BenchMark Information

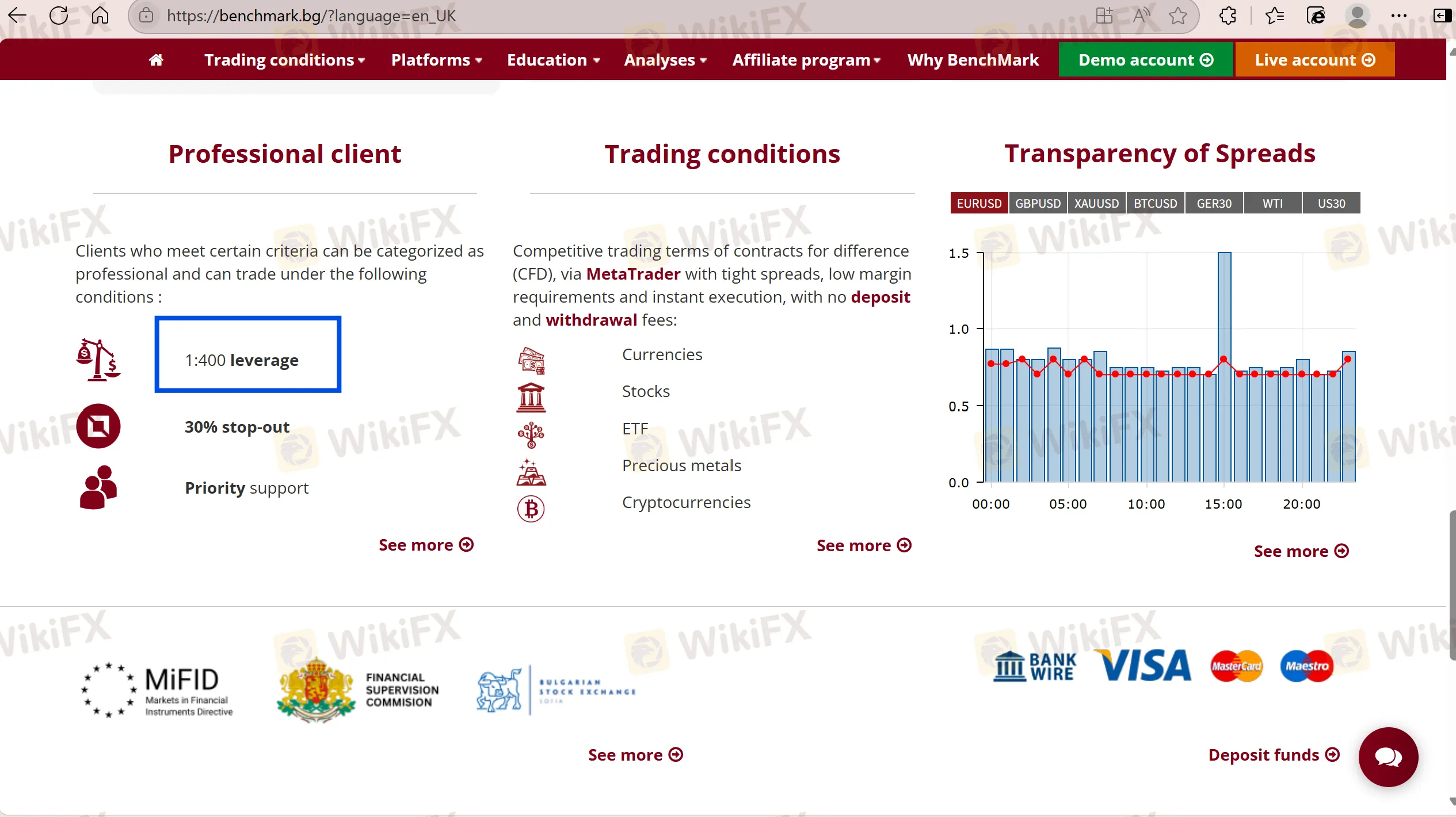

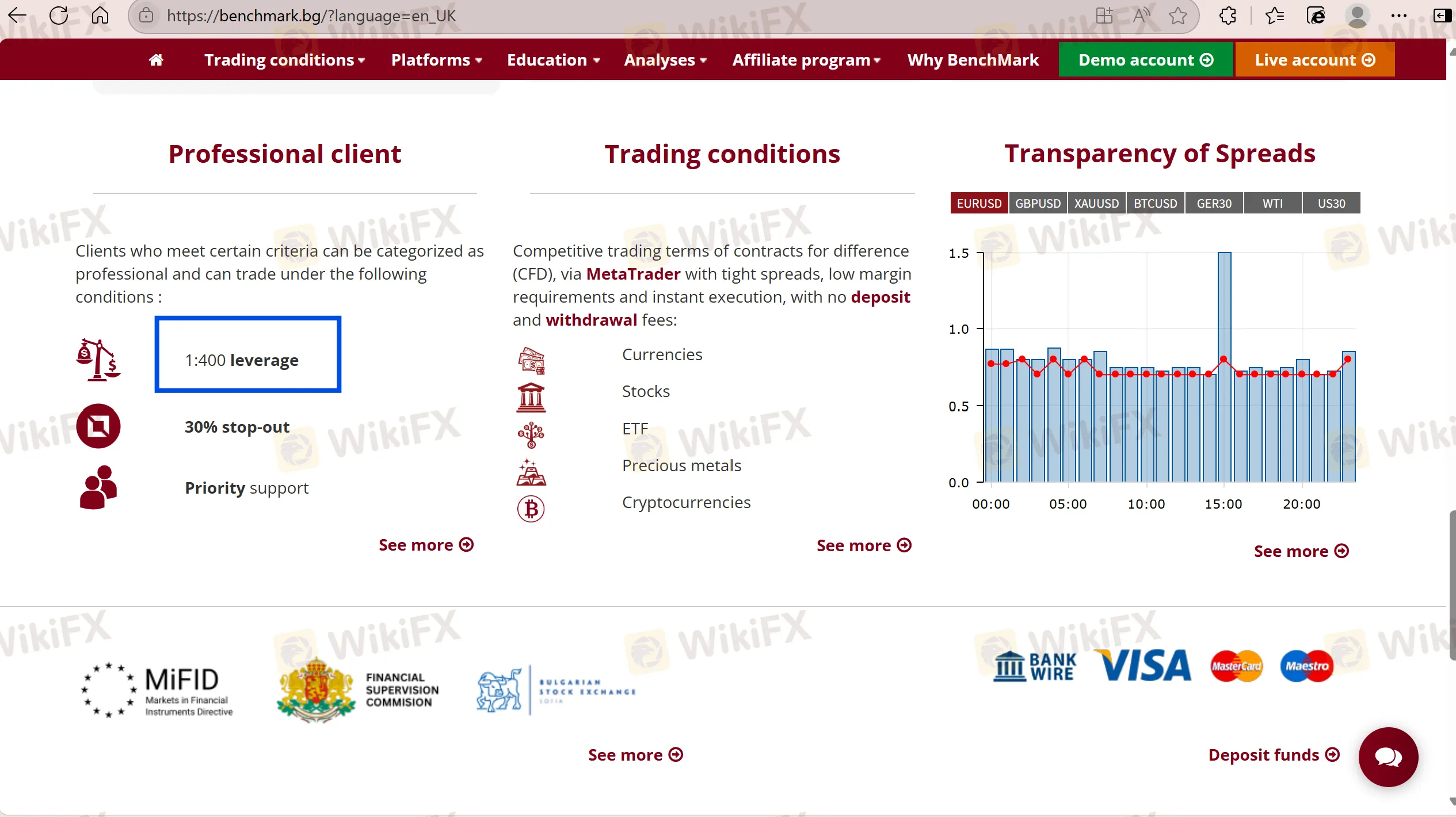

Established in 2003 and part of the BenchMark Group, BenchMark Finance is an investment intermediary. Specializing in brokerage services for trading financial instruments across international markets, with a maximum leverage of 1:400 including currency pairs, stocks, commodities, stock indices, funds, futures, and more. The firm also facilitates trading on the Bulgarian Stock Exchange for assets such as stocks, bonds, compensation notes, and compensation vouchers. The minimum spread is from 0.6 pips. However, BenchMark is still risky due to its Suspicious Clone status.

Pros and Cons

Is BenchMark Legit?

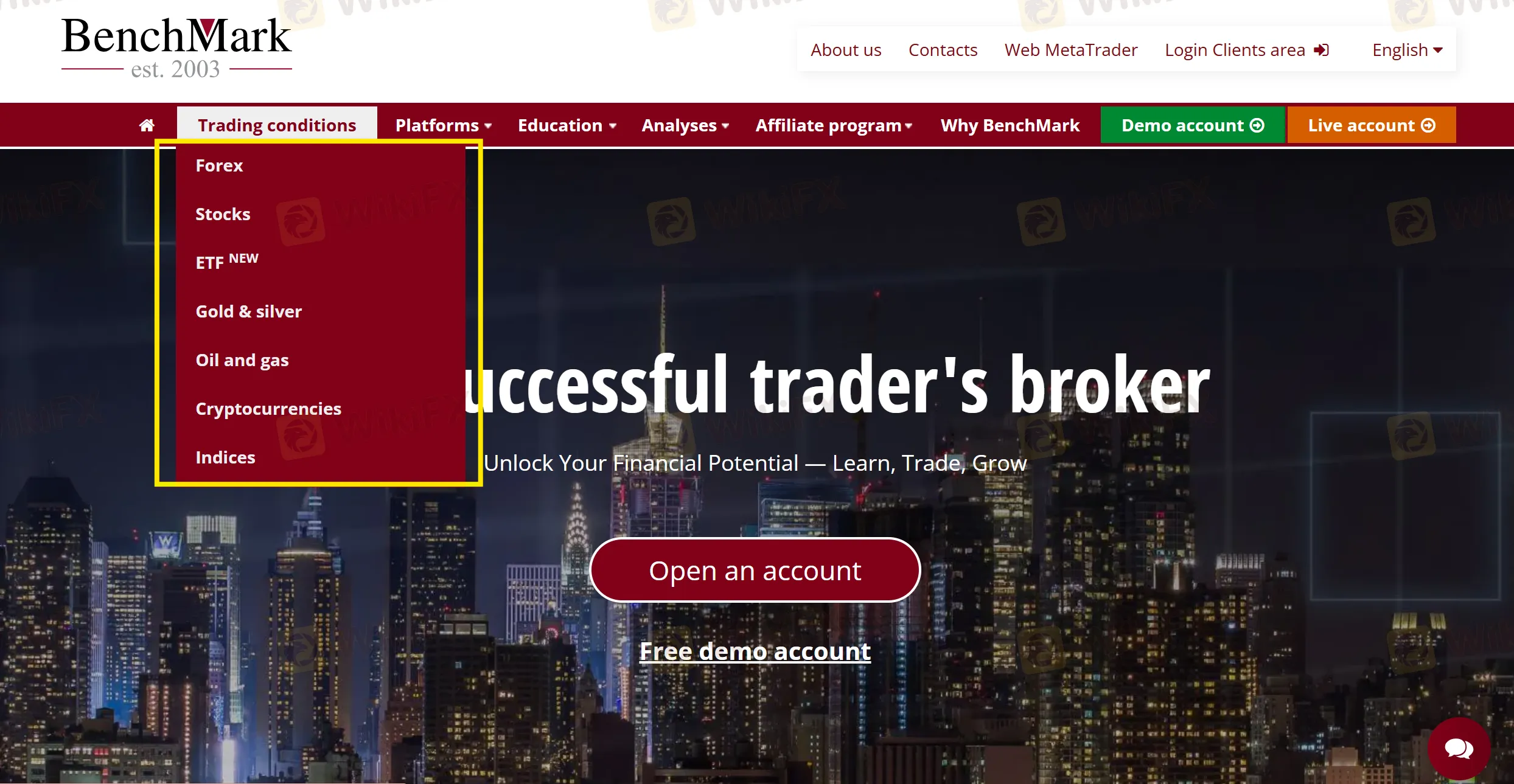

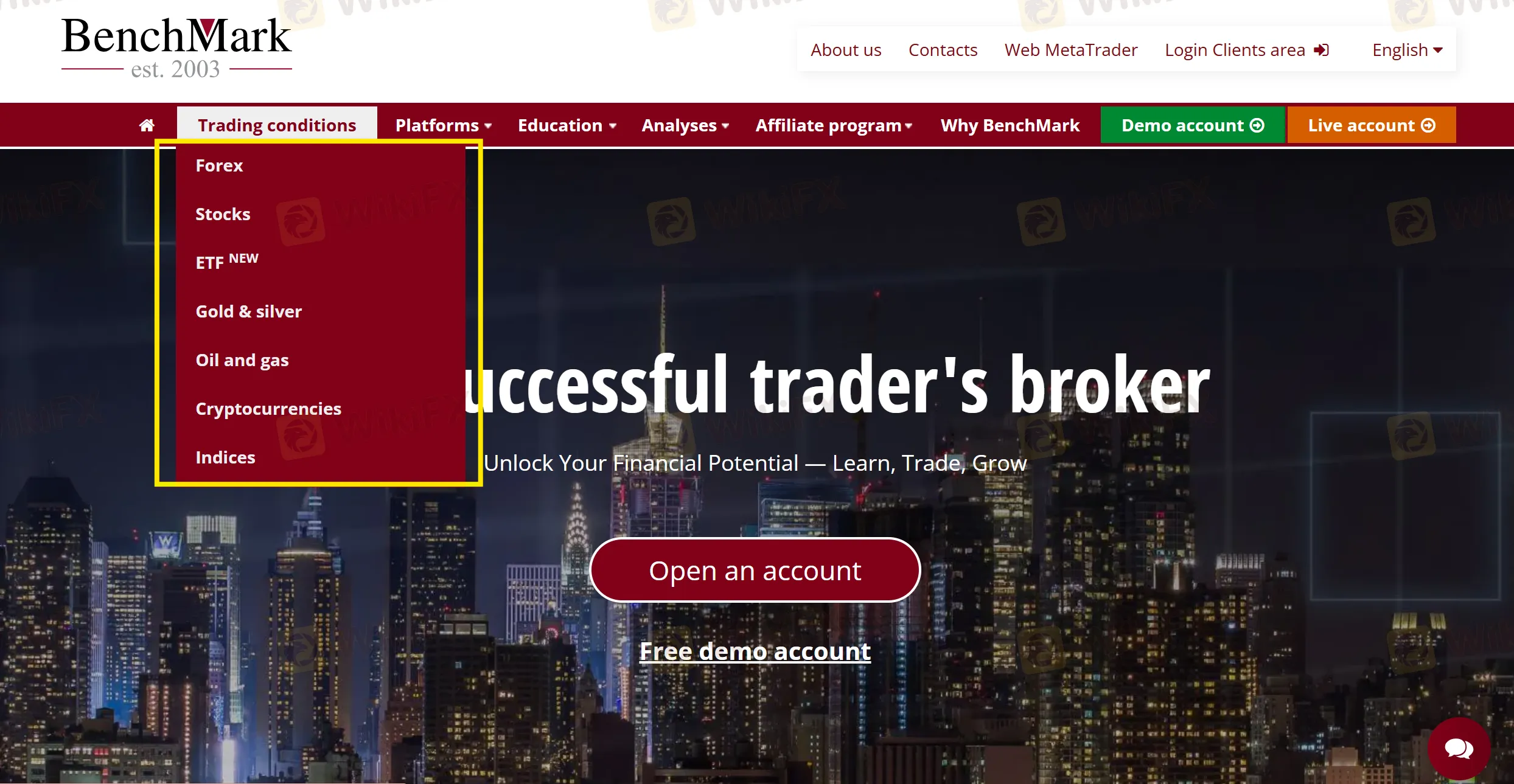

What Can I Trade on BenchMark?

BenchMark offers a wide range of market instruments, including forex, cryptocurrencies, stocks, ETFs, metals, oil & gas, and indices.

Account Type

BenchMark has two account types: a demo account and a live account. The demo account is predominantly used to familiarize traders with the trading platform and for educational purposes only.

BenchMark Fees

The spread is from 0.6 pips. The lower the spread, the faster the liquidity.

Leverage

The maximum leverage is 1:400, meaning that profits and losses are magnified 400 times.

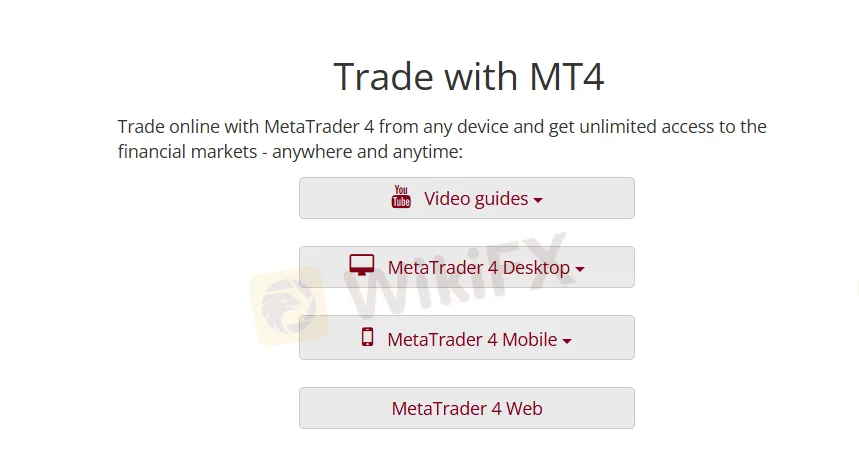

Trading Platform

BenchMark cooperates with the authoritative MT4 and MT5 trading platforms available in Desktop(Windows/MacOS), Mobile(Android/iOS), and Web to trade. Junior traders prefer MT4 over MT5. Traders with rich experience are more suitable for using MT5. MT4 and MT5 not only provide various trading strategies but also implement EA systems.

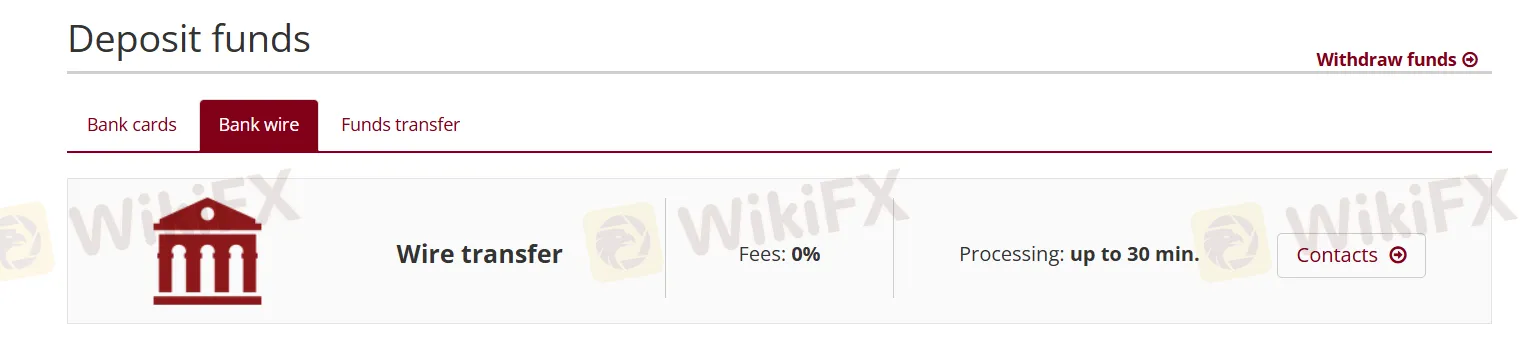

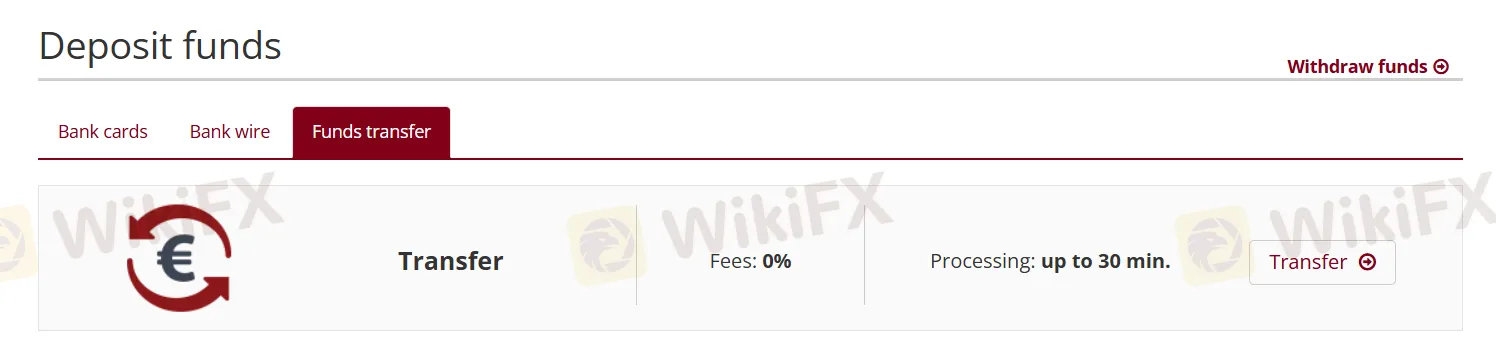

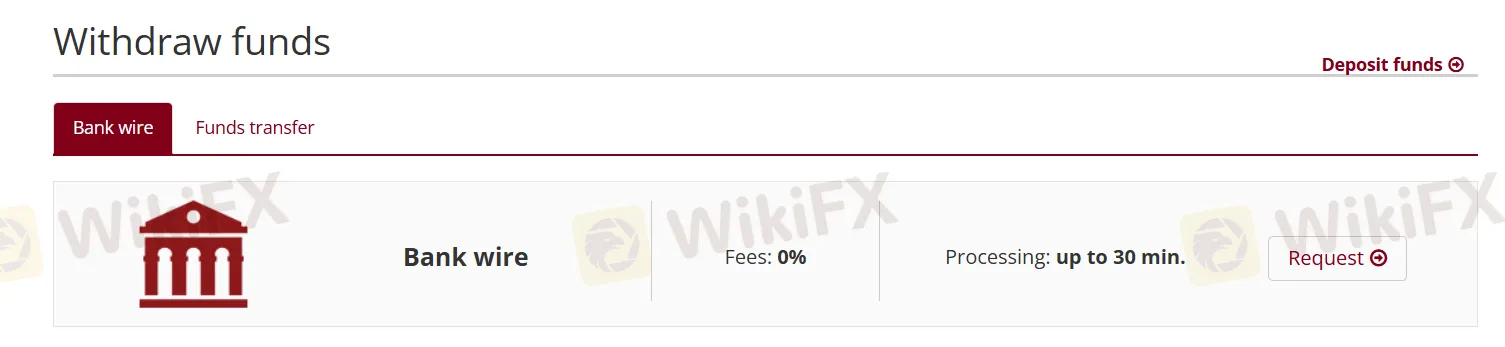

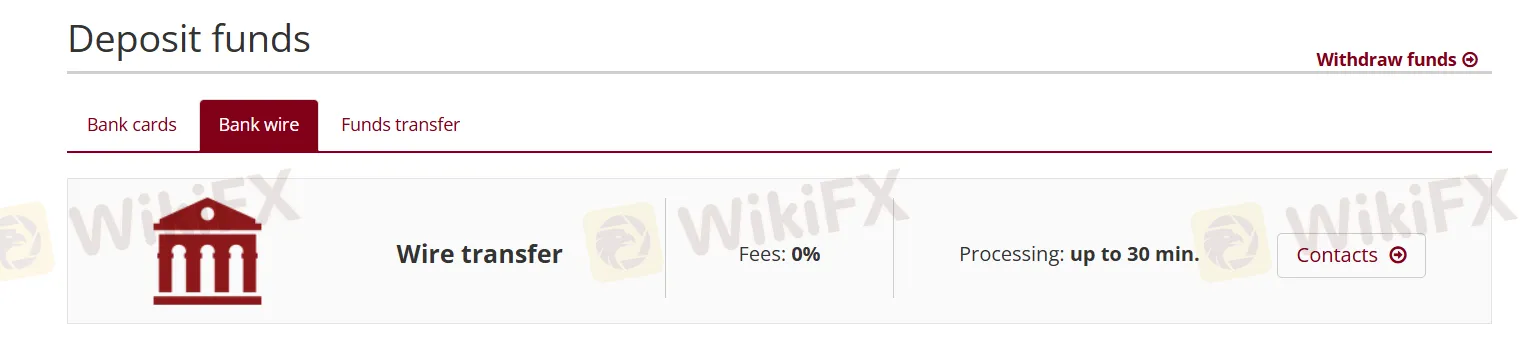

Deposit and Withdrawal

Traders can fund their accounts via debit/credit cards for free, with 24/7 processing on working days. Wire transfers are also fee-free, processed on working days between 07:00-14:45 GMT. Client account fund transfers are accepted anytime, but executed within the same working-hour window. For withdrawals, bank wires are available 24/7 and processed on business days between 07:00-14:45 GMT.