Perfil de la compañía

| GMO CLICK Resumen de la reseña | |

| Establecido | 2005 |

| País registrado | Japón |

| Regulación | FSA |

| Instrumentos de mercado | Acciones, fondos de inversión, divisas, CFDs, índices bursátiles, bonos |

| Cuenta demo | / |

| Apalancamiento | / |

| Spread | / |

| Plataforma de trading | 13 plataformas (GMO Click FX, Hatchu-kun FX Plus, PLATINUM CHART, etc.) |

| Depósito mínimo | / |

| Soporte al cliente | Teléfono fijo: 0120-727-930 |

| Móvil: 03-6221-0190 | |

Información de GMO CLICK

Fundada en 2005, GMO Click Securities es una empresa de servicios financieros con licencia y controlada bajo la FSA de Japón. Entre sus muchas opciones de inversión se encuentran las divisas, acciones, CFDs y cuentas NISA con ventajas fiscales. La empresa opera varios sistemas de trading diseñados para cualquier persona, desde principiantes hasta traders experimentados.

Pros y contras

| Pros | Cons |

| Regulado por la FSA de Japón | Algunos detalles de la plataforma dispersos |

| Tarifas de trading muy bajas, especialmente para divisas y CFDs | Se aplica una tarifa por retiro de moneda extranjera |

| Gestión de cuenta gratuita y sin tarifa por inactividad | |

| Largo tiempo de operación | |

| Diversas plataformas de trading |

¿Es GMO CLICK legítimo?

Sí, GMO CLICK es una institución financiera legal y regulada. Está autorizada por la Agencia de Servicios Financieros (FSA) de Japón con una licencia de Forex minorista, bajo el número de licencia 関東財務局長(金商)第77号, vigente desde el 30 de septiembre de 2007.

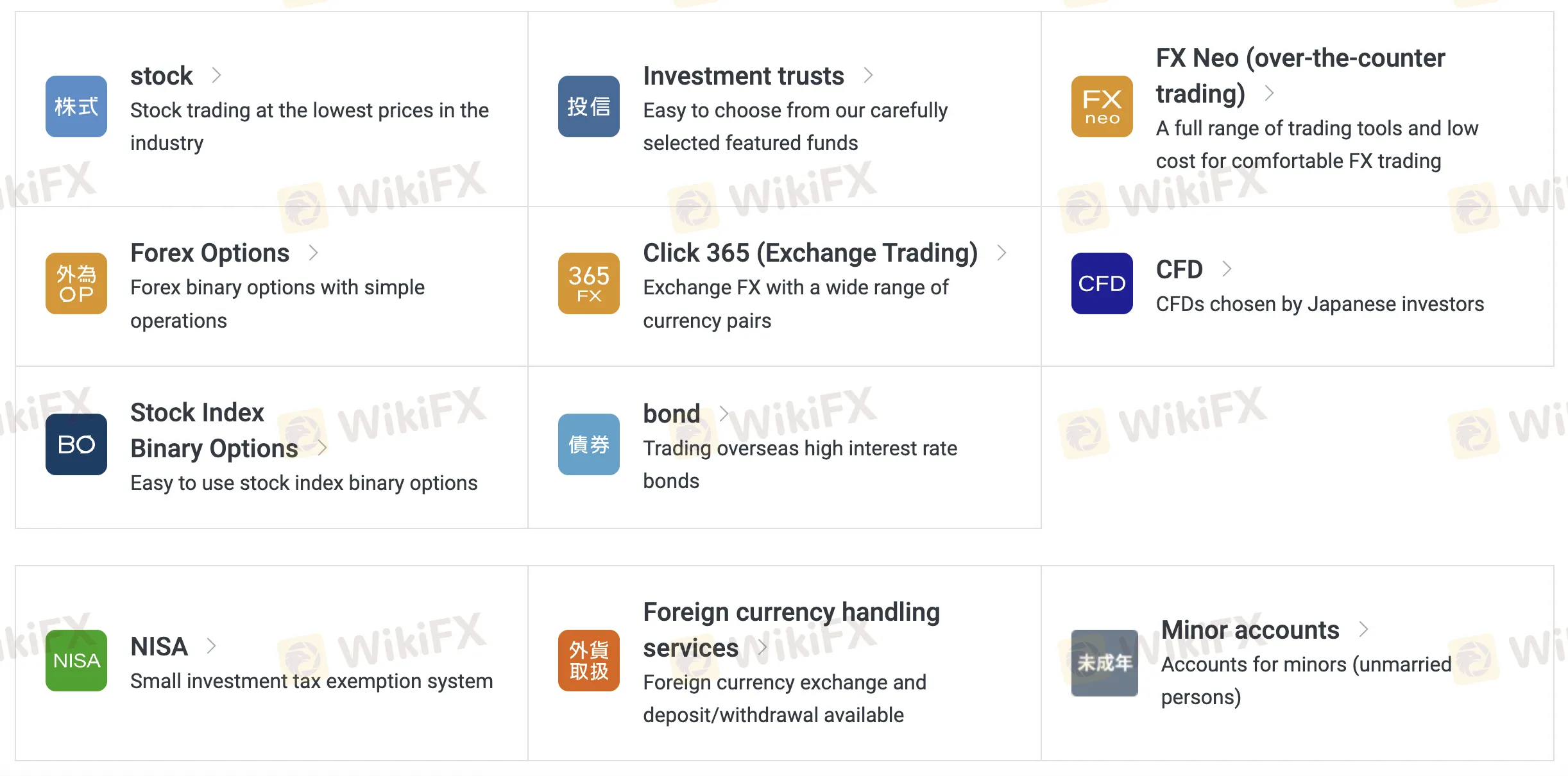

¿Qué puedo negociar en GMO CLICK?

Entre sus muchas herramientas de inversión y trading, GMO Click Securities ofrece acciones, divisas, opciones, CFDs, bonos y otros. Sus productos son adecuados tanto para inversores ordinarios como para aquellos que buscan cuentas modestas con beneficios fiscales.

| Instrumentos de trading | Soportados |

| Acciones | ✔ |

| Fondos de inversión | ✔ |

| Forex | ✔ |

| CFDs | ✔ |

| Índices bursátiles | ✔ |

| Bonos | ✔ |

| Opciones | ❌ |

| ETFs | ❌ |

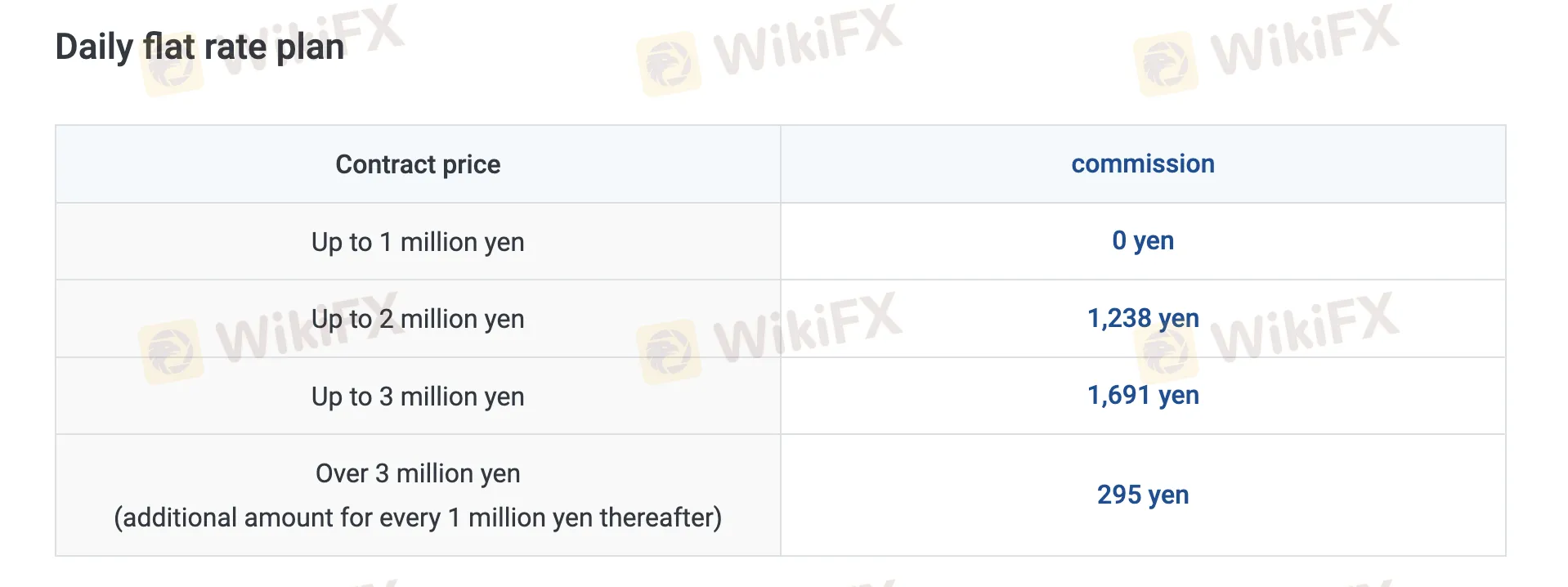

GMO CLICK Tarifas

GMO Click es conocido por ofrecer algunas de las tarifas más bajas en la industria, especialmente para el FX, CFD y comercio de acciones, con comisiones cero en muchos productos y spreads ajustados.

| Producto de Trading | Tarifas |

| Acciones al Contado | Plan Diario Fijo: ¥0 (hasta ¥1M/día), luego escalado |

| Plan por Operación: Desde ¥50 | |

| Acciones con Margen | Plan Fijo: ¥0 (hasta ¥1M), luego escalado |

| Plan por Operación: Desde ¥97 | |

| FX Neo | 0, se aplican spreads |

| Opciones de Forex | 0 |

| Click365 | 0 para contratos estándar; ¥770–990/boleto para Click365 Large |

| CFD | 0 |

| Opciones Binarias de Índices Bursátiles | 0 |

| Bonos | 0 |

Tasas de Swap

| Tipo | Tasa Anual |

| Interés del Comprador (General) | 2.00% |

| Interés del Vendedor | 0.00% |

| Comisión de Préstamo de Acciones (Crédito General - Corto Plazo) | 3.85% |

| Plan VIP (Comprador Institucional) | 1.80% |

Comisiones no relacionadas con el trading

| Tipo de comisión | Monto |

| Comisión de depósito | 0 (Depósitos instantáneos); se aplican comisiones de cajero automático/banco |

| Comisión de retiro | 0 (JPY) ¥1,500 por retiros de moneda extranjera de FX |

| Comisión por inactividad | 0 |

| Comisión por orden de centro de llamadas | 0.11% del monto de la operación (mín ¥3,520, máx ¥220,000) |

| Venta de acciones fraccionarias | 2.2% del precio del contrato |

| Comisión por compra de lote impar | ¥1,100/marca |

| Comisiones de gestión de cuenta | 0 |

| Comisión por emisión de documentos | ¥1,100 (informes, datos personales, etc.) |

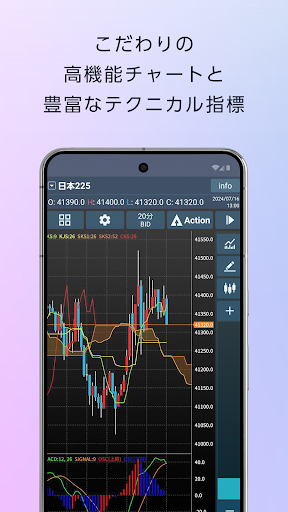

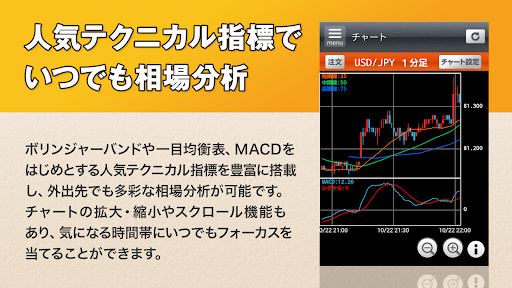

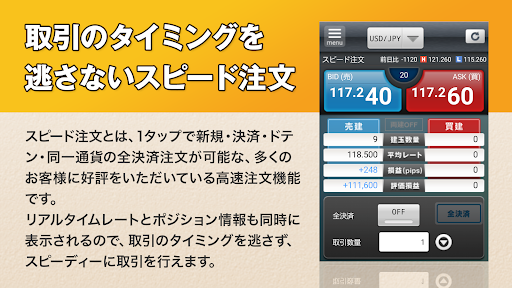

Plataforma de trading

| Plataforma/Aplicación | Compatible | Dispositivos disponibles | Adecuado para |

| GMO Click FX | ✔ | iPhone / Android / Apple Watch | Operadores de FX (todos los niveles) |

| Hatchu-kun FX Plus | ✔ | Windows | Operadores de FX que necesitan funciones avanzadas |

| PLATINUM CHART | ✔ | Windows / Mac | Usuarios de gráficos técnicos de FX y CFD |

| FX Watch! | ✔ | Wear OS | Alertas de FX en relojes inteligentes |

| GMO Click CFD | ✔ | iPhone / Android / Apple Watch | Operadores de CFD |

| Hatchu-kun CFD | ✔ | Windows / Mac | Operadores de CFD que necesitan herramientas basadas en PC |

| GMO Click Stock | ✔ | iPhone / Android | Operadores de acciones (acceso móvil) |

| GMO Click Stocks for iPad | ✔ | iPad / Mac | Operadores de acciones que prefieren tabletas |

| Super Hatchu-kun | ✔ | Windows | Operadores de acciones que requieren trading de escritorio |

| iClick Forex | ✔ | iPhone / Android | Principiantes en FX o operadores móviles |

| GMO Click Stock BO | ✔ | iPhone / Android | Operadores de opciones binarias de acciones |

| iClickFX365 | ✔ | iPhone | Operadores de FX365 (móvil) |

| FXroid365 | ✔ | Android | Operadores de FX365 (móvil) |