Thông tin chung

Trung Quốc

Trung QuốcĐiểm

Trung Quốc

|

5-10 năm

|

Trung Quốc

|

5-10 năm

| https://www.cesfutures.com/

Website

Chỉ số đánh giá

Mức ảnh hưởng

C

Mức ảnh hưởng NO.1

Trung Quốc 6.23

Trung Quốc 6.23 Giấy phép

Giấy phépCơ quan sở hữu giấy phép:东航期货有限责任公司

Số giấy phép cai quản:0153

Trung Quốc

Trung Quốc Trung Quốc

Trung Quốc cesfutures.com

cesfutures.com Trung Quốc

Trung Quốc Trung Quốc

Trung Quốc Chưa kích hoạt VIP

Chưa kích hoạt VIP

| Ces Futures Tóm tắt Đánh giá | |

| Thành lập | 2010 |

| Quốc gia/Vùng đăng ký | Trung Quốc |

| Quy định | CFFE (Được quy định) |

| Công cụ thị trường | Hợp đồng tương lai |

| Tài khoản Demo | ✅ |

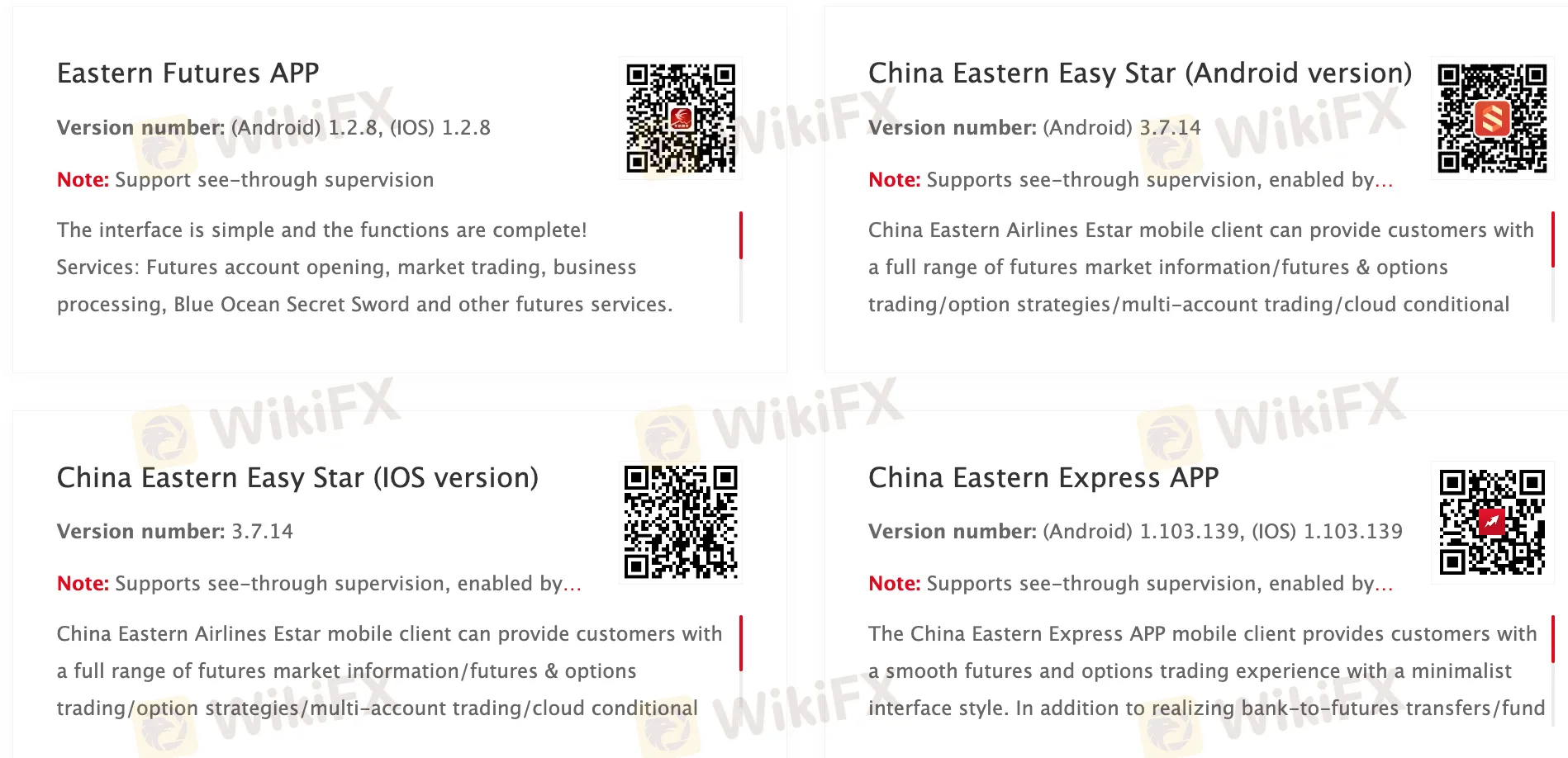

| Nền tảng giao dịch | Ứng dụng Eastern Futures, China Eastern Easy Star (phiên bản Android), China Eastern Easy Star (phiên bản IOS), Ứng dụng China Eastern Express, Khách hàng Polestar V9.5 của Eastern Airlines Futures, Khách hàng Polestar V9.3 của Eastern Airlines Futures, Khách hàng mới Eastern Futures Express V3, Bản Cloud Trading Edition của Eastern Futures Boyi, Phần mềm thị trường Eastern Airlines Futures Winshun Edition (Wenhua WH6), Khách hàng Eastern Futures Express V2, Terminal Eastern Futures Trading Pioneer, Khách hàng Polestar V8.5 của Eastern Futures Yisheng, Khách hàng cổ điển V8.3 của Eastern Futures Yisheng, Terminal giao dịch Kuaiqi V2 (Phiên bản Bí mật Quốc gia), Bản Cloud Boyi của Eastern Airlines Futures (Phiên bản Bí mật Quốc gia), vv. |

| Hỗ trợ Khách hàng | Trò chuyện trực tuyến |

| Điện thoại: 4008-889-889 | |

| Wechat, tiktok | |

| Email: service@kiiik.com | |

Ces Futures là một nhà môi giới được quy định, cung cấp giao dịch trên hợp đồng tương lai trên các nền tảng giao dịch khác nhau.

| Ưu điểm | Nhược điểm |

| Các nền tảng giao dịch đa dạng | Giới hạn loại sản phẩm giao dịch |

| Tài khoản Demo | Áp dụng phí trao đổi và ký quỹ |

| Được quy định tốt | |

| Hỗ trợ trò chuyện trực tuyến | |

| Thời gian hoạt động lâu dài |

Có. Ces Futures được cấp phép bởi CFFEX để cung cấp dịch vụ.

| Quốc gia được quy định | Cơ quan quy định | Tình trạng hiện tại | Thực thể được quy định | Loại giấy phép | Số giấy phép |

| Sở Giao dịch Hợp đồng Tương lai Tài chính Trung Quốc | Được quy định | Ces Futures有限责任公司 | Giấy phép Hợp đồng Tương lai | 0153 |

Ces Futures cung cấp giao dịch trên hợp đồng tương lai.

| Các công cụ có thể giao dịch | Được hỗ trợ |

| Hợp đồng tương lai | ✔ |

| Ngoại hối | ❌ |

| Hàng hóa | ❌ |

| Chỉ số | ❌ |

| Cổ phiếu | ❌ |

| Đồng tiền mã hóa | ❌ |

| Trái phiếu | ❌ |

| Tùy chọn | ❌ |

| ETFs | ❌ |

Nhà môi giới chưa cung cấp rõ ràng các loại tài khoản mà họ cung cấp. Khách hàng có thể mở tài khoản demo để bắt đầu giao dịch hợp đồng tương lai.

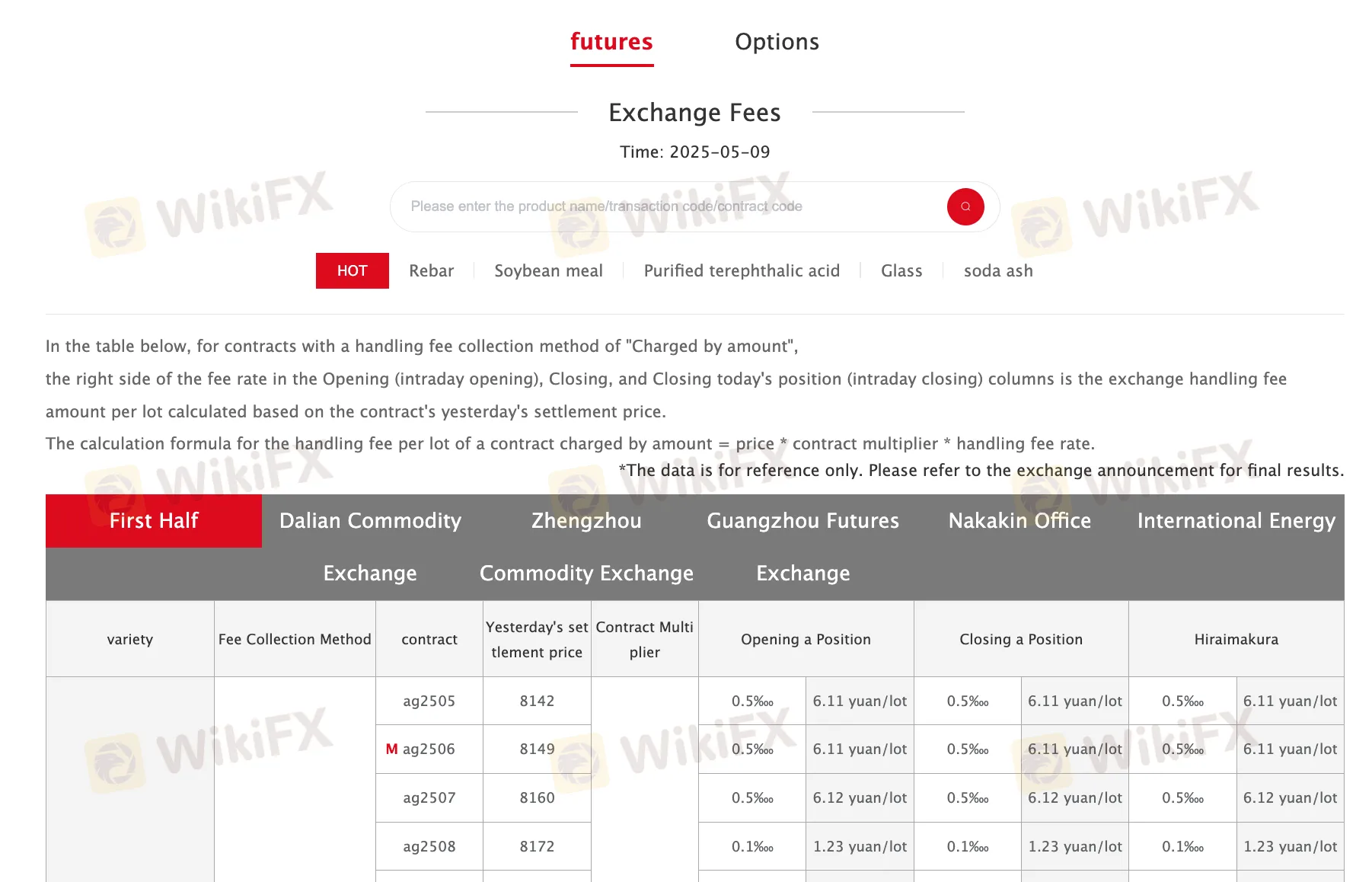

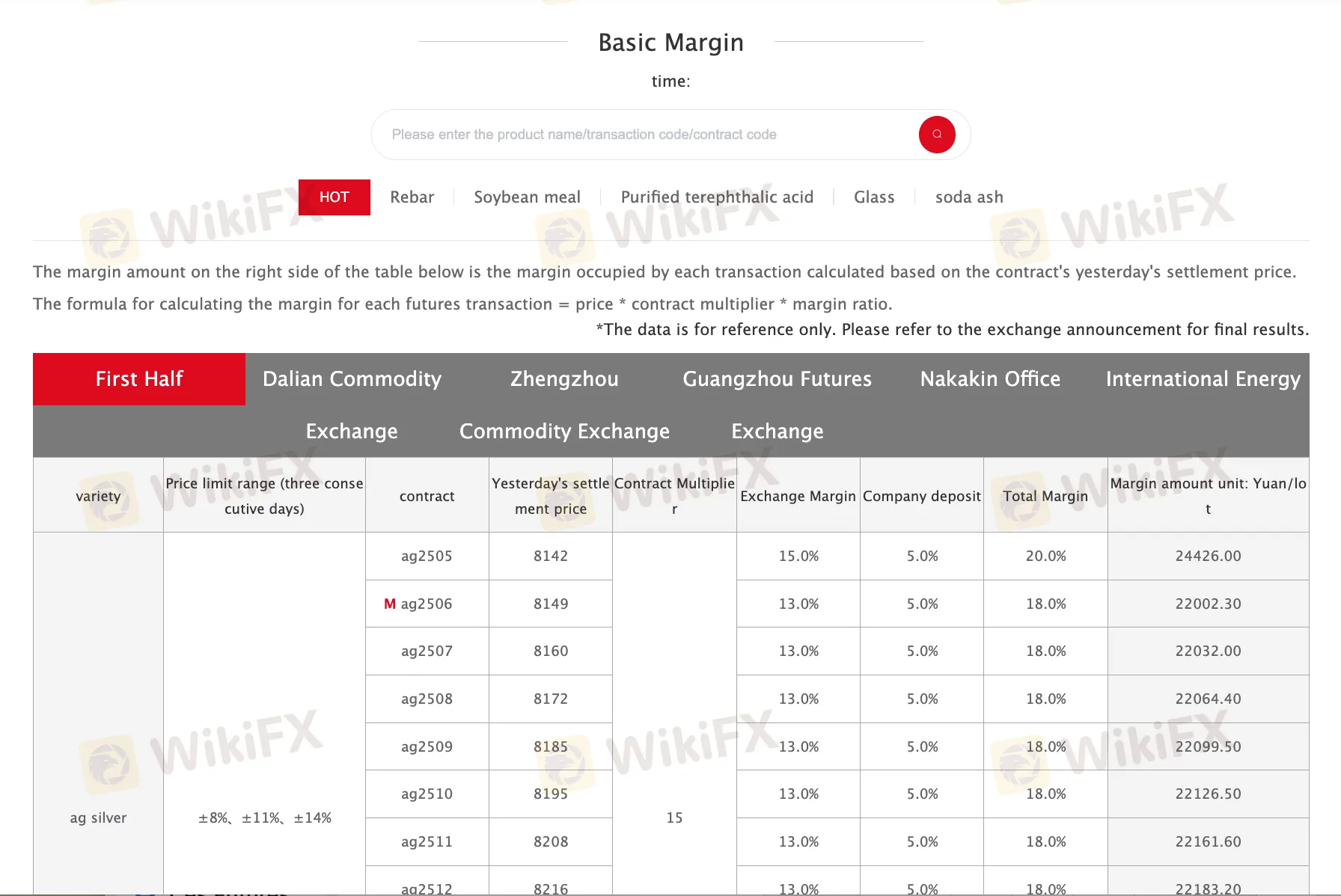

Nhà môi giới yêu cầu phí trao đổi và phí margin cho các loại công cụ giao dịch khác nhau.

Nhà môi giới cung cấp các nền tảng giao dịch khác nhau, bao gồm ứng dụng Eastern Futures, China Eastern Easy Star (phiên bản Android), China Eastern Easy Star (phiên bản IOS), ứng dụng China Eastern Express, Eastern Airlines Futures Polestar V9.5 Client, Eastern Airlines Futures Polestar V9.3 Client, Eastern Futures Express V3 New Generation Client, Eastern Futures Boyi Cloud Trading Edition, Eastern Airlines Futures Market Software Winshun Edition (Wenhua WH6), Eastern Futures Express V2 Client, Eastern Futures Trading Pioneer Terminal, Eastern Futures Yisheng Polestar V8.5 Client, Eastern Futures Yisheng Classic Client V8.3, Kuaiqi V2 Trading Terminal (Phiên bản Bí mật Quốc gia) và Eastern Airlines Futures Boyi Cloud (Phiên bản Bí mật Quốc gia).

Thiết bị có sẵn: máy tính để bàn và di động (IOS, Android).

Không có số tiền gửi tối thiểu hoặc rút tiền được xác định và không có phí hoặc chi phí cụ thể. Trang web chỉ hiển thị thời gian gửi và rút tiền.

From my perspective as a trader, assessing Ces Futures involves a close look at both their strengths and possible risks. While Ces Futures is regulated in China by the CFFEX and has operated for five to ten years, I don't overlook certain limitations. The broker focuses solely on futures trading—there are no forex, stocks, commodities, or crypto products available. For me, this restricts diversification, which is crucial for managing risk, especially during volatile market periods. Another consideration is that while they offer multiple trading platforms and demo accounts, I found no clear information on specific account types or minimum deposit and withdrawal requirements. Lack of transparency around fees and procedures can sometimes complicate managing costs and cash flow. Additionally, fees for exchange and margin are applicable, and since these aren't detailed up front, there's a risk I could face higher trading costs than expected. Regulatory oversight by CFFEX and China's relatively strict supervision does provide a measure of security, but as with any broker, I remain vigilant. Ensuring my strategies align with their limited product range and platform ecosystem is essential. Ultimately, while regulation is reassuring, the reduced product breadth and some ambiguous fee details mean I proceed cautiously and keep my trading expectations realistic.

From my experience as a trader who prioritizes both regulatory oversight and transparent operations, I approach every broker with a critical eye. Ces Futures stands out as one of the few firms I’ve encountered that holds a valid license from the China Financial Futures Exchange (CFFEX), which is notable given the strict regulatory environment in China. I personally consider regulatory status a fundamental component when evaluating any broker’s legitimacy; regulation by CFFEX strongly signals that Ces Futures is required to abide by operational and capital requirements set by Chinese authorities. Additionally, Ces Futures has been operating for over five years—another important factor for me, as longevity can imply ongoing compliance and client trust. The broker offers a range of trading platforms and demo accounts, which suggests an effort to accommodate users and support trading practice. On the downside, I noticed the product selection is limited strictly to futures products, so it’s not suitable for traders looking for forex, commodities, or equities. I’m always cautious and recommend thoroughly understanding fee structures and withdrawal processes before committing any capital. While Ces Futures appears legitimate by regulatory standards and reasonable transparency, I would always urge anyone to exercise due diligence, as even regulated brokers are not risk-free. For me, the combination of CFFEX oversight and a history of operations offers reassurance, but it’s still important to carefully monitor your account and understand all terms before trading.

Based on my personal experience and careful review of Ces Futures, I recognize a few important strengths as well as areas that might be limiting, especially for traders like myself who are used to a variety of global products. The most notable advantage for me is that Ces Futures is properly regulated in China, holding a valid futures license from the China Financial Futures Exchange (CFFEX). Regulatory oversight is critical in my selection process, as it provides some level of client protection and transparency. Ces Futures also operates with several years of experience—over five years—which can be reassuring. I appreciate that they offer multiple trading platforms compatible with both desktop and mobile devices, allowing for a certain degree of flexibility. Demo accounts are available, which I find essential for those who want to familiarize themselves with the platform’s features and performance before committing real capital. However, Ces Futures does have clear limitations. The broker is focused exclusively on futures trading; there is no access to forex, stocks, commodities, or crypto assets. For me, this single-asset focus could be restrictive, especially if I’m seeking portfolio diversification or exposure to different markets within one brokerage. Additionally, their product offering is not as comprehensive as some internationally recognized brokers I’ve used. Another point worth mentioning is that information on account types and transaction fees is somewhat limited and lacks detail, which makes it challenging for me to estimate the true trading costs upfront or to compare account features directly. Overall, Ces Futures may appeal to traders who primarily want regulated access to Chinese futures markets and value a range of platform options, but it falls short if broad asset selection and global instruments are essential to your trading strategy. As always, I recommend careful due diligence before making any financial commitments.

As a seasoned trader, I've always prioritized the safety and reliability of my funds when working with any brokerage. With Ces Futures, I have looked closely at their operational transparency and regulatory status before considering them. They are regulated in China by the China Financial Futures Exchange (CFFEX), which does give me some reassurance about the integrity of their processes, especially because Chinese financial supervision tends to be quite rigorous. However, specific information about withdrawal timeframes is notably absent from Ces Futures’ publicly available details. On their website, the only mention related to withdrawals is the display of deposit and withdrawal time—not the actual processing durations for bank accounts or e-wallets. From my experience, when a broker does not explicitly state withdrawal speeds or minimum/maximum transaction amounts, it’s wise for traders to take a cautious approach. Regulatory oversight can help minimize risks of unreasonable delays, but without official commitments, there is still a degree of uncertainty. Given the lack of explicit promises on timing, my conservative stance would be to expect standard industry durations, perhaps one to several business days for most regulated brokers, but I cannot confirm a precise window for Ces Futures. Therefore, for anyone planning significant withdrawals, I would recommend first initiating a smaller test withdrawal and ensuring customer support is responsive, as this helps manage both expectations and risk.

Vui lòng nhập...

TOP

TOP

Chrome

Chrome extension

Yêu cầu về quy định của nhà môi giới ngoại hối toàn cầu

Đánh giá nhanh chóng website của các sàn giao dịch

Tải ngay