Abstract:A close look at ZarVista's regulatory status shows major red flags that mark it as a high-risk broker for traders. This analysis goes beyond the company's marketing materials to examine the real substance of its licenses, business structure, and operating history. The main issues we will explore include its dependence on weak offshore regulation, a large number of serious user complaints, and worrying details about its corporate identity. It is also important to note that ZarVista previously operated under the name Zara FX, a detail that provides important background to its history. This article aims to deliver a complete, evidence-based breakdown of the ZarVista license framework and its real-world effects, helping traders understand the serious risks involved before investing.

Introduction: Understanding What's at Stake

A close look at ZarVista's regulatory status shows major red flags that mark it as a high-risk broker for traders. This analysis goes beyond the company's marketing materials to examine the real substance of its licenses, business structure, and operating history. The main issues we will explore include its dependence on weak offshore regulation, a large number of serious user complaints, and worrying details about its corporate identity. It is also important to note that ZarVista previously operated under the name Zara FX, a detail that provides important background to its history. This article aims to deliver a complete, evidence-based breakdown of the ZarVista license framework and its real-world effects, helping traders understand the serious risks involved before investing.

Executive Summary: Profile at a Glance

For traders needing a quick assessment, the following data points bring together the most important findings. These numbers, taken from independent analysis and public records, paint a clear picture of the broker's standing in the industry. The extremely low score and related warnings serve as an immediate sign of the broker's questionable safety profile.

Breaking Down License Claims

A broker's regulatory license is the foundation of its trustworthiness. However, not all licenses are the same. ZarVista's claims of being a regulated company require careful examination. The broker operates under what is known as offshore regulation. This term refers to licenses granted by countries with less strict financial oversight, minimal capital requirements, and weaker enforcement systems compared to top-tier regulatory bodies like the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC).

While getting an offshore license is a legal business practice, it offers traders much less protection. These countries often lack investor compensation funds, which are designed to protect clients' capital if a broker goes out of business. Furthermore, the dispute resolution processes are typically ineffective, leaving traders with little to no practical help if they face issues such as withdrawal denials or trade manipulation. The value of a license is not in its existence, but in the quality and strength of the protection it guarantees.

The Mauritius FSC License

ZarVista's regulatory portfolio includes a license from the Financial Services Commission (FSC) of Mauritius. The specific details are as follows:

· Licensed Entity: Zarvista Capital Markets (MU) Ltd

· License Type: Securities Trading License (EP)

· License Number: GB23202450

· Status: Regulated

Mauritius is generally considered a more established and reputable offshore financial center compared to other, more questionable jurisdictions. The FSC has a framework in place for licensing and supervising financial firms. However, it is important to understand its limitations. The FSC's regulatory requirements are not as strict as those in premier financial hubs. The oversight on client fund separation, operational transparency, and capital adequacy is less demanding. For traders, this means that while the broker is not entirely unregulated, the safety net provided by the Mauritius FSC is much thinner than what one would find with a broker regulated in the UK, EU, or Australia.

The Comoros MISA Registration

The second pillar of ZarVista's regulatory claim is its registration in Comoros, a detail that raises a much more significant red flag.

· Regulator: Mwali International Services Authority (MISA)

· License Number: T2023293

· Registered Region: Comoros

The Mwali International Services Authority in the Union of the Comoros is widely regarded within the financial industry as one of the weakest and least credible regulatory bodies globally. Getting a license from MISA is known to be a quick, cheap, and simple process with minimal background checks or ongoing compliance requirements. This jurisdiction is often chosen by firms looking to project an image of being “regulated” without subjecting themselves to any meaningful supervision. For traders, a Comoros license offers virtually no protection or legal help. In the event of a dispute or broker default, seeking assistance from MISA is unlikely to produce any results. This registration should be viewed not as a mark of legitimacy, but as a clear warning sign.

Verifying Regulatory Claims

A broker's regulatory status is not fixed; it can be downgraded, suspended, or revoked. Therefore, ongoing verification is a critical part of a trader's research.

For a real-time check on the ZarVista Regulation status and the validity of these licenses, platforms such as WikiFX provide updated details and direct links to regulator records.

A Complicated Corporate Web

Beyond licenses, a broker's corporate structure and physical presence provide important insights into its legitimacy and accountability. A transparent, well-established firm will have a clear and verifiable presence. An investigation into ZarVista reveals a complicated structure that appears designed for a lack of transparency. The operation is spread across several countries, each playing a different role:

· Zarvista Capital Markets Ltd: This is the primary corporate entity, which is officially registered in Comoros. This aligns with the weak MISA registration and serves as the legal base in a jurisdiction with minimal oversight.

· Zarvista Capital Markets (MU) Ltd: This separate entity is the holder of the Mauritius FSC license. Using a different entity for a different license is a common practice, but it adds a layer of complexity for clients trying to determine which entity they are contracting with.

· ZARVISTA SERVICES LTD: This “related company,” registered in Cyprus (Reg. No. HE445683) in August 2024, adds another piece to the puzzle. Cyprus is a well-known financial hub within the EU, but this entity is not a regulated broker. It may function as a payment processor, a marketing arm, or a service provider. Its existence creates potential confusion about the operational chain of command and accountability.

Adding to these structural concerns are the results of physical office investigations. Field surveys conducted to verify the registered addresses of ZarVista's predecessor, Zara FX, in both Canada and Cyprus concluded with “No Office Found.” The inability to confirm a physical, operational headquarters is a classic sign of a high-risk operation. A broker that exists only on the internet, with no real office for staff, management, or compliance, lacks fundamental substance and accountability.

User Experiences: A Complaint Pattern

Regulatory analysis and corporate investigation provide a structural view of risk. To understand the practical effects, we must turn to the first-hand experiences of its users. An analysis of publicly available user feedback and complaints reveals a disturbing and consistent pattern of serious issues. While a small number of positive reviews exist, praising platform features, they are vastly outnumbered by severe allegations, particularly concerning the most critical aspect of trading: accessing funds.

The Most Common Issue: Withdrawals

The most frequent and alarming theme among user complaints is the inability to withdraw capital. These are not minor delays but systematic blockages that prevent traders from accessing their capital and profits. Specific allegations include:

· Withdrawal requests being outright rejected without clear or justifiable reasons.

· Users report that they are suddenly unable to access the broker's website to even start a withdrawal, a problem that effectively locks them out of their accounts.

· Cases where credit card refund attempts were declined, with the broker reportedly shifting responsibility by telling the client to resolve the issue with their own bank.

Severe Allegations: Fraud and Seizures

Beyond withdrawal difficulties, a significant number of users have made severe accusations of outright fraud and fund confiscation. These allegations paint a picture of a broker actively working against its clients' interests. The details are alarming:

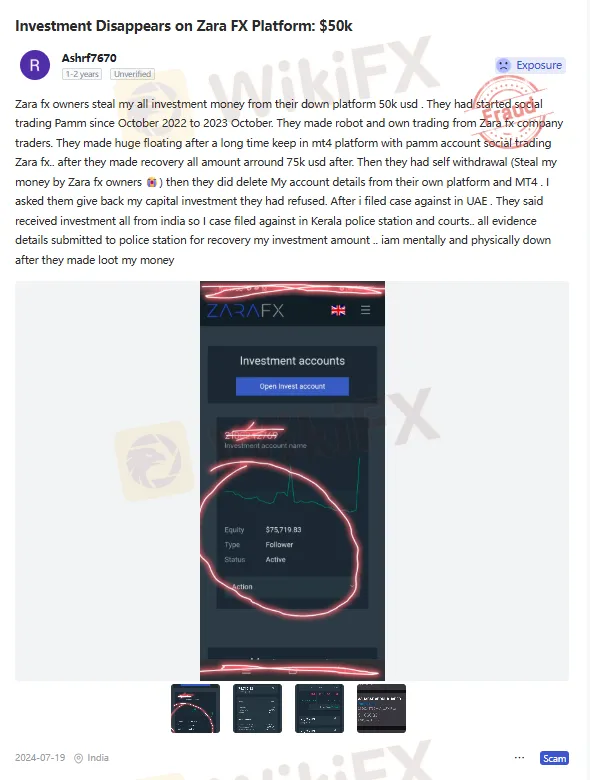

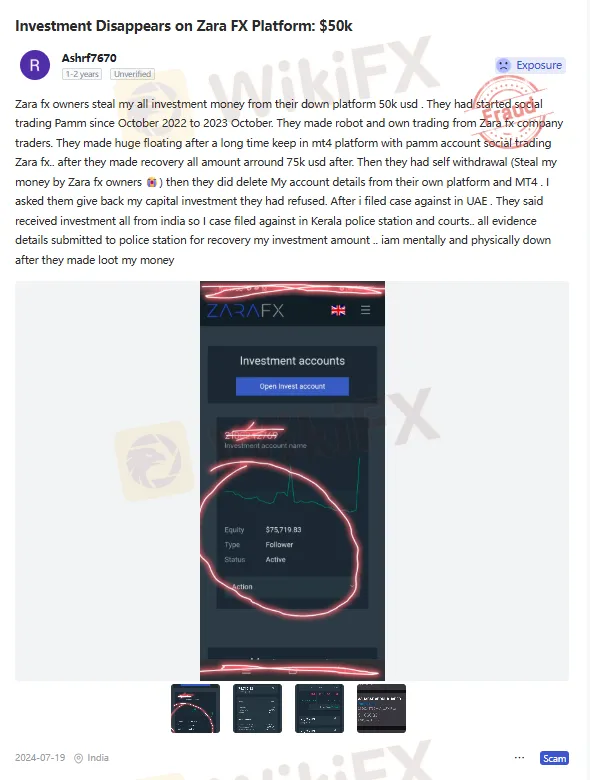

· Multiple reports allege that the broker “steals” investment money. One user from India filed a detailed complaint claiming a loss of $50,000 USD from a PAMM account, alleging the broker's own traders manipulated the account before the user's funds and account history were deleted.

· Another user reported that their profits were rejected on the grounds of “manipulation” without any scientific evidence provided by the broker.

· There are claims of accounts being deleted entirely after funds were allegedly taken by the company, effectively erasing any record of the client's investment.

· Significantly, some users have reported escalating their disputes by filing legal cases in the UAE and India, indicating the severity of the financial losses and the broker's unwillingness to resolve the issues internally.

Complaint Screenshots

The Voice of the Community

Reading through the full range of user reviews is a critical research step. To see these detailed exposure reports and user comments regarding the ZarVista license and operations, traders can consult the community section on WikiFX.

Conclusion: A Clear Verdict

The evidence leads to a clear conclusion. The combination of weak offshore regulation from Comoros and Mauritius, an extremely low trust score of 2.07 out of 10, failed physical office verifications, and a significant volume of severe user complaints regarding withdrawals and alleged fraud firmly places ZarVista in the high-risk broker category. The framework for ZarVista Regulation does not provide the level of security, transparency, or client protection that is standard with top-tier, reputable regulators.

The issues identified are not minor compliance problems; they are fundamental flaws that expose traders to a substantial risk of financial loss. The pattern of complaints suggests that the problems are not isolated incidents but may be indicative of the broker's business model. While the company offers modern platforms and attractive trading conditions on the surface, these features are rendered meaningless if clients cannot reliably access their funds.

The financial markets carry natural risks, and choosing an untrustworthy broker multiplies that risk exponentially. We strongly urge all traders to use independent verification tools. For a comprehensive and up-to-date safety assessment of over 50,000 brokers, including ZarVista, visit WikiFX to check its full profile, license details, and latest user reviews before making any financial commitment.