Điểm

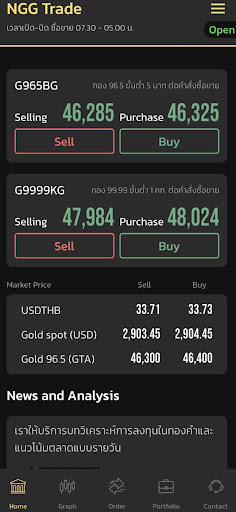

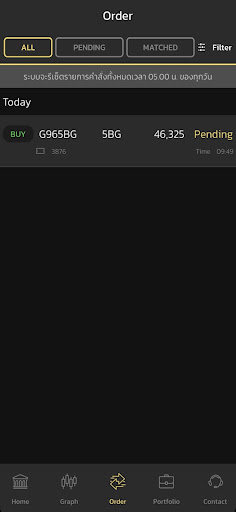

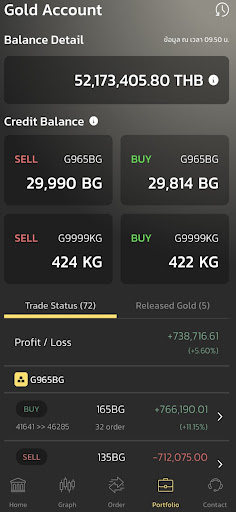

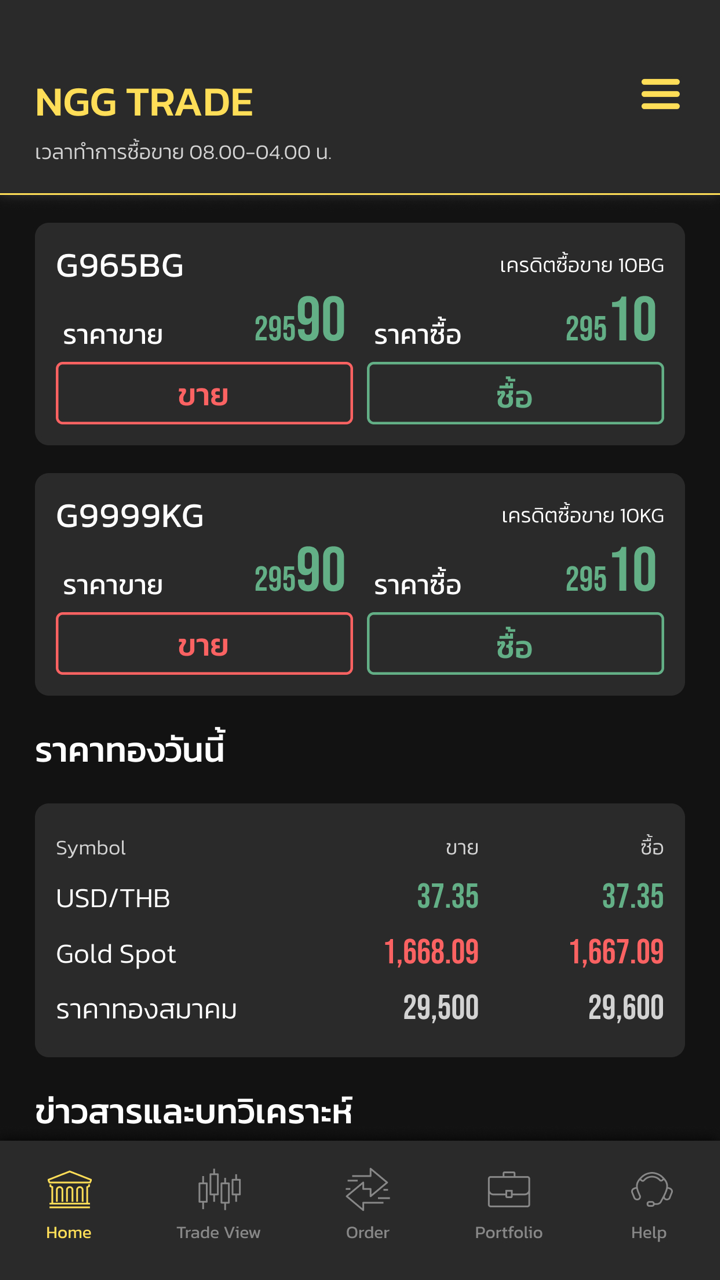

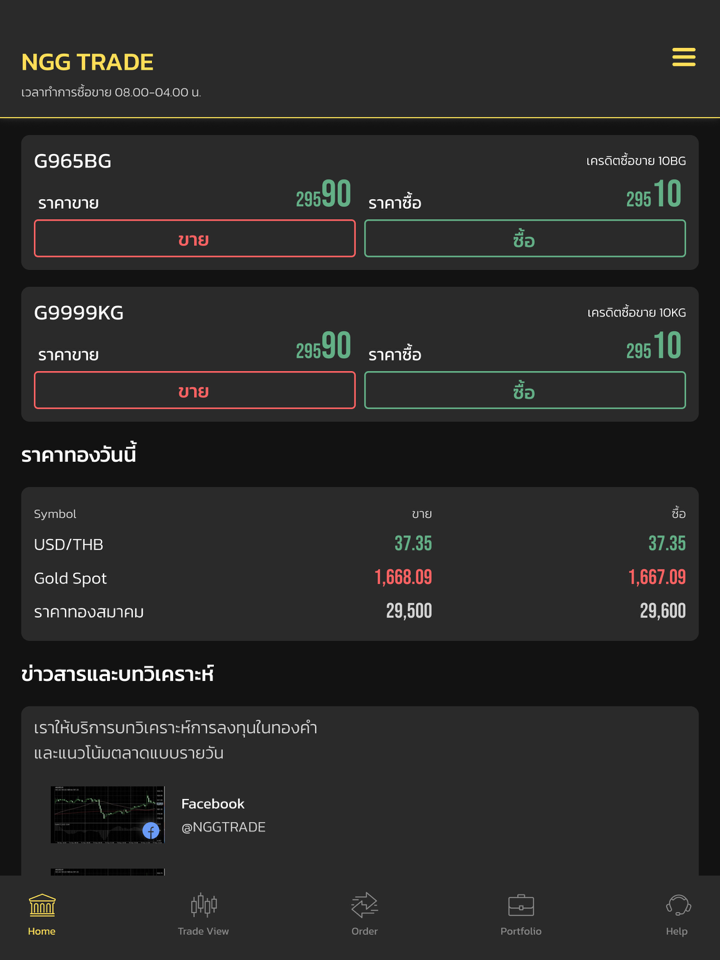

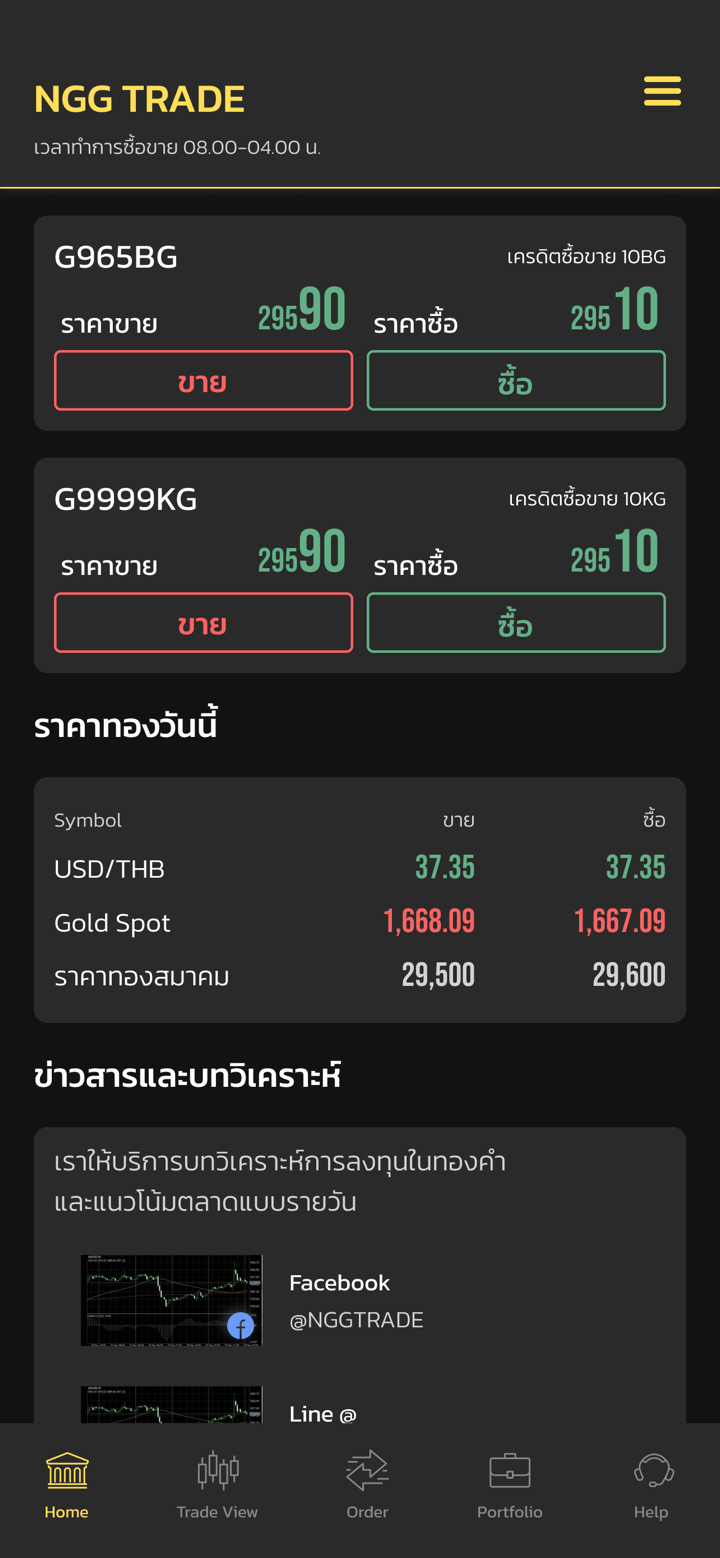

NGG TRADE

Thái Lan | 5-10 năm |

Thái Lan | 5-10 năm |https://www.nggtrade.com/?lang=en#

Website

Chỉ số đánh giá

Nhận dạng MT4/5

MT4/5

Chính thức

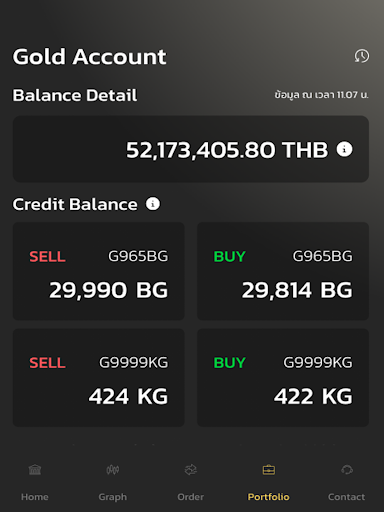

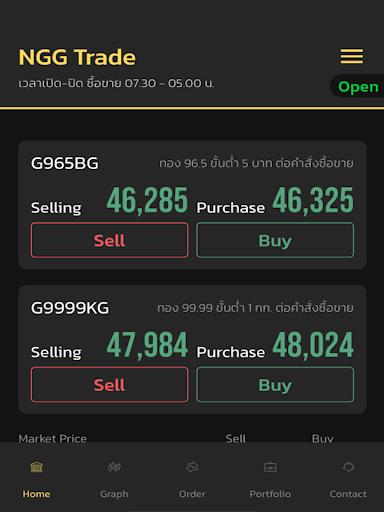

NGGTRADE-Precious Investment

Mức ảnh hưởng

C

Mức ảnh hưởng NO.1

Thái Lan 3.03

Thái Lan 3.03 Nhận dạng MT4/5

Nhận dạng MT4/5

Chính thức

Singapore

SingaporeMức ảnh hưởng

Mức ảnh hưởng

C

Mức ảnh hưởng NO.1

Thái Lan 3.03

Thái Lan 3.03 Liên hệ

Cơ quan quản lý Forex

Cơ quan quản lý Forex

Không tìm thấy giấy phép giao dịch ngoại hối. Vui lòng lưu ý những rủi ro.

- Sàn giao dịch này thiếu quy định ngoại hối hợp lệ. Vui lòng lưu ý rủi ro!

Thông tin chung

Thái Lan

Thái Lan

Các nhà giao dịch MT4/5 chính thức sẽ có dịch vụ hệ thống âm thanh và hỗ trợ kỹ thuật tiếp theo. Nhìn chung, hoạt động kinh doanh và công nghệ của họ tương đối hoàn thiện và khả năng kiểm soát rủi ro của họ rất mạnh

Người dùng đã xem NGG TRADE cũng đã xem..

GO Markets

STARTRADER

PU Prime

HANTEC MARKETS

Website

nggtrade.com

203.150.228.102Vị trí ServerThái Lan

Số lưu hồ sơ--Quốc gia/khu vực phổ biến--Thời gian thành lập tên miền--Website--Công ty--

Sơ đồ quan hệ

Các công ty liên quan

Tóm tắt về công ty

- 5-10 năm

- Giấy phép giám sát quản lý có dấu hiệu đáng ngờ

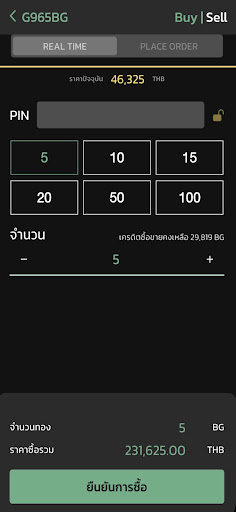

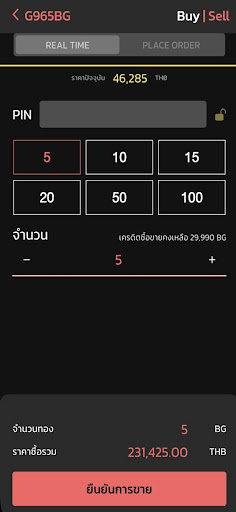

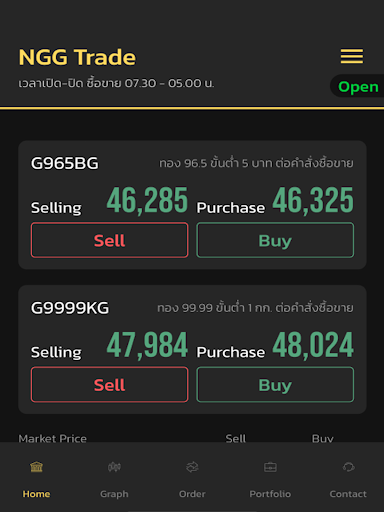

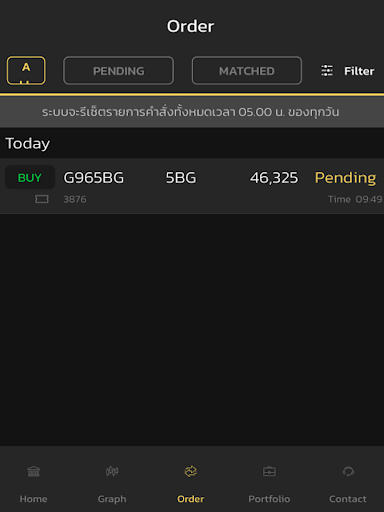

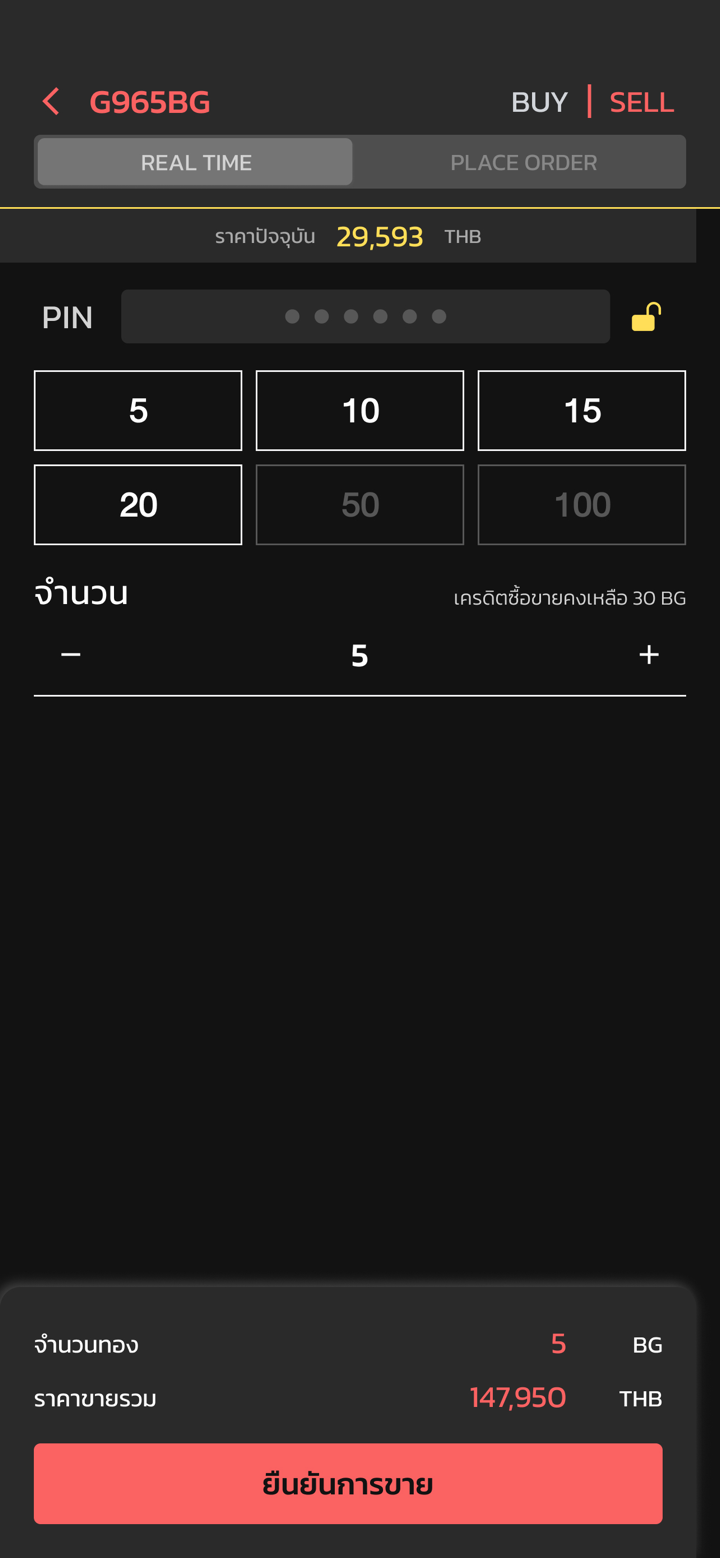

- MT5 Chính thức

- Tự tìm hiểu

- Nhà môi giới khu vực

- Nguy cơ rủi ro cao

Hỏi & Đáp về Wiki

Does NGG provide a free demo account, and if so, are there any restrictions such as a time limit?

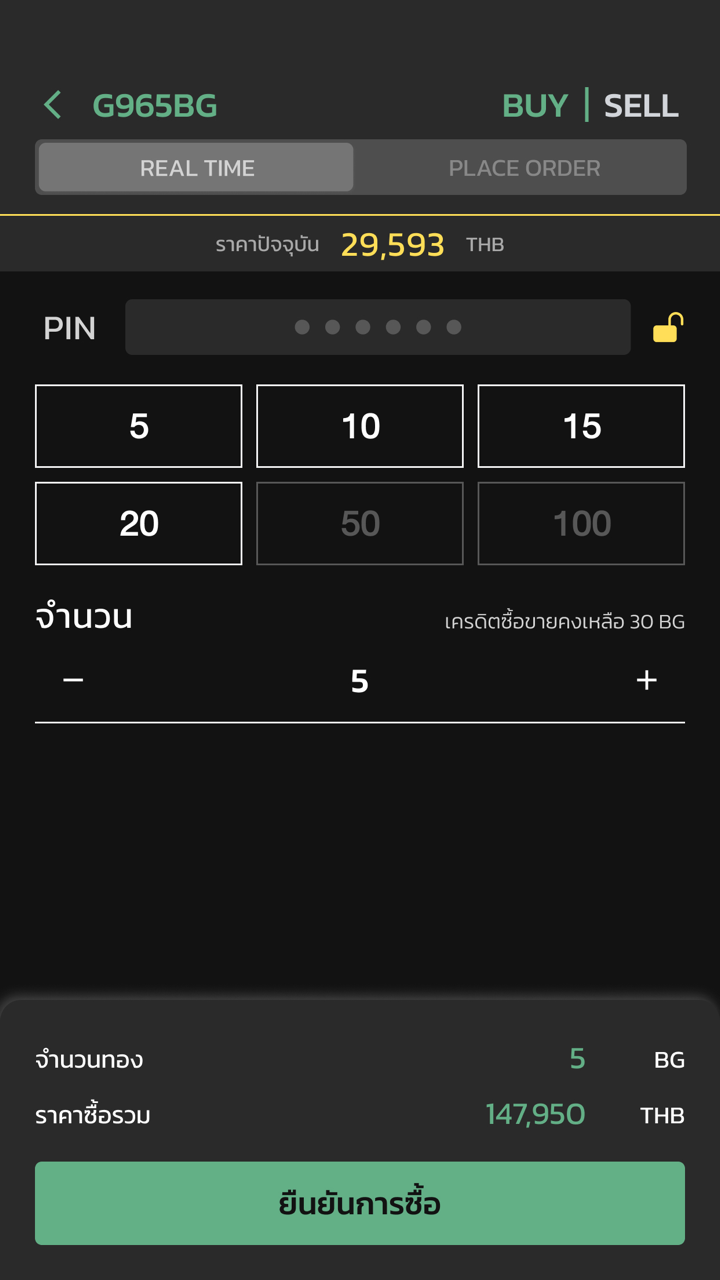

Based on my research and personal review, I could not find any clear indication that NGG offers a free demo account. For me as an experienced trader, access to a risk-free demo environment is especially important when considering a new broker, particularly one that is unregulated and specialized in a single market like gold. While NGG does provide trading on MT5 and its proprietary NGG Trade App, and the platform details are laid out for live accounts, there’s no mention of demo options, time limitations, or access conditions. This lack of information around demo accounts is a notable concern for me, as it removes the opportunity for traders to safely test execution, platform features, and service quality before risking real money. In the context of brokers with limited regulation and transparency, a demo account can be a crucial tool to build trust and understanding of conditions and potential hidden barriers. Because of this, I would approach with heightened caution, and if demo access is essential for my trading decisions—as it is for most responsible traders—I would consider reaching out directly to NGG’s support for clarification, and be prepared to look for alternatives if the absence of a demo account persists.

How much is the smallest amount I’m allowed to withdraw from my NGG account in a single transaction?

As someone who takes due diligence very seriously in all my trading activities, especially when considering brokers without regulatory oversight, I have closely examined NGG’s available information. Unfortunately, based on what I have seen, NGG does not publicly state a clear minimum withdrawal amount per transaction. The broker does specify that withdrawals require manually filling out a form and submitting it directly to their customer service email or Line account, but the absence of transparent, fixed minimums raises additional caution for me. In my experience, a lack of explicit withdrawal thresholds can complicate financial planning and may contribute to uncertainty, particularly with an unregulated broker. Personally, I consider this a red flag, and I would need direct confirmation from NGG’s support before assuming my desired withdrawal amount is permitted. Given the high-risk nature suggested by their unregulated status and limited transparency, I always recommend erring on the side of caution and confirming all money movement conditions before making any deposits or trading decisions with NGG.

Is NGG overseen by any financial regulators, and if so, which authorities are responsible for their regulation?

From my experience and careful review of NGG, I found no evidence that this broker is overseen by any recognized financial regulators. According to all the information I could verify, NGG operates without a valid regulatory license. This lack of regulation is not a trivial issue for me as a trader, because when a broker is unregulated, there’s no independent authority actively supervising its activities or enforcing compliance with industry standards. As someone who places a high priority on the safety of my trading capital and the fairness of execution, I am always cautious with unregulated brokers, regardless of any technical strengths or product offerings they might have. In my view, regulation is critical in maintaining transparency and recourse for clients. Without an established regulatory framework, traders do not have a reliable path to recourse if disputes arise, and there is a higher inherent risk related to the handling of funds and market integrity. While NGG positions itself as a gold-focused broker with platforms like MT5 and its own NGG Trade app, the absence of formal regulatory oversight is a fundamental concern in my evaluation of its reliability and trustworthiness for financial transactions.

How do the different account types provided by NGG differ from one another?

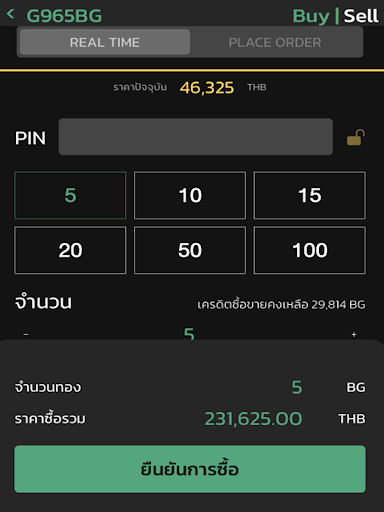

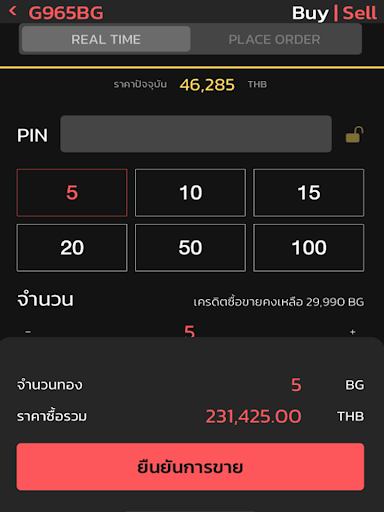

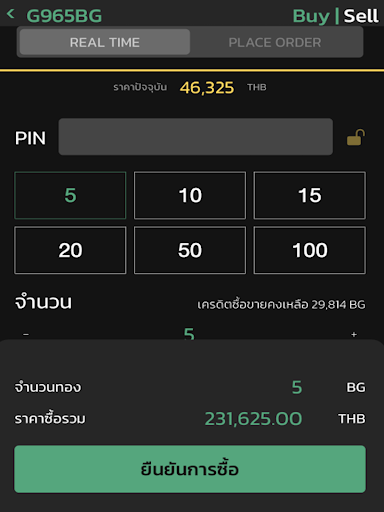

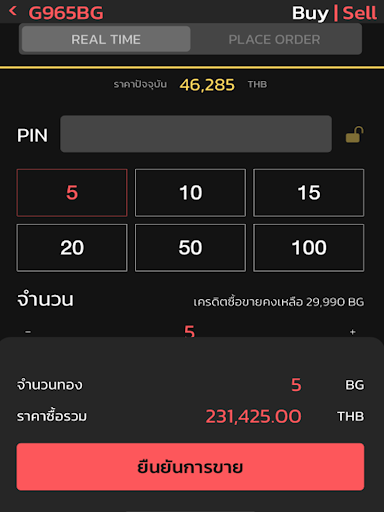

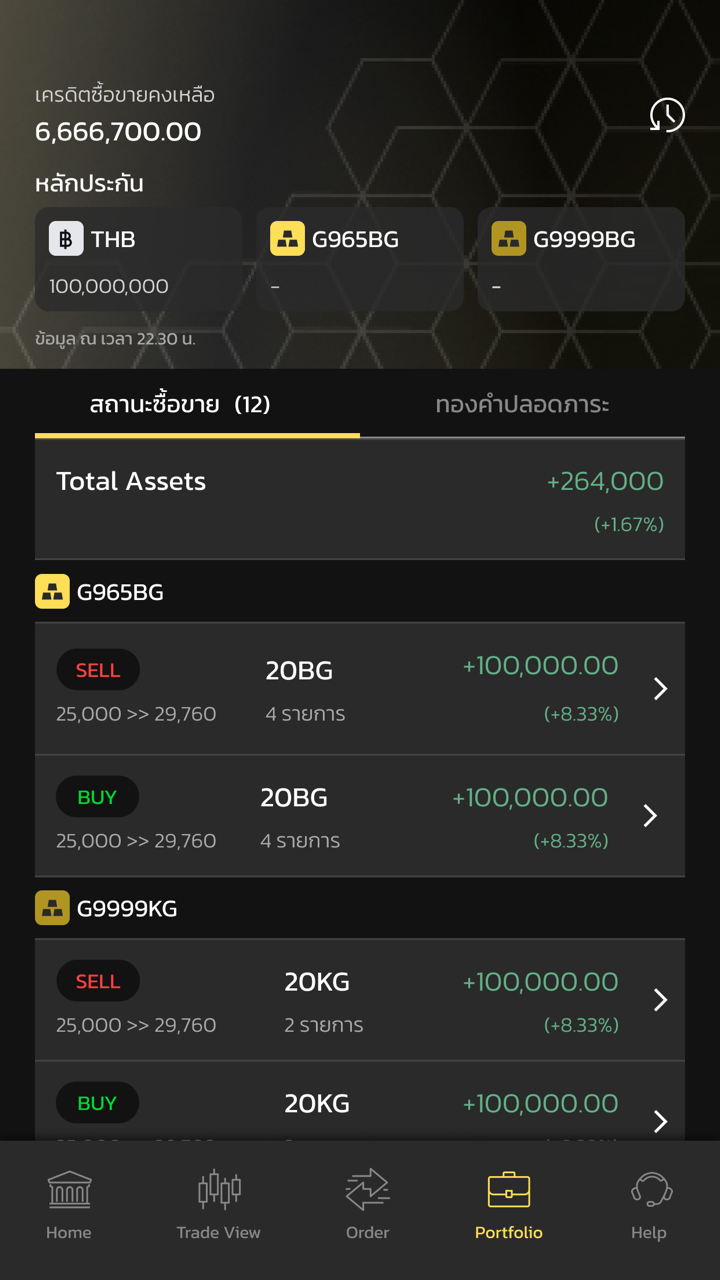

In my review of NGG, I found that the broker is quite specialized, focusing exclusively on gold trading. When I examined their account types, it became clear that NGG does not offer the typical variety of account structures found at larger, regulated brokers. Instead, the only explicitly mentioned account variant is an Islamic account geared towards traders who require Sharia-compliant investing. There is no information available—at least from what I could access—regarding standard, ECN, or premium accounts, nor any details on tiered offerings based on deposit size, leverage, or enhanced trading conditions. This singular focus may simplify choices, but it also limits flexibility for traders seeking tailored solutions, such as accounts for high-frequency trading or VIP clients. What I did notice is that NGG’s accounts require a gold-collateralized deposit, with a margin arrangement specific to gold bar values—this is a very different setup compared to typical forex accounts denominated in fiat currency. For me, this means that the "account type" here is essentially defined more by margin and collateral parameters than by the usual differentiators like spreads, commissions, or asset classes. Given the lack of regulatory oversight and minimal transparency around account structures, my experience leads me to advise caution. For traders who have specialized needs or require more robust account segregation and clear, published conditions, NGG’s single-account model could be a drawback. The limited offerings may suffice for those strictly focused on gold and needing an Islamic account, but for broader trading objectives, this setup is restrictive.

Nội dung bình luận

Vui lòng nhập...

TOP

TOP

Chrome

Chrome extension

Yêu cầu về quy định của nhà môi giới ngoại hối toàn cầu

Đánh giá nhanh chóng website của các sàn giao dịch

Tải ngay