مقدمة عن الشركة

| RCB ملخص المراجعة | |

| تأسست | ٢٠٠٢ |

| بلد التسجيل | قبرص |

| التنظيم | لا يوجد تنظيم |

| دعم العملاء | البريد الإلكتروني: rcb@rcbcy.com |

| العنوان: ٢ شارع أماثونتوس، ليماسول، قبرص | |

معلومات RCB

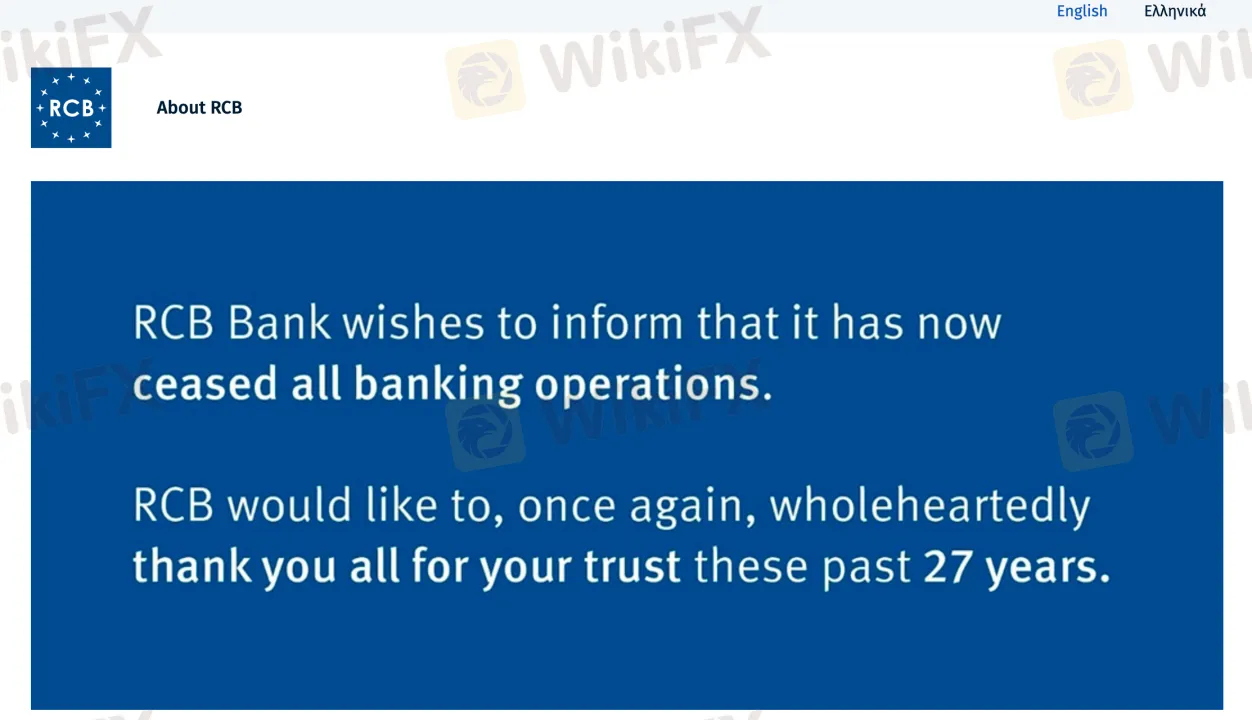

تأسست RCB في عام ٢٠٠٢ ومسجلة في قبرص. لا تخضع لتنظيم CySEC أو أي سلطة مالية دولية رئيسية. حتى الآن، أوقف البنك رسميًا جميع العمليات المالية ولا يقدم خدمات استثمارية أو بنكية بعد الآن.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| تاريخ تشغيل طويل | لا يوجد تنظيم |

| معروف سابقًا في سوق قبرص | أوقف رسميًا جميع الخدمات |

| لا تتوفر منصة تداول أو منتجات أو أدوات عملاء |

هل RCB شرعي؟

RCB (rcbcy.com) ليس وسيطًا مُنظمًا. على الرغم من تسجيله في قبرص، إلا أنه لا يحمل ترخيصًا من CySEC، السلطة الرسمية للرقابة المالية في قبرص.

وفقًا لبيانات Whois، تم تسجيل نطاق rcbcy.com في ٢١ مارس ٢٠٠٢، وتم تحديثه آخر مرة في ١١ مارس ٢٠٢٤. حاليًا نشط ومنتهي الصلاحية في ٢١ مارس ٢٠٢٩.

المنتجات والخدمات

يتحقق من الموقع الرسمي لبنك RCB (rcbcy.com) أن البنك قد أوقف جميع الأنشطة المصرفية. يظهر إعلان إغلاق يقدر العملاء على ثقتهم على مدى السنوات ال٢٧ الماضية. على الرغم من أن النطاق لا يزال نشطًا، يدعي الموقع أن RCB لم يعد بنكًا أو وسيطًا عاملًا حيث لا تقدم أي خدمات مالية.