Basic Information

Cyprus

CyprusScore

Cyprus

|

10-15 years

|

Cyprus

|

10-15 years

| https://www.finansero.com/

Website

Rating Index

Influence

C

Influence index NO.1

United States 3.63

United States 3.63 Licenses

LicensesLicensed Entity:Global Trade CIF Ltd

License No. 190/13

Cyprus

Cyprus finansero.com

finansero.com United States

United States

| ILimits Invest Review Summary | |

| Founded | 12 years |

| Registered Country/Region | Cyprus |

| Regulation | Regulated |

| Market Instruments | Currencies, cryptocurrencies, stocks, commodities, indices, ETFs and derivatives |

| Demo Account | N/A |

| Leverage | Up to 1:200 |

| Spread | N/A |

| Trading Platform | XCITE App |

| Min Deposit | $200 |

| Customer Support | Email: customer.service@finansero.comPhone: +447441938812Address: Athalassas 62, Mezzanine, Strovolos, 2012, Nicosia, Cyprus |

Established in 2012, FINANSERO is a regulated brokerage firm registered in Cyprus. The firm specializes in CFDs trading across multiple instruments (currencies, cryptocurrencies, stocks, commodities, indices, ETFs and derivatives), with proprietary mobile and desktop platforms (XCITE App). The minimum deposit is $200 while the maximum leverage given is 1:200.

Clients can contact it through multiple methods, including phone number (+447441938812), Email (customer.service@finansero.com) and live chat on Whatsapp and facebook.

| Pros | Cons |

| Proprietary platforms (XCITE) | Accounts charge a higher fee at the lower tier |

| Multiple account types | Charging currency conversion fee and inactive account fee |

| Regulated state | Higher minimum deposit |

| Accessible official website with relatively full information |

FINANSERO is authorized and regulated by the Cyprus Securities and Exchange Commission (CYSEC), with registration number 190/13.

| Regulated Country | Regulated Authority | Regulated Entity | Reguted state | License Type | License Number |

| Cyprus Securities and Exchange Commission | Global Trade CIF Ltd | Regulated | Straight Through Processing(STP) | 190/13 |

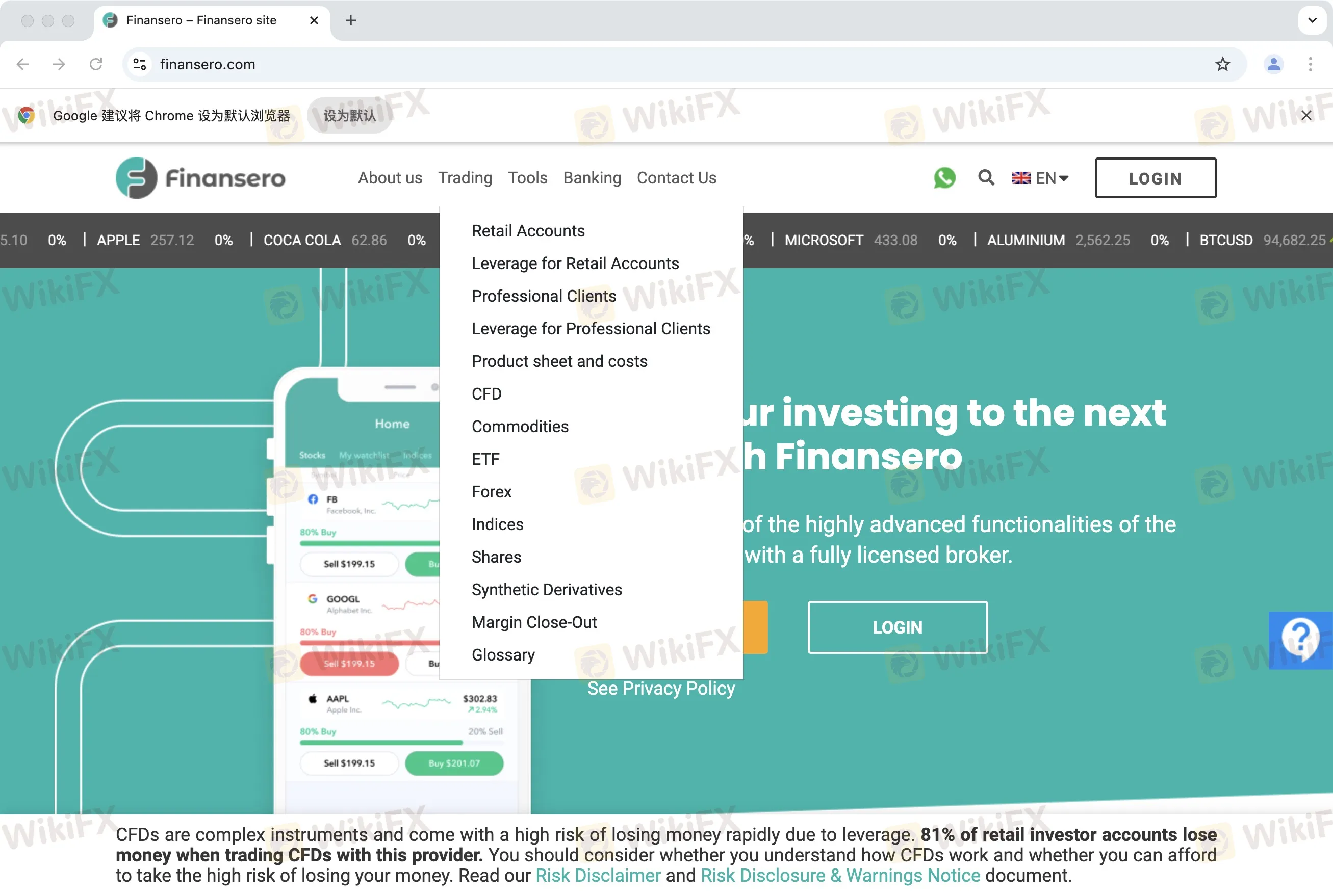

FINANSERO offers CFDS in more than 300 currencies, cryptocurrencies, stocks, forex, commodities, indices, ETFs and derivatives to retail and professional clients.

| Tradable Instruments | Supported |

| Commodities | ✔ |

| Currencies | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| ETFs | ✔ |

| Cryptocurrencies | ✔ |

| Derivatives | ✔ |

| Forex | ✔ |

| Mutual Funds | ❌ |

| Futures | ❌ |

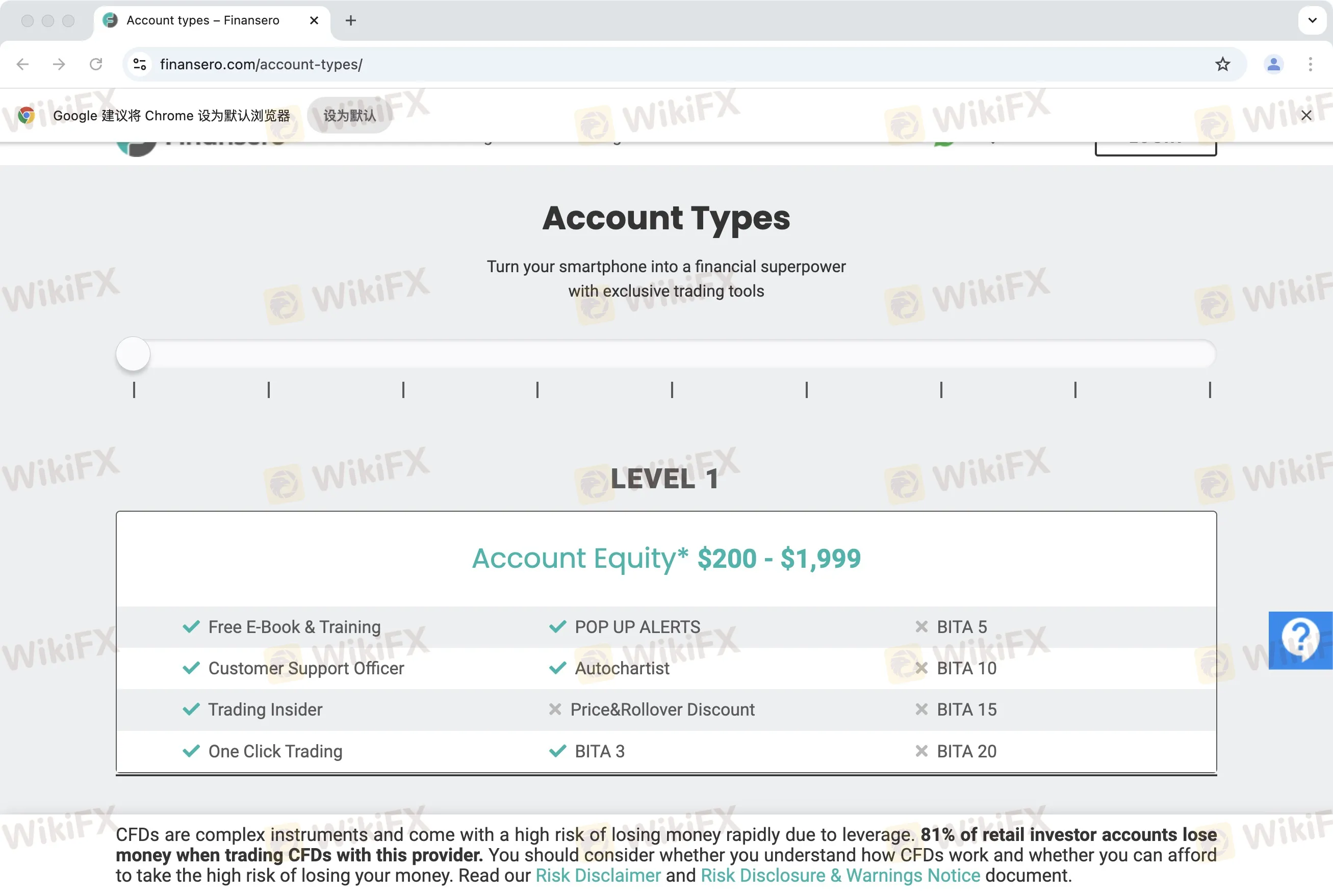

FINANSERO divides its accounts into nine levels.

Free ebooks and training, customer support Officer, Trading Insider, one-click trading, pop-up alerts, and bita5 are available for all levels.

Unless account assets exceed $5,000, clients will not be able to enjoy the advanced features of Autochartist.

If a trading account is worth more than $100,000, clients can enjoy a 40% discount on prices and rollovers.

| Benefit | Level 1 | Level 2 | Level 3 | Level 4 | Level 5 | Level 6 | Level 7 | Level 8 | Level 9 |

| Account Equity | $200 - $1,999 | $2,000 - $4,999 | $5,000 - $9,999 | $10,000 - $14,999 | $15,000 - $29,999 | $30,000 - $49,999 | $50,000 - $74,999 | $75,000 - $99,999 | $100,000 - ∞ |

| Free E-Book & Training | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Customer Support Officer | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Trading Insider | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| One Click Trading | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| POP-UP Alerts | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Autochartist | X | X | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Price & Rollover Discount | X | 5% | 10% | 15% | 20% | 25% | 30% | 35% | 40% |

| BITA 5 | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| BITA 10 | X | X | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| BITA 15 | X | X | X | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| BITA 20 | X | X | X | X | X | ✔ | ✔ | ✔ | ✔ |

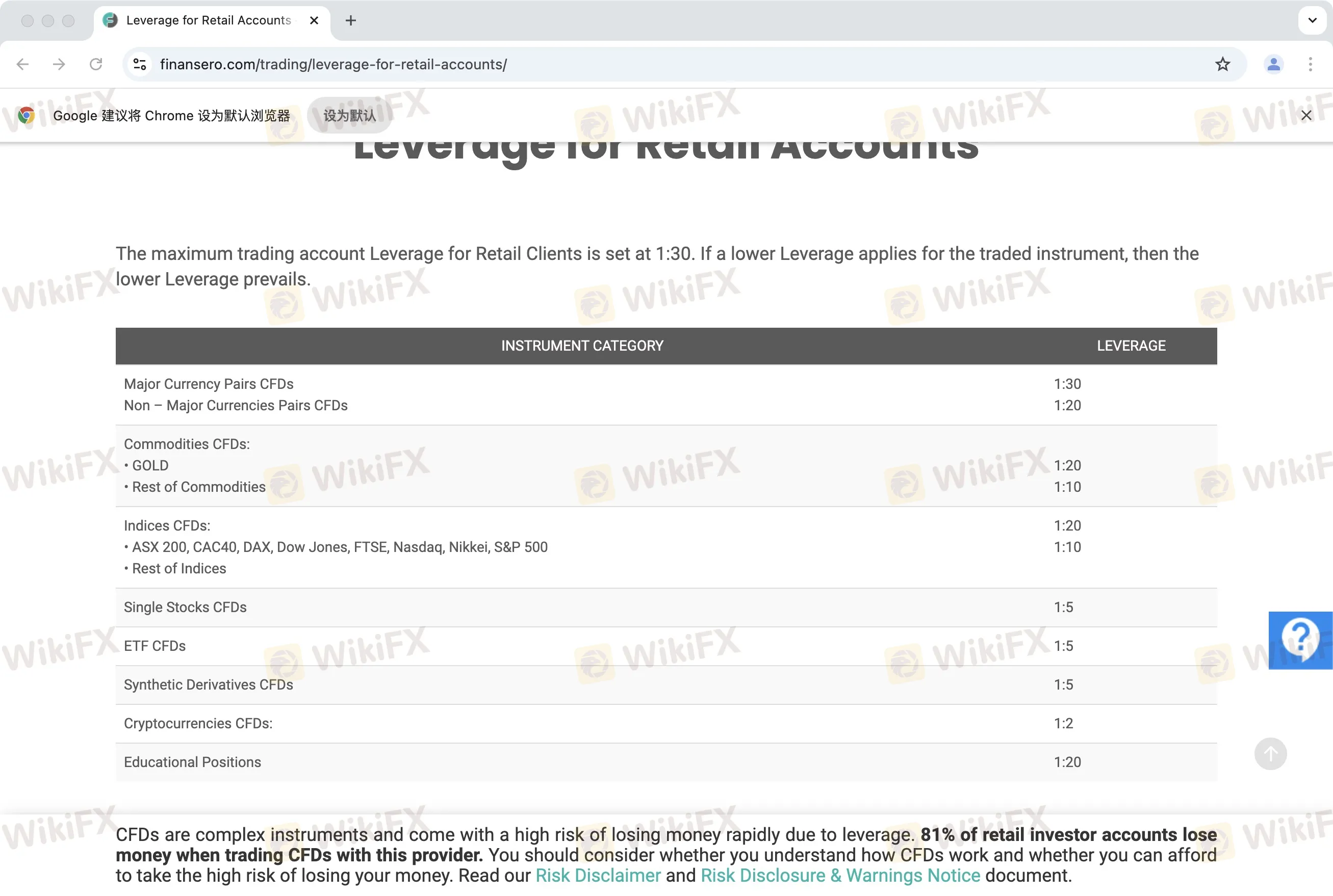

The maximum leverage for retail and professional customers is different. The settings are 1:30 and 1:2000, respectively.

Trading account Leverage for Retail Clients:

| INSTRUMENT CATEGORY | LEVERAGE |

| Major Currency Pairs CFDsNon – Major Currencies Pairs CFDs | 1:301:20 |

| Commodities CFDs:• GOLD• Rest of Commodities | 1:201:10 |

| Indices CFDs:• ASX 200, CAC40, DAX, Dow Jones, FTSE, Nasdaq, Nikkei, S&P 500• Rest of Indices | 1:201:10 |

| Single Stocks CFDs | 1:5 |

| ETF CFDs | 1:5 |

| Synthetic Derivatives CFDs | 1:5 |

| Cryptocurrencies CFDs: | 1:2 |

| Educational Positions | 1:20 |

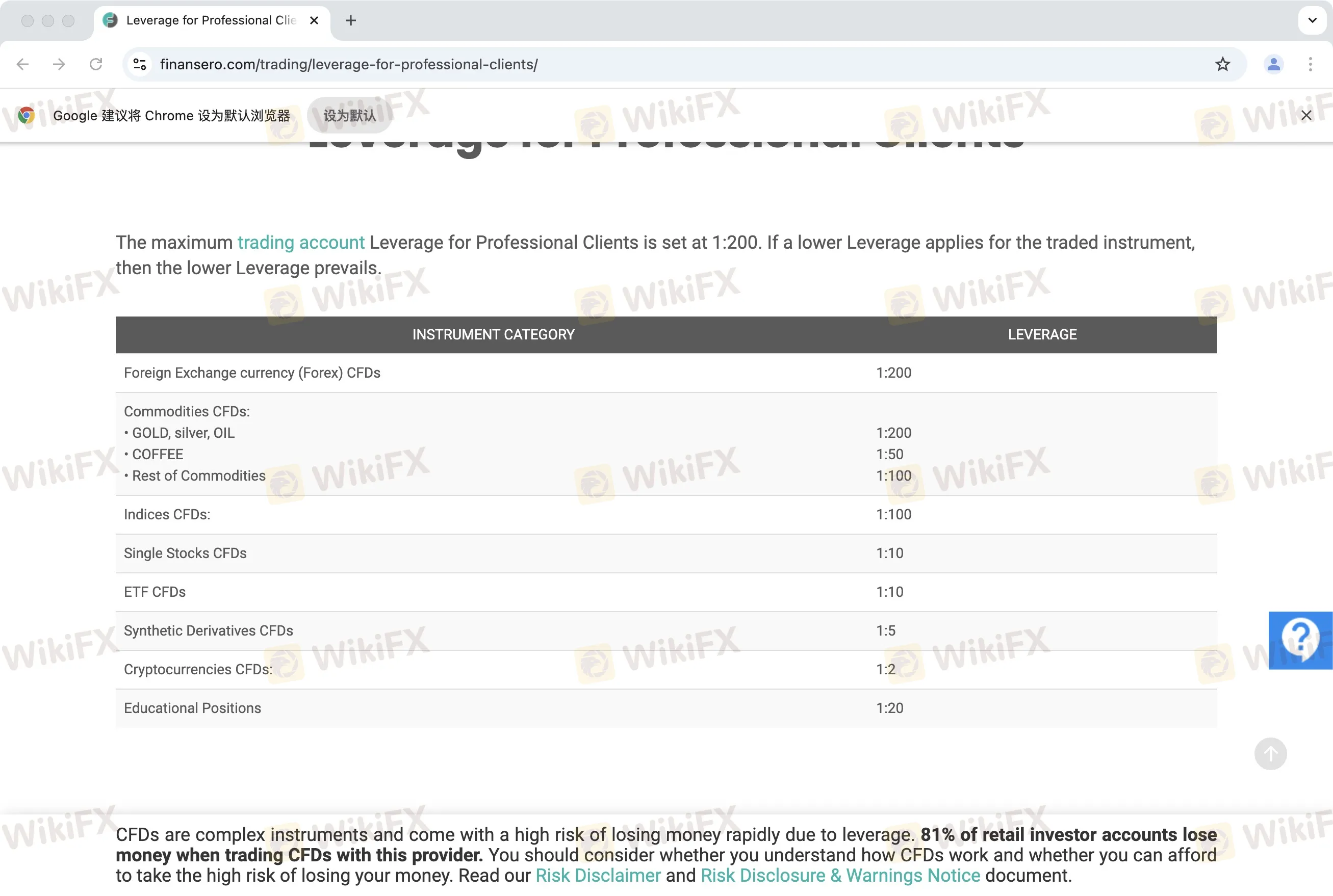

Trading account Leverage for Professional Clients:

| INSTRUMENT CATEGORY | LEVERAGE |

| Foreign Exchange currency (Forex) CFDs | 1:200 |

| Commodities CFDs:• GOLD, silver, OIL• COFFEE• Rest of Commodities | 1:2001:501:100 |

| Indices CFDs: | 1:100 |

| Single Stocks CFDs | 1:10 |

| ETF CFDs | 1:10 |

| Synthetic Derivatives CFDs | 1:5 |

| Cryptocurrencies CFDs: | 1:2 |

| Educational Positions | 1:20 |

If the first 5 trades fail, the broker will refund your money.

As for fees, details of rollover fees for different products are shown below:

| CFD Product | Rollover Fee |

| Currencies | 0.015% of the overnight exposure |

| Commodities | 0.022% of the overnight exposure |

| Indices | 0.0165% of the overnight exposure |

| Shares | 0.055% of the overnight exposure |

| ETFs | 0.0165% of the overnight exposure |

| Synthetic Derivatives | Depend on the derivatives |

| Cryptocurrencies | 0.50% (Retail Clients) 0.50% (Professional Clients) |

In addition, accounts with no trading activity for at least three months may be subject to a quarterly fee of €150. The currency conversion fee is 0.7% of realized net profit and loss on the transaction and is reflected in real time in unrealized net profit and loss on the position.

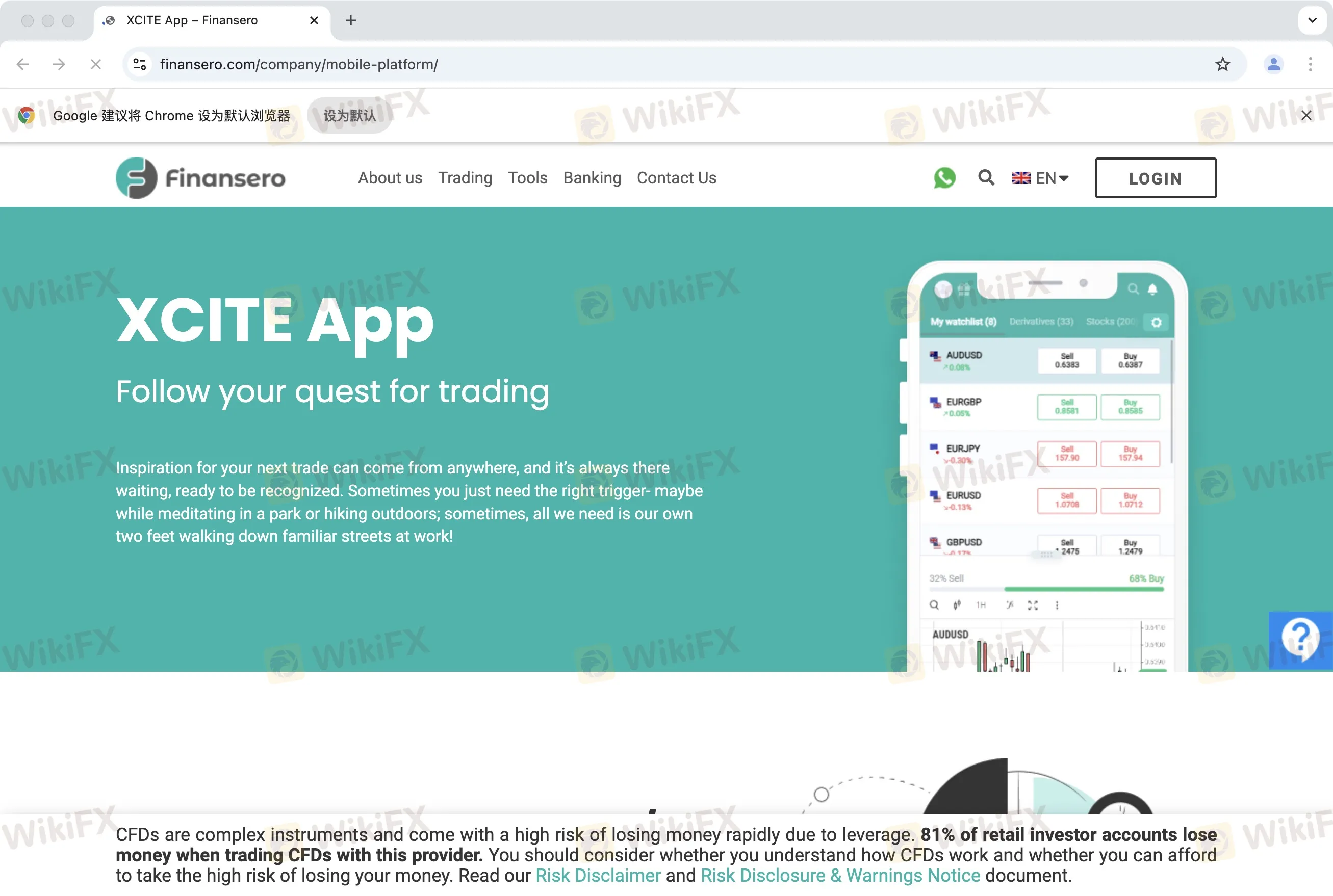

FINANSERO provides its proprietary trading platform, namely XCITE.

| Trading Platform | Supported | Available Devices | Suitable for |

| XCITE | ✔ | Windows, MAC, IOS, Android | Investors of all experience levels |

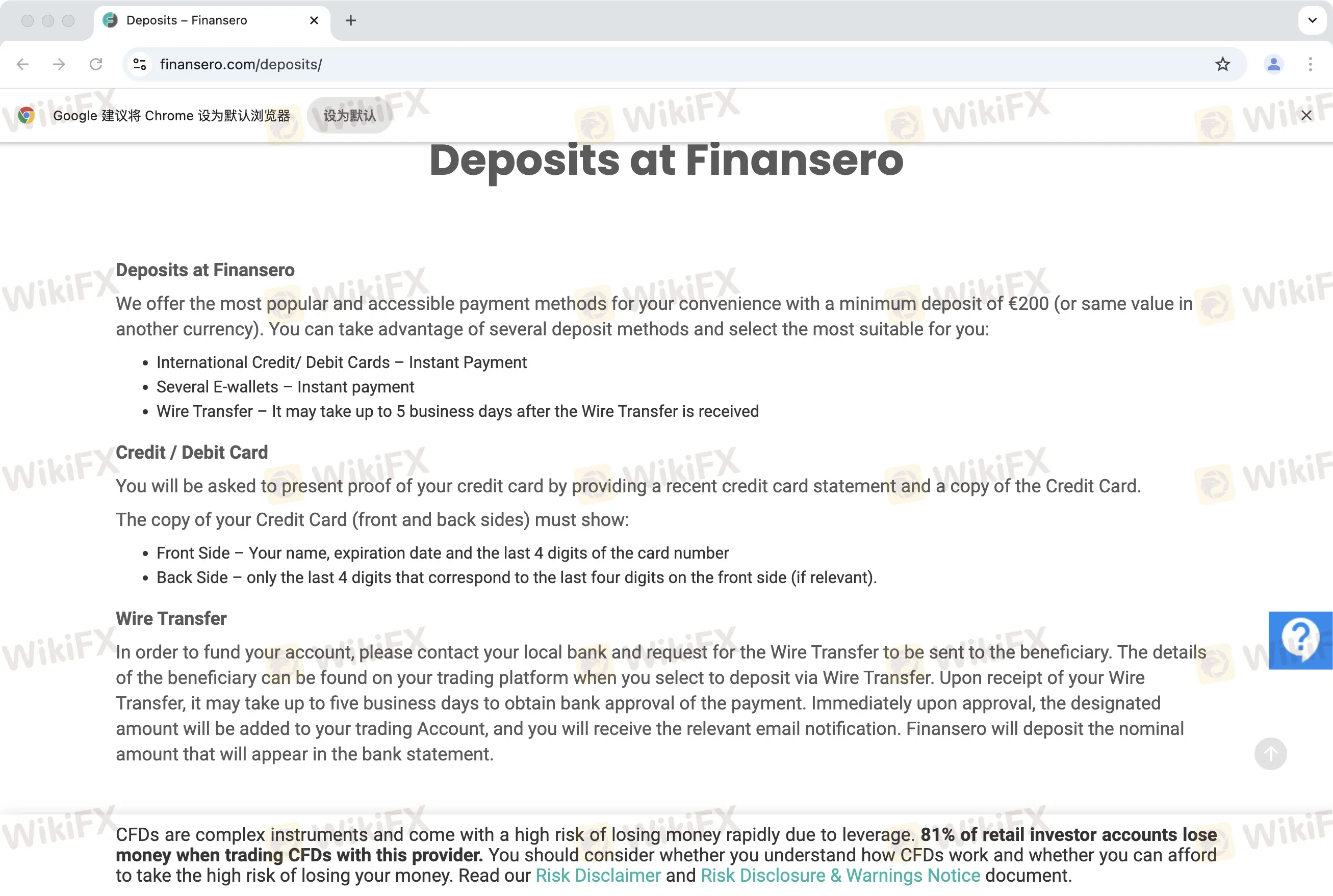

The payment methods include visa, Diner Club, Mustercard, Bank Transfer, Apple Pay, Skrill, Google Pay, OEAL, and Open Banking.

Accessible payment method with a minimum deposit of €200.

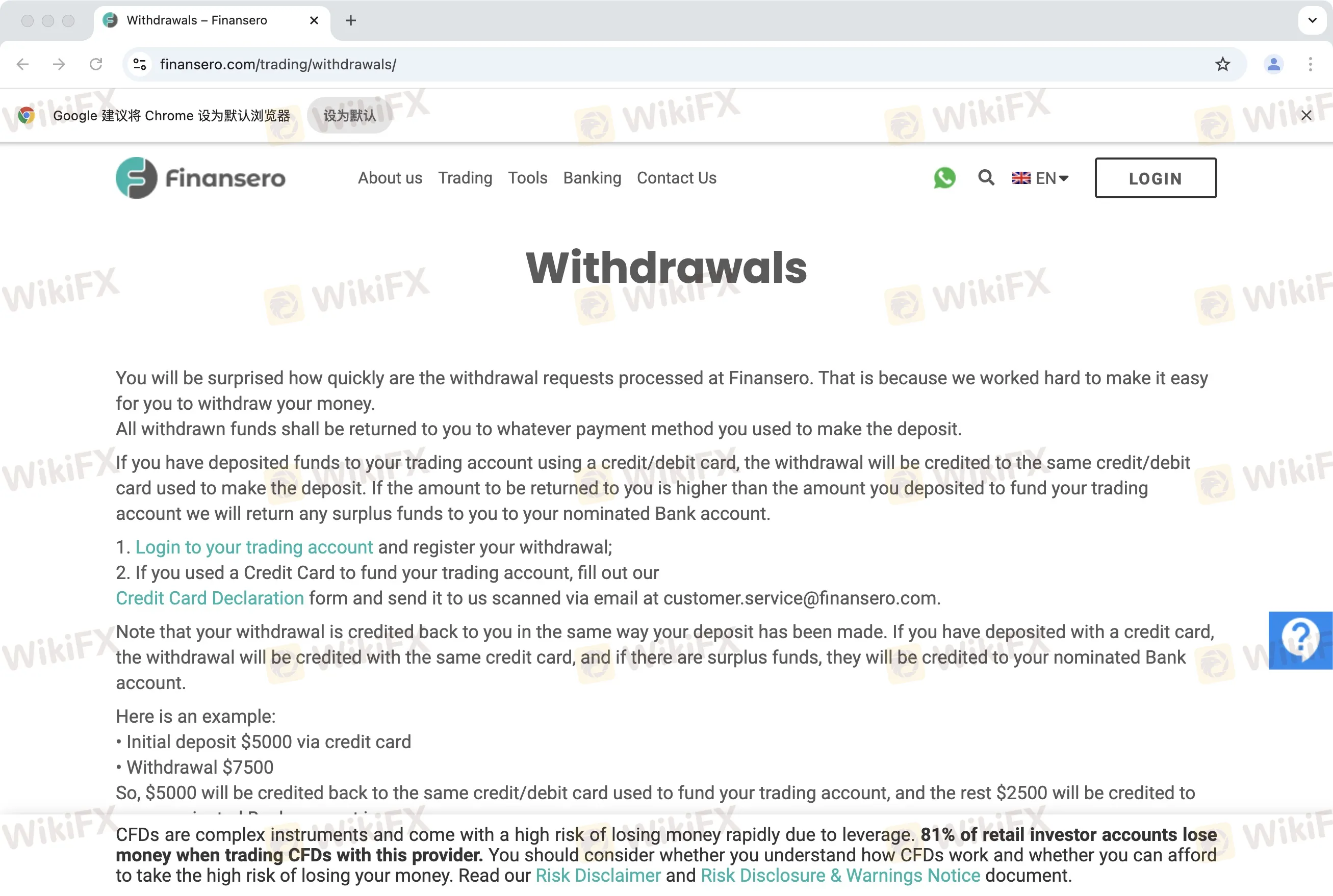

Withdrawals will be credited back in the same way as deposits. If there are any funds left, it will be credited to designated bank account.

No commission is charged for deposit and withdrawal.

Deposit Options:

| Deposit Options | Min. Deposit | Fees | Processing Time |

| International Credit/ Debit Cards | €200 | No Commission | Instant |

| Several E-wallets | €200 | No Commission | Instant |

| Wire Transfer | €200 | No Commission | It may take up to 5 business days |

Withdrawal Options:

| Withdrawal Options | Min. Withdrawal | Fees | Processing Time |

| International Credit/ Debit Cards | N/A | No Commission | FINANSERO processes it within 24 hours. After that, it depends on your bank or e-wallet. |

| Several E-wallets | N/A | No Commission | FINANSERO processes it within 24 hours. After that, it depends on your bank or e-wallet. |

| Wire Transfer | N/A | No Commission | FINANSERO processes it within 24 hours. After that, it depends on your bank or e-wallet. |

FINANSERO charges a currency conversion fee of 0.7% on realized profits and losses during trades. This fee is automatically deducted and is reflected in real-time in the unrealized profit or loss of the position. The broker also applies rollover fees to overnight positions, including 0.015% for currency CFDs and 0.022% for commodities CFDs. There is an additional quarterly inactivity fee of €150 for accounts with no activity for at least three months. In my FINANSERO review, I find that the lack of transparency on their website about these fees could be an issue for some traders. While the spreads are not disclosed, it is crucial to consider these additional charges when trading.

One of the main downsides of FINANSERO is that it operates with a proprietary platform (XCITE), which may not be as familiar or feature-rich as industry-standard platforms like MT4 or MT5. This can be a dealbreaker for traders who are used to these established platforms for their superior charting tools, automated trading features, and overall user experience. Additionally, the minimum deposit requirement of $200 is relatively high compared to some other brokers that offer lower or no minimum deposit. In my FINANSERO review, I also note that while the broker is regulated by CySEC, its relatively limited market reputation and higher deposit requirements may not be ideal for all traders.

FINANSERO supports multiple payment methods, including international credit/debit cards (VISA and MasterCard), bank transfers, Apple Pay, Skrill, Google Pay, and e-wallets like Neteller. This variety of payment methods provides flexibility for traders to choose their preferred method for deposits and withdrawals. In my FINANSERO review, I appreciate the accessibility of these options, which makes it easier for international traders to fund their accounts or withdraw their funds. However, it is important to note that the minimum deposit requirement is €200, which could be restrictive for some traders, particularly those who prefer smaller deposits.

FINANSERO offers different leverage options for retail and professional clients. For retail clients, leverage is limited to 1:30 for major currency pairs and up to 1:200 for other instruments like commodities and indices. For professional clients, leverage increases up to 1:2000, which allows for larger positions with smaller investments. In my FINANSERO review, I advise caution when using high leverage, especially for beginners, as it increases both potential profits and losses. While high leverage offers opportunities for greater gains, it also amplifies the risks, so it is essential to use it responsibly.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now