Thông tin chung

Trung Quốc

Trung QuốcĐiểm

Trung Quốc

|

5-10 năm

|

Trung Quốc

|

5-10 năm

| http://www.dhfutures.com/

Website

Chỉ số đánh giá

Giấy phép

Giấy phépCơ quan sở hữu giấy phép:江苏东华期货有限公司

Số giấy phép cai quản:0209

Trung Quốc

Trung Quốc dhfutures.com

dhfutures.com Trung Quốc

Trung Quốc| DONGHUA FUTURES Tóm tắt đánh giá | |

| Thành lập | 1993 |

| Quốc gia/Vùng | Trung Quốc |

| Quy định | CFFE (được quy định) |

| Công cụ Thị trường | Hợp đồng tương lai, Hàng hóa |

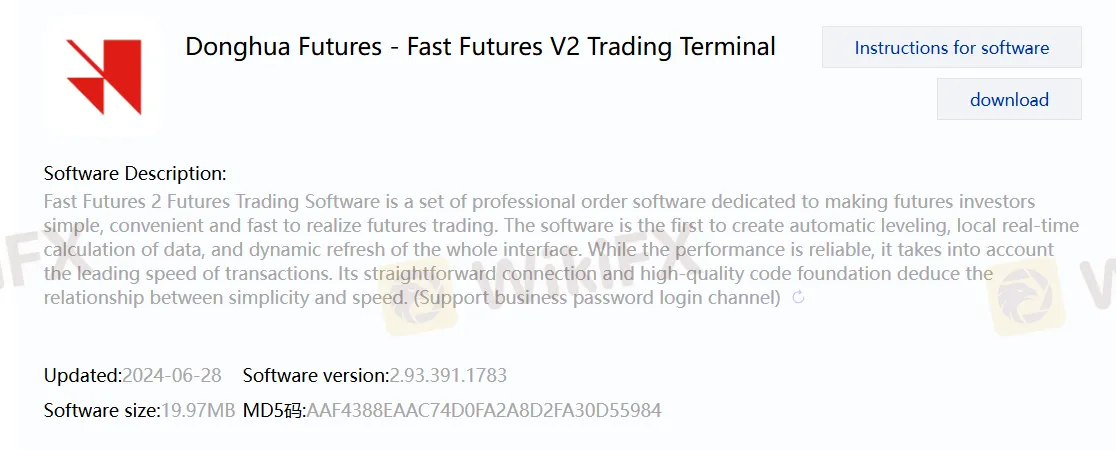

| Nền tảng Giao dịch | Terminal Giao dịch Fast Futures V2, Terminal Giao dịch Fast Futures V3, Bản Cloud Giao dịch Wenhua Yingshun, Bản Cloud Giao dịch Boyi, Phần mềm mã MD5 |

| Hỗ trợ Khách hàng | Mạng xã hội: Tài khoản Chính thức WeChat |

Jiangsu Donghua Futures là một công ty môi giới hợp đồng tương lai được cấp phép bởi Sở Giao dịch Hợp đồng Tương lai Tài chính Trung Quốc. Được thành lập vào năm 1993, công ty là đại lý giao dịch được ủy quyền cho tất cả các hợp đồng hàng hóa và tài chính tương lai được niêm yết tại Trung Quốc. Dịch vụ toàn diện của họ bao gồm thanh toán giao dịch, phối hợp giao nhận, tư vấn thị trường, giáo dục nhà đầu tư và dịch vụ thông tin thị trường.

| Ưu điểm | Nhược điểm |

| Được quy định | Kênh liên hệ hạn chế |

| Thời gian hoạt động lâu | Cấu trúc phí không rõ ràng |

| Nhiều nền tảng giao dịch | Thiếu thông tin về việc gửi và rút tiền |

DONGHUA FUTURES được quy định bởi Sở Giao dịch Hợp đồng Tương lai Tài chính Trung Quốc (CFFE), giữ Giấy phép Hợp đồng Tương lai (Số 0209).

| Quốc gia được quy định | Cơ quan được quy định | Tình trạng Quy định | Thực thể được quy định | Loại Giấy phép | Số Giấy phép |

| Sở Giao dịch Hợp đồng Tương lai Tài chính Trung Quốc (CFFE) | Được quy định | Công ty Hợp đồng Tương lai Jiangsu Donghua | Giấy phép Hợp đồng Tương lai | 0209 |

DONGHUA FUTURES khẳng định cung cấp hợp đồng tương lai và tất cả các hàng hóa được liệt kê tại Trung Quốc.

| Tài sản Giao dịch | Có sẵn |

| hợp đồng tương lai | ✔ |

| hàng hóa | ✔ |

| ngoại hối | ❌ |

| năng lượng | ❌ |

| cổ phiếu | ❌ |

| tiền điện tử | ❌ |

| trái phiếu | ❌ |

| lựa chọn | ❌ |

| ETFs | ❌ |

Các nền tảng giao dịch bao gồm Fast Futures V2 Trading Terminal, Fast Futures V3 Trading Terminal, Wenhua Yingshun Cloud Trading Edition, Boyi Cloud Trading Edition và phần mềm mã MD5.

| Nền tảng Giao dịch | Hỗ trợ | Thiết bị Có sẵn |

| Fast Futures V2 Trading Terminal | ✔ | Máy tính để bàn |

| Fast Futures V3 Trading Terminal | ✔ | Máy tính để bàn |

| Wenhua Yingshun Cloud Trading Edition | ✔ | Máy tính để bàn |

| Boyi Cloud Trading Edition | ✔ | Máy tính để bàn |

| Phần mềm mã MD5 | ✔ | Máy tính để bàn |

Based on my deep dive into DONGHUA FUTURES, one of the fundamental questions I always consider before opening an account is the transparency around deposit and withdrawal fees. For me, clear and upfront information on these costs is a non-negotiable part of trusting any broker. In the case of DONGHUA FUTURES, I found the publicly available information lacking in this area. There’s no straightforward disclosure of their deposit or withdrawal fee structure, and this limited transparency raises an immediate flag in my risk assessment. As an experienced trader, I understand that even regulated brokers can vary widely in how they communicate operational costs. DONGHUA FUTURES is indeed regulated by the China Financial Futures Exchange and has been established for quite some time, indicating a certain level of reliability, at least from a compliance standpoint. However, the absence of explicit information regarding potential charges for account funding or withdrawals prevents me from making concrete assumptions about hidden fees. In my practice, if such details are not easily accessible, I treat it as a potential risk until clarified directly with the broker. Given the caution required when handling funds with any financial intermediary, I personally would contact DONGHUA FUTURES support directly and request a written confirmation before making any significant deposits or withdrawal requests. This step is crucial for safeguarding my capital and ensuring there are no unwelcome surprises. For me, clear communication around fees is a cornerstone of a trustworthy trading relationship.

As a trader who approaches new brokers with caution, I looked into DONGHUA FUTURES to evaluate key metrics like spreads and transparency. Based on the available information, DONGHUA FUTURES is a China-based firm established in 1993, regulated by the China Financial Futures Exchange with an official futures license. However, from what I’ve found, DONGHUA FUTURES only offers trading in futures and listed commodities within China, and does not provide forex products such as EUR/USD. Because forex pairs, including EUR/USD, are not part of their offering, there is no published or typical spread available for EUR/USD on a standard account with them. From my perspective, this lack of forex product availability is crucial to understand before considering DONGHUA FUTURES for any foreign exchange trading activities. Additionally, the general lack of transparency around fee structures and deposit/withdrawal procedures reinforces my conservative stance: traders—myself included—should always prioritize full clarity and regulatory safeguards. In summary, if EUR/USD spreads are a deciding factor for you, DONGHUA FUTURES would not meet that requirement, since they do not provide forex trading at all.

From my experience as a trader, the regulatory status of DONGHUA FUTURES offers some important safeguards, although it is crucial to have realistic expectations. DONGHUA FUTURES is regulated in China by the China Financial Futures Exchange (CFFE), holding an official Futures License (No. 0209). In my view, regulation by a recognized authority means the company must adhere to specific rules set by the regulator, such as maintaining minimum capital requirements, segregating client funds, and submitting to compliance checks. These measures can help mitigate operational risks, and offer a layer of protection against mismanagement or malpractice, which is particularly important in the often-volatile futures markets. However, I always remind myself that regulation alone does not guarantee the absolute safety of funds. While oversight by the CFFE suggests some degree of legitimacy and company accountability, I am also mindful that the actual effectiveness of these protections can depend on both the robustness of local regulatory frameworks and how actively they are enforced. It is worth noting that DONGHUA FUTURES does not offer a broad range of asset classes; their license specifically covers futures and commodities trading within China, not forex, stocks, or other instruments. For me, transparency, regulatory adherence, and a clear operational history are key factors, but I would still remain vigilant, monitor communications, and carefully assess the procedures for deposits and withdrawals before fully trusting any platform with my capital.

As an experienced trader, I take the legitimacy and transparency of any brokerage I use very seriously, especially when it comes to platforms operating within China’s regulatory landscape. Based on my careful review, DONGHUA FUTURES holds a valid futures license and is regulated by the China Financial Futures Exchange—this is a foundational requirement for legitimacy in the Chinese market. The company’s relatively long operational history, reportedly established in 1993, also provides some assurance of stability and ongoing compliance. I’ve noted that their offering is strictly limited to Chinese-listed commodity and financial futures, with no access to forex, stocks, or other global instruments, aligning with their regulatory scope and suggesting a conservative business model. The broker uses several proprietary trading platforms, which appear to be robust and locally focused, but this also means international traders or those accustomed to platforms like MT4/5 may not find it suitable. On the cautionary side, I observed a lack of clarity regarding fee structures, deposit/withdrawal processes, and limited contact channels. For me, these gaps are significant, as they hinder full transparency and may present challenges if account or transaction issues arise. In my judgment, the broker does fulfill core regulatory and operational criteria for legitimacy within China’s futures market, but I would approach them cautiously and recommend verifying all costs and terms in detail before committing funds. This posture, in my experience, helps manage potential risks in an evolving regulatory environment.

Vui lòng nhập...

TOP

TOP

Chrome

Chrome extension

Yêu cầu về quy định của nhà môi giới ngoại hối toàn cầu

Đánh giá nhanh chóng website của các sàn giao dịch

Tải ngay