a decade and is subject to regulatory oversight in several jurisdictions.

The legitimate FXTM profile can be verified here:

https://www.wikifx.com/en/dealer/3351410785.html

The impersonation website charlesz.vip has no regulatory authorization and no confirmed link to FXTM. Investors who rely solely on branding or logos, without verifying the domain and license information, may mistakenly believe they are dealing with the genuine broker.

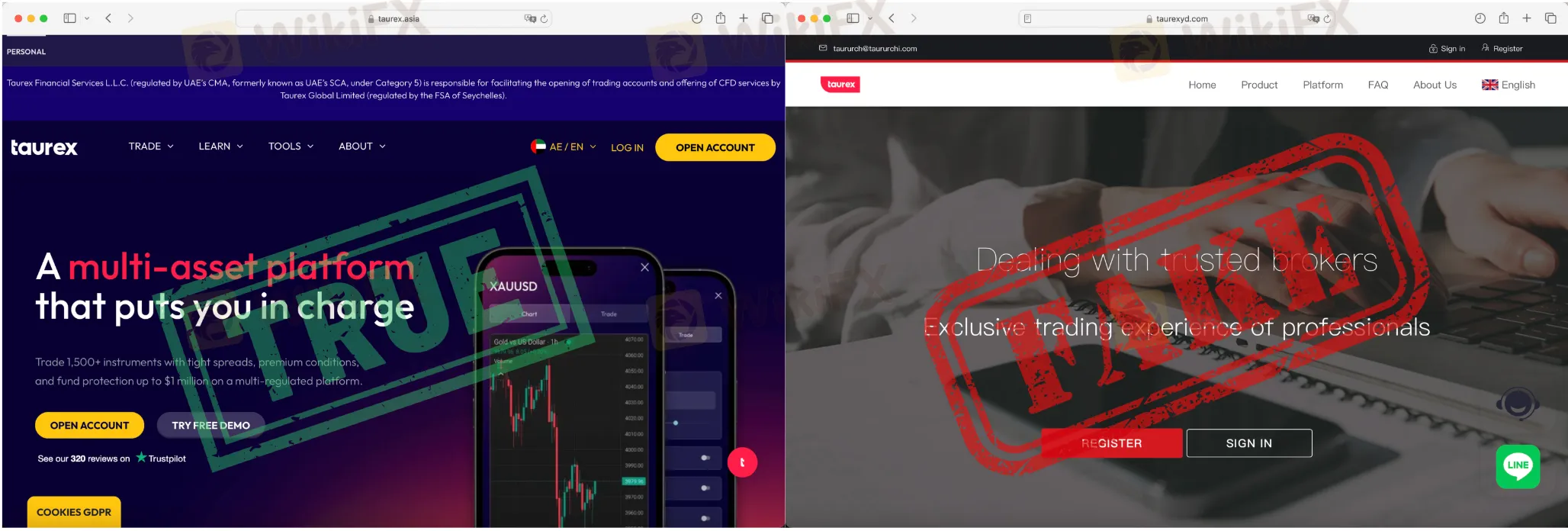

The third case involves taurexyd.com, a website impersonating Taurex by directly using its brand identity. As with the previous cases, the impersonation relies on the reputation of a regulated broker to gain user trust.

WikiFX records show that the real Taurex operates under regulatory supervision and holds recognized licenses. Its official corporate and regulatory information is publicly available and verifiable.

The verified Taurex profile is available at:

https://www.wikifx.com/en/dealer/2831566703.html

The domain taurexyd.com, however, is not associated with the licensed Taurex entity and does not appear in any official regulatory records. The use of the Taurex name and branding on this site therefore represents another clear case of impersonation.

Across all three cases, the core risk does not lie in visual similarity alone, but in brand misuse. These impersonation websites adopt the names and logos of regulated brokers while operating under unrelated domains and without authorization.

This approach exploits a simple assumption many investors make: that a familiar name or logo guarantees legitimacy. In reality, regulatory protection applies only to the licensed entity operating under its official domain, not to third-party websites using copied branding.

These cases highlight why independent verification tools have become essential in modern online trading. Regulators license specific legal entities and domains—not brand names in isolation.

WikiFX helps investors bridge this gap by consolidating regulatory data, license records, operational history, and risk alerts in one place. By checking a brokers WikiFX profile before engaging, investors can confirm whether the website they are visiting actually belongs to the licensed entity.

Impersonation scams are evolving. Rather than inventing new brands, fraudsters increasingly borrow trust from existing ones.

Before registering or transferring funds, investors should:

In an environment where identity misuse is becoming more common, verification is no longer optional—it is a necessity.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

Weltrade scam surge in August 2025: traders report fake prices, slippage manipulation, and delayed withdrawals. Protect your funds and think twice before trading.

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

IG boosts FCA compliance by integrating Adclear’s AI tools. Learn how automation accelerates marketing approvals and ensures regulatory accuracy.