Şirket özeti

| Commerzbank İnceleme Özeti | |

| Kuruluş Yılı | 1870 |

| Kayıtlı Ülke/Bölge | Almanya |

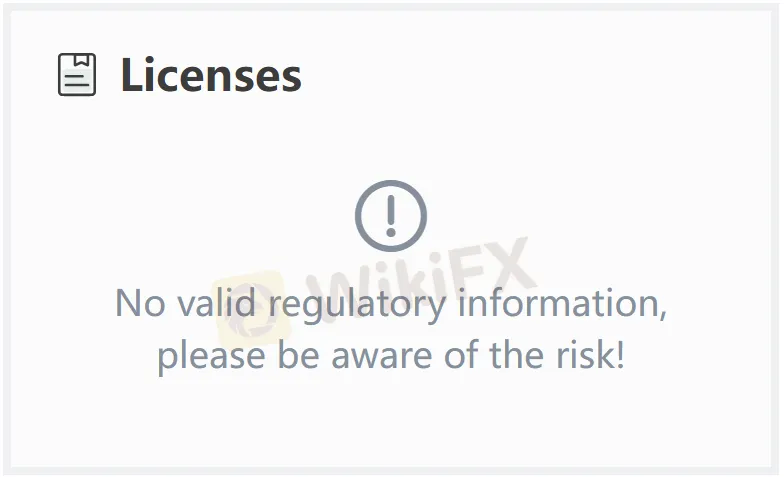

| Düzenleme | Düzenleme Yok |

| Ürünler ve Hizmetler | Nakit Hizmetleri, Ticaret Hizmetleri, Bankacılık Ürünleri ve Piyasa Ürünleri |

| Müşteri Desteği | Telefon: +49 69 136-20, 0800 1010159 |

| E-posta: info-recruiting@commerzbank.com, info@commerzbank.com | |

| Facebook, Instagram, LinkedIn, YouTube | |

Commerzbank, 1870 yılında kurulmuş ve Almanya'da kayıtlı olan düzenlemesi olmayan bir finansal kuruluştur. Nakit Hizmetleri, Ticaret Hizmetleri, Bankacılık Ürünleri ve Piyasa Ürünleri gibi geniş bir ürün ve hizmet yelpazesi sunmaktadır. Ayrıca, Commerzbank aynı zamanda özel müşterilere, iş müşterilerine ve kurumsal müşterilere hizmetler sunmaktadır.

Artıları ve Eksileri

| Artılar | Eksiler |

| Uzun geçmiş | Düzenleme yok |

| Geniş ürün ve hizmet yelpazesi | Belirsiz ücret yapısı |

Commerzbank Güvenilir mi?

Şu anda, Commerzbank geçerli bir düzenlemeye sahip değildir. Lütfen riskin farkında olun!

Ürünler ve Hizmetler

Commerzbank, müşterilere Nakit Hizmetleri, Ticaret Hizmetleri, Bankacılık Ürünleri ve Piyasa Ürünleri sunmaktadır.