Basic Information

Japan

JapanScore

Japan

|

15-20 years

|

Japan

|

15-20 years

| https://www.marusan-sec.co.jp/english/

Website

Rating Index

Capital Ratio

Great

Capital

Influence

B

Influence index NO.1

Japan 8.03

Japan 8.03Capital Ratio

Great

Capital

Influence

B

Influence index NO.1

Japan 8.03

Japan 8.03 Licenses

LicensesLicensed Entity:丸三証券株式会社

License No. 関東財務局長(金商)第167号

Single Core

1G

40G

1M*ADSL

Japan

Japan

| MARUSAN Review Summary | |

| Founded | 1996 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Market Instruments | Investment trusts, stocks, and bonds |

| Demo Account | ❌ |

| Leverage | / |

| Spread | Varies with different currencies |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Phone: 0120-03-1319 (hours 9:00~17:00 / Except Saturdays, Sundays, holidays) |

| Email: toiawase03@marusan-sec.co.jp | |

| Address: 東京都千代田区麹町三丁目3番6 | |

MARUSAN, established in 1996 and based in Japan, is a financial services company regulated by the Financial Services Agency (FSA). Clients can trade various trading instruments such as investment trusts, stocks, and bonds. The firm offers a General Account a Specific Account.

| Pros | Cons |

| Regulated by FSA | Limited info on accounts |

| Diverse customer support channels | Limited info on trading fees |

| A wide range of products | No demo accounts |

| Lack of info on trading platforms |

Yes, at present, MARUSAN is regulated by FSA, holding a retail forex license.

| Regulated Country | Regulated Authority | Regulated Entity | Current Status | License Type | License Number |

| The Financial Services Agency (FSA) | 丸三証券株式会社 | Regulated | Retail Forex License | 関東財務局長(金商)第167号 |

MARUSAN provides traders with investment trusts, stocks, and bonds.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Bonds | ✔ |

| Investment Trusts | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

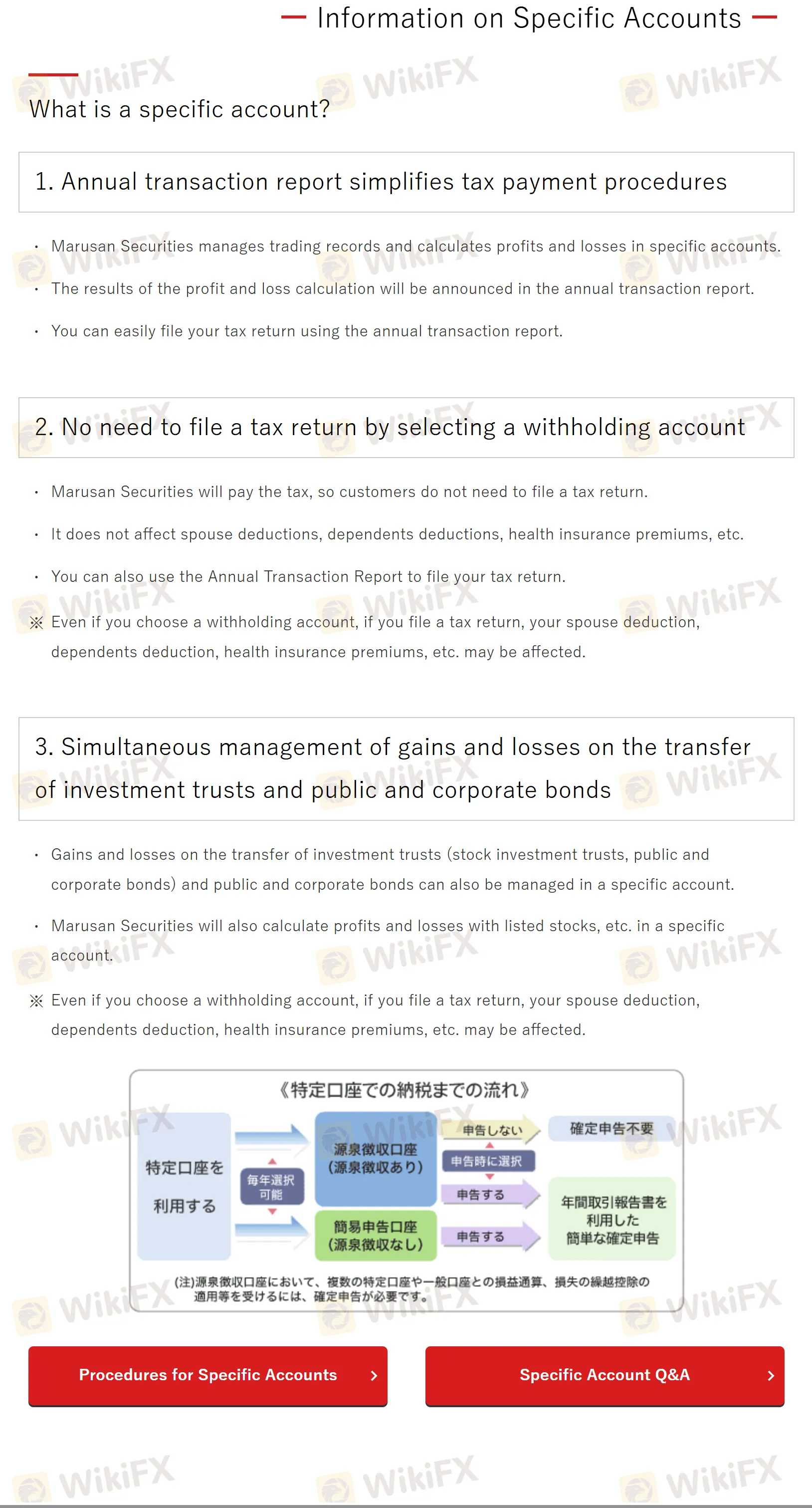

MARUSAN offers the General Account and the Specific account.

The General Account serves as a comprehensive platform for managing and administering funds allocated for purchasing stocks and investment trusts. Funds deposited into this account are managed within the Money Reserve Fund (MRF), which primarily consists of short-term bonds and highly rated public bonds.

The Specific account offers additional features tailored to meet specific user needs, such as simplified tax procedures with an annual transaction report.

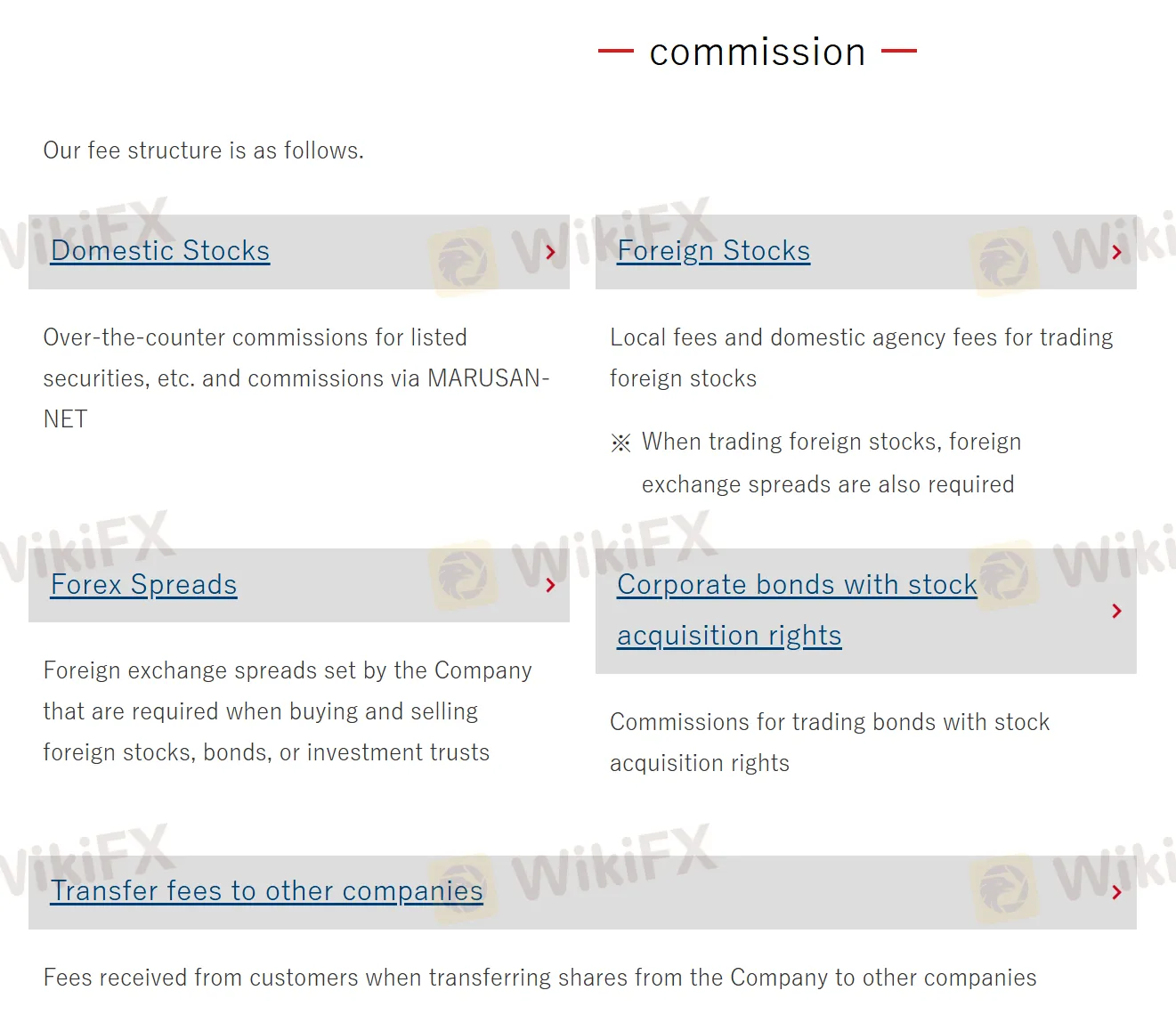

| Currency | Spread |

| US dollar | Less than 100,000 US dollars 50 sen, 100,000 US dollars or more 25 sen |

| Euro | 75 sen |

| Canadian dollar | 80 sen |

| British Pound Sterling | ¥1 |

| Australian Dollar | ¥1 |

| New Zealand dollar | ¥1 |

| Mexican Peso | 10 sen |

| Hong Kong Dollar | 15 sen |

For other detailed infomation about fees, you can refer to the company's official website: https://www.marusan-sec.co.jp/torihiki/fee/.

Yes, MARUSAN is a legitimate broker, as it holds a retail forex license from the FSA. This indicates that the broker has met the necessary standards set by the regulatory body to offer financial services in Japan. From my experience, having an FSA license ensures a high level of credibility and safety. However, since MARUSAN specializes more in asset management than active retail trading, I would suggest assessing if their offerings meet your specific trading or investment needs before making a commitment.

MARUSAN offers two main account types: the General Account and the Specific Account. The General Account is used for managing funds allocated for buying stocks and investment trusts, while the Specific Account offers additional features like simplified tax reporting. However, MARUSAN does not provide a demo account, which could be a disadvantage for traders who want to test the platform before making a commitment. I recommend contacting MARUSAN to clarify any further account options or details.

MARUSAN has a varied fee structure depending on the type of transaction. For example, equity securities like stocks and ETFs are subject to a commission based on the transaction amount. The commission rate decreases with larger transactions, which is a typical practice in the industry. For foreign currency transactions, the spread varies depending on the currency being traded. In my opinion, while the fees are standard for the industry, the tiered system can be quite complex, so I would recommend reviewing the fee details thoroughly before proceeding with any trades.

MARUSAN’s FSA regulation ensures that the firm operates within a legal and compliant framework, which enhances its safety for investors. The regulatory body’s role is to ensure financial transparency, safeguard investors, and maintain market stability. From my point of view, MARUSAN’s safety is reinforced by the FSA oversight, though potential clients should understand the specific trading and investment services offered by the firm. Ensuring their offerings meet your needs is crucial.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now