Company Summary

| BCEL Review Summary | |

| Founded | 1975 |

| Registered Country/Region | Lao PDR |

| Regulation | Not regulated |

| Products and Services | Deposits, Loans, Cards, Fund Transfers, Electronic Banking, Trade Finance, Utilities Payment |

| Demo Account | ❌ |

| Spread | USD ~270, EUR ~480 (approx. FX spread) |

| Trading Platform | BCEL One, BCEL i-Bank, FastTrack, BCEL OneProof |

| Customer Support | Tel:(+856-21)213200 |

| Fax:(+856-21) 213202 | |

| bcelhqv@bcel.com.la | |

BCEL Information

Founded in 1975, BCEL is a major commercial bank in Laos providing retail and corporate banking services. Though not a regulated broker, it offers various financial products including savings accounts, loans, fund transfers, and electronic banking tools.

Pros and Cons

| Pros | Cons |

| Broad range of personal and business banking services | Not regulated |

| Multiple digital banking tools and platforms | No demo or Islamic accounts |

| FX exchange service available with multiple currencies | No leverage for active trading |

Is BCEL Legit?

BCEL (Banque Pour Le Commerce Exterieur Lao Public) is not a licensed or regulated financial broker under Thailands financial regulatory authorities. Although it operates financial services such as deposits, loans, and fund transfers, it does not hold a trading or brokerage license from regulatory bodies like the FCA (UK), ASIC (Australia), CySEC (Cyprus), or the SEC (Thailand).

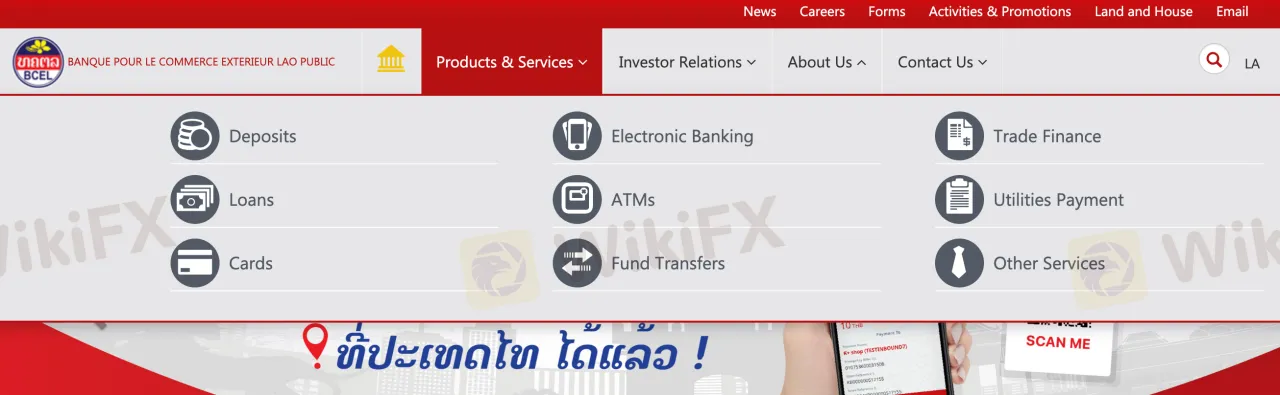

Products and Services

BCEL (Banque Pour Le Commerce Exterieur Lao Public) provides a range of banking products and services designed for personal as well as corporate use. Amongst these are utility payments, financial transfers, electronic banking, cards, loans, and deposit accounts.

| Product/Service | Available |

| Deposits | ✅ |

| Loans | ✅ |

| Cards | ✅ |

| Electronic Banking | ✅ |

| ATMs | ✅ |

| Fund Transfers | ✅ |

| Trade Finance | ✅ |

| Utilities Payment | ✅ |

| Other Services | ✅ |

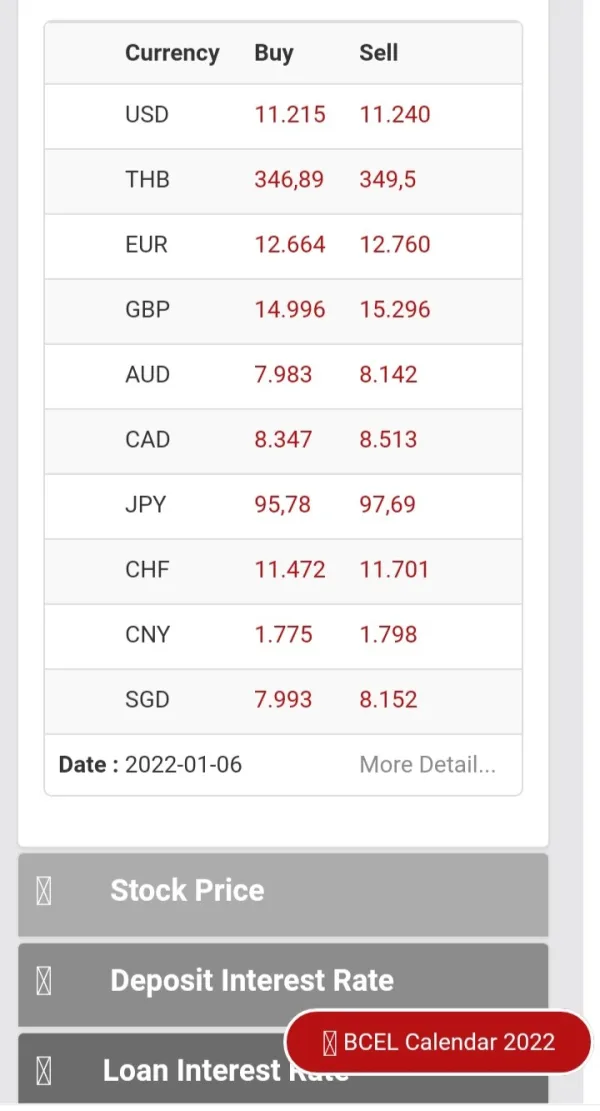

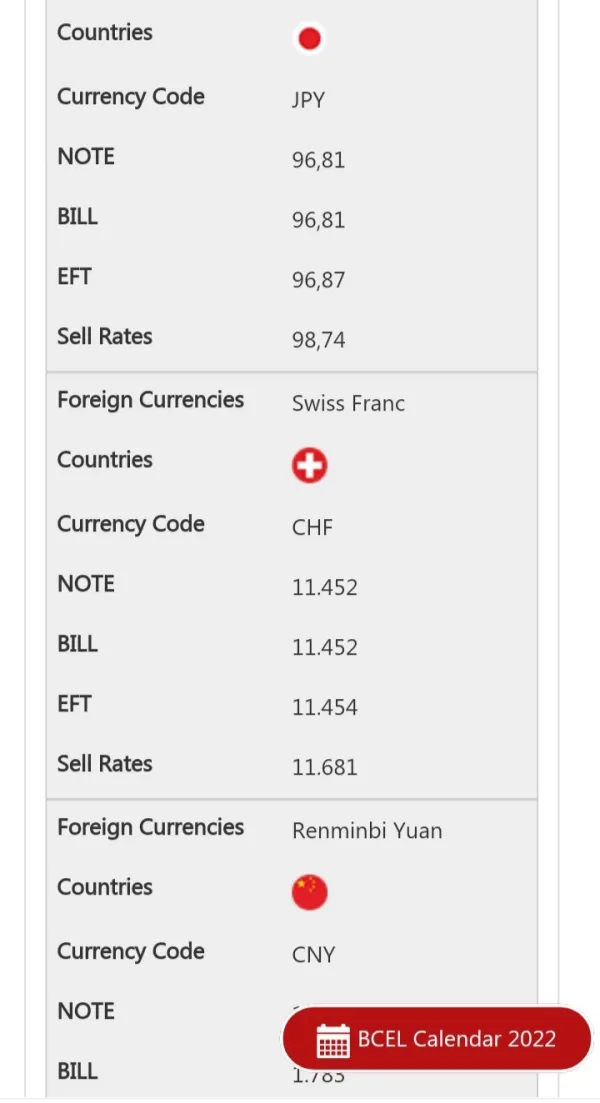

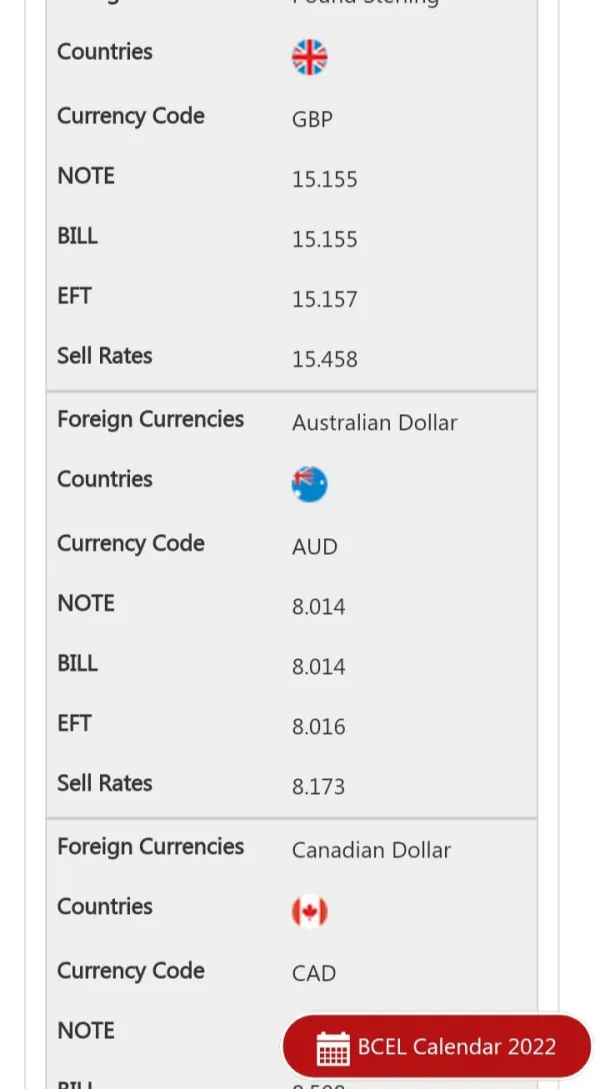

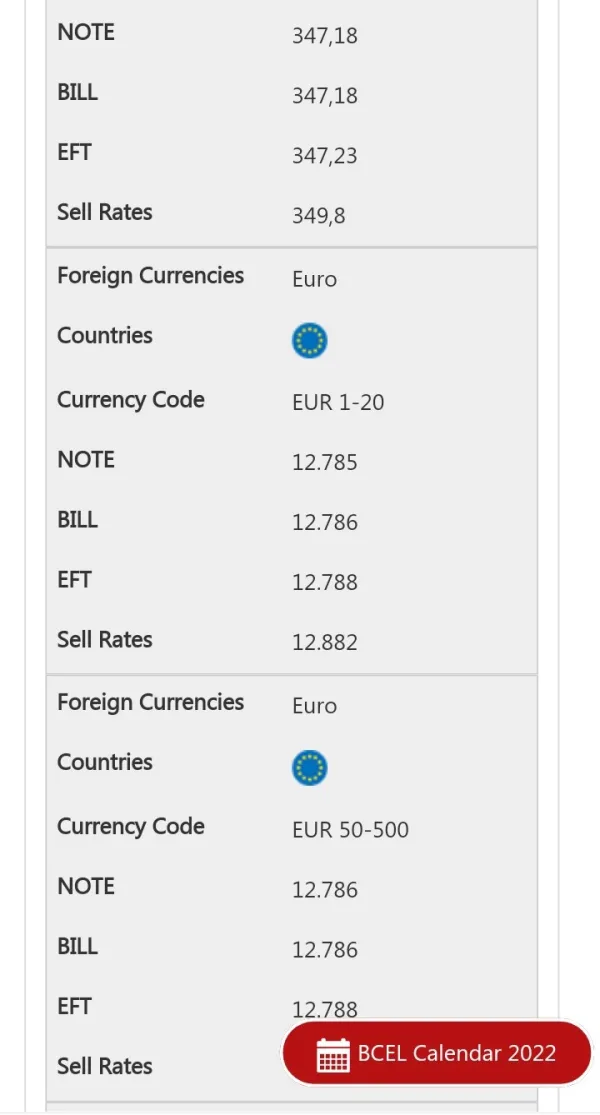

BCEL Fees

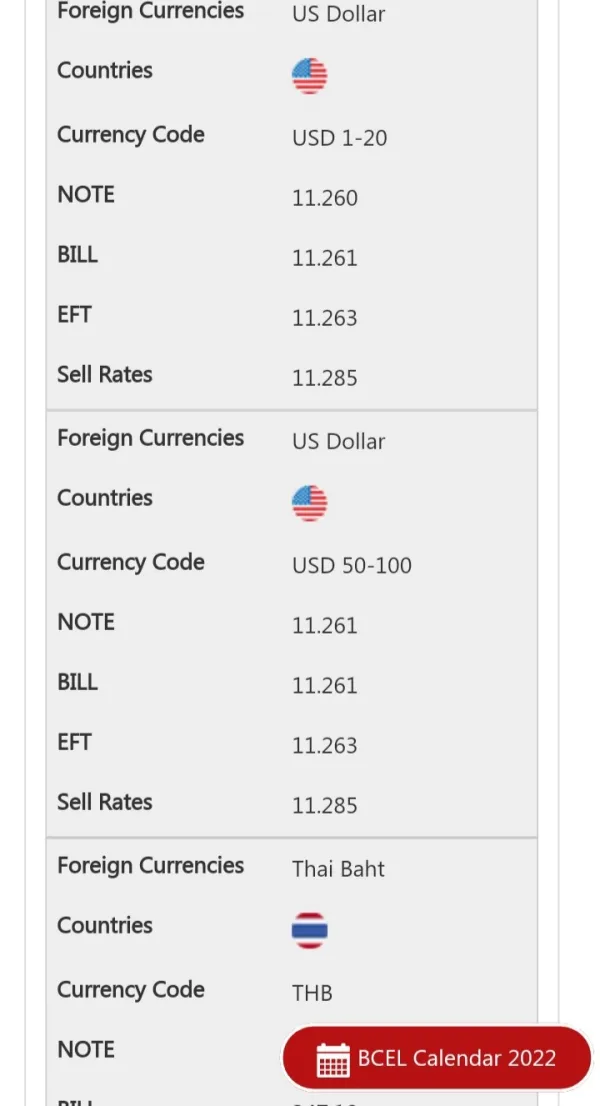

BCELs trading-related fees, based on foreign currency exchange services, are generally competitive and in line with regional banking standards. Their exchange rates for major currencies such as USD, EUR, and JPY reflect standard banking spreads.

| Currency | Buy Rate (EFT) | Sell Rate |

| USD (1–100 Notes) | 21,345 | 21,615 |

| EUR (1–500 Notes) | 24,056 | 24,534 |

| GBP | 28,179 | 28,740 |

| AUD | 13,709 | 14,118 |

| JPY | 148.18 | 151.08 |

| SGD | 15,150 | 15,451 |

| CNY | 2,903 | 2,958 |

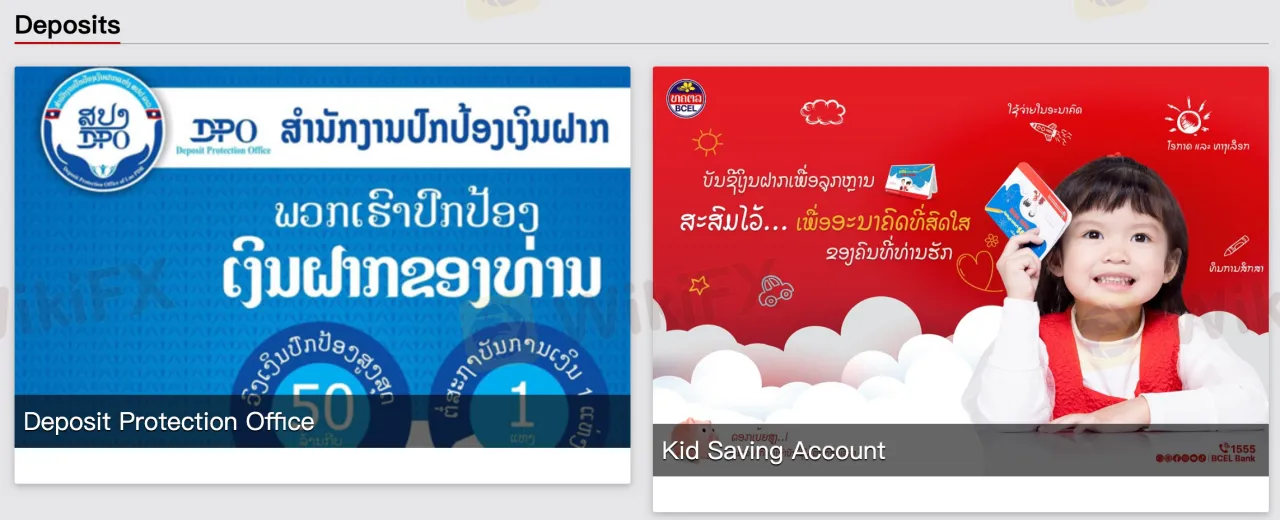

Account Types

BCEL offers several types of deposit accounts, each tailored to different customer needs. There is no indication of demo or Islamic (swap-free) accounts.

| Account Type | Description | Suitable For |

| Saving Account | Standard interest-bearing account | General users |

| Fixed Deposit Account | Time-bound savings with fixed interest | Long-term savers |

| Current Account | For frequent transactions, includes checkbook services | Business users, professionals |

| Kid Saving Account | Savings product for children | Parents saving for children |

| Pension Saving Account | Long-term retirement savings | Individuals planning for retirement |

| Deposit Protection Office | Coverage under deposit insurance scheme | All eligible account holders |

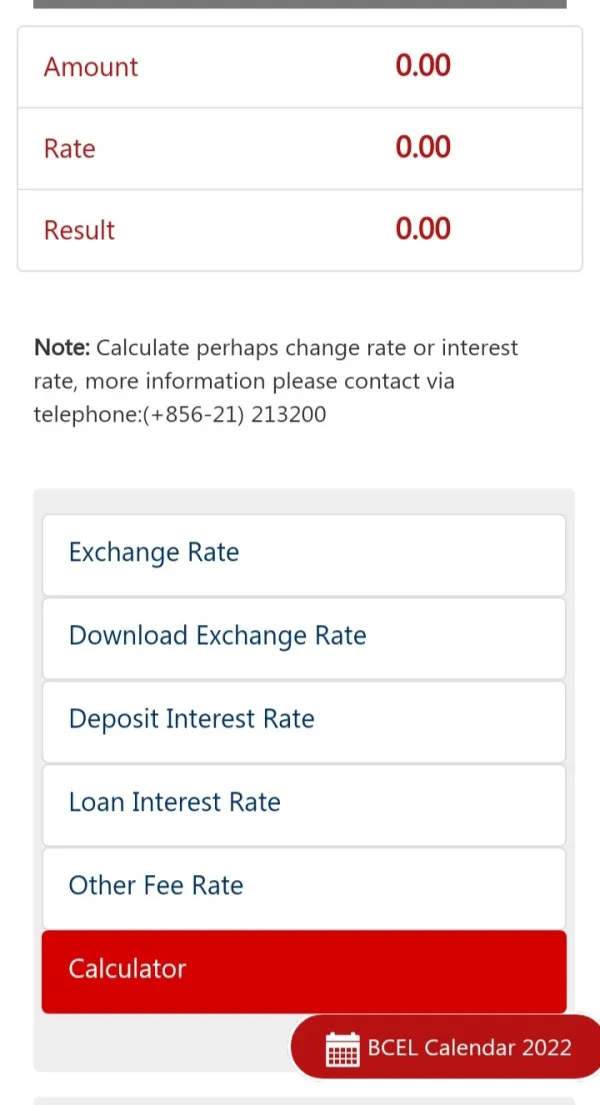

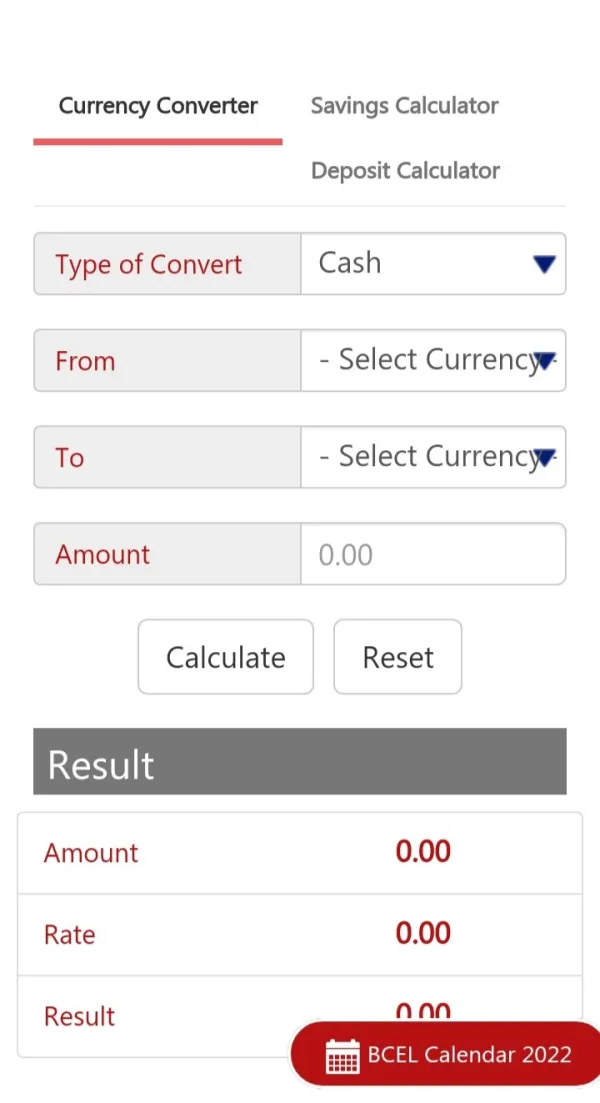

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for What Kind of Traders |

| BCEL One | ✔ | Smartphone (iOS/Android) | Retail clients seeking mobile banking convenience |

| BCEL i-Bank | ✔ | Desktop, Tablet | Users preferring online banking via browser |

| FastTrack | ✔ | Smartphone | Fast access users for regular transactions |

| BCEL OneProof | ✔ | Smartphone | Users needing proof of transactions digitally |

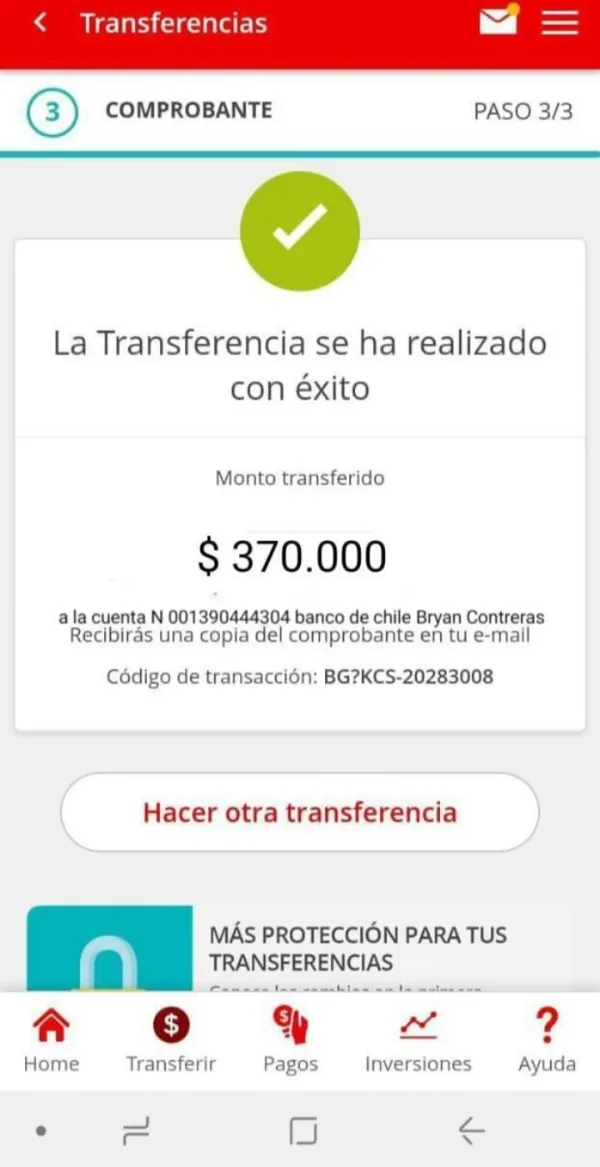

FX2704492760

Argentina

The operations are completely false. In addition to the fact that once you reach the minimum of $1500, they tell you that the payment will arrive within a period of 3 weeks, but it is not in reality. They only tell you that to calm you down and do not report, but they make me angry anyways. They scammed me $370

Exposure

FX3660911861

Mexico

I invested $132.96 and operated as a professional trader. I can say that the black market is being manipulated, so that any type of operation that I carry out goes to negative and loses everything.

Exposure

Phed Tollen

Laos

Who withdrew it for me?

Exposure

卢付祥

United States

I am so glad to have been referred to BCEL by my friend, who is into Forex trading as well. They are very proficient at monitoring the system, implementing the Forex trades and being constantly supportive whenever I requested additional information or assistance. Now, all I do is just have a quick look at their daily report. Thanks a lot!

Positive