Giới thiệu doanh nghiệp

| Oriental Securities Corporation Tóm tắt Đánh giá | |

| Thành lập | 1979 |

| Quốc gia/Vùng | Đài Loan |

| Quy định | Sở giao dịch Đài Bắc |

| Công cụ Thị trường | Chứng khoán, Hợp đồng tương lai, Trái phiếu |

| Nền tảng Giao dịch | Oriental Securities Corporation-亞東e指賺 |

| Hỗ trợ Khách hàng | Điện thoại: 02-7753-1899;0800-088-567;02-405-0218 |

| Email: service@osc.com.tw | |

Thông tin về Oriental Securities Corporation

Oriental Securities Corporation, thành lập tại Đài Loan vào năm 1979 và được quy định bởi Sở giao dịch Đài Bắc, là một nền tảng giao dịch trực tuyến cung cấp giao dịch các tài sản tài chính đa dạng và cung cấp một nền tảng giao dịch di động.

Ưu điểm và Nhược điểm

| Ưu điểm | Nhược điểm |

|

|

| |

|

Oriental Securities Corporation Có Uy tín không?

Oriental Securities Corporation có giấy phép "Giao dịch chứng khoán" được quy định bởi Sở giao dịch Đài Bắc tại Đài Loan.

Tôi có thể giao dịch gì trên Oriental Securities Corporation?

Nền tảng Oriental Securities Corporation cung cấp các tài sản tài chính để giao dịch, bao gồm chứng khoán, hợp đồng tương lai và trái phiếu.

| Công cụ Giao dịch | Hỗ trợ |

| Chứng khoán | ✔ |

| Hợp đồng tương lai | ✔ |

| Trái phiếu | ✔ |

| Forex | ❌ |

| Hàng hóa | ❌ |

| Chỉ số | ❌ |

| Cổ phiếu | ❌ |

| Tiền điện tử | ❌ |

| Options | ❌ |

| ETFs | ❌ |

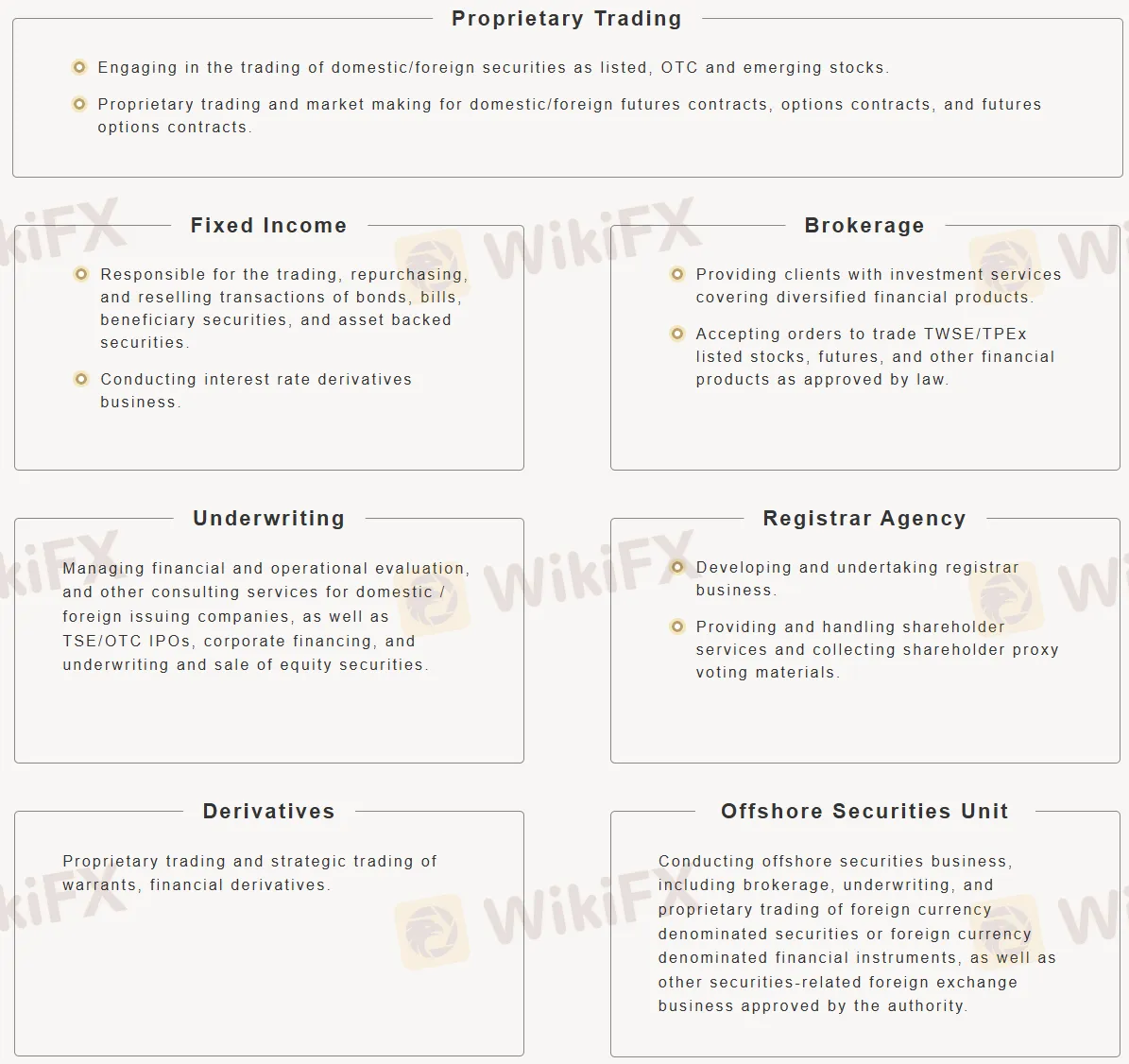

Các Doanh nghiệp Chính

Dưới đây là các ngành kinh doanh chính của Oriental Securities Corporation:

- Proprietary Trading: Giao dịch cổ phiếu và các hợp đồng tương lai/ tùy chọn khác nhau.

- Fixed Income: Xử lý trái phiếu và các sản phẩm tài chính liên quan đến lãi suất.

- Brokerage: Cung cấp dịch vụ đầu tư và thực hiện giao dịch cho khách hàng (cổ phiếu, hợp đồng tương lai, v.v.).

- Underwriting: Quản lý IPOs, tài chính doanh nghiệp và bán hàng cổ phiếu.

- Registrar Agency: Xử lý dịch vụ cổ đông và bỏ phiếu ủy quyền.

- Derivatives: Giao dịch phiếu mua quyền và các sản phẩm tài chính phái sinh.

- Offshore Securities Unit: Tiến hành kinh doanh chứng khoán quốc tế (môi giới, phát hành, giao dịch cổ phiếu trong ngoại tệ).

Nền tảng Giao dịch

| Nền tảng Giao dịch | Hỗ trợ | Thiết Bị Có Sẵn |

| Oriental Securities Corporation-亞東e指賺 | ✔ | IOS, Android |