公司簡介

| MARUSAN 評論摘要 | |

| 成立年份 | 1996 |

| 註冊國家/地區 | 日本 |

| 監管 | FSA |

| 市場工具 | 投資信託、股票和債券 |

| 模擬帳戶 | ❌ |

| 槓桿 | / |

| 點差 | 因不同貨幣而異 |

| 交易平台 | / |

| 最低存款 | / |

| 客戶支援 | 電話:0120-03-1319(9:00~17:00 / 週六、週日、假期除外) |

| 電郵:toiawase03@marusan-sec.co.jp | |

| 地址:東京都千代田區麴町三丁目3番6 | |

MARUSAN成立於1996年,總部設於日本,是一家由金融廳(FSA)監管的金融服務公司。客戶可以交易各種交易工具,如投資信託、股票和債券。該公司提供一般帳戶和特定帳戶。

優點和缺點

| 優點 | 缺點 |

| 受FSA監管 | 帳戶資訊有限 |

| 多元化客戶支援渠道 | 交易費用資訊有限 |

| 產品範圍廣泛 | 無模擬帳戶 |

| 交易平台資訊不足 |

MARUSAN 是否合法?

是的,目前MARUSAN受FSA監管,持有零售外匯牌照。

| 監管國家 | 監管機構 | 監管實體 | 當前狀態 | 牌照類型 | 牌照號碼 |

| MARUSAN株式会社 | 受監管 | 零售外匯牌照 | 関東財務局長(金商)第167号 |

我可以在MARUSAN上交易什麼?

MARUSAN 為交易者提供投資信託、股票和債券。

| 可交易工具 | 支援 |

| 股票 | ✔ |

| 債券 | ✔ |

| 投資信託 | ✔ |

| 外匯 | ❌ |

| 大宗商品 | ❌ |

| 指數 | ❌ |

| 加密貨幣 | ❌ |

| 期權 | ❌ |

| 交易所交易基金 | ❌ |

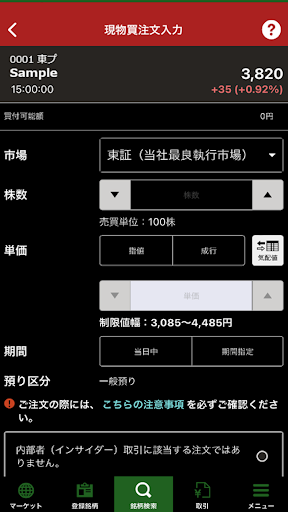

帳戶類型

MARUSAN 提供一般帳戶和特定帳戶。

一般帳戶作為管理和管理購買股票和投資信託資金的綜合平台。 存入此帳戶的資金將在貨幣儲備基金(MRF)內管理,該基金主要由短期債券和評級高的公共債券組成。

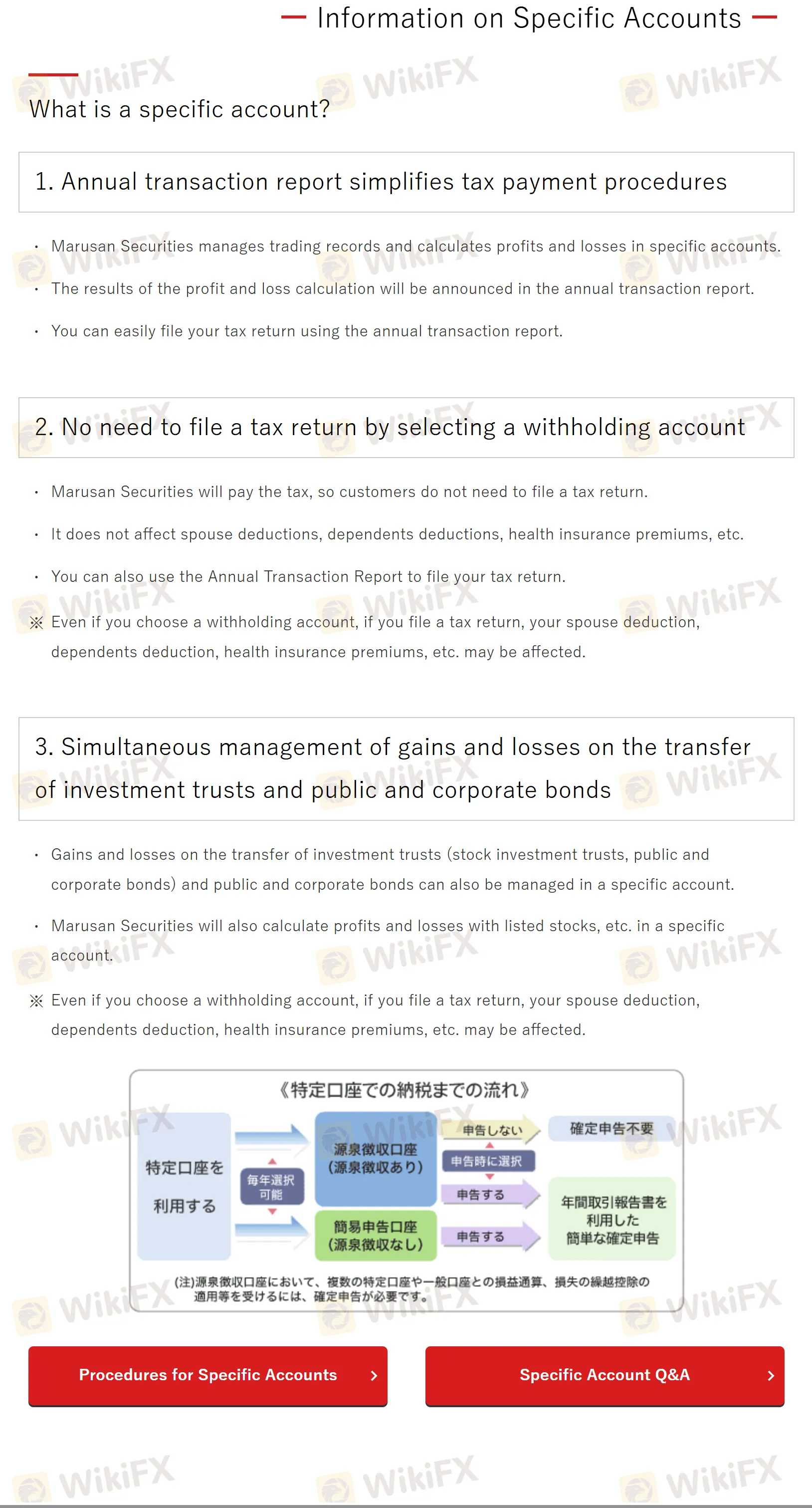

特定帳戶提供額外功能,以滿足特定用戶需求,例如簡化的稅務程序和年度交易報告。

費用

| 貨幣 | 點差 |

| 美元 | 不足100,000美元50分,100,000美元或以上25分 |

| 歐元 | 75分 |

| 加拿大元 | 80分 |

| 英鎊 | ¥1 |

| 澳大利亞元 | ¥1 |

| 紐西蘭元 | ¥1 |

| 墨西哥披索 | 10分 |

| 港元 | 15分 |

有關費用的其他詳細信息,請參閱公司的官方網站:https://www.marusan-sec.co.jp/torihiki/fee/。