Giới thiệu doanh nghiệp

| DBFS Tóm tắt Đánh giá | |

| Thành lập | 2008 |

| Quốc gia/Vùng đăng ký | Ấn Độ |

| Quy định | Không có quy định |

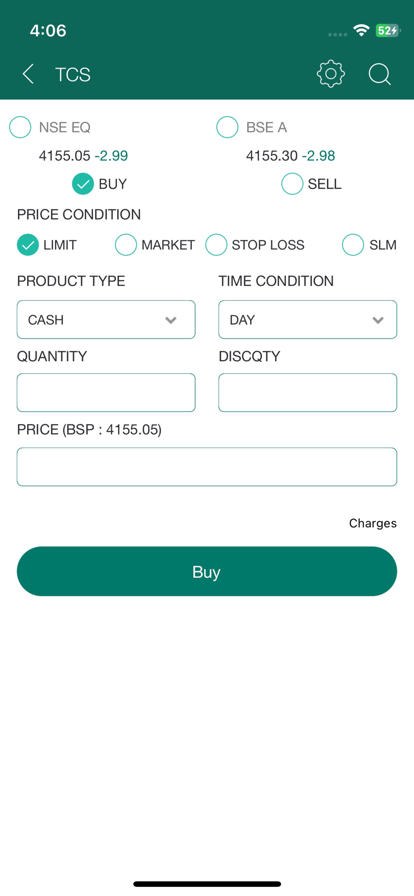

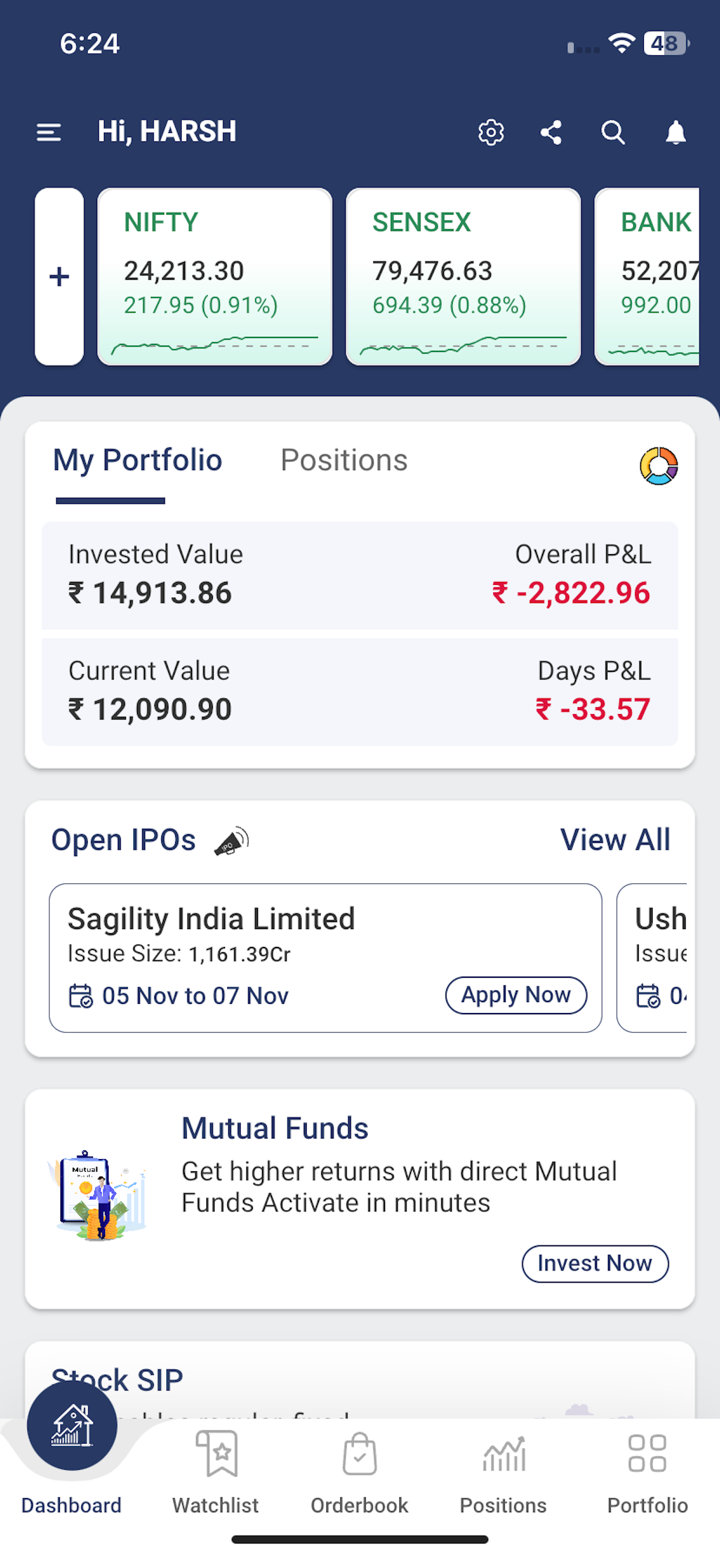

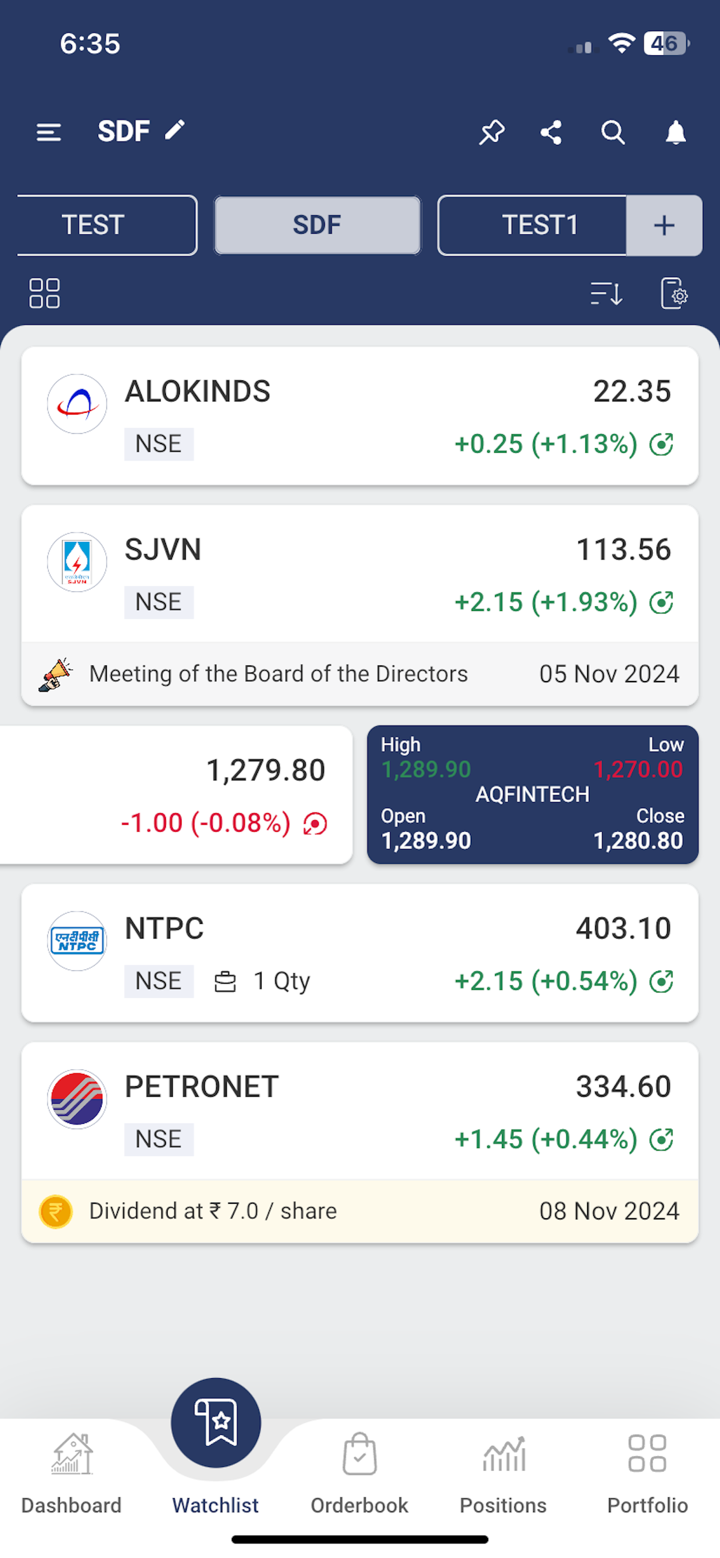

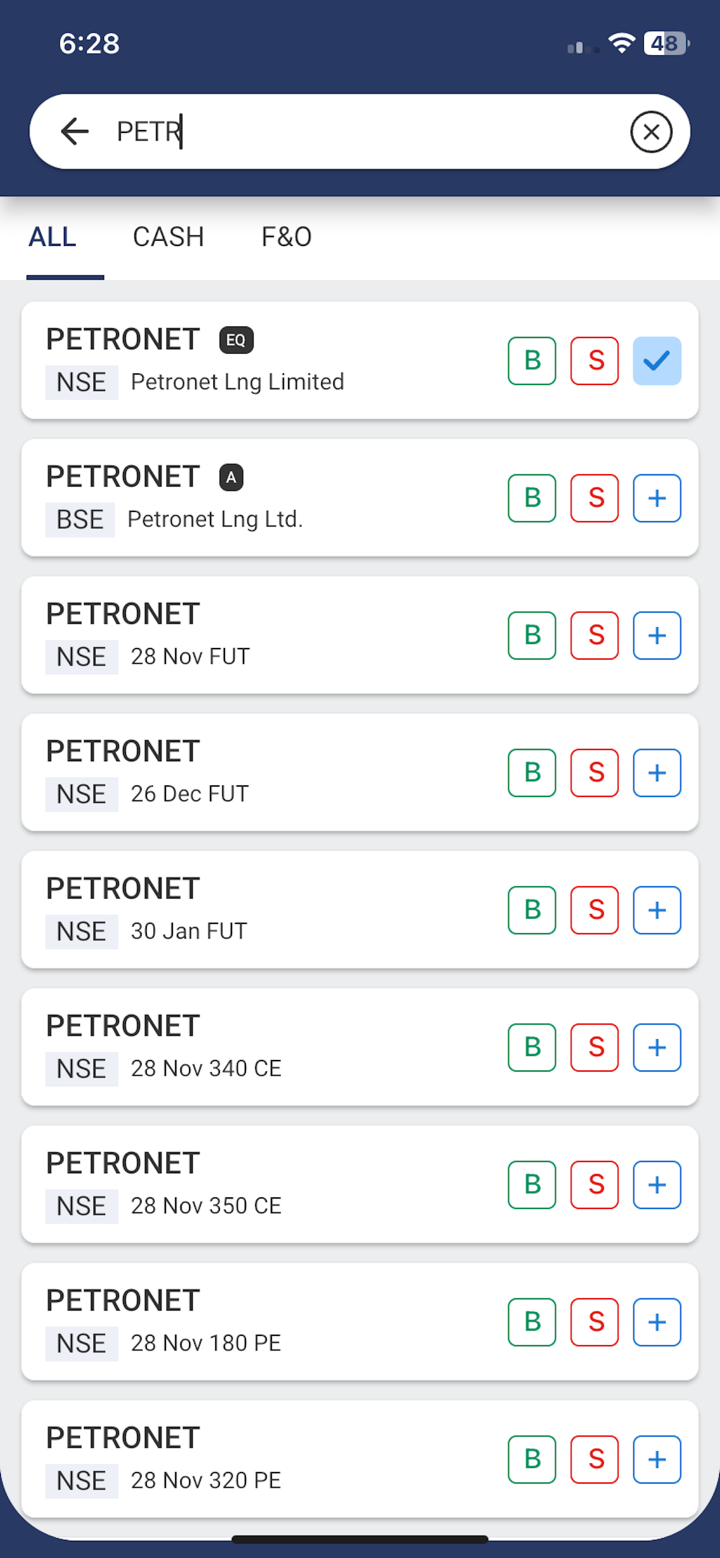

| Sản phẩm Giao dịch | cổ phiếu, trái phiếu, quỹ hỗn hợp, tương lai, tùy chọn |

| Tài khoản Demo | ✅ |

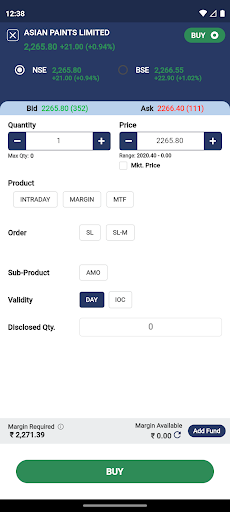

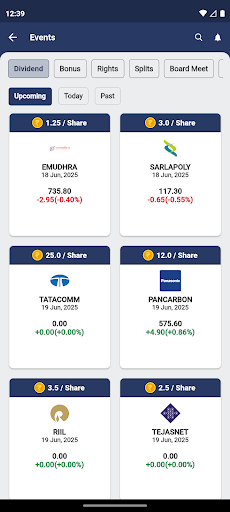

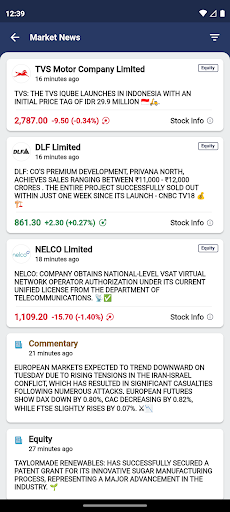

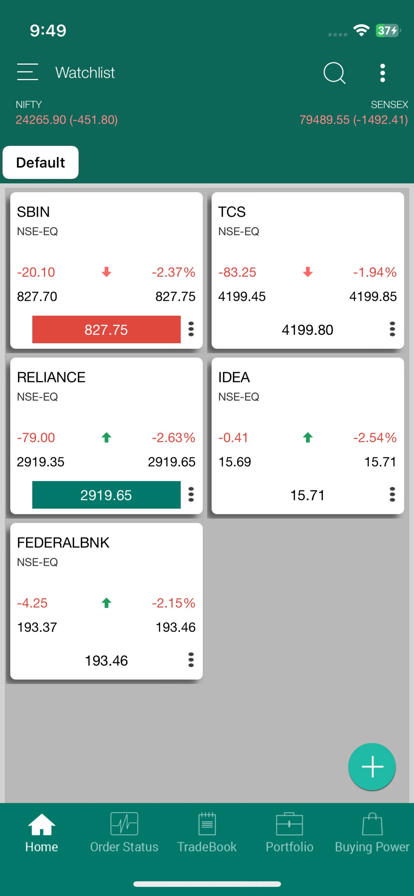

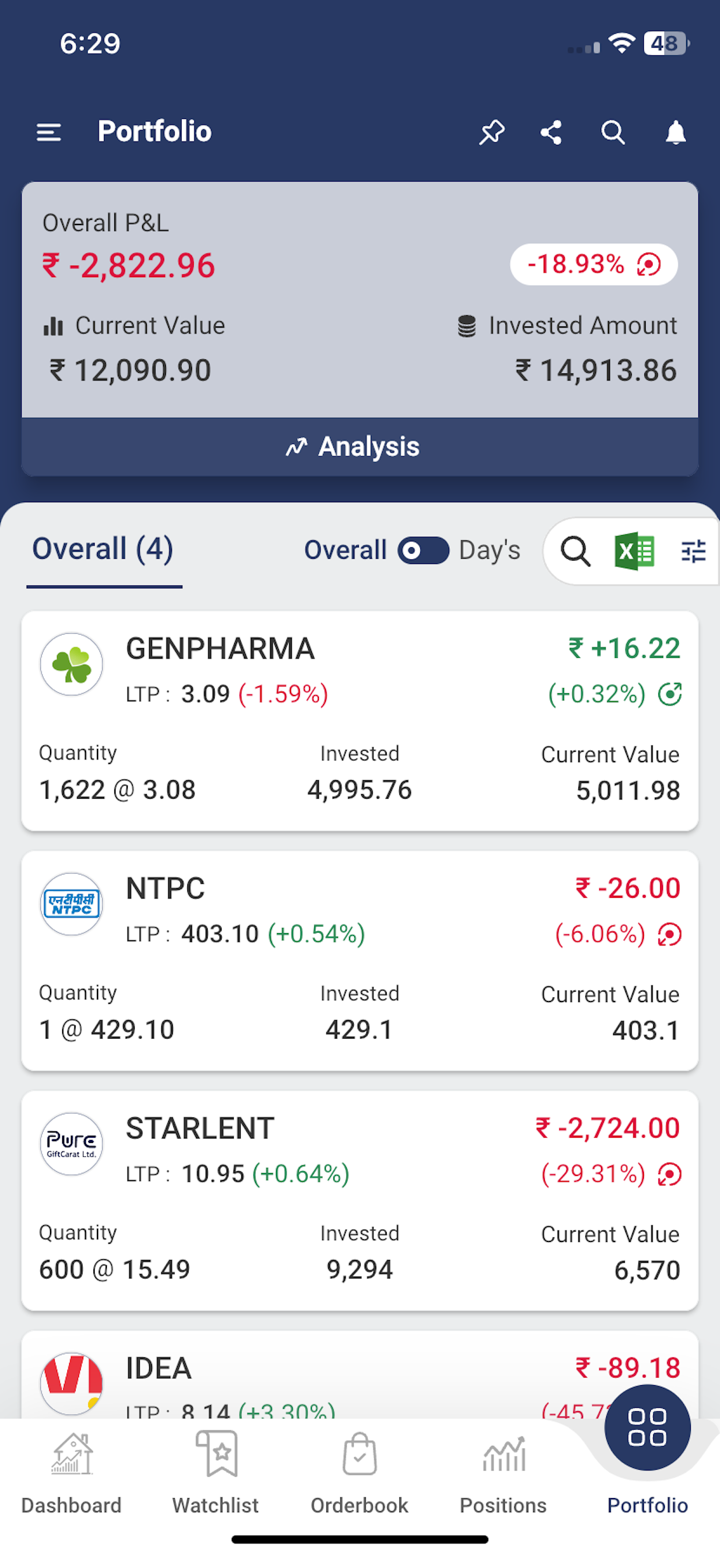

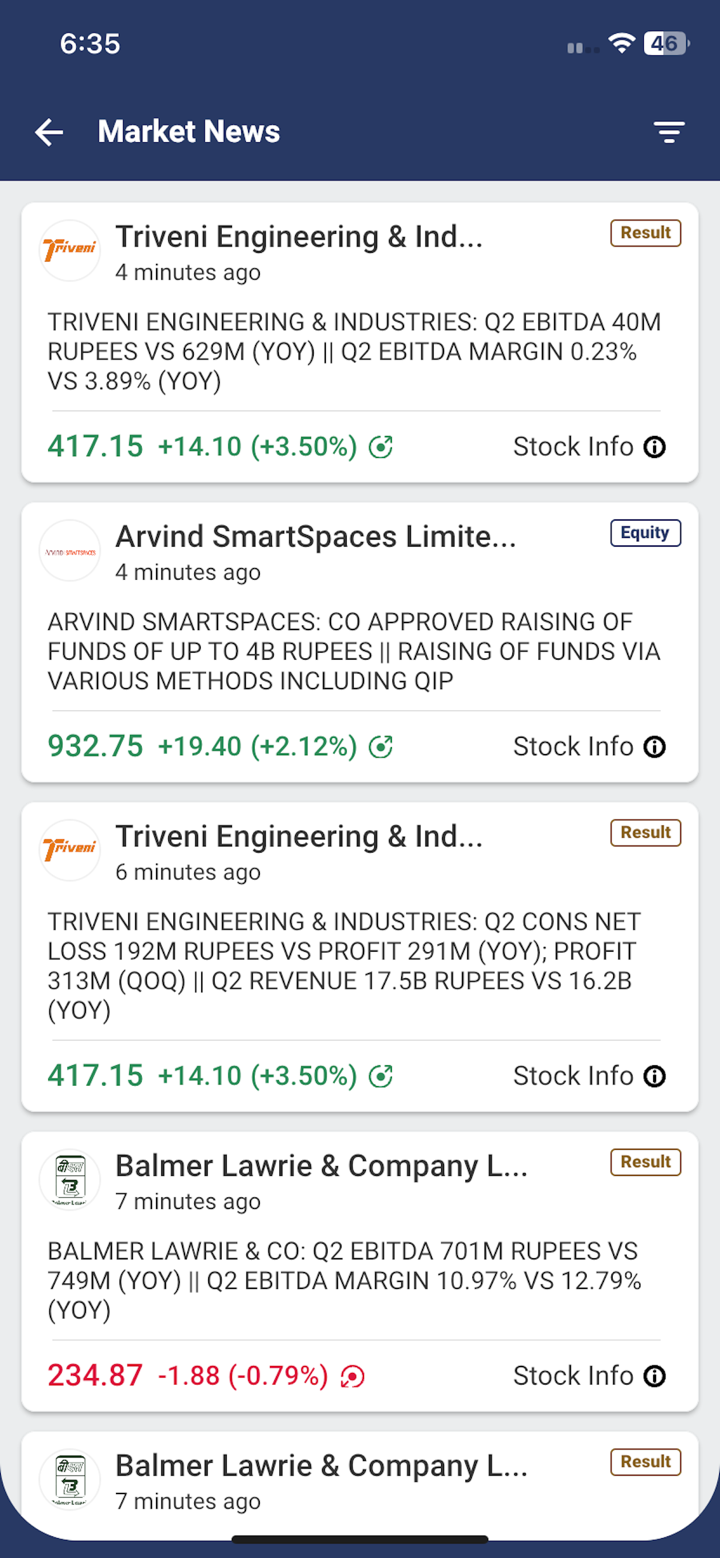

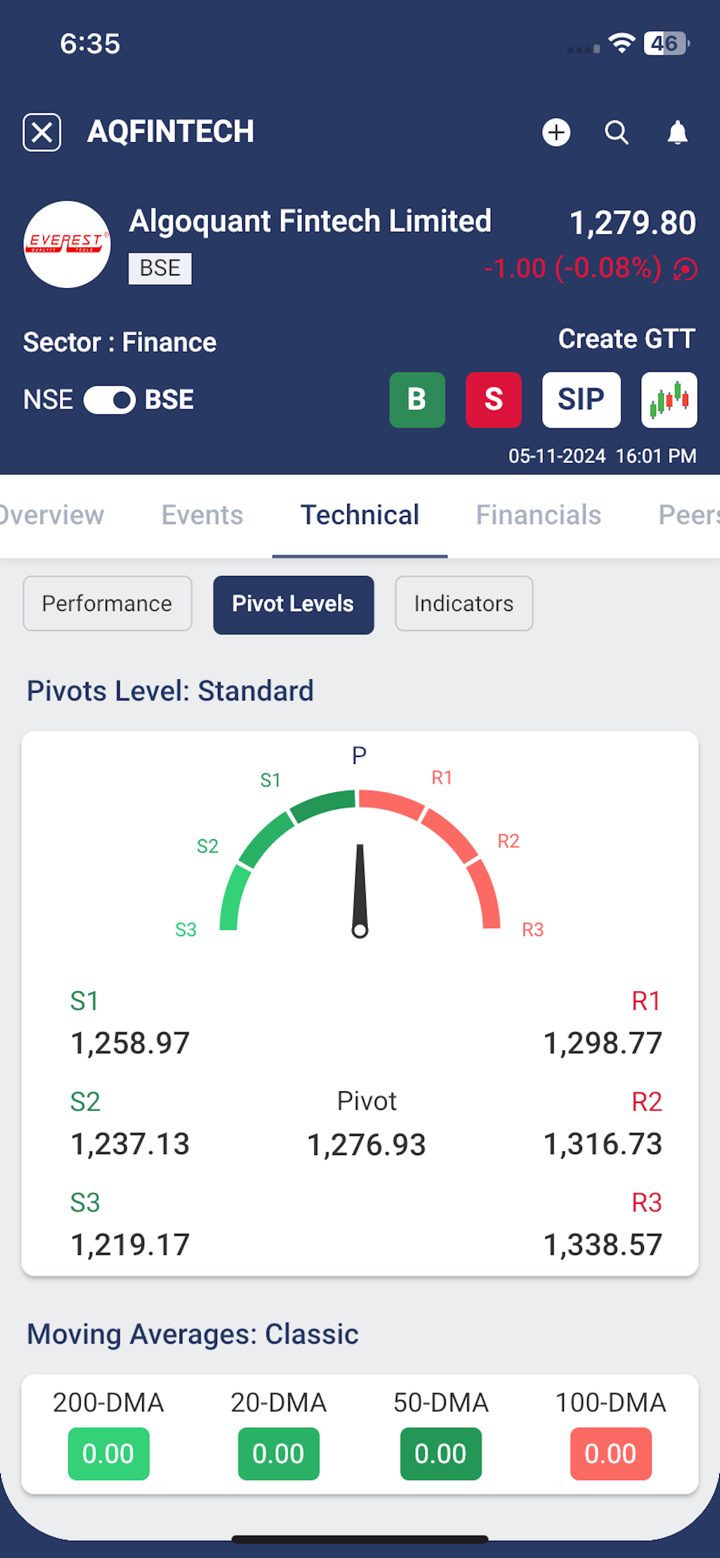

| Nền tảng Giao dịch | Ứng dụng DBFS |

| Yêu cầu Tiền gửi Tối thiểu | / |

| Hỗ trợ Khách hàng | Điện thoại: 91 484 256 6000 /260 |

| Email: helpdesk@dbfsindia.com, ho@dbfsindia.com | |

| Địa chỉ: Tầng 2, Tòa nhà Chammany, Đường Kaloor – Kadavanthra, Kaloor, Kochi, Kerala – 682017 | |

| Facebook, YouTube, Instagram, LinkedIn, X | |

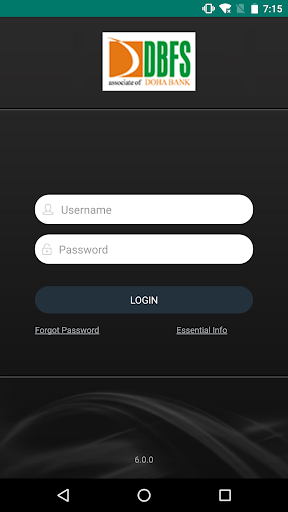

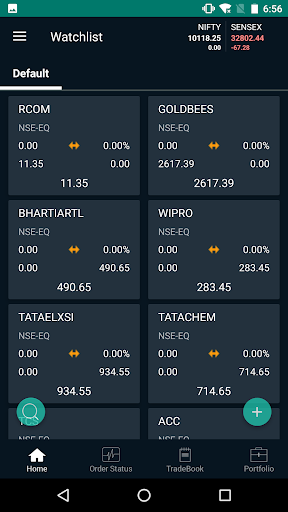

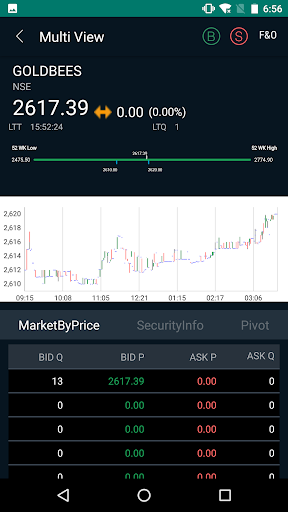

DBFS là một công ty tài chính không được quy định thành lập vào năm 2008, có trụ sở tại Ấn Độ. Công ty cung cấp giao dịch các loại cổ phiếu, trái phiếu, quỹ hỗn hợp, tương lai và tùy chọn. Công ty cung cấp tài khoản demo và ứng dụng DBFS, có sẵn trên cả App Store và Google Play. Tuy nhiên, thông tin về phí giao dịch và chi tiết tài khoản có hạn chế.

Ưu điểm và Nhược điểm

| Ưu điểm | Nhược điểm |

| Có sẵn tài khoản demo | Không có quy định |

| Đa dạng sản phẩm giao dịch | Thông tin hạn chế về tài khoản |

| Thông tin hạn chế về phí giao dịch |

DBFS Có Uy tín không?

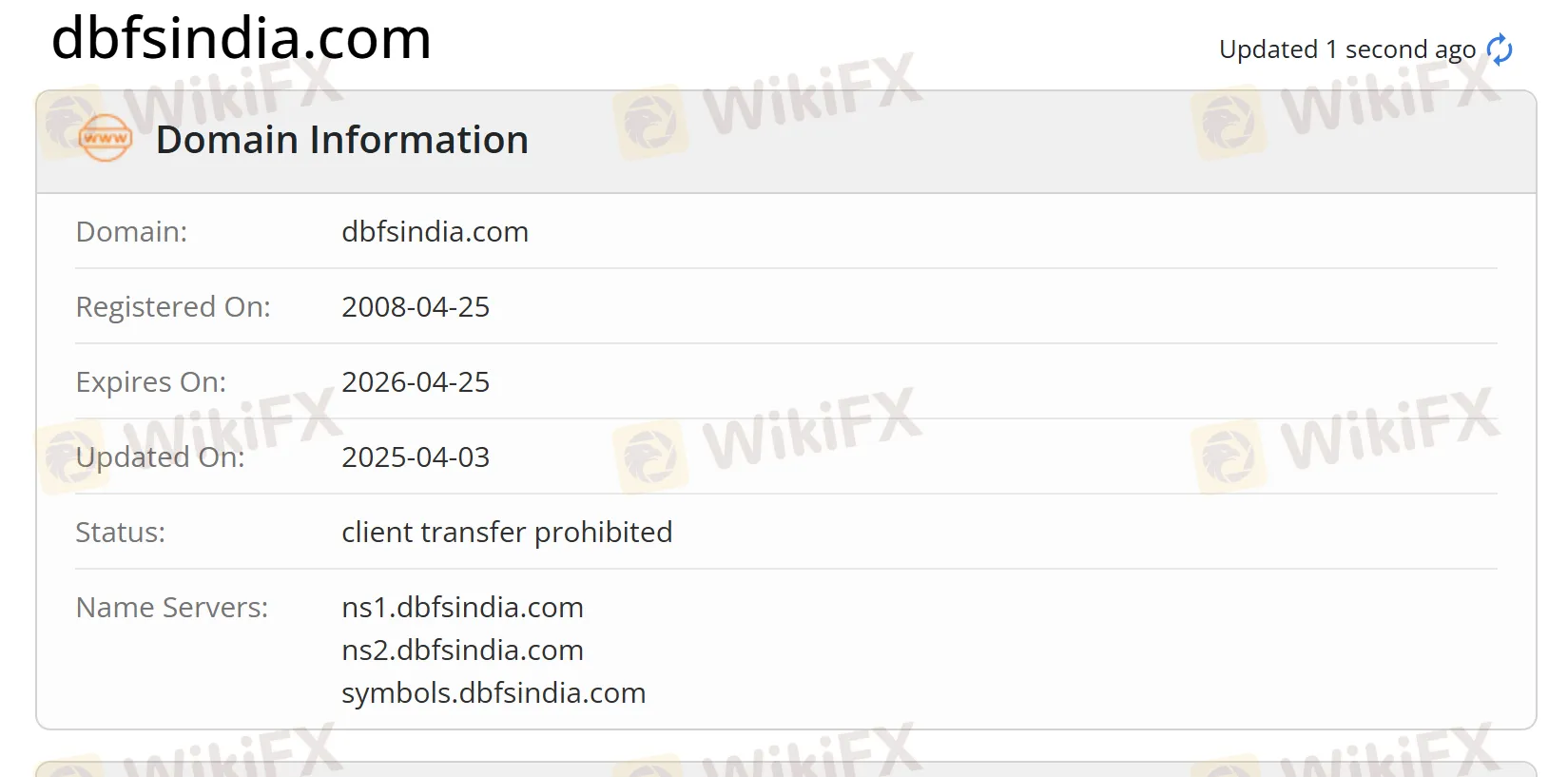

Hiện tại, DBFS thiếu quy định hợp lệ. Tên miền của nó được đăng ký vào ngày 25 tháng 4 năm 2008, và trạng thái hiện tại là “Khách chuyển cấp cấp”. Chúng tôi khuyên bạn nên xem xét các công ty được quy định khác.

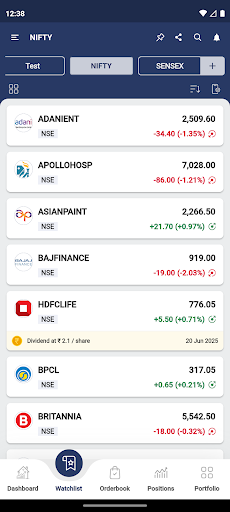

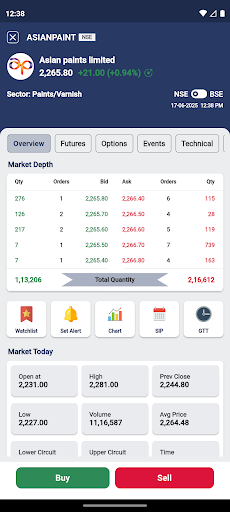

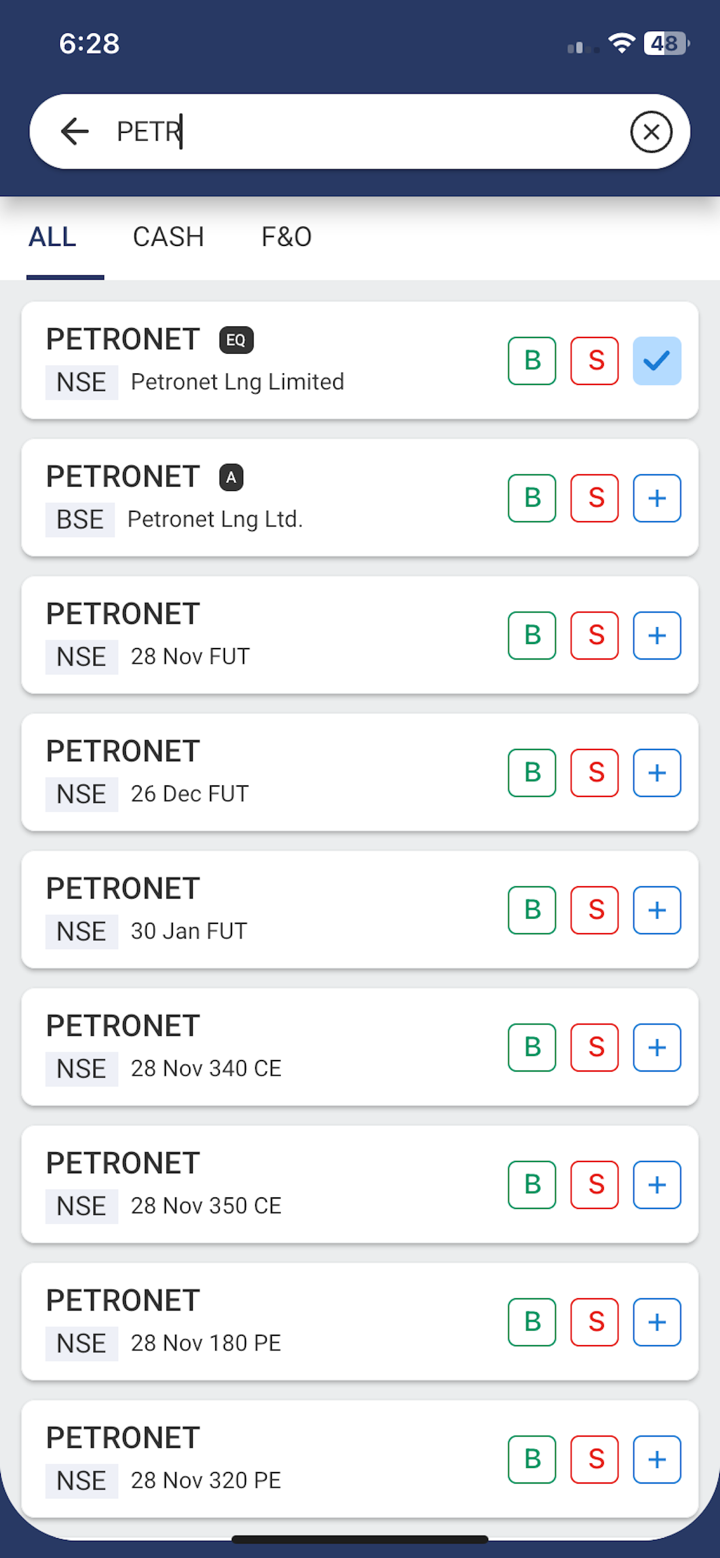

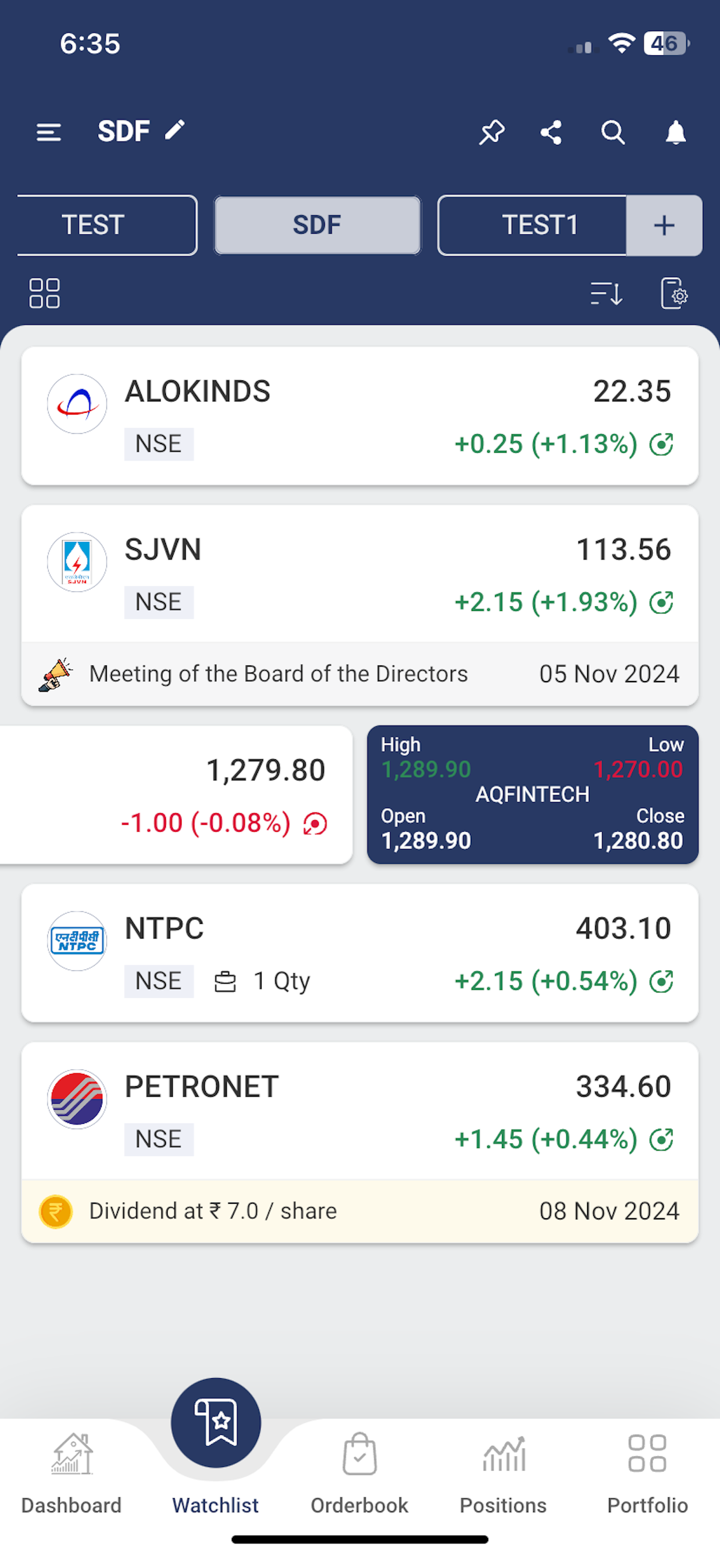

Bạn Có Thể Giao Dịch Gì trên DBFS?

| Sản Phẩm Giao Dịch | Hỗ Trợ |

| Cổ Phiếu | ✔ |

| Trái Phiếu | ✔ |

| Quỹ Hỗ Trợ | ✔ |

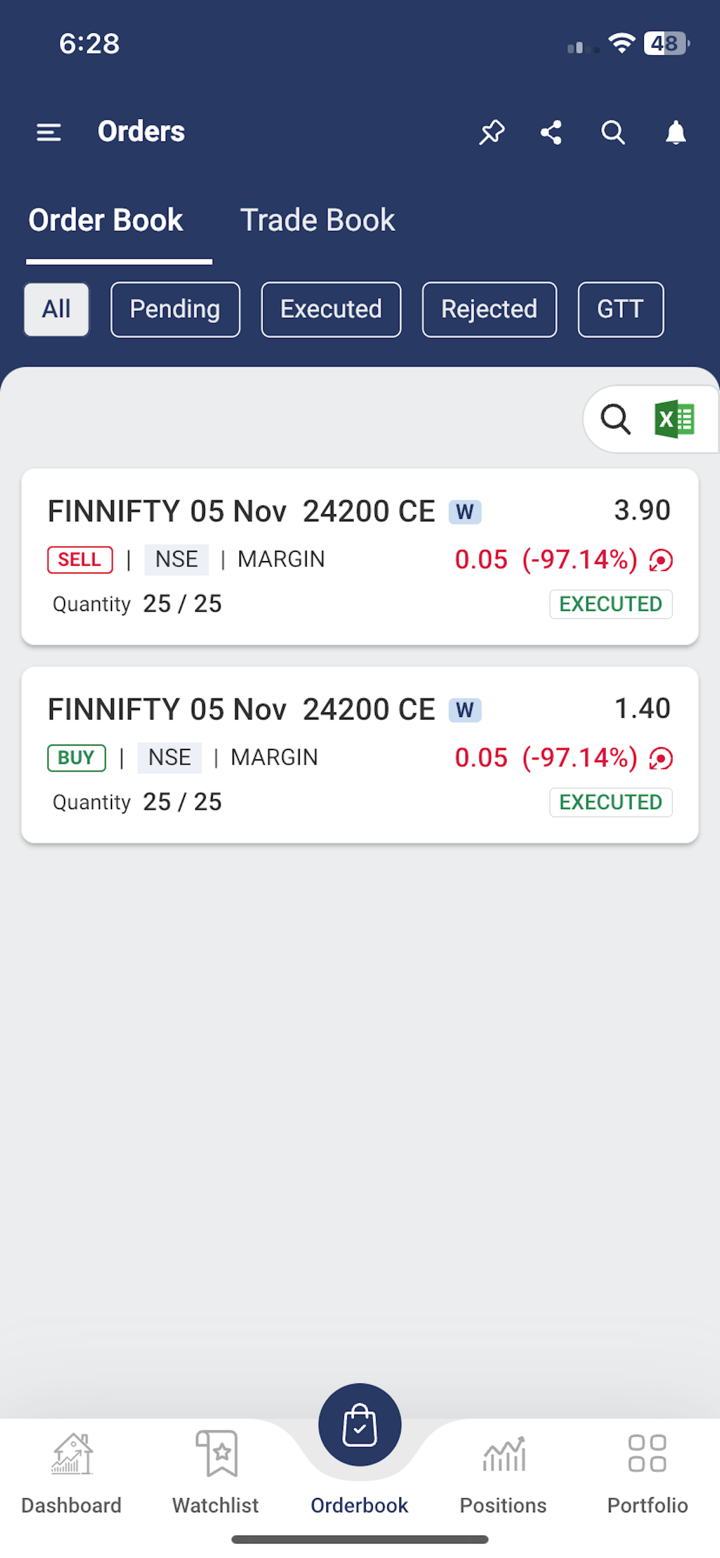

| Hợp Đồng Tương Lai | ✔ |

| Tùy Chọn | ✔ |

| Forex | ❌ |

| Hàng Hóa | ❌ |

| Chỉ Số | ❌ |

| Cổ Phiếu | ❌ |

| Tiền Điện Tử | ❌ |

| ETFs | ❌ |

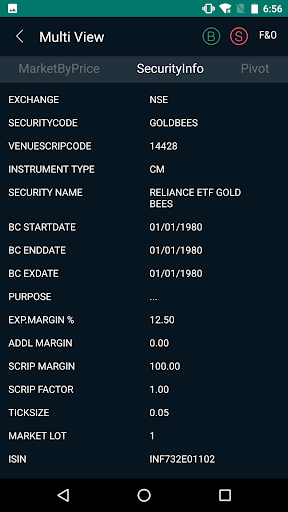

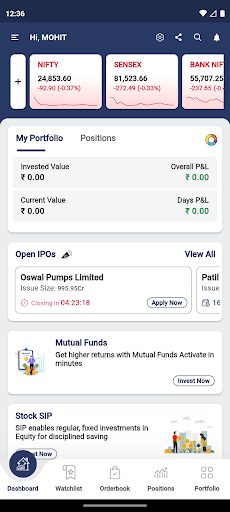

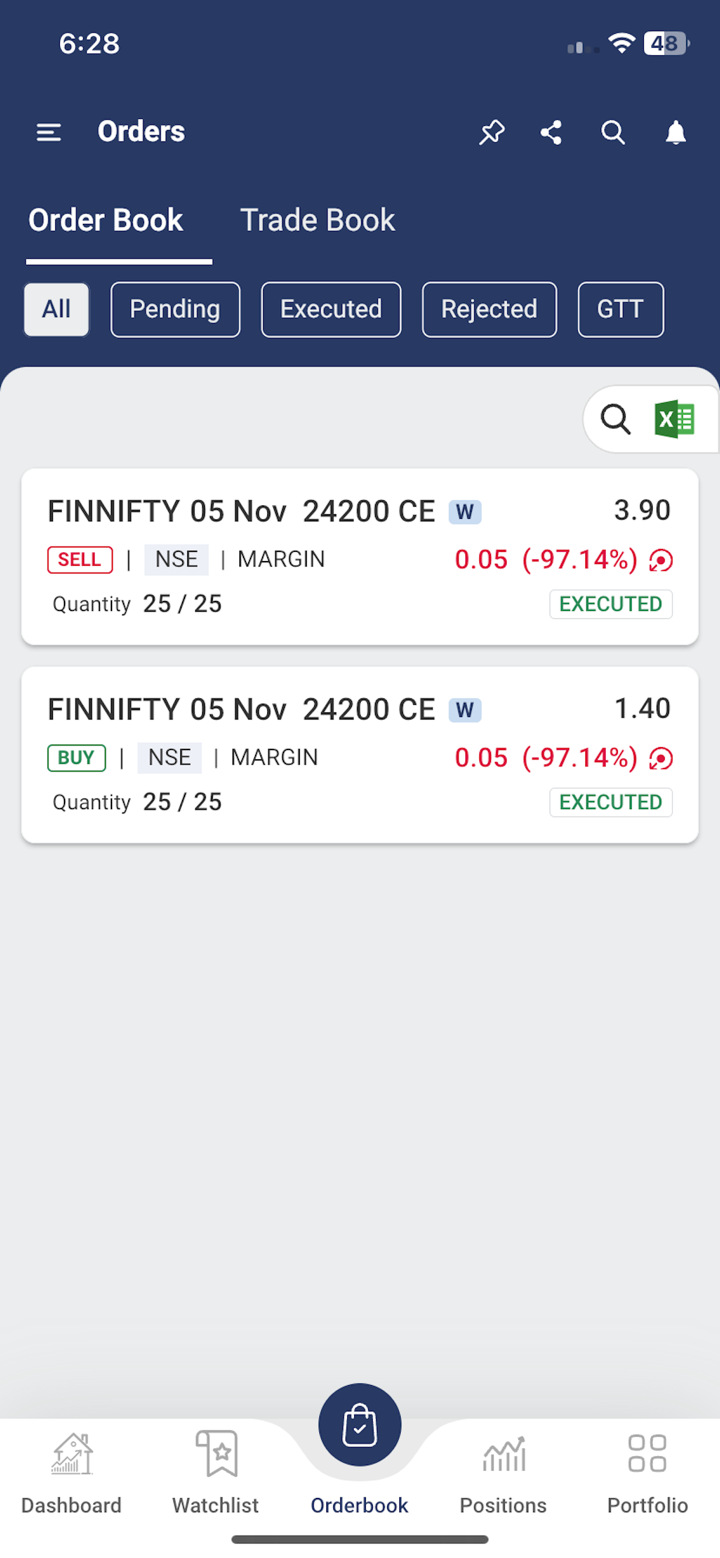

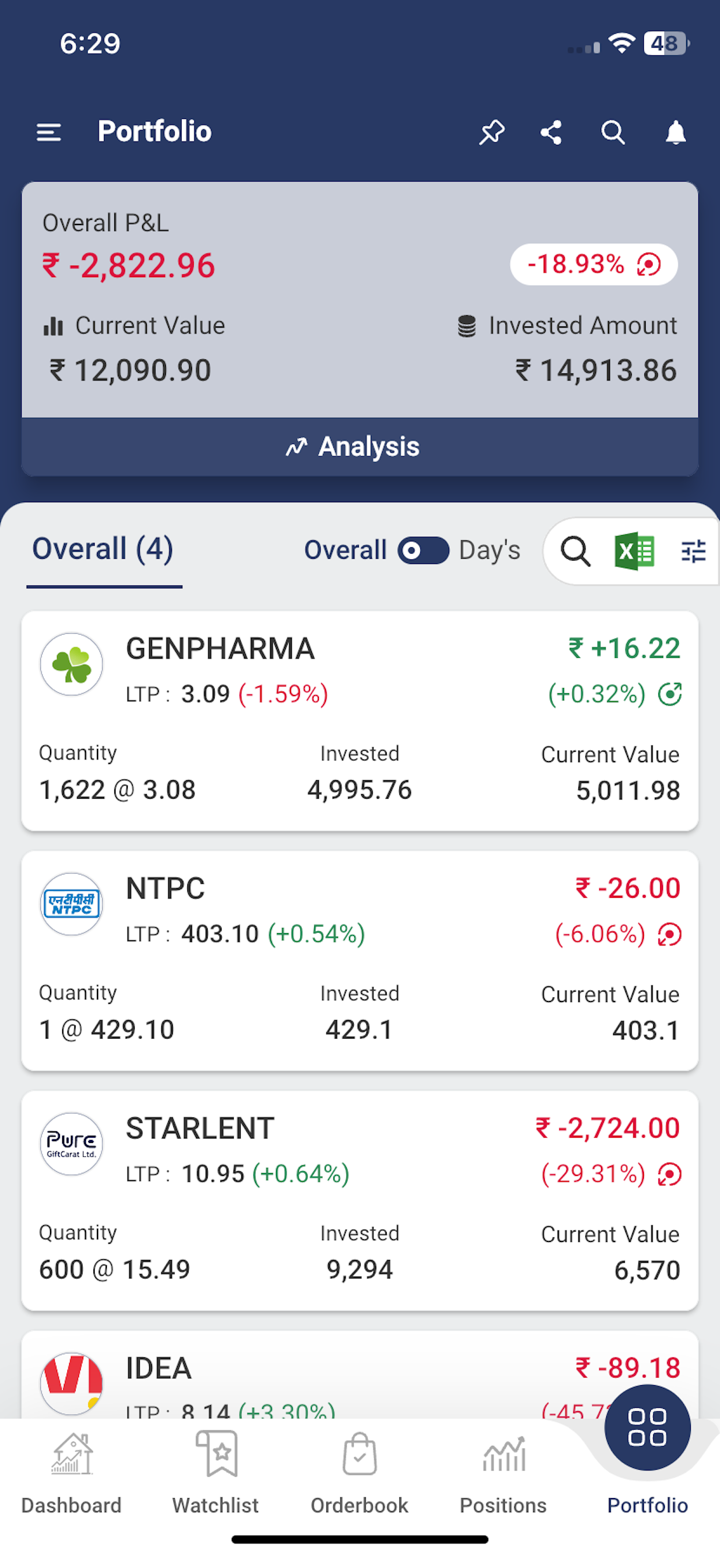

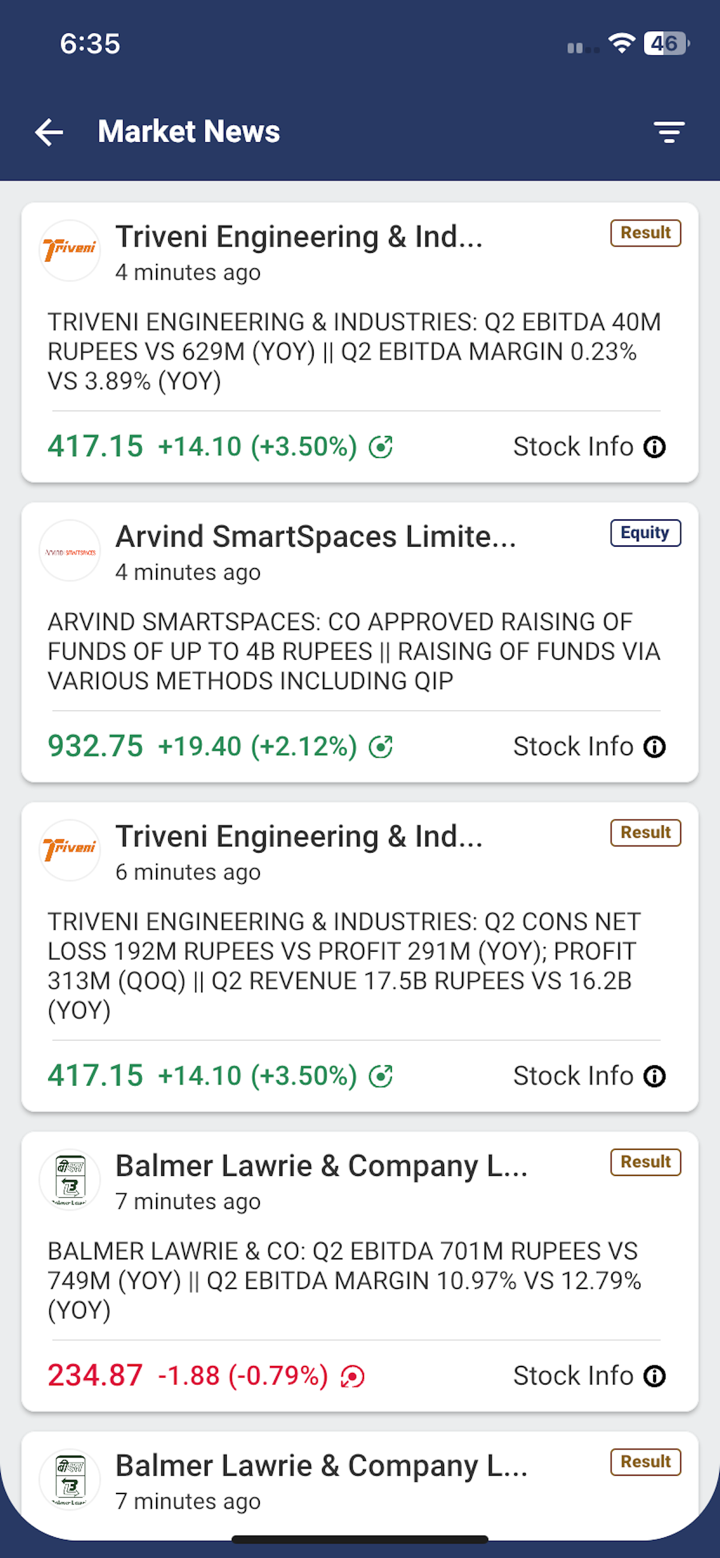

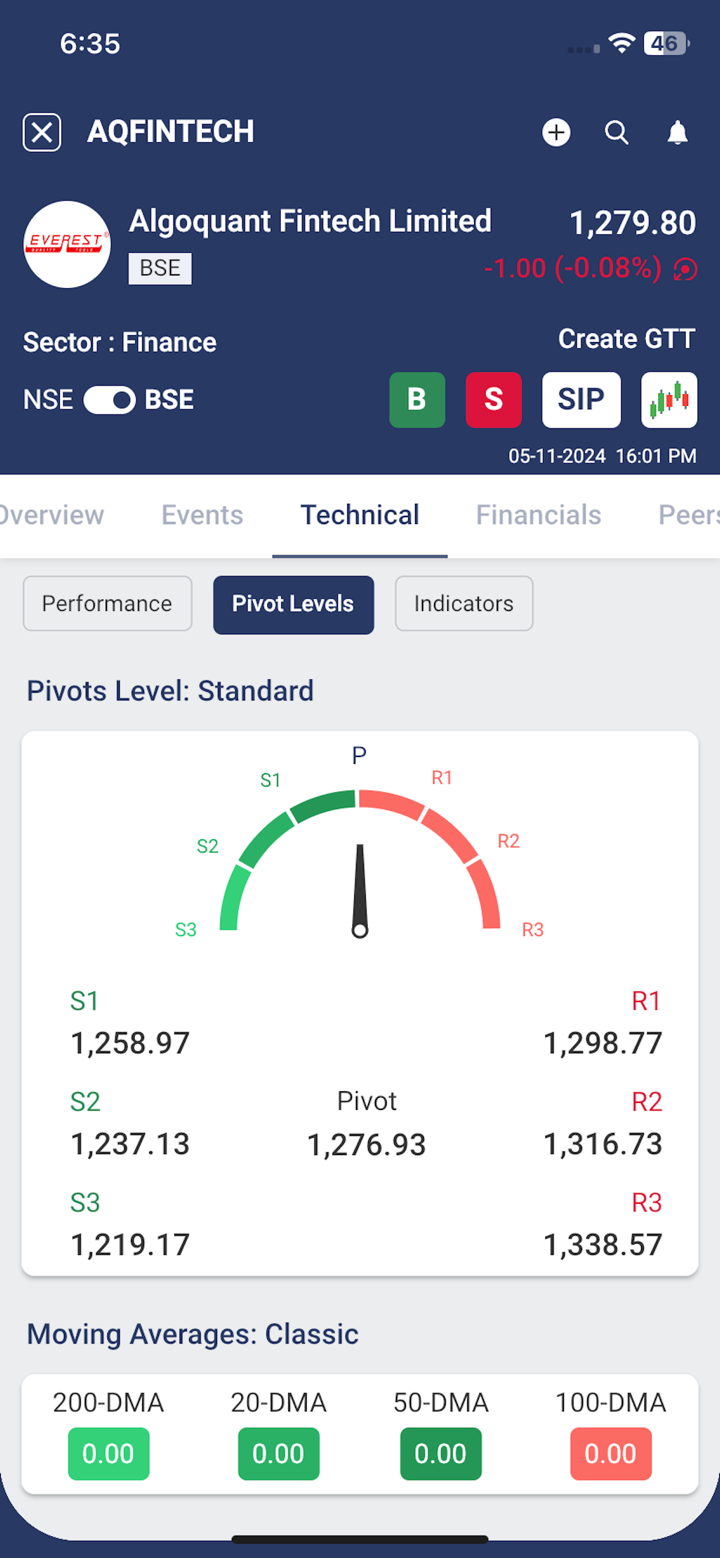

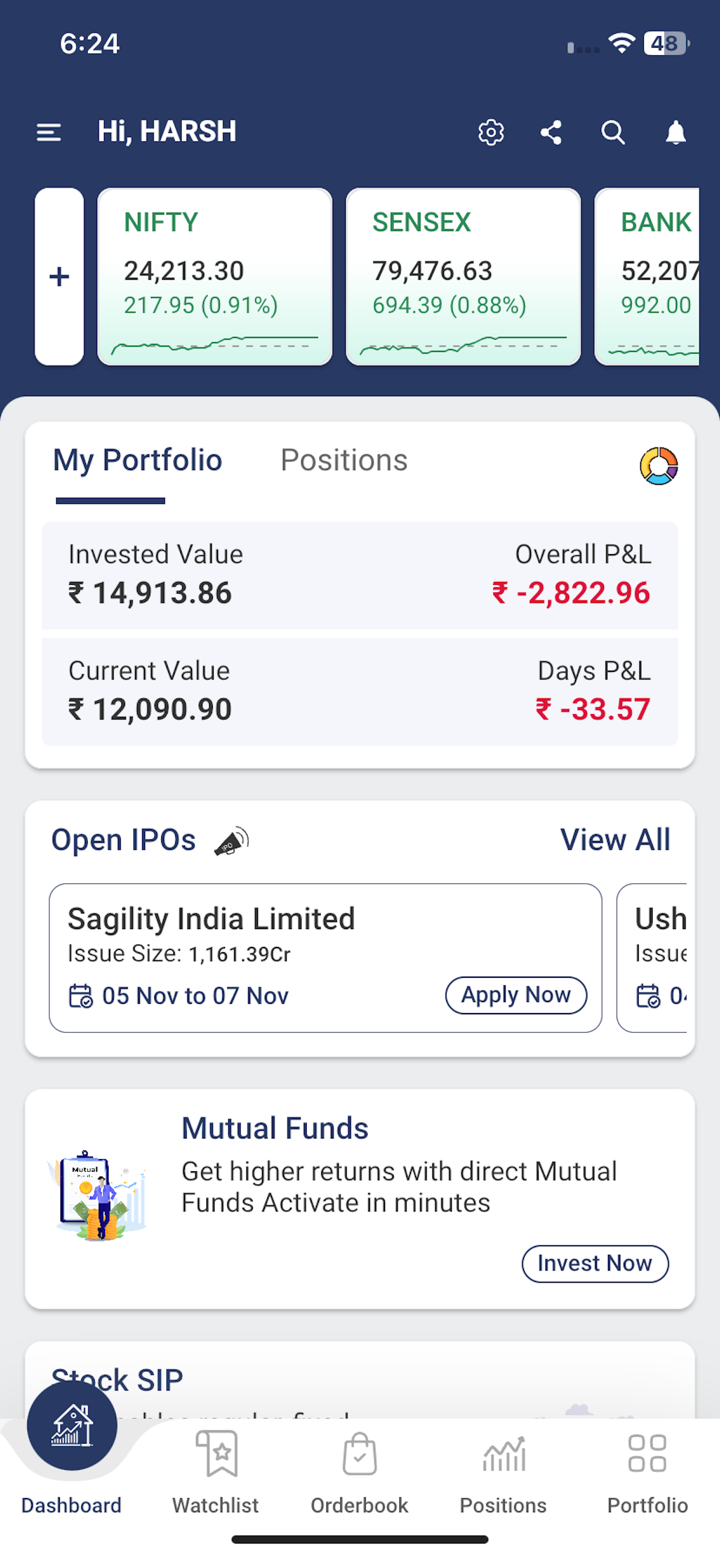

Nền Tảng Giao Dịch

| Nền Tảng Giao Dịch | Hỗ Trợ | Thiết Bị Có Sẵn |

| Ứng Dụng DBFS | ✔ | App Store, Google Play |