公司简介

| 贝莱德评论摘要 | |

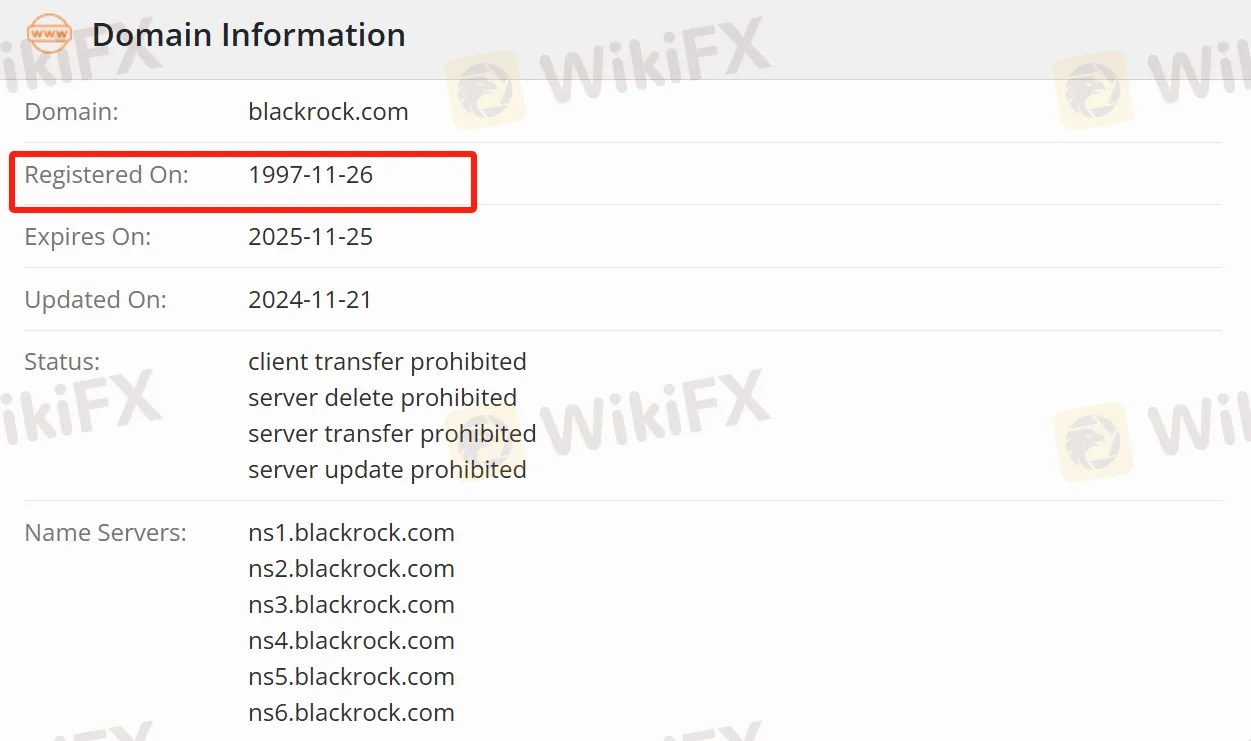

| 注册日期 | 1997-11-26 |

| 注册国家/地区 | 香港 |

| 监管 | 受监管 |

| 产品和服务 | 股票、固定收益、数字资产、大宗商品、房地产和ETF |

| 客户支持 | 202-414-2100/302-797-2000(华盛顿);+27 (0) 21 403 6441(非洲);+57 (1) 319 2598(波哥大);31 (0) 20 549 5200(阿姆斯特丹),等。 |

| Instagram、LinkedIn、Twitter、YouTube、TikTok | |

贝莱德 信息

BlackRock是一家全球投资、咨询和风险管理解决方案提供商,帮助个人实现财务福祉。作为一家金融技术提供商,拥有来自不同背景、讲述135种语言的超过19,000名员工,在42个国家开展业务。其客户包括个人和家庭、财务顾问、教育和非营利组织、养老金计划、保险公司、政府等。

优缺点

| 优点 | 缺点 |

| 受监管 | 费用结构不清晰 |

| 受监管 | 由于规模大缺乏个性化 |

| 丰富的投资经验 | |

| 多样化的客户群 |

贝莱德 是否合法?

BlackRock是一家合法合规的企业。多年来在全球金融市场运营,并受多个国家的金融监管机构监督和监管。

| 受监管国家 | 监管机构 | 受监管实体 | 许可证类型 | 许可证号码 | 当前状态 |

| SFC | BlackRock Asset Management North Asia Limited | 期货合同交易 | AFF275 | 受监管 |

| MAS | LACKROCK (SINGAPORE) LIMITED | 零售外汇许可证 | 未公布 | 受监管 |

| ASIC | BLACKROCK INVESTMENT MANAGEMENT (AUSTRALIA) LIMITED | 投资咨询许可证 | 000230523 | 超出 |

| FCA | BlackRock International, Limited | 投资咨询许可证 | 178638 | 超出 |

贝莱德提供哪些产品和服务?

在BlackRock,个人和家庭可以投资于诸如退休、购房和子女教育等目标;财务顾问可以利用其平台帮助不同收入水平的客户进行投资规划;养老金计划可以管理各类专业人士的退休储蓄;政府可以通过BlackRock为基础设施项目和其他倡议筹集资金。此外,客户群体还包括财务顾问和保险公司。

此外,投资者可以根据其地区选择各种交易所交易基金(ETF)产品。对于美国市场,通过iShares,提供的产品包括股票、固定收益、数字资产、大宗商品、房地产等。对于美国市场,通过BlackRock,产品包括iShares ETF和共同基金,而对于澳大利亚,提供的产品包括股票、固定收益、房地产等。

| 资产 | 支持 |

| 股票 | ✔ |

| 固定收益 | ✔ |

| 数字资产 | ✔ |

| 大宗商品 | ✔ |

| 房地产 | ✔ |

| ETFs | ✔ |

欲了解更多资产信息,请点击访问官方网站。

美国

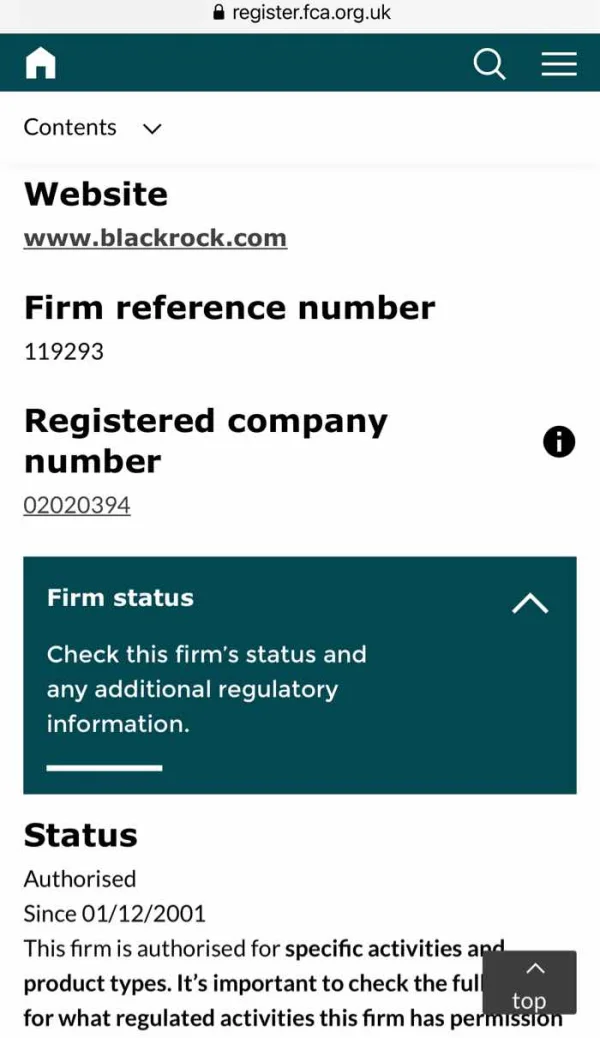

这个公司目前(2020年11月末)来看是受到FCA强监管的,请看图片。不知为何该APP跟它有仇似的显示超限经营。

曝光

FX3248546053

加拿大

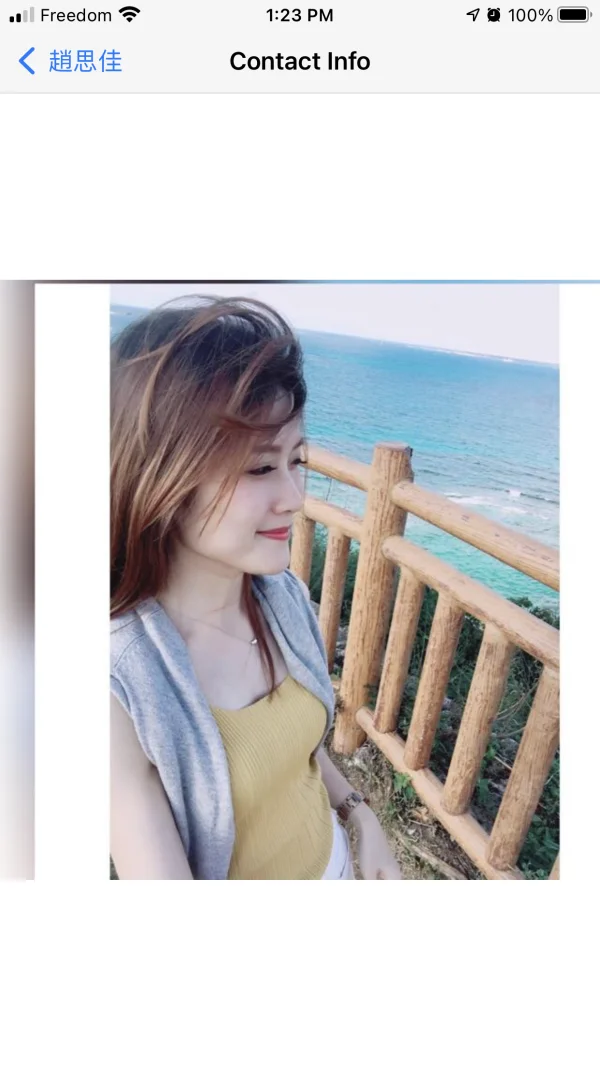

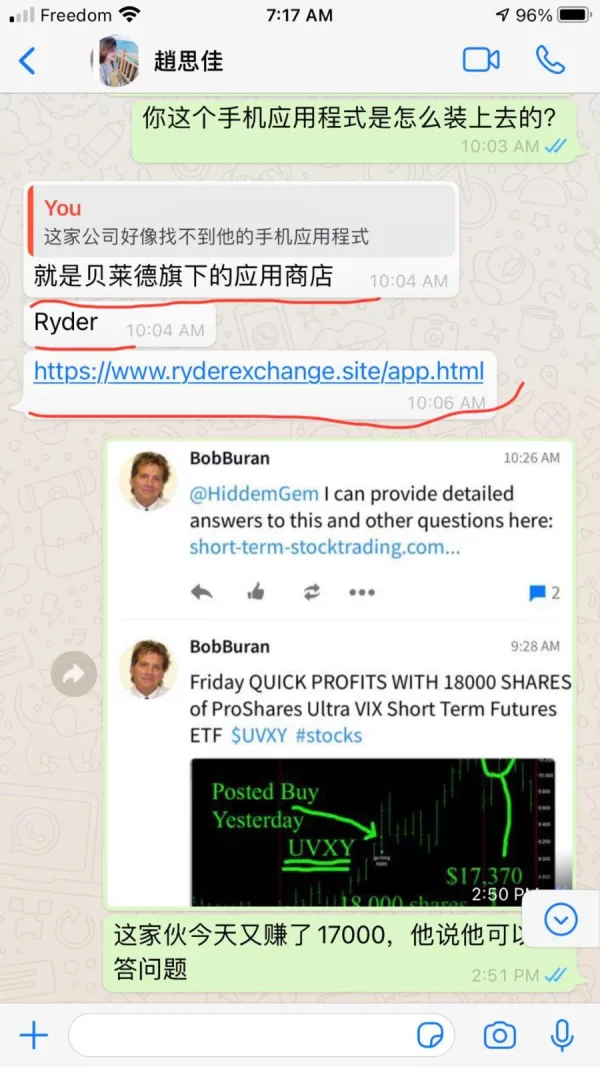

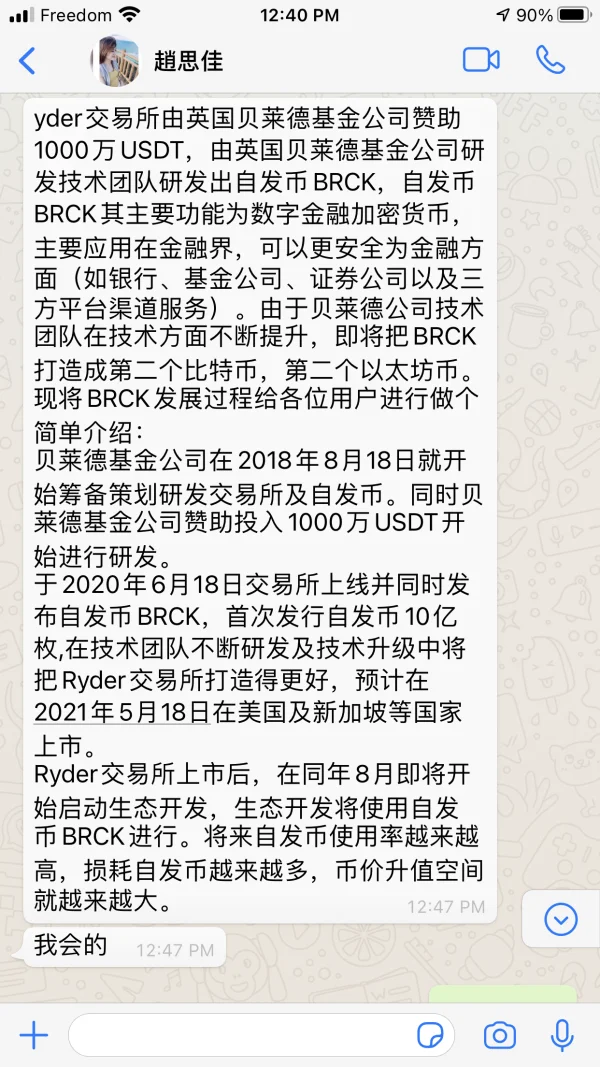

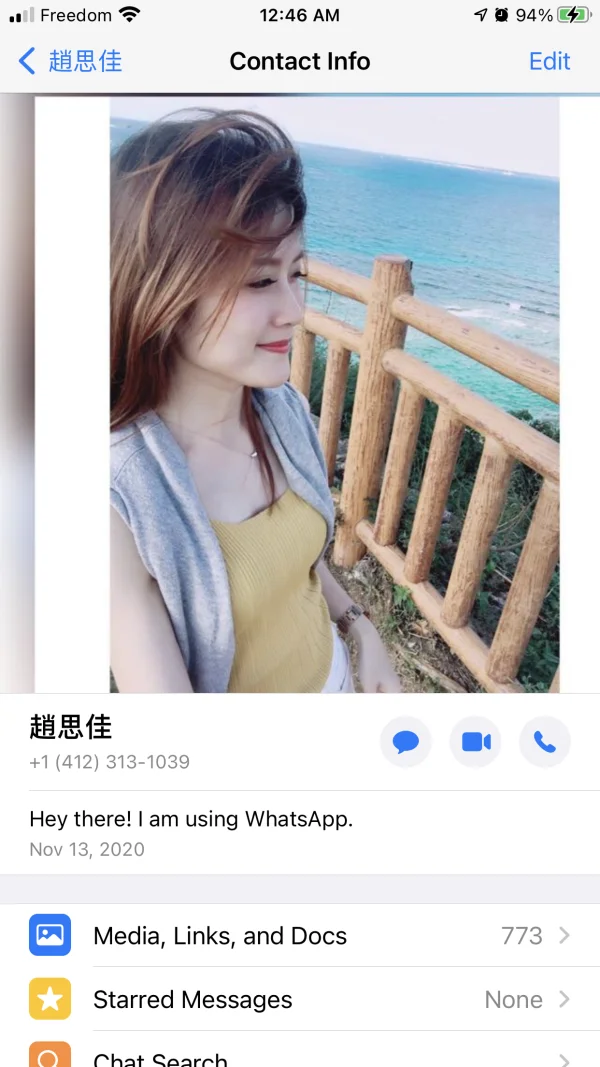

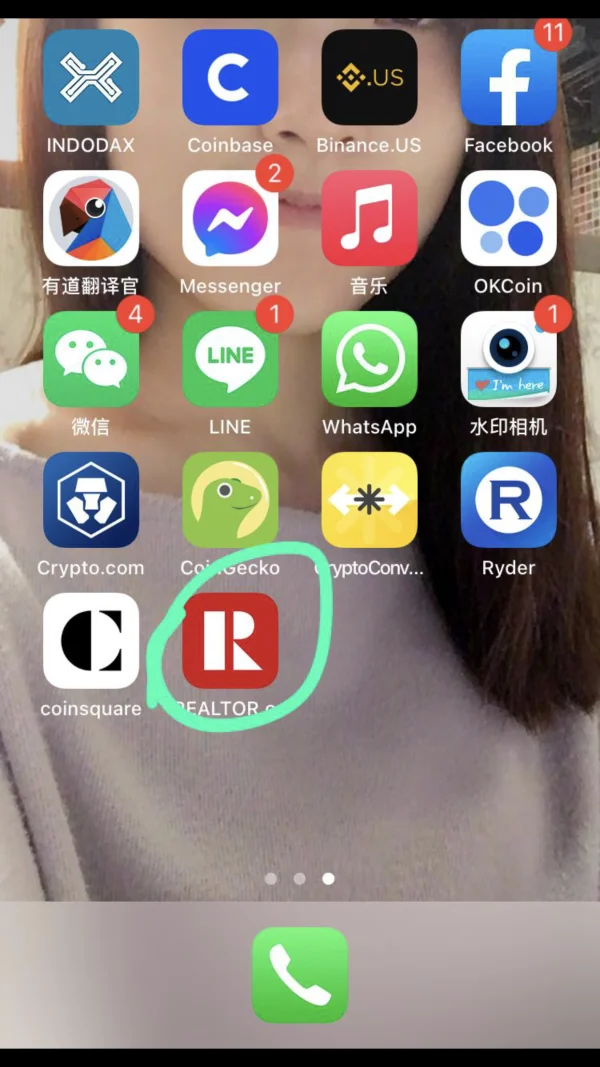

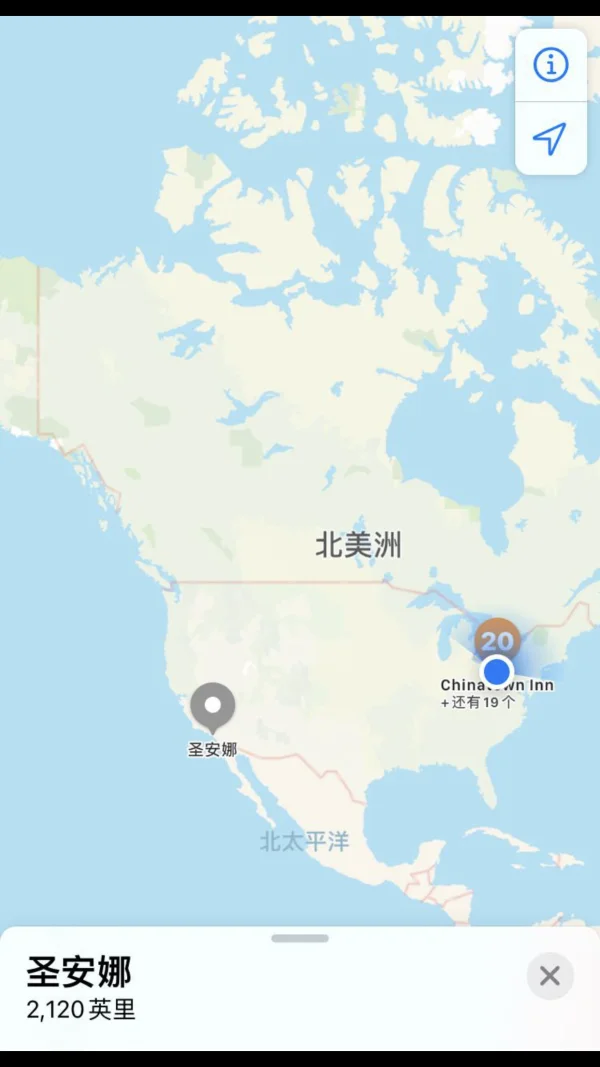

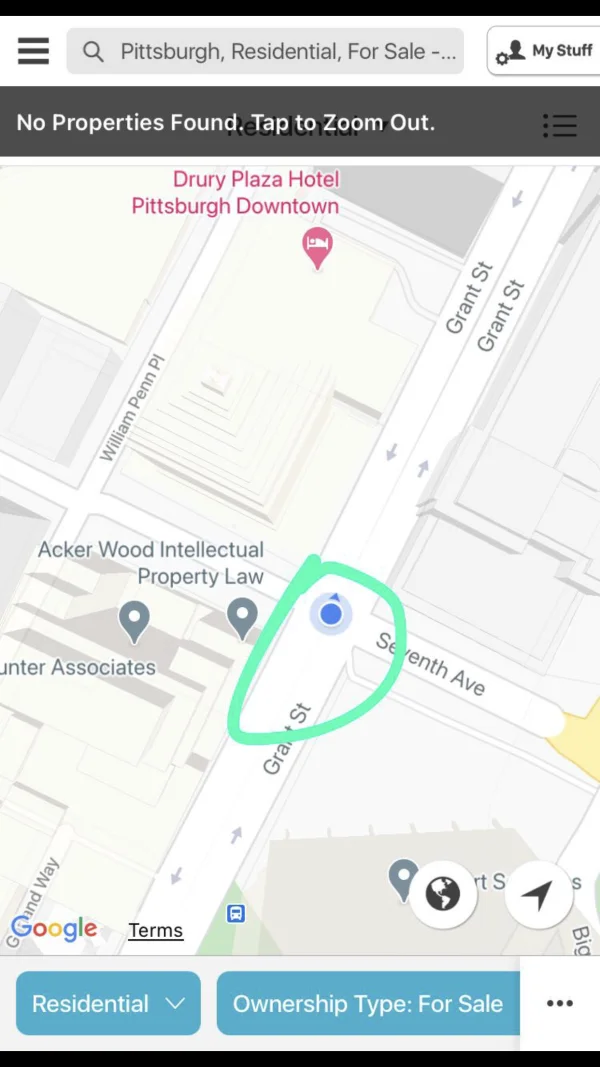

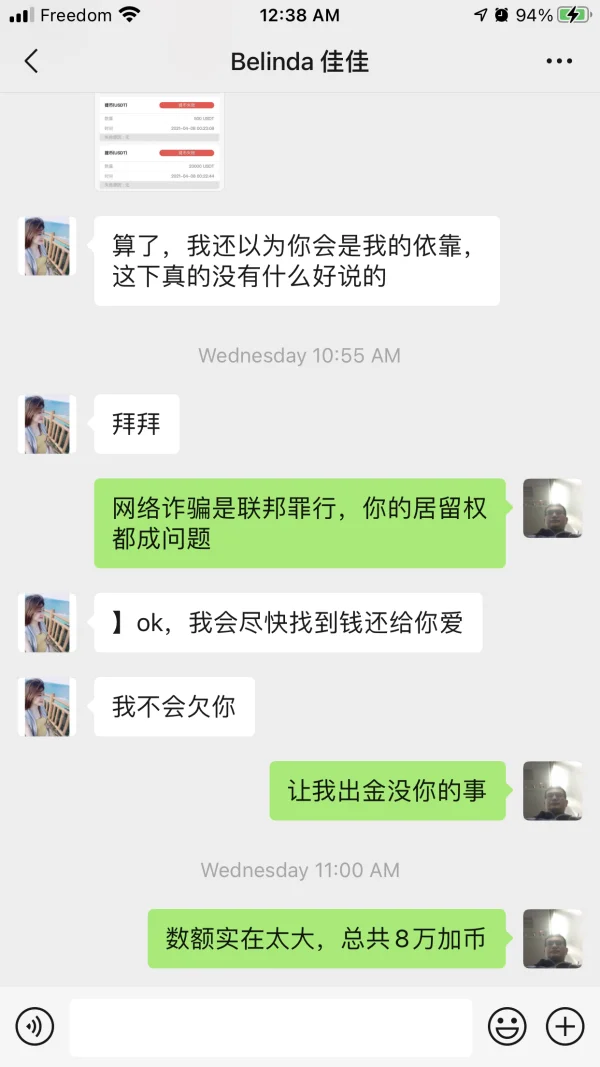

交易平台无法出金:本人加拿大国籍, 住Calgary, 在2021年2月底在Facebook上认识“赵思佳” , https://www.facebook.com/profile.php?id=100057196732746 中国国籍,美国永久居民, 交换了电话号码, 她的是+1(412)313-1039, 她推荐交易平台:https://www.ryderexchange.site/wap,名称是莱德. 并声称交易平台和加密货币BRCK/USDT将在5月上市。(1USDT=1美元),我存入1700 USDT, 提取500 USDT,成功。我存入15000 USDT, 提取1300 USDT,成功。“赵思佳”此时以年介34岁,生育最重要为由,和我建立未婚夫妻关系,并要求我说出所有的财产,并进一步要求我存入30万 USDT到这个交易平台以作为以后共同婚房费用。在交易平台我总资产50000 USDT时, 提取3200 USDT,成功。在交易平台我总资产80000 USDT时,提取32000 USDT,失败。此时被交易平台以IP地址有问题为由要求做高级认证。高级认证成功后再提款500 USDT,失败,被交易平台告知要交税22000 USDT才可以提款。询问“赵思佳”,她说她的钱也提不出来,交易平台说她的账户异动,她已经向当地警察和FBI报案。隔天后我要求“赵思佳”出示她的提款截图,她说已经提款数次,跟以前说法相矛盾,我方知被骗。要求“赵思佳”出示她的报警截图证据,没有回应。“赵思佳”以相互不信任为由结束未婚夫妻关系。此时我已经向交易平台充值8万多加拿大货币。我警告“赵思佳”网络诈骗是犯罪,她不再跟我联络,然后在Facebook上把我屏蔽。“赵思佳”电话号码+1(412)313-1039,查实并非她本人身份证注册。“赵思佳”的活动范围大约在美国宾夕凡利亚州匹兹堡的唐人街一带。“赵思佳”声称她爸爸开了建筑公司。

曝光

FX3248546053

加拿大

*家住美国宾夕法尼亚州匹兹堡唐人街附近的女骗子“赵思佳”声称Ryder交易平台是由英国贝莱德基金公司赞助1000万USDT,并研发出自发币 BRCK/USDT, 将于五月份上市。

曝光

tombita

秘鲁

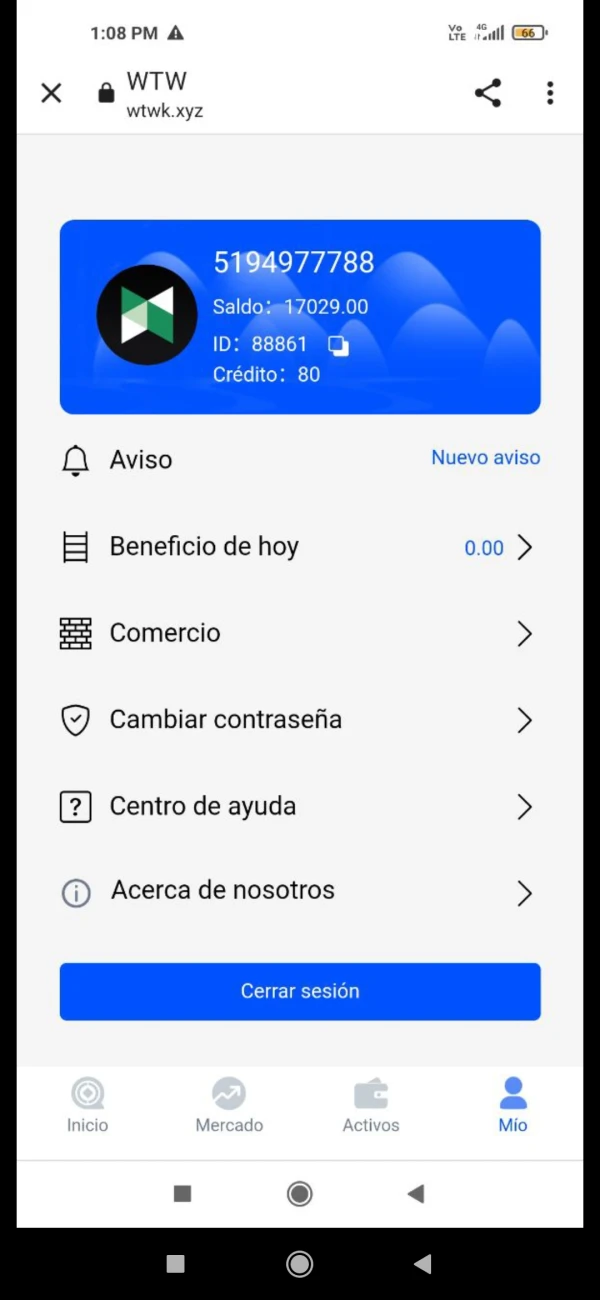

应该给我提款,但他们告诉我必须再进行一次更大的退款

曝光

FX1245234069

美国

很难相信这家已经存在超过 15 年的公司也是骗子。说实话,要不是我习惯性的去看看wikifx,我早就傻傻的投资在这里了。

中评

FX3644586767

台湾

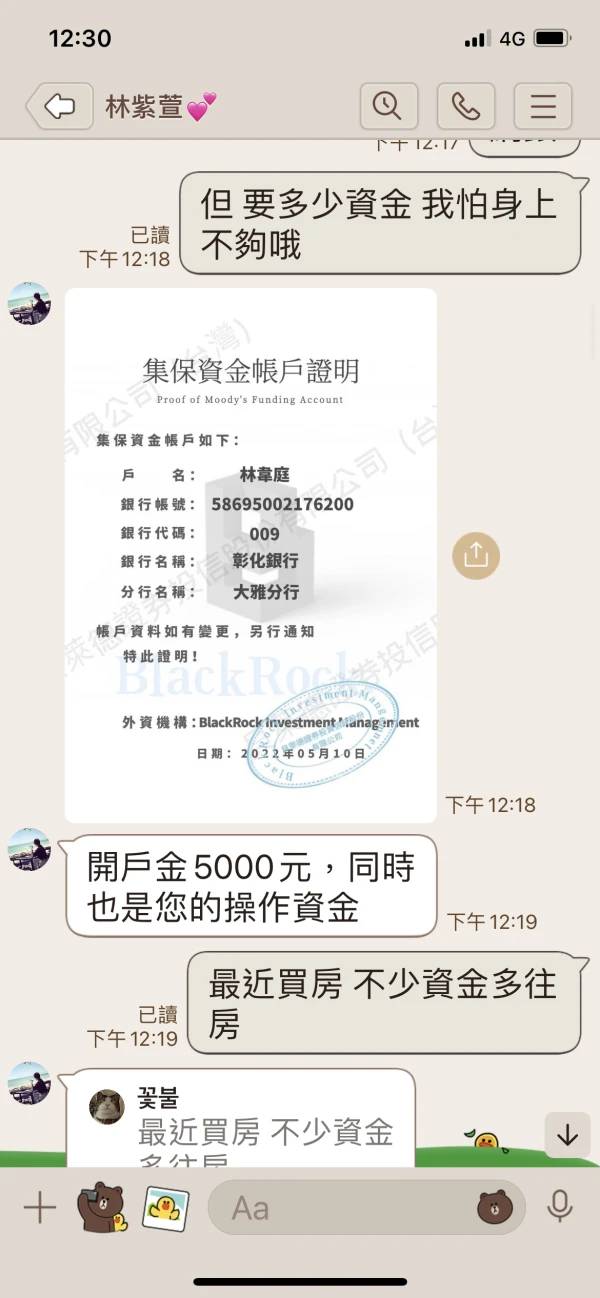

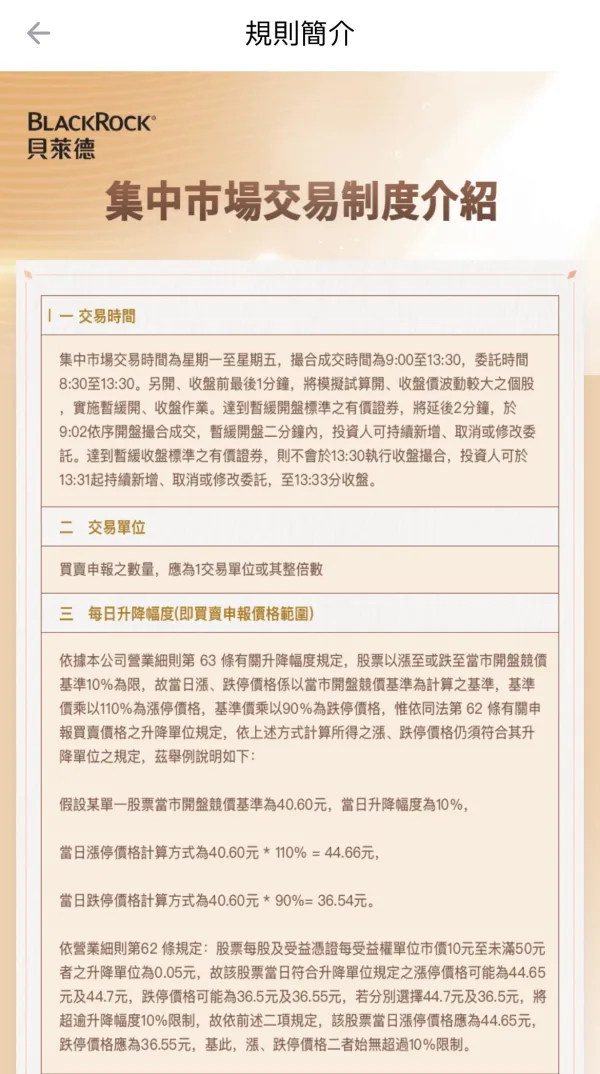

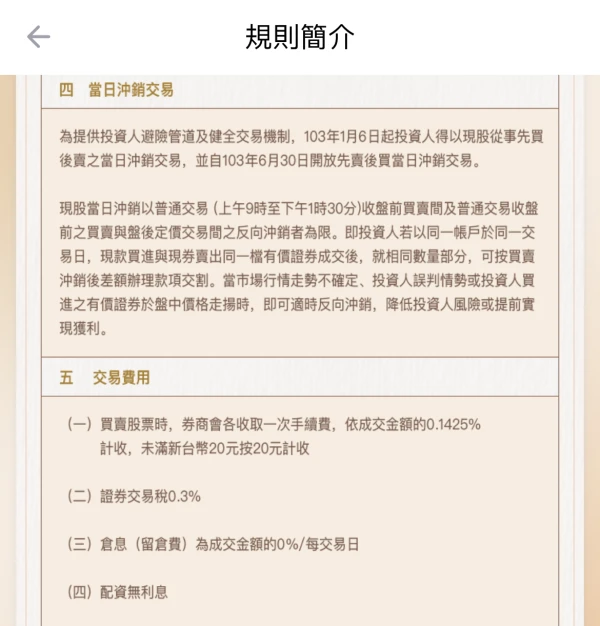

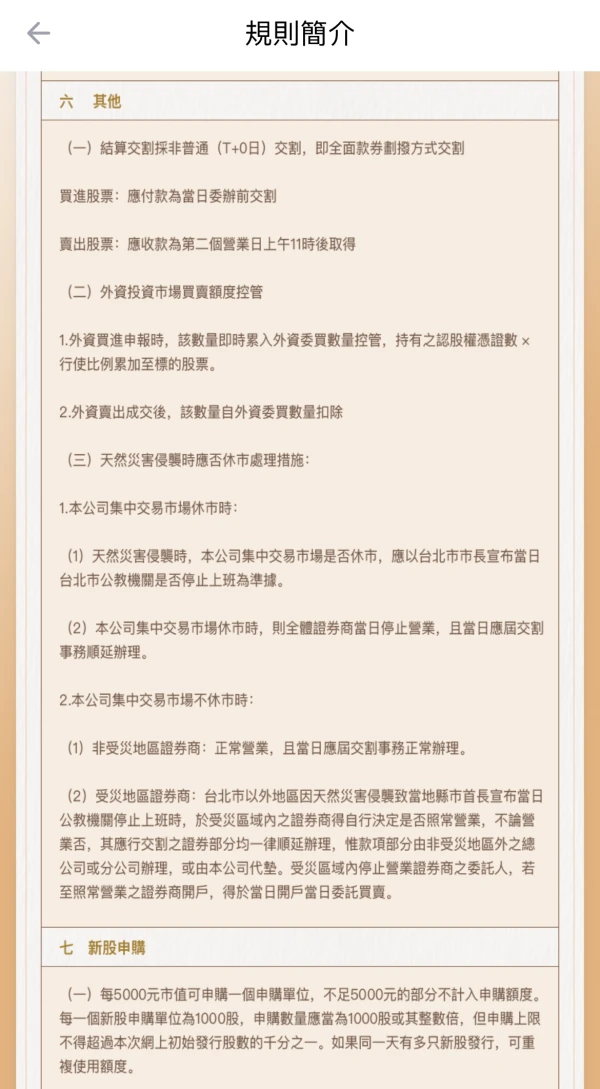

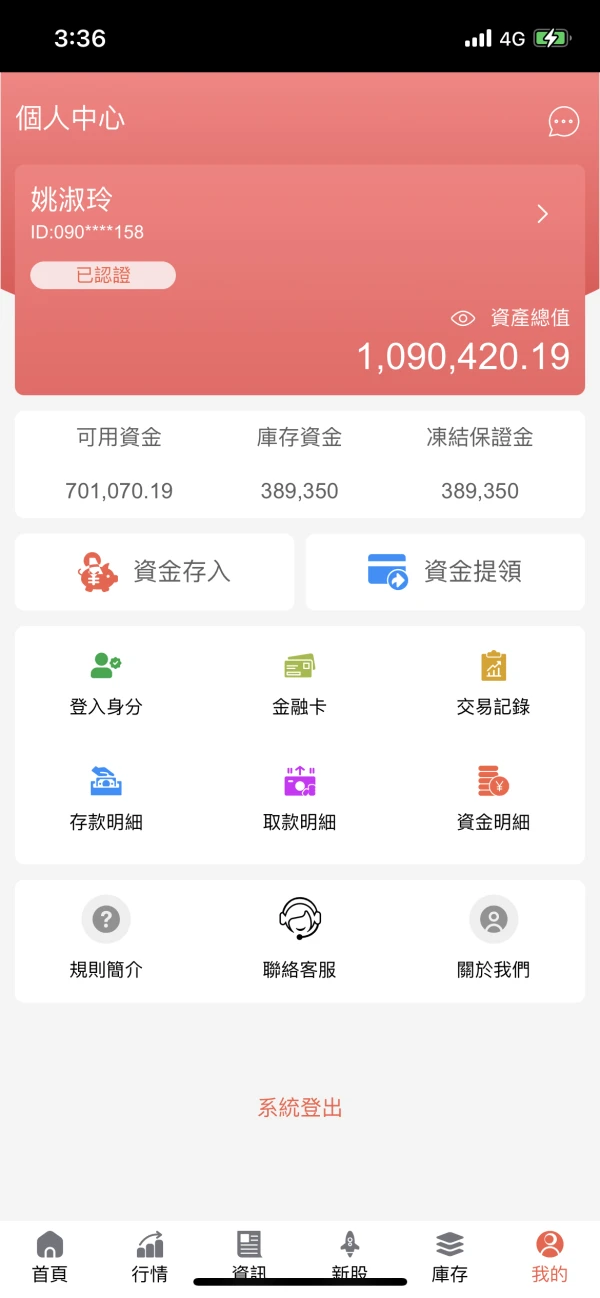

小心假投資 真詐騙 入金要5000開戶 之後又隔日沖 抽籤股 又鉅額 再來圈購 一直強迫被害人入金 等到要出金時說 對方帳戶有問題要繳保證金或 各種理由無法出金 才得知受騙

曝光

FX4802127712

泰国

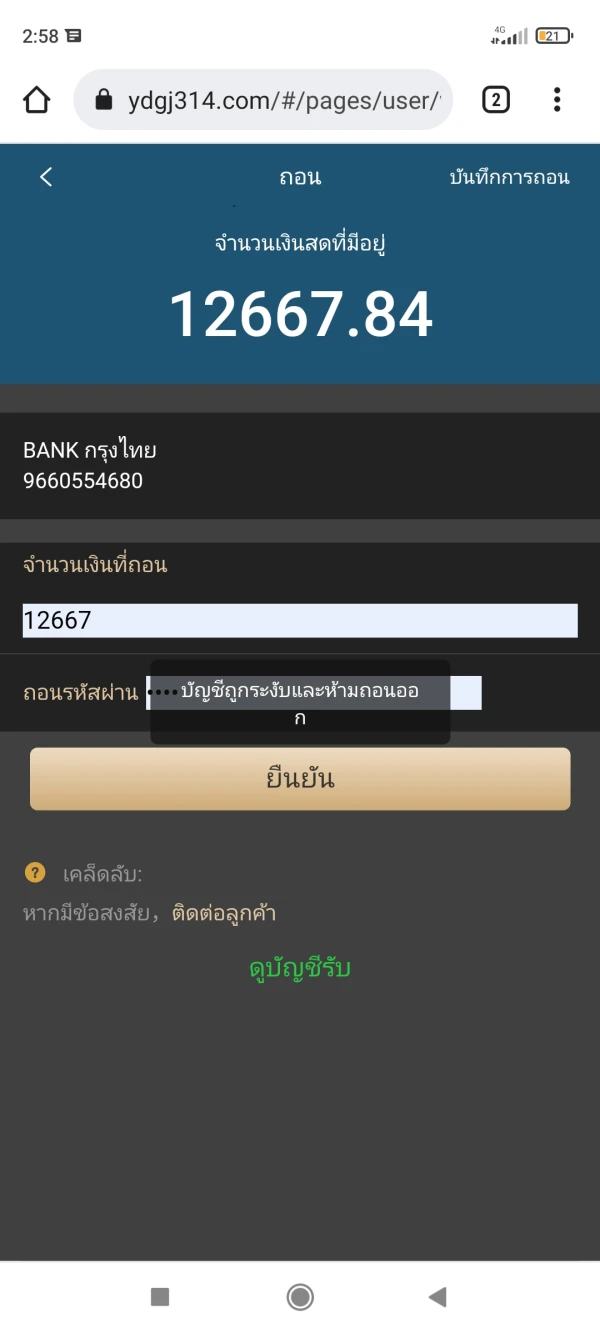

我的身份证怎么会被暂停?那你再说一遍3个月就可以退了,总之是退不退,还是12667作弊?你告诉自己它是可移动的。

曝光

FX1305625852

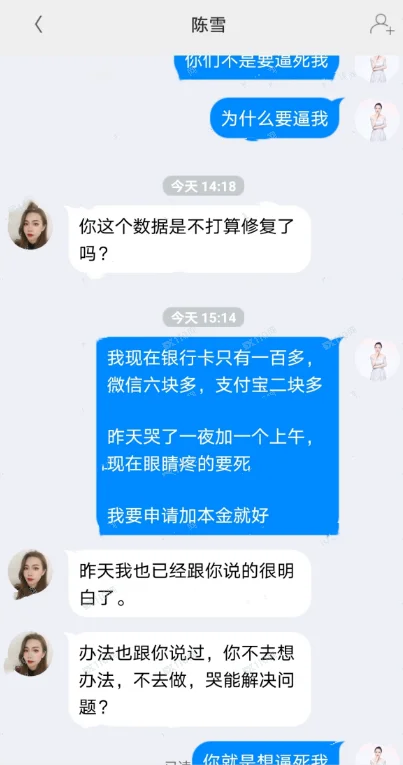

马来西亚

大家一定要警惕这个平台在这里你会一直提现失败,说你没有完成任务,然后那些客服接待员还会一直引诱你借钱继续加本金,今天发在这里曝光他不是请谁来可怜我,是让大家警惕不要再做这个平台了,擦亮眼睛!

曝光

FX3248546053

加拿大

我遇到了“赵思佳”在Facebook上,她推荐赖德交易所,我存入1700 USDT然后成功提取500 USDT;我存入15000 USDT,然后成功提取1300 USDT。当我的总资产是50000 USDT,并成功提取3200 USDT。当我的总资产是80000 USDT,无法提取到32000 USDT。在我成功完成高级认证后,我提取900 USDT都失败了,而且无法提现。

曝光