Company Summary

| CORPORATE COMMODITIES LIMITED Review Summary | |

| Founded | 1982 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Market Instruments | Securities, Futures, Stocks |

| Demo Account | ❌ |

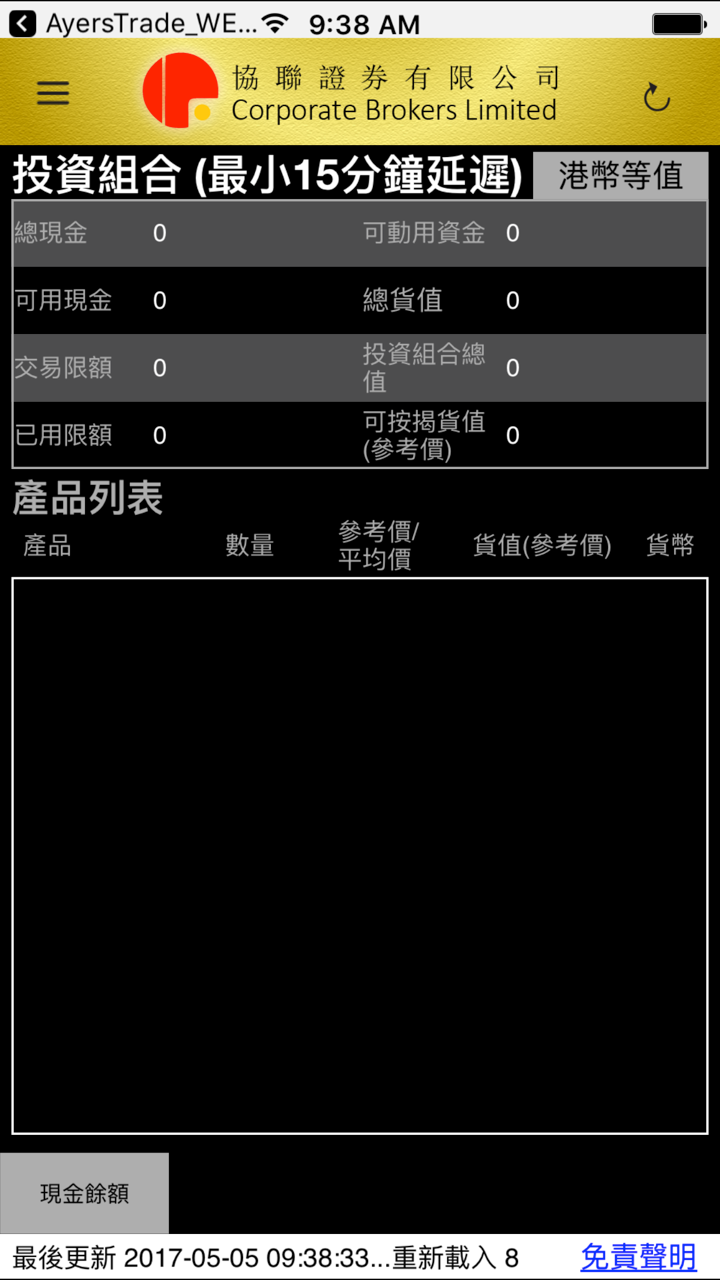

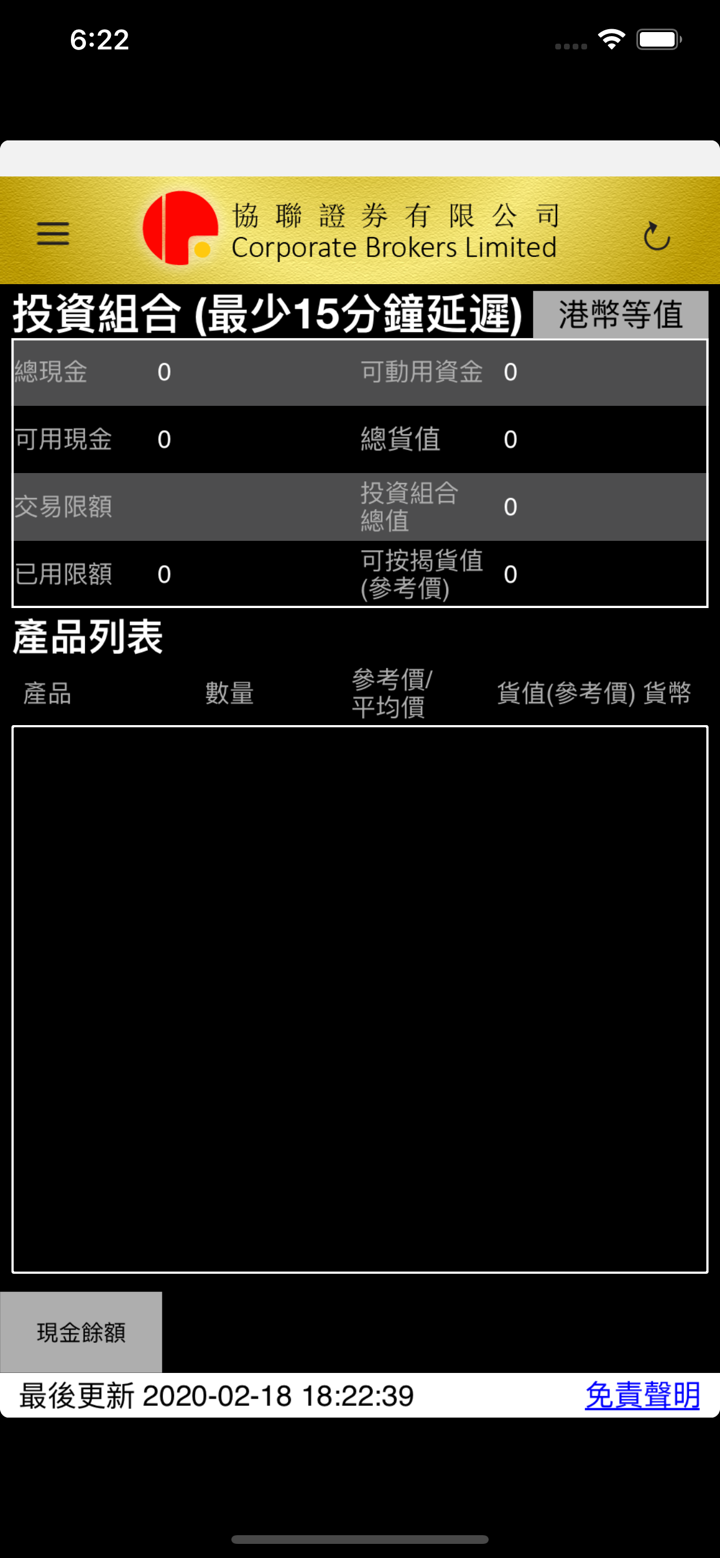

| Trading Platform | Online Securities Trading, Online Futures Trading, Mobile Trading App |

| Customer Support | Tel: 2832 0132 |

| Fax: 2832 0123 | |

| Email: enquiry@cblhk.com | |

CORPORATE COMMODITIES LIMITED Information

Corporate Commodities Limited, founded in 1982 and headquartered in Hong Kong, is regulated by the Securities and Futures Commission (SFC) under license AAK110 for futures trading. It provides securities and futures trading services, including access to Stock Connect for trading equities in Shanghai and Shenzhen.

Pros and Cons

| Pros | Cons |

| Regulated by Hong Kong SFC | No demo or Islamic accounts available |

| Supports both securities and futures trading | Limited trading products |

| Multiple platforms: web, PC, and mobile supported | Minimum deposit not clearly stated |

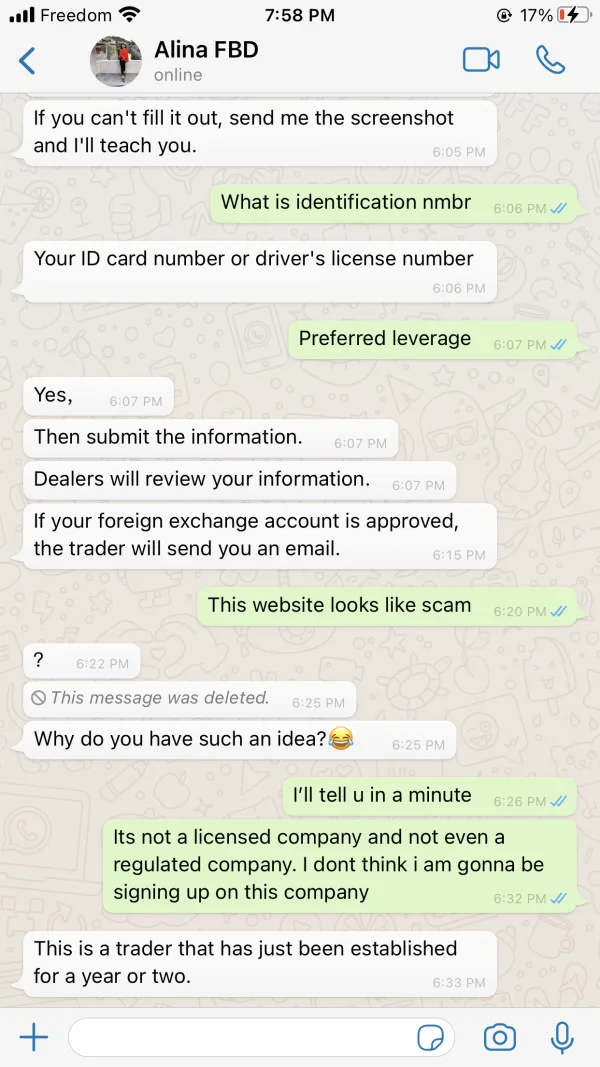

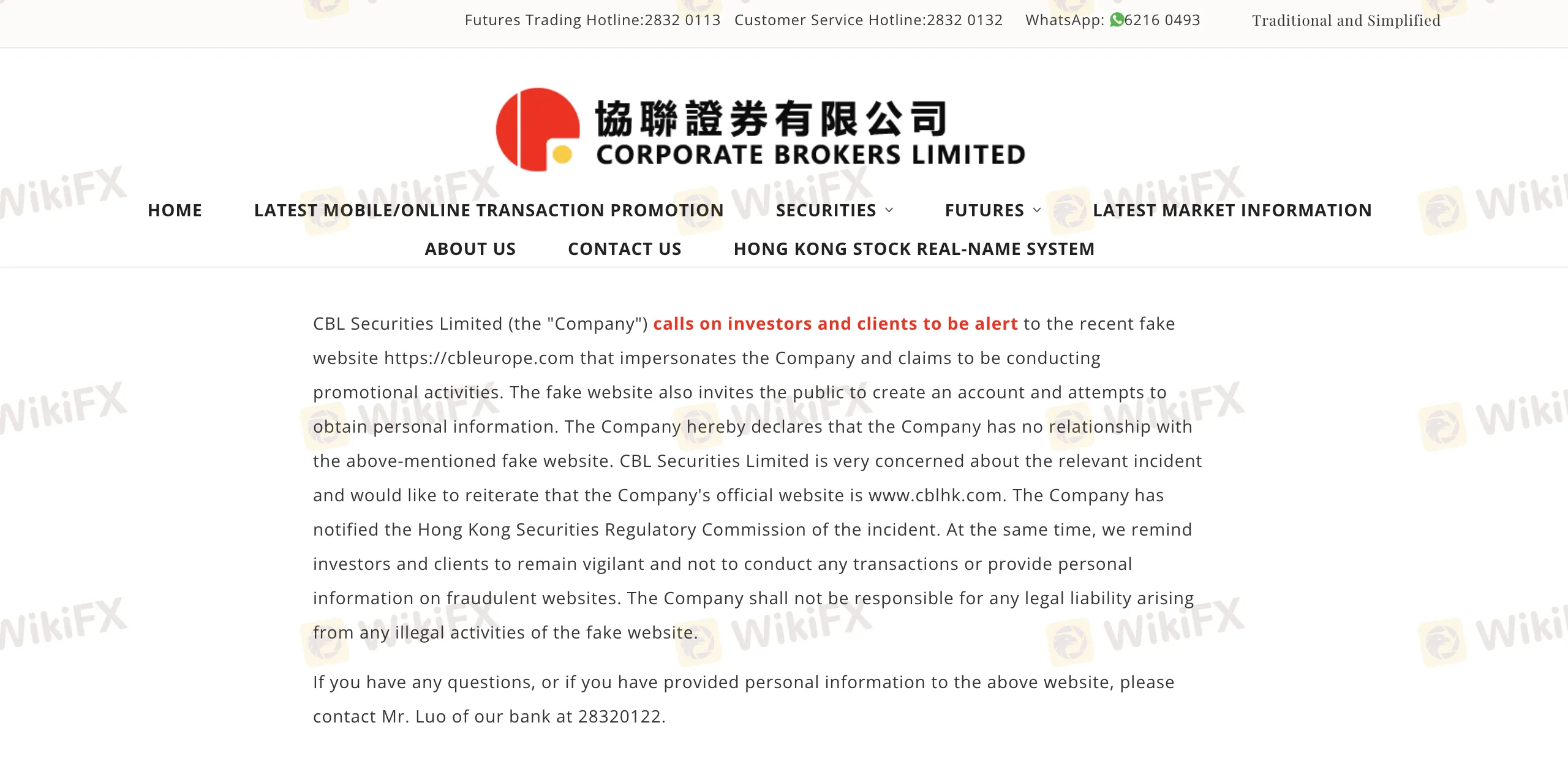

Is CORPORATE COMMODITIES LIMITED Legit?

Corporate Commodities Limited is regulated by the Securities and Futures Commission (SFC) of Hong Kong and holds a valid license (No. AAK110) to trade futures contracts, which has been in existence since February 18, 2004. However, a related firm, Corporate Brokers Limited, once held a license (No. AAC806) for dealing in securities, but its regulatory status has been changed to “Exceeded,” suggesting that the license is no longer valid.

What Can I Trade on CORPORATE COMMODITIES LIMITED?

The company provides trading services in securities and futures, as well as access to the Hong Kong and Mainland China stock markets through Stock Connect.

| Trading Instruments | Supported |

| Securities | ✔ |

| Futures | ✔ |

| Stocks | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

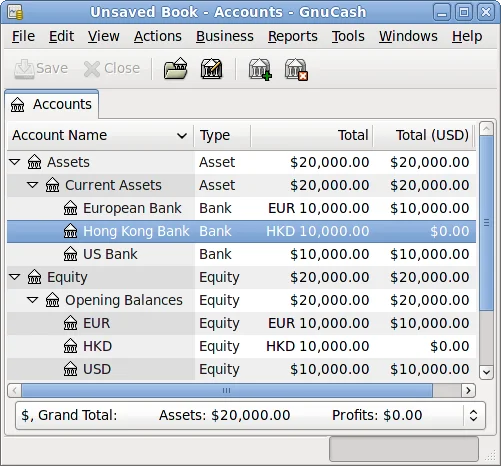

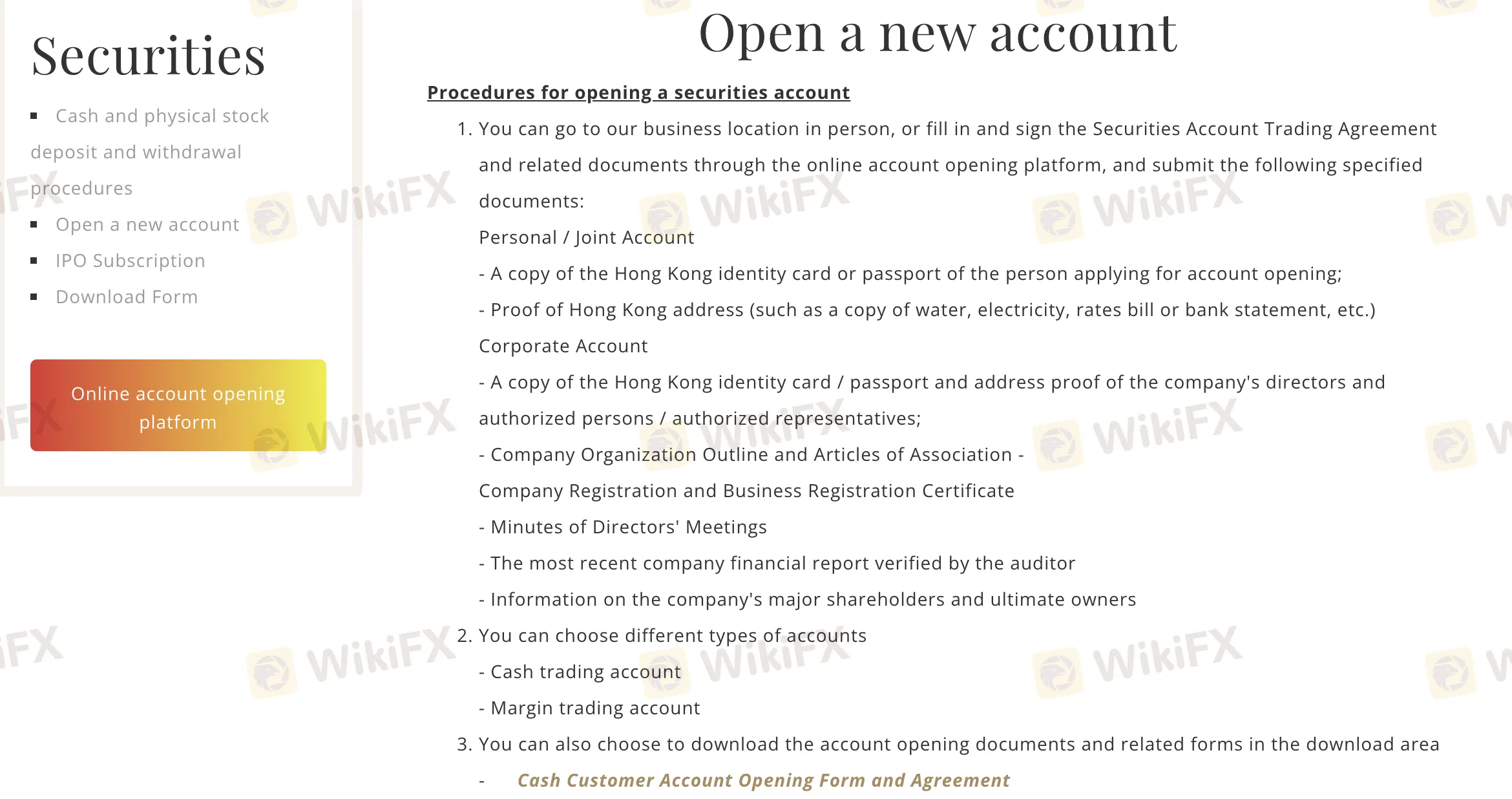

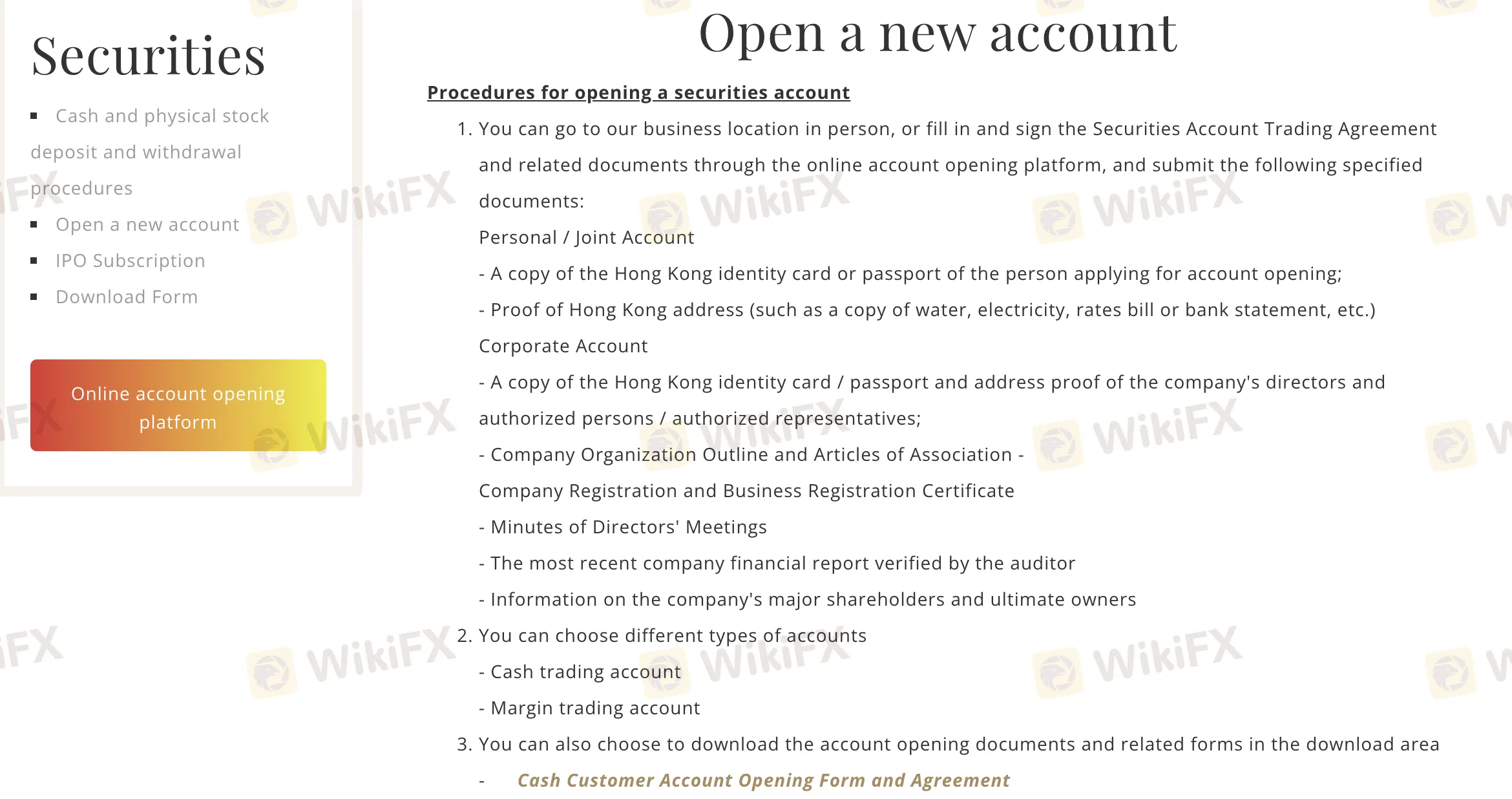

Account Type

Corporate Commodities Limited provides three types of actual trading accounts: cash securities accounts, margin securities accounts, and futures trading accounts. It currently does not provide demo or Islamic accounts (swap-free). Each account is suitable for a variety of trader profiles, including novice, experienced, leveraged, and futures traders.

CORPORATE COMMODITIES LIMITED Fees

Corporate Commodities Limited's fees are generally consistent with industry standards in Hong Kong. Some minimum charges (e.g., internet trading for HKD 50) are slightly cheaper than those of large brokerage firms, while others (such as futures and administrative fees) are ordinary or moderately priced. Overall, fees are competitive with the Hong Kong market average.

| Category | Service Item | Fee |

| Securities | Brokerage – Dealer Assisted | Negotiable (Min: HKD 100) |

| Brokerage – Internet/Mobile | Negotiable (Min: HKD 50) | |

| Stamp Duty | 0.10% | |

| Trading Fee | 0.01% | |

| SFC Levy | 0.00% | |

| FRC Levy | 0.00% | |

| Settlement Fee | 0.01%, Min HKD 5, Max HKD 300 | |

| Physical Stock Withdrawal | HKD 30 + HKD 5 (if <1 lot) | |

| SI (Settlement Instruction) | 0.05%, Min HKD 200 | |

| ISI (Investor Settlement Instruction) | 0.01%, Min HKD 20 | |

| Dividend Collection | 0.50%, Min HKD 30 | |

| Futures | Hang Seng Index Futures – Internet | HKD 20 / 50 (Day / Non-Day) |

| Hang Seng Index Mini Futures – Internet | HKD 12 / 20 | |

| Commission on Options | 1% of value | |

| SFC Levy (Futures/Options) | HKD 0.54 / 0.10 | |

| Exchange Fee (Futures/Options) | HKD 10 / 3.5 / etc. | |

| Auto Close-out Fee (on expiry) | HKD 100 (varies) | |

| Other Charges | Monthly Quote System (AASTOCKS) | HKD 368 |

| Inactive Account Fee | HKD 50/year | |

| Outgoing T/T (HK/Overseas) | HKD 200 / 300 | |

| Statement Reprint | HKD 100 |

Trading Platform

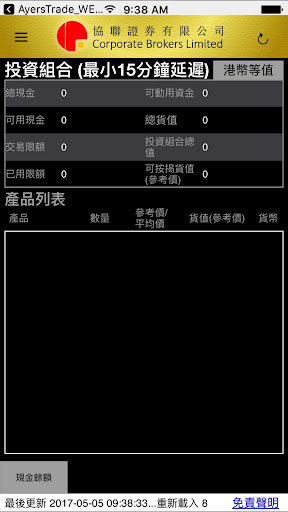

| Trading Platform | Supported | Available Devices | Suitable For |

| Online Securities Trading | ✔ | PC / Web browser | Stock investors and general traders |

| Online Futures Trading | ✔ | PC / Web platform (downloadable) | Futures and derivatives traders |

| Mobile Trading App | ✔ | iOS / Android smartphones | Traders who need mobile access |

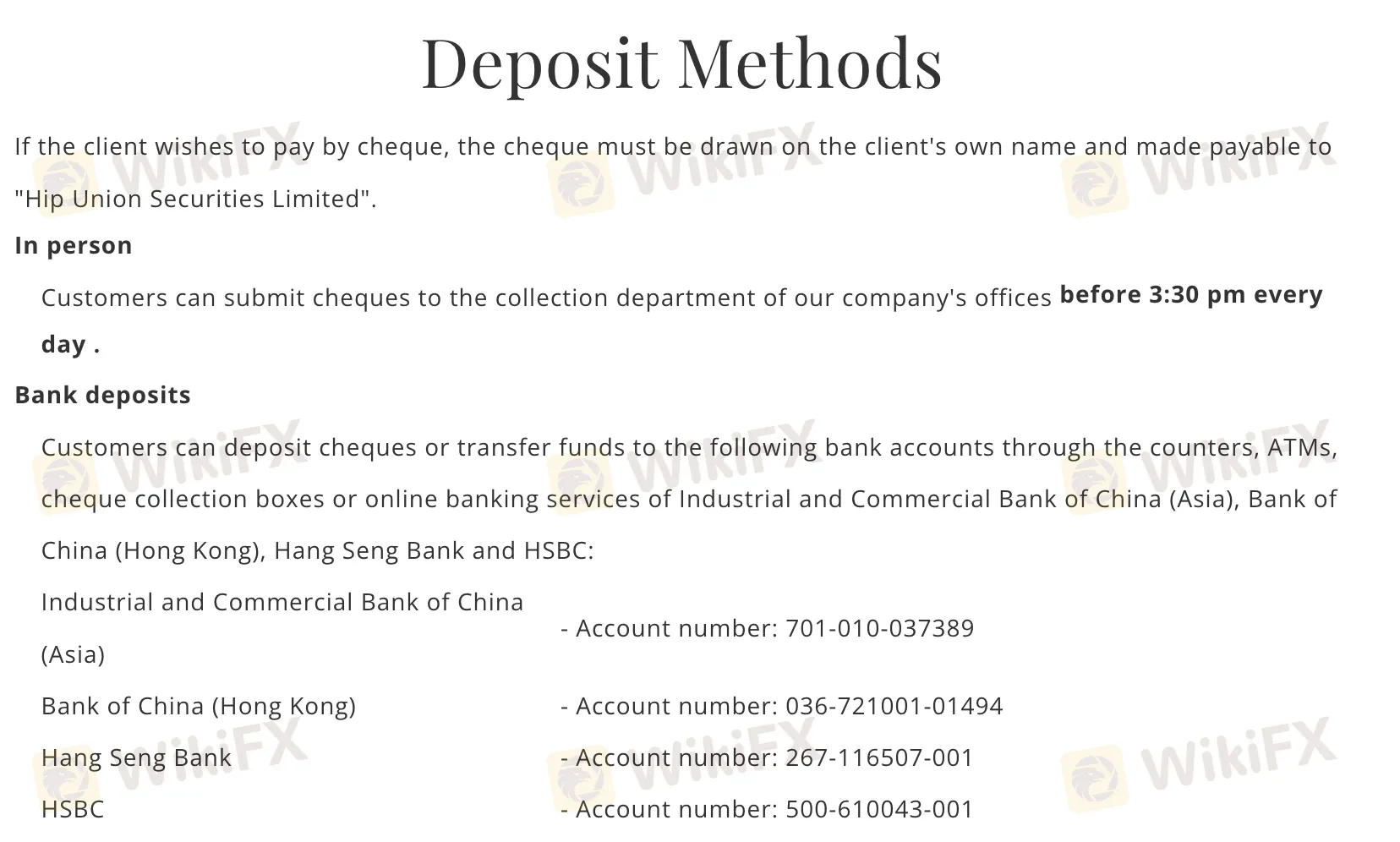

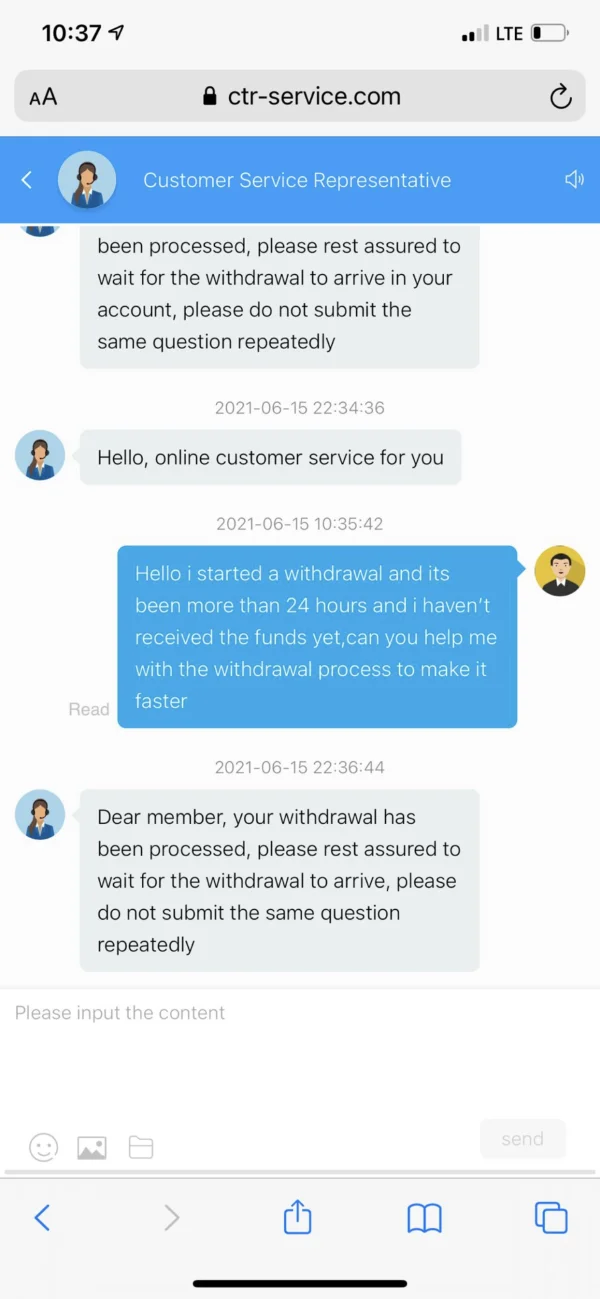

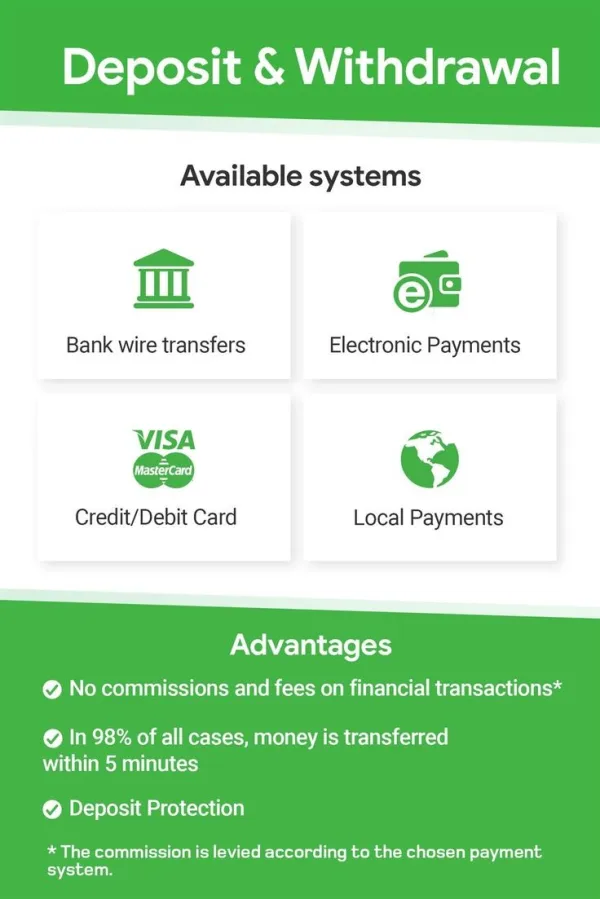

Deposit and Withdrawal

Corporate Commodities Limited does not charge fees on deposits or withdrawals made in the client's name. The minimum deposit amount is not expressly stated, thus it may change depending on the account type or trading criteria.

| Payment Method | Fees | Processing Time |

| Cheque (in person) | ❌ | Same day if before 3:30 PM |

| Bank Transfer (ATM / online / counter) | ❌ | Within 1 business day |

| Withdrawal by Cheque | ❌ | Usually next business day |

| Bank Transfer (Withdrawal) | ❌ | As per bank processing times |

| Stock Withdrawal (Physical or Transfer) | Company fees apply | Varies |