Resumo da empresa

| LINE FXResumo da Revisão | |

| Fundado | 2019-04-23 |

| País/Região Registrado | Japão |

| Regulação | Não regulamentado |

| Produtos | 23 pares de moedas |

| Alavancagem | Até 1:25 |

| Spread | A partir de 0.3 pips |

| Plataforma de Negociação | LINE FX(Smart Phone)/LINE FX Pro(PC)/TradingView |

| X, Line, Facebook | |

Informações sobre LINE FX

Registrado no Japão, LINE FX é uma empresa de valores mobiliários que tem acesso a 23 pares de moedas sem comissão. O horário principal do EUR/USD (fixado em princípio) das 9:00 às 5:00 do dia seguinte é de 0.3 pips, em outros horários varia de 0.4 a 9.0 pips. Quanto menor o spread, melhor a liquidez.

A taxa de transação é de 0 ienes. No entanto, há uma diferença (spread) entre os preços de compra e venda das moedas oferecidas pela LINE FX. Ao fazer um pedido, é necessário uma margem de 4% ou mais (alavancagem de 25 vezes) para cada par de moedas.

LINE FX é Legítimo?

A Agência de Serviços Financeiros (FSA) regula LINE FX com o número de licença 関東財務局長(金商)第3144号 e Licença Tipo Retail Forex License, tornando-o mais seguro do que os não regulamentados.

Ferramentas de Negociação

Ferramentas de negociação para iniciantes e especialistas, o TradingView possui recursos de gráficos, o LINE FX está disponível para smartphones e o LINE FX Pro é adequado para PC

| Ferramentas de Negociação | Suportado | Dispositivos Disponíveis |

| LINE FX | ✔ | Smart Phone |

| LINE FX Pro | ✔ | PC |

| TradingView | ✔ | - |

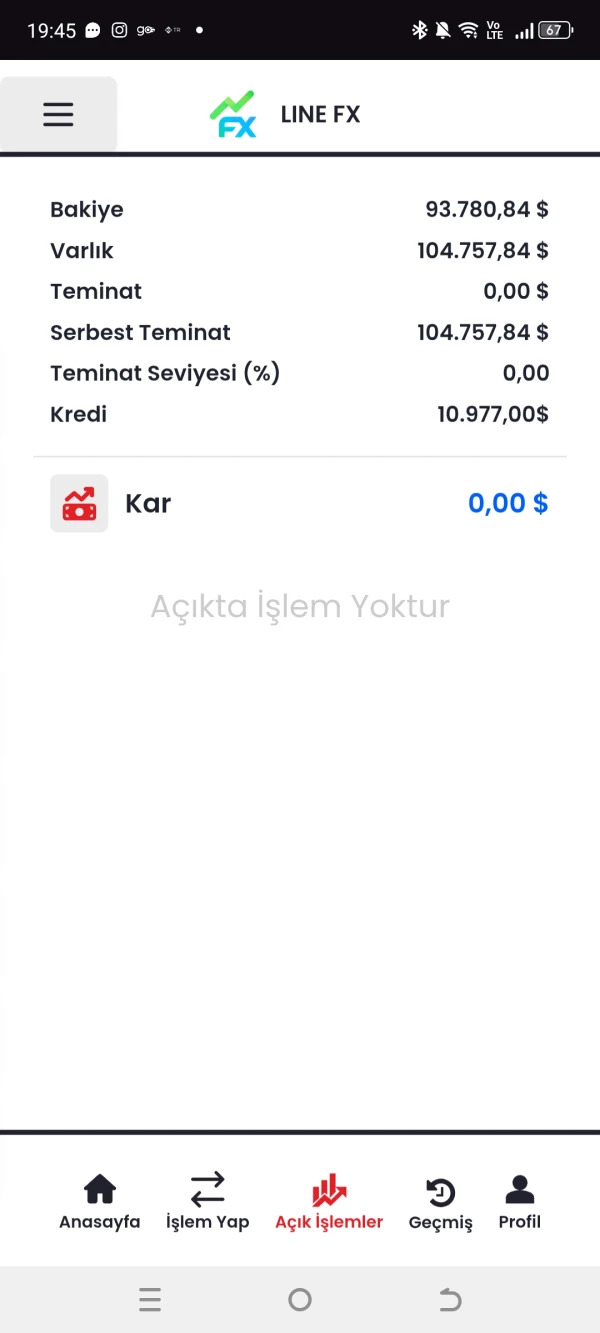

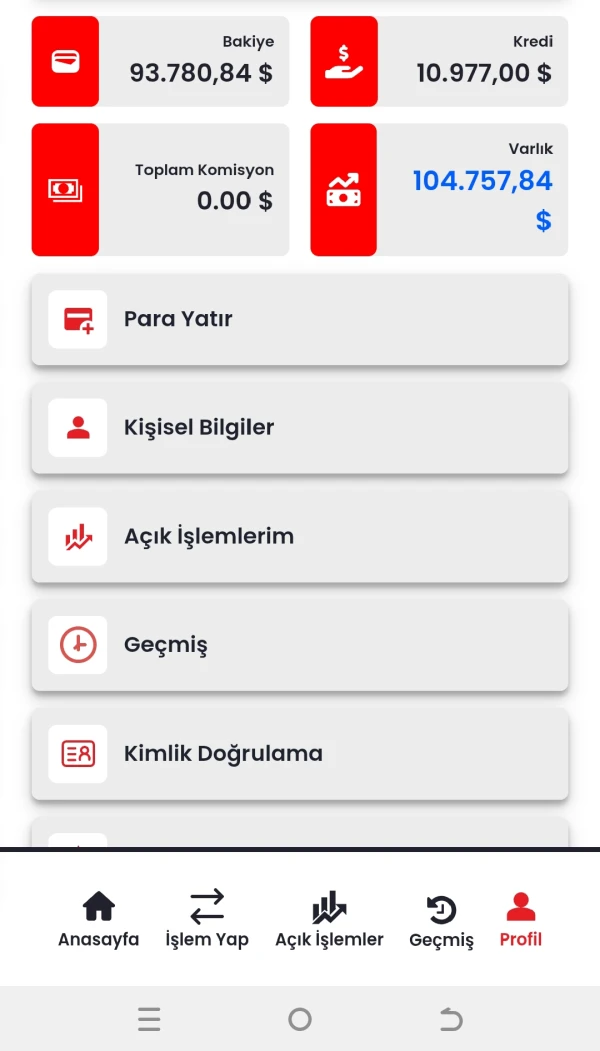

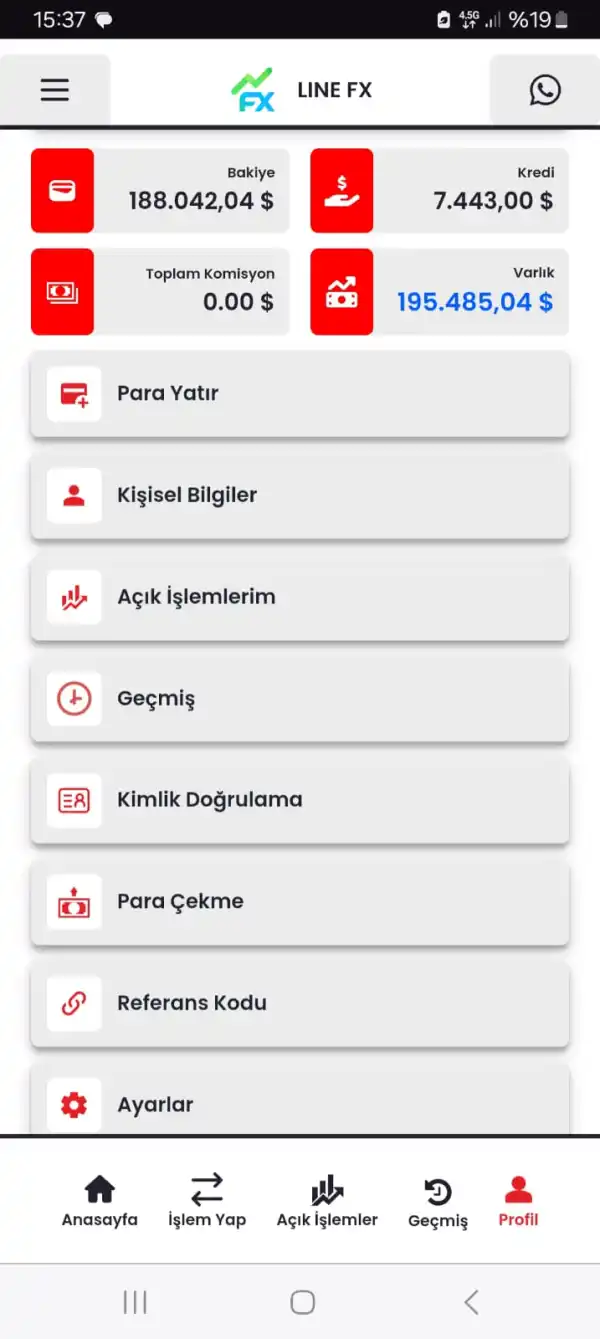

Depósito e Retirada

LINE FX aceita transferências bancárias e QuickCash para pagamento e transferências bancárias para saques. Os pagamentos por transferência bancária requerem uma comissão. Exceto para pagamentos QuickCash que especificam instituições financeiras, outros pagamentos se aplicam a todos os bancos e o tempo de processamento geralmente é em até 24 horas.

| Procedimento | Métodos de Pagamento | Comissão | Instituições financeiras disponíveis | Horário de funcionamento |

| Pagamento | Transferência bancária | Responsabilidade do cliente | Todos os bancos | Geralmente 24 horas |

| QuickCash | grátis | Mitsubishi UFJ BankSumitomo Mitsui Banking CorporationMizuho BankSumishin SBI Net BankRakuten Bank JapanPost BankPayPay Bank | ||

| Saque | Transferência bancária | grátis | Todos os bancos |