Información básica

Reino Unido

Reino Unido

Calificación

Reino Unido

|

De 2 a 5 años

|

Reino Unido

|

De 2 a 5 años

| https://tradenow.pro

Sitio web

Índice de calificación

influencia

D

índice de influencia NO.1

India 2.48

India 2.48 Licencias

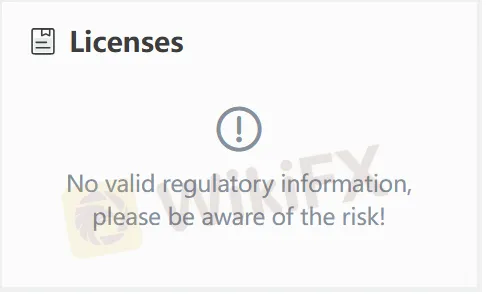

LicenciasNo información reguladora válida, ¡preste atención a los riesgos!

Reino Unido

Reino Unido tradenow.pro

tradenow.pro Singapur

Singapur

| TradeNow Resumen de la reseña | |

| Establecido | 2023 |

| País/Región Registrada | Reino Unido |

| Regulación | Sin regulación |

| Instrumentos de Mercado | Acciones, Materias primas, Índices, Criptomonedas, CFD |

| Cuenta Demo | ✅ |

| Apalancamiento | / |

| Spread | / |

| Plataforma de Trading | TradeNow |

| Depósito Mínimo | 0 |

| Soporte al Cliente | Soporte 24/7, correo electrónico: info@tradenow.pro |

TradeNow es un corredor de divisas recién fundado registrado en el Reino Unido. Los instrumentos negociables incluyen acciones, materias primas, índices, criptomonedas y CFD. No hay requisito de depósito mínimo. TradeNow es arriesgado debido a su estado no regulado.

| Pros | Contras |

| Varios instrumentos negociables | Sin regulación |

| Soporte al cliente 24/7 | MT4/MT5 no disponibles |

| Cuentas demo disponibles | Tiempo de establecimiento corto |

| Depósito y retiro gratuitos | Solo soporte por correo electrónico |

TradeNow no está regulado, lo que lo hace menos seguro que los corredores regulados. ¡Por favor, tenga en cuenta el riesgo!

TradeNow ofrece una amplia gama de instrumentos de mercado, incluyendo acciones, materias primas, índices, criptomonedas y CFD.

| Instrumentos Negociables | Soportados |

| Índice | ✔ |

| Materia prima | ✔ |

| Acciones | ✔ |

| Criptomoneda | ✔ |

| CFD | ✔ |

| ETF | ❌ |

| Bono | ❌ |

| Opción | ❌ |

| Fondo Mutuo | ❌ |

TradeNow proporciona una plataforma de trading propia disponible en iOS y Android para operar, en lugar de la autoritaria MT4/MT5 con herramientas de análisis maduras y sistemas inteligentes de EA.

| Plataforma de Trading | Soportada | Dispositivos Disponibles | Adecuada para |

| TradeNow | ✔ | iOS, Android | / |

| MT4 | ❌ | / | Principiantes |

| MT5 | ❌ | / | Traders experimentados |

TradeNow no cobra ninguna tarifa por depósitos y retiros. Sin embargo, los métodos de pago, el tiempo de procesamiento y las tarifas asociadas son desconocidos.

Yes, the biggest drawback for me is the unregulated status of TradeNow. Trading with an unregulated broker opens up various risks, including the possibility of withdrawal delays, lack of customer support, and potential fraud. I’ve learned over the years that a regulated broker provides a layer of protection that I cannot afford to overlook. Without this protection, I would be hesitant to deposit significant funds into my account. Another downside is that TradeNow doesn’t support the popular and reliable MT4 or MT5 platforms, which I personally rely on for technical analysis and automated trading strategies. I’ve found that these platforms are essential for serious traders, and their absence makes the platform less appealing. Finally, TradeNow is a relatively new broker, and as someone who values stability, I prefer working with more established brokers that have a proven track record. For me, these cons are significant enough to make me hesitant about using TradeNow for long-term trading.

Based on the information I’ve found, TradeNow does not charge commissions for deposits or withdrawals, which is a benefit for traders looking to minimize their costs. However, the lack of transparency regarding other fees, such as spreads, commissions, or additional transaction charges, is something that makes me cautious. In my experience, even if there are no commissions, other hidden fees can significantly affect my overall profitability. I always prefer brokers who disclose all fees clearly so I can make informed decisions about my trades. The absence of detailed fee information on TradeNow’s website means I would need to reach out to customer support for further clarification. If I were to trade with TradeNow, I would definitely confirm any hidden fees before depositing any funds. A TradeNow review may provide more details, but I would still advise caution.

The biggest advantage of TradeNow, from my point of view, is the accessibility it provides to new traders. There is no minimum deposit required, which is great for beginners who want to start trading without committing large amounts of capital. The ability to start small is something I appreciate when I am testing out a new broker. Additionally, TradeNow offers a variety of tradable instruments, such as stocks, commodities, indices, and cryptocurrencies, which gives traders the opportunity to diversify their portfolios. I also value the availability of a demo account, which is essential for learning and practicing before risking real money. However, despite these advantages, the lack of regulation is a major con for me. In my experience, it’s always better to trade with a regulated broker that has a proven track record of fair practices. Even though the platform offers a user-friendly interface and 24/7 customer support, I would be wary about the lack of external oversight. For anyone considering a TradeNow login, I would strongly recommend researching thoroughly before proceeding.

From my perspective, the lack of regulation makes TradeNow less safe compared to other brokers that are properly regulated. When I’m looking for a broker to trade with, safety is my top priority. I need to know that my funds are protected and that the broker is accountable to financial authorities. While TradeNow offers a wide range of assets like stocks, commodities, and cryptocurrencies, which are certainly attractive, the absence of regulation makes me question its legitimacy. In my experience, unregulated brokers tend to have more issues with withdrawals, transparency, and customer support. When I trade with a broker, I need to feel confident that I am not at risk of losing my money due to negligence or unfair practices. I’ve learned from experience that a regulated broker offers essential protections and resources in case anything goes wrong. Given TradeNow's unregulated status, I would be cautious about trusting it with my funds. A TradeNow review would likely highlight the positive aspects, but I would still emphasize the importance of security and regulation when considering a broker.

Ingrese...

TOP

TOP

Chrome

Extensión de Chrome

Consulta regulatoria de bróker de Forex global

Navegue por los sitios web de los brokers de divisas e identifique con precisión los brokers legítimos y los fraudulentos.

Instalar ahora