公司簡介

| 國富期貨 評論摘要 | |

| 成立年份 | 1992 |

| 註冊國家/地區 | 中國 |

| 監管機構 | CFFEX |

| 產品與服務 | 農產品、金屬、能源、化學品、股指期貨、國債期貨、原油、商品期貨經紀、金融期貨經紀、期貨投資諮詢和資產管理業務 |

| 模擬帳戶 | ❌ |

| 交易平台 | 期貨交易軟件(桌面和手機) |

| 最低存款 | / |

| 客戶支援 | 微信 |

| 電話:021-80210555 | |

| 傳真:021-80210500 | |

| 地址:中國(上海)自由貿易試驗區金康路308號6樓01、02和04室 | |

Guo Fu Futures成立於1992年,註冊於中國,是一家受中國金融期貨交易所(CFFEX)監管的期貨經紀公司。它提供廣泛的產品和服務,如農產品、金屬、能源、化學品、股指期貨、國債期貨、原油、商品期貨經紀、金融期貨經紀、期貨投資諮詢和資產管理業務。此外,它提供期貨交易軟件。

優點和缺點

| 優點 | 缺點 |

| 受CFFEX監管 | 有關帳戶類型的信息有限 |

| 多元化的客戶支援渠道 | 有關交易費用的信息有限 |

| 廣泛的產品和服務 | 沒有模擬帳戶 |

| 長時間運作 |

國富期貨 是否合法?

是的,國富期貨目前受中國金融期貨交易所有限公司(CFFEX)監管,持有期貨牌照。

| 監管國家 | 監管機構 | 監管實體 | 當前狀態 | 牌照類型 | 牌照號碼 |

| 中國金融期貨交易所有限公司(CFFEX) | 國富期貨有限公司 | 受監管 | 期貨牌照 | 0315 |

我可以在國富期貨上交易什麼?

在 國富期貨,您可以交易農產品、金屬、能源、化學品、股指期貨、國債期貨、原油、商品期貨經紀、金融期貨經紀、期貨投資諮詢和資產管理業務。

| 可交易工具 | 支援 |

| 商品 | ✔ |

| 期貨 | ✔ |

| 外匯 | ❌ |

| 指數 | ❌ |

| 加密貨幣 | ❌ |

| 期權 | ❌ |

| ETFs | ❌ |

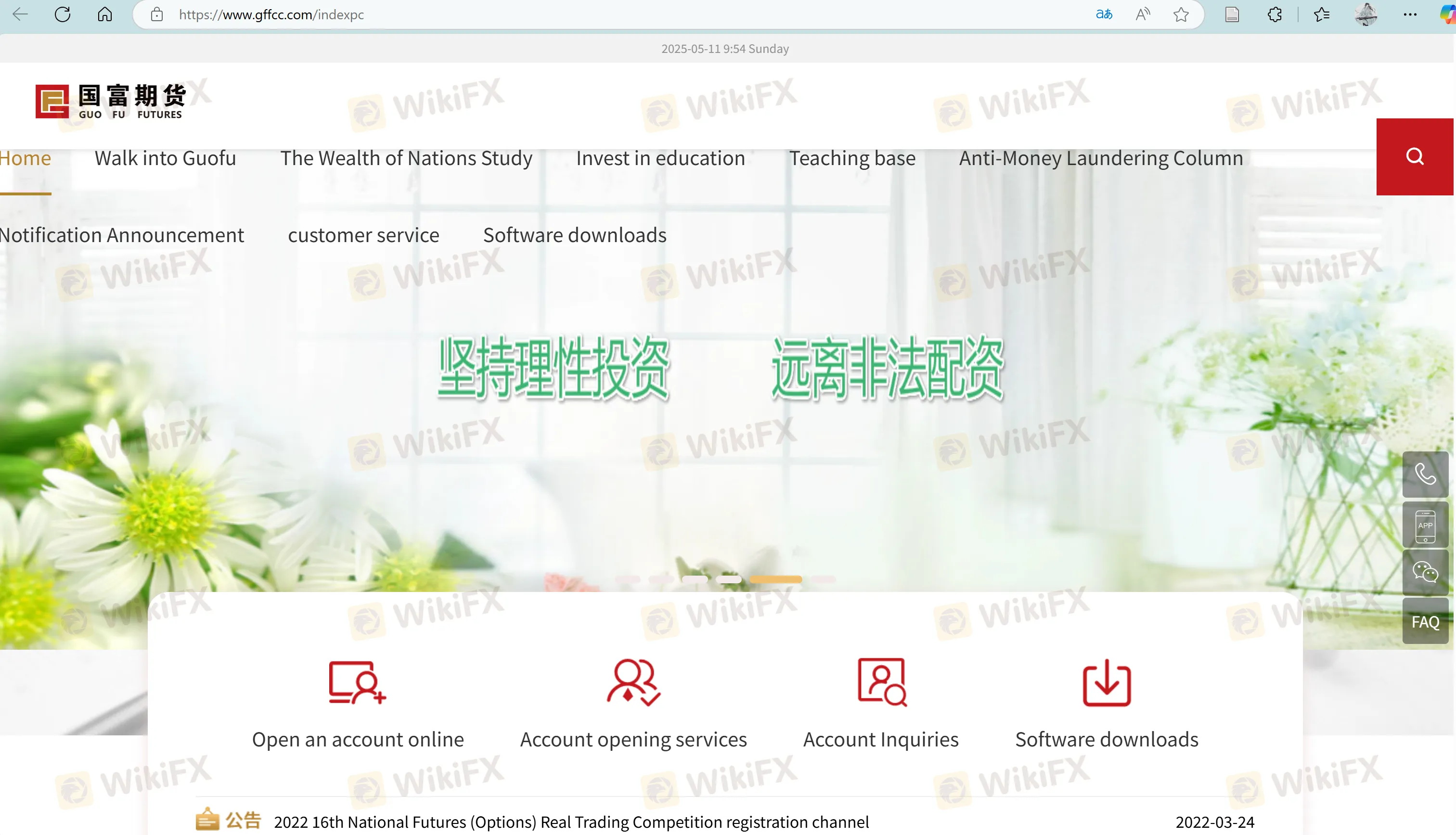

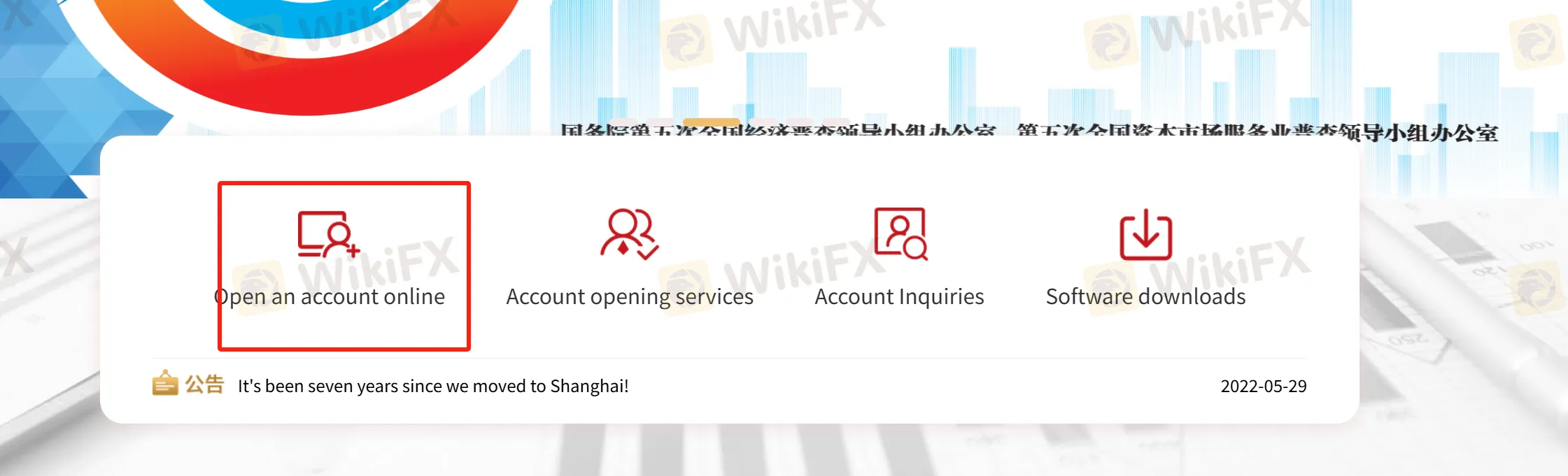

如何在 國富期貨 開立帳戶?

- 點擊「線上開戶」開始帳戶創建流程。

- 在提供的頁面上填寫個人資料。

- 成功創建帳戶後,即可開始交易。

- 請注意系統在交易日的8:40~17:45開放。

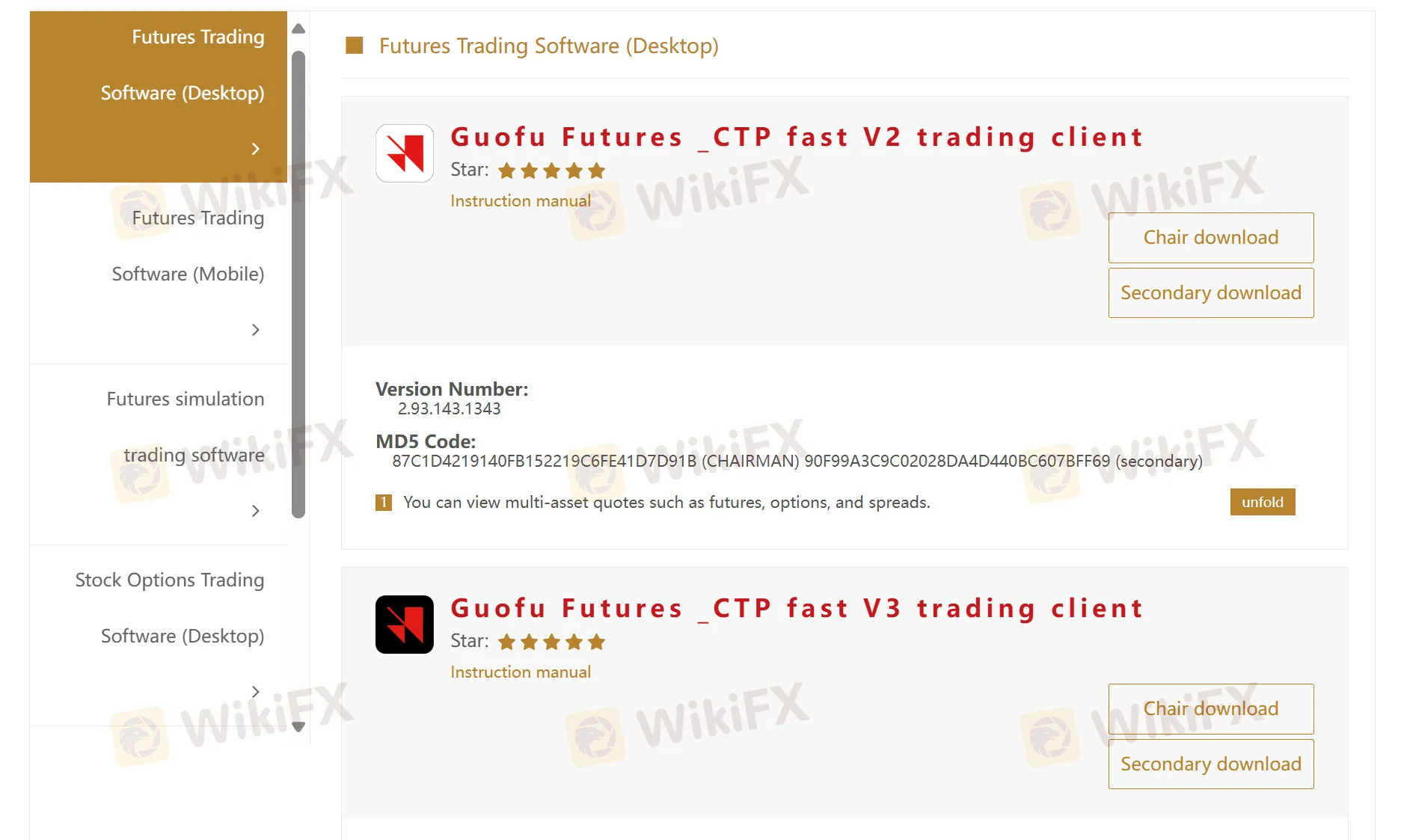

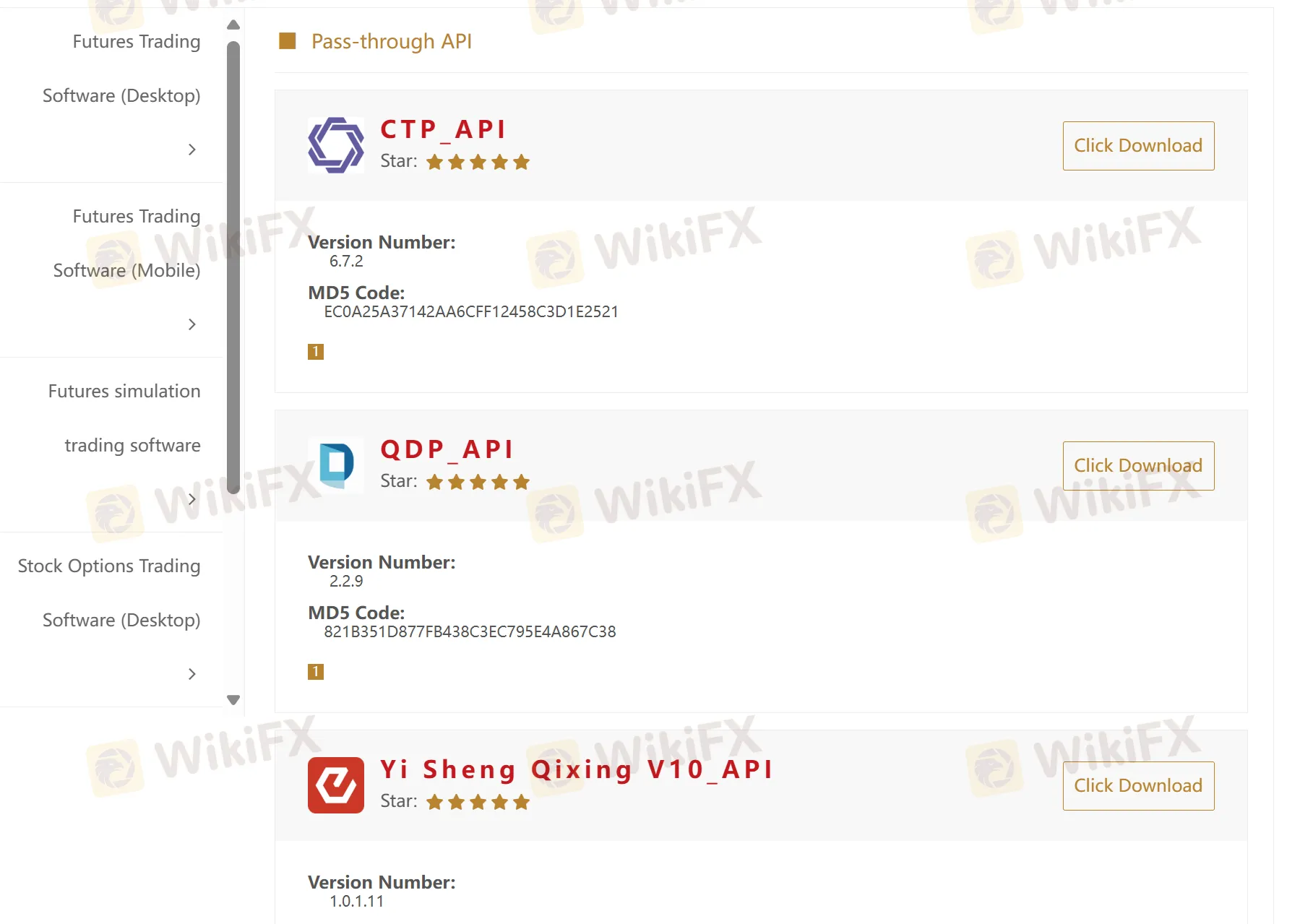

交易平台

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| 期貨交易軟件 | ✔ | 桌面、手機 | / |

| 通過 API | ✔ | 桌面 | / |

| MT4 | ❌ | / | 初學者 |

| MT5 | ❌ | / | 經驗豐富的交易者 |