Company Summary

| RCB Review Summary | |

| Founded | 2002 |

| Registered Country | Cyprus |

| Regulation | No regulation |

| Customer Support | Email: rcb@rcbcy.com |

| Address: 2 Amathountos Street, Limassol, Cyprus | |

RCB Information

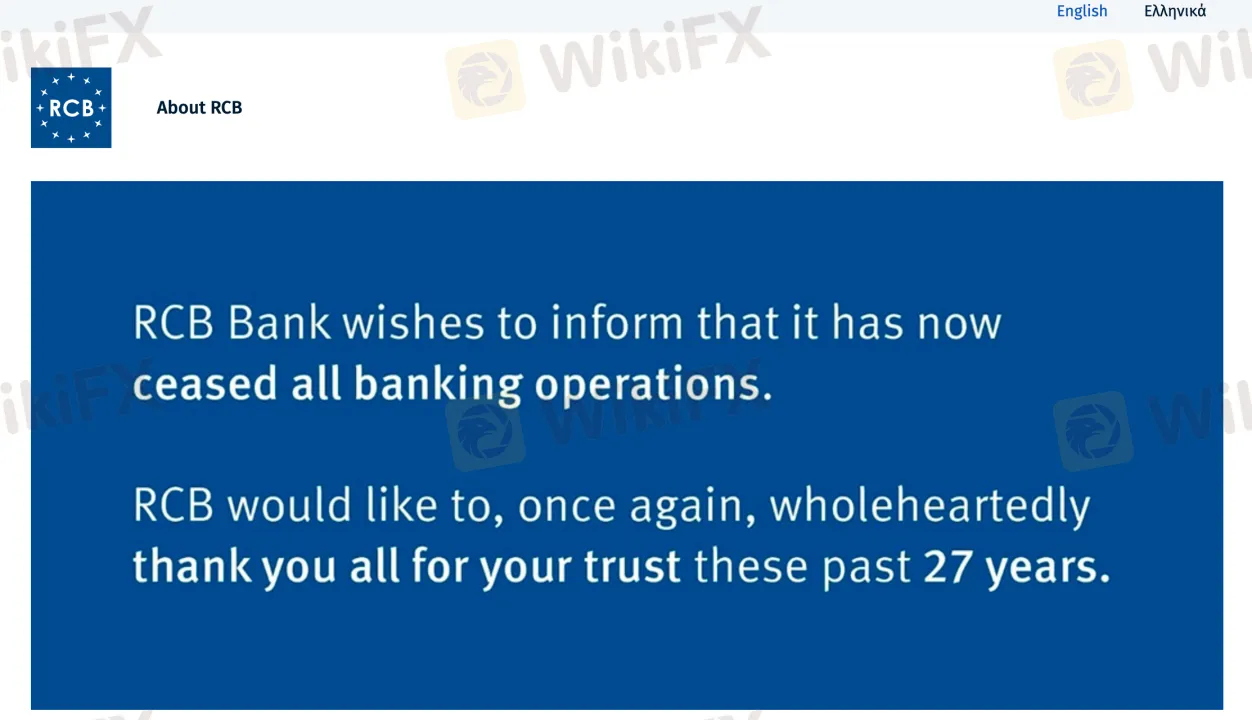

RCB was established in 2002 and registered in Cyprus. It is not regulated by CySEC or any major international financial authority. As of now, the bank has officially ceased all financial operations and no longer provides investment or banking services.

Pros and Cons

| Pros | Cons |

| Long operational history | No regulation |

| Previously known in Cyprus market | Officially ceased all services |

| No trading platform, products, or customer tools available |

Is RCB Legit?

RCB (rcbcy.com) is not a regulated broker. Although it is registered in Cyprus, it does not hold a license from CySEC, the official financial regulatory authority of Cyprus.

According to Whois data, the domain rcbcy.com was registered on March 21, 2002, and was last updated on March 11, 2024. It is currently active and set to expire on March 21, 2029.

Products and Services

RCB Bank's official site (rcbcy.com) verifies the bank has stopped all banking activity. It shows a closing announcement appreciating customers for their confidence over the last 27 years. Though the domain is still operational, the site claims RCB is no longer a working bank or broker as it provides no financial services.