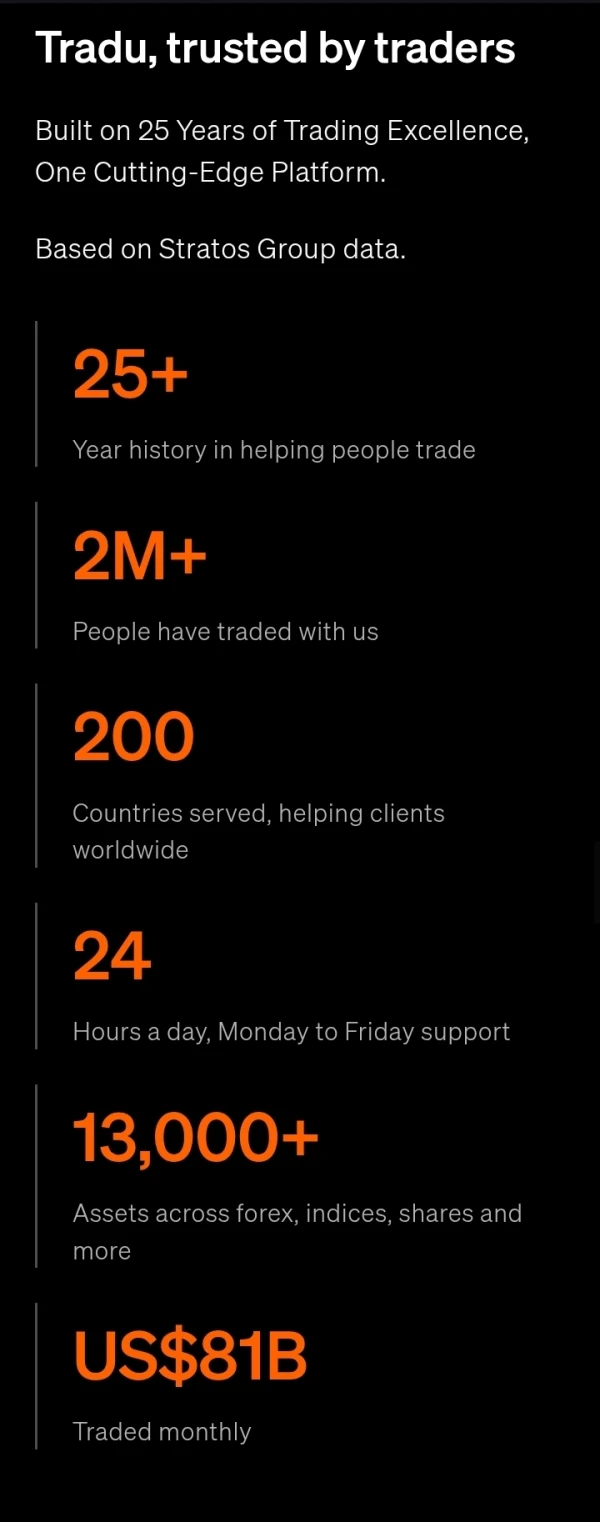

Company Summary

| Tradu Review Summary | |

| Founded | 2003 |

| Registered Country/Region | United Kingdom |

| Regulation | Regulated by CySEC (License 392/20); Offshore regulation by Seychelles FSA (License SD147). Claims ASIC (License 309763) but suspected clone. |

| Market Instruments | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| Demo Account | / |

| Leverage | Up to 1:500 |

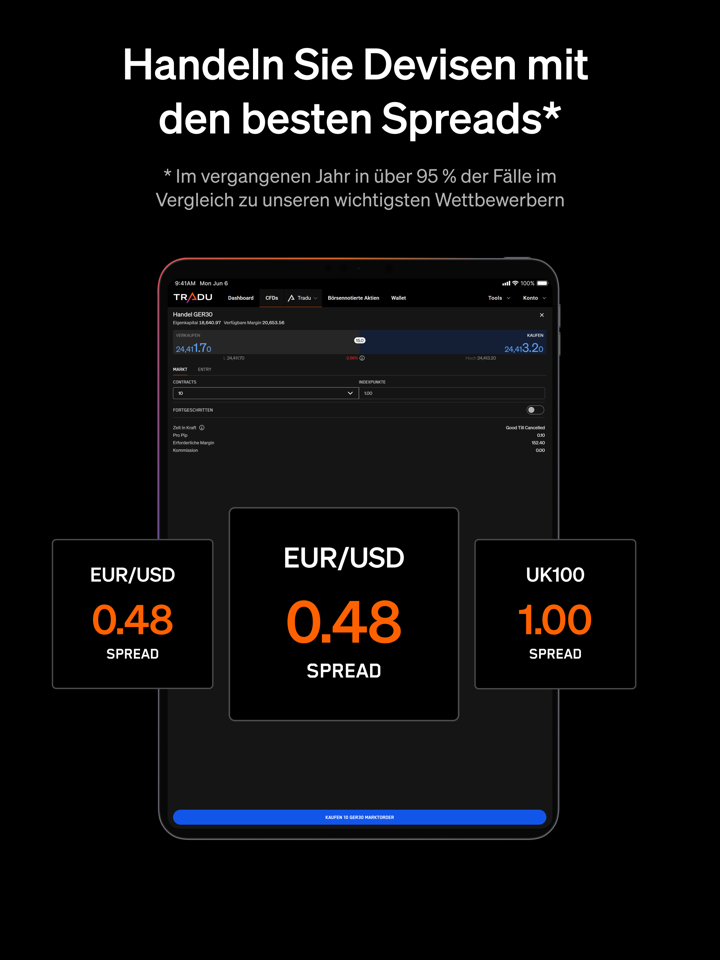

| Spread | EUR/USD: From 1.5 pips, NAS100: Tight spreads, Tesla Stock: $0.01/share, $1 minimum per trade |

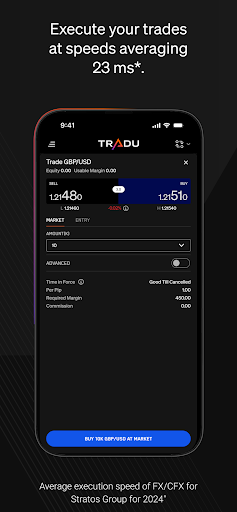

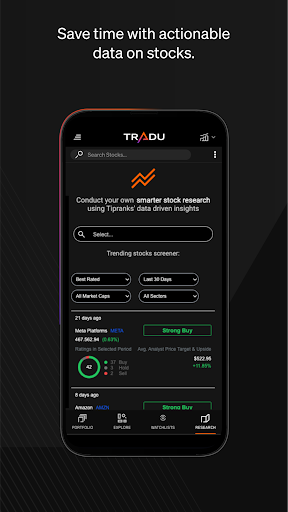

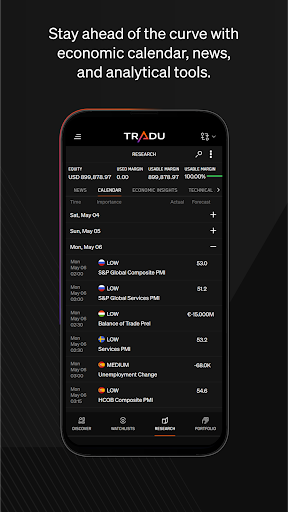

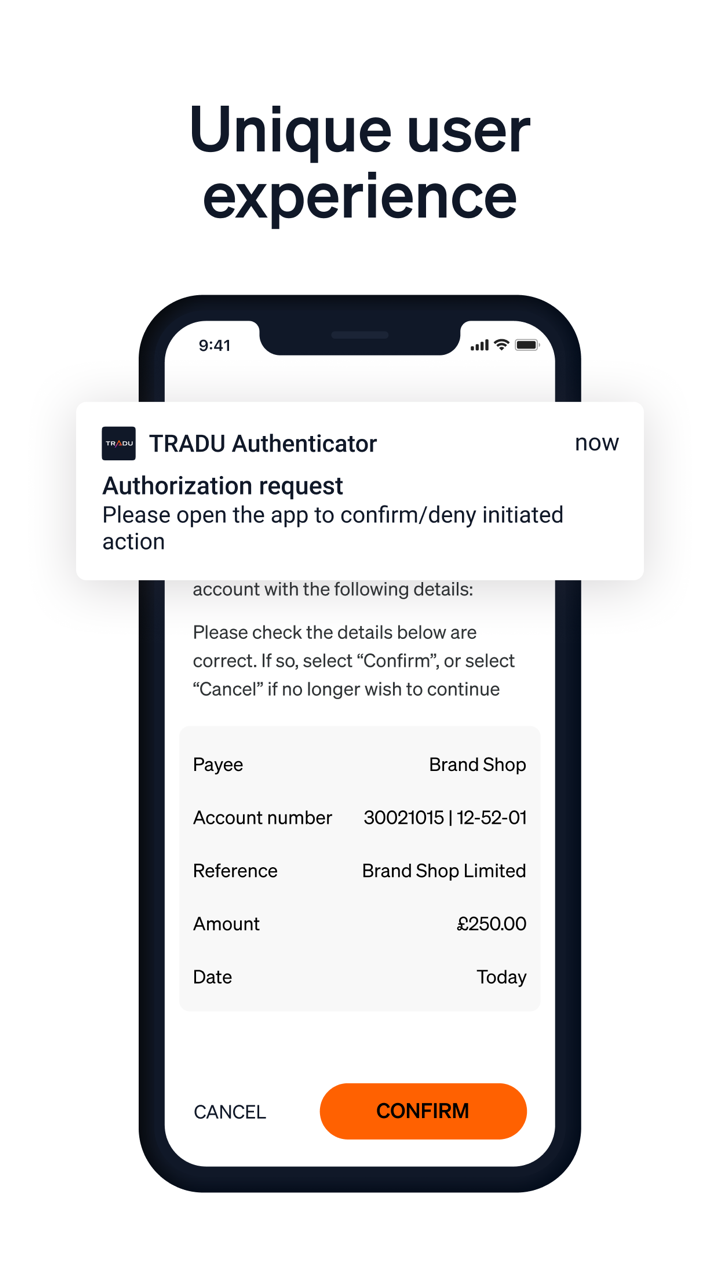

| Trading Platform | Web Trading Platform, Tradu App |

| Min Deposit | No minimum deposit required |

| Customer Support | - Live Web Chat |

| - Email: infoapac@tradu.com | |

| - Phone: +60 327081326 | |

Tradu Information

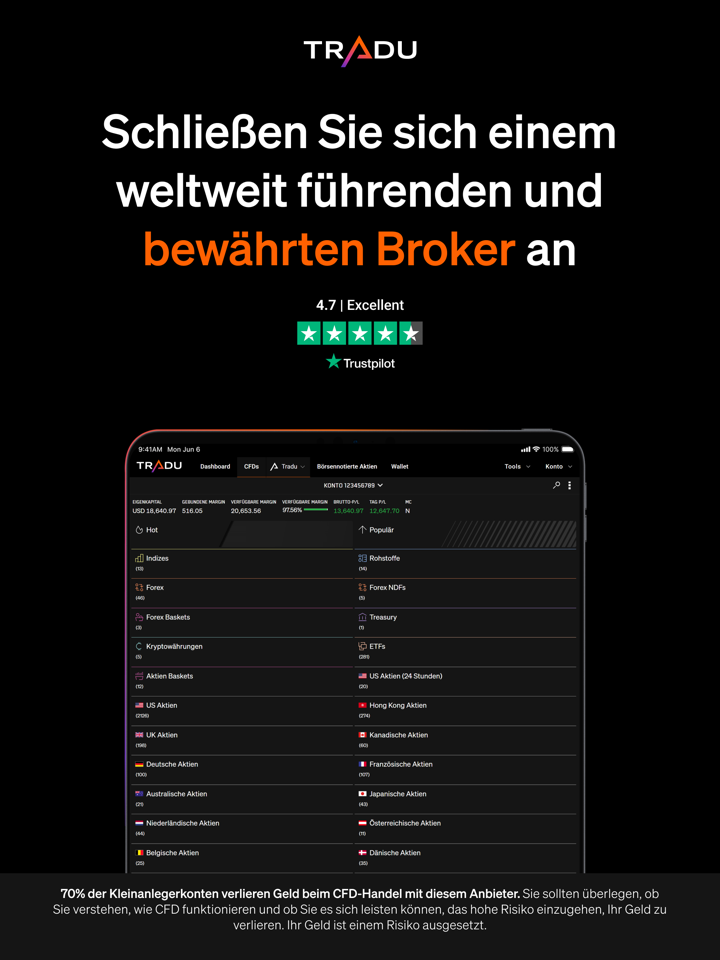

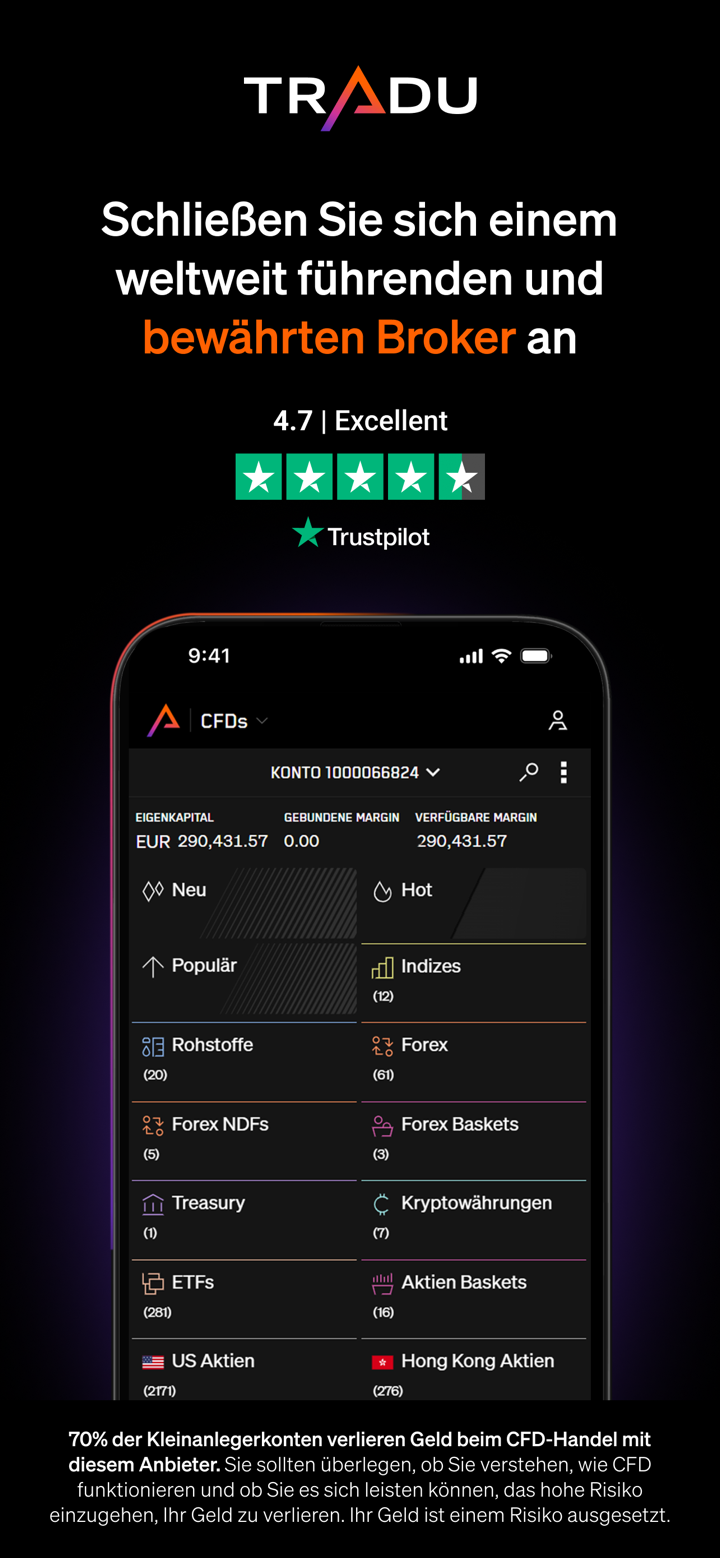

Tradu is a broker established in the UK that is governed by the CySEC and the Seychelles FSA. Forex, equities, indices, commodities, and cryptocurrencies are among the many tradable assets it provides. A wide spectrum of traders can use the broker because it offers cheap fees and no minimum deposit. However, some users might find it less appealing due to the absence of demo or Islamic accounts.

Pros and Cons

| Pros | Cons |

| Regulated by CySEC | Suspected ASIC clone license |

| No deposit or withdrawal fees | Offshore regulation risks |

| Wide range of tradable instruments | Limited leverage for some products |

| Low trading fees and tight spreads | No Demo or Islamic account options |

Is Tradu Legit?

Under license number 392/20, awarded to Stratos Europe LTD., Tradu is governed by the Cyprus Securities and Exchange Commission (CySEC). This control guarantees adherence to EU financial policies.

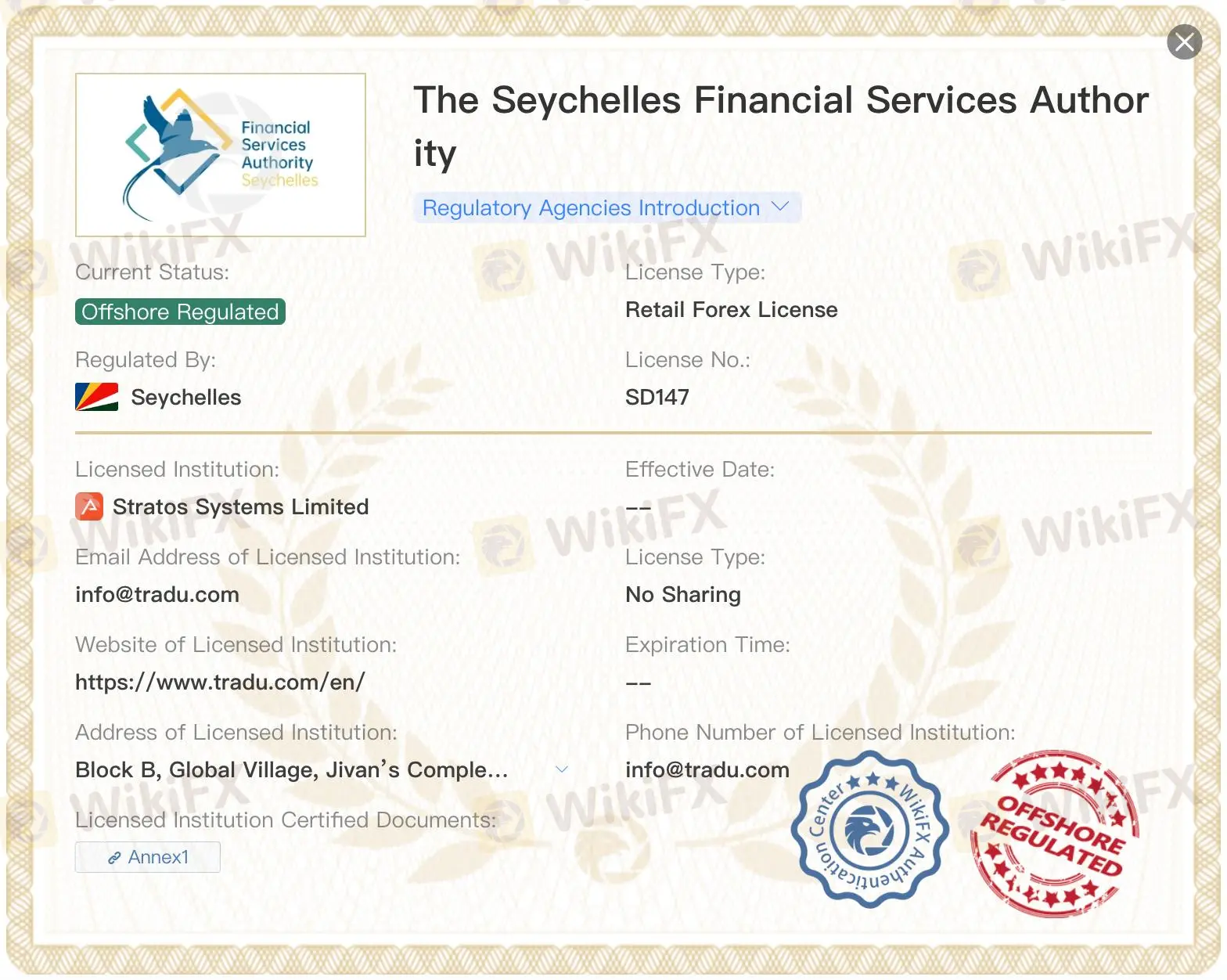

The broker also holds an offshore retail forex license from the Seychelles Financial Services Authority (FSA), license number SD147, awarded to Stratos Systems Limited. Usually offering less control, offshore rules increase the dangers to traders.

Under license number 309763, issued to Stratos Trading Pty. Limited, Tradu claims control by the Australian Securities and Investment Commission (ASIC). But this license is thought to be a clone, hence traders should be careful dealing with this company.

| License Authority | License Type | License Number |

| Cyprus Securities and Exchange Commission (CySEC) | EU Financial Regulation | 392/20 |

| Seychelles Financial Services Authority (FSA) | Offshore Retail Forex | SD147 |

| Australian Securities and Investment Commission (ASIC) | Financial Market Regulation (Clone Suspected) | 309763 |

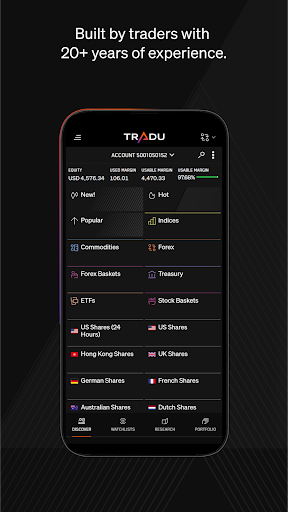

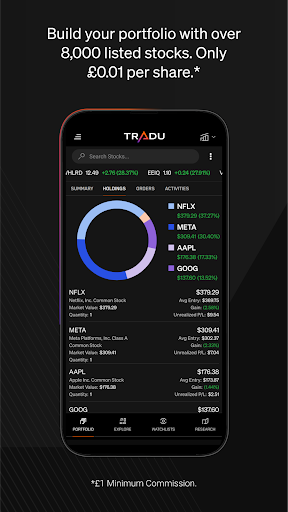

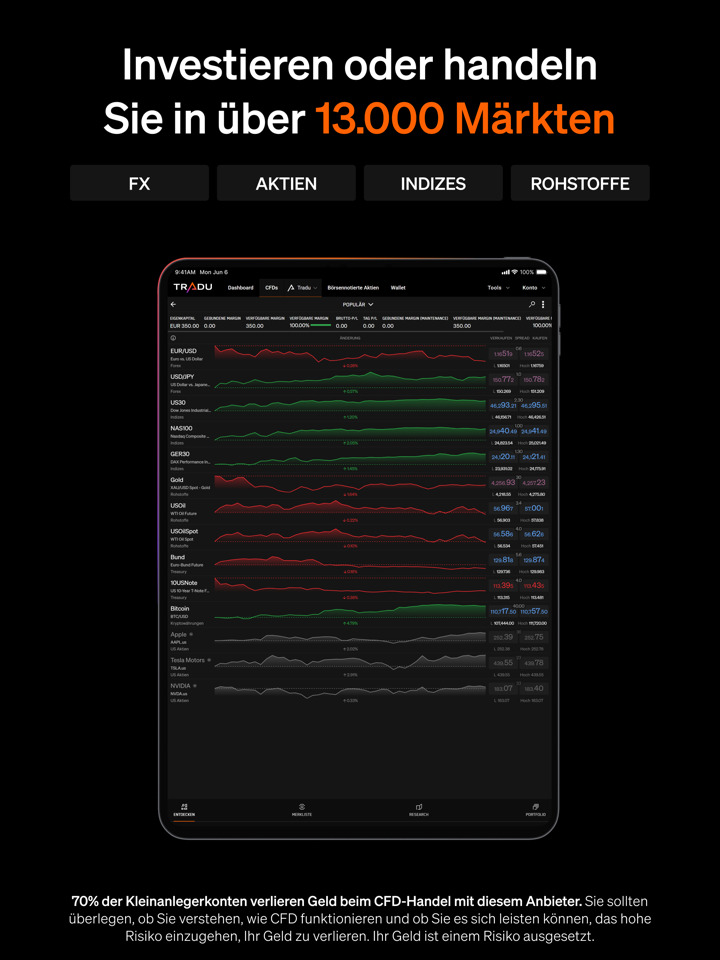

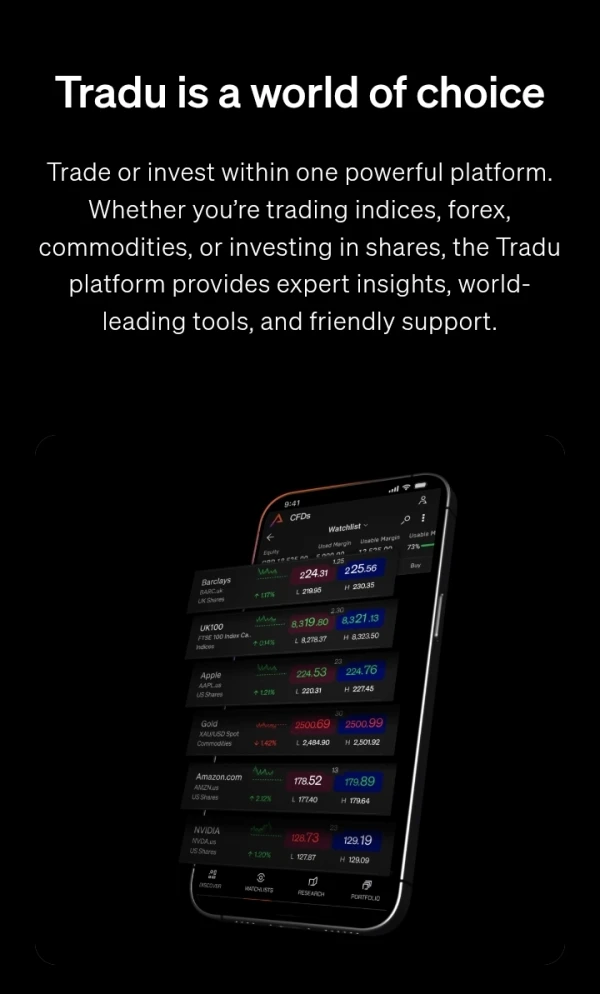

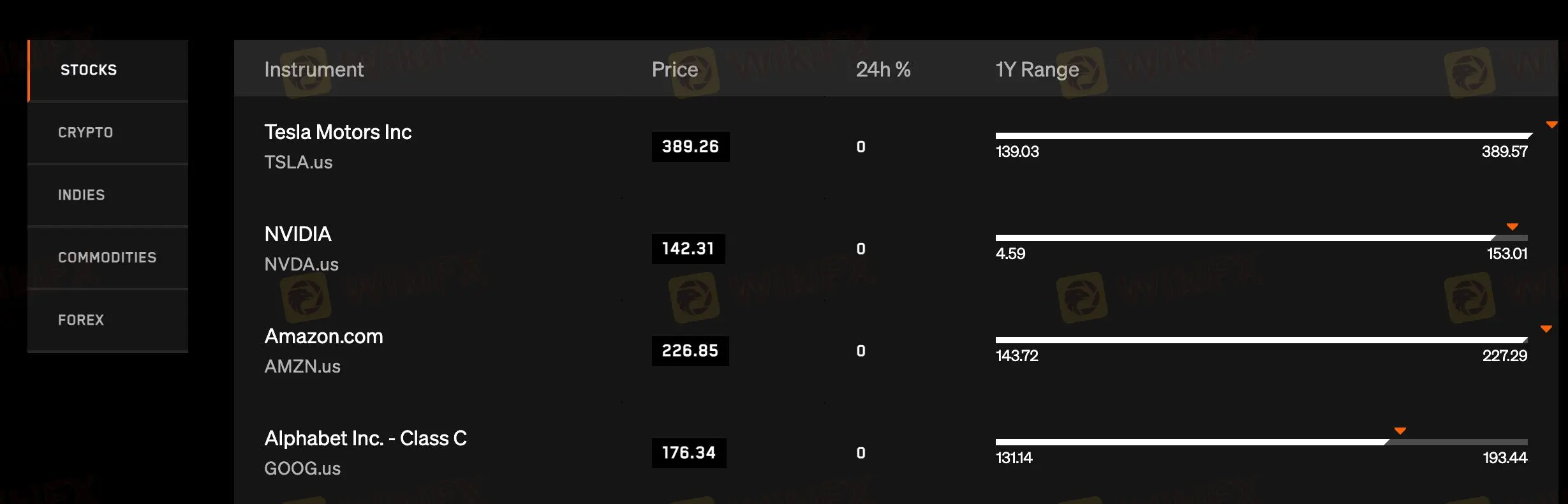

What Can I Trade on Tradu?

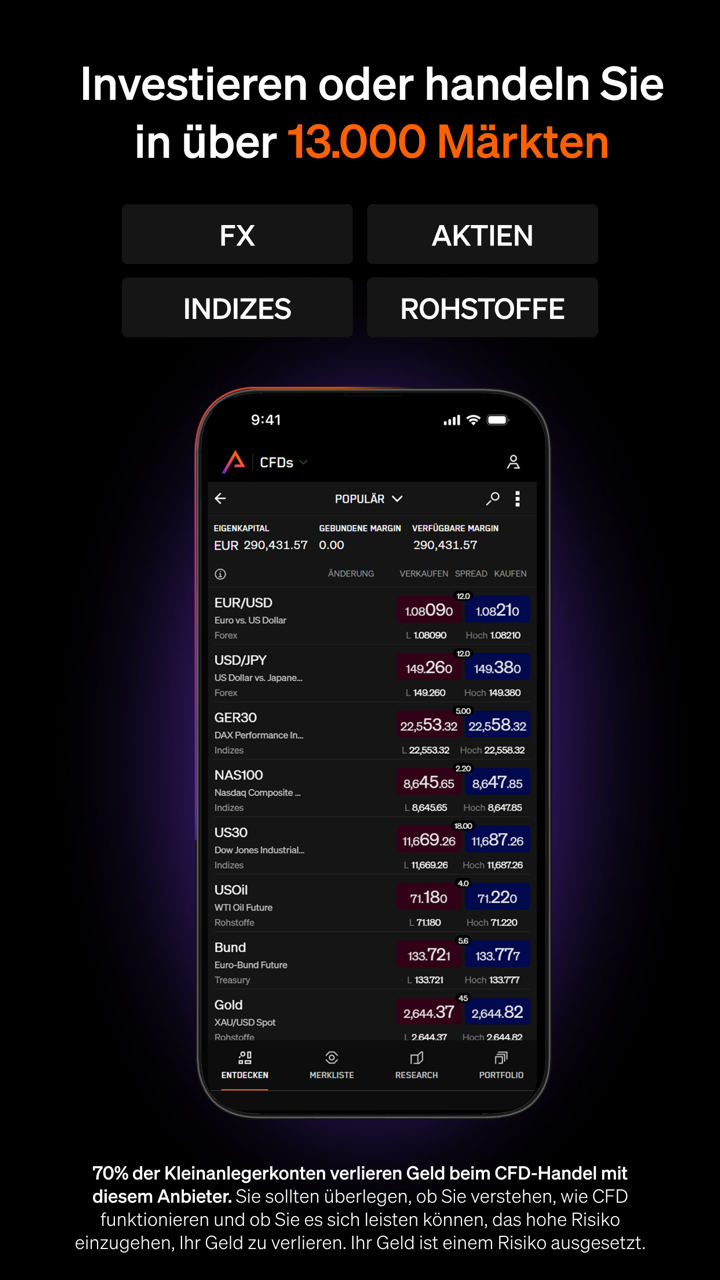

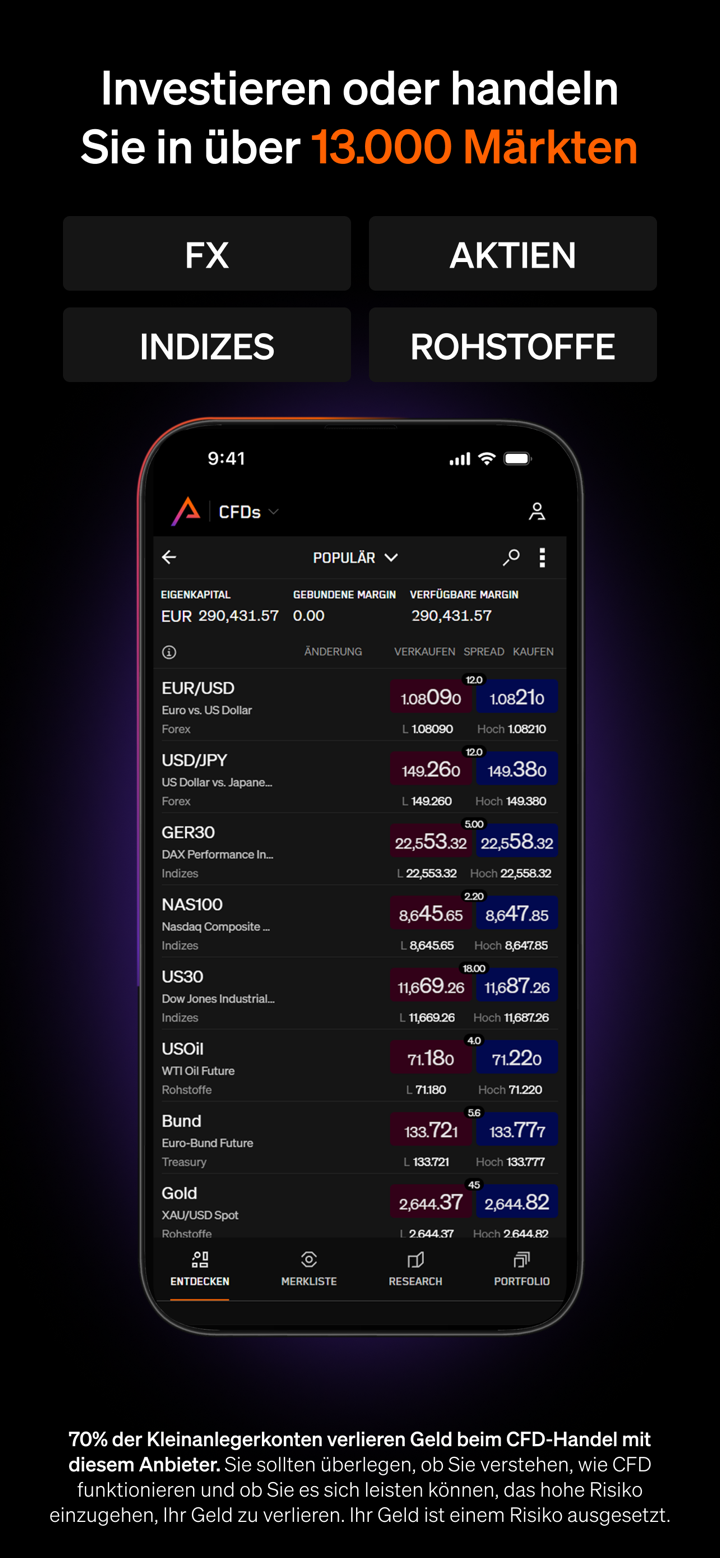

Tradu offers a wide spectrum of tradable assets, which helps investors and traders to create their portfolios. Among the dozens of products available are indices, commodities, CFDs on FX, listed equities, and cryptocurrencies.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Cryptocurrencies | ✔ |

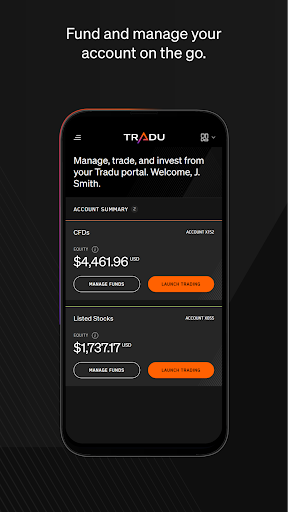

Account Types

Tradu provides one main kind of live trading account that lets users trade using many different financial instruments. On the platform, no particular reference of Islamic or Demo accounts exists.

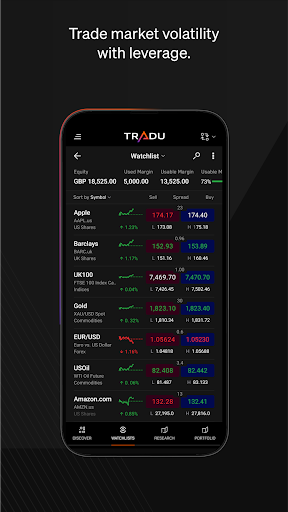

Leverage

Tradu gives traders leverage choices ranging from 1:20, therefore enabling them to increase their trading holdings. Leverage raises possible losses even if it can raise possible returns.

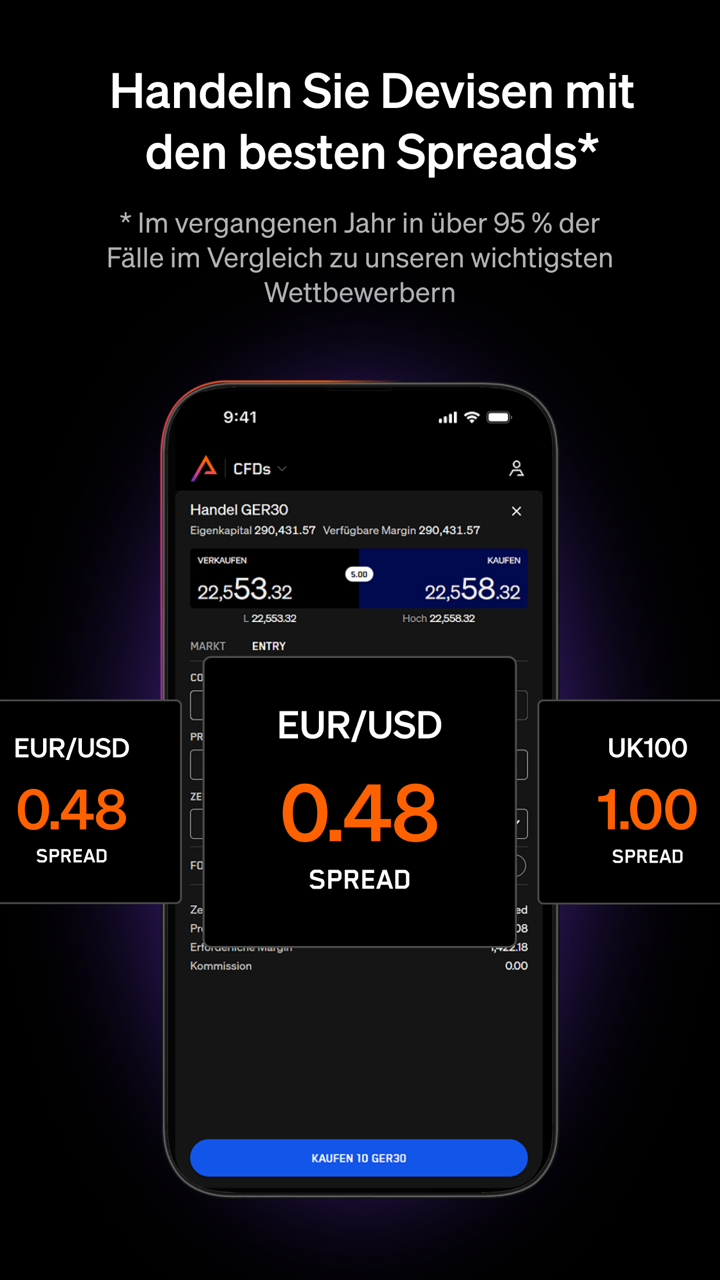

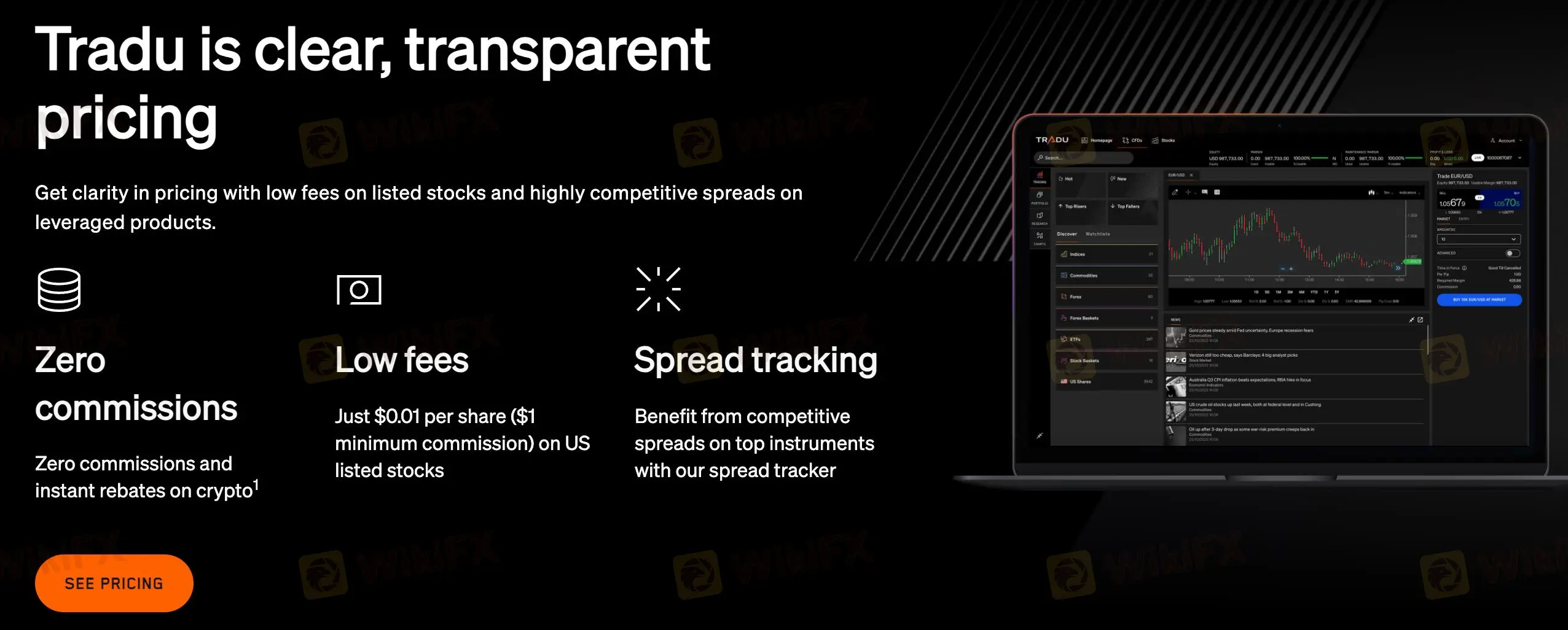

Tradu Fees

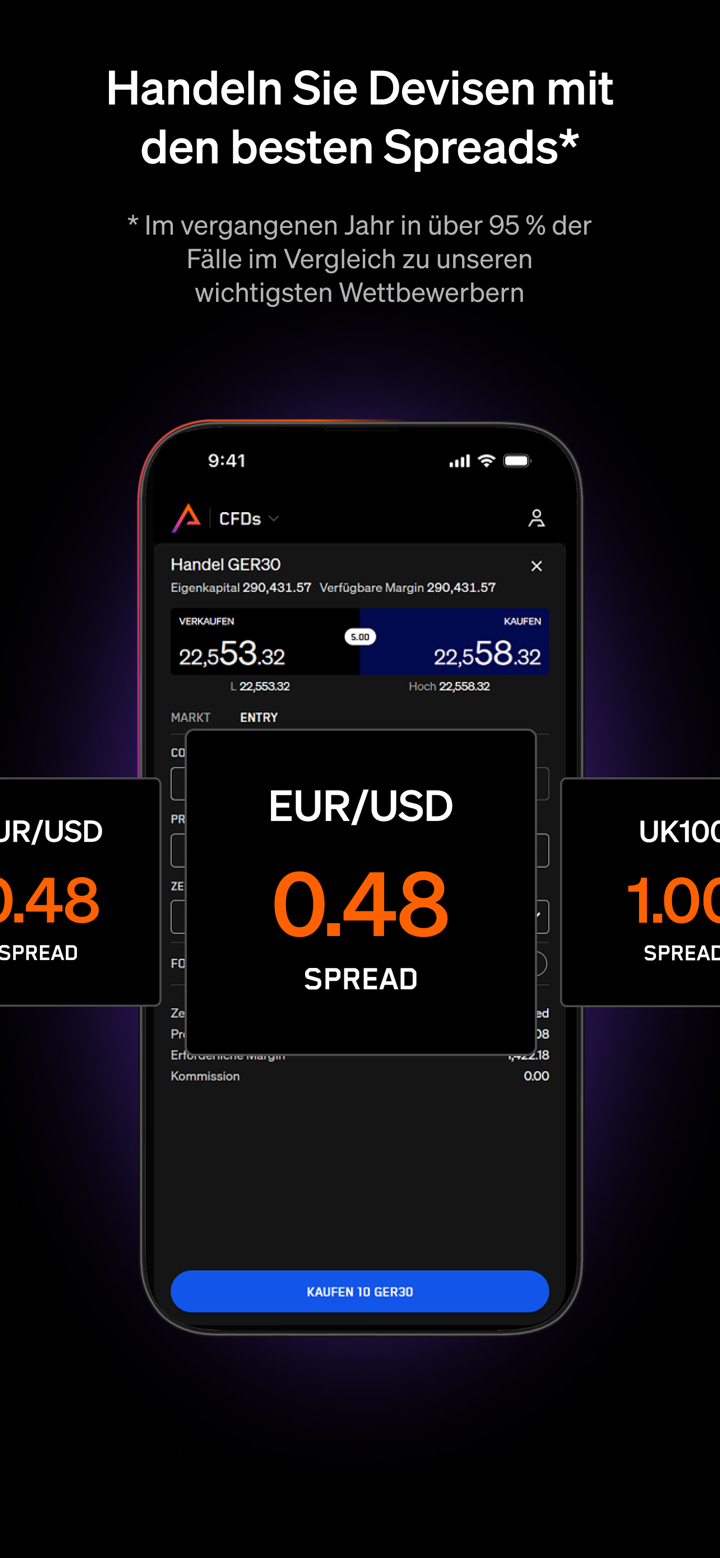

Tradu's fees are competitive compared to industry standards. The broker provides zero commissions on leveraged products, and spreads vary based on the instrument traded. However, listed stocks incur a $0.01 per share fee with a $1 minimum commission per trade.

| Instrument | Spread | Commission |

| EUR/USD | From 1.5 pips | None (CFD) |

| NAS100 | Tight spread | None (CFD) |

| Crude Oil | Tight spread | None (CFD) |

| Tesla Stock | $0.01/share | $1 minimum per trade |

| Bitcoin (BTC) | Tight spread | None (CFD) |

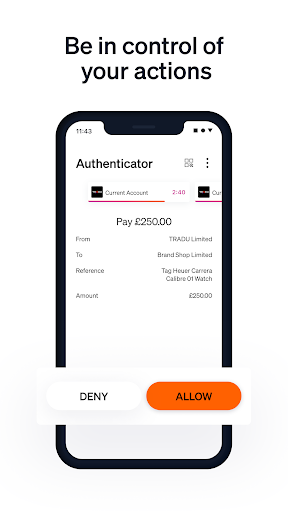

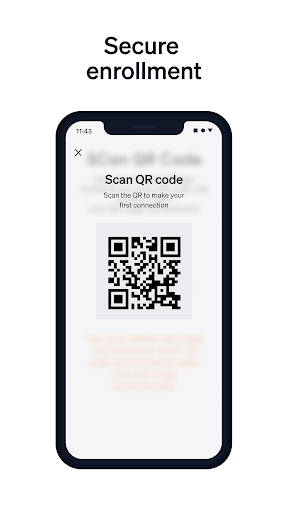

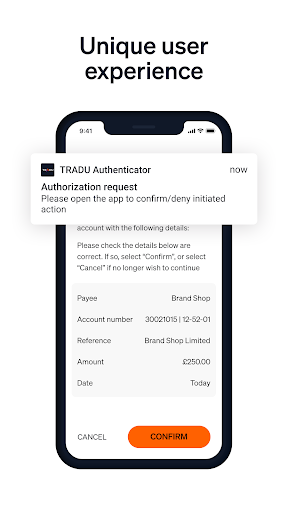

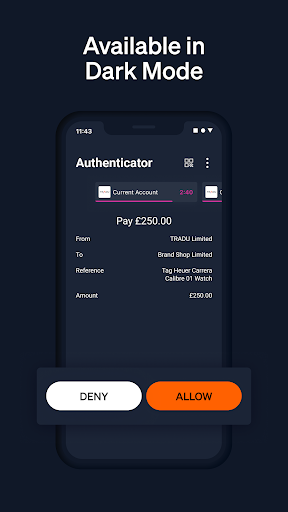

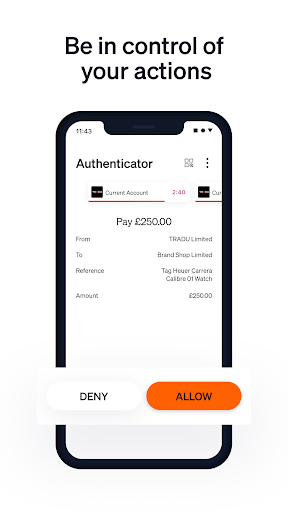

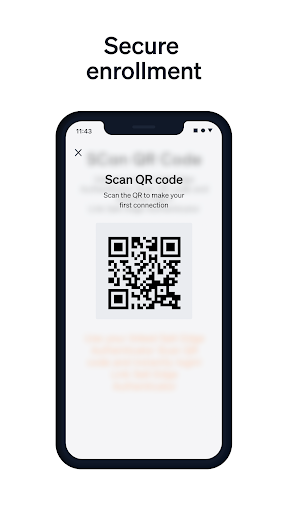

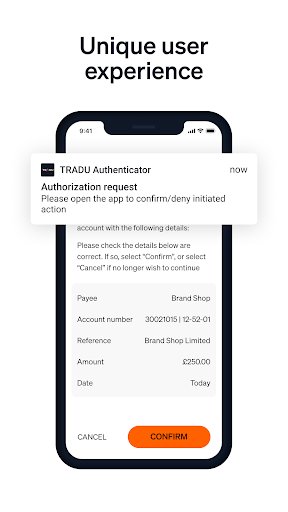

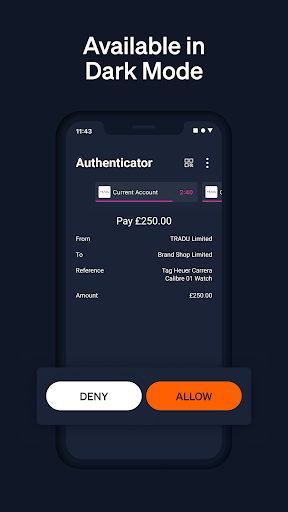

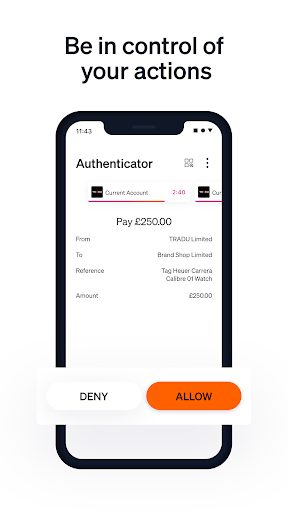

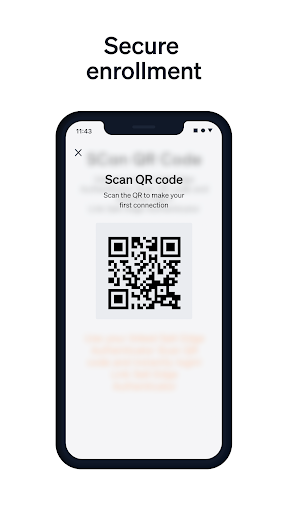

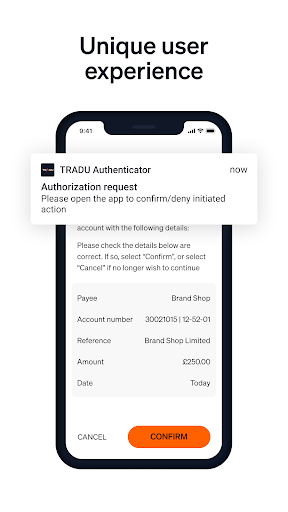

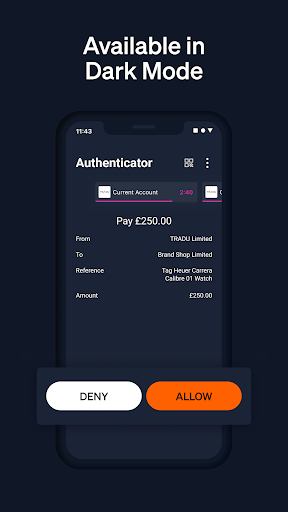

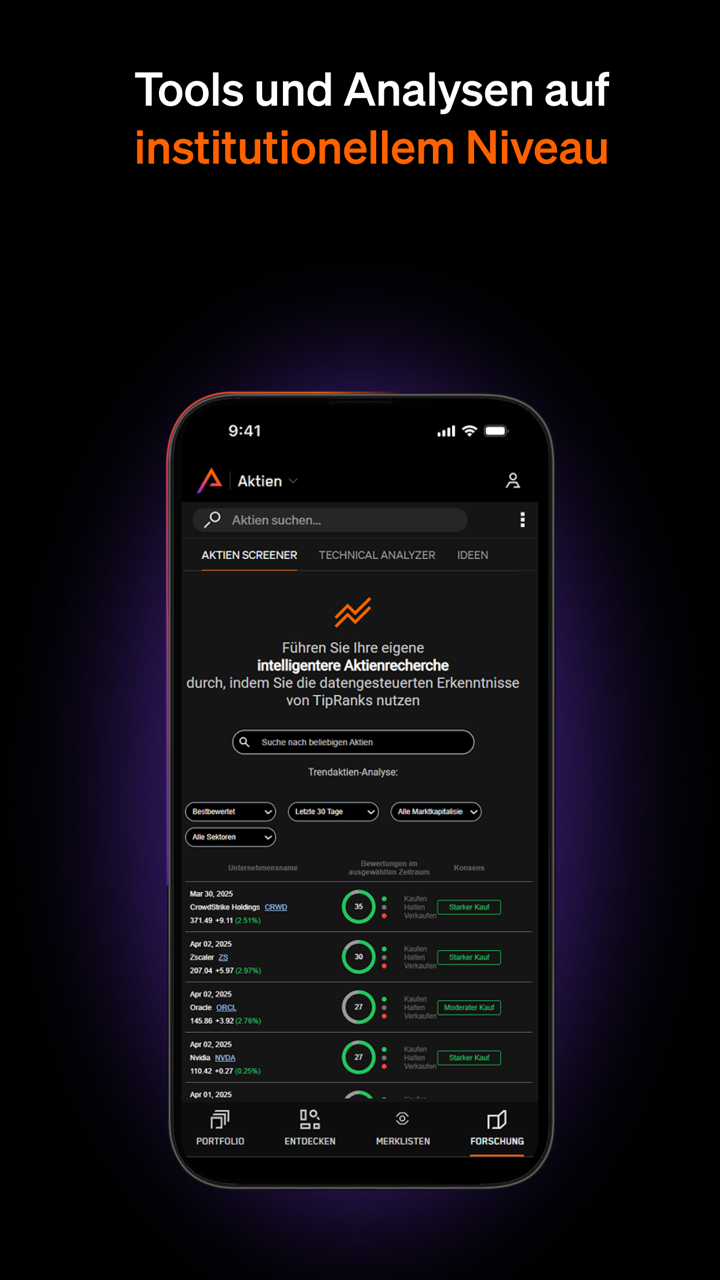

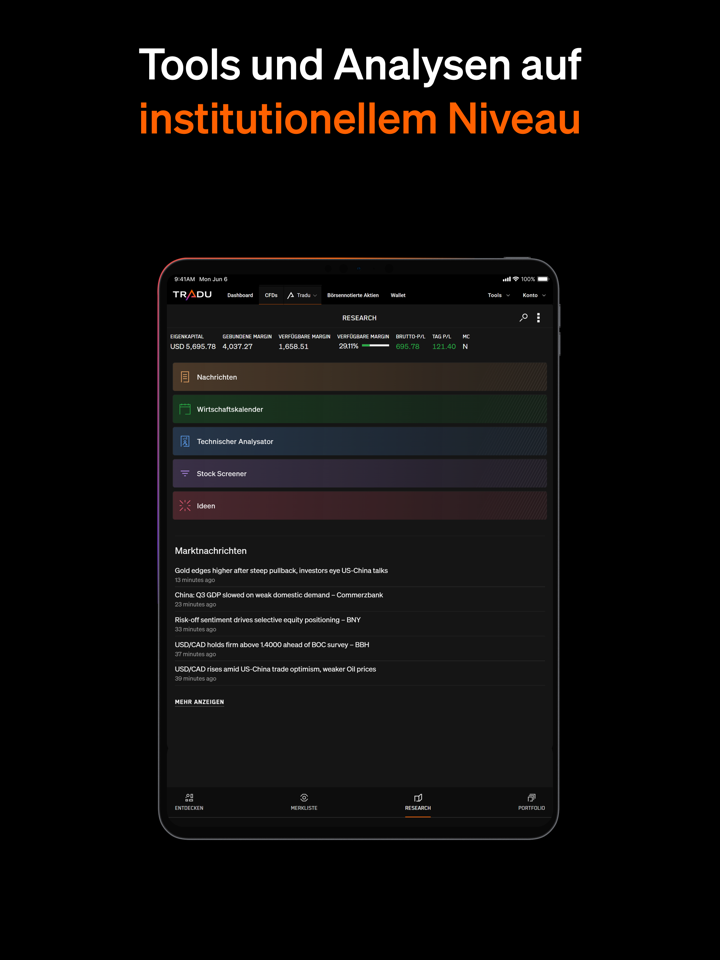

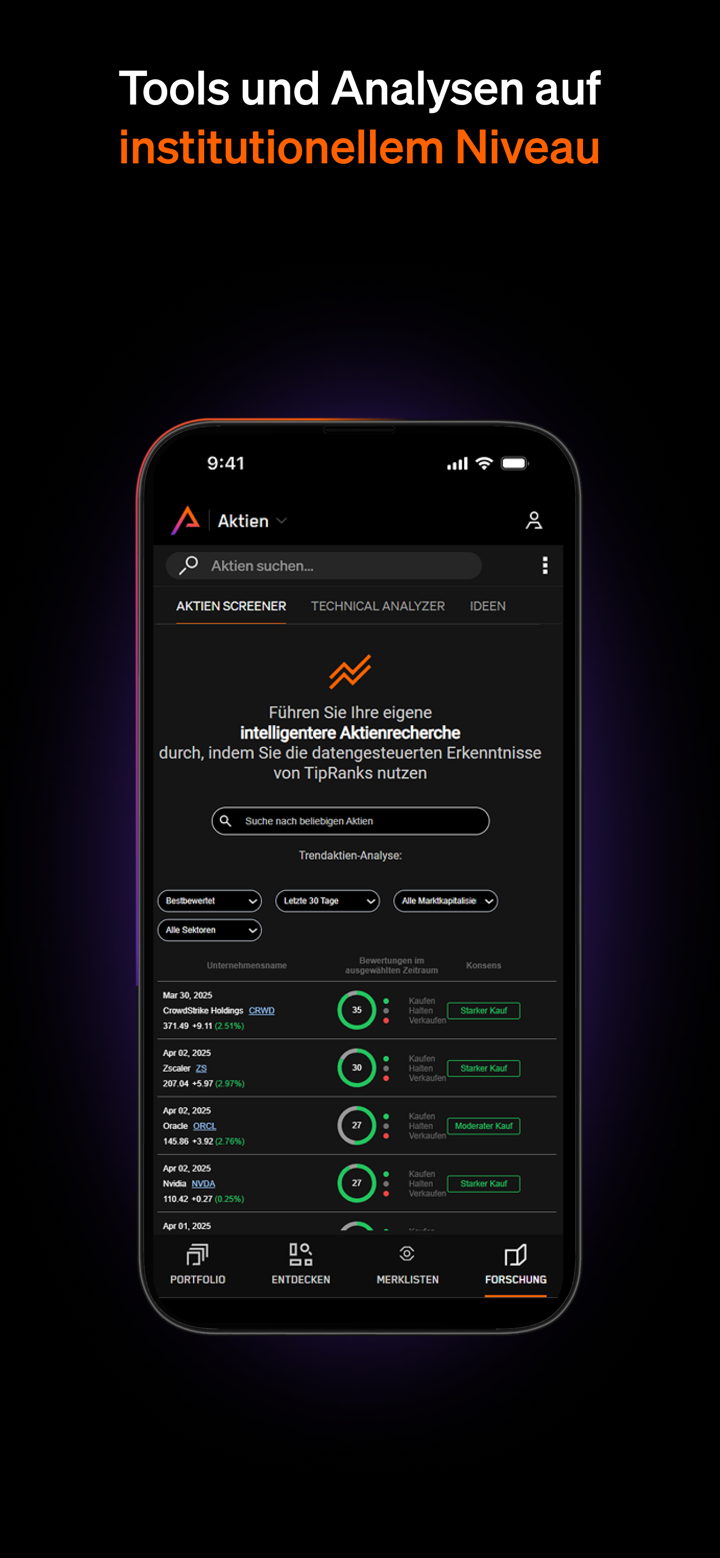

Trading Platform

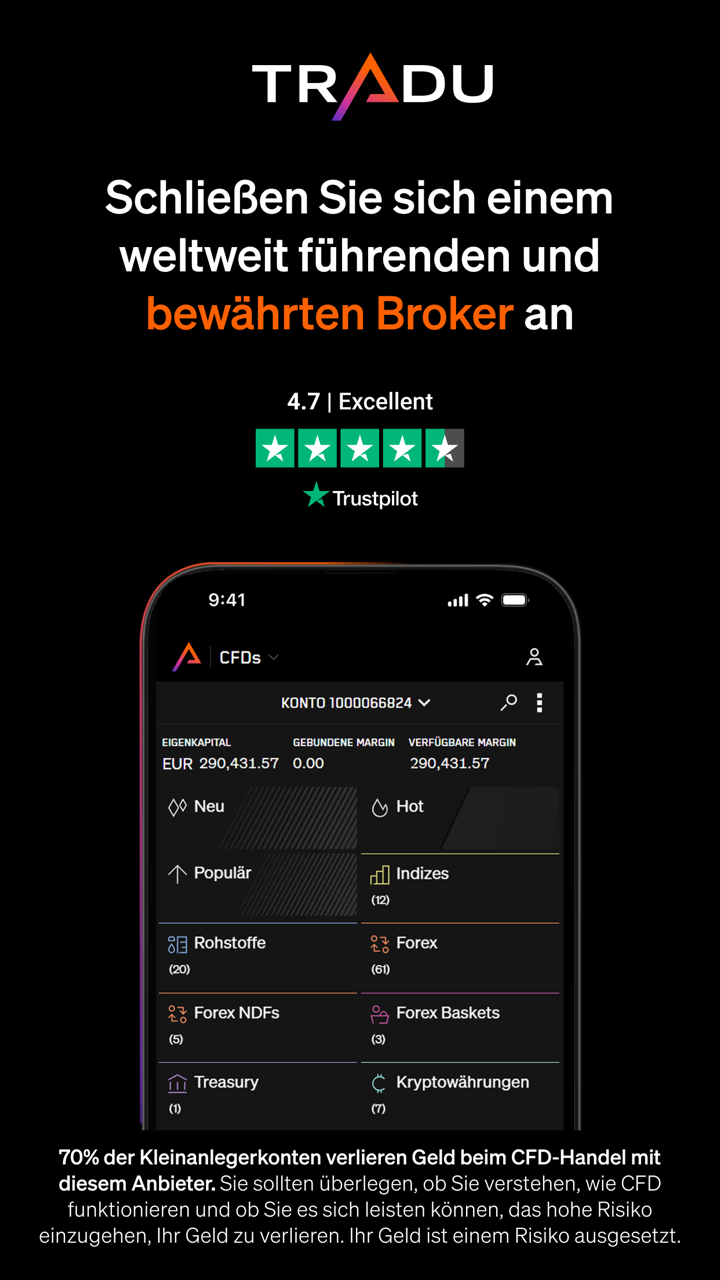

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| Web Trading Platform | ✔ | Desktop, Mobile Browser | Traders seeking browser-based trading without downloads |

| Tradu App | ✔ | iOS, Android | Mobile traders seeking on-the-go trading capabilities |

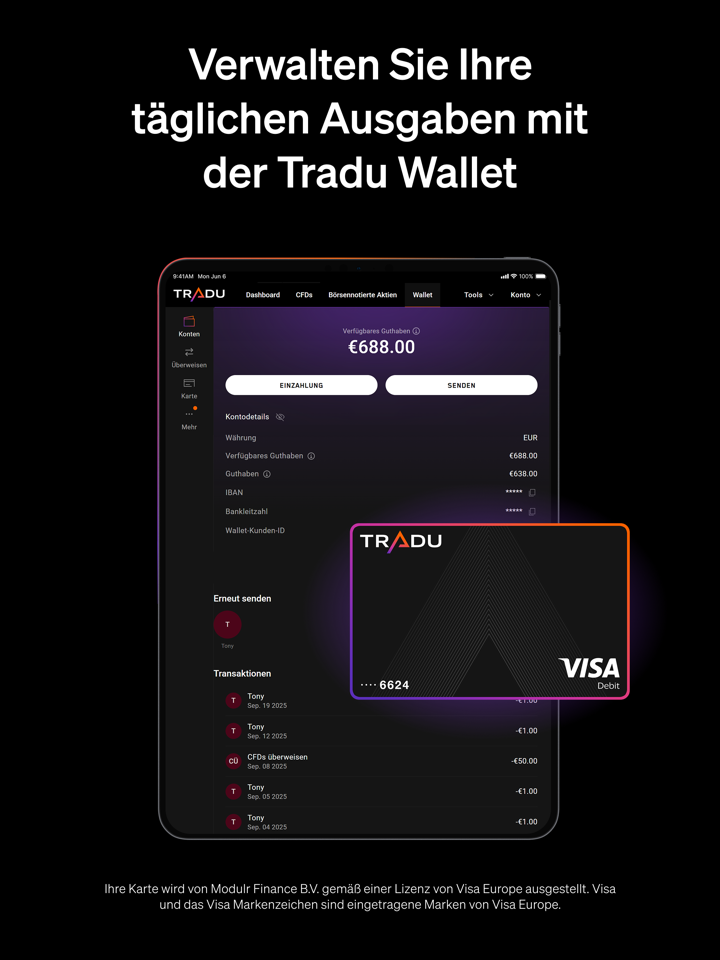

Deposit and Withdrawal

Tradu does not charge any deposit or withdrawal fees. There is no set minimum deposit, making it accessible for traders of all levels.

| Payment Method | Min. Deposit/Withdrawal | Fees | Processing Time |

| Credit/Debit Card | No minimum | Free | Instant |

| Skrill | No minimum | Free | Instant |

| Neteller | No minimum | Free | Instant |

| Bank Wire | No minimum | Free | 1-3 Business Days |