Company Summary

| ZHONGZHOU FUTURES Review Summary | |

| Founded | 2002 |

| Registered Country/Region | China |

| Regulation | CFFEX |

| Trading Products | Commodity Futures, Financial Futures, Options |

| Demo Account | ✅ |

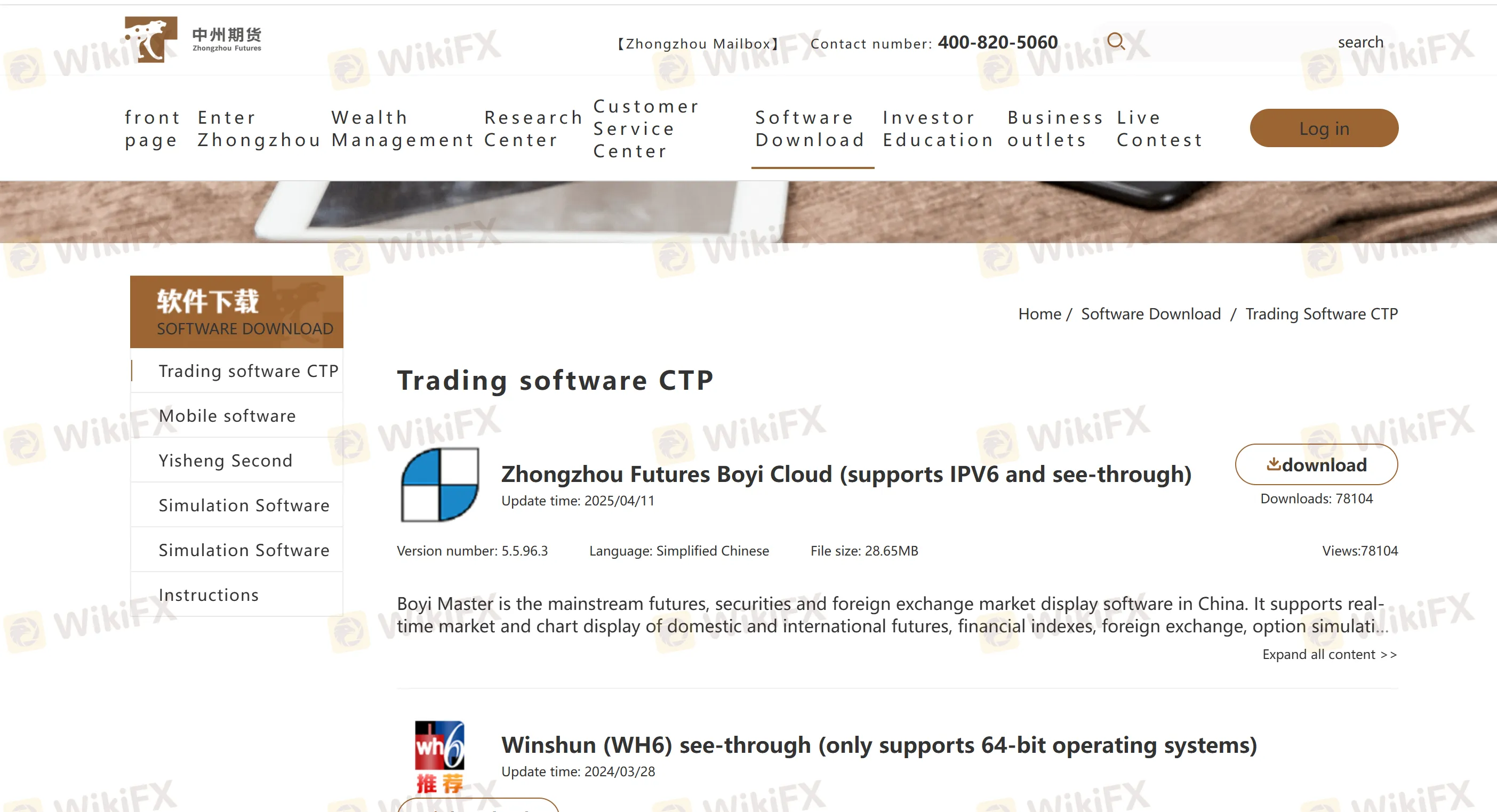

| Trading Platform | Boyiyun, Winshun WH6, Kuaiqi V3, Zhongzhou Futures APP, Wenhua Suishenxing, Longquan Liangjian System, and Trading Blaster (TB) |

| Minimum Deposit | / |

| Customer Support | Tel: 021-68902258 |

| Hotline: 400-820-5060 | |

| Email: zzzjb@zzfco.net | |

| Shanghai Management Headquarters Address: 22F, Block A, Wanshuo Building, No. 198 Jingzhou Road, Yangpu District | |

ZHONGZHOU FUTURES Information

ZHONGZHOU FUTURES is a legitimate futures company approved by the China Securities Regulatory Commission (CSRC). Headquartered in Nansha, Guangzhou, it is an official member of the Shanghai Futures Exchange, Dalian Commodity Exchange, Zhengzhou Commodity Exchange, China Financial Futures Exchange, Shanghai International Energy Trading Center, and Guangzhou Futures Exchange. With nationwide business coverage, it provides trading services for commodity futures, financial futures, options, as well as asset management and futures consulting services.

Pros and Cons

| Pros | Cons |

| Regulated by CFFEX | Higher thresholds for some services (e.g., CFFEX requires 500,000 RMB). |

| Diverse trading products | Complex offline account opening process |

| Various trading platforms | Simulated trading limitations (consumes “simulated beans”) |

| Long operation time | |

| Demo accounts available |

Is ZHONGZHOU FUTURES Legit?

Yes, ZHONGZHOU FUTURES is legal and compliant. It holds a Futures Brokerage Business License (No. 0271) issued by the China Financial Futures Exchange (CFFEX), and its legitimacy can be verified in the official directory on the website of the China Futures Association (CFA).

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| China Financial Futures Exchange (CFFEX) | Regulated | 中州期货有限公司 | China | Futures License | 0271 |

What Can I Trade on ZHONGZHOU FUTURES?

ZHONGZHOU FUTURES offers tradable products including commodity futures, financial futures, options, and international varieties.

| Tradable Instruments | Subcategory | Representative Varieties |

| Commodity Futures | Black Industry | Steel, iron ore, coke, coking coal, etc. |

| Energy & Chemical | Crude oil, methanol, ethylene glycol, PTA, asphalt, etc. | |

| Agricultural Products | Corn, live pigs, soybean meal, soybean oil, palm oil, cotton, etc. | |

| Financial Futures | Stock Index Futures | CSI 300 (IF), CSI 500 (IC), CSI 1000 (IM), etc. |

| Treasury Bond Futures | 10-year Treasury bond (T), 5-year Treasury bond (TF), etc. | |

| Options | Commodity Options | Sugar options, rubber options, iron ore options, etc. |

| Financial Options | CSI 300 stock index options (IO), CSI 1000 stock index options (MO), etc. | |

| International Varieties | Offshore Futures | CME crude oil, LME copper, New York gold, etc. |

Account Type

ZHONGZHOU FUTURES offers individual accounts suitable for ordinary investors, institutional accounts for corporate hedging or professional investment institutions, and simulation/demo accounts for strategy testing or novice practice (such as the Wenhua Suishenxing demo account and the SimNow simulation platform).

Trading Platform

| Type | Platform | Suitable for |

| PC | Boyiyun | Suitable for trend traders |

| Winshun WH6 | Requires high configuration (Quad-core CPU, 8G RAM) | |

| Kuaiqi V3 | Suitable for professional investors | |

| Mobile | Zhongzhou Futures APP | Supports Android/iOS |

| Wenhua Suishenxing | Simulated trading requires consuming simulated beans | |

| Quantitative Platform | Longquan Liangjian System | Suitable for quantitative traders |

| Trading Blaster (TB) | Suitable for strategy developers |

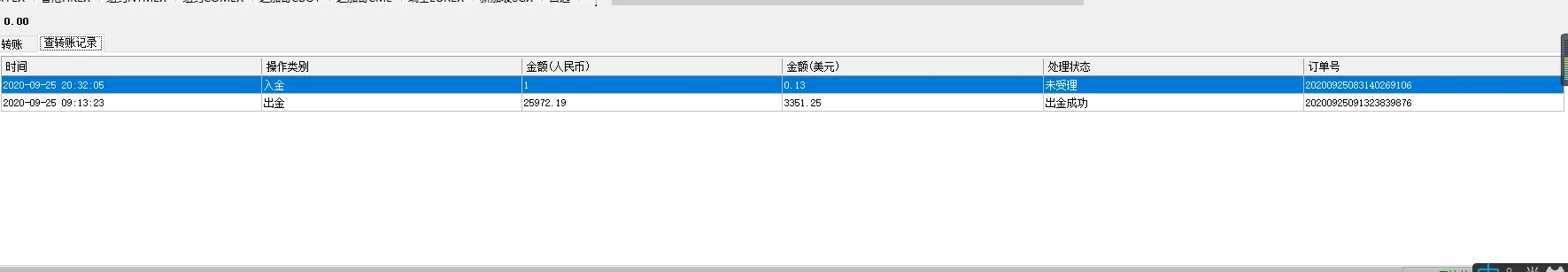

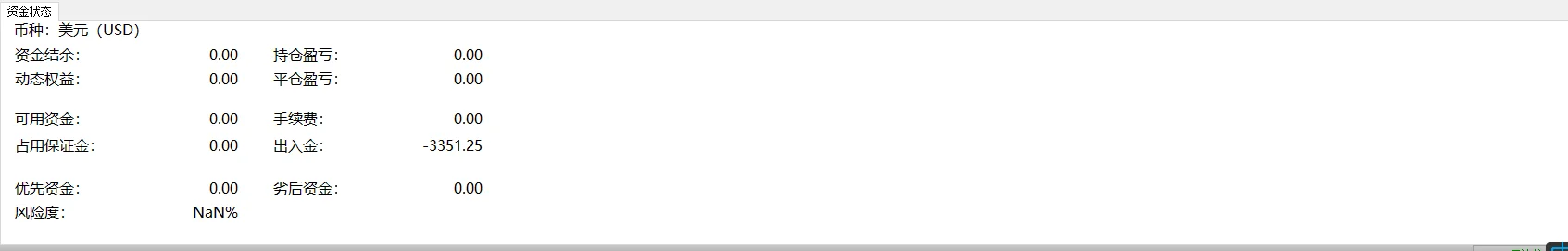

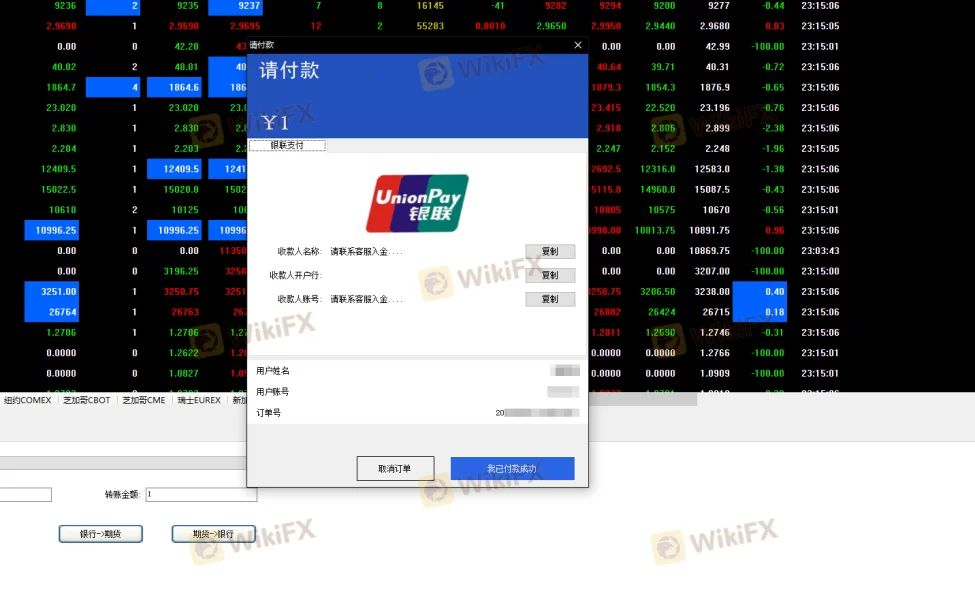

Deposit and Withdrawal

Fund deposit supports silver-futures transfer (12 banks, including the Bank of China and the Industrial and Commercial Bank of China), with real-time arrival.

The general deposit time is 08:30-16:00 on trading days (subject to bank notifications). The default daily cumulative withdrawal limit is 1,000,000 RMB, with a minimum reserved fund of 100 RMB (which can be applied for withdrawal when there is no trading). Withdrawals can be operated from 09:00-15:30 on trading days.