Company Summary

| Oriental Securities Corporation Review Summary | |

| Founded | 1979 |

| Registered Country/Region | Taiwan |

| Regulation | Taipei Exchange |

| Market Instruments | Securities, Futures, Bonds |

| Trading Platform | 亞東證券-亞東e指賺 |

| Customer Support | Tel: 02-7753-1899;0800-088-567;02-405-0218 |

| Email: service@osc.com.tw | |

Oriental Securities Corporation Information

Oriental Securities Corporation, established in Taiwan in 1979 and regulated by the Taipei Exchange, is an online trading platform that offers trading in diverse financial assets and provides a mobile trading platform.

Pros and Cons

| Pros | Cons |

|

|

| |

|

Is Oriental Securities Corporation Legit?

Oriental Securities Corporation has a “Dealing in securities” license regulated by the Taipei Exchange in Taiwan.

What Can I Trade on Oriental Securities Corporation?

Oriental Securities Corporation platform offers financial assets to trade, including securities, futures, and bonds.

| Tradable Instruments | Supported |

| Securities | ✔ |

| Futures | ✔ |

| Bonds | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Major Businesses

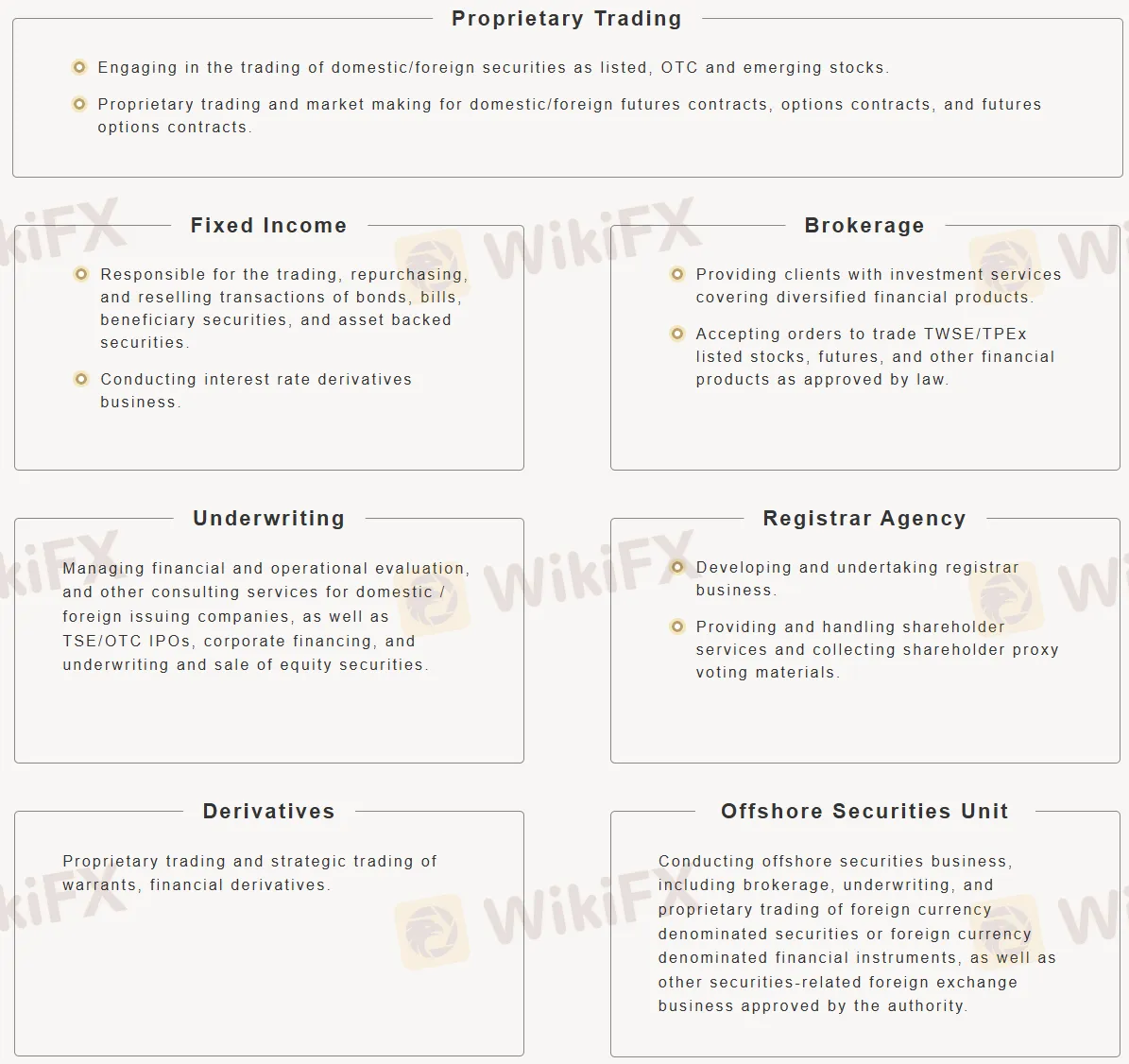

Here are the major businesses of Oriental Securities Corporation:

- Proprietary Trading: Trades stocks and various futures/options.

- Fixed Income: Deals with bonds and interest rate derivatives.

- Brokerage: Offers investment services and executes trades for clients (stocks, futures, etc.).

- Underwriting: Manages IPOs, corporate financing, and equity sales.

- Registrar Agency: Handles shareholder services and proxy voting.

- Derivatives: Trades warrants and financial derivatives.

- Offshore Securities Unit: Conducts international securities business (brokerage, underwriting, proprietary trading in foreign currencies).

Trading Platform

| Trading Platform | Supported | Available Devices |

| 亞東證券-亞東e指賺 | ✔ | IOS, Android |