Şirket özeti

| LINE FXİnceleme Özeti | |

| Kuruluş Tarihi | 2019-04-23 |

| Kayıtlı Ülke/Bölge | Japonya |

| Düzenleme | Düzenlenmemiş |

| Ürünler | 23 döviz çifti |

| Kaldıraç | 1:25'e kadar |

| Spread | 0.3 pip'ten başlayarak |

| İşlem Platformu | LINE FX(Akıllı Telefon)/LINE FX Pro(PC)/TradingView |

| X, Line, Facebook | |

LINE FX Bilgileri

Japonya'da kayıtlı olan LINE FX, komisyonsuz 23 döviz çiftine erişimi olan bir menkul kıymetler şirketidir. EUR/USD çekirdek saatleri (ilke olarak sabit) 9:00 - ertesi gün 5:00 arası 0.3 pip, diğer saatlerde 0.4-9.0 pip'tir. Spread ne kadar düşükse, likidite o kadar iyidir.

İşlem ücreti 0 yen'dir. Ancak, LINE FX tarafından sunulan döviz çiftlerinin alış ve satış fiyatları arasında bir fark (spread) vardır. Bir emir verirken, her döviz çifti için %4 veya daha fazla bir teminat (kaldıraç 25 katı) gereklidir.

LINE FX Güvenilir mi?

LINE FX, Finansal Hizmetler Ajansı (FSA) tarafından düzenlenmektedir ve lisans numarası 関東財務局長(金商)第3144号 ve Lisans Türü Perakende Forex Lisansı'dır, bu da düzenlenmemiş olanlardan daha güvenlidir.

İşlem Araçları

Başlangıç ve uzmanlar için işlem araçları, TradingView grafikleme yeteneklerine sahiptir, LINE FX akıllı telefonlar için kullanılabilir ve LINE FX Pro PC için uygundur

| İşlem Araçları | Desteklenen | Kullanılabilir Cihazlar |

| LINE FX | ✔ | Akıllı Telefon |

| LINE FX Pro | ✔ | PC |

| TradingView | ✔ | - |

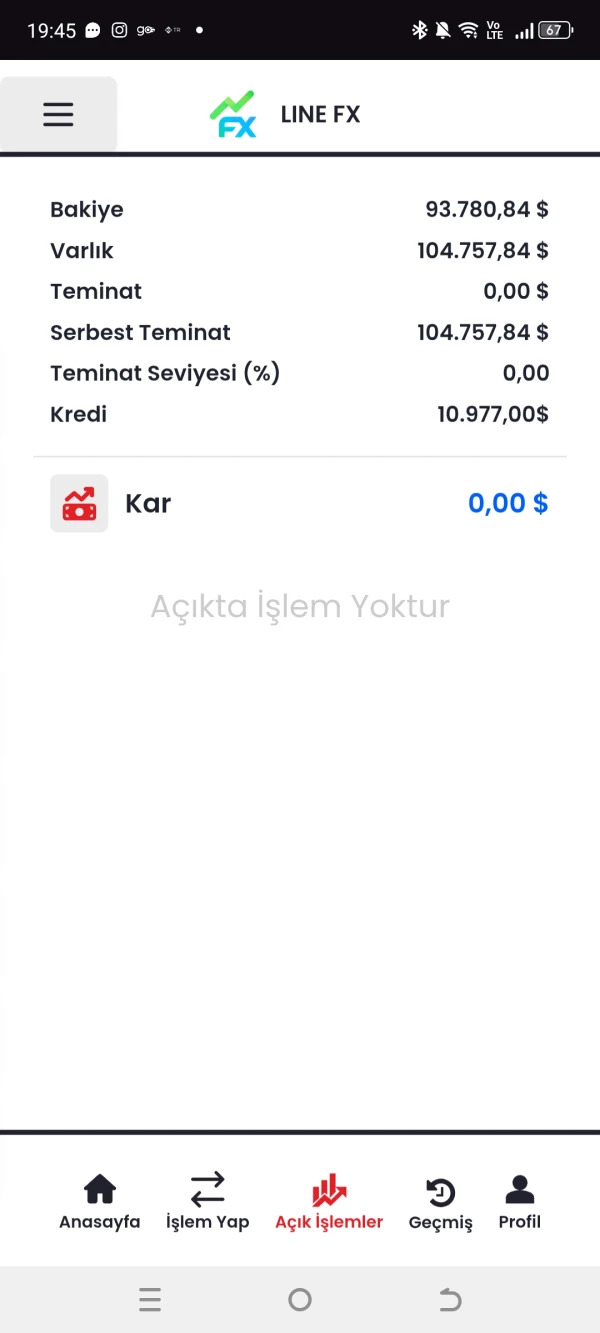

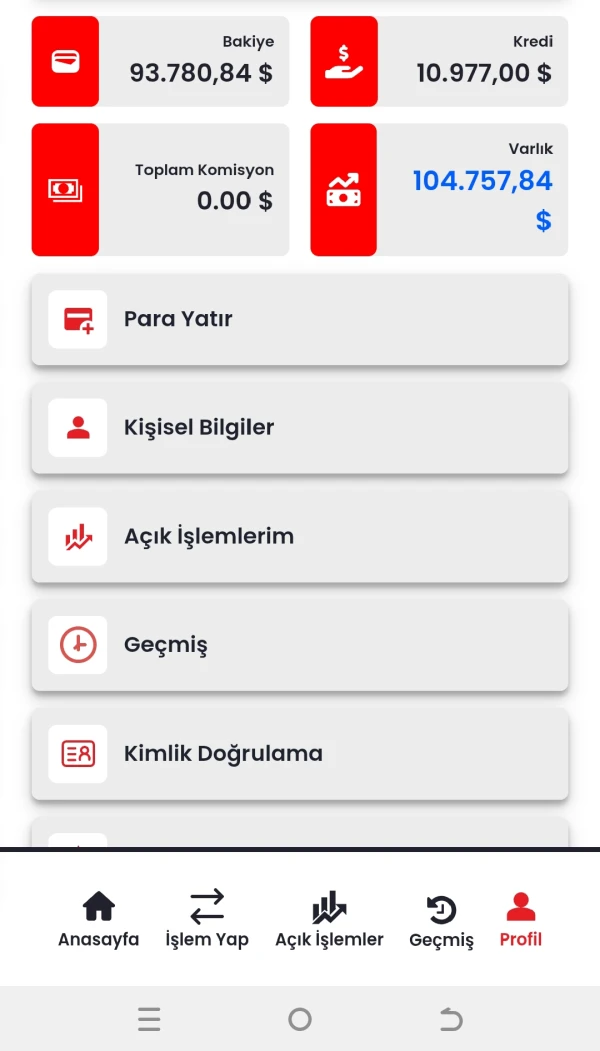

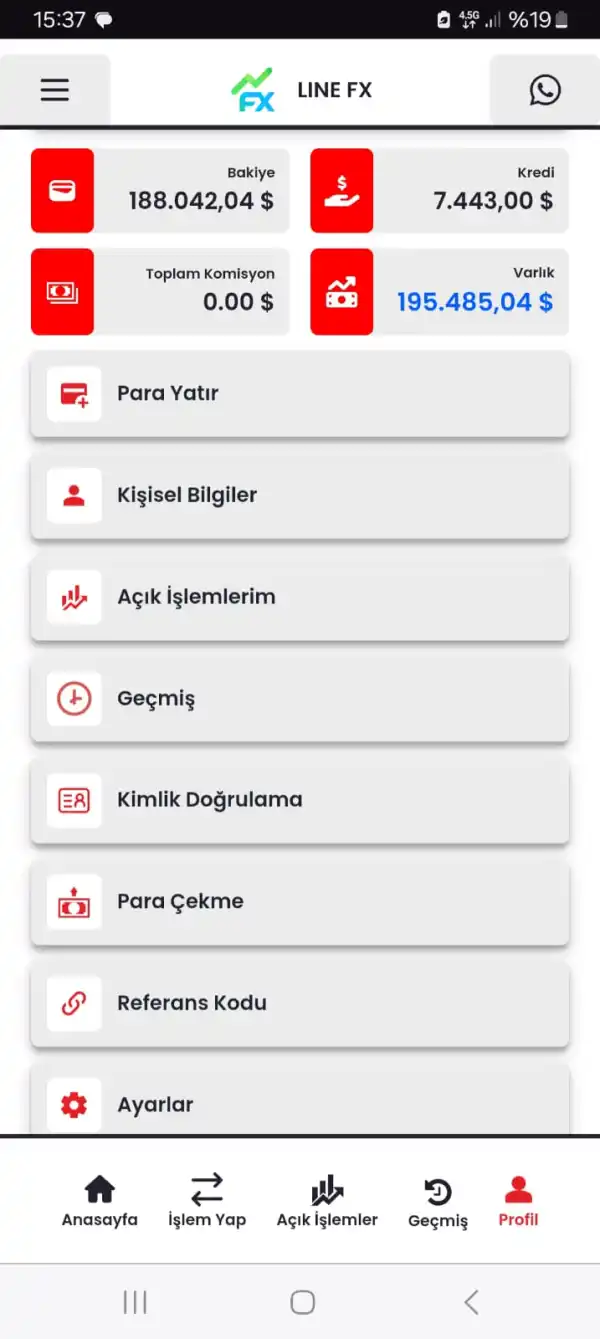

Para Yatırma ve Çekme

LINE FX ödemeler için banka transferleri ve QuickCash kabul eder ve çekimler için banka transferleri kullanır. Banka transferi ödemeleri bir komisyon gerektirir. Finansal kurumları belirten QuickCash ödemeleri dışındaki diğer ödemeler tüm bankalara uygulanır ve işlem süresi genellikle 24 saat içinde gerçekleşir.

| Prosedür | Ödeme Yöntemleri | Komisyon | Kullanılabilir finansal kurumlar | Çalışma saatleri |

| Ödeme | Banka transferi | Müşterinin sorumluluğu | Tüm bankalar | Genellikle 24 saat |

| QuickCash | ücretsiz | Mitsubishi UFJ BankSumitomo Mitsui Banking CorporationMizuho BankSumishin SBI Net BankRakuten Bank JapanPost BankPayPay Bank | ||

| Çekim | Banka transferi | ücretsiz | Tüm bankalar |