Resumo da empresa

| GMO CLICK Resumo da Revisão | |

| Fundação | 2005 |

| País Registrado | Japão |

| Regulação | FSA |

| Instrumentos de Mercado | Ações, fundos de investimento, forex, CFDs, índices de ações, títulos |

| Conta Demonstrativa | / |

| Alavancagem | / |

| Spread | / |

| Plataforma de Negociação | 13 plataformas (GMO Click FX, Hatchu-kun FX Plus, PLATINUM CHART, etc.) |

| Depósito Mínimo | / |

| Suporte ao Cliente | Telefone Fixo: 0120-727-930 |

| Celular: 03-6221-0190 | |

Informações sobre GMO CLICK

Fundada em 2005, a GMO Click Securities é uma empresa de serviços financeiros licenciada e controlada sob a FSA do Japão. Entre suas muitas opções de investimento estão FX, ações, CFDs e contas NISA com vantagens fiscais. A empresa opera vários sistemas de negociação projetados para qualquer pessoa, desde novatos até traders experientes.

Prós e Contras

| Prós | Contras |

| Regulado pela FSA do Japão | Alguns detalhes da plataforma dispersos |

| Taxas de negociação muito baixas, especialmente para FX e CFDs | Aplicação de taxa de retirada de moeda estrangeira |

| Gestão de conta gratuita e sem taxa de inatividade | |

| Tempo de operação longo | |

| Diversas plataformas de negociação |

GMO CLICK é Legítimo?

Sim, GMO CLICK é uma instituição financeira legal e regulamentada. É autorizada pela Agência de Serviços Financeiros (FSA) do Japão com uma Licença de Forex para Varejo, sob o número de licença 関東財務局長(金商)第77号, efetiva desde 30 de setembro de 2007.

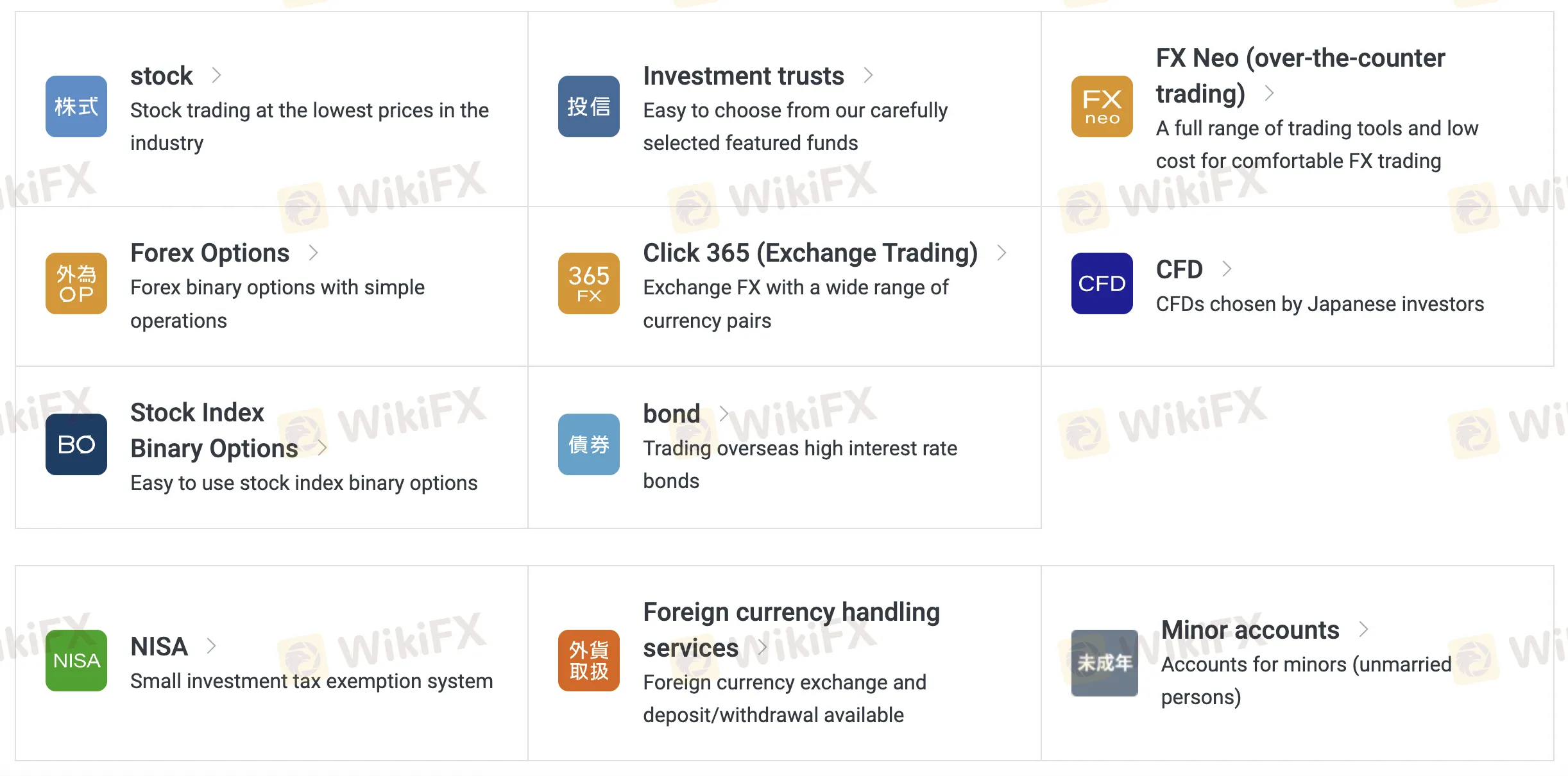

O Que Posso Negociar na GMO CLICK?

Entre suas muitas ferramentas de investimento e negociação, a GMO Click Securities oferece ações, FX, opções, CFDs, títulos e outros. Seus produtos são adequados para investidores comuns, bem como para aqueles que buscam contas modestas com benefícios fiscais.

| Instrumentos de Negociação | Suportados |

| Ações | ✔ |

| Fundos de Investimento | ✔ |

| Forex | ✔ |

| CFDs | ✔ |

| Índices de Ações | ✔ |

| Títulos | ✔ |

| Opções | ❌ |

| ETFs | ❌ |

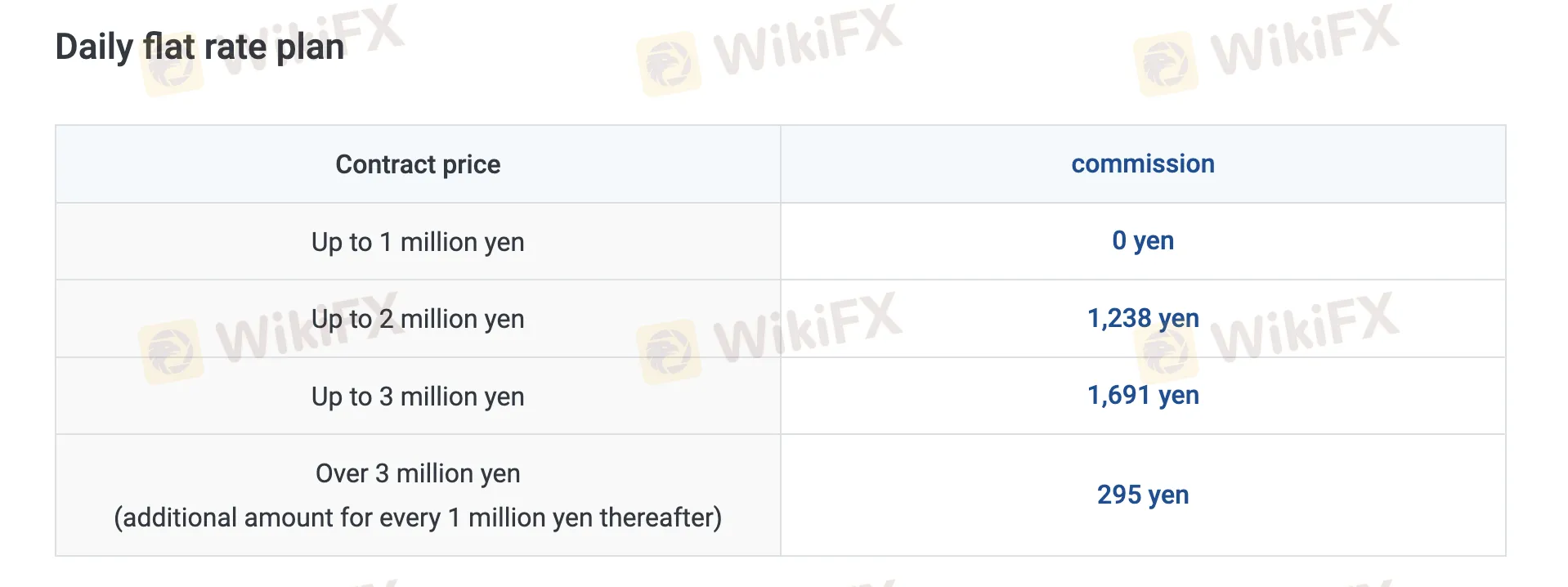

GMO CLICK Taxas

A GMO Click é conhecida por oferecer algumas das taxas mais baixas do setor, especialmente para FX, CFD e negociação de ações, com comissões zero em muitos produtos e spreads apertados.

| Produto de Negociação | Taxas |

| Ações à Vista | Plano Diário Fixo: ¥0 (até ¥1M/dia), depois escalonado |

| Plano por Negociação: A partir de ¥50 | |

| Ações com Margem | Plano Fixo: ¥0 (até ¥1M), depois escalonado |

| Plano por Negociação: A partir de ¥97 | |

| FX Neo | 0, spreads aplicáveis |

| Opções Forex | 0 |

| Click365 | 0 para contratos padrão; ¥770–990/bilhete para Click365 Large |

| CFD | 0 |

| Opções Binárias de Índice de Ações | 0 |

| Obrigações | 0 |

Taxas de Swap

| Tipo | Taxa Anual |

| Juros do Comprador (Geral) | 2.00% |

| Juros do Vendedor | 0.00% |

| Taxa de Empréstimo de Ações (Crédito Geral - Curto Prazo) | 3.85% |

| Plano VIP (Comprador Institucional) | 1.80% |

Taxas Não Relacionadas à Negociação

| Tipo de Taxa | Valor |

| Taxa de Depósito | 0 (Depósitos instantâneos); Taxas de caixas eletrônicos/bancos aplicáveis |

| Taxa de Retirada | 0 (JPY) ¥1.500 para retiradas de moeda estrangeira de FX |

| Taxa de Inatividade | 0 |

| Taxa de Pedido por Telefone | 0,11% do valor da negociação (mín ¥3.520, máx ¥220.000) |

| Vendas de Ações Fracionárias | 2,2% do preço do contrato |

| Taxa de Compra de Lote Ímpar | ¥1.100/marca |

| Taxas de Gerenciamento de Conta | 0 |

| Taxa de Emissão de Documentos | ¥1.100 (relatórios, dados pessoais, etc.) |

Plataforma de Negociação

| Plataforma/Aplicativo | Compatível | Dispositivos Disponíveis | Adequado para |

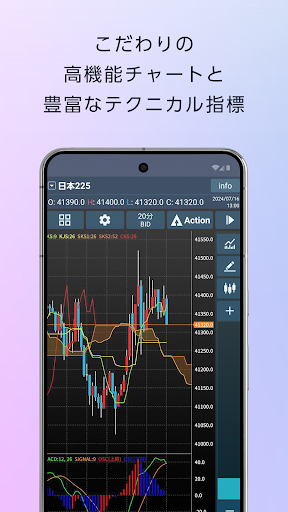

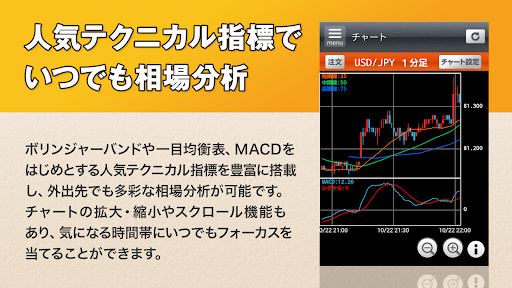

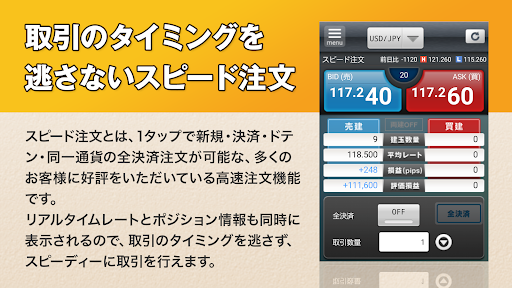

| GMO Click FX | ✔ | iPhone / Android / Apple Watch | Traders de FX (todos os níveis) |

| Hatchu-kun FX Plus | ✔ | Windows | Traders de FX que necessitam de funções avançadas |

| PLATINUM CHART | ✔ | Windows / Mac | Usuários de gráficos técnicos de FX & CFD |

| FX Watch! | ✔ | Wear OS | Alertas de FX em smartwatches |

| GMO Click CFD | ✔ | iPhone / Android / Apple Watch | Traders de CFD |

| Hatchu-kun CFD | ✔ | Windows / Mac | Traders de CFD que necessitam de ferramentas baseadas em PC |

| GMO Click Stock | ✔ | iPhone / Android | Traders de ações (acesso móvel) |

| GMO Click Stocks for iPad | ✔ | iPad / Mac | Traders de ações que preferem tablets |

| Super Hatchu-kun | ✔ | Windows | Traders de ações que necessitam de negociação desktop |

| iClick Forex | ✔ | iPhone / Android | Iniciantes em FX ou traders em movimento |

| GMO Click Stock BO | ✔ | iPhone / Android | Traders de Opções Binárias de Ações |

| iClickFX365 | ✔ | iPhone | Traders FX365 (móvel) |

| FXroid365 | ✔ | Android | Traders FX365 (móvel) |