Profil perusahaan

| Patria Finance Ringkasan Ulasan | |

| Dibentuk | 1996 |

| Negara/Daerah Terdaftar | Republik Ceko |

| Regulasi | Tidak Diatur |

| Instrumen Pasar | Saham, Dana, ETF, Komoditas, Derivatif, Obligasi |

| Akun Demo | ✅ |

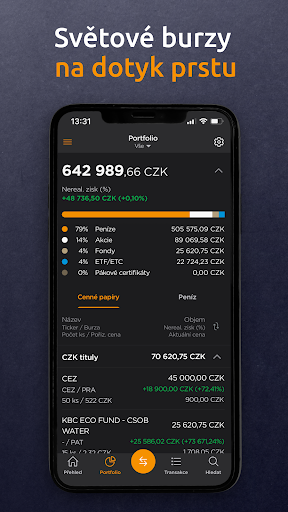

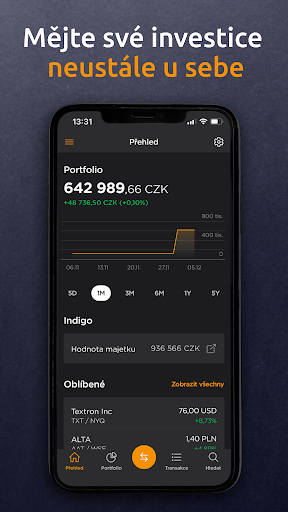

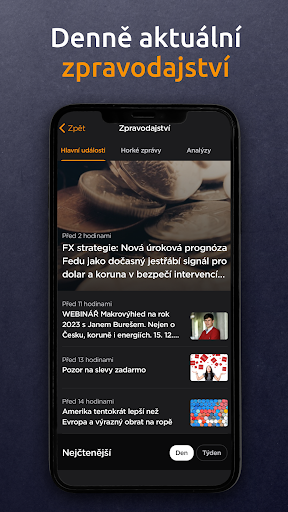

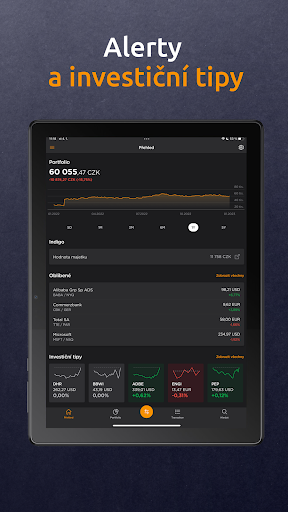

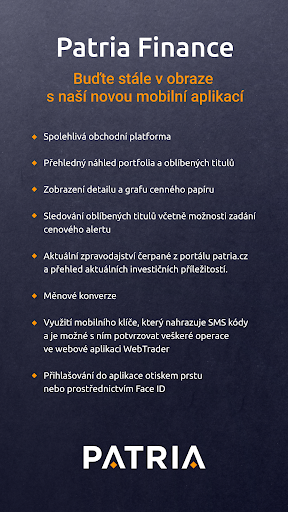

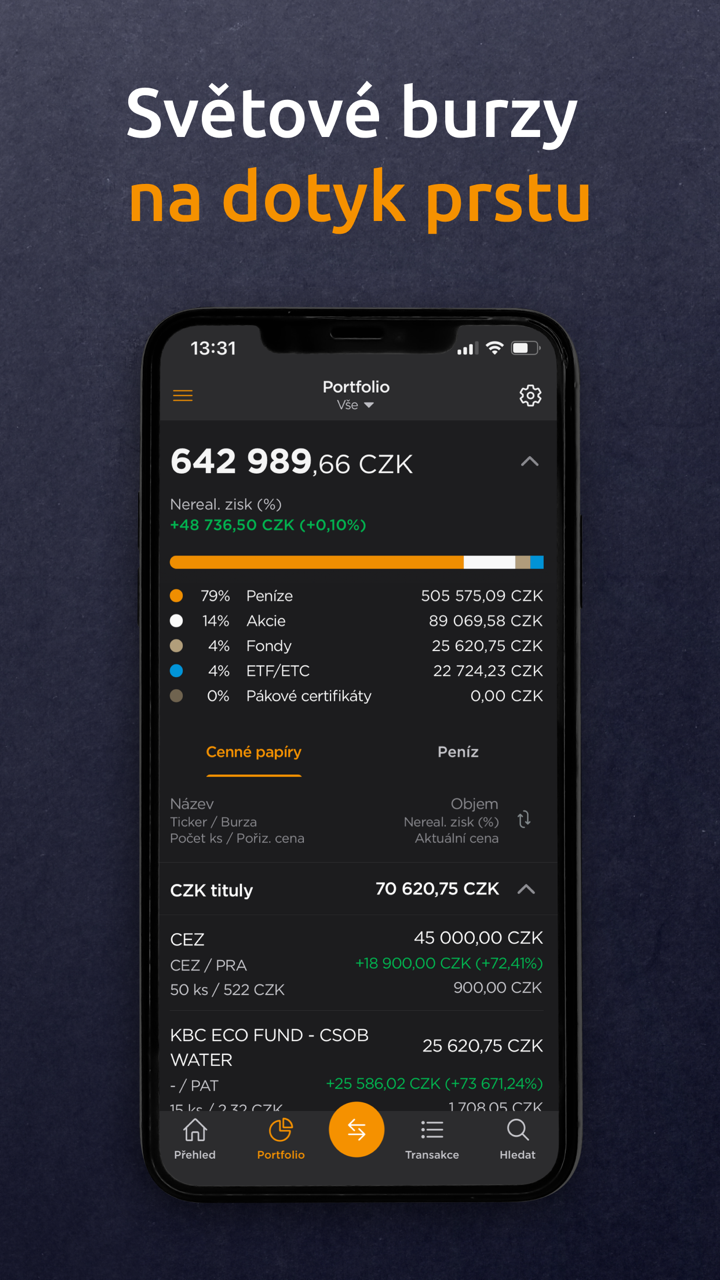

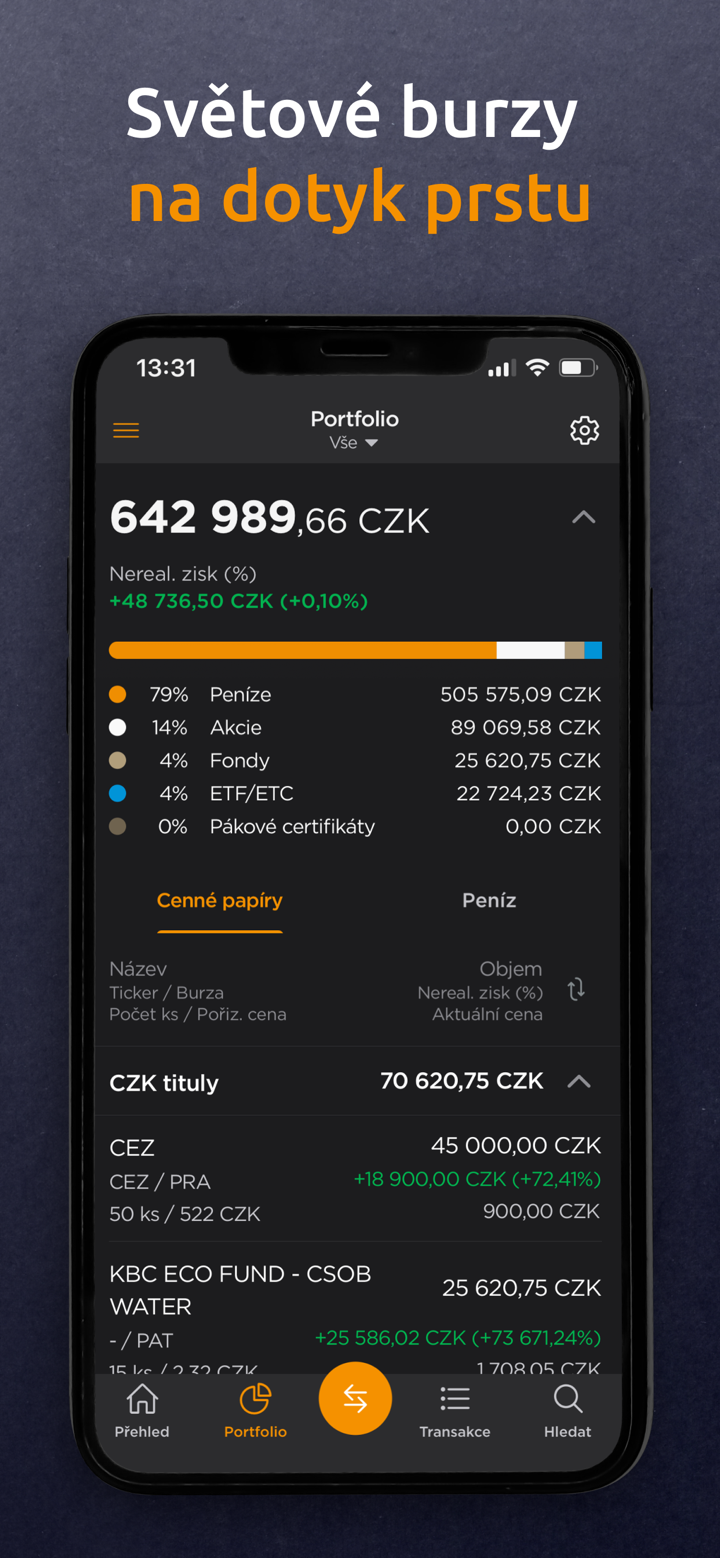

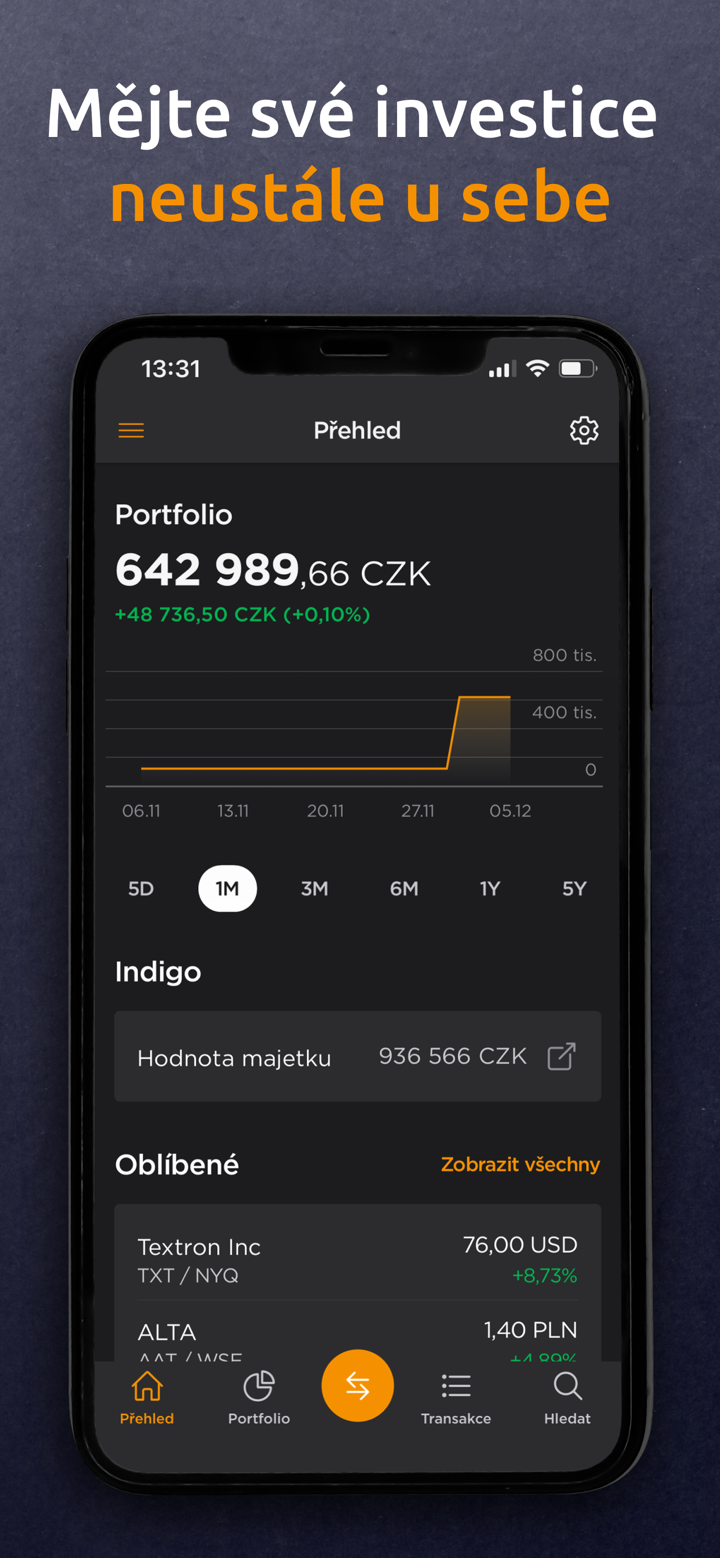

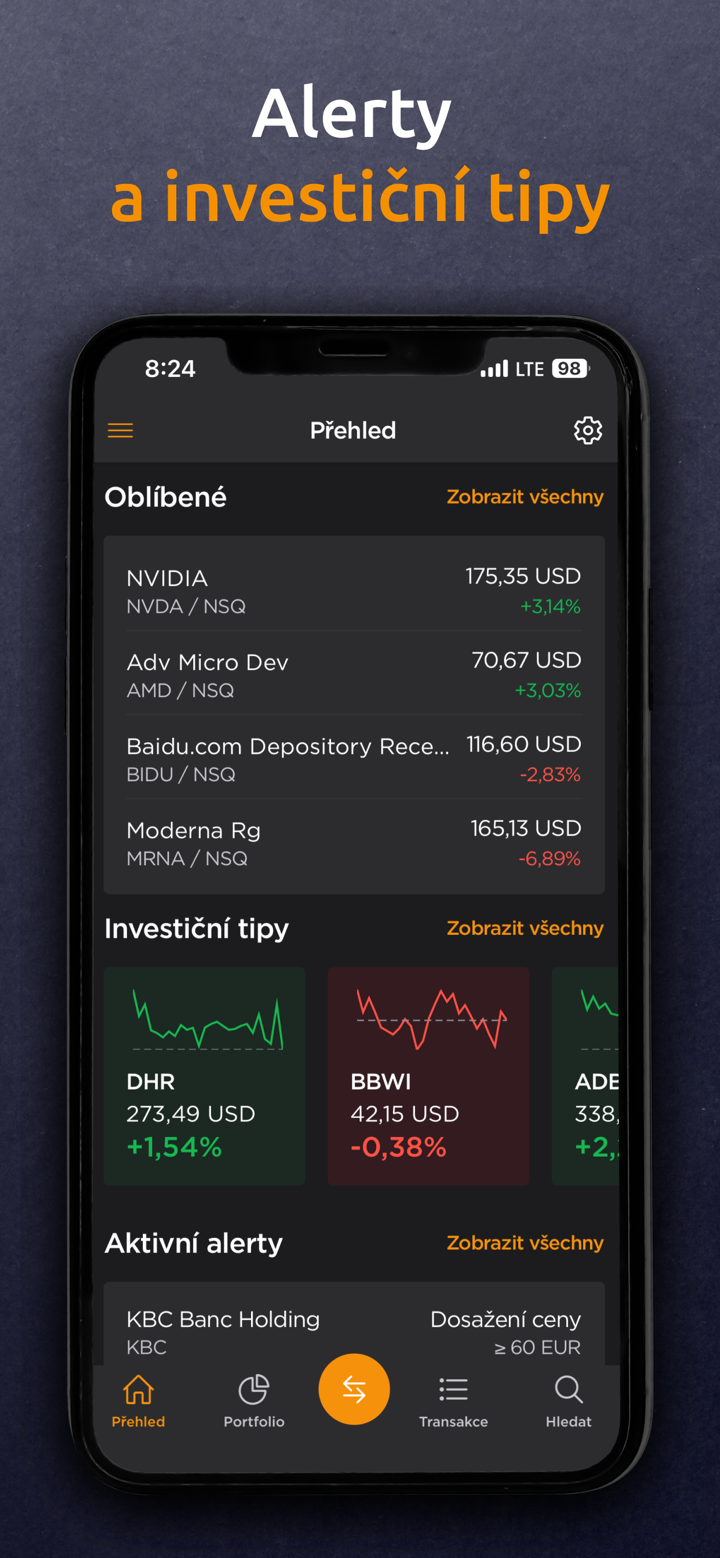

| Platform Perdagangan | WebTrader, MobileTrader, Indigo |

| Deposit Minimum | / |

| Dukungan Pelanggan | Formulir Kontak |

| Telepon: (+420) 221 424 240 | |

| Email: patria@patria.cz | |

| Alamat: Výmolova 353/3, 150 27 Praha 5 | |

Patria Finance adalah sebuah perusahaan keuangan tidak diatur yang didirikan di Republik Ceko pada tahun 1996. Perusahaan ini menawarkan berbagai instrumen pasar, termasuk saham, dana, ETF, komoditas, derivatif, dan obligasi. Perusahaan ini menyediakan akun demo dan mendukung perdagangan melalui platform WebTrader, MobileTrader, dan Indigo.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Akun demo tersedia | Tidak diatur |

| Beragam produk perdagangan | Informasi terbatas pada akun |

| Platform perdagangan yang beragam | |

| Berbagai saluran dukungan pelanggan |

Apakah Patria Finance Legal?

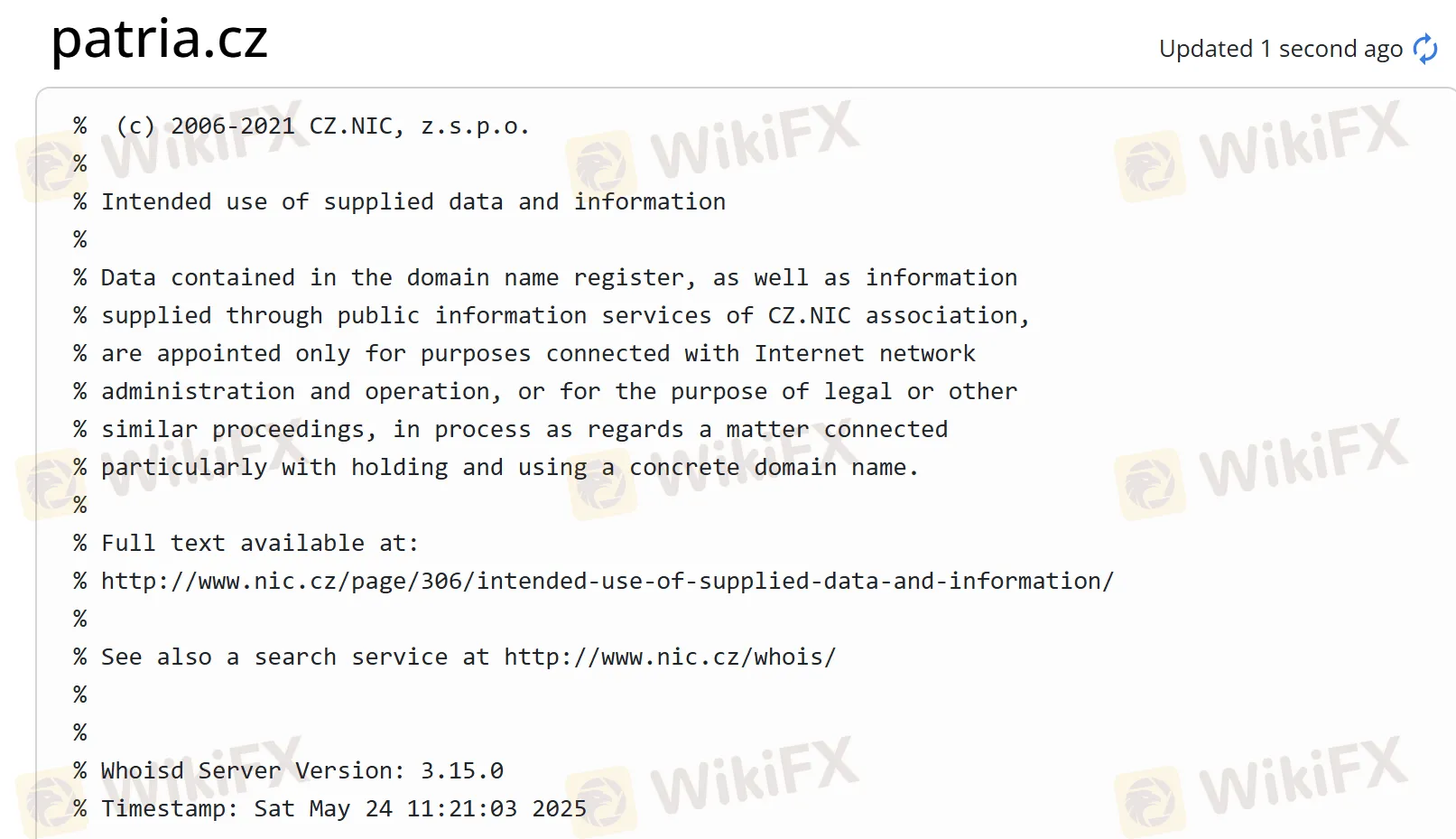

Saat ini, Patria Finance tidak memiliki regulasi yang valid. Tampaknya domainnya terdaftar pada tahun 1996, namun status saat ini tidak diketahui. Harap perhatikan dengan seksama keamanan dana Anda jika memilih broker ini.

Apa yang Dapat Saya Perdagangkan di Patria Finance?

Di Patria Finance, Anda dapat berdagang dengan Saham, Dana, ETF, Komoditas, Derivatif, dan Obligasi.

| Instrumen Perdagangan | Didukung |

| Saham | ✔ |

| Dana | ✔ |

| ETF | ✔ |

| Komoditas | ✔ |

| Derivatif | ✔ |

| Obligasi | ✔ |

| Forex | ❌ |

| Indeks | ❌ |

| Kriptokurensi | ❌ |

| Opsi | ❌ |

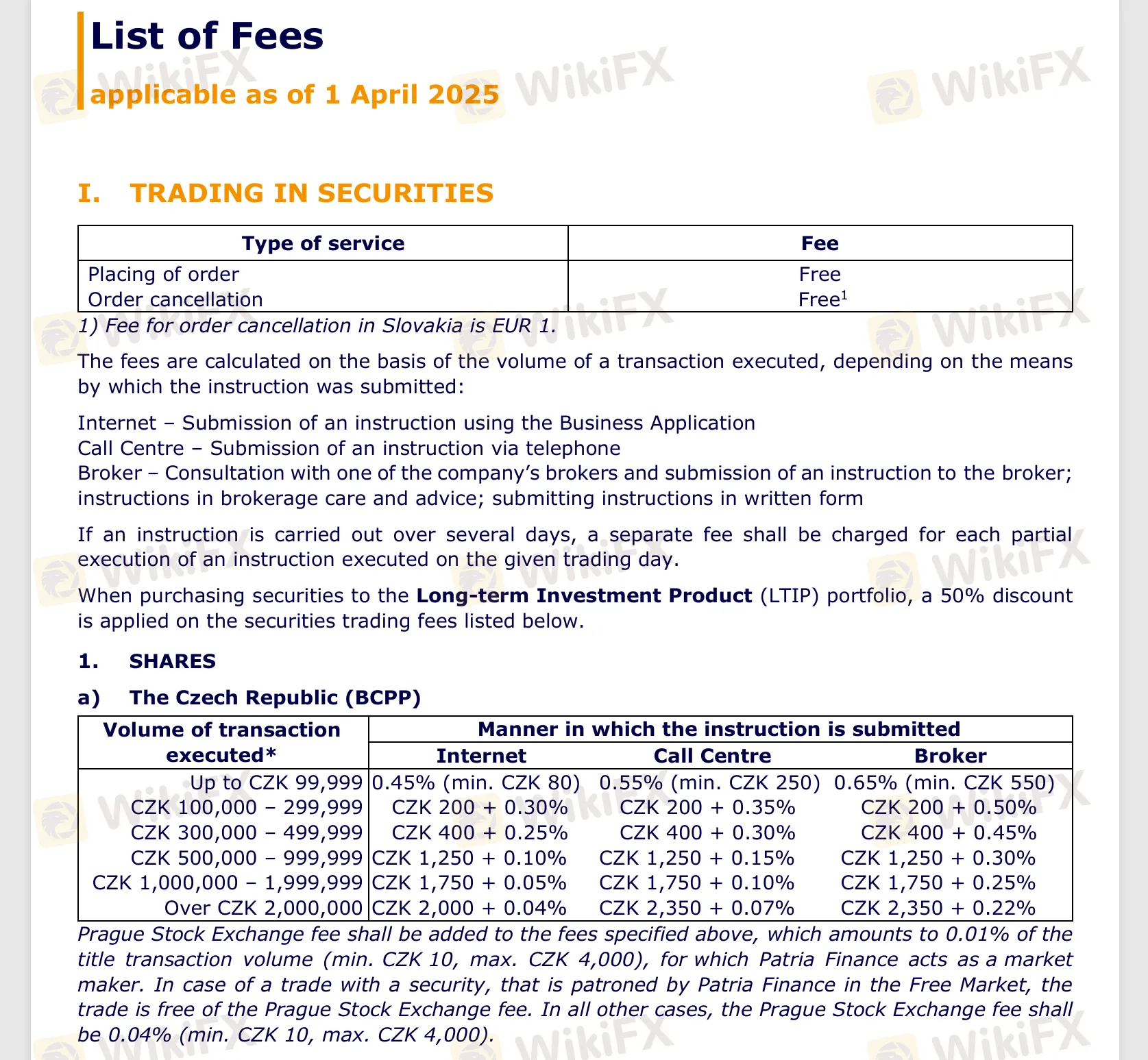

Biaya

Ada file pdf (https://cdn.patria.cz/Sazebnik-PD.en.pdf) di situs web mereka yang menjelaskan struktur biaya yang terperinci yang dapat Anda lihat.

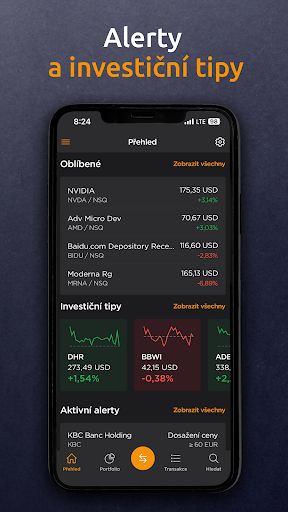

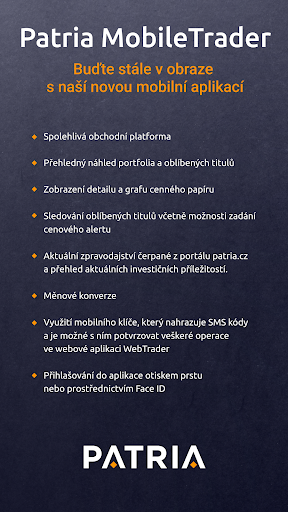

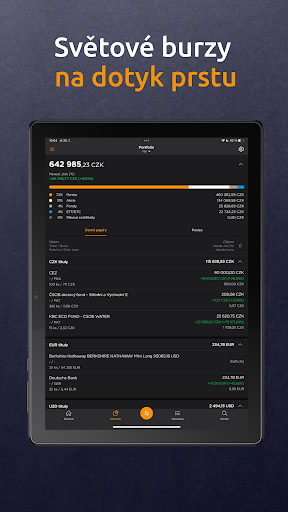

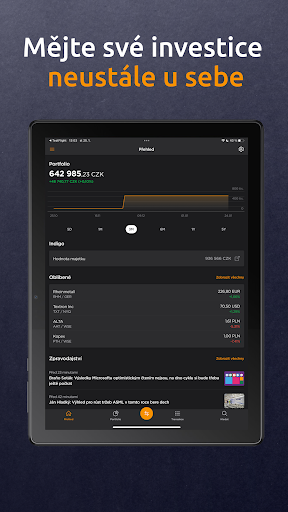

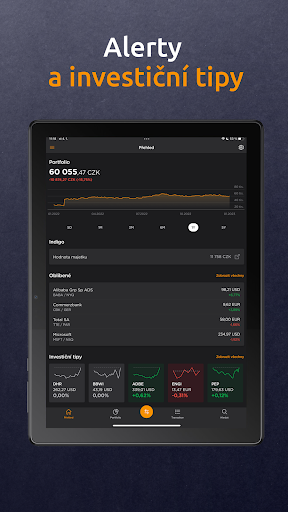

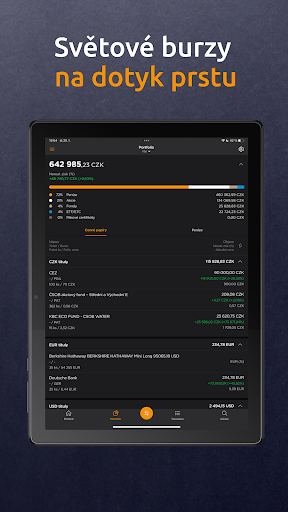

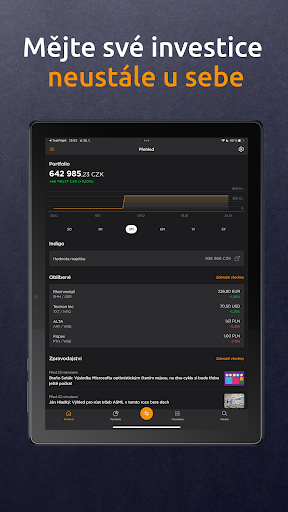

Platform Perdagangan

| Platform Perdagangan | Didukung | Perangkat Tersedia |

| WebTrader, Indigo | ✔ | / |

| MobileTrader | ✔ | App Store, Google play |