Описание компании

| DBFS Обзор | |

| Основана | 2008 |

| Страна/Регион регистрации | Индия |

| Регулирование | Нет регулирования |

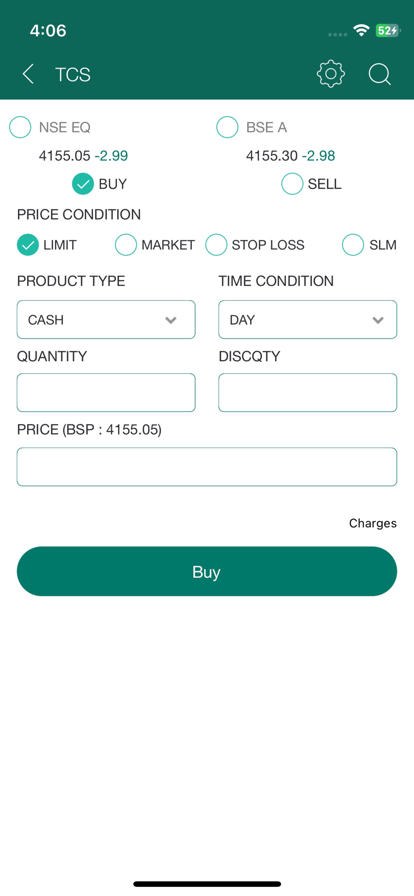

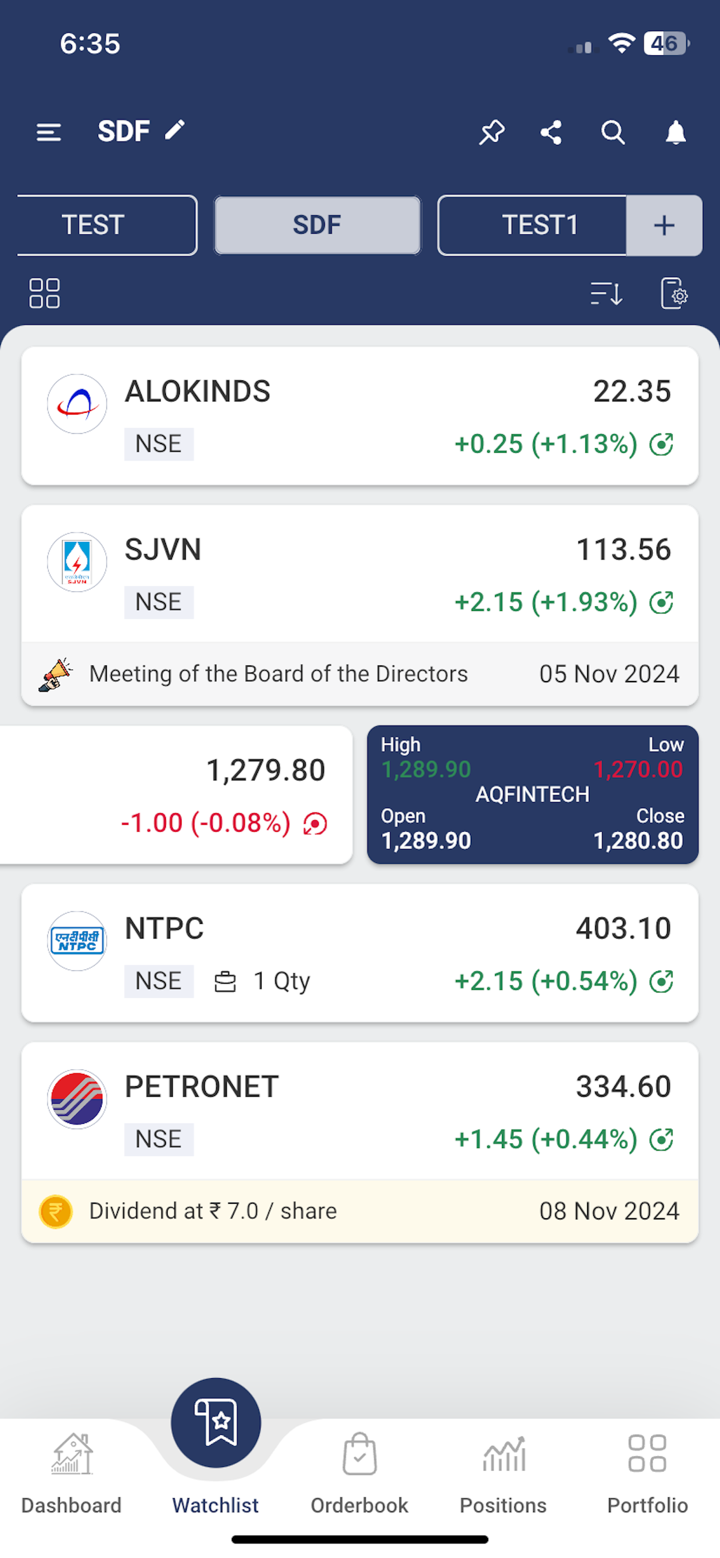

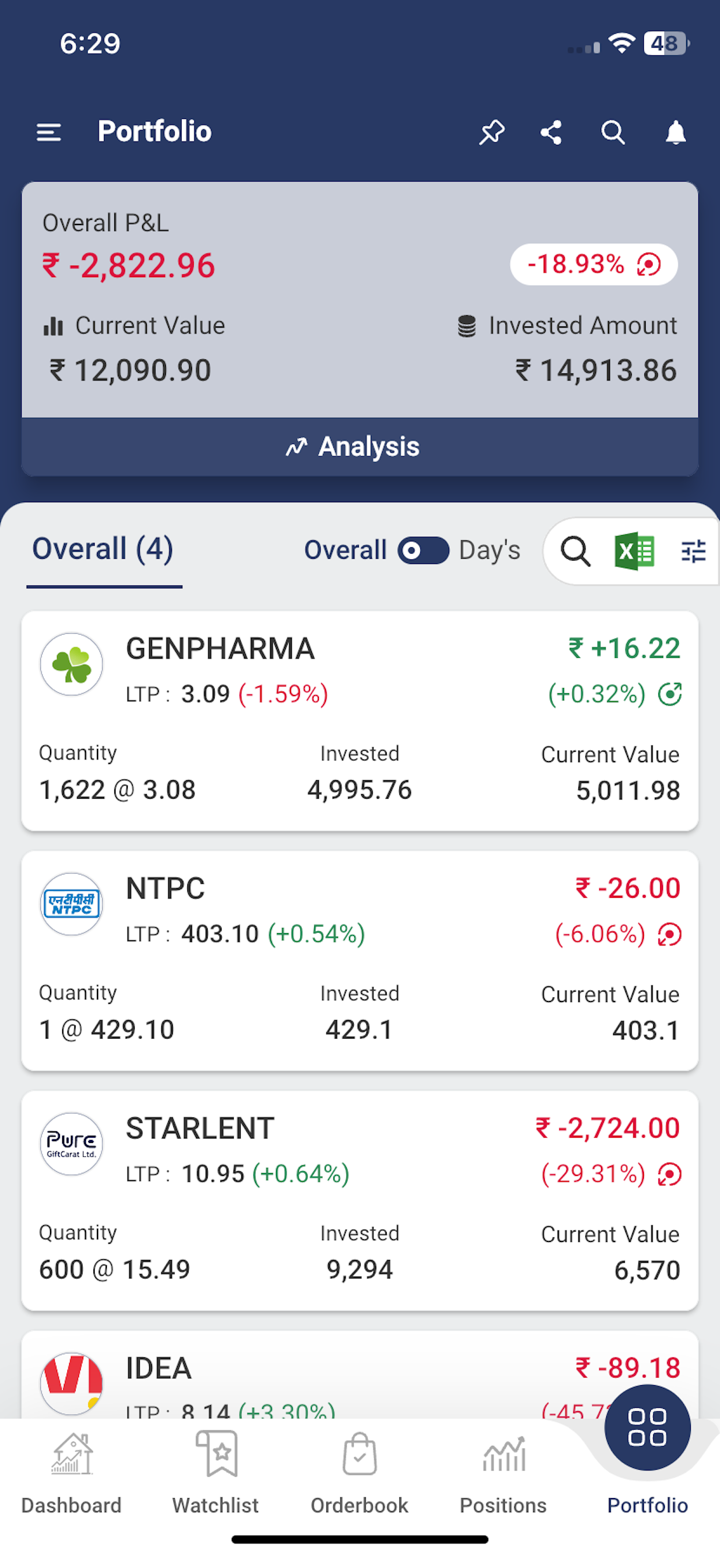

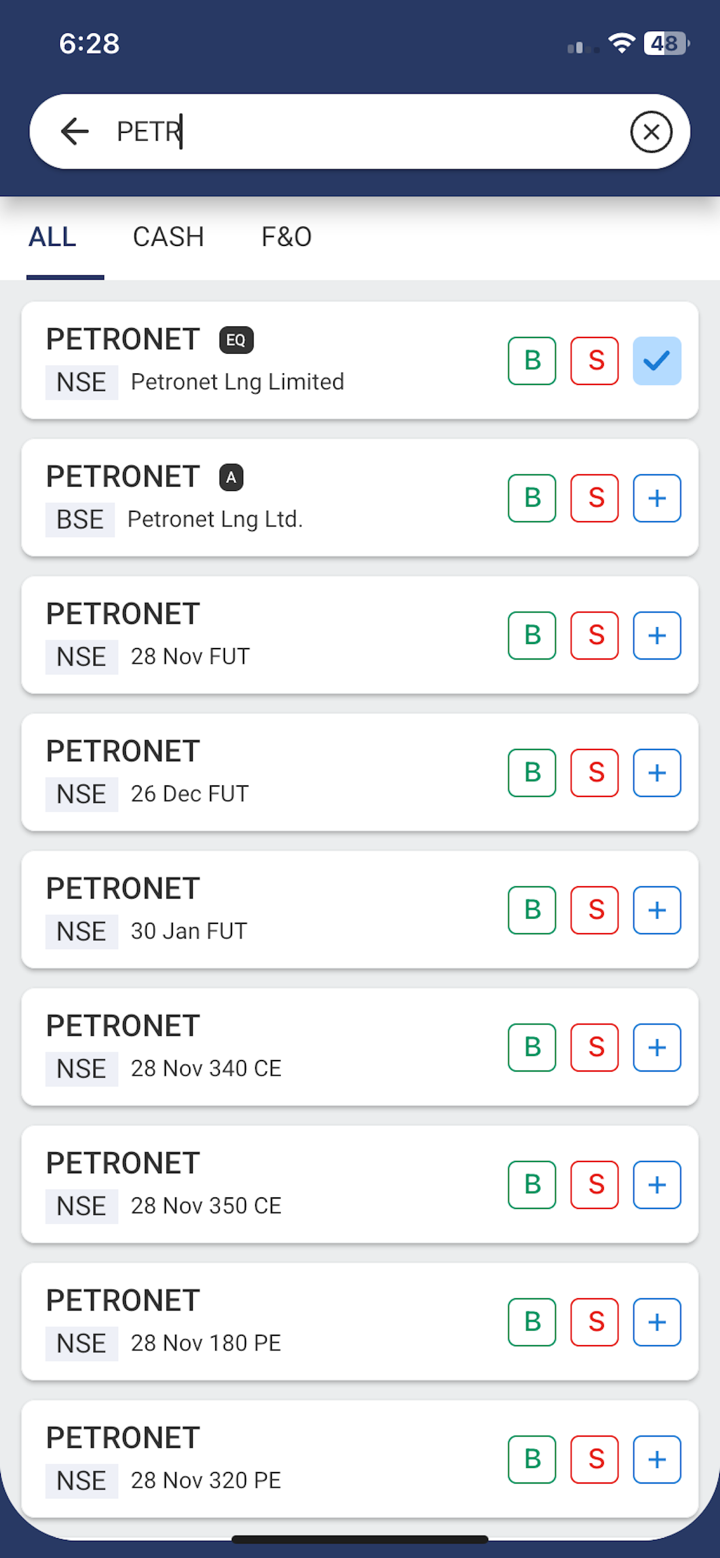

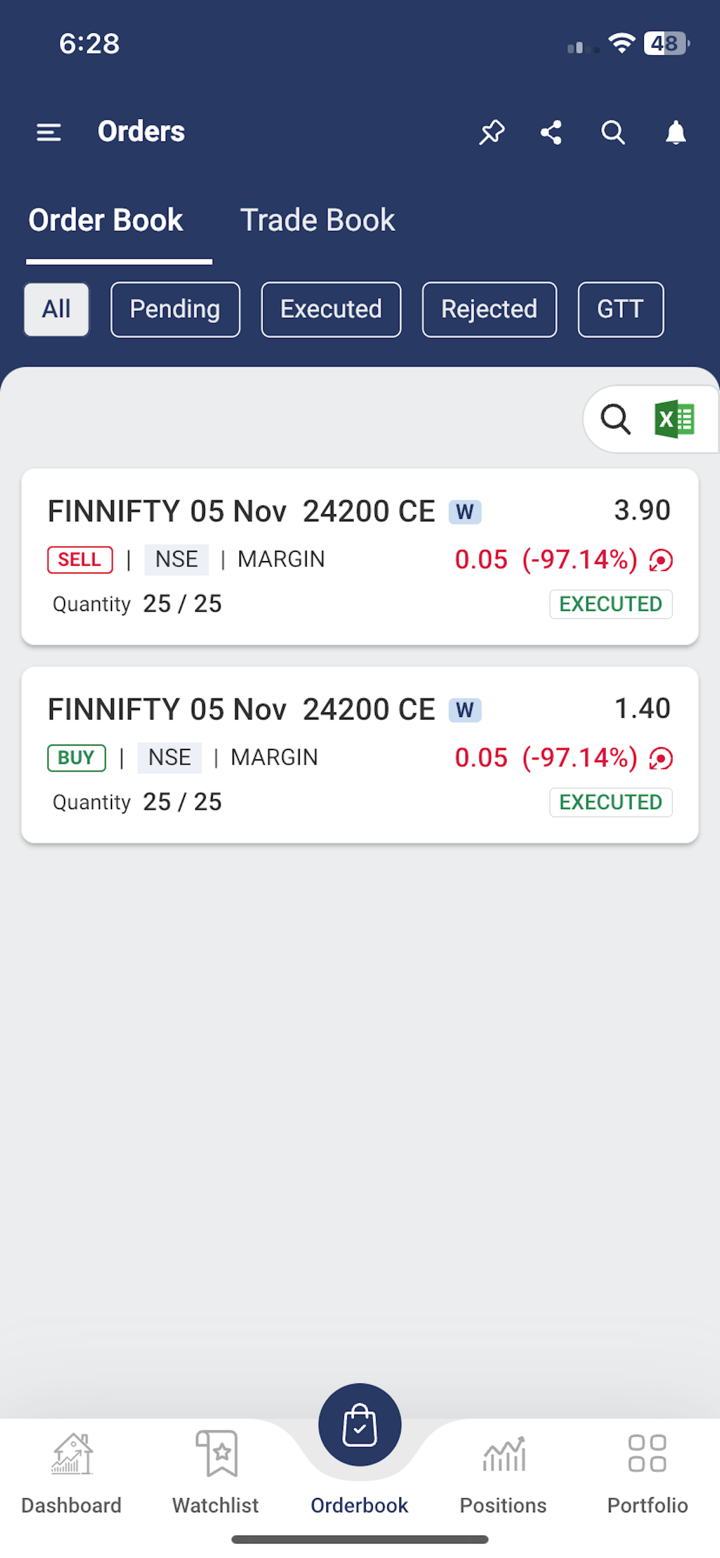

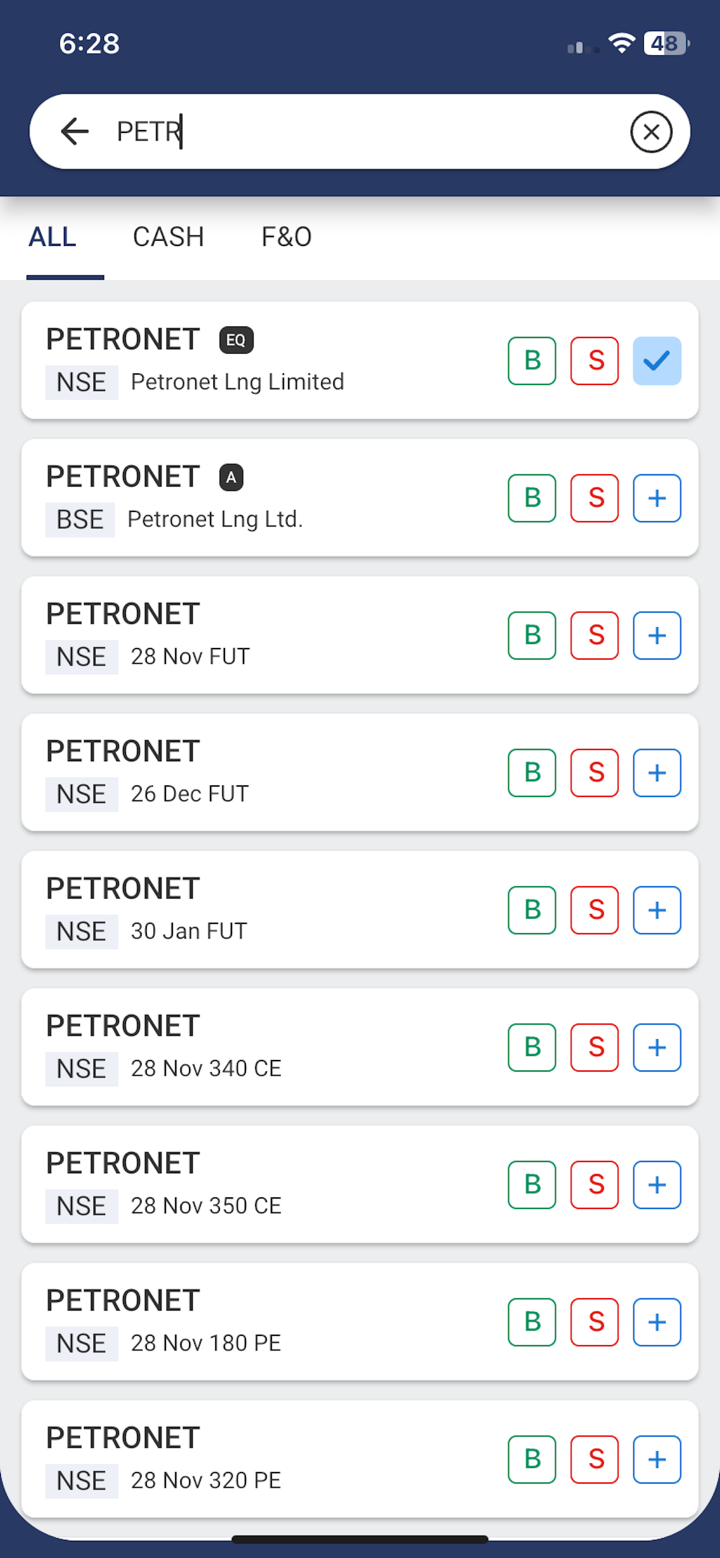

| Торговые продукты | акции, облигации, инвестиционные фонды, фьючерсы, опционы |

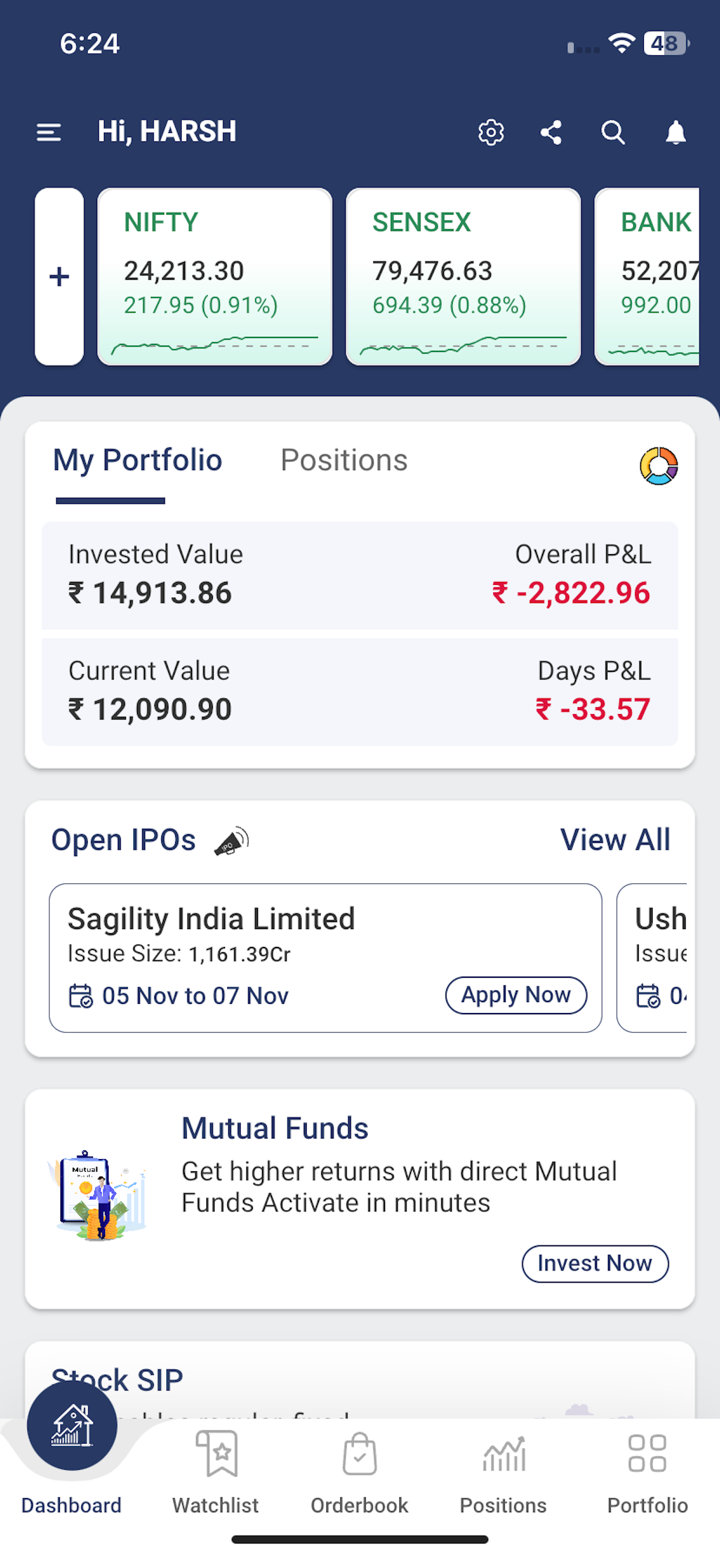

| Демо-счет | ✅ |

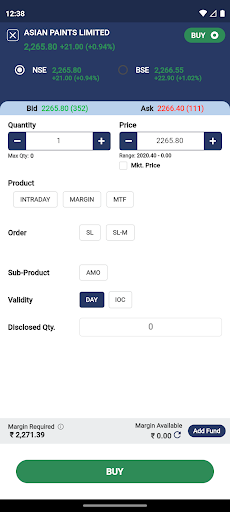

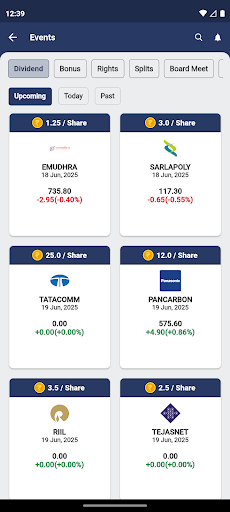

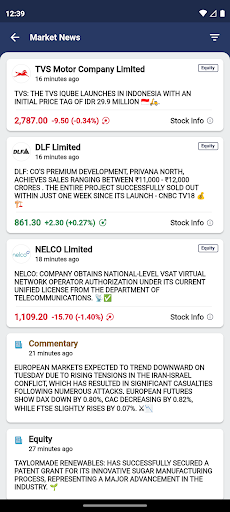

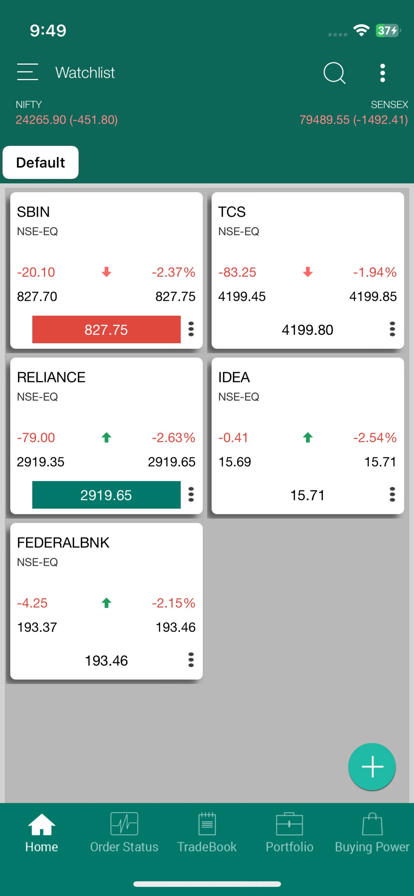

| Торговая платформа | DBFS приложение |

| Минимальный депозит | / |

| Поддержка клиентов | Телефон: 91 484 256 6000 /260 |

| Эл. почта: helpdesk@dbfsindia.com, ho@dbfsindia.com | |

| Адрес: 2-й этаж, Chammany Chambers, Kaloor – Kadavanthra Road, Kaloor, Kochi, Керала – 682017 | |

| Facebook, YouTube, Instagram, LinkedIn, X | |

DBFS - это нерегулируемая финансовая компания, основанная в 2008 году, с штаб-квартирой в Индии. Она предлагает торговлю акциями, облигациями, инвестиционными фондами, фьючерсами и опционами. Компания предоставляет демо-счет и приложение DBFS, доступное как в App Store, так и в Google Play. Однако информация о торговых комиссиях и деталях счета ограничена.

Плюсы и минусы

| Плюсы | Минусы |

| Доступны демо-счета | Нет регулирования |

| Разнообразие торговых продуктов | Ограниченная информация о счетах |

| Ограниченная информация о торговых комиссиях |

Является ли DBFS законным?

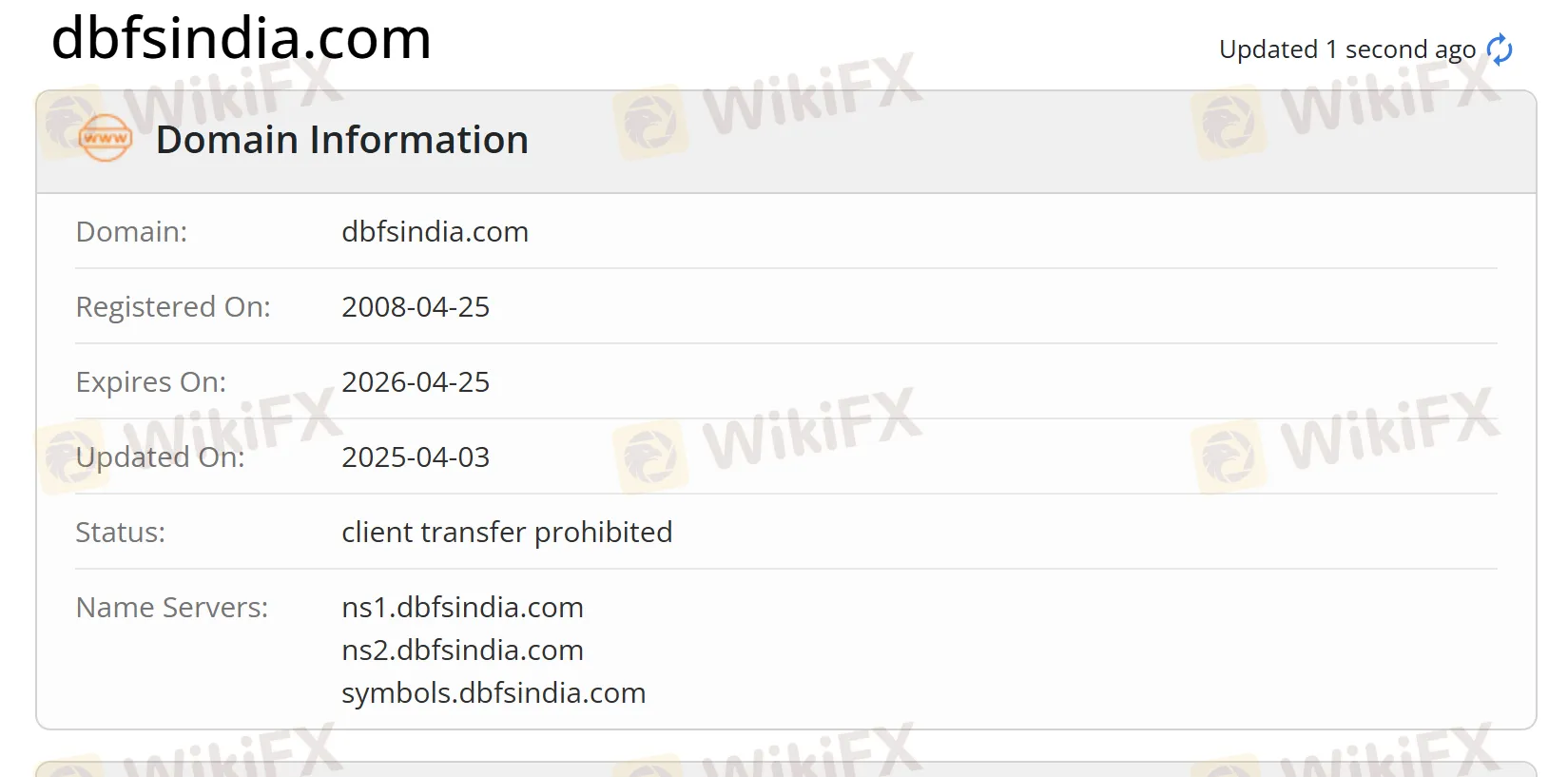

В настоящее время, DBFS не имеет действующего регулирования. Его домен был зарегистрирован 25 апреля 2008 года, и текущий статус - "клиентский запрет на передачу". Мы рекомендуем вам рассмотреть другие регулируемые фирмы.

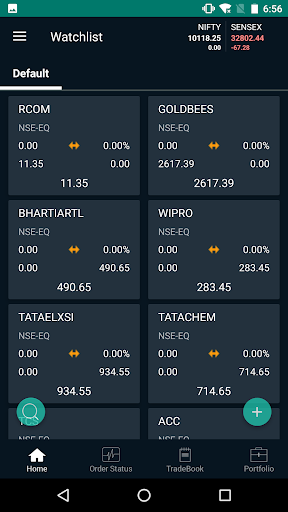

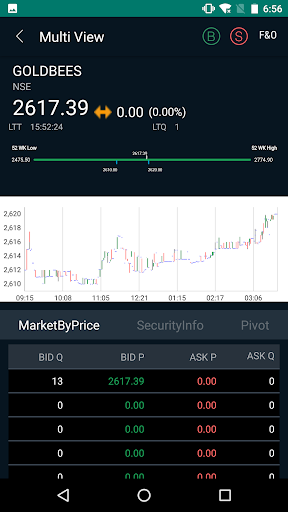

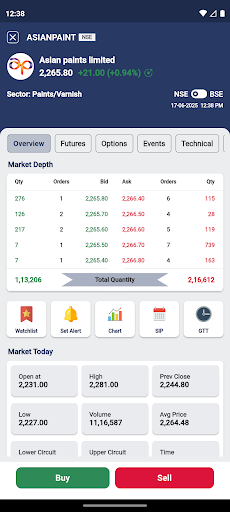

На что я могу торговать на DBFS?

| Торговые продукты | Поддерживается |

| Акции | ✔ |

| Облигации | ✔ |

| Инвестиционные фонды | ✔ |

| Фьючерсы | ✔ |

| Опционы | ✔ |

| Форекс | ❌ |

| Товары | ❌ |

| Индексы | ❌ |

| Акции | ❌ |

| Криптовалюты | ❌ |

| ETF | ❌ |

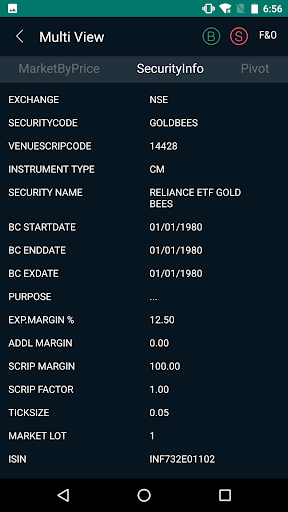

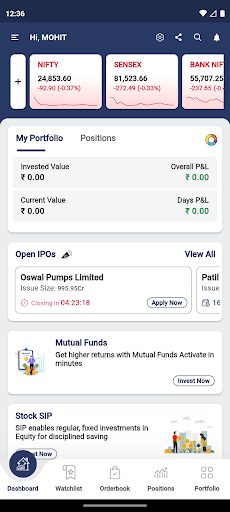

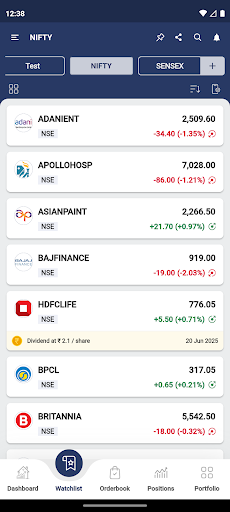

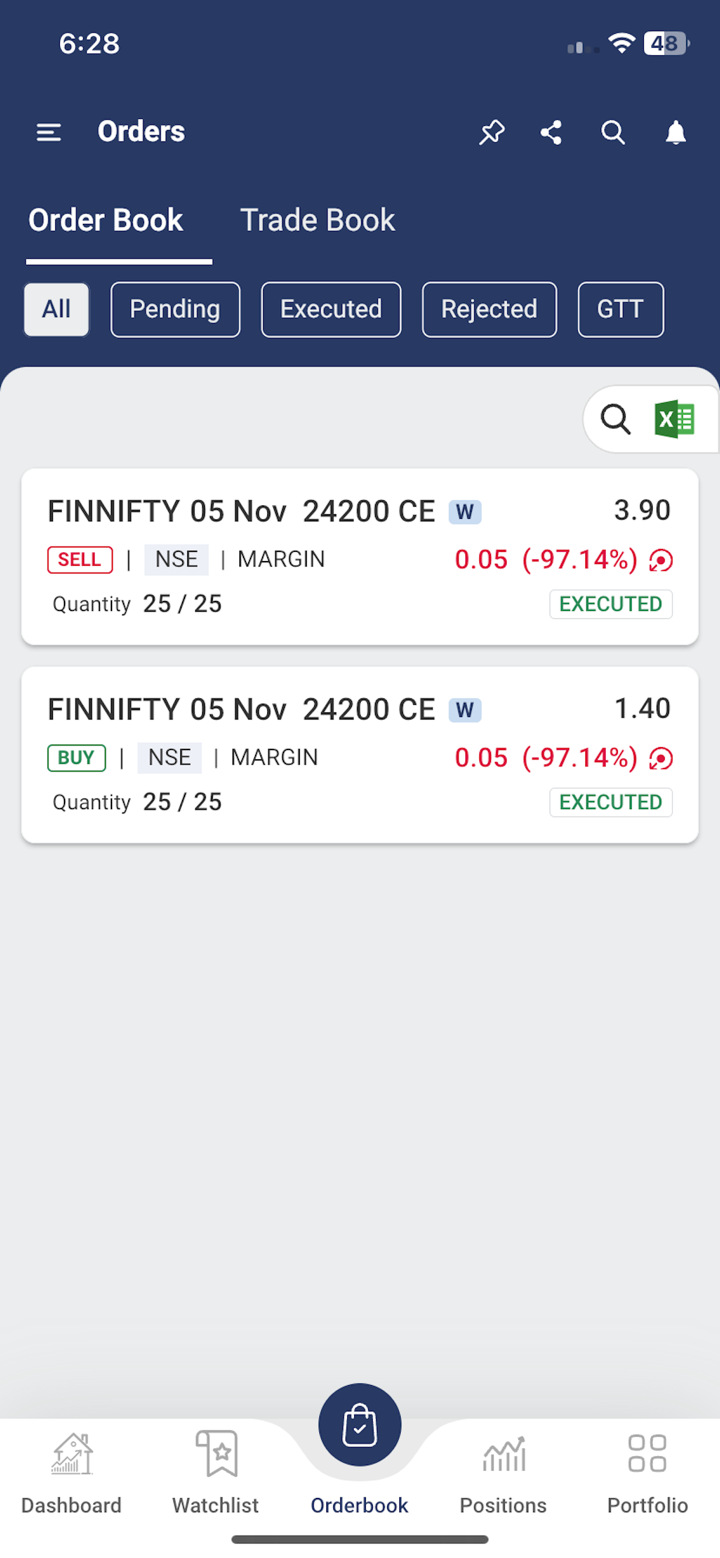

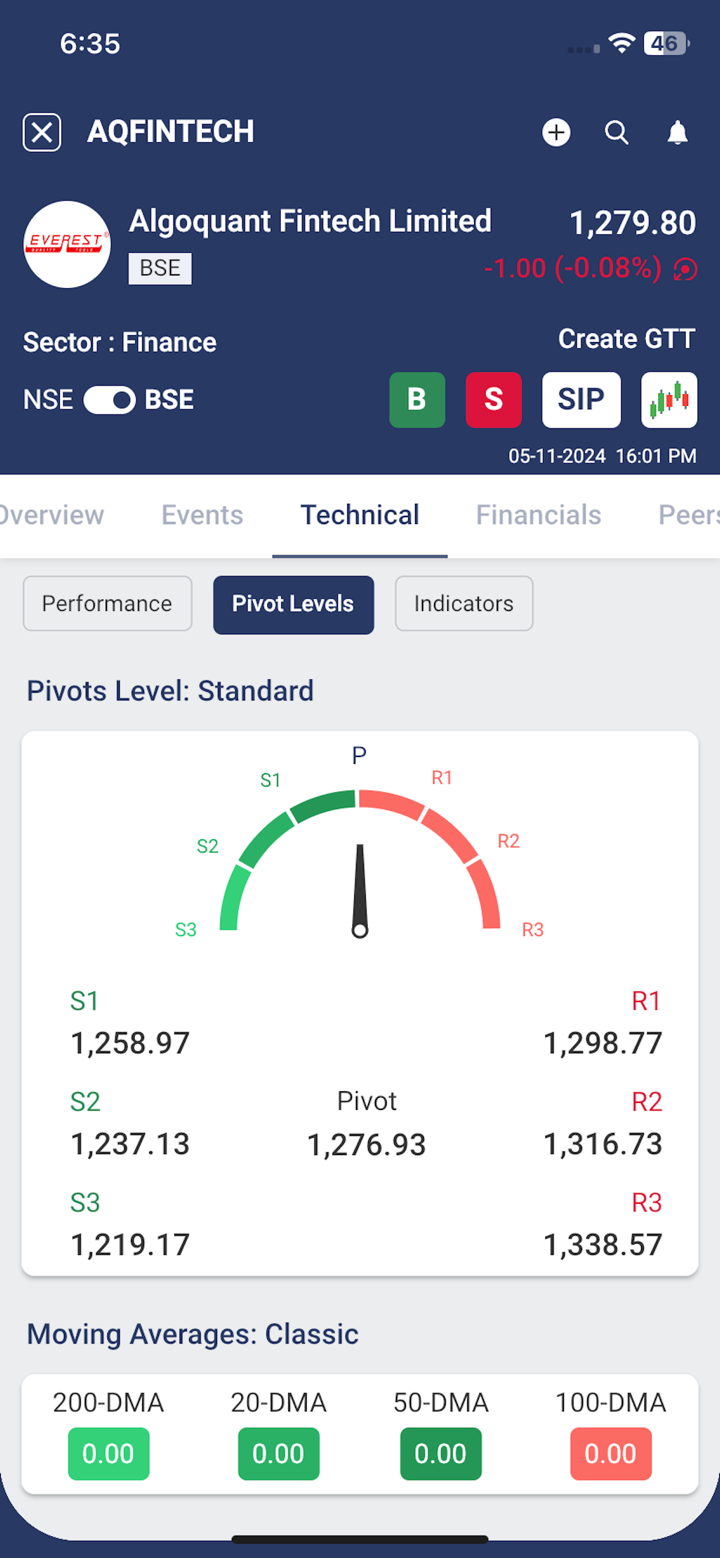

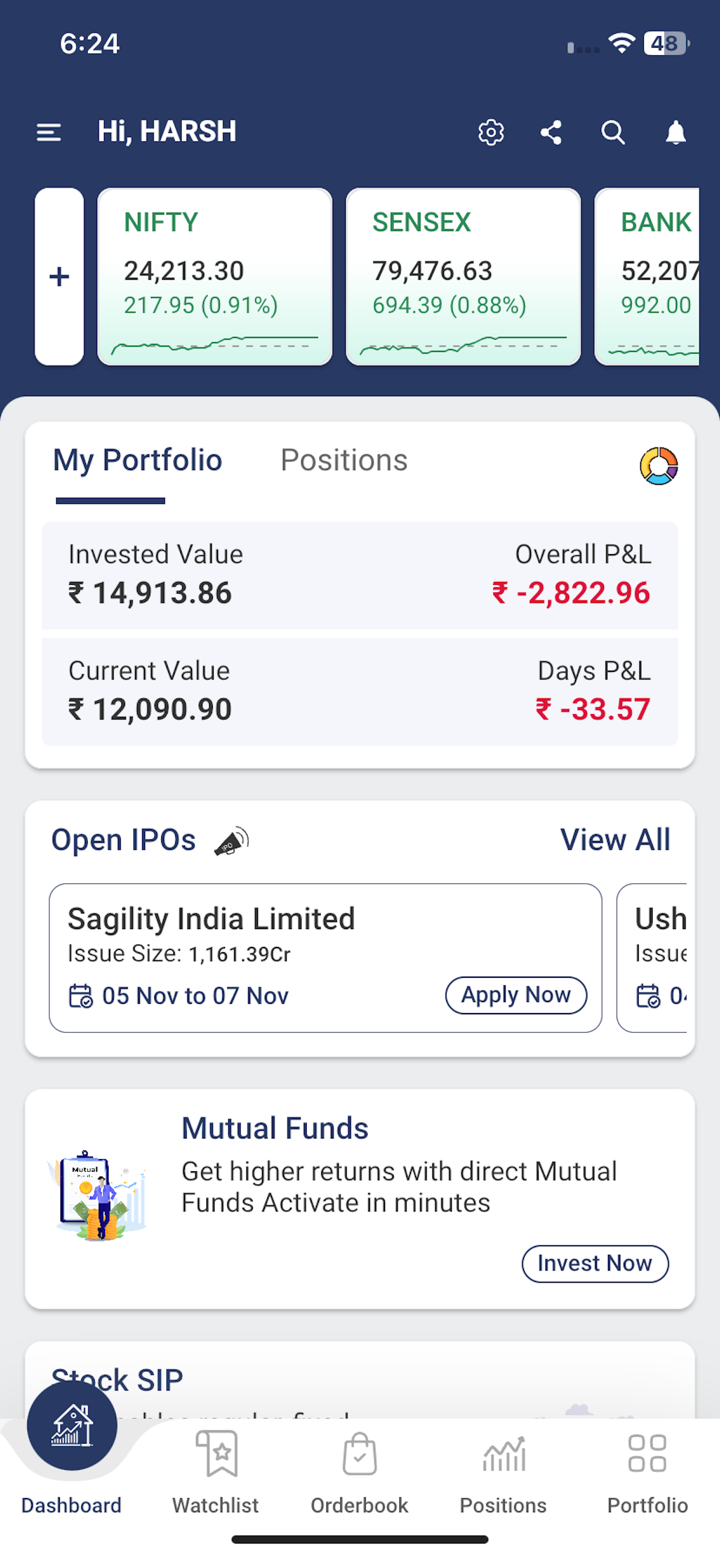

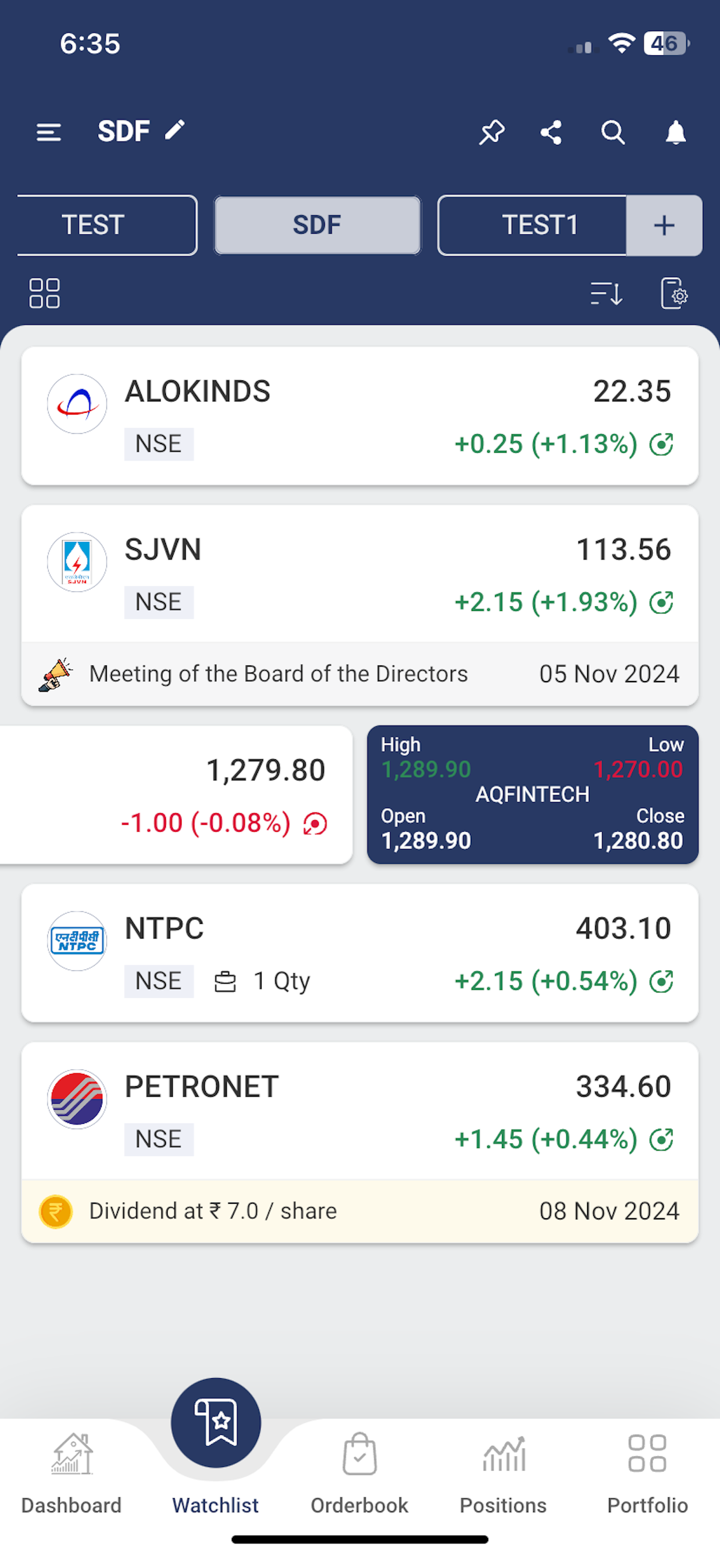

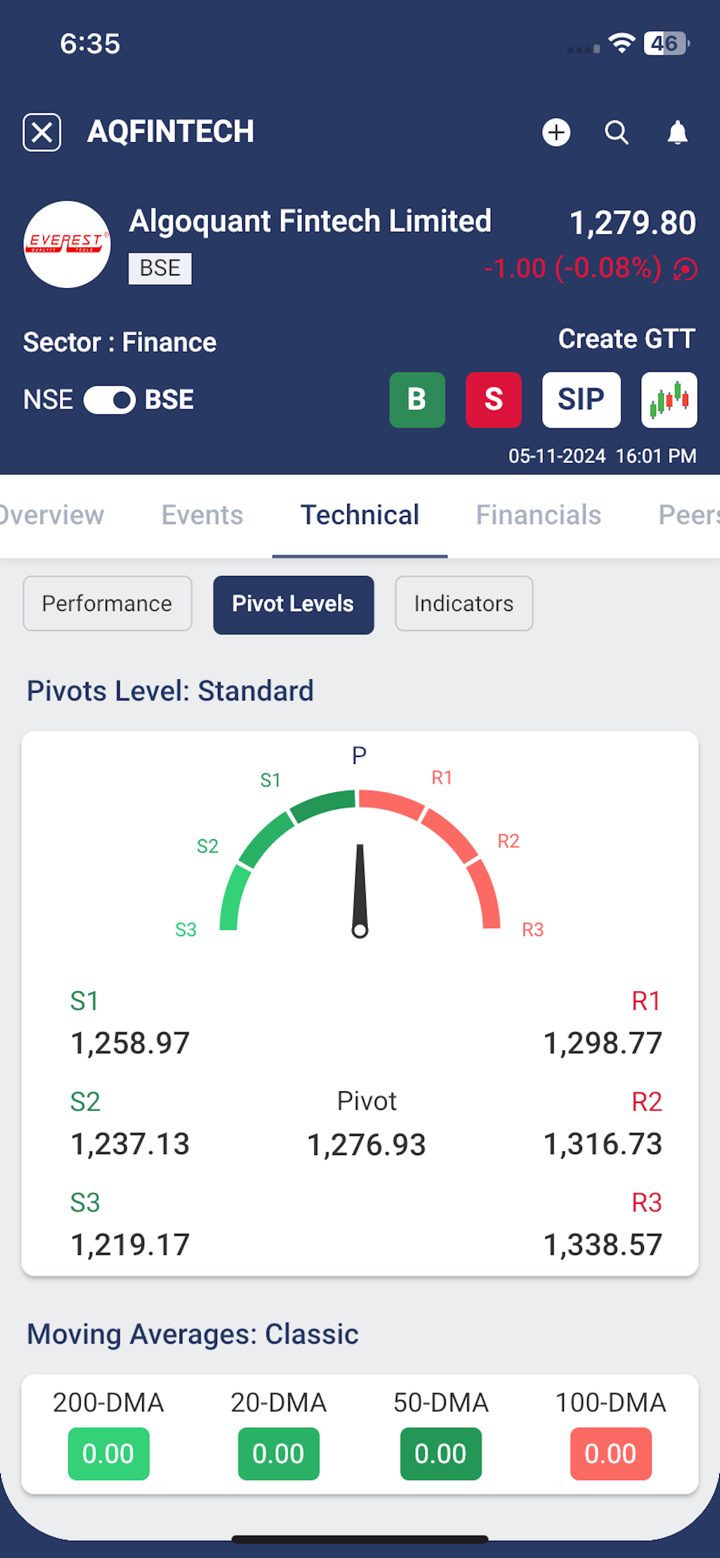

Торговая платформа

| Торговая платформа | Поддерживается | Доступные устройства |

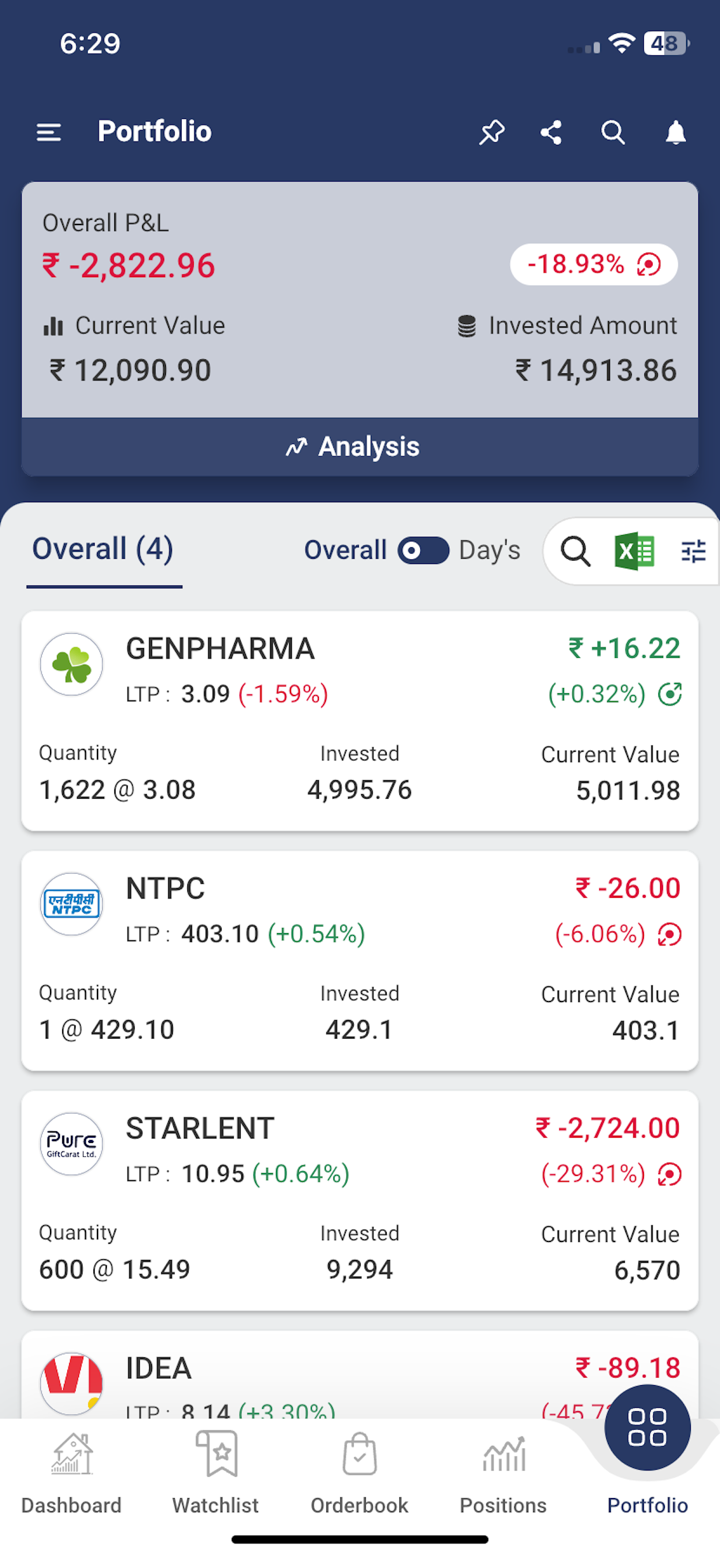

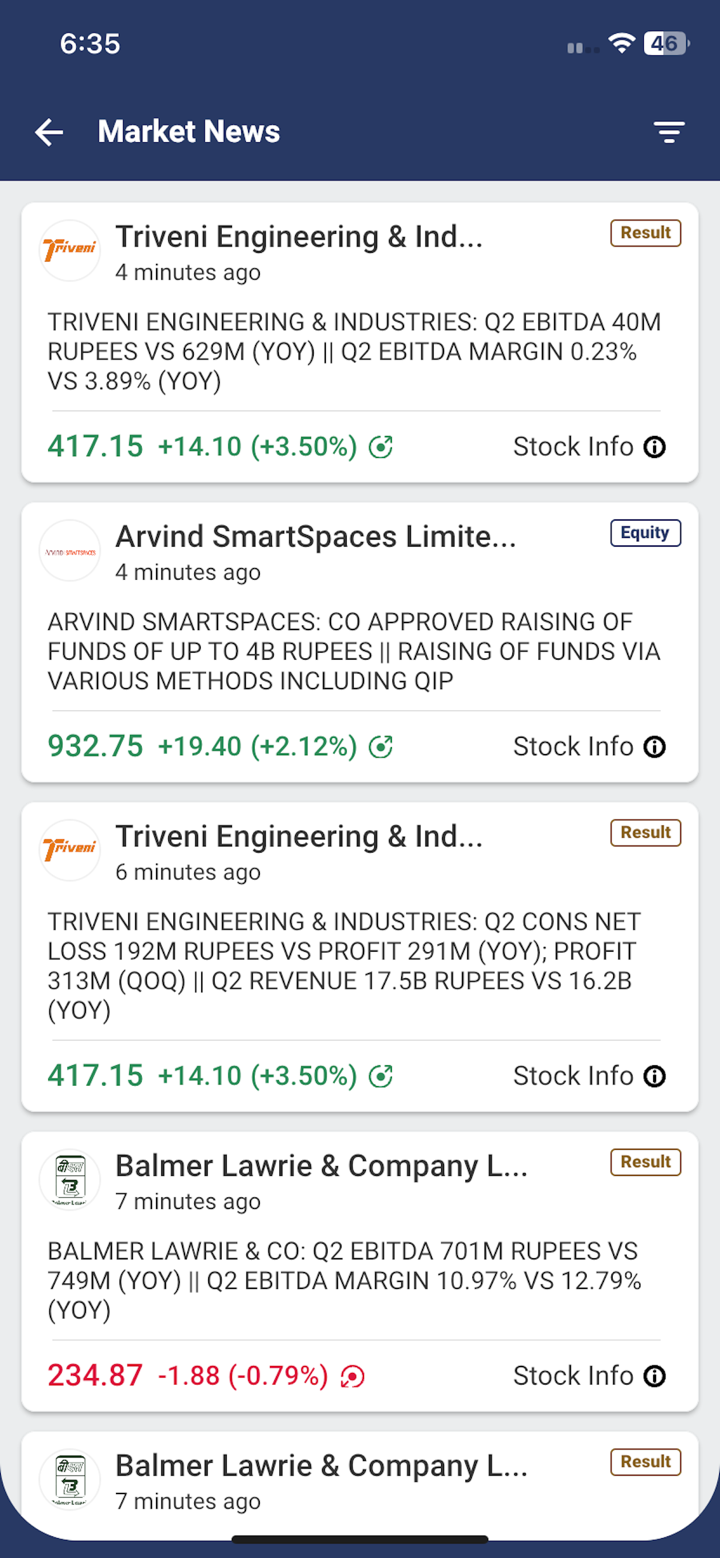

| Приложение DBFS | ✔ | App Store, Google Play |