회사 소개

| RCB 리뷰 요약 | |

| 설립 연도 | 2002 |

| 등록 국가 | 키프로스 |

| 규제 | 규제 없음 |

| 고객 지원 | 이메일: rcb@rcbcy.com |

| 주소: 키프로스 리마쏠 아마훈토스 거리 2 | |

RCB 정보

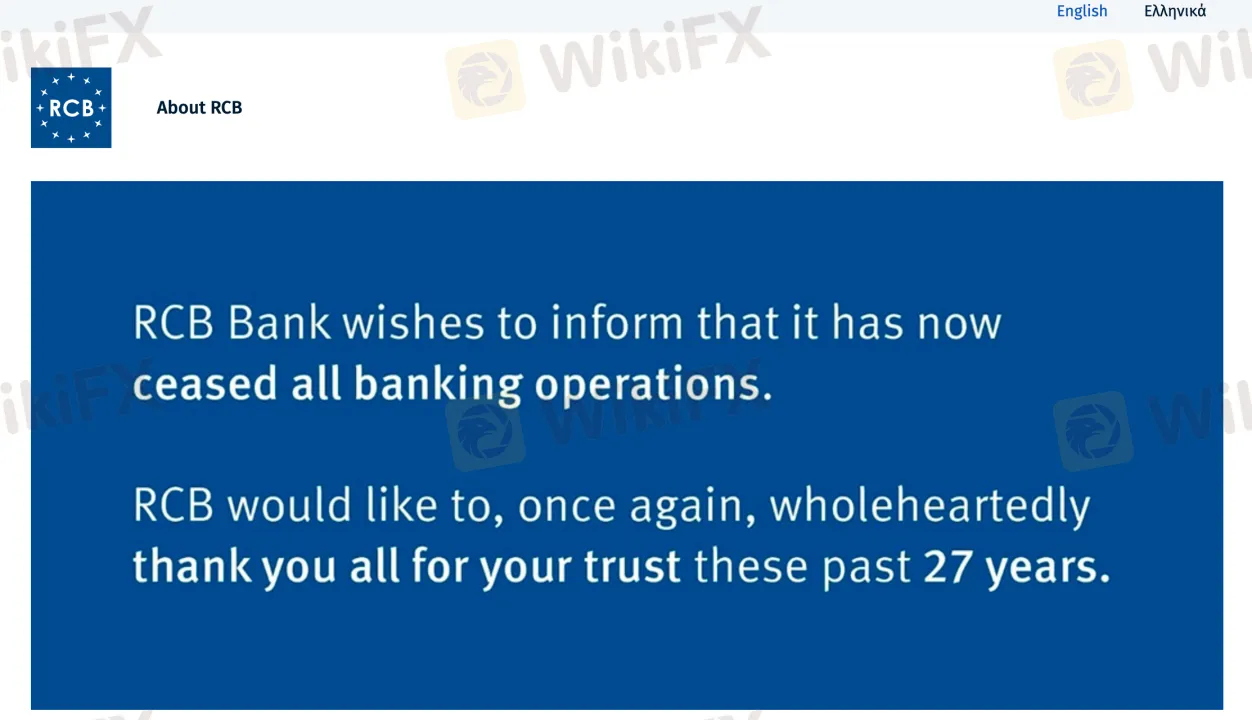

RCB은 2002년에 설립되어 키프로스에 등록되었습니다. CySEC이나 다른 주요 국제 금융 당국에 의해 규제되지 않았습니다. 현재 은행은 공식적으로 모든 금융 활동을 중단하고 투자 또는 은행 서비스를 더 이상 제공하지 않습니다.

장단점

| 장점 | 단점 |

| 긴 운영 역사 | 규제 없음 |

| 키프로스 시장에서 이전에 알려진 | 공식적으로 모든 서비스 중단 |

| 거래 플랫폼, 제품 또는 고객 도구 없음 |

RCB 합법적인가요?

RCB (rcbcy.com)은 규제되지 않은 브로커입니다. 키프로스에 등록되어 있지만, 키프로스의 공식 금융 규제 당국인 CySEC으로부터 라이선스를 보유하고 있지 않습니다.

Whois 데이터에 따르면, 도메인 rcbcy.com은 2002년 3월 21일에 등록되었으며, 마지막으로 2024년 3월 11일에 업데이트되었습니다. 현재 활성화되어 있으며 2029년 3월 21일에 만료될 예정입니다.

제품 및 서비스

RCB 은행의 공식 사이트 (rcbcy.com)은 은행이 모든 은행 활동을 중단했음을 확인합니다. 27년 동안의 신뢰에 감사드리는 폐쇄 공지가 표시됩니다. 도메인은 여전히 운영 중이지만, 사이트는 RCB이 더 이상 금융 서비스를 제공하지 않는 은행이나 브로커가 아니라고 주장합니다.