Company Summary

| BACB Review Summary | |

| Founded | 1995 |

| Registered Country/Region | Bulgaria |

| Regulation | No regulation |

| Services | Cards, loans, savings, payments |

| Platform/APP | BACB Pay |

| Minimum Deposit | 5 BGN/EUR/USD |

| Customer Support | 24/7 support, live chat |

| Tel: 070014488 | |

| Facebook, Instagram, LinkedIn | |

| Address: Sofiya 2, Slavyanska Str | |

BACB Information

BACB is an unregulated service provider of premier brokerage and financial services, which was founded in Bulgaria in 1995. It offers services for cards, loans, savings and payments.

Pros and Cons

| Pros | Cons |

| Long operation time | Lack of regulation |

| No deposit fees | Complex fee structure |

| Low minimum deposit requirement | Limited payment options |

| Live chat support |

Is BACB Legit?

No. BACB currently has no valid regulations. Please be aware of the risk!

Services

| Services | Supported |

| Cards | ✔ |

| Loans | ✔ |

| Savings | ✔ |

| Payments | ✔ |

Account Type

| Account Type | Minimum Deposit |

| Leuro Account | / |

| Clean Account with VISA Card | 500 BGN |

| Current Account | 5 BGN/EUR/USD |

| Joint Current Account | 5 BGN/EUR/USD |

| Escrow Account | / |

| Escrow Account with Basic Services | 5 BGN |

BACB Fees

| Category | Product/Service | Terms & Rates | Notes |

| Deposit Accounts | Current Account (BGN/USD/EUR) | - Interest Rate: 0.01%–0.05% (varies by currency) | Fees may apply for withdrawals/transfers. |

| - Minimum Balance: 0 | |||

| Savings Account (BGN) | - Interest Rate: 0.10%–0.50% (term-dependent) | Early withdrawal penalties apply. | |

| - Term Options: 1–12 months | |||

| Fixed Deposit (USD/EUR) | - Interest Rate: 0.15%–1.20% (varies by term/currency) | No partial withdrawals allowed. | |

| - Minimum Deposit: $/€1,000 | |||

| Loans | Consumer Loans (BGN) | - Interest Rate: 4.9%–9.9% (fixed) | Secured/unsecured options available. |

| - Term: Up to 7 years | |||

| - Processing Fee: 1% of loan amount | |||

| Mortgage Loans (BGN/EUR) | - Interest Rate: 2.5%–5.5% (variable/fixed) | Property insurance required. | |

| - Term: Up to 30 years | |||

| - LTV: Up to 80% | |||

| Fees | Account Maintenance | - Monthly Fee: 5 BGN (waived for balances >5,000 BGN) | Applies to current accounts. |

| International Transfers (SWIFT) | - Outgoing: 0.1% (min. 20 BGN, max. 100 BGN) | Additional intermediary bank fees may apply. | |

| - Incoming: 10 BGN per transaction | |||

| ATM Withdrawals | - BACB ATMs: 0 | Limits may apply for daily withdrawals. | |

| - Non-BACB ATMs: 2 BGN per transaction (domestic) | |||

| Special Conditions | Student/Youth Accounts | - Interest Rate: 0.25% (BGN) | Valid for clients aged 16–25. |

| - No Maintenance Fees | |||

| Pensioner Accounts | - Interest Rate: 0.30% (BGN) | Requires proof of pension status. | |

| - Free Card Issuance |

More details can be found via https://www.bacb.bg/en/files/61-interest-rates-terms.pdf

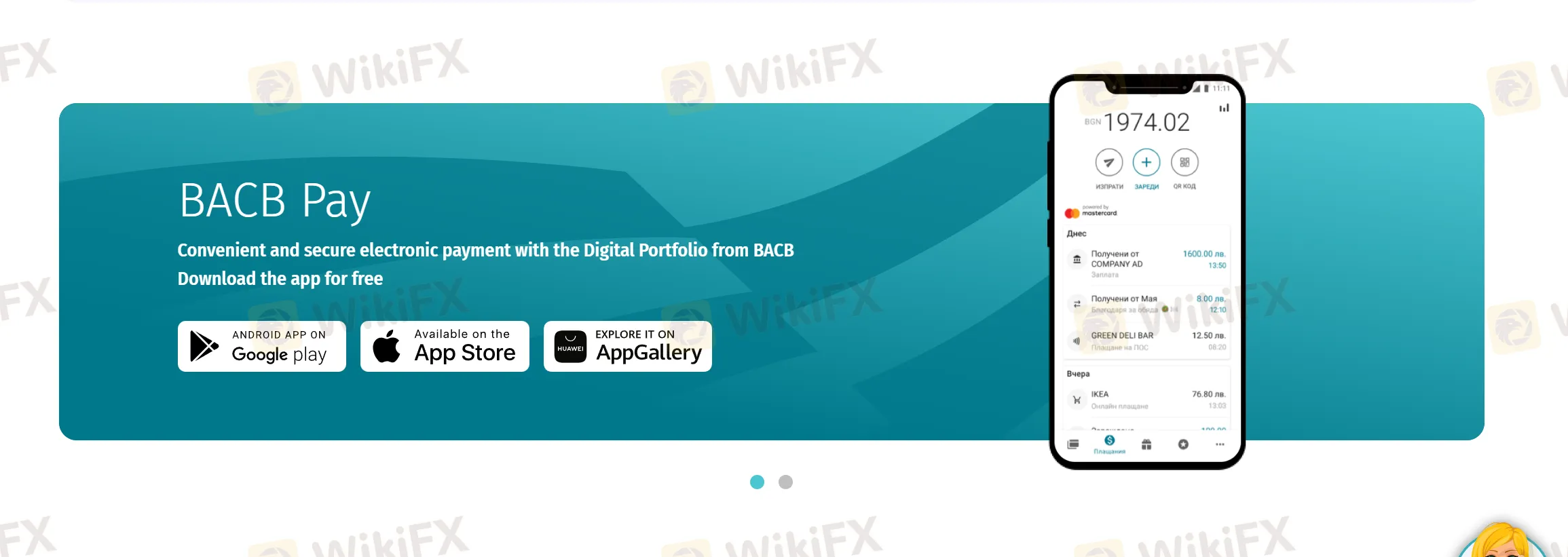

Platform/APP

BACB uses its own platforms which are available in web, PC, and mobile devices.

| Platform/APP | Supported | Available Devices |

| BACB Pay | ✔ | Mobile, PC, web |

Deposit and Withdrawal

BACB accepts payments via pop cards, debit cards and credit cards.