基礎資訊

捷克

捷克

天眼評分

捷克

|

5-10年

|

捷克

|

5-10年

| https://www.patria-direct.cz/en

官方網址

評分指數

影響力

D

影響力指數 NO.1

捷克 2.45

捷克 2.45 監管資訊

監管資訊暫未查證到有效監管資訊,請注意風險!

捷克

捷克 patria-direct.cz

patria-direct.cz 捷克

捷克

| Patria Finance 評論摘要 | |

| 成立年份 | 1996 |

| 註冊國家/地區 | 捷克共和國 |

| 監管 | 無監管 |

| 市場工具 | 股票、基金、ETF、大宗商品、衍生品、債券 |

| 模擬帳戶 | ✅ |

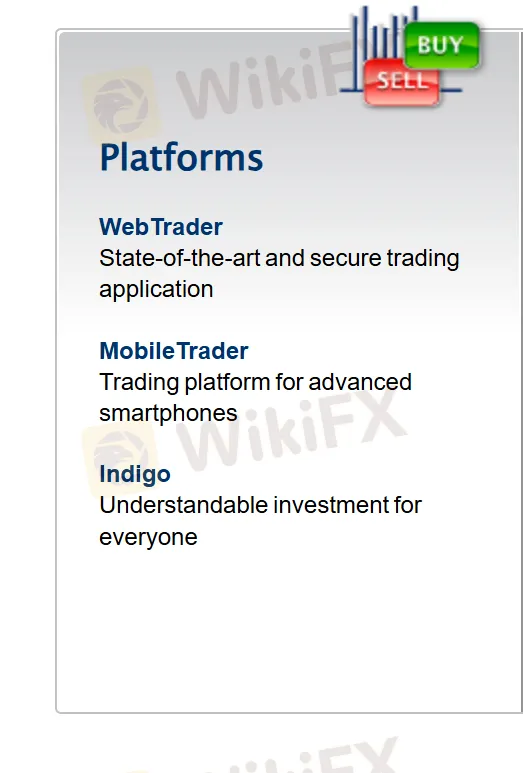

| 交易平台 | WebTrader、MobileTrader、Indigo |

| 最低存款 | / |

| 客戶支援 | 聯絡表格 |

| 電話:(+420) 221 424 240 | |

| 電郵:patria@patria.cz | |

| 地址:Výmolova 353/3, 150 27 Prague 5 | |

Patria Finance 是一家於1996年在捷克共和國成立的無監管金融公司。該公司提供各種市場工具,包括股票、基金、ETF、大宗商品、衍生品和債券。該公司提供模擬帳戶,並支援透過WebTrader、MobileTrader和Indigo平台進行交易。

| 優點 | 缺點 |

| 提供模擬帳戶 | 無監管 |

| 多元化的交易產品 | 帳戶資訊有限 |

| 多樣化的交易平台 | |

| 多元化的客戶支援渠道 |

目前,Patria Finance 缺乏有效監管。該域名似乎於1996年註冊,但目前狀態不明。如果選擇此經紀商,請特別注意您資金的安全。

在 Patria Finance 上,您可以交易股票、基金、ETF、大宗商品、衍生品和債券。

| 交易工具 | 支援 |

| 股票 | ✔ |

| 基金 | ✔ |

| ETF | ✔ |

| 大宗商品 | ✔ |

| 衍生品 | ✔ |

| 債券 | ✔ |

| 外匯 | ❌ |

| 指數 | ❌ |

| 加密貨幣 | ❌ |

| 期權 | ❌ |

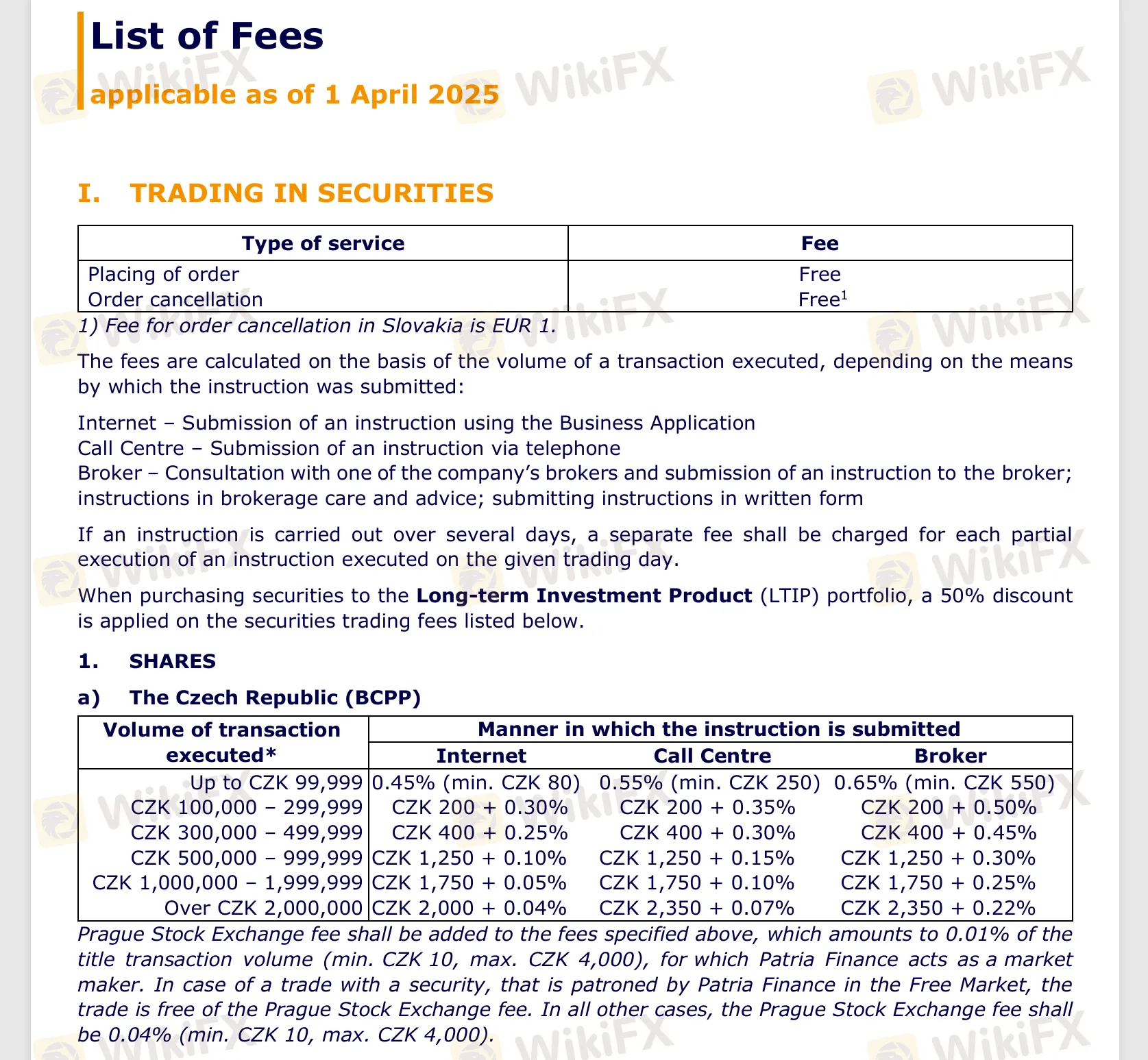

他們的網站上有一份 pdf 檔案(https://cdn.patria.cz/Sazebnik-PD.en.pdf),詳細描述了費用結構,您可以參考。

| 交易平台 | 支援 | 可用設備 |

| WebTrader, Indigo | ✔ | / |

| MobileTrader | ✔ | App Store, Google play |

As an independent trader who approaches every broker with a healthy skepticism, I always prioritize fee transparency and fund safety. When I examined Patria Finance, one of my key concerns was understanding all costs involved, especially regarding deposits and withdrawals. Unfortunately, I found that their fee structure isn't prominently displayed on their platform or main informational pages. They do reference a PDF on their website detailing fees, but the fact that this information requires extra effort to locate raises a red flag for me in terms of user transparency. In my experience, reputable brokers tend to present vital information—especially about fund movements—upfront and clearly. Moreover, Patria Finance operates without valid regulation, which adds another layer of caution. Without oversight, there’s no regulatory requirement for them to adhere to industry standards regarding fees or fair customer treatment, including for deposits and withdrawals. This uncertainty is why, in my own trading, I would be exceedingly careful. I would thoroughly examine the fee schedule document (the PDF referenced) myself before committing any funds, to ensure I am fully aware of any potential charges on deposits or withdrawals. If you, like me, prefer complete clarity and regulatory safeguard, relying solely on Patria Finance’s self-published documents may not provide the assurance you need.

From my research and experience in reviewing brokers, I always begin by examining the available instruments and verifying whether a platform is suitable for my own trading priorities. Looking at Patria Finance, I see that it offers exposure to a range of market instruments, including stocks, funds, ETFs, commodities, derivatives, and bonds. The commodities category often includes assets like gold and crude oil, but the broker does not provide a very detailed breakdown. Importantly, I could not find any explicit mention of leveraged trading in spot gold (such as XAU/USD) or direct crude oil contracts, which are standard offerings in more globally recognized forex or multi-asset brokers. Additionally, Patria Finance does not offer forex trading accounts, and it is quite clear from their disclosures that specific forex pairs, including XAU/USD, are not available. This is a significant point for me, as XAU/USD (gold quoted in US dollars) is typically a forex instrument and requires a broker to be explicitly set up for that market. If your goal is to trade gold or oil in the classic sense—such as XAU/USD or oil CFDs—you’re likely to be disappointed. Given the lack of valid regulation and the very limited transparency about their account types and precise instrument list, I personally would be very cautious. In my view, the broker may offer some indirect access to commodities via ETFs or derivatives, but not the specialized instruments that active traders usually seek, like XAU/USD or spot crude oil. For my own trading, this absence would be a deal-breaker. I recommend anyone considering Patria Finance clarify directly with them before funding an account, especially if gold or oil trading in the traditional CFD or forex forms is a priority.

In my experience as an independent trader, a clear understanding of broker fees is essential for evaluating trading costs and managing risk effectively. When I investigated Patria Finance, I found their fee structure relatively opaque. While they provide a public PDF with detailed charges on their website, I was unable to locate a straightforward summary directly on their main site, which made comparison challenging and required considerably more due diligence from my end. Based on the available information, Patria Finance does not offer forex trading, so there are no spreads or swaps typical of forex brokers. Instead, their focus is on a range of instruments—stocks, funds, ETFs, commodities, derivatives, and bonds. Usually, trading such instruments involves commissions per transaction, platform fees, and possibly custodial fees or charges for account maintenance, but the specifics for each asset class need to be individually verified in their published document. My main concern stems from their lack of regulatory oversight, which I find especially significant when considering costs. Without regulation, transparency isn't guaranteed; fee changes may occur without notice, and dispute resolution is more precarious. This lack of clear and accessible fee breakdowns on the main interface makes it harder for traders like myself to conduct an upfront cost-benefit analysis. In conclusion, anyone considering Patria Finance should exercise caution, scrutinize their fee PDF thoroughly, and be aware of the inherent risks of trading with an unregulated entity where hidden or unexpected charges could impact profitability. For me, this level of uncertainty does not align with my risk management standards.

Speaking as an active trader who assesses brokers with a conservative lens, I need to clarify that Patria Finance does not, in fact, offer forex trading—including EUR/USD—based on my review of their publicly available information and trading product lists. My due diligence, which is something I believe every trader should practice, revealed that their focus is instead on stocks, funds, ETFs, commodities, derivatives, and bonds, with no direct support for currency pairs or major forex markets. Additionally, it is important to underscore that Patria Finance currently operates without any valid regulatory oversight and has been flagged for a suspicious regulatory license—this is highly significant for anyone concerned about the security and transparency of their trading environment. The lack of regulation inherently increases risk, and I would not consider trading any products, especially highly leveraged instruments like forex, through an unregulated and high-risk broker. For anyone specifically interested in trading EUR/USD or other forex pairs, my experience leads me to recommend seeking brokers that are both well regulated and transparent about their typical spreads, trading conditions, and client fund protection measures. Prudence and safety should always come first.

請輸入...