公司簡介

| StoneX 檢討摘要 | |

| 成立年份 | 2003 |

| 註冊國家/地區 | 美國 |

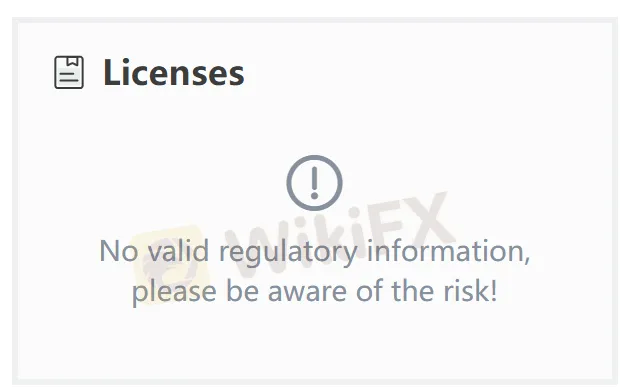

| 監管 | 無監管 |

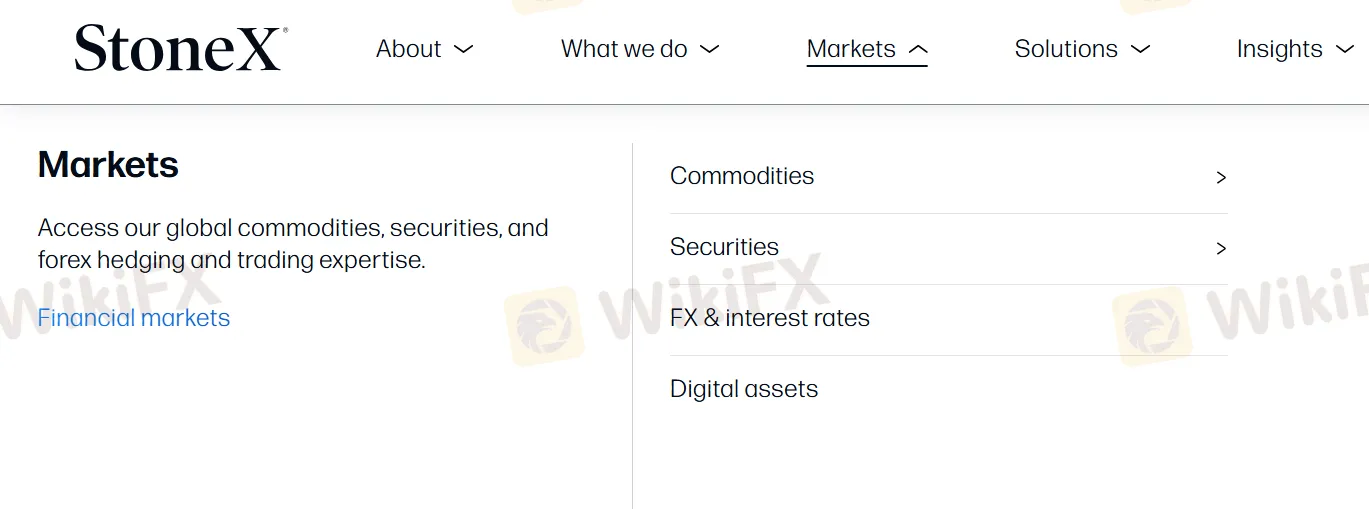

| 市場工具 | 商品、證券、外匯、數字資產 |

| 模擬帳戶 | ✅ |

| 槓桿 | / |

| 點差 | / |

| 交易平台 | StoneX One |

| 最低存款 | / |

| 客戶支援 | 電話:+12124853500 |

| 地址:230 Park Avenue, 10th Floor, New York, NY 10169 | |

| X、Instagram、LinkedIn、YouTube | |

StoneX 資訊

成立於2003年,StoneX 是一家在美國註冊的無監管經紀商,提供在StoneX One平台上交易商品、證券、外匯和數字資產。

優缺點

| 優點 | 缺點 |

| 模擬帳戶 | 無監管 |

| 分離帳戶 | 收費結構不清晰 |

| 多樣化交易產品 | 沒有存取和提款資訊 |

| 長期運營歷史 |

StoneX 是否合法?

否。StoneX 目前沒有有效的監管。請注意風險!

我可以在StoneX上交易什麼?

StoneX 提供商品、證券、外匯和數字資產交易。

| 可交易工具 | 支援 |

| 商品 | ✔ |

| 證券 | ✔ |

| 外匯 | ✔ |

| 數字資產 | ✔ |

| 指數 | ❌ |

| 債券 | ❌ |

| 期權 | ❌ |

| ETFs | ❌ |

帳戶類型

通過StoneX One,投資者和交易員可以開立證券帳戶,目前這些帳戶僅適用於美國居民。此外,StoneX One提供模擬帳戶。

交易平台

StoneX One 使用自家的交易平台。

| 交易平台 | 支援 | 適合對象 |

| StoneX One | ✔ | / |

| MT4 | ❌ | 初學者 |

| MT5 | ❌ | 經驗豐富的交易者 |

FX1310826796

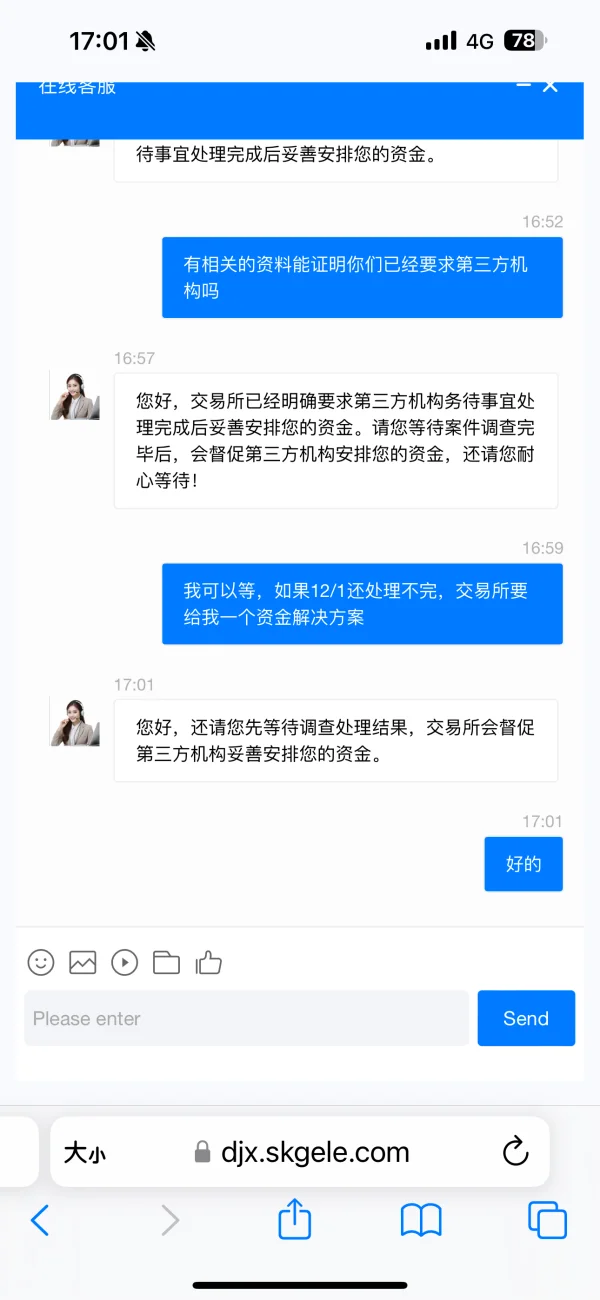

香港

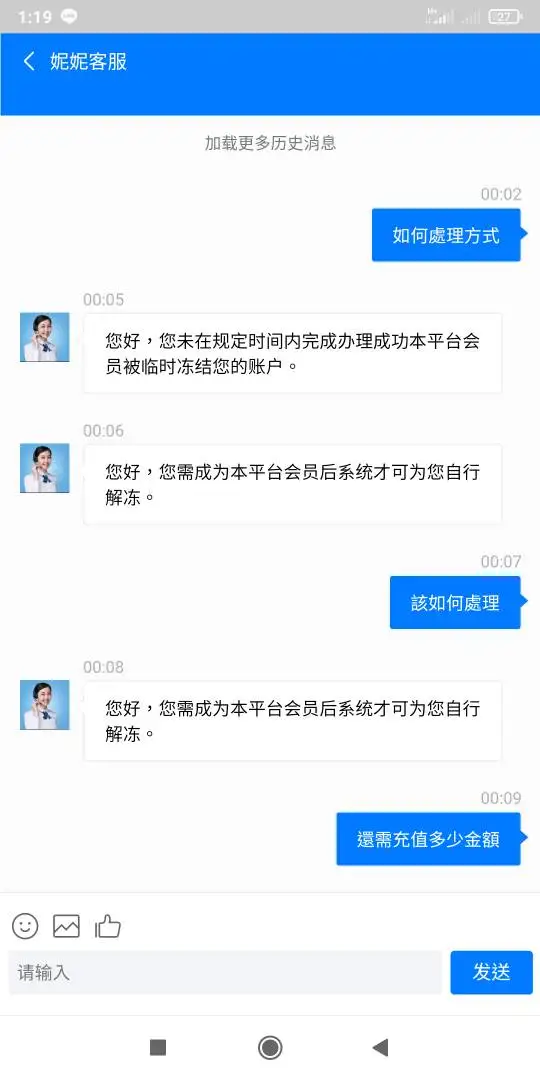

先是在杰富瑞交易所注册的账号,只提现一次,后面就是各种理由不给提现,然后交各种解冻金保证金,好不容易交完了可以提现,现在说第三方机构转账时被冻结账户,改成现金交易,又说现金也被警察扣了,从10月底开始与Stonex合并了,让我等15个工作日,到时间后又让等15个工作日,现在直接Stonex交易所也登不进去了,链接网址失效了,请帮忙找到链接。

爆料

FX2372073304

台灣

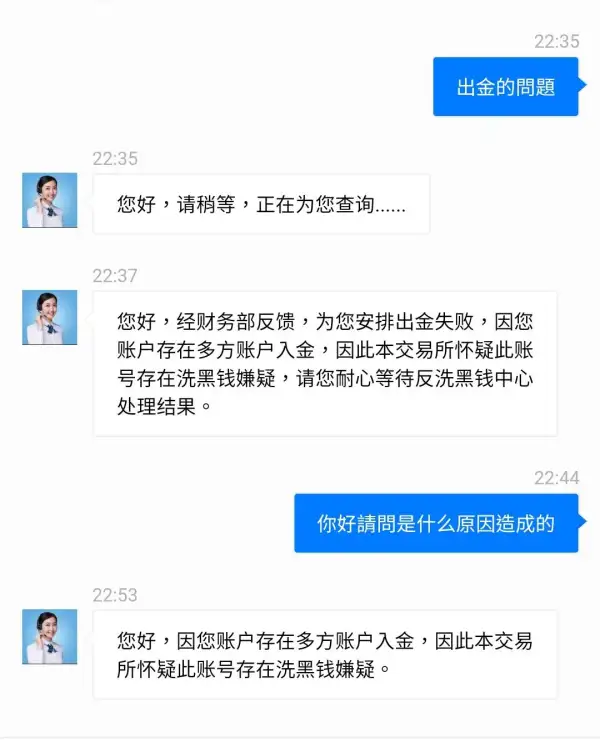

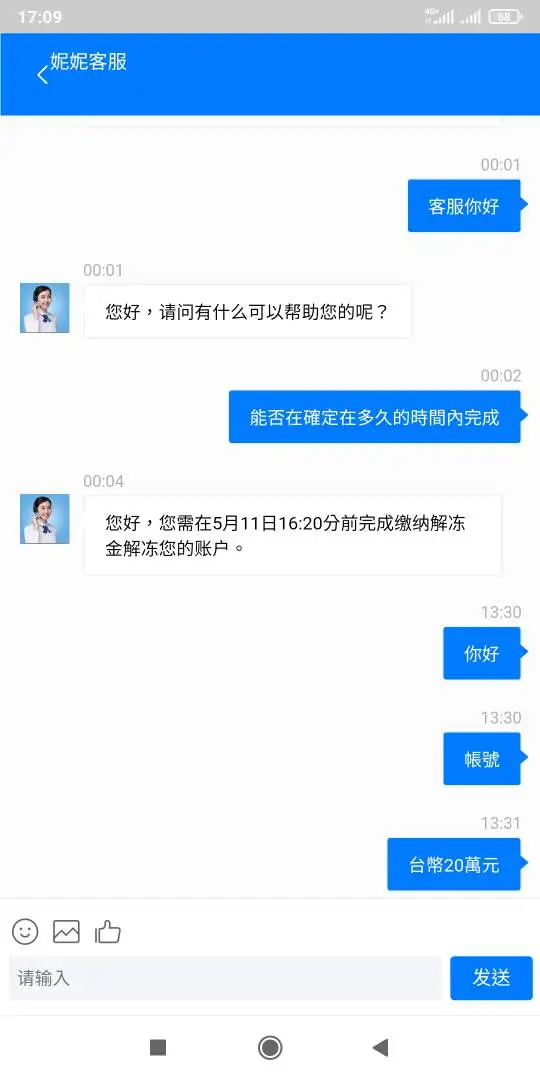

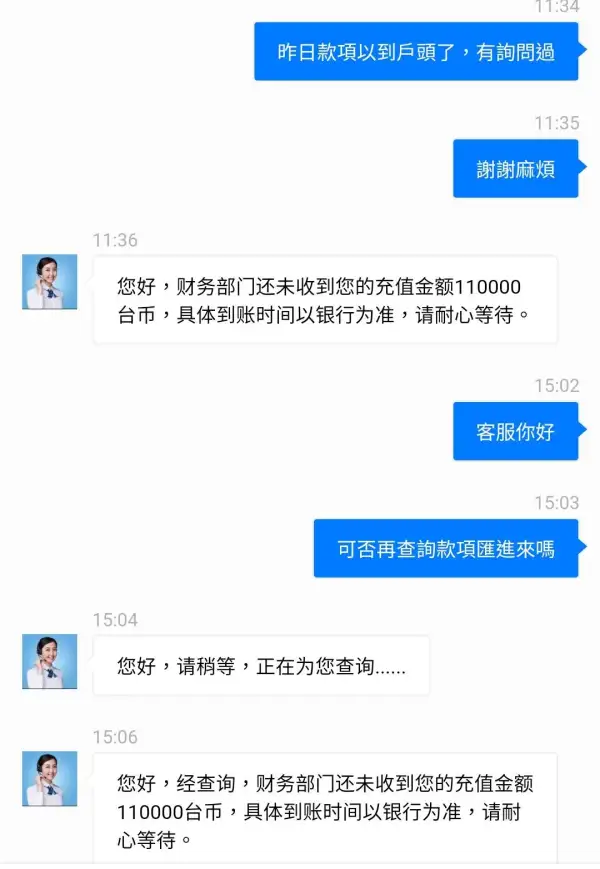

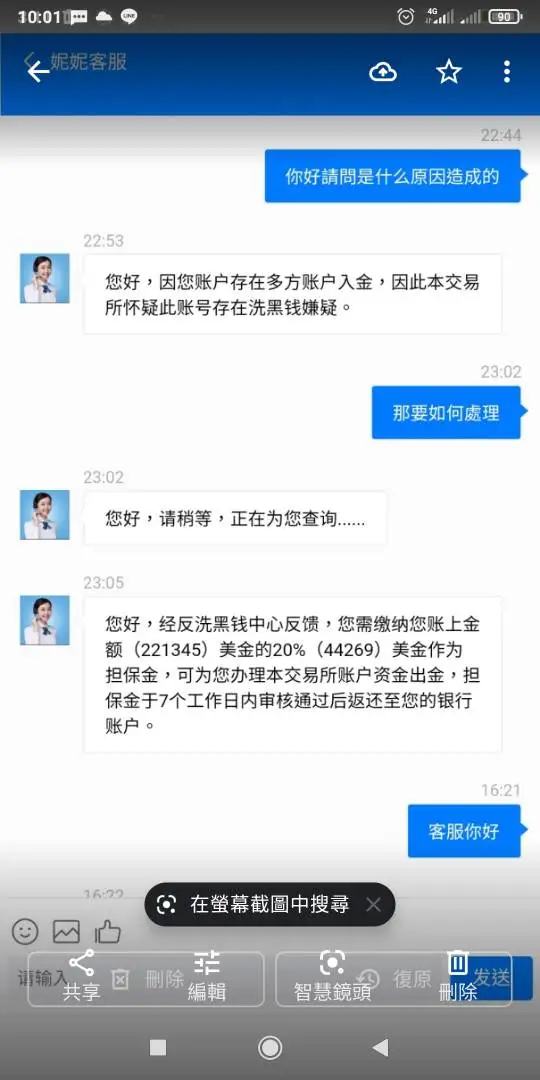

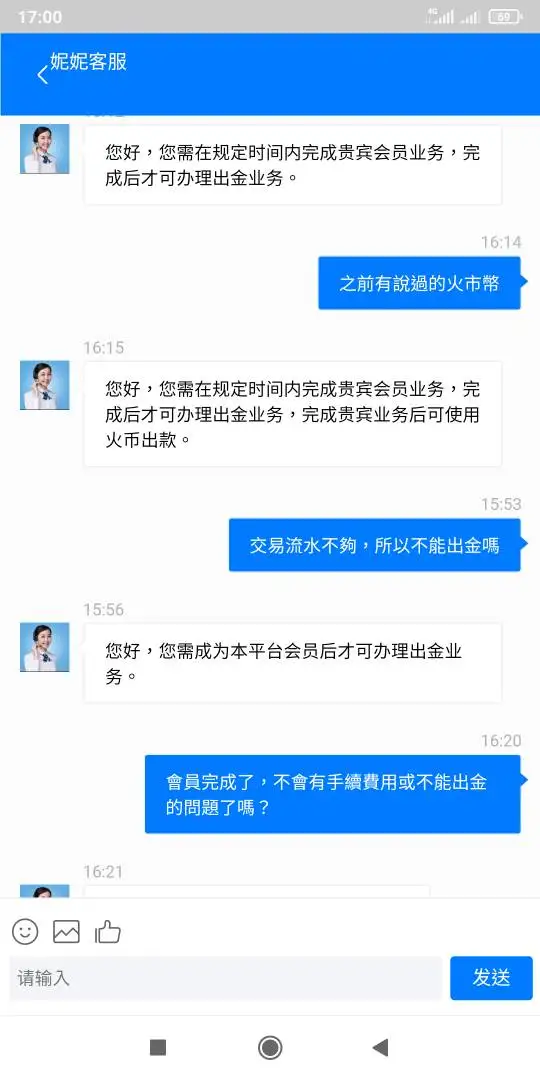

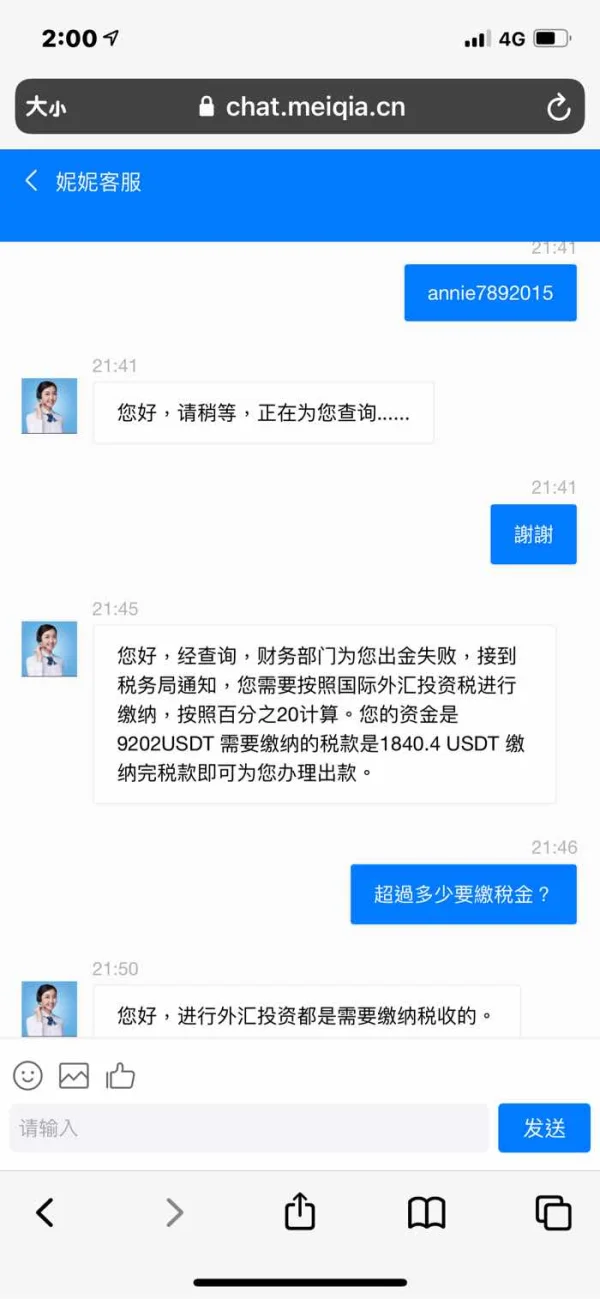

由一位女性朋友,介紹認識做美金平台的人,剛開始前兩次都順利出金,去做外匯指定時間內都沒有,虧損狀態,對方給了一個專案,彩金回饋9999美金,需入5.2W,完成後又是會員加入要38888美金的問題,時間內沒完成需負擔總金額10%,又補完要出金了,平台說流水號不夠×5次(全部要出金的時候都同樣的話)又在做美金,歐元,日元外匯交易流水號,都賺到錢,對方有時說押漲,可是我就會按錯,按跌,完全沒輸到任何錢,在最後這次流水號做好了,款項來到了221,345元美金就,要出金謝,平台給了一個多方入帳,洗黑錢嫌疑的名稱,無法出金,需補20%,44269美金做擔保,7日內審核通過之後,沒有任何嫌疑,才會把擔保金44269美元歸還,其於221,345美元還是無法出金

爆料

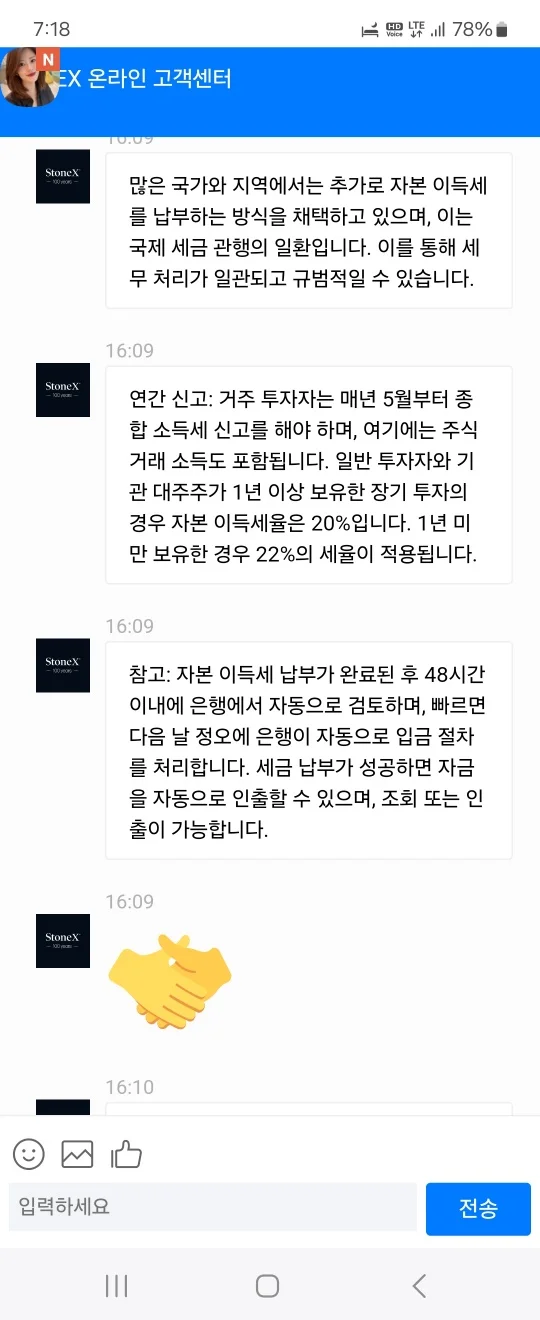

FX3914838800

台灣

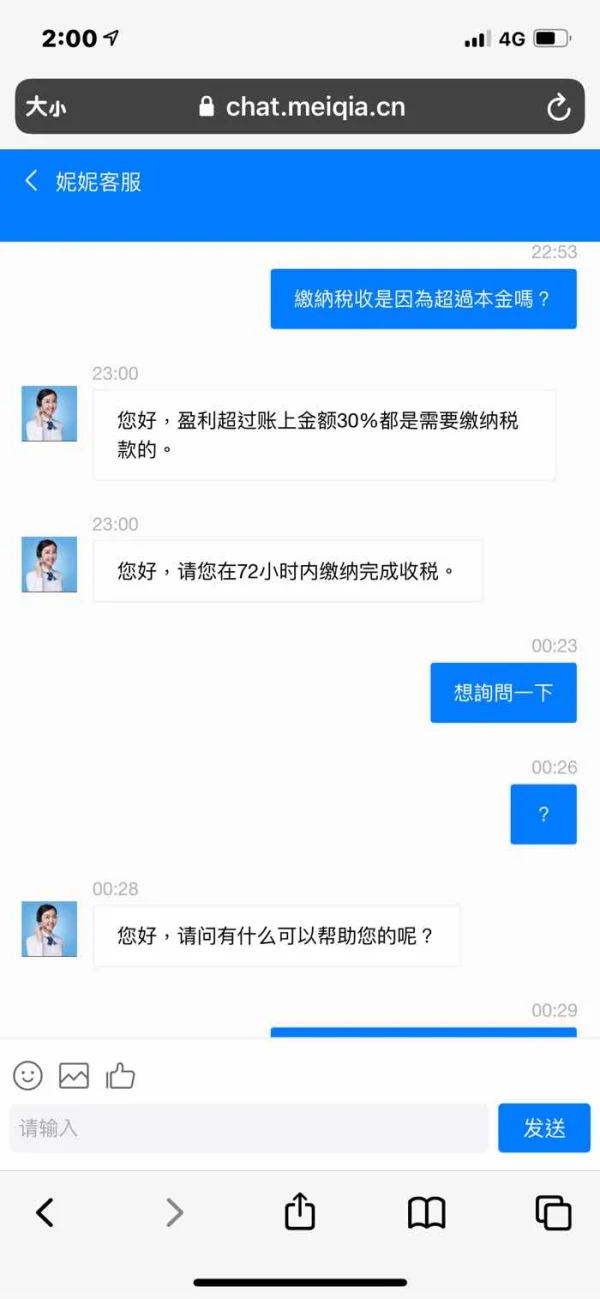

說一定要繳完20%稅收才可以正常出金 什麼時候規定出金要繳納稅收? 結果後來就凍結帳戶,最好是退回本金

爆料

Henry9

新西蘭

在我們開始使用StoneX之前,處理跨國支付是一個頭痛的問題。現在,有了他們的外匯解決方案,一切變得更加順暢。他們處理複雜性,而我更專注於經營我們的業務。

好評

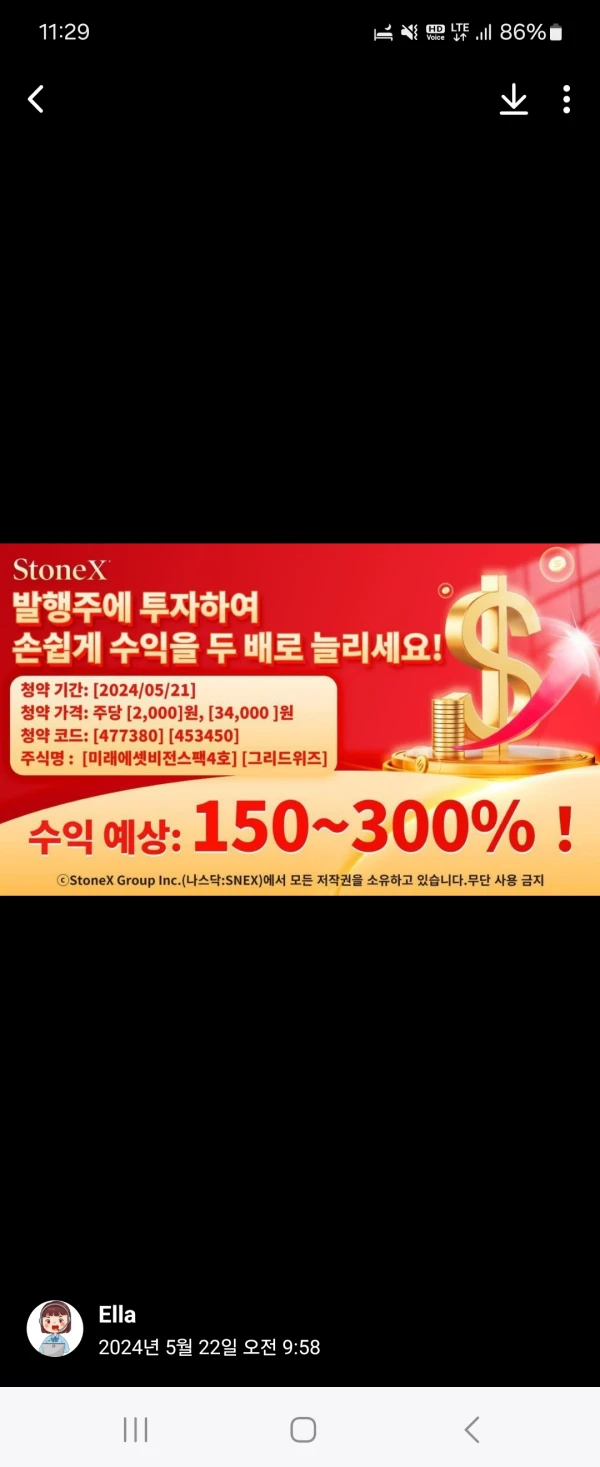

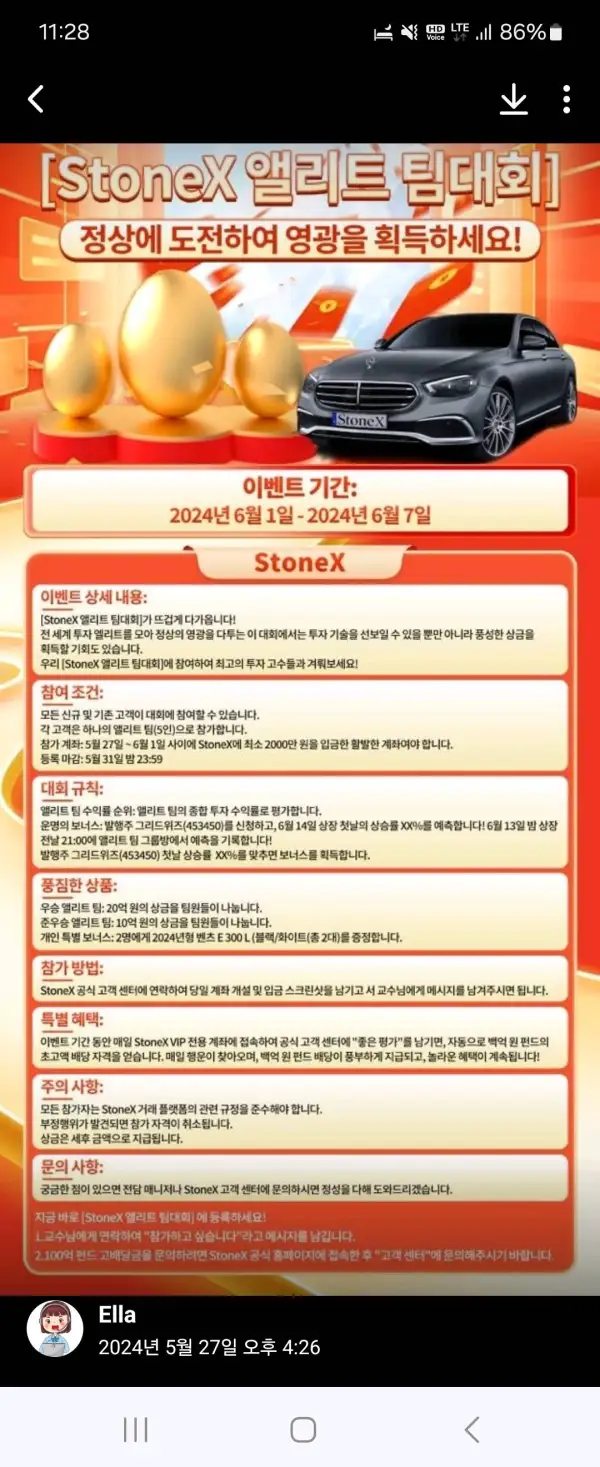

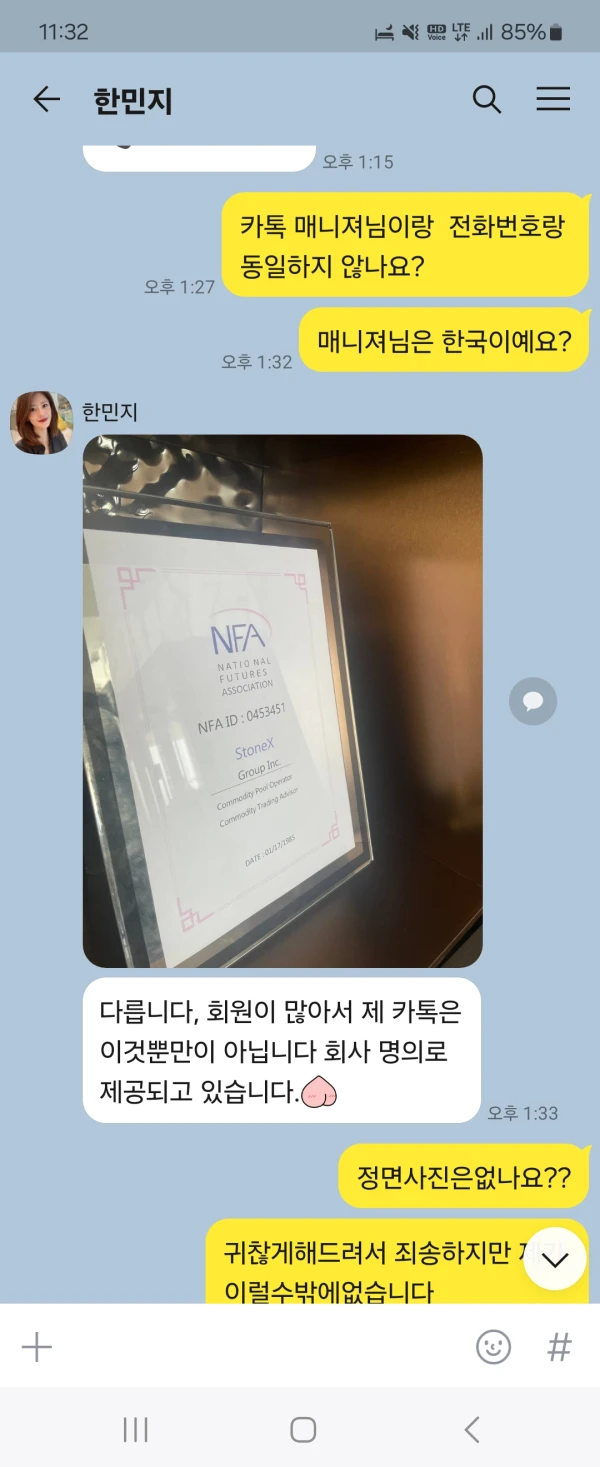

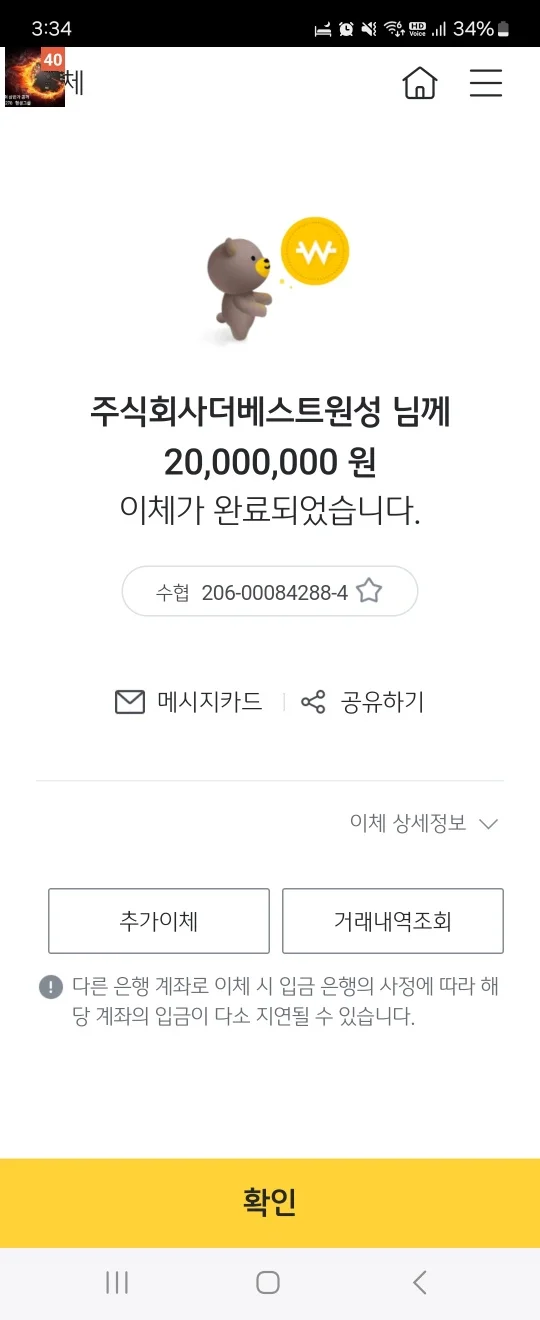

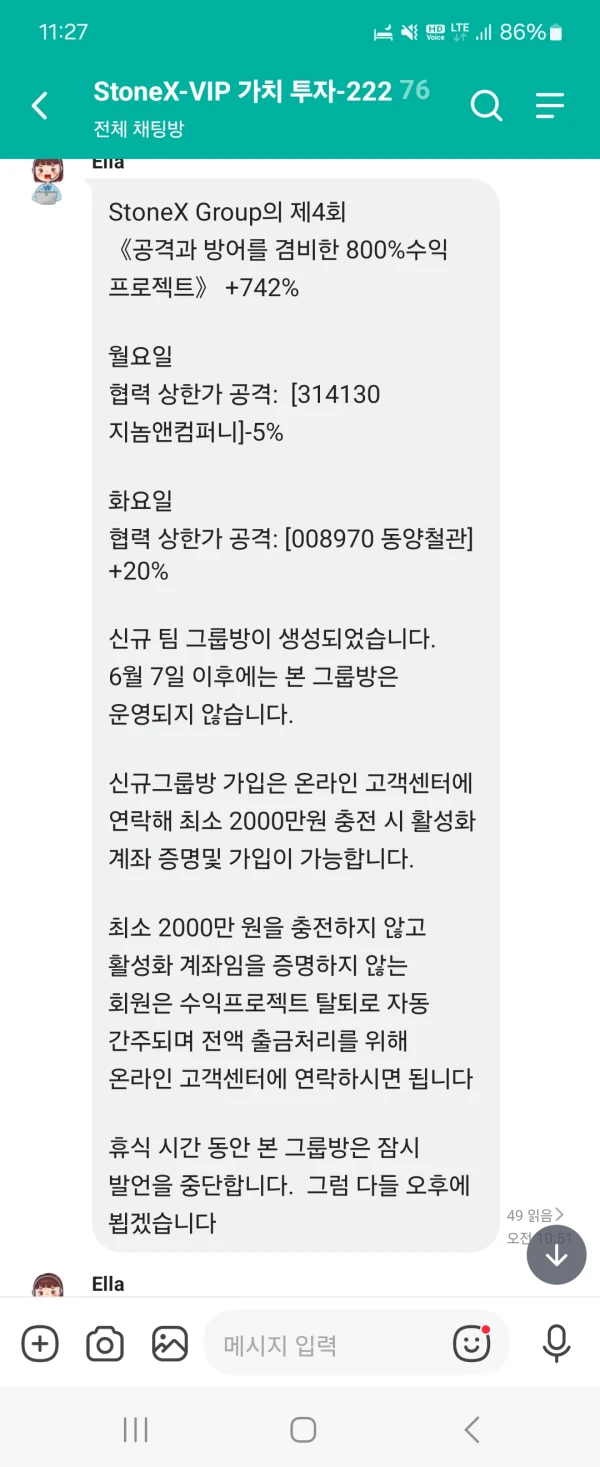

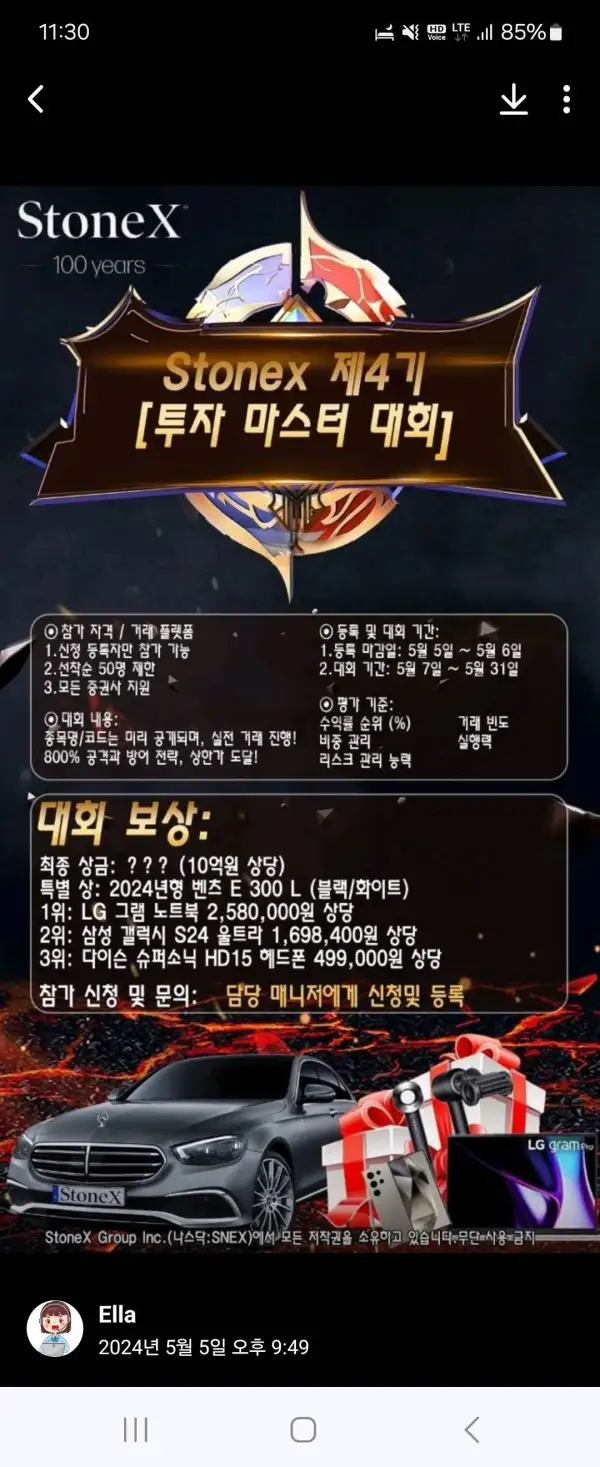

춘자

韓國

叫我申請新股,之後話抽籤中咗要我鎖住筆錢,跟住叫我全數提款,結果手續費1800萬韓圜。貸款25%供款2000萬韓圜。快速轉帳服務費1500萬韓圜。交完錢之後,而家又話要交轉讓所得稅3600萬韓圜。話如果今日唔入數,筆錢就會被凍結。啲戶口似乎全部都係假嘅。我係咪被騙咗??我放咗太多錢入去喇。

爆料

FX1490860758

美國

我曾經從證券到貨幣進行交易,多樣性一直讓它保持著刺激。無縫的全球支付使交易快速且方便。交易實物商品是一種有趣的體驗。然而,掌握一些場外產品有點需要學習曲線...

中評

子衿17205

英國

我對 StoneX 的產品和服務、出色的客戶支持、定制的交易條件和快速的執行時間非常滿意!

好評

HQ

哥倫比亞

呢個網站嘅界面大小喺我個顯示器度睇落唔係幾好。我覺得個網站有啲過時。Wikifx話佢嘅牌照係假嘅,搞到我都有啲驚,所以決定唔喺度交易。你哋有冇可靠嘅期權平台可以推薦?

中評

Supamit Phompinit

泰國

我在https://monteco.top平台交易,賺取了124654.41usdt的巨額利潤。他們說需要先轉賬10%的稅款,因為他們無法從他們的賬戶中扣除款項。

爆料