Company Summary

| Pluang Review Summary | |

| Founded | 2013 |

| Registered Country/Region | Indonesia |

| Regulation | Not regulated |

| Market Instruments | US Stocks, ETFs, Crypto, Gold, Mutual Funds, Options, Crypto Futures |

| Demo Account | ❌ |

| Leverage | Up to 1:4 |

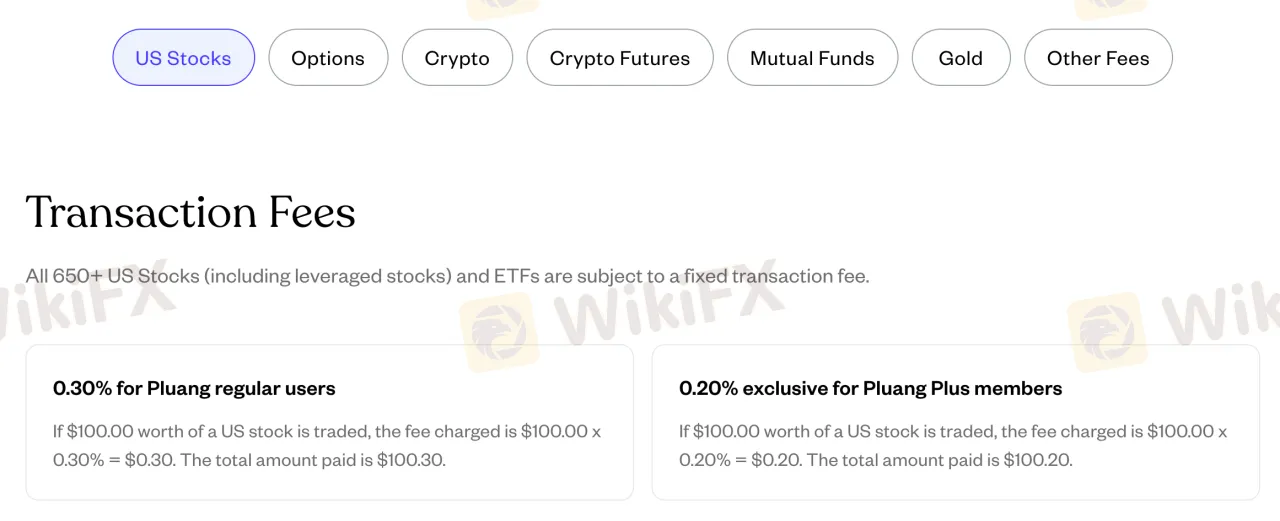

| Spread | US Stocks transaction fee: 0.30% (regular users) / 0.20% (Pluang Plus) |

| Trading Platform | Pluang Mobile App, Pluang Web Trading |

| Min Deposit | Rp10,000 |

| Customer Support | Email (24/7): tanya@pluang.com |

| Live Chat (24/7): Available via Pluang App | |

| Call Center: (021) 8063 0065 (Mon–Fri, 09:00–18:00 WIB, except holidays) | |

Pluang Information

Pluang, founded in 2013 and based in Indonesia, is a mobile-first investment platform offering over 1,000 assets including US stocks, ETFs, crypto, gold, mutual funds, options, and futures. It is not regulated either locally or internationally. It mainly targets beginner investors and casual traders with low minimum deposits and an easy-to-use app interface.

Pros and Cons

| Pros | Cons |

| Access to a wide range of assets including US stocks and crypto | Not regulated |

| Low minimum deposit requirement (Rp10,000) | Limited to specific asset classes (no forex or CFDs) |

| Beginner-friendly mobile and web trading platforms | Leverage fees and transaction costs may apply |

Is Pluang Legit?

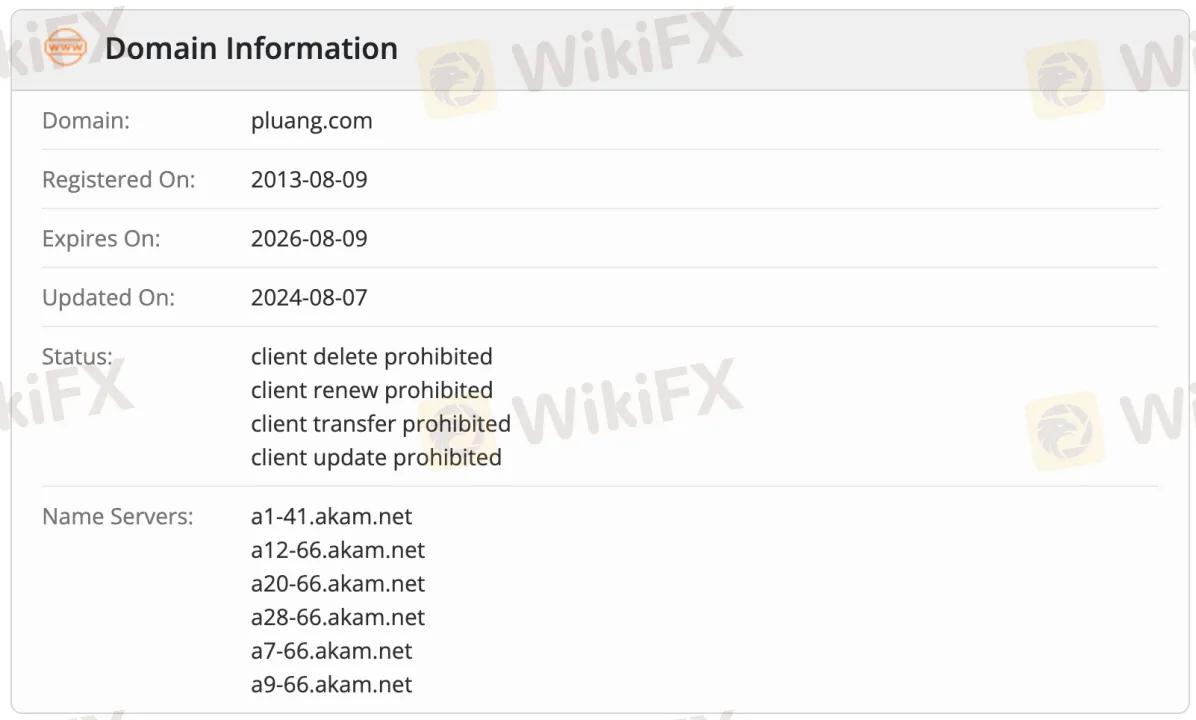

Pluang is not a regulated broker. It is not regulated by Indonesia's primary financial authorities for securities trading, such as OJK (Otoritas Jasa Keuangan).

According to WHOIS data, the domain pluang.com was registered on August 9, 2013, last updated on August 7, 2024, and will expire on August 9, 2026.

What Can I Trade on Pluang?

Pluang offers access to over 1,000 assets, including 650+ US stocks and ETFs, 360+ crypto assets, 65+ mutual funds, gold, options, and crypto futures.

| Tradable Instruments | Supported |

| Forex | ❌ |

| Commodities (Gold) | ✅ |

| Crypto | ✅ |

| CFD | ❌ |

| Indexes | ❌ |

| Stock | ✅ |

| ETF | ✅ |

| Mutual Funds | ✅ |

| Options | ✅ |

| Crypto Futures | ✅ |

Account Types

Pluang offers two main account types: the Standard Account and the Pro Features Account. There is no Demo Account available and no Islamic (Swap-Free) Account option.

| Account Type | Available | Best For | Key Features |

| Standard Account | ✅ | Beginners and casual investors | Access to US stocks, crypto, gold, mutual funds, simple trading |

| Pro Features Account | ✅ | Active and professional traders | Advanced Orders, Crypto Order Book, Watchlists, Screeners |

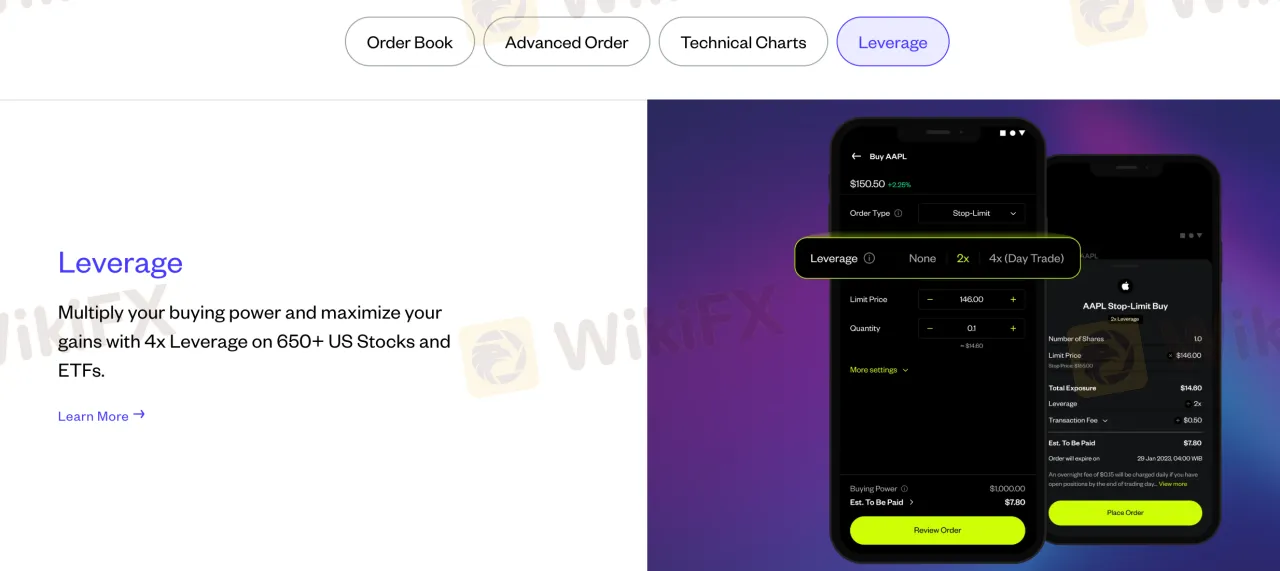

Leverage

Pluang offers up to 4× leverage on over 650+ US stocks and ETFs, allowing traders to multiply their buying power and potentially maximize returns within a shorter time frame. While leverage can amplify profits, it also increases potential losses.

Pluang Fees

Pluangs trading fees are relatively low compared to industry standards, especially for US stocks and ETFs. While the platform charges modest transaction fees, there are additional regulatory charges and daily leverage fees that users need to consider, particularly for leveraged and options trading.

| Product | Spreads/Fees |

| US Stocks & ETFs | 0.30% transaction fee (regular users) / 0.20% (Pluang Plus members) |

| Dividend Tax | 15% for unleveraged stocks, 30% for leveraged stocks |

| Daily Leverage Fee | 0.023% per day (8.25% p.a.) for regular users, 0.015% per day (5.25% p.a.) for Pluang Plus members |

| Crypto, Mutual Funds, Gold, Options | Fees not fully detailed, regulatory fees apply for options |

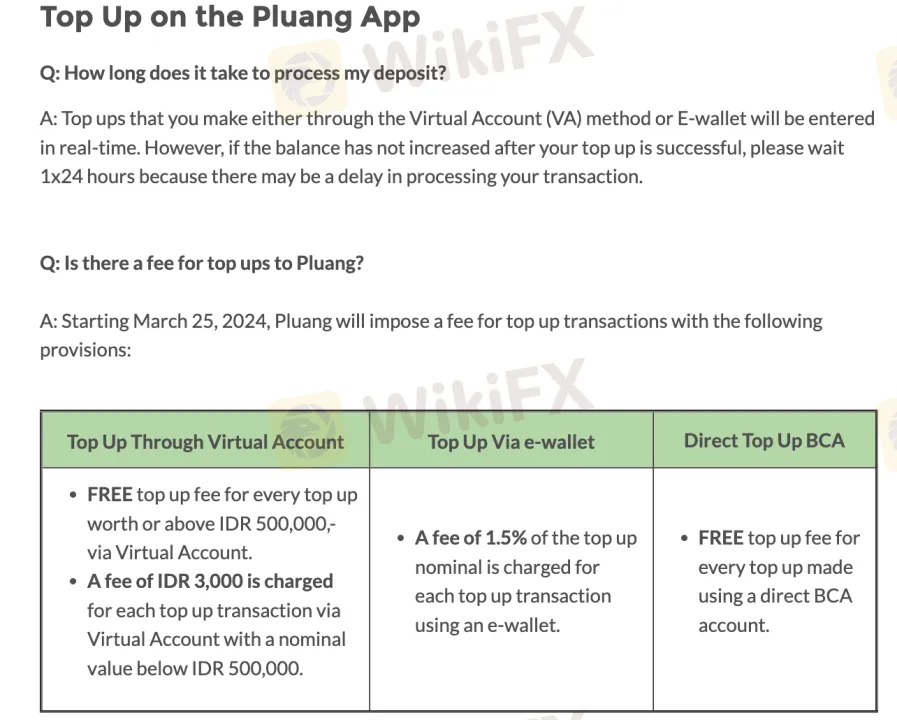

Non-Trading Fees

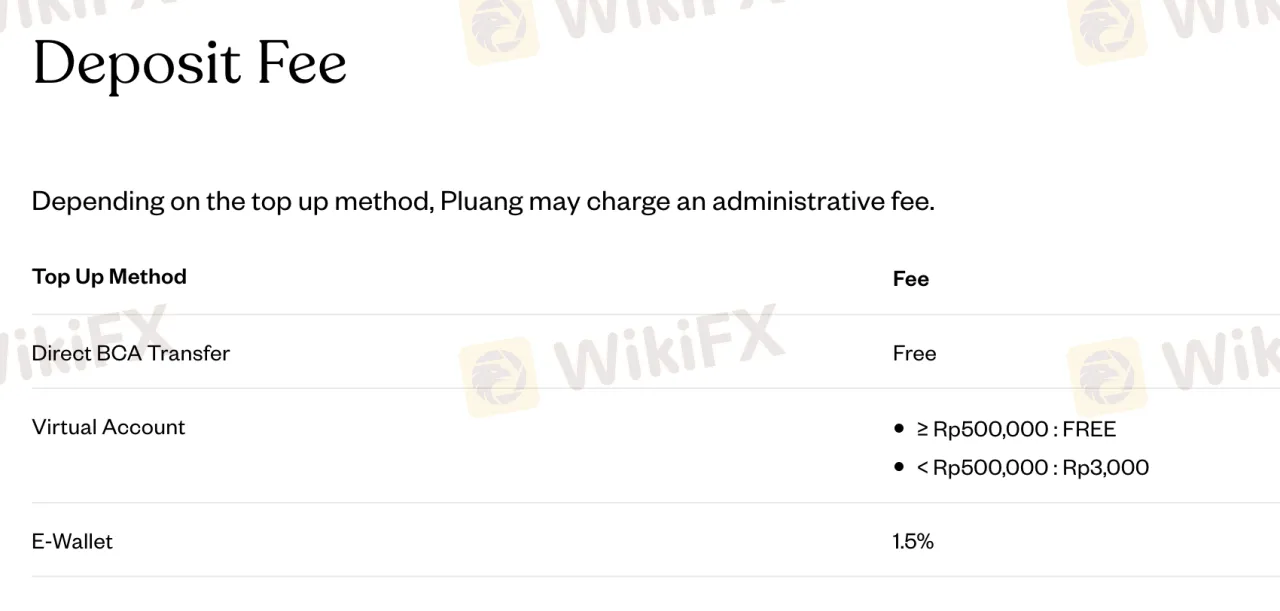

| Non-Trading Fees | Details |

| Deposit Fee | Direct BCA Transfer: Free |

| Virtual Account: Free if ≥ Rp500,000; Rp3,000 if < Rp500,000 | |

| E-Wallet: 1.5% fee | |

| Withdrawal Fee | First transaction per month: Free |

| Second and onward: Rp4,500 per transaction | |

| Inactivity Fee | Not mentioned |

| Foreign Exchange Fee | 0.25% conversion fee for IDR to USD and vice versa, plus market spread (variable based on time and liquidity) |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| Pluang Mobile App | ✔ | Android, iOS smartphones/tablets | Beginner and casual traders, mobile-first users |

| Pluang Web Trading | ✔ | PC, Mac (Web Browser) | Traders needing larger screens and chart analysis |

| MetaTrader 4 (MT4) | ❌ | – | – |

| MetaTrader 5 (MT5) | ❌ | – | – |

Deposit and Withdrawal

Pluang generally does not charge a deposit fee for large transactions, but small deposits via Virtual Account or E-Wallet incur a fee.

Withdrawals are free for the first time each month, and a small fee (Rp4,500) is charged from the second withdrawal onwards.

The minimum deposit is Rp10,000, and the minimum withdrawal is Rp10,000.

Deposit Options

| Deposit Method | Min. Deposit | Fees | Processing Time |

| Direct BCA Transfer | Rp500,000 | Free | Real-time to 1 business day |

| Virtual Account (VA) | Rp10,000 | Free if ≥ Rp500,000; Rp3,000 if < Rp500,000 | Real-time to 1 business day |

| E-Wallet (e.g., Gopay) | Rp10,000 | 1.5% of deposit amount | Real-time |

Withdrawal Options

| Withdrawal Method | Min. Withdrawal | Fees | Processing Time |

| Bank Transfer | Rp10,000 | First withdrawal free; Rp4,500 per subsequent withdrawal | 1–3 business days |