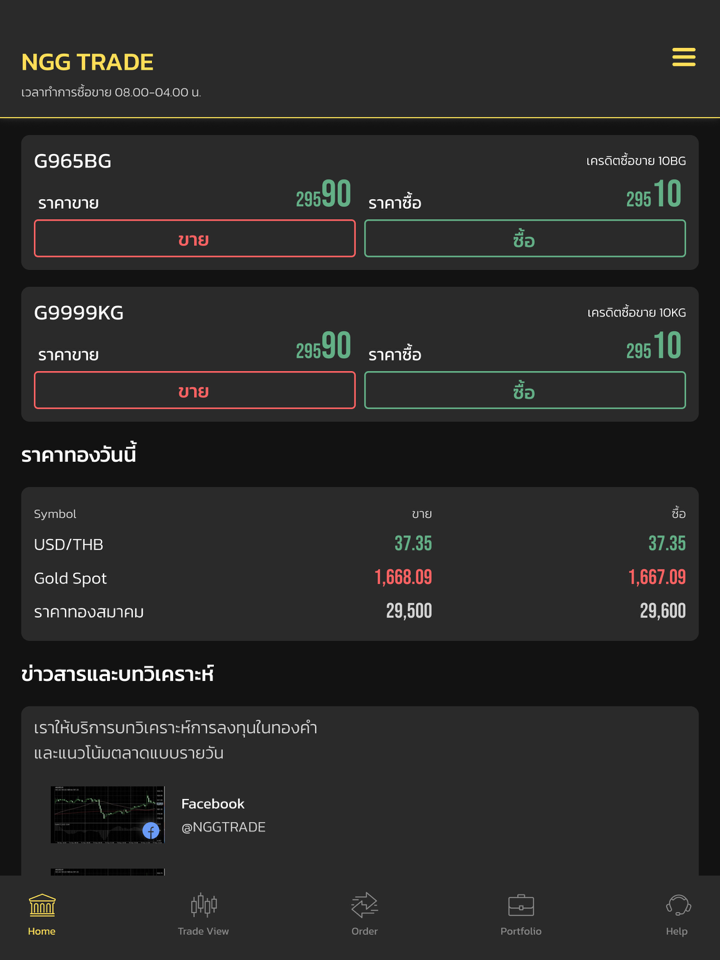

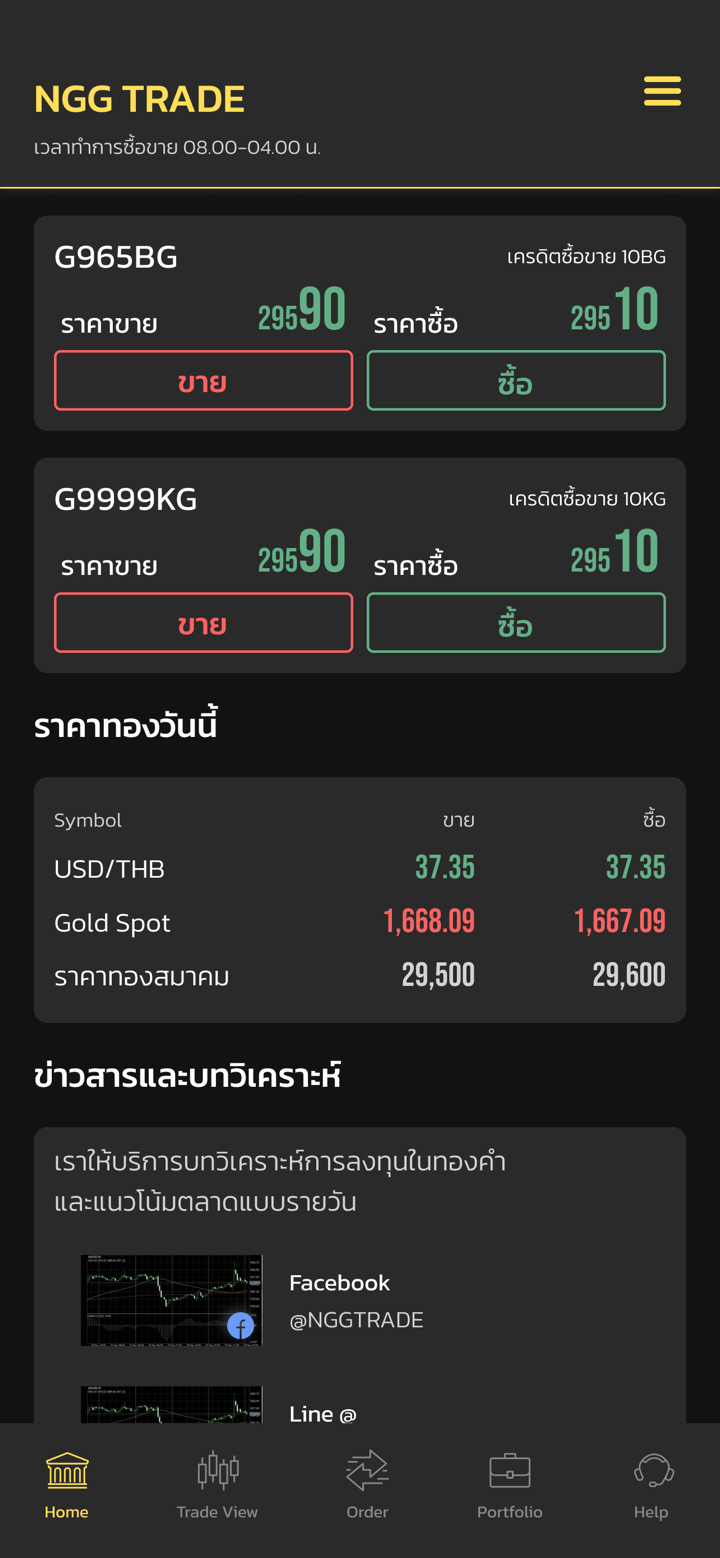

Profil perusahaan

| Ringkasan Ulasan | |

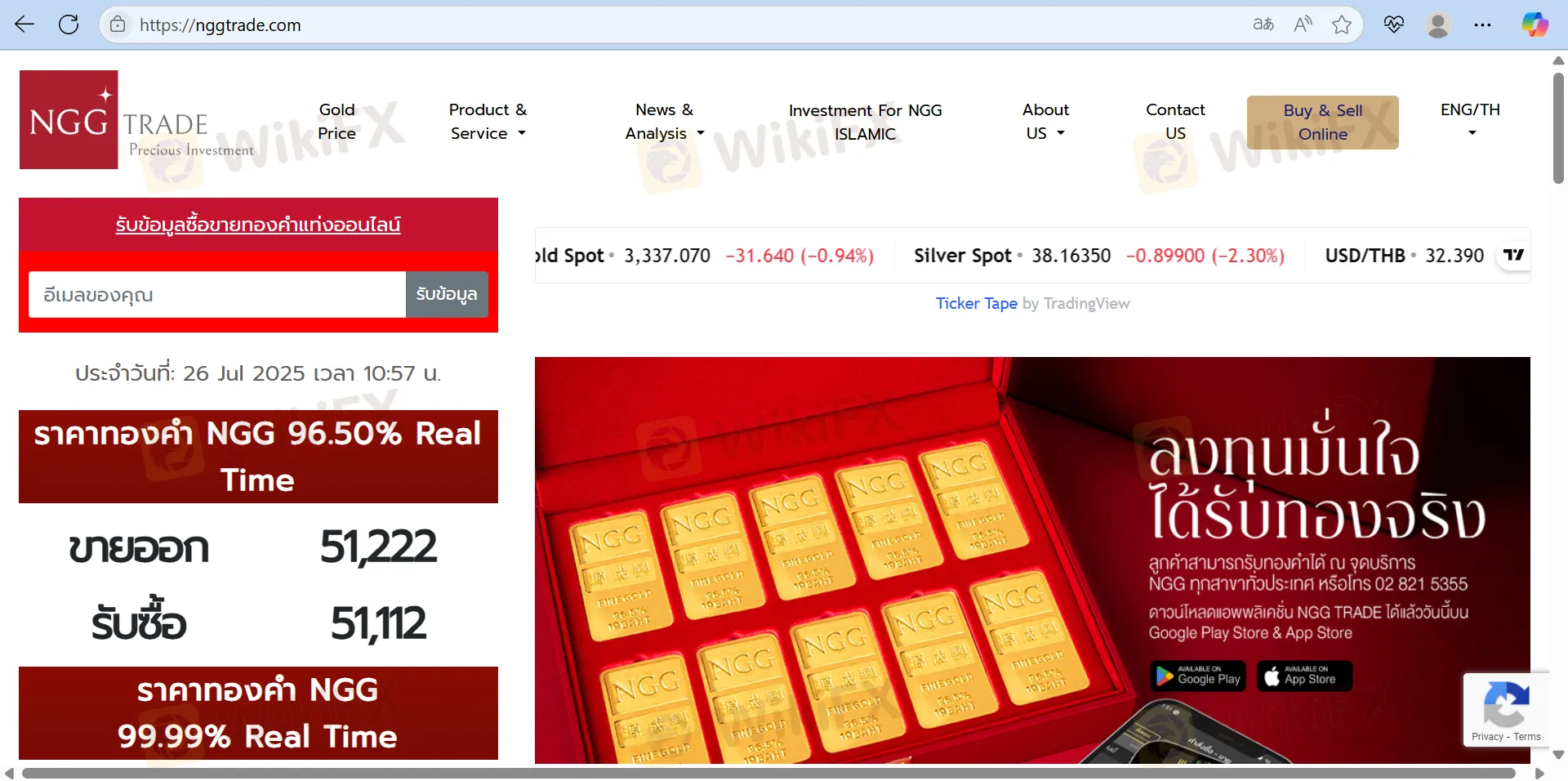

| Didirikan | tahun 2020 |

| Negara/Wilayah Terdaftar | Thailand |

| Peraturan | Tidak ada regulasi |

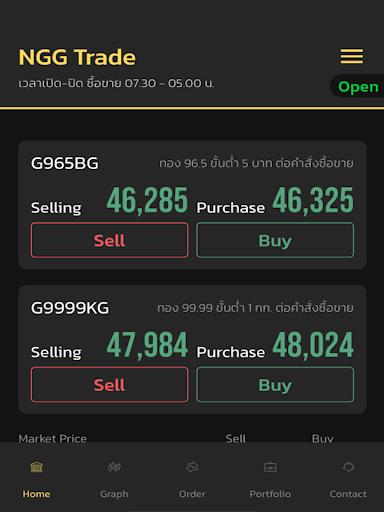

| Instrumen Pasar | Emas |

| Akun Demo | / |

| Manfaat | rentang baris="1">/|

| Menyebar | / |

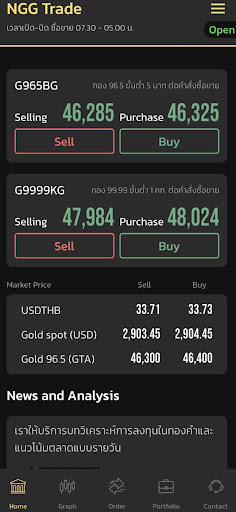

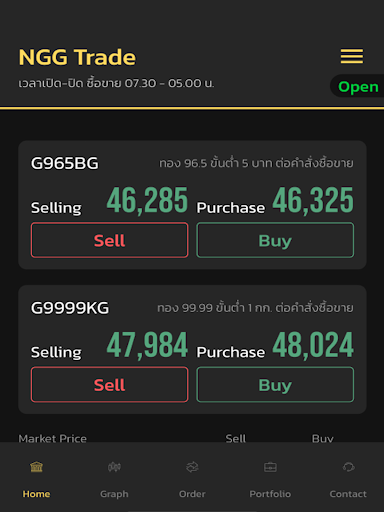

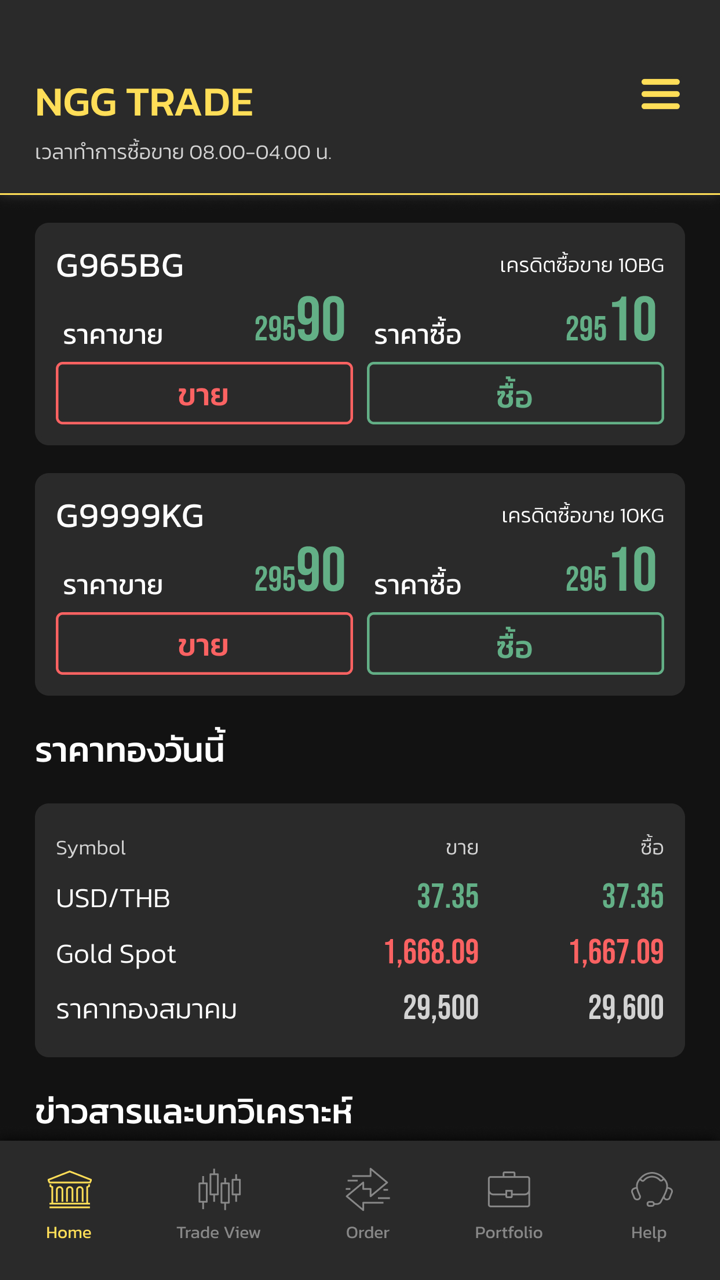

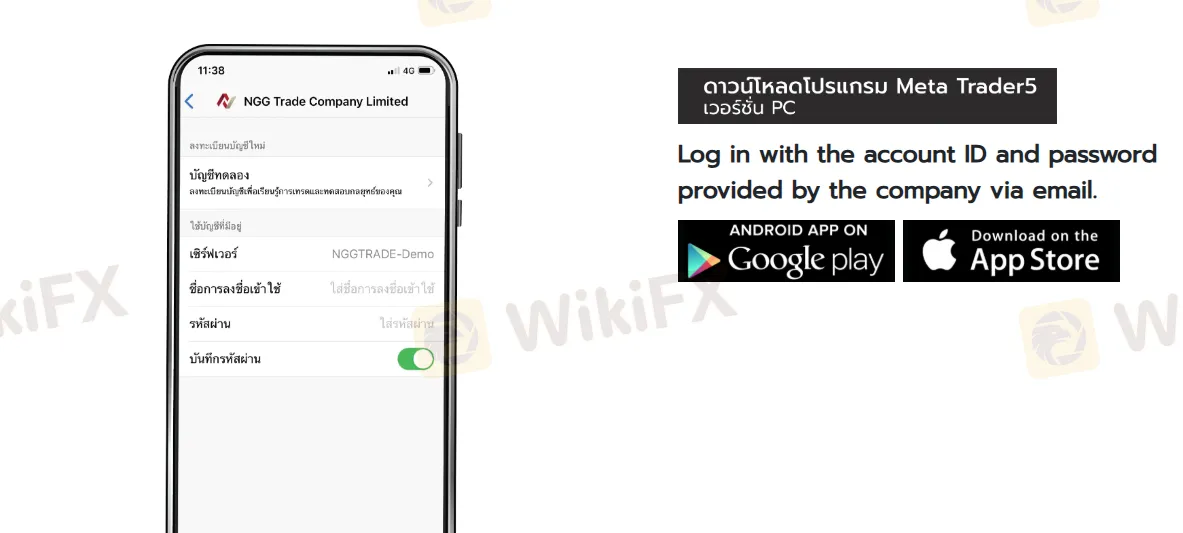

| Platform Perdagangan | NGG Aplikasi Perdagangan, MT5 |

| Setoran Minimum | / |

| Dukungan Pelanggan | Telp: +66 0-2821-5355 |

| Surel: cs@nggtrade.com | |

| Garis: https://page.line.me/559qlobw?openQrModal=true | |

| Facebook: https://www.facebook.com/NGGPERDAGANGAN | |

| Alamat: No.555 Soi Chok Chai Chong Chamroen Bang Phong Phang, Yan Nawa, Bangkok 10120 | |

Didirikan pada tahun 2020, NGG adalah broker Thailand yang berspesialisasi dalam perdagangan emas. NGG tidak hanya menawarkan platform NGG Trade, tetapi juga menyediakan MT5 untuk para trader. Selain itu, terdapat akun Islami NGG untuk investasi. Namun, status NGG tidak teregulasi dan harus diperlakukan dengan hati-hati.

Pro dan Kontra

| Kelebihan | Kontra |

| Tidak ada regulasi | |

| Dukungan MT5 | Info terbatas tentang detail perdagangan |

| Beberapa saluran kontak | |

| Islam accounts tersedia |

Apakah NGG Sah?

Tidak, NGG tidak diatur . Harap waspadai risikonya!

| Instrumen yang Dapat Diperdagangkan | Didukung |

| Emas | ✔ |

| Indeks | ❌ |

| Obligasi | ❌ |

| Valas | ❌ |

| Mata uang kripto | ❌ |

| Saham | ❌ |

| ETF (Dana Investasi) | ❌ |

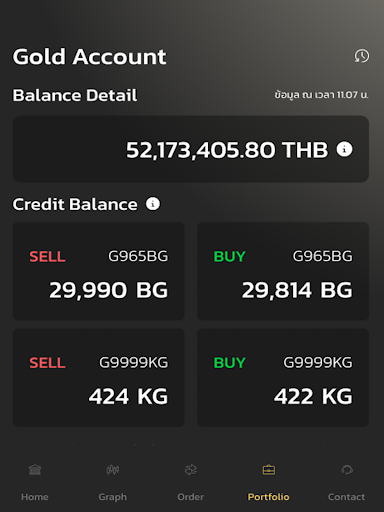

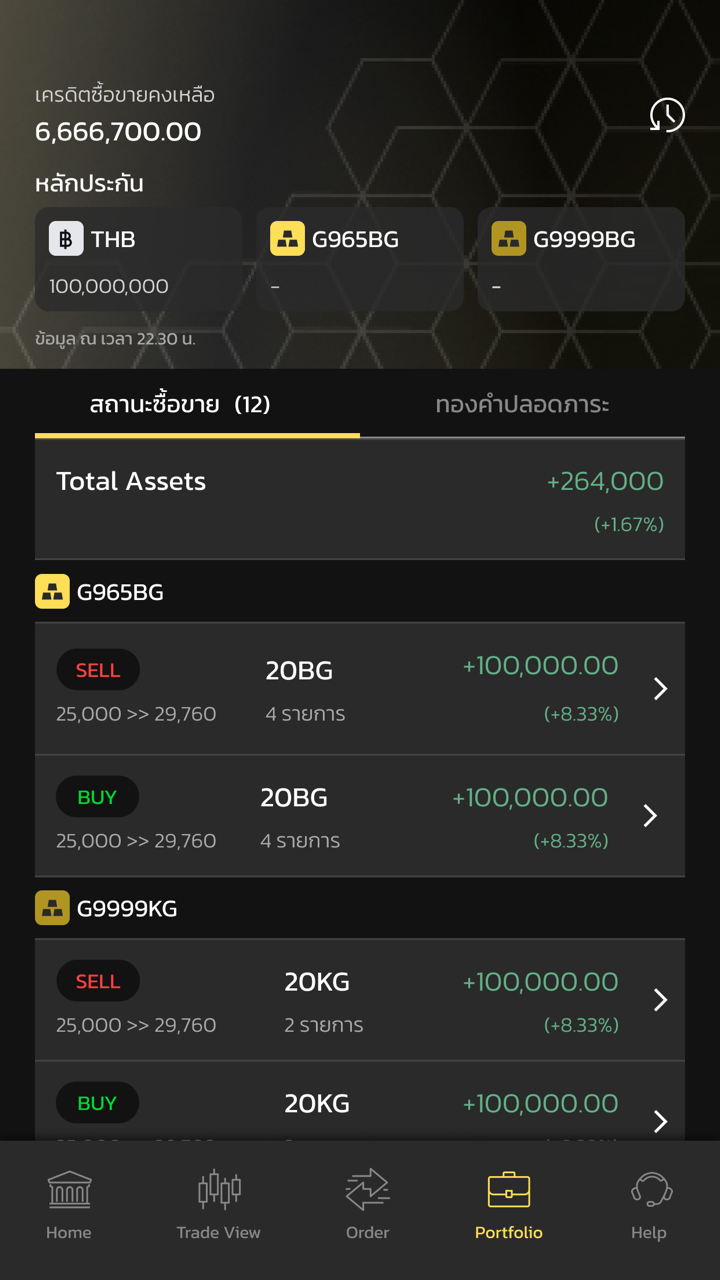

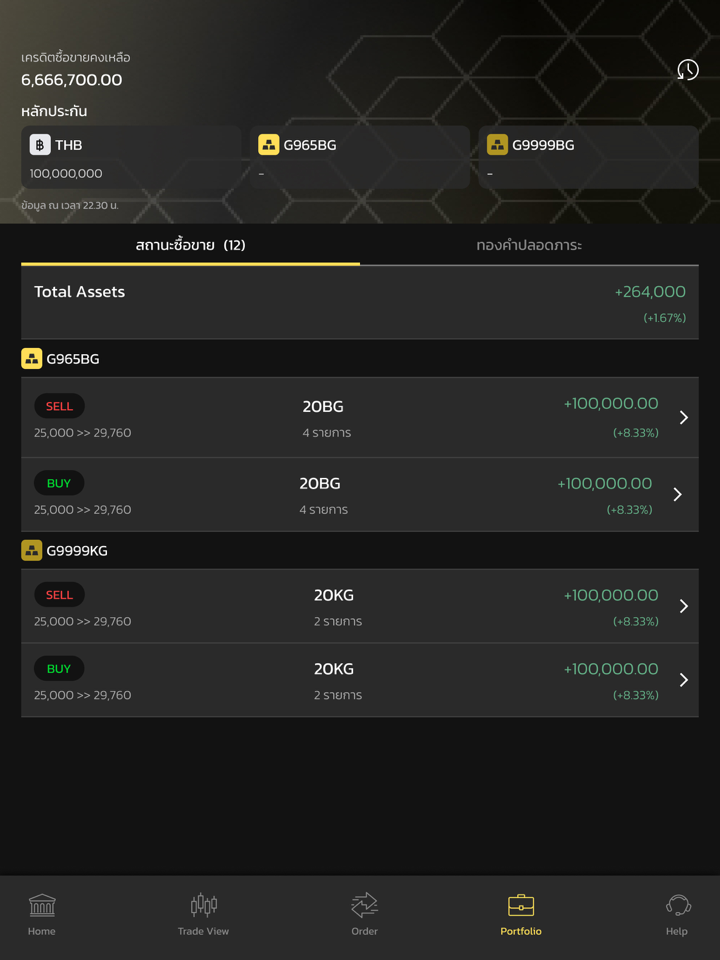

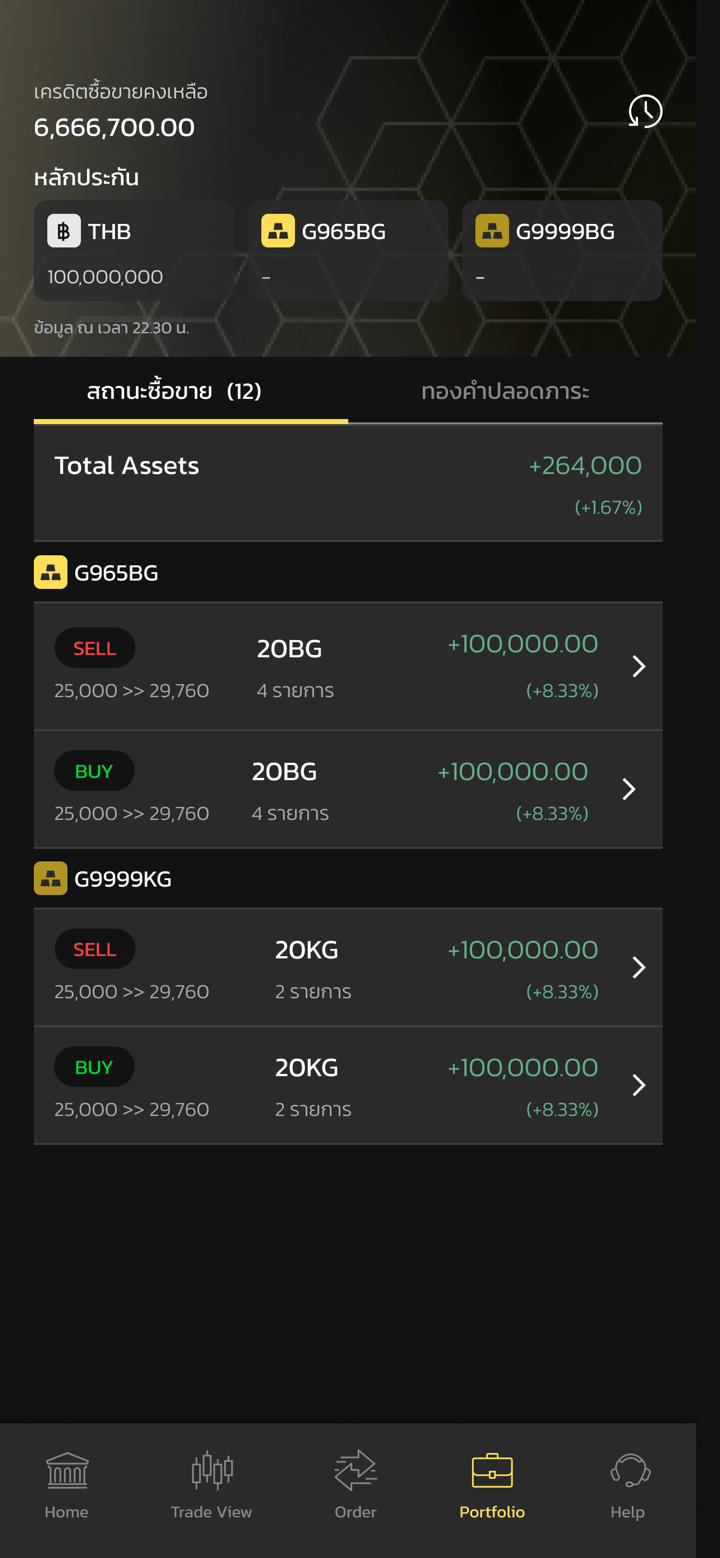

Jenis Akun

NGG menawarkan accounts Islami untuk investor.

Biaya

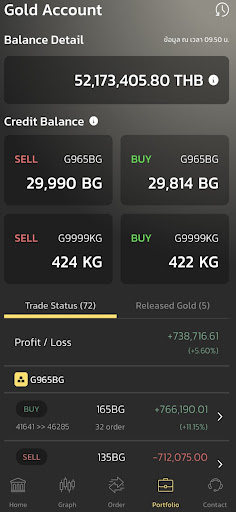

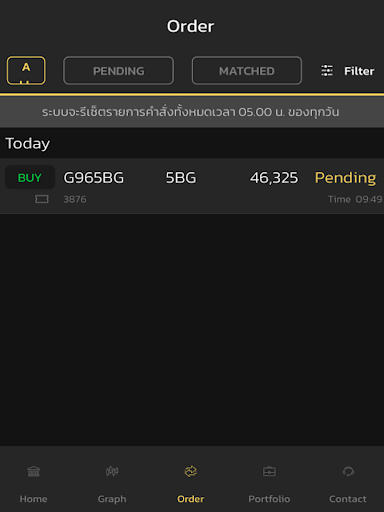

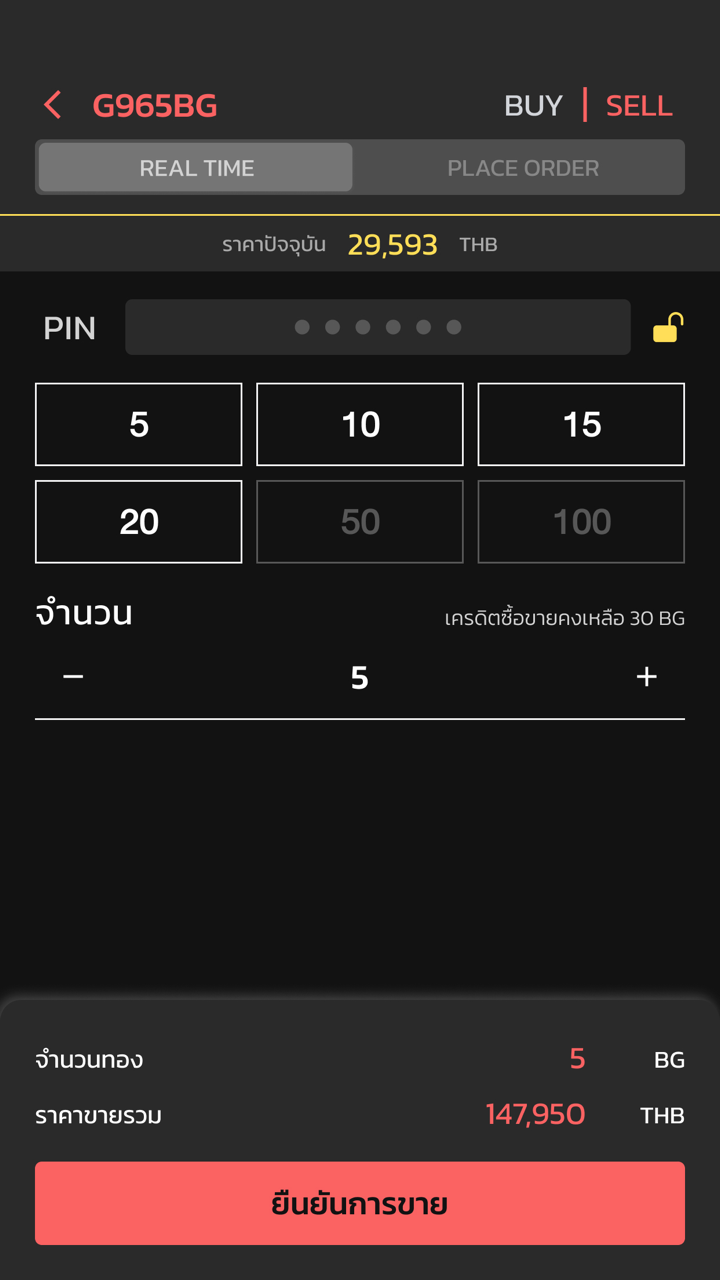

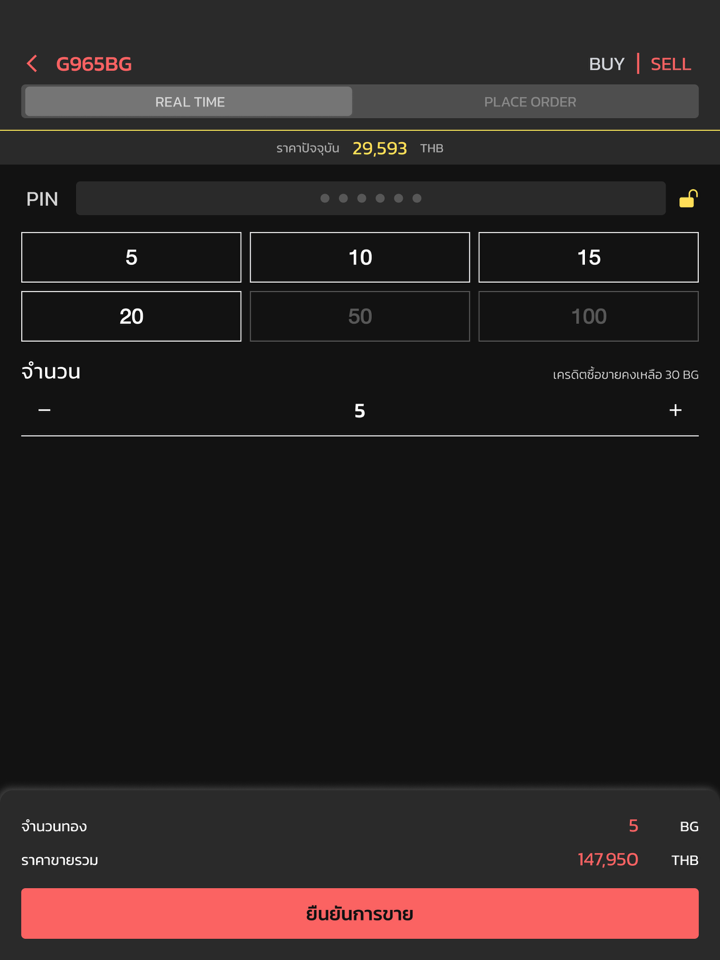

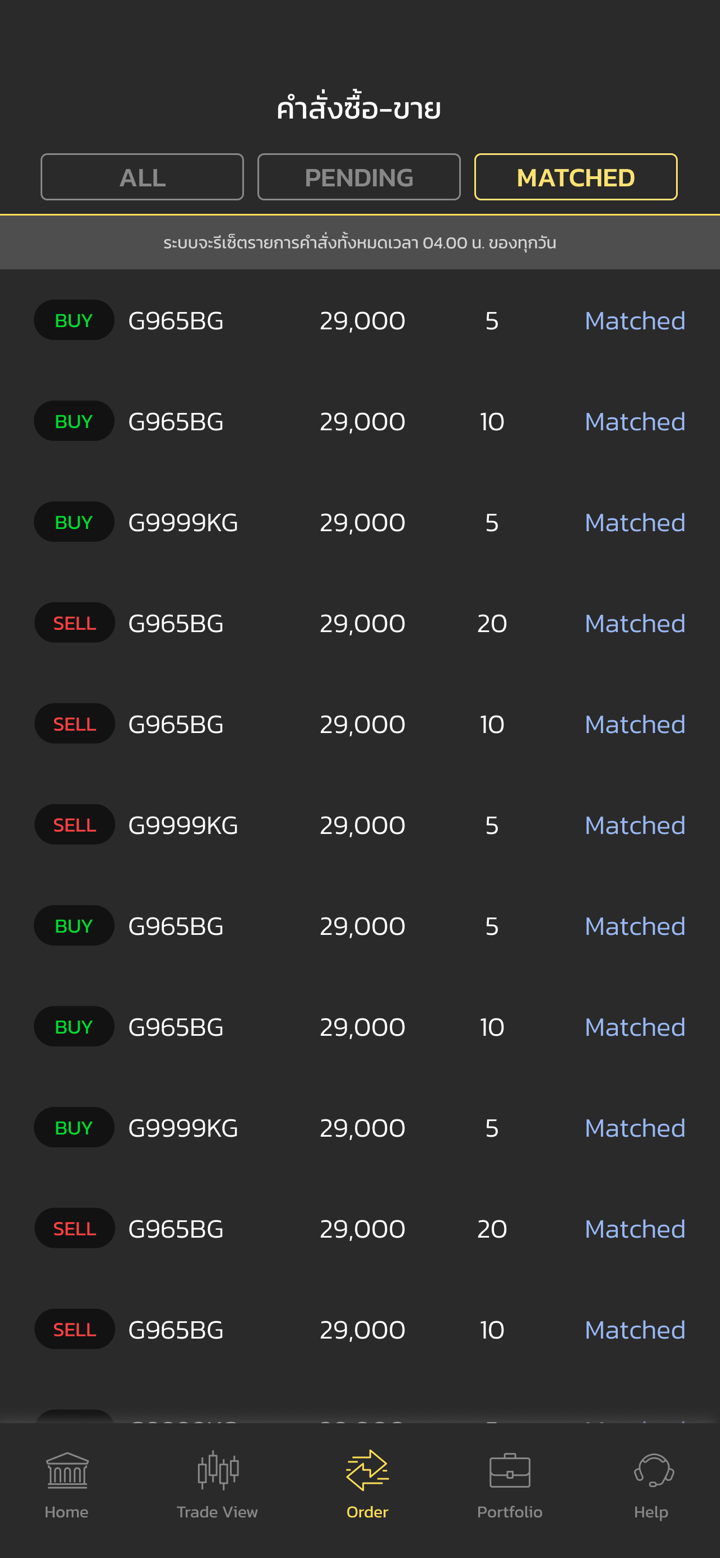

Margin 70% perlu dipertahankan. Jika nilai agunan atau margin turun di bawah 30%, GNN akan otomatis menutup posisi pada harga mark-up penutupan GTA.

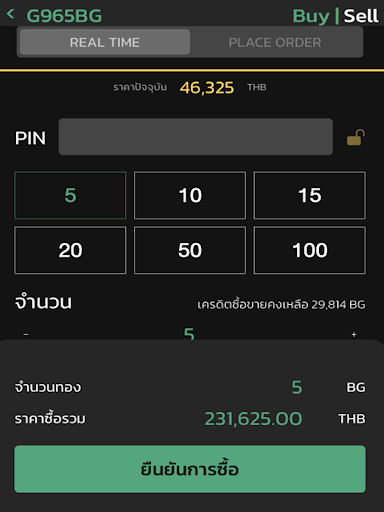

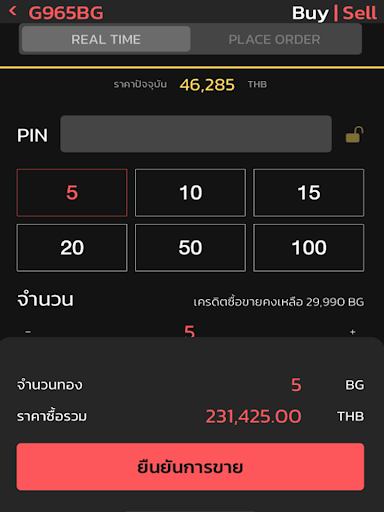

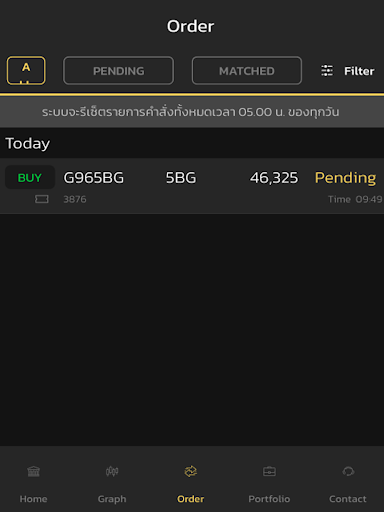

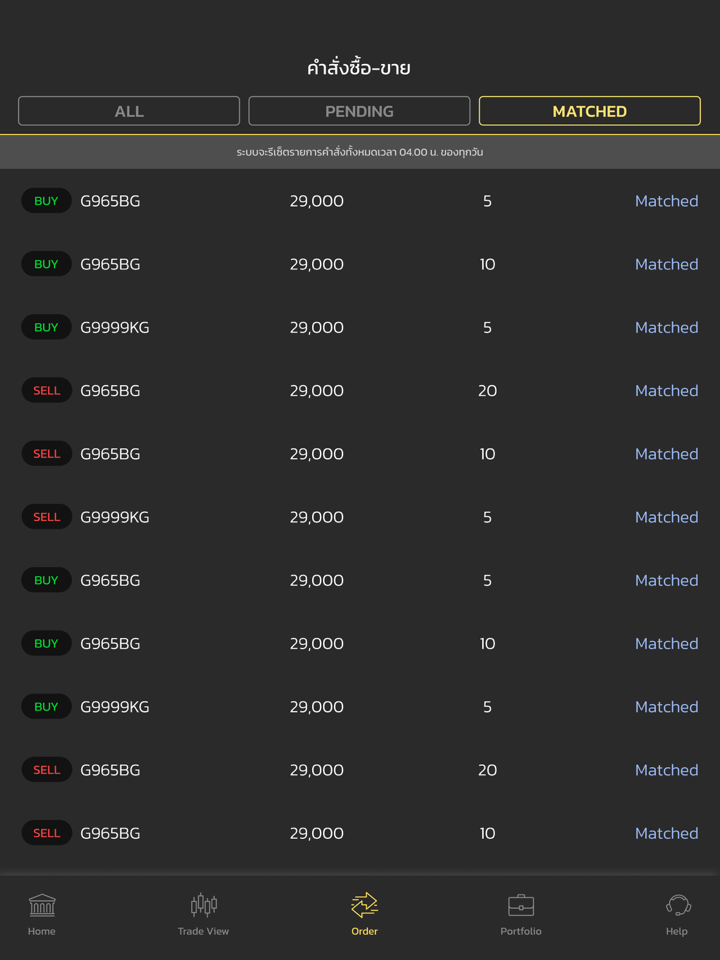

-record-id-Kz0PdSrqrosv2BxvZHBcNB4DnIR">Platform Perdagangan

| Platform Perdagangan | Didukung | Perangkat yang Tersedia | Cocok untuk |

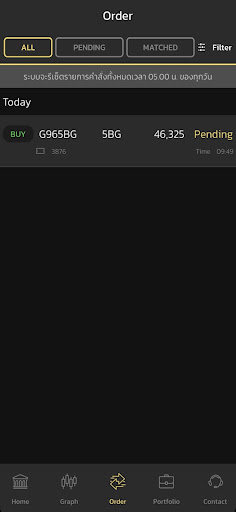

| Perdagangan | ✔ | Seluler | / |

| MT5 | ✔ | PC, web, seluler | rowspan="1">Pedagang berpengalaman|

| MT4 | ❌ | / | Pemula |

Deposit dan Penarikan

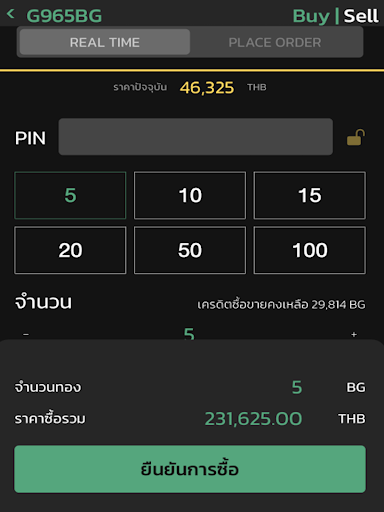

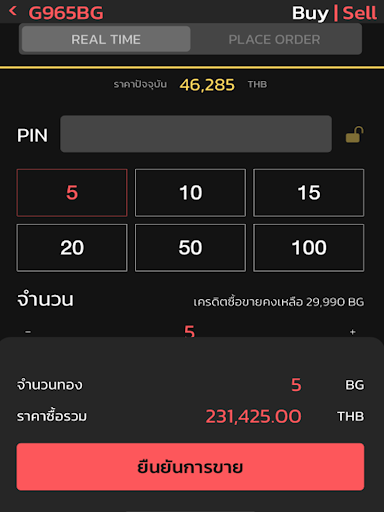

Deposito

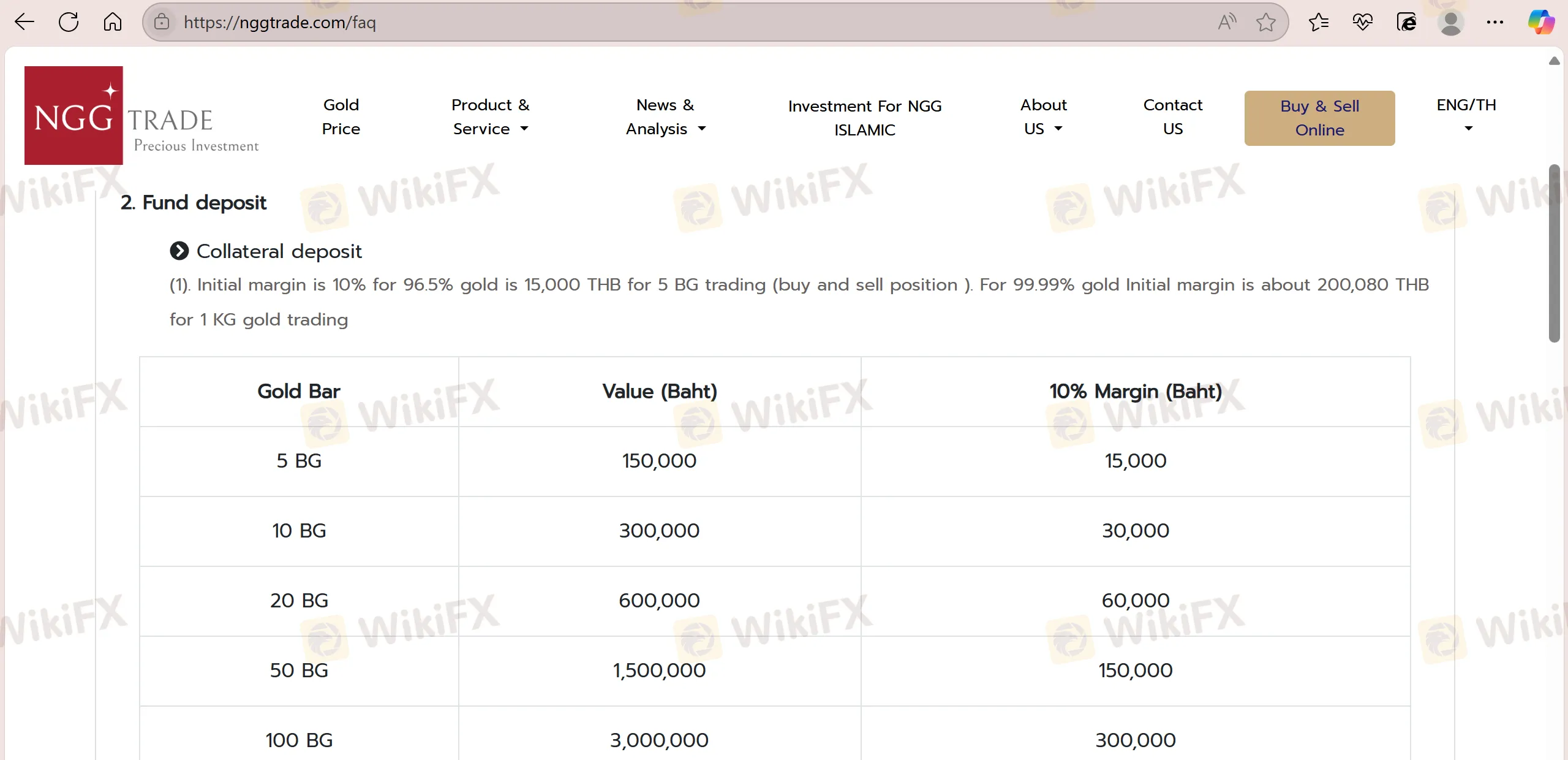

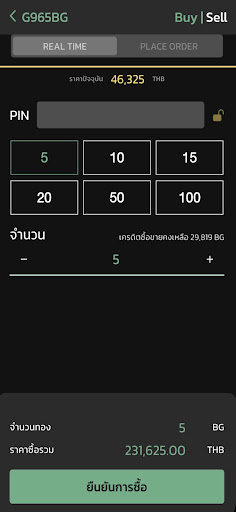

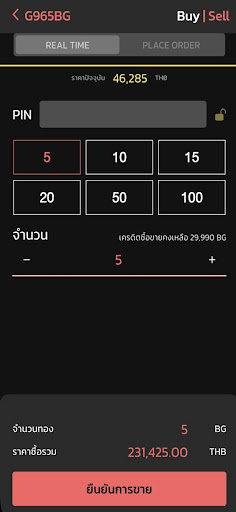

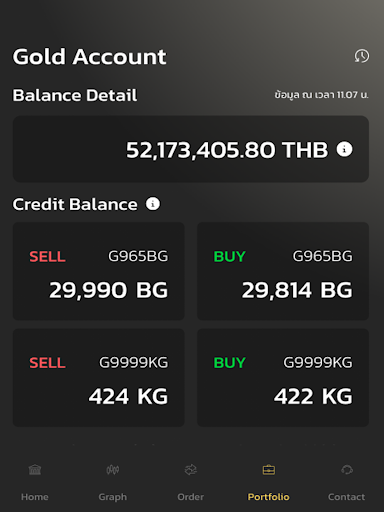

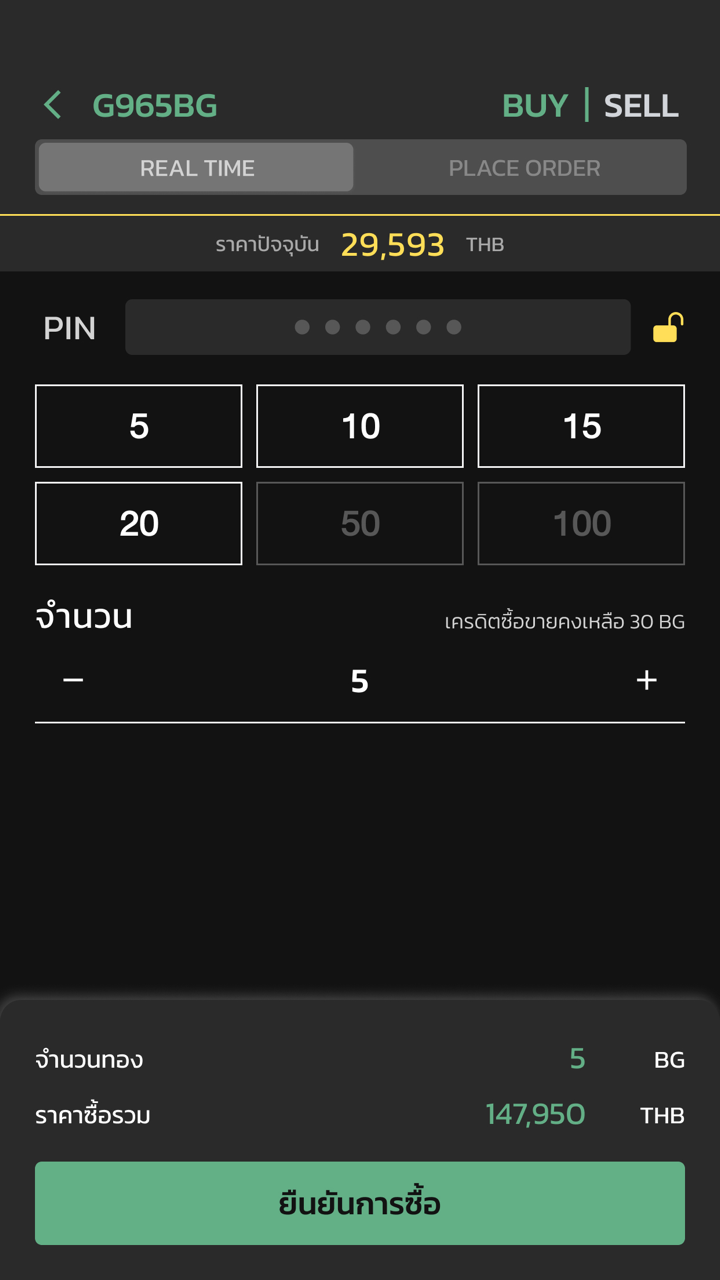

Setoran minimum untuk agunan emas adalah 5 BG dan 80% dari harga real-time akan dihitung sebagai batas perdagangan.

| Emas Batangan | colspan="1" rowspan="1"> Nilai (Baht)Margin 10% (Baht) | |

| 5 BG | 150.000 | 15.000 |

| 10 BG | 300.000 | 30.000 |

| 20 BG | 600.000 | 60.000 |

| 50 BG | 1.500.000 | 150.000 |

| 100 BG | 3.000.000 | 300.000 |

| 2.000.000 | 200.000 | |

| 5 kg | 10.000.000 | 1.000.000 |

Penarikan

Klien diharuskan mengisi formulir penarikan dan mengirimkannya ke cs@nggtrade.com atau Line: @nggtrade.