Shoofar

1-2年

Which trading platforms are offered by Topstep? Do they support MT4, MT5, or cTrader?

From my experience with Topstep, I’ve found their platform offering to be both extensive and distinctly tailored for futures traders. Topstep supports a variety of advanced trading platforms, catering to different trader profiles—from beginners to professionals. The array includes TopstepX, NinjaTrader, Quantower, Tradovate, TradingView, T4, R|Trader Pro, ATAS Order Flow, MotiveWave, VolFix, Bookmap, Investor/RT, Jigsaw Daytradr, MultiCharts, Sierra Chart, and Trade Navigator. These platforms are recognized in the futures trading space for their sophisticated analytics, order execution, and charting tools.

However, it’s important to clarify that Topstep does not support MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader. That’s a significant consideration, especially for those coming from the forex or CFD world where MT4 and MT5 are industry standards. The absence of these platforms underscores Topstep’s focus on listed futures contracts rather than spot forex, and their emphasis on professional-grade, futures-oriented platforms. For me, the variety available was useful, but I had to adapt to interfaces that were different from the more common MT4/MT5 environment. This aspect might require a learning curve for traders used to MetaTrader or cTrader, and in my view, it’s a factor to weigh carefully before committing to their ecosystem.

Broker Issues

Platform

Account

Leverage

Instruments

Moshiheya

1-2年

What are the main risks or downsides to keep in mind when using Topstep?

From my perspective as an independent trader, the primary risk I see with Topstep is that it operates without any recognized regulatory oversight. Despite its long presence in the market and U.S. registration, Topstep does not hold licenses from major authorities like the NFA, ASIC, or FCA. For me, this lack of regulation immediately raises questions about recourse if something goes wrong, ranging from disputes over payouts to platform malfunctions or changes in terms. In my career, I’ve found regulatory protections to be crucial for trader confidence, especially when actual funds are at stake.

Another concern is Topstep’s proprietary model; rather than traditional live accounts, traders must pass a simulated evaluation. While this can be beneficial for some, it means that the pathway to accessing funded capital is tightly controlled and subject to the firm's shifting rules and evaluation criteria. There’s always a risk the company could adjust requirements or fees in ways that disadvantage traders.

Transparency is also cited as lacking. I’m always cautious when I can’t independently verify how my data, results, or even the rules of engagement are managed—especially if I have no regulatory agency to appeal to for clarity.

In short, the absence of regulation, limited transparency, and the proprietary nature of Topstep’s evaluation structure are the most significant downsides in my view. For traders considering Topstep, it’s vital to proceed conservatively, understand all program terms in detail, and never risk funds you can’t afford to lose.

sinopi

1-2年

Can you outline the particular benefits that Topstep offers in terms of its available trading instruments and the way its fees are structured?

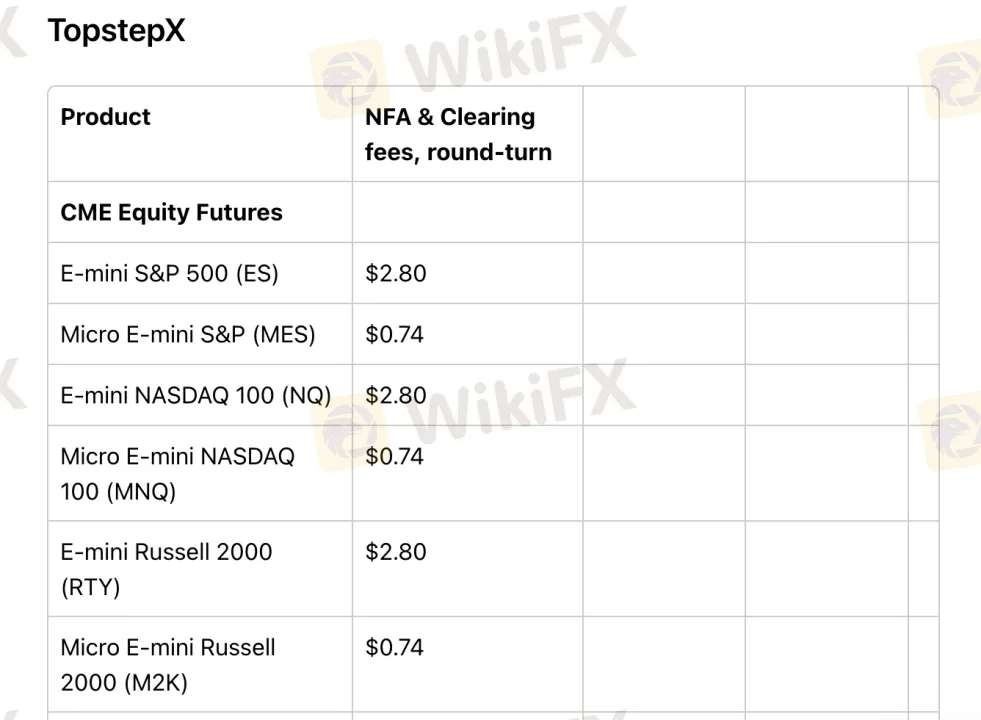

From my own perspective as an independent trader who prioritizes risk management and transparency, Topstep offers a mixed set of benefits and limitations when it comes to trading instruments and fees. The broker focuses exclusively on futures contracts; currently, it supports CME equity futures, forex futures, agricultural futures, energy futures, metals, and interest rate futures. I find this range is reasonably comprehensive for futures traders but may feel restrictive for those accustomed to spot forex, stocks, options, or crypto trading—none of which are available here.

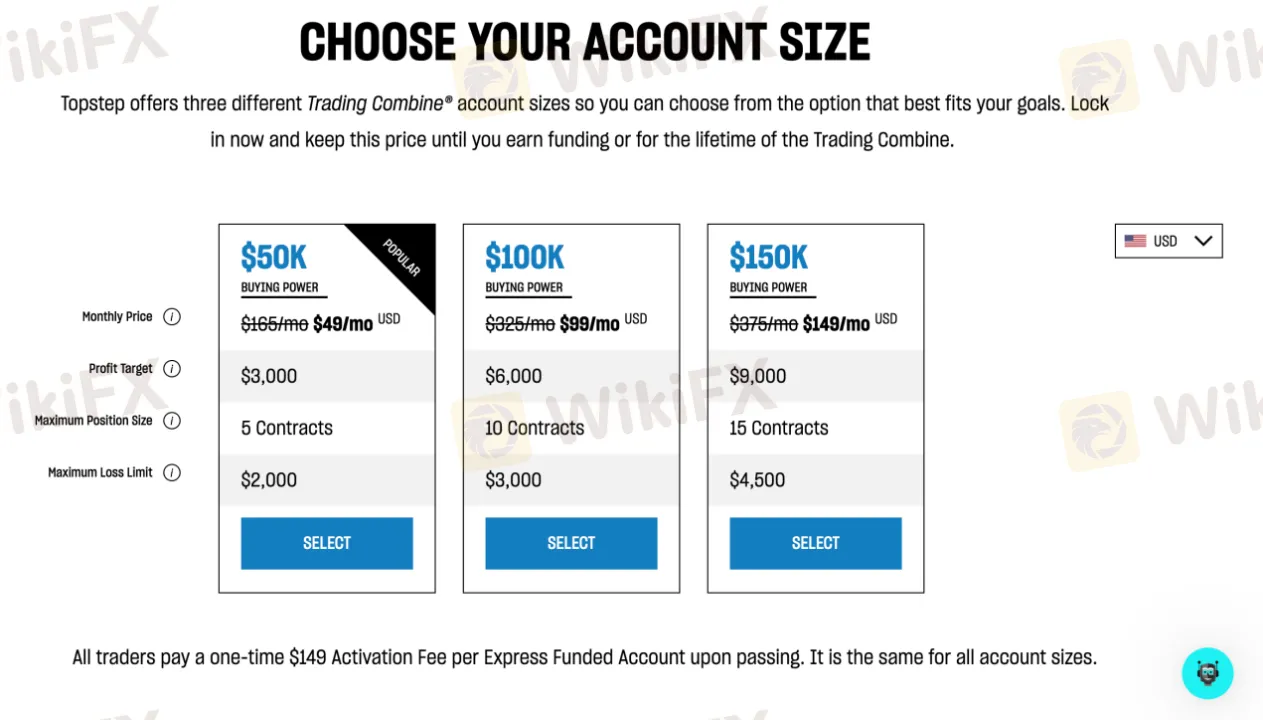

In terms of fee structure, one feature I do appreciate is the clear breakdown of transaction costs for popular futures products, such as the E-mini and Micro E-mini contracts. For someone like me, who is keenly aware of how quickly fees can erode profits in an active setting, the low to moderate round-turn fees—especially when using Topstep’s own platform—are competitive in the proprietary trading industry. Additionally, not having to worry about swap rates or overnight rollover fees is a plus, as swing trading isn’t permitted and all positions must be closed before the end of session. This clarity reduces hidden costs associated with holding trades overnight.

However, I remain cautious due to the absence of regulatory oversight and limited transparency in some of their policies. For traders pursuing opportunities in listed futures markets—especially those comfortable with daily trading discipline—Topstep’s focused offering and fee model may fit, but careful due diligence remains essential.

Chris hagerman

1-2年

Does Topstep provide a complimentary demo account, and if so, are there any restrictions such as a time limit?

As someone who's traded across a variety of platforms, I pay close attention to whether brokers and prop firms offer realistic demo experiences. In Topstep's case, they do provide access to a demo account, but not in the traditional sense most brokers do. Their core offering is the "Trading Combine," which is a simulated trading environment designed specifically to evaluate your trading performance. This demo-like account isn't a free practice tool; rather, it's a paid evaluation you must pass to potentially access firm capital.

There’s no explicit mention of a traditional, unrestricted demo account available for complimentary, indefinite use. The Trading Combine itself, for all intents and purposes, is limited by the fee structure and by specific rules and objectives that must be met, which makes it quite different from an open-ended demo. Topstep’s evaluation periods are not endless—they’re structured and results-driven, and your access to the simulated account ends when either you pass, fail, or exhaust your paid evaluation period.

In my view, this means that while a form of demo trading is provided, it comes with significant restrictions and should not be interpreted as a free, unlimited practice account for casual experimentation. For me, the lack of a standard, non-expiring demo account is something to keep in mind if your priority is risk-free practice rather than aiming for a funded account through their challenge.

Broker Issues

Account

Platform

Leverage

Instruments