简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

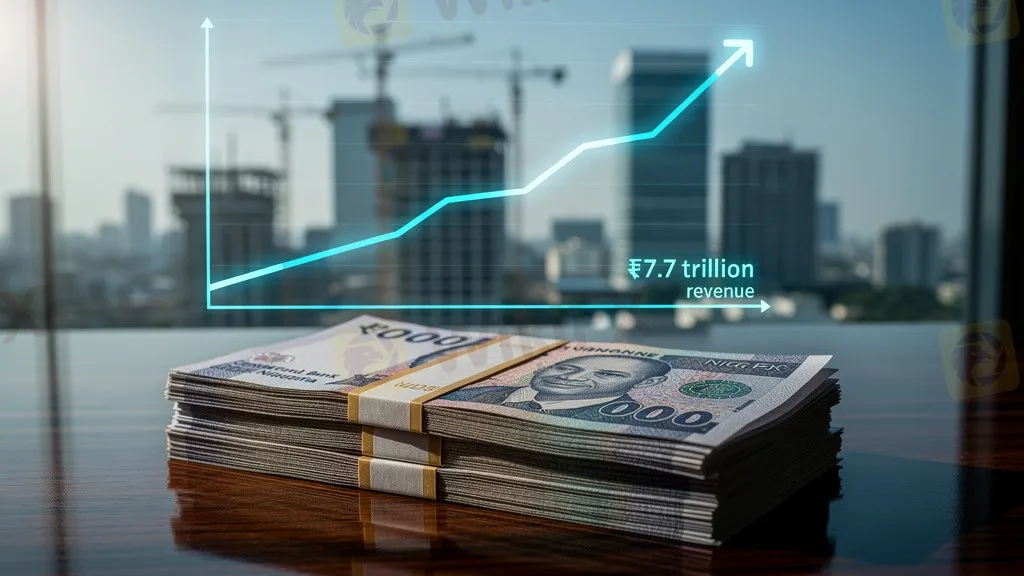

Nigeria Outlook: FX Stability Critical to Growth as Fiscal Revenue Surges

Abstract:Market leaders in Nigeria emphasize foreign exchange stability over interest rates as the primary driver for sustainable growth, bolstering the outlook for the Naira. Meanwhile, fiscal data reveals a 26% jump in VAT allocations, alongside new World Bank-backed infrastructure deals.

Nigeria's macroeconomic landscape in 2026 shows signs of structural adjustment as financial leaders prioritize FX predictability and fiscal revenues hit record levels to drive long-term infrastructure investment.

FX Stability Prioritized Over Rate Levels

Babatunde Folawiyo of Coronation Merchant Bank emphasizes that FX market predictability is more vital than interest rates for FDI. A stable NGN is considered the linchpin for corporate expansion.

Fiscal Consolidation & Infrastructure Support

Recent fiscal data indicates a shift toward non-oil revenue strength, reducing the reliance on domestic borrowing and providing a buffer for the Naira.

- VAT allocations: N7.73 trillion in 2025

- Year-on-year growth: 26.46% increase from 2024

- Previous revenue: N6.11 trillion

- Strategic Partner: IFC (International Finance Corporation)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

Binary.com Review — Missing Trades & Reporting Issues Investigated

OpoFinance Withdrawal Issues: Traders Warn Others

Geopolitical Risk Radar: Russia Nuclear Treaty Expiry Looms; Iran Weighs Diplomacy

Global Markets Rattle: Commodities and Crypto Slump as 'Trump Trade' Fades

Kudotrade Review: Safety, Regulation & Forex Trading Details

FXPN Review 2026: Is This Forex Broker Safe?

Naira Rallies to Start February as Government targets Fiscal Consolidation

SNB Strategy: Intervention Preferred Over Negative Rates as Inflation Flatlines

Currency Calculator