Company Summary

| PASHA CapitalReview Summary | |

| Founded | 2012 |

| Registered Country/Region | Azerbaijan |

| Regulation | No regulation |

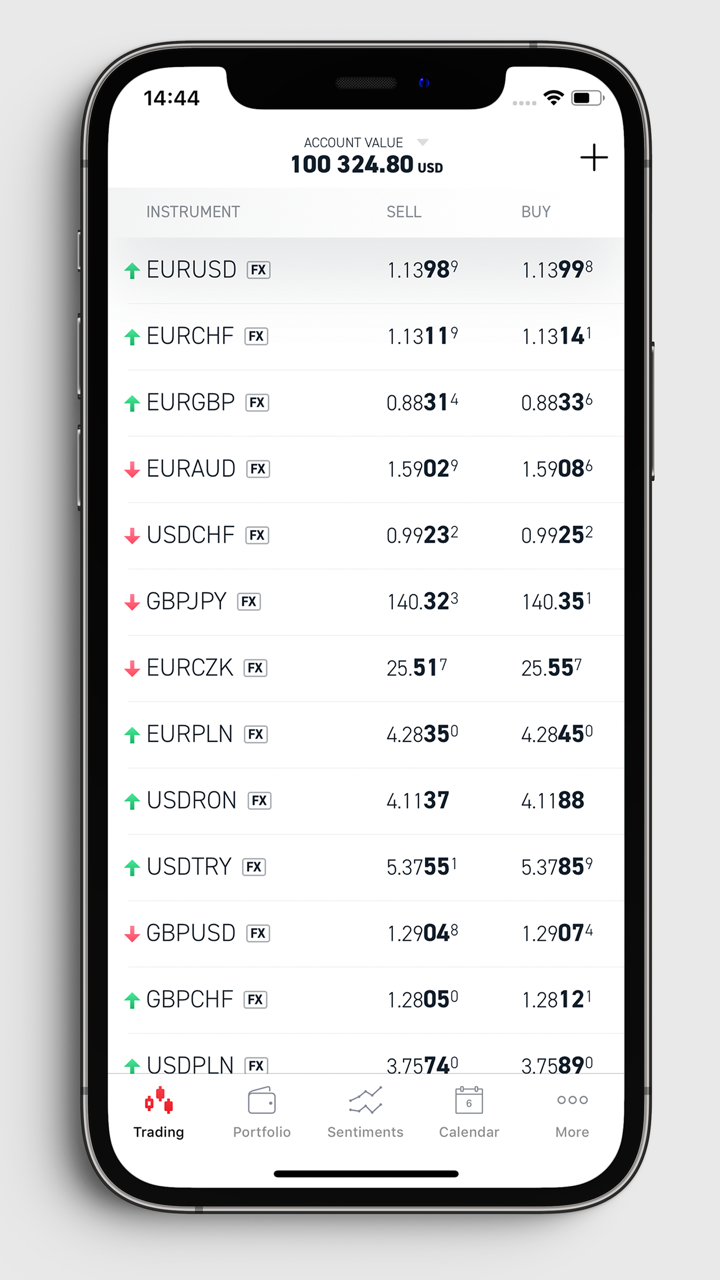

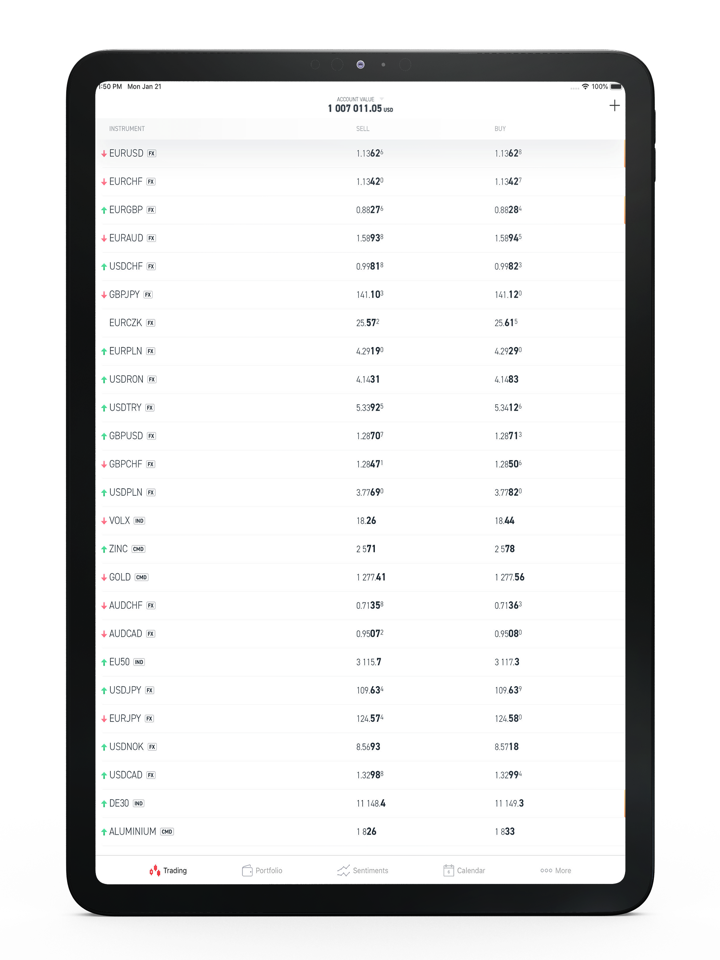

| Market Instruments | Currency Pairs, Commodities, Precious Metals, Fund Indices, FX, CFDs, futures, indices, metals, energy, share and bond sales |

| Demo Account | Classic Account, Individual Account |

| Leverage | Up to 1:50 |

| Spread | Competitive Spreads of 0.2 pips |

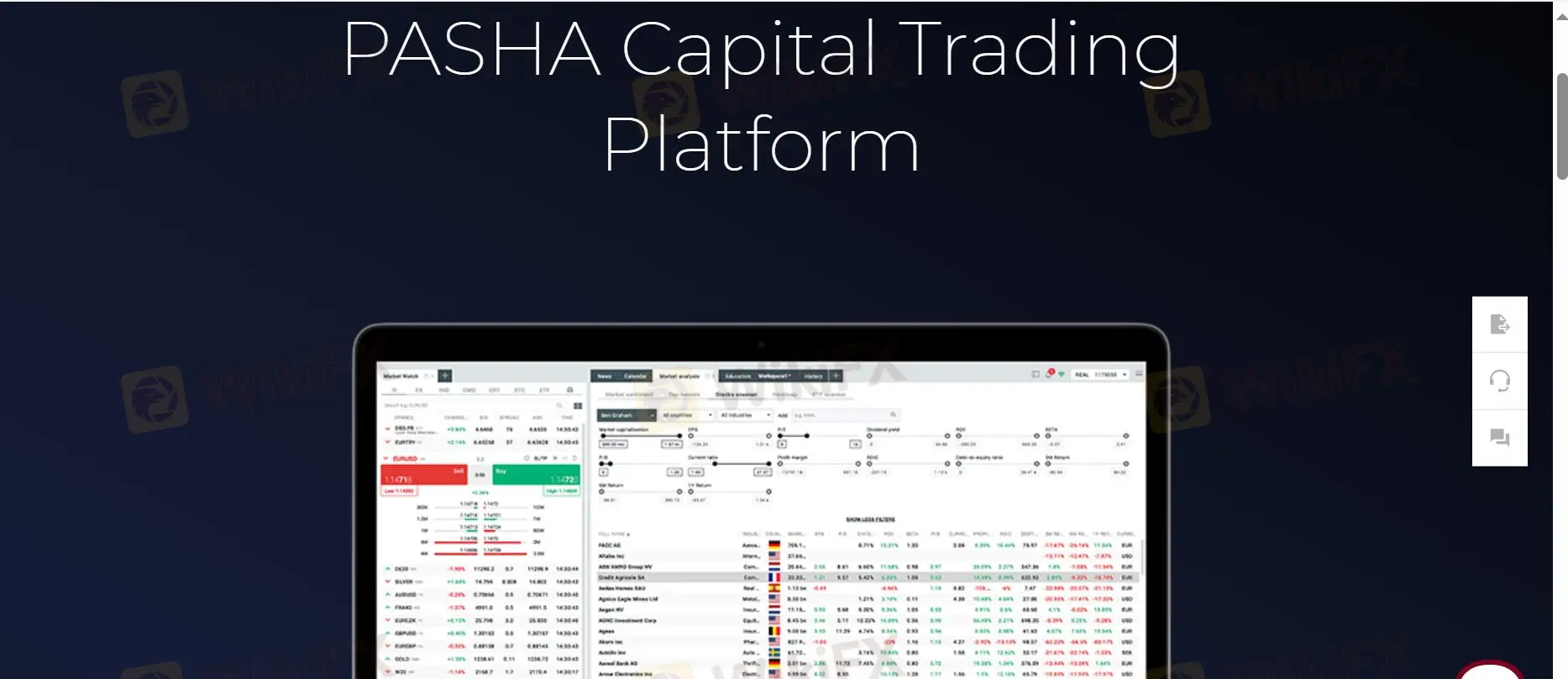

| Trading Platform | the PASHA Capital Trading Platform |

| Min Deposit | $200 |

| Customer Support | Phone: +994 55 226 33 66 |

| Email: office@pashacapital.az | |

| Physical Address: Caspian Plaza, 44 Jafar Jabbarli street, Baku AZ1065, Azerbaijan | |

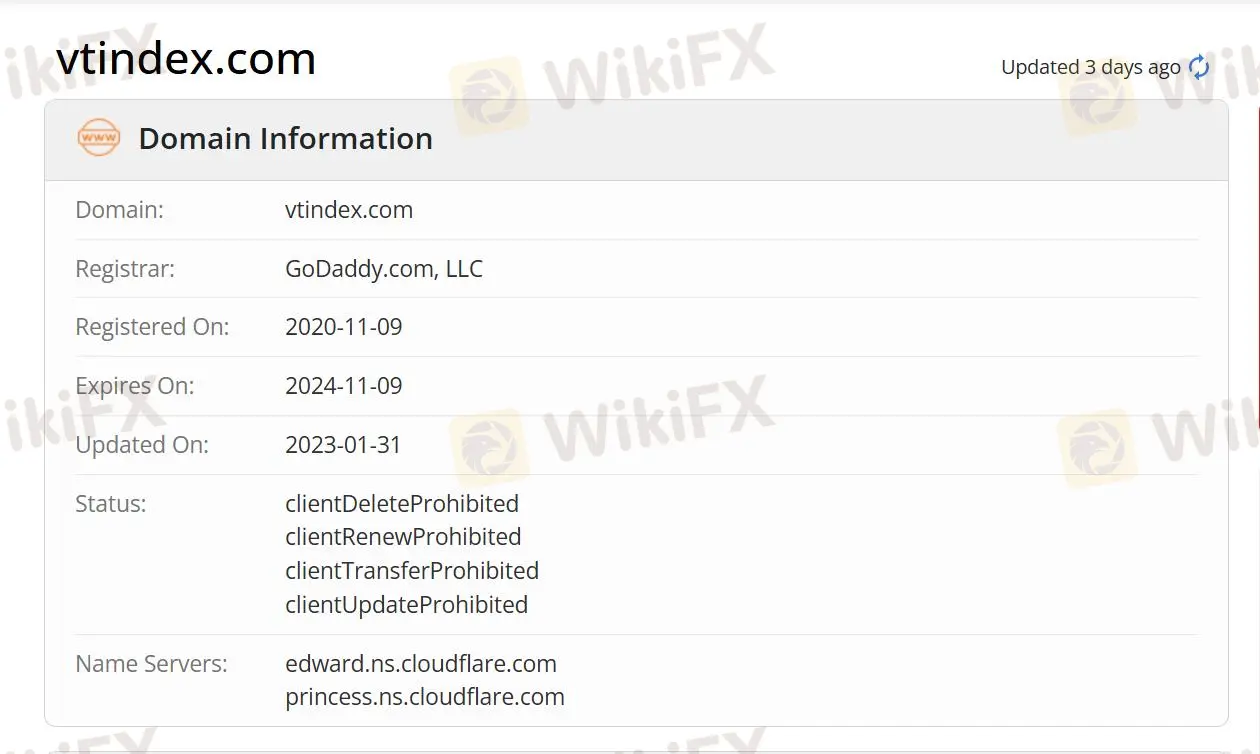

PASHA Capital Information

PASHA Capital, founded in 2012, is a mature brokerage registered in Azerbaijan. The trading instruments it provides cover Currency Pairs, Commodities, Precious Metals and so on. It has competitive spreads. But it is currently unregulated and lacks security.

Pros and Cons

| Pros | Cons |

| Competitive Spreads of 0.2 pips | No regulation |

| Various Trading Products | Limited Trading Platform Options (the sole option available) |

| Diversified Services | Limited Leverage Options (1:50) |

| Social Media Presence |

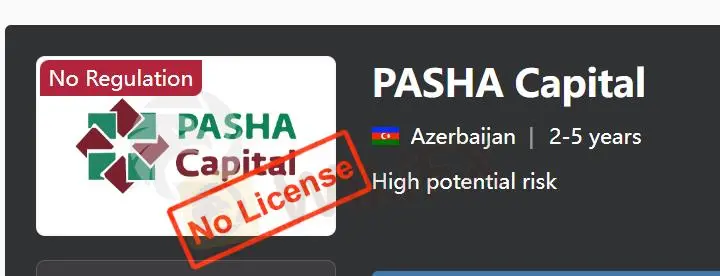

Is PASHA Capital Legit?

It is clear that PASHA Capital, which was registered in 2012 but is currently unregulated, has high potential risk.

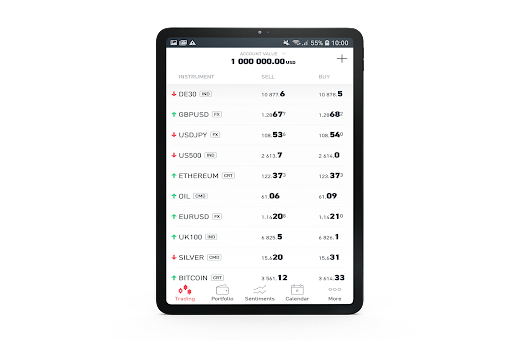

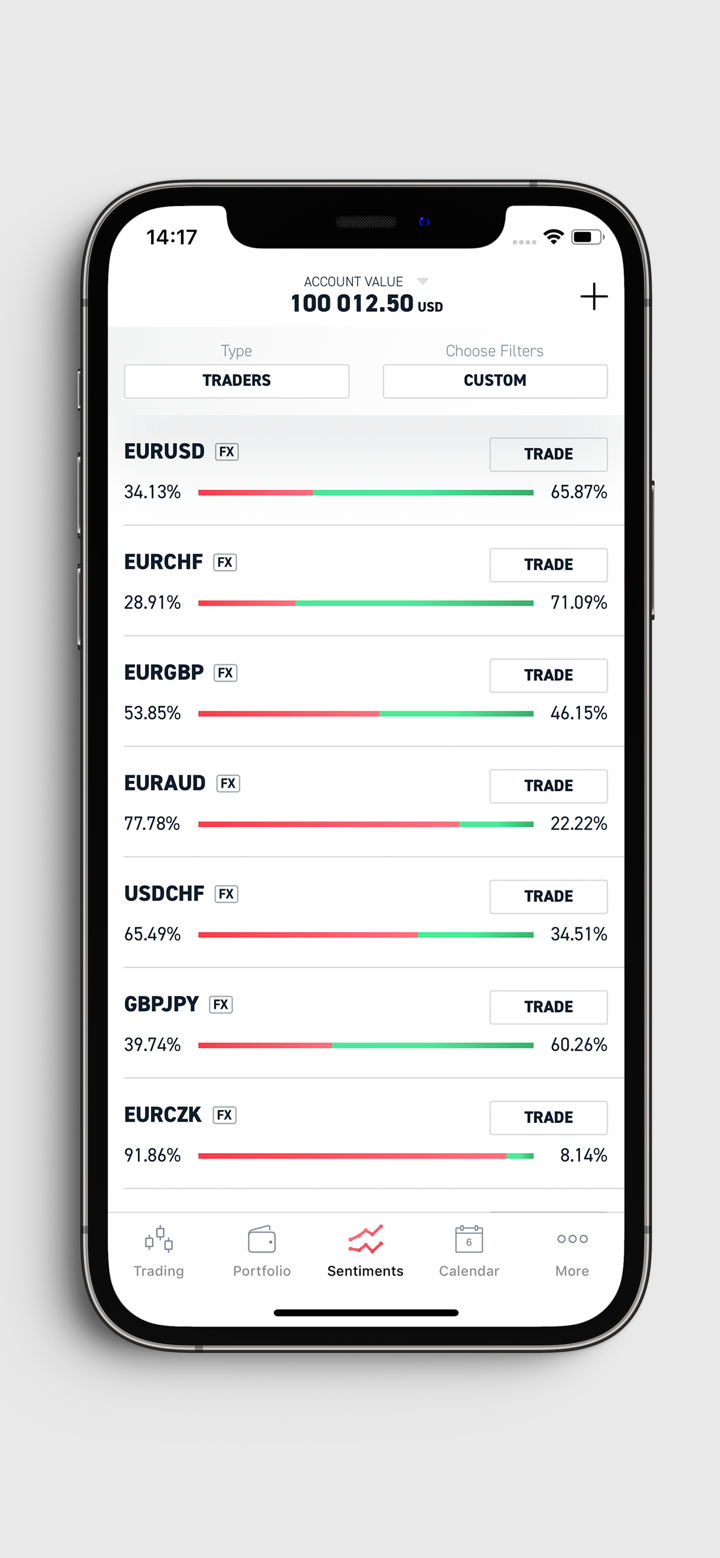

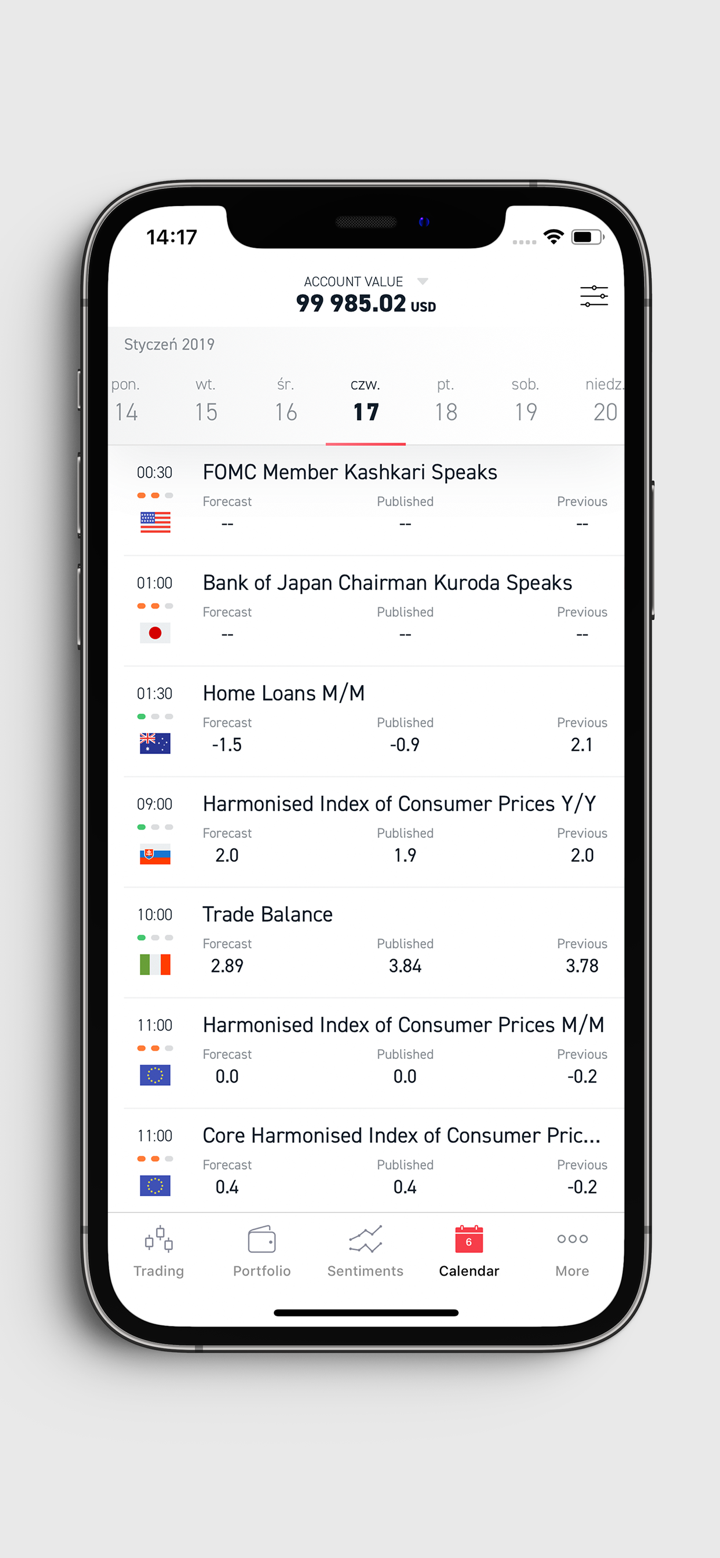

What Can I Trade on PASHA Capital?

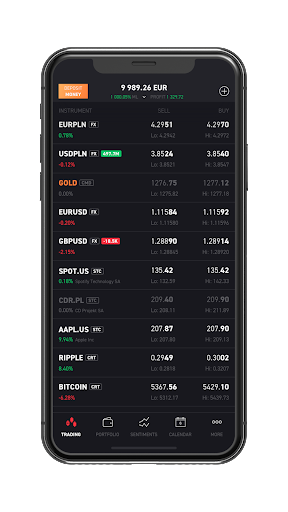

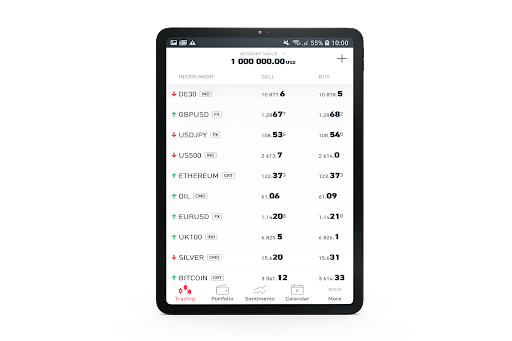

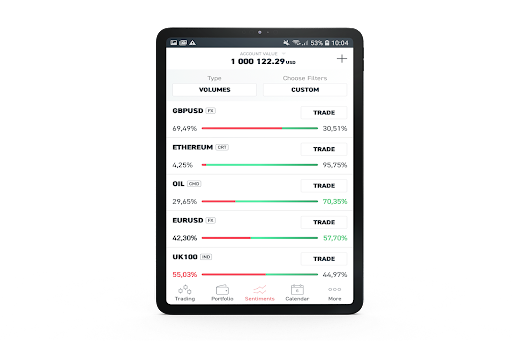

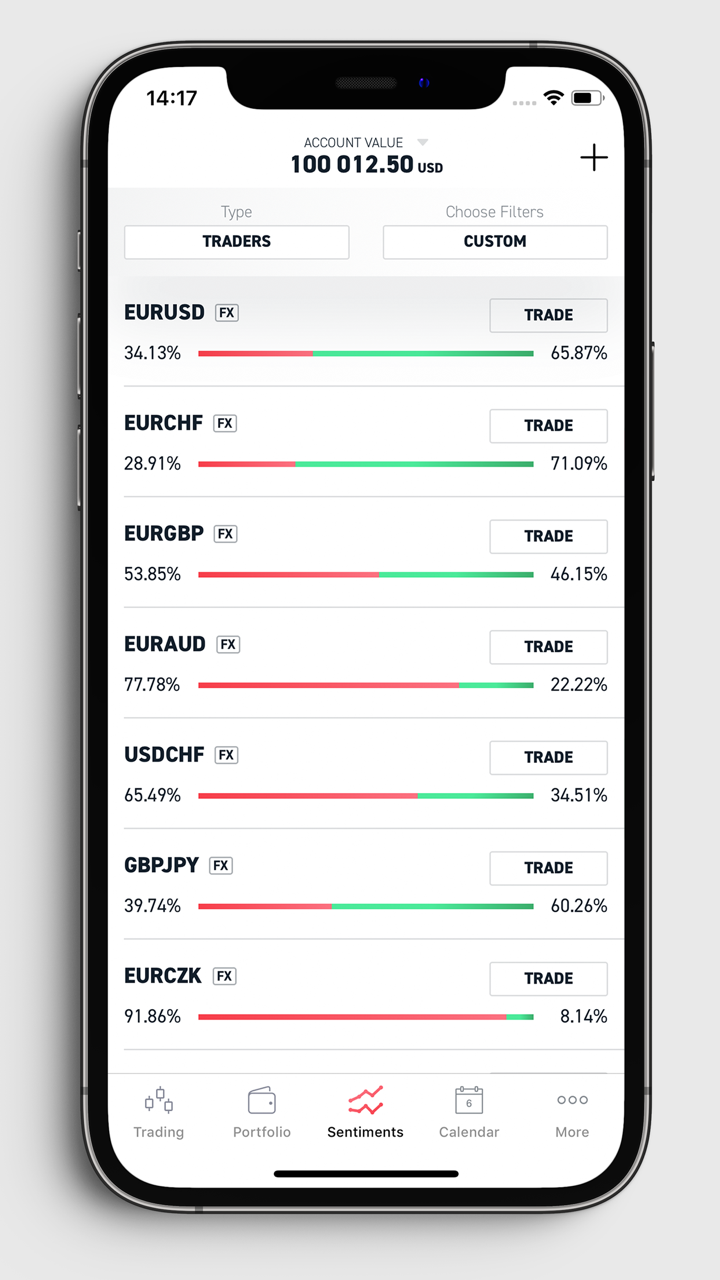

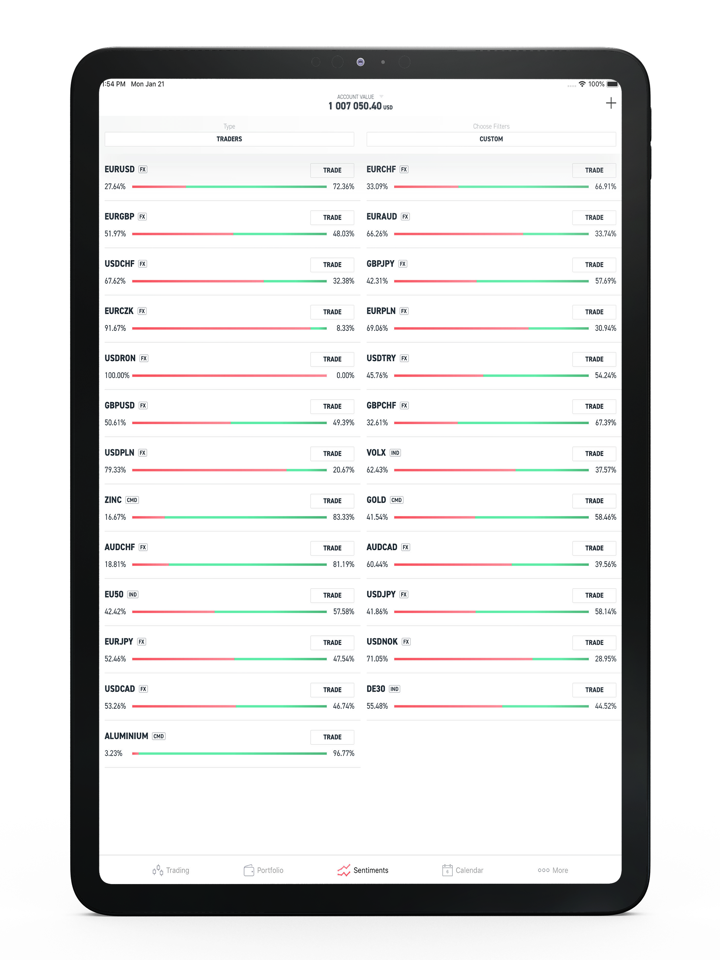

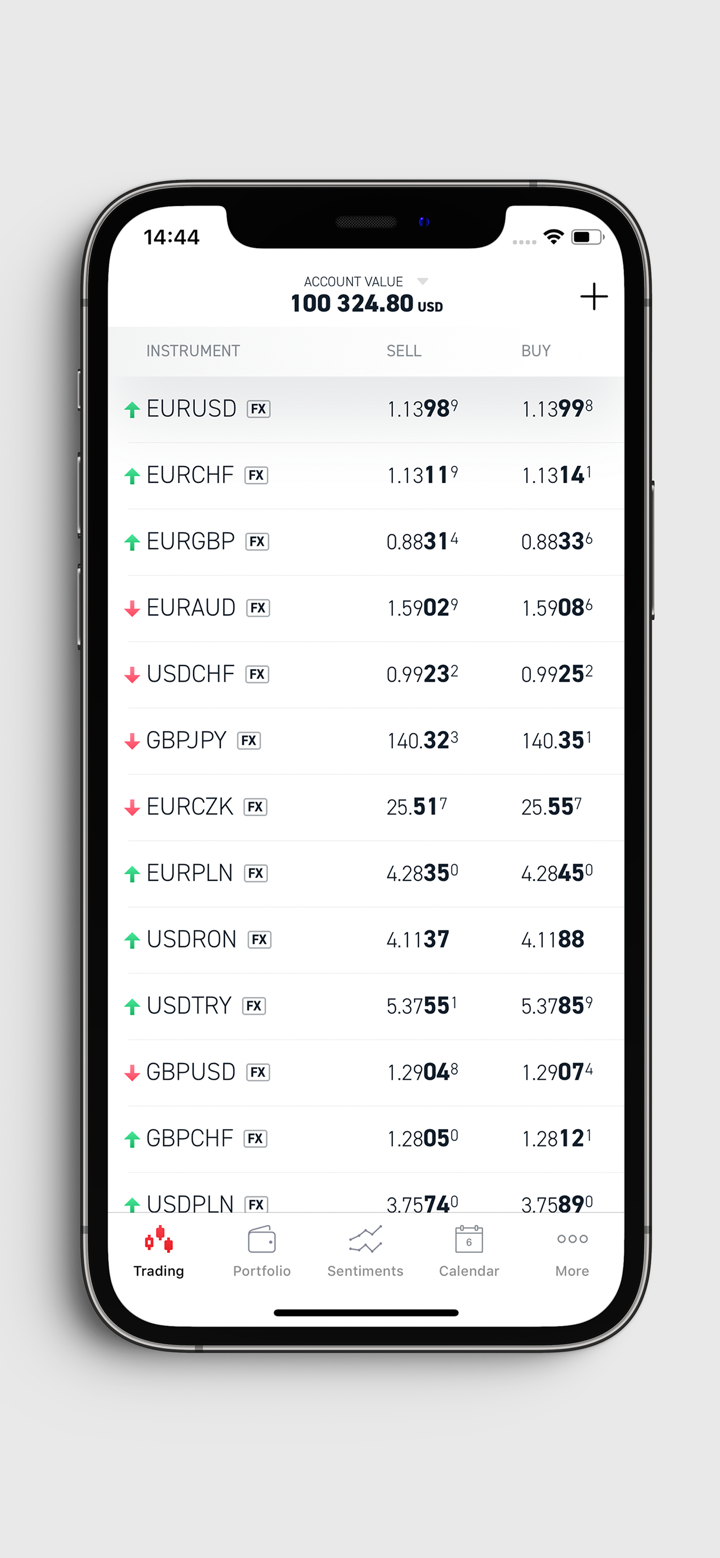

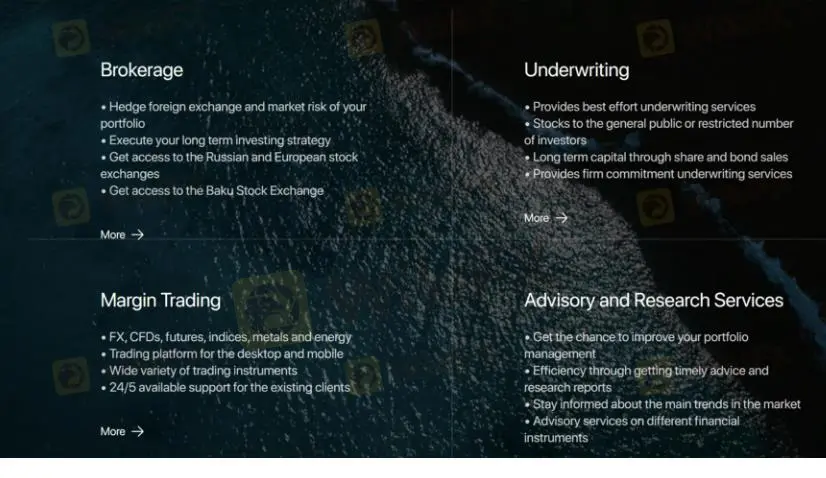

PASHA Capital provides a wide range of services and products to cater to their clients' needs. PASHA offer trading in over 2000 currency pairs and have options in fund indices, which consist of a selection of securities from specific segments of the market.

PASHA also offers consulting and research services. By subscribing, you can get support from a professional team to improve your portfolio management efficiency and stay updated on key trends in the market and specific industries.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| ETFs | ✔ |

| Funds | ✔ |

| Bonds | ✔ |

| Indices | ✔ |

| Futures | ✔ |

| Precious metals & Commodities | ✔ |

| Cryptocurrencies | ✔ |

| CFDS | ❌ |

| Derivatives | ❌ |

| Options | ❌ |

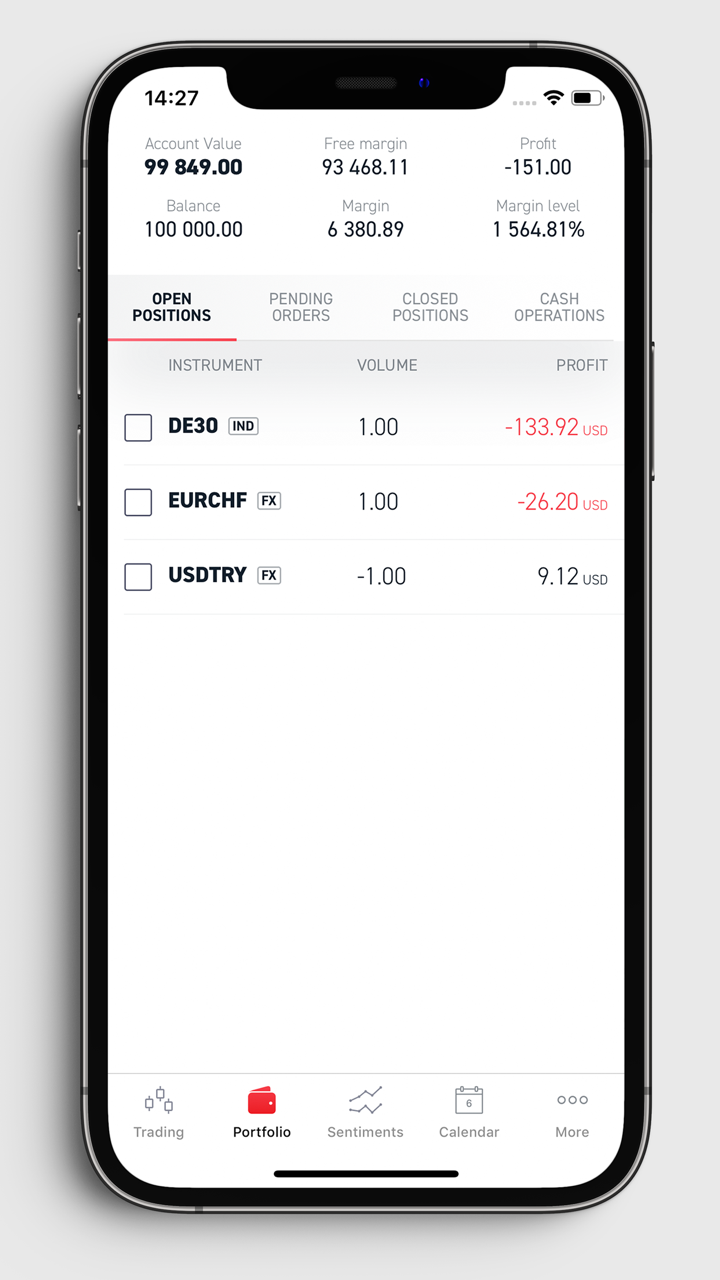

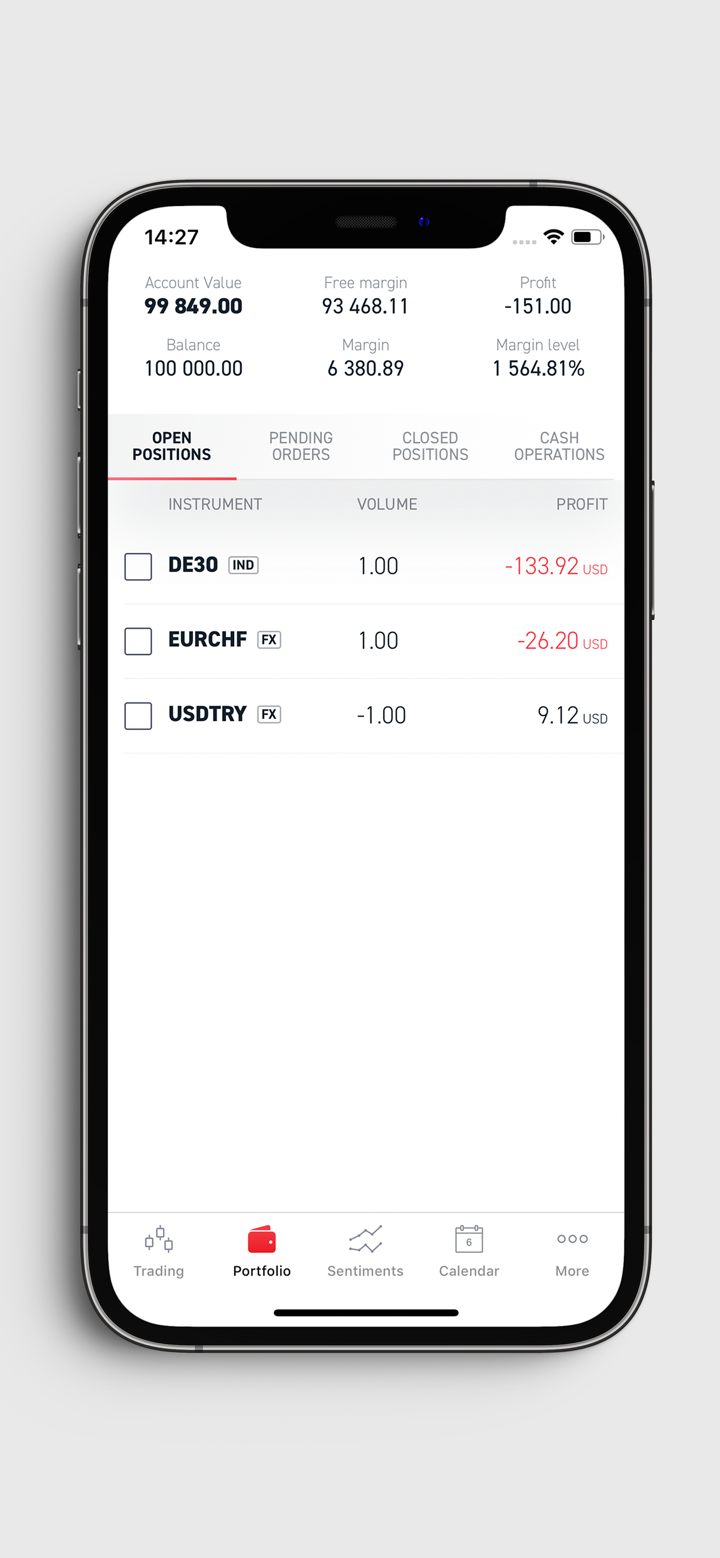

Account Types

PASHA Capital offers two account types with some similarities and key differences:

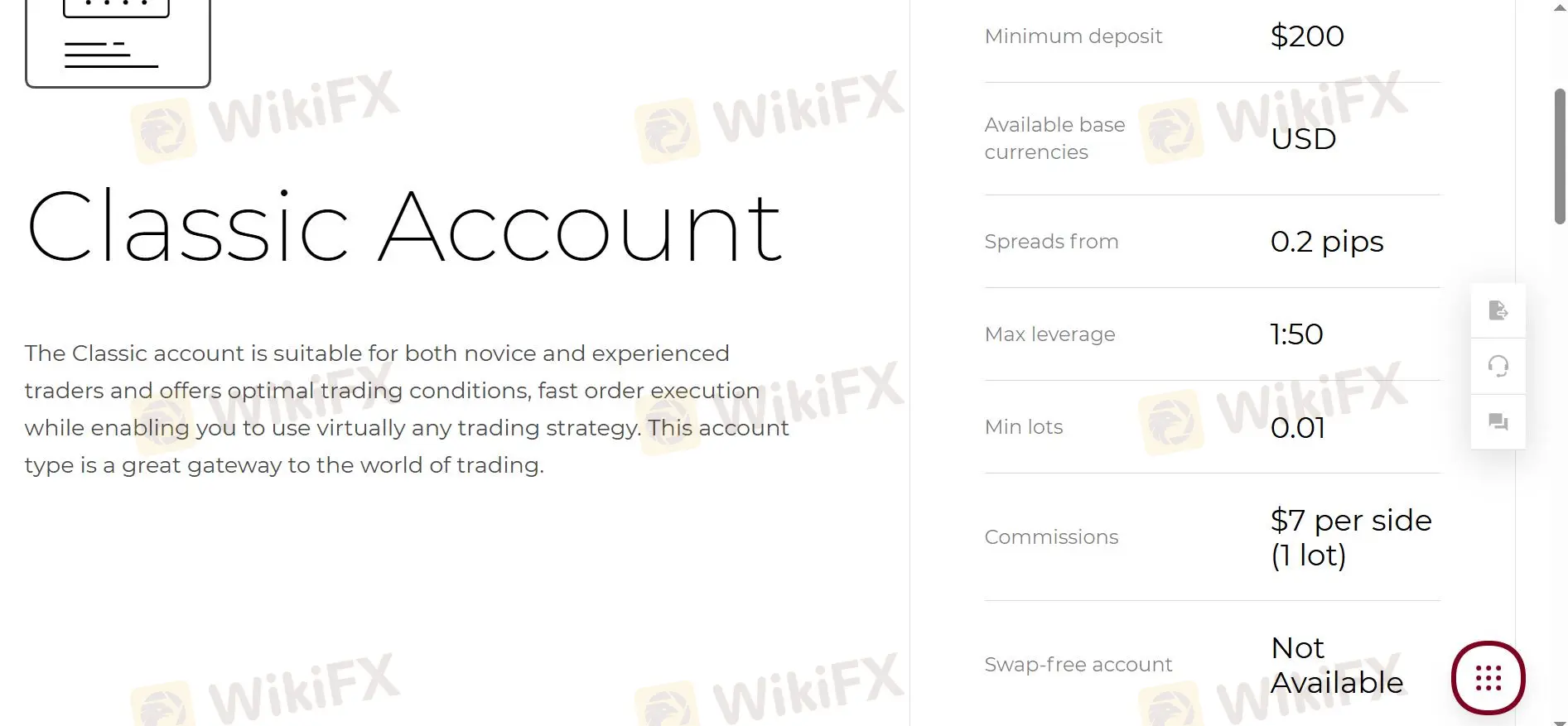

Classic Account:

- Minimum Deposit: $200

- Commission: $7+ per side (1 lot)

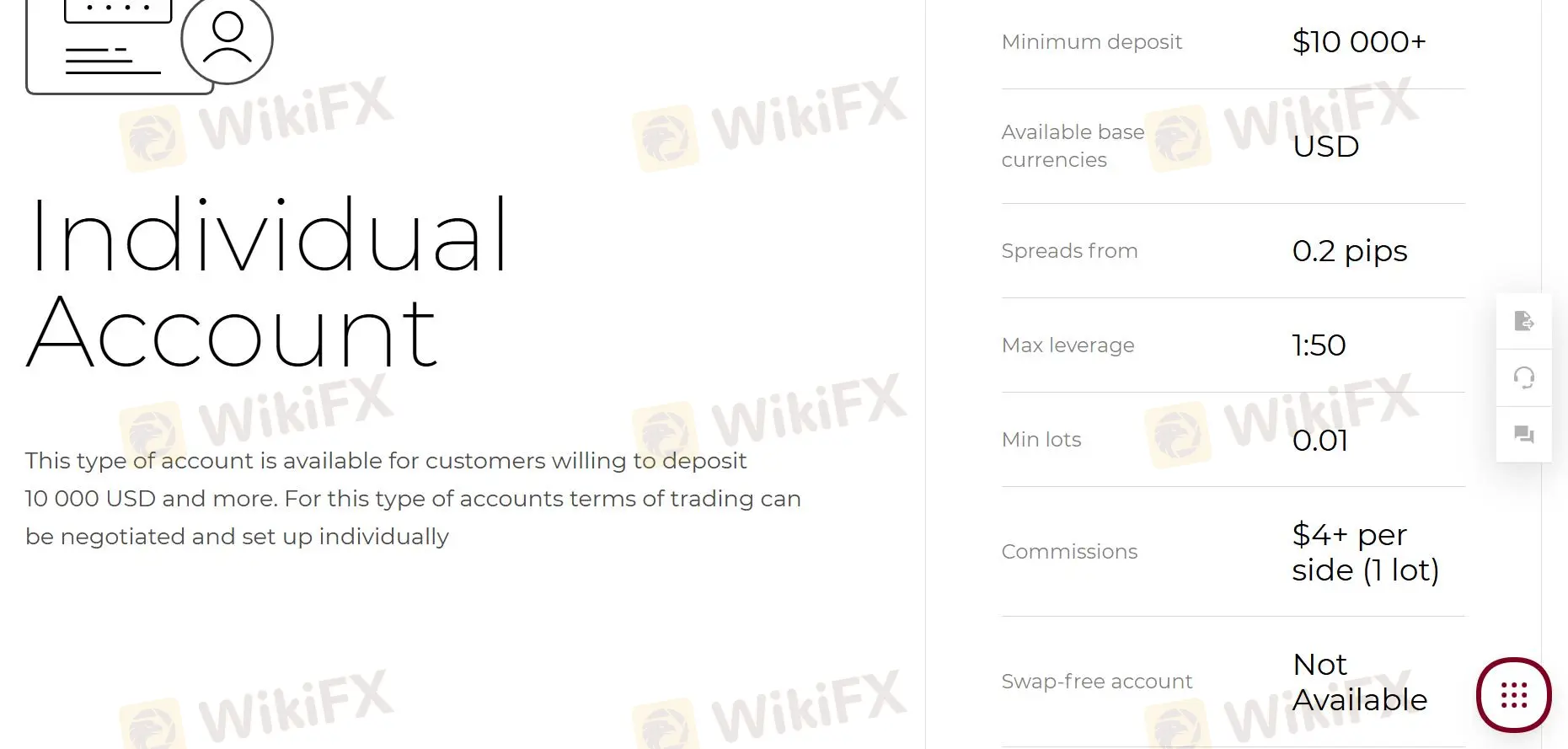

Individual Account:

- Minimum Deposit: $10,000

- Commission: $4+ per side (1 lot)

Both accounts have the same minimum spreads ($200), leverage options (1:50), and swap fees. The classic account is great for newcomers, while the individual account is designed for more experienced investors, providing a more personalized experience and potentially lower commissions.

| Account Types | Classic Account | Individual Account |

| Minimum Deposit | $200 | $10,000 |

| Spread from | 0.2 pips | 0.2 pips |

| Leverage | 1:50 | 1:50 |

| Min lots | 0.01 | 0.01 |

| Commissions | $7+ per side (1 lot) | $4+ per side (1 lot) |

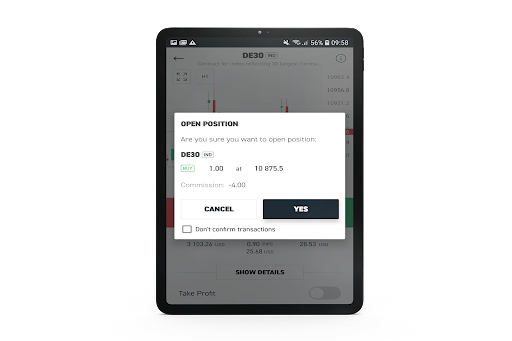

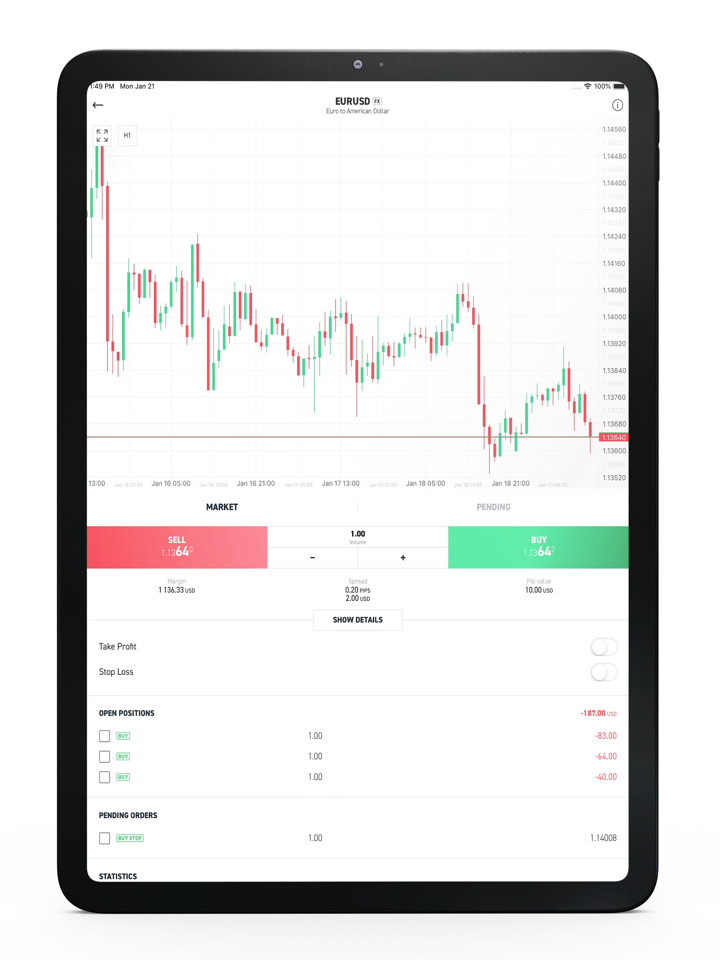

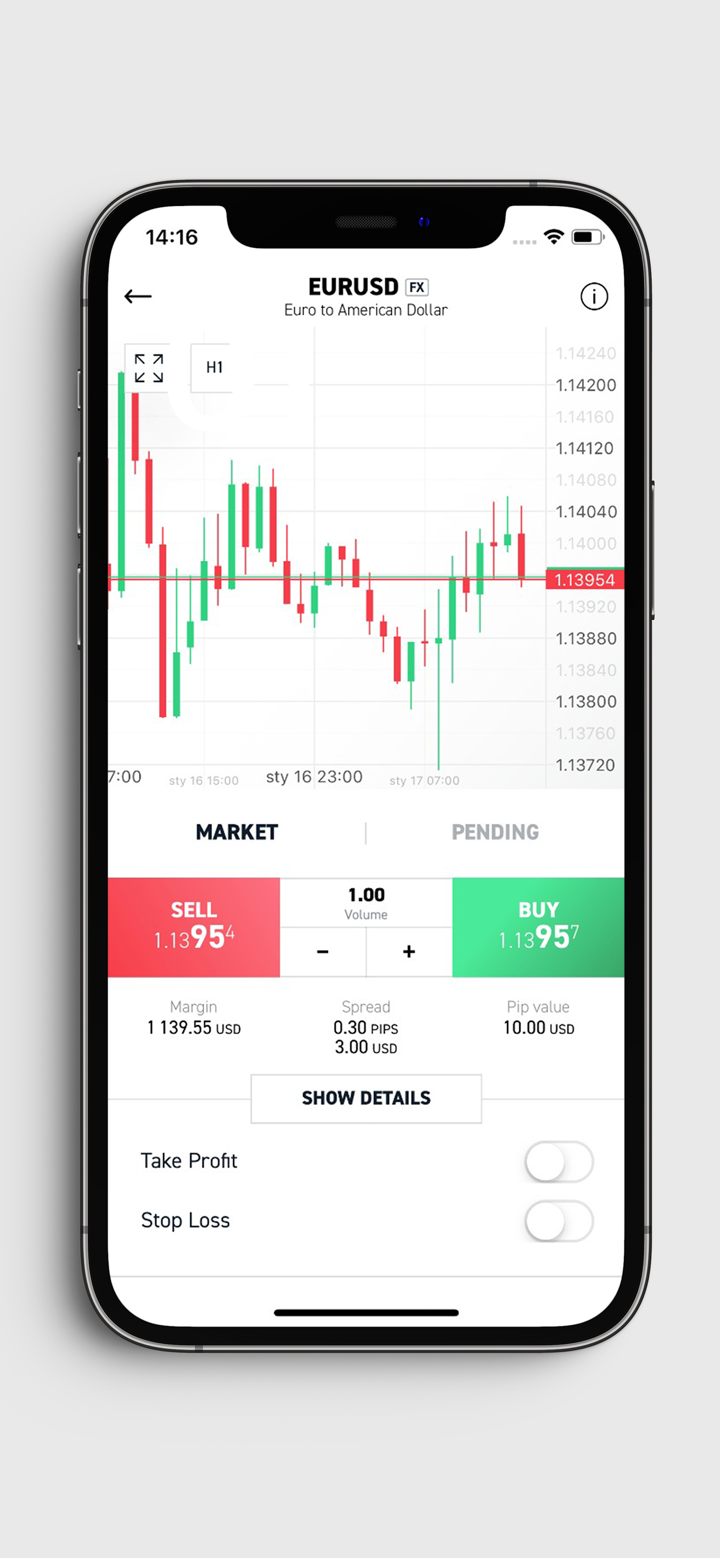

PASHA Fees

At PASHA Capital, the fees for both account types include spreads, commissions, and swap fees. The minimum spread starts at 0.2 pips.

For commissions:

- Classic Account: $7 per trade

- Individual Account: $1 per trade

Both accounts also have swap fees, as outlined in the account details.

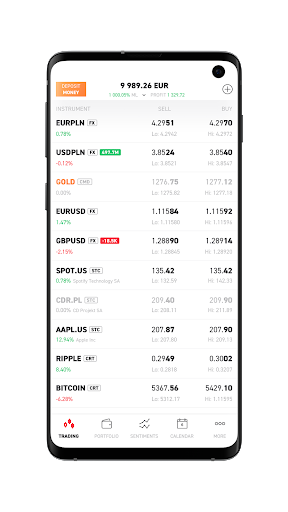

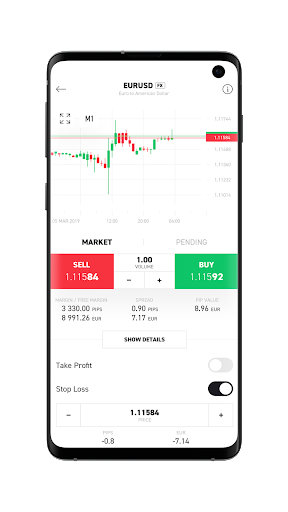

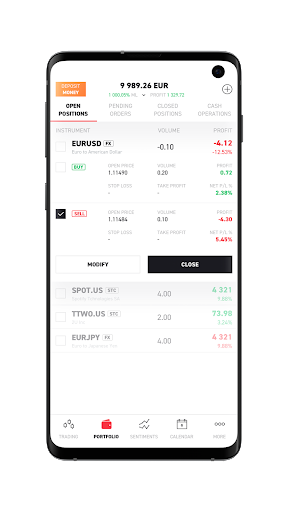

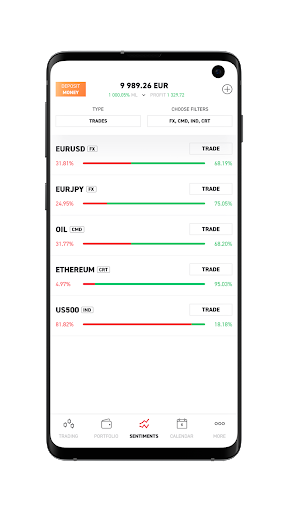

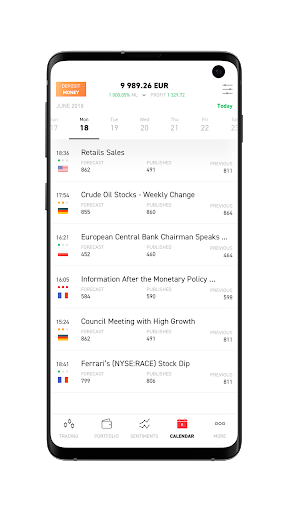

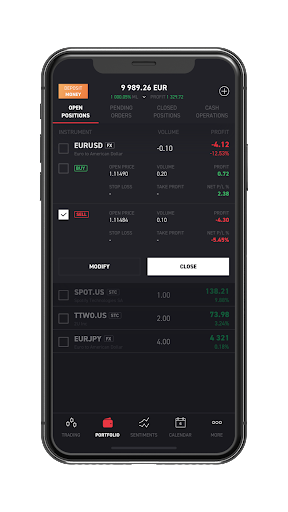

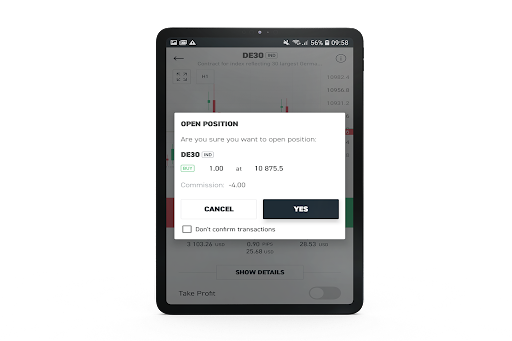

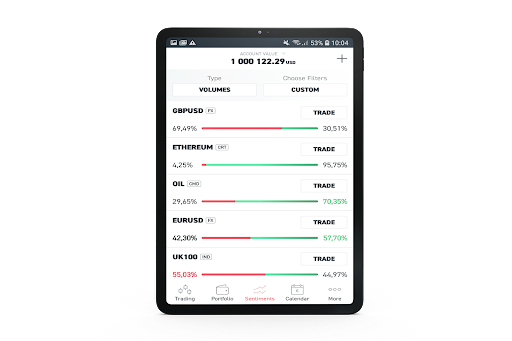

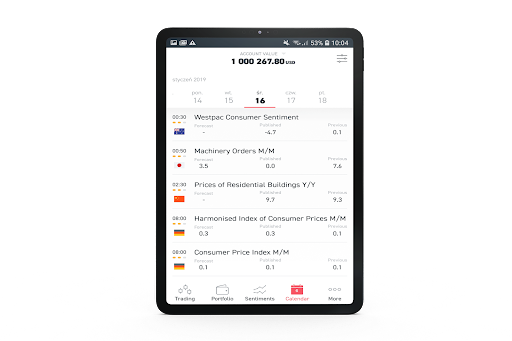

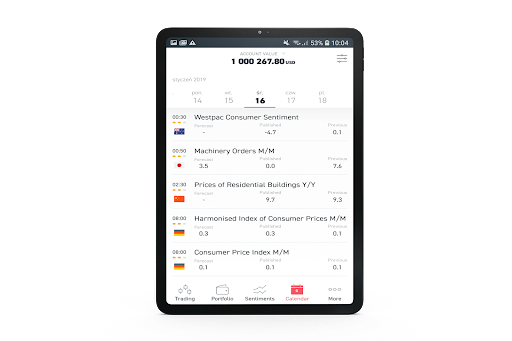

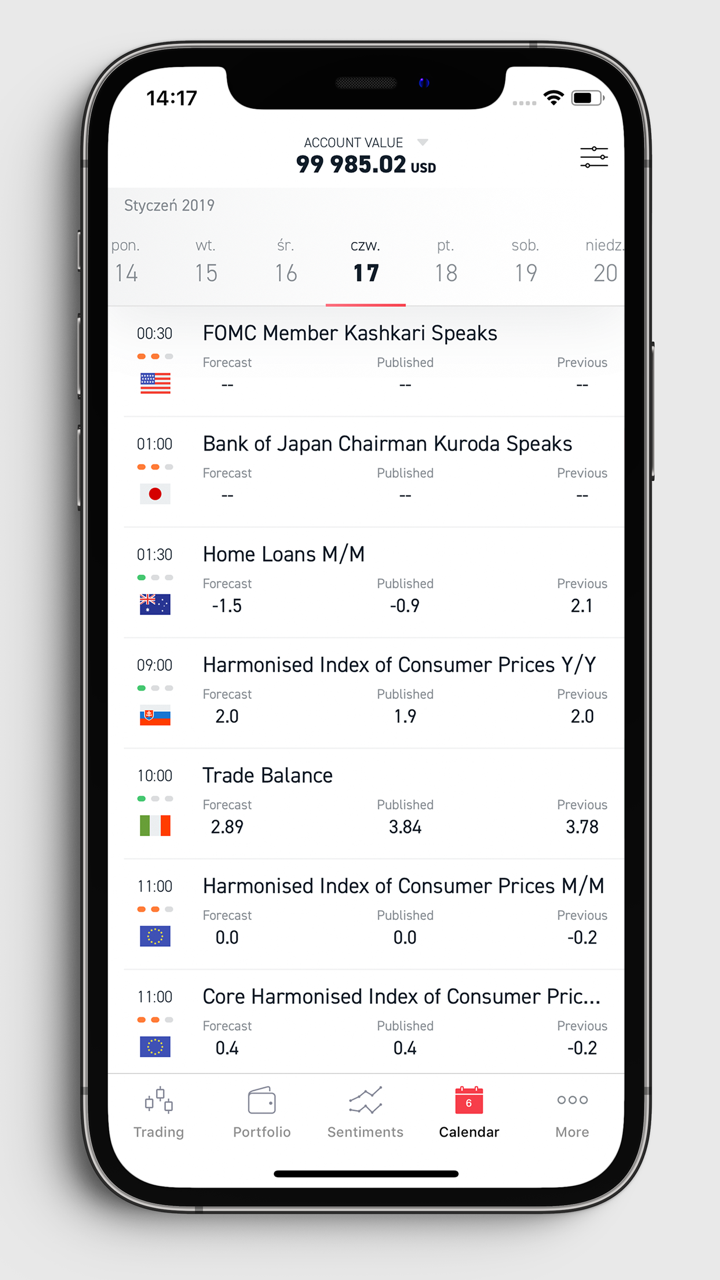

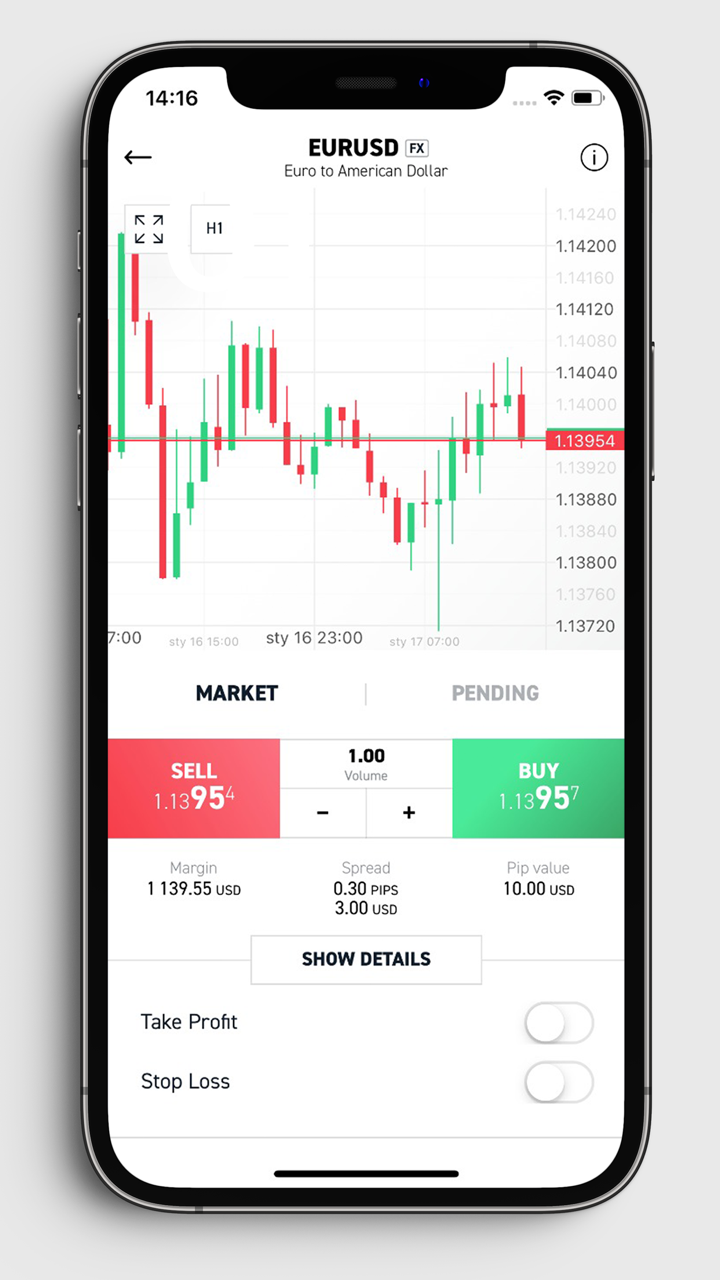

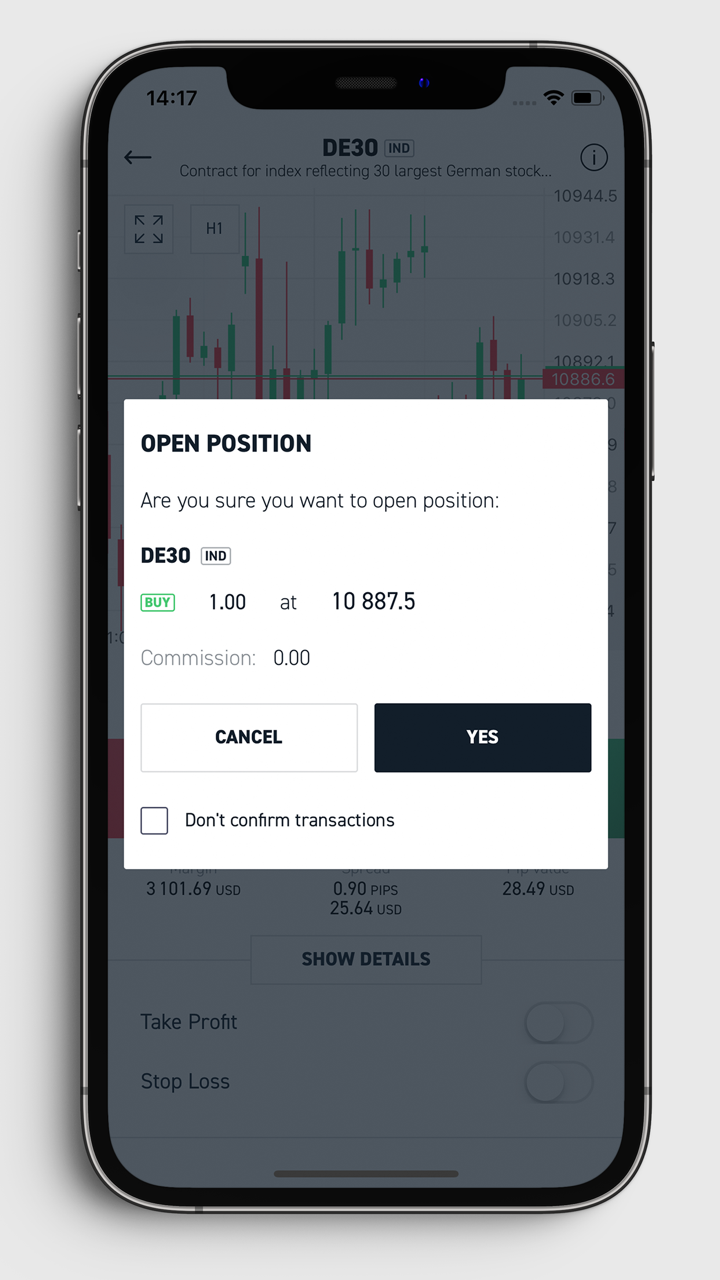

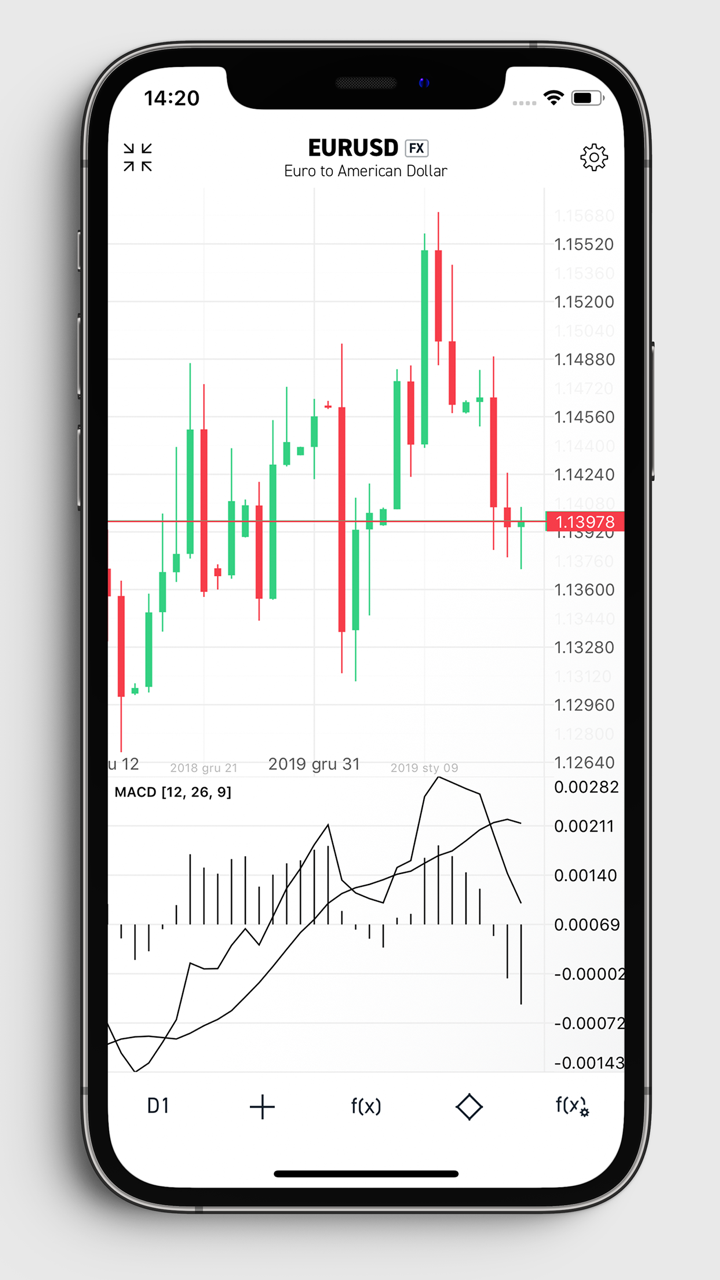

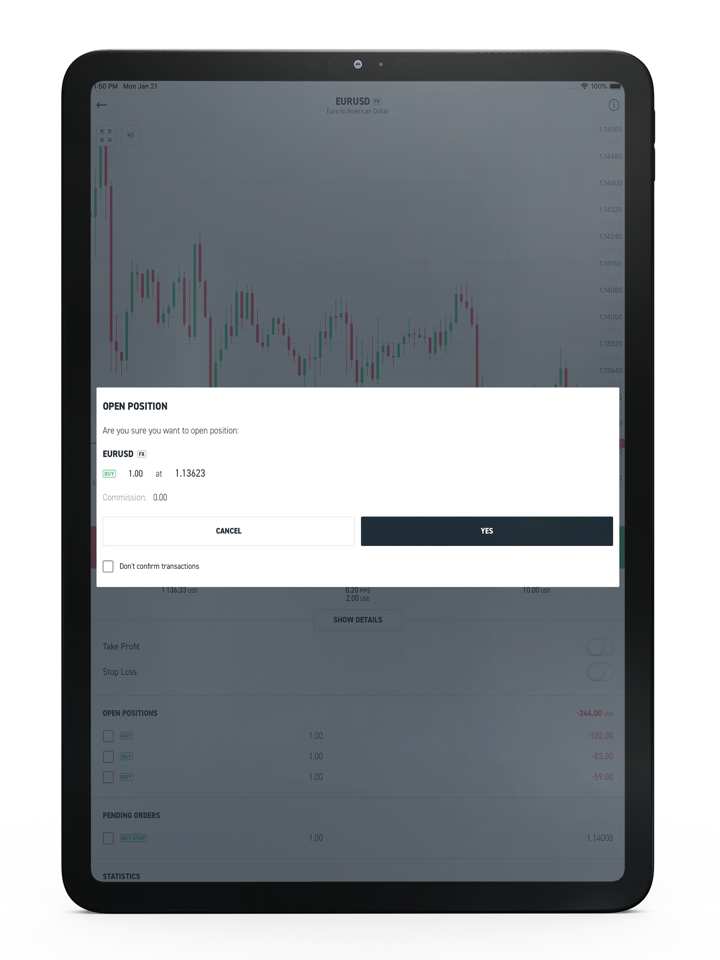

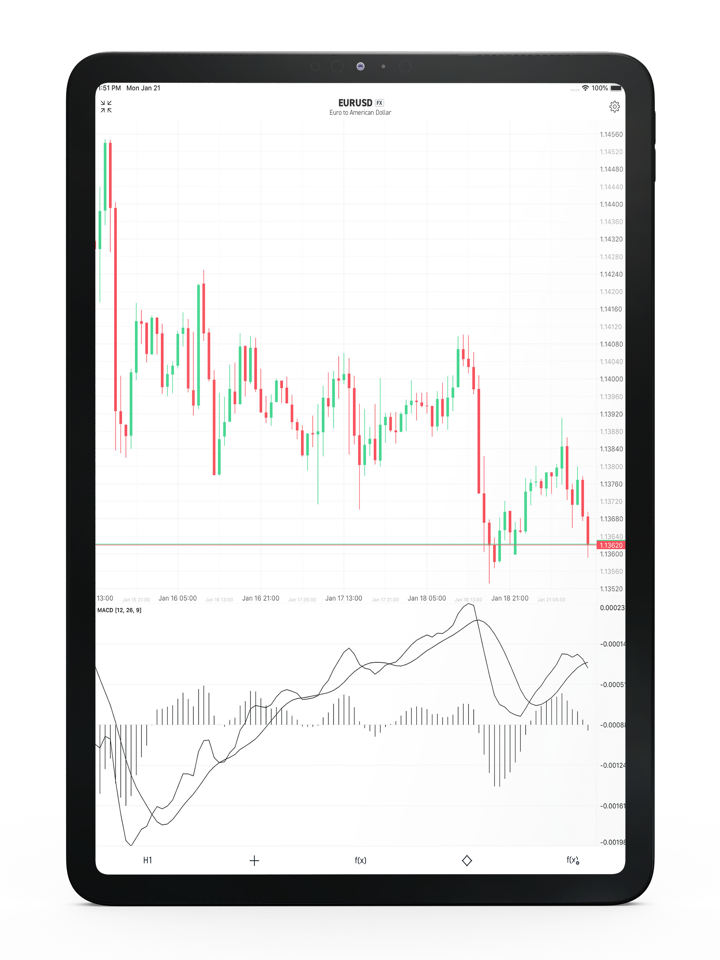

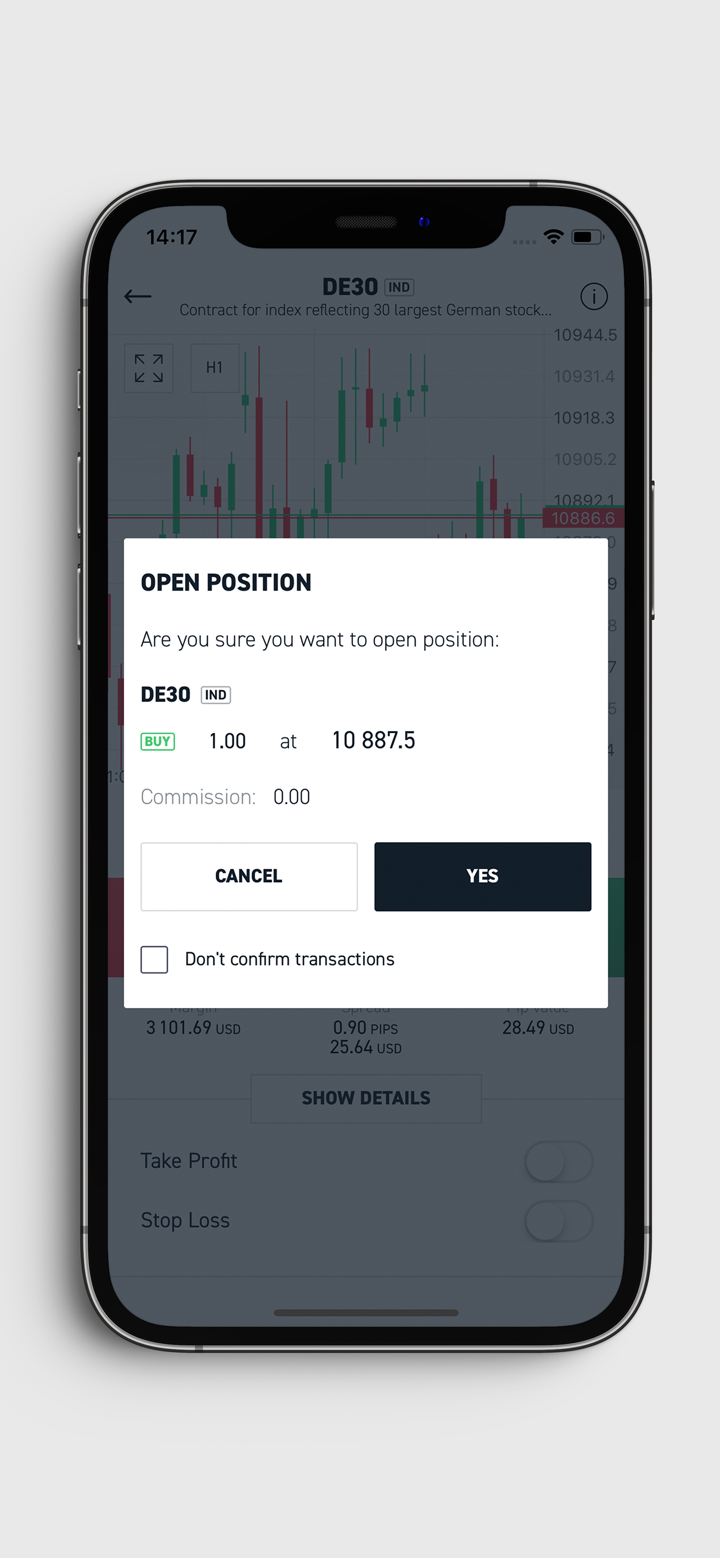

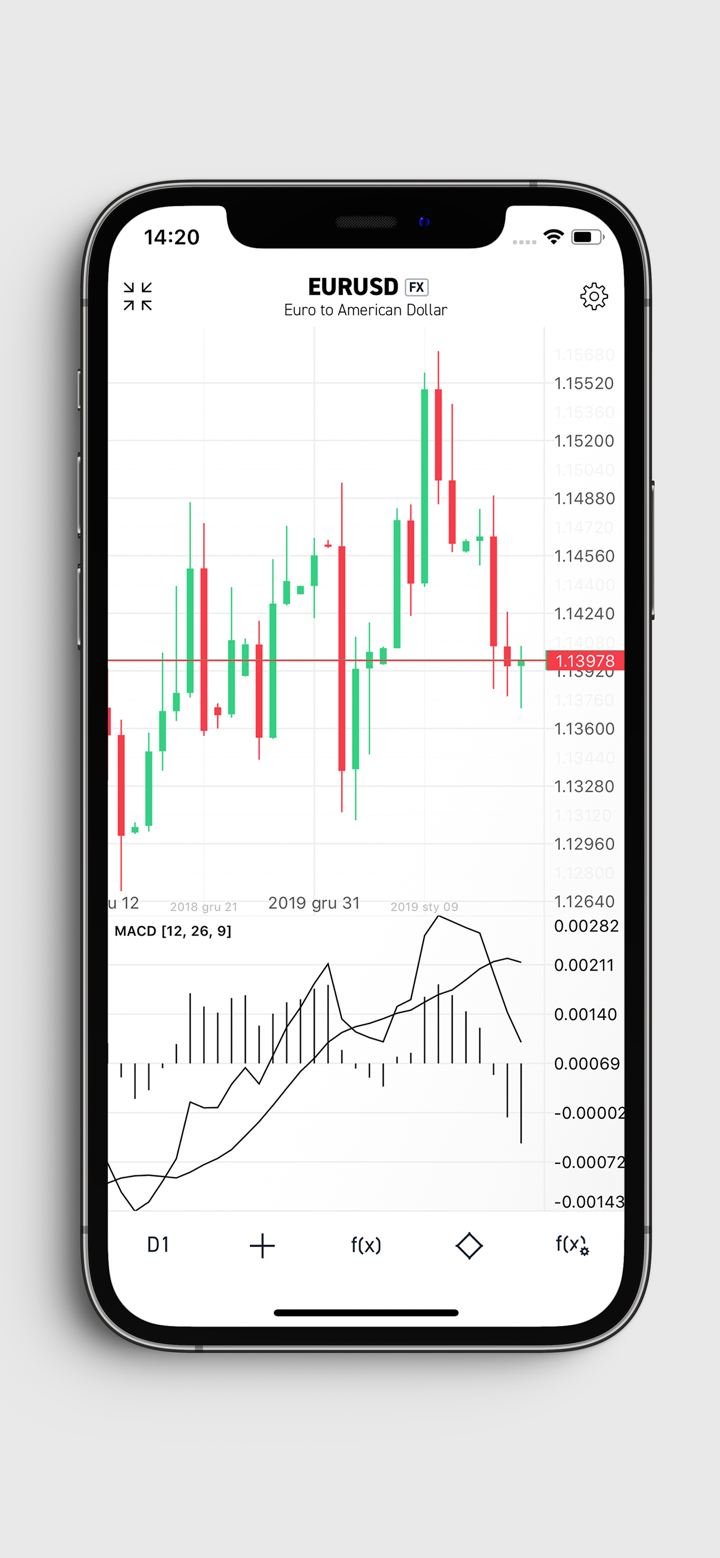

Trading Platform

PASHA's trading platform is PASHA Capital Trading Platform, which supports traders on the web and desktop.